Good morning from Paul & Graham!

All done for today!

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

** New SCVR summary spreadsheet for calendar 2024 ** This is the live one! (updated 6/9/2024)

Archive - SCVR summary spreadsheet for calendar 2023.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices). My video explaining/reviewing it.

My other video (June 2024) - How to screen for broker upgrades on Stockopedia. More stock screening strategies here (possible bargains?) - 21/9/2024.

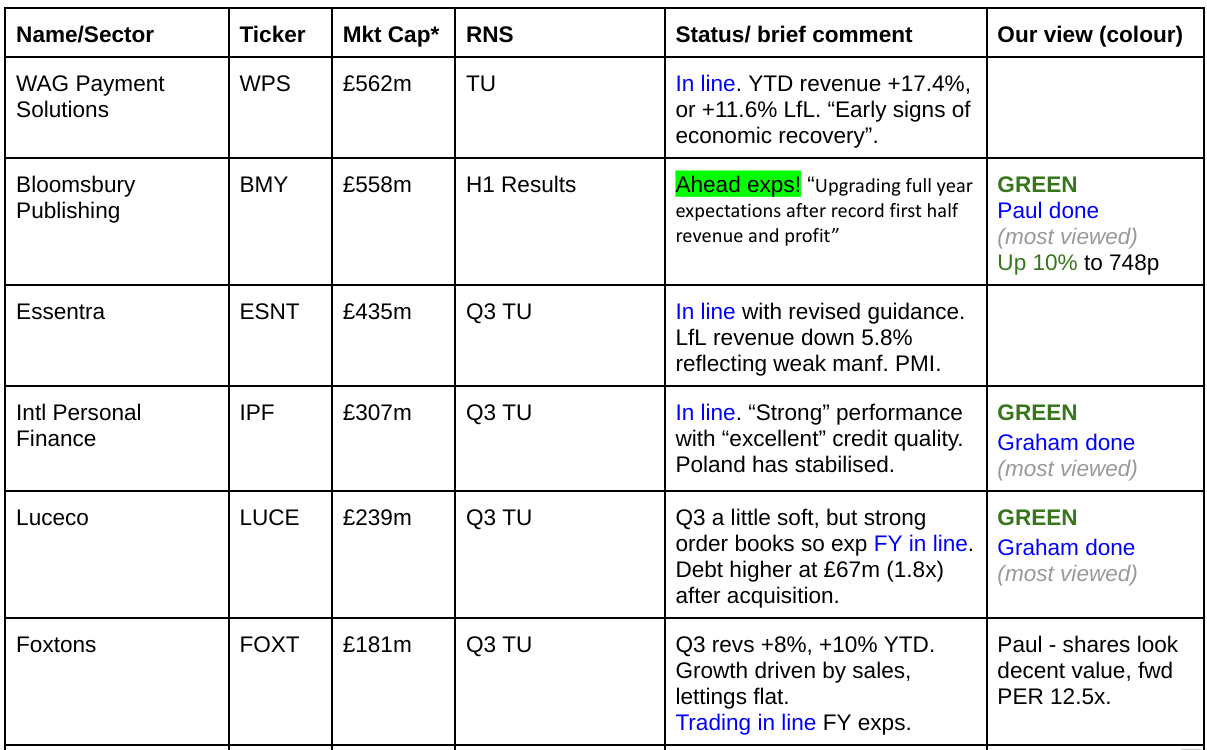

Companies Reporting

Other mid-morning movers (with news)

Abrdn (LON:ABDN) - down 8% to 151p (£2.78bn mkt cap) - Q3 Update - Paul - NO COLOUR

Adverse market reaction to this fund manager’s update.

Continuing fund outflows in Q3 from main business, partly offset by inflows at interactive investor.

In the process of deep cost cutting.

Assets under management and administration up slightly (<1%) to £507bn.

Shares stand out for discount to NTAV and remarkable 8.9% dividend yield. Large, complicated balance sheet.

Could be worth a closer look maybe?

Travis Perkins (LON:TPK) - down 6% to 870p (£1.85bn) - Q3 Update - Paul - NO COLOUR

Poor sales in its merchanting division, and only expects hesitant recovery - wider read-across? -

“Overall, the Group's key end markets are stabilising with some very early signs of recovery. Management expects to see positive growth in these underlying markets over the next twelve months, but that this growth will be slow and non-linear at the outset, with the benefit to financial performance starting to be realised in the second half of 2025.”

Second profit warning of late. Lowers adj operating profit guidance from £150m (Aug) to £135m (new).

New CEO is critical, saying business has been distracted & lost its focus.

Paul’s view - yet more evidence that recovery isn’t really happening yet in the building supplies sector generally.

Mears (LON:MER) - down 15% last 2 days (£300m) - Paul - AMBER/GREEN

I was wondering why Mears shares have fallen sharply this week on no RNSs.

The news tab on Stockopedia often contains useful news summaries from other providers, so is the first place to check what’s going on. In this case, a news digest post says that the FT has said -

“Britain ministers are keen to renegotiate terms or end the contracts for asylum accommodation with outsourcers including Serco SRP.L and Mears MERG.L as private companies made huge profits.”

Paul’s opinion - we’ve discussed this issue here before, it’s not a secret that Mears has been making bumper profits from contracts to house asylum seekers. The forecasts already show lower profits expected next year in this area. So it will be interesting to see if the company comments, and how robust its profits turn out to be, and if any changes are made to broker forecasts. The StockReport is now showing a forward PER of 9.9x, and 4.5% dividend yield.

See my review of its H1 results here on 8/8/2024.

Summaries

Bloomsbury Publishing (LON:BMY) - up 7% to 731p (at 09:23) £596m mkt cap - H1 Results & FY upgrade - Paul - GREEN

It's another ahead of expectations update from BMY, which has had a "stellar" H1 driven by two key authors. Forecasts are raised, hence my previous concerns about a stretched valuation have subsided. The cash pile has now largely gone, being spent on a large acquisition in the under-performing academic division. Profit concentration does worry me, but the figures are so good it has to be GREEN again.

International Personal Finance (LON:IPF) - down 5% to 135p (£293m) - Q3 2024 Trading Update - Graham - GREEN

An in-line Q3 update with IPF on track for adj. PBT of £78-82m. Poland has stabilised with business no longer shrinking there in terms of the receivables book or year-on-year lending numbers. All other geographies are performing fine and I continue to like this at a PER of only about 6x.

Luceco (LON:LUCE) - unch. at 148.2p (£238m) - Q3 2024 Trading Update - Graham - GREEN

An in-line update from this supplier of wiring accessories, EV chargers, etc. Q3 LfL revenue is down but with a strong order book, H2 as a whole is expected to show LfL growth. The recent £30m acquisition looks interesting and I’m happy to leave our GREEN stance unchanged for now.

Applied Nutrition (APN) - up 3% to 144p (£360m mkt cap) - First day of dealings - Paul - AMBER/GREEN

I don't touch IPOs normally, as they're nearly always overpriced and opportunistic. However this one look a decent business, highly profitable, and growing strongly. Valuation is about 18x PER, which also looks OK. Why are the founding Directors selling nearly half their positions though?

Dunelm (LON:DNLM) - up 1% to 1,202p (£2.4bn) - Q1 Trading Update - Paul - AMBER

Annoyingly vague update that doesn't say how it's traded vs expectations. So I'm guessing that it's probably in line - why not say so then? It's a good business, but with both growth and valuation seeming ordinary, I can't get excited about a PER of 15x. Divis are excellent though at 5.1% (EDIT: higher if we include regular special divis).

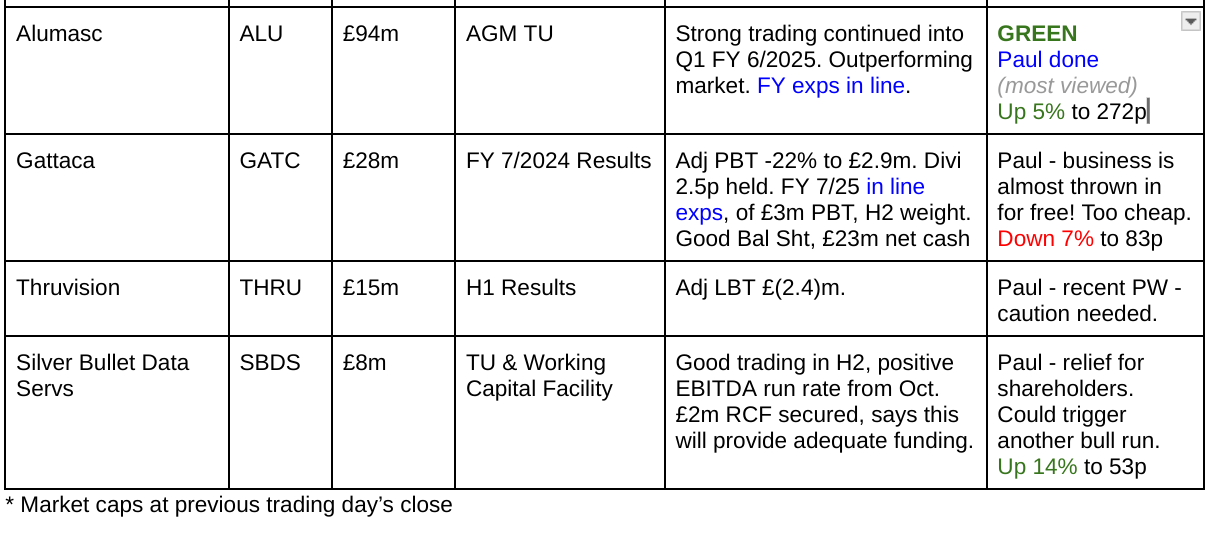

Alumasc (LON:ALU) - up 3% to 268p (£96m) - AGM Trading Update - Paul - GREEN

It's another encouraging-sounding, in line with expectations update. All looks good here. Valuation appears cheap, and with rising forecasts, this looks an interesting situation. I can't see anything wrong with it anyway. Is the recent pullback (AIM jitters?) a buying opportunity? It depends what happens in next week's budget!

Paul’s Section:

Alumasc (LON:ALU)

Up 3% to 268p (£96m) - AGM Trading Update - Paul - GREEN

As mentioned in the quick, early comments, this is a reassuring update which confirms trading is in line with full year expectations. So reassuring rather than particularly price sensitive - that’s why it sank down the list of priorities today.

Alumasc really stands out in this sector (building supplies) due to having an unusually strong operating margin (which it’s further increasing), and seemingly unaffected by the general sector downturn. We’ve covered it a lot in the SCVRs here.

Outlook comments are quite vague but sound positive -

“While demand headwinds in Alumasc's key markets are expected to persist for the rest of 2024, the quality of the Group's businesses and the execution of its well identified strategic priorities means the Board remains confident of delivering another year of growth, in line with its expectations.”

Broker forecasts have been rising nicely too -

The valuation isn’t just reasonable, it still looks cheap -

Paul’s opinion - I remain a fan, and there’s been a useful recent pullback too, so could be a buying opportunity maybe, providing nothing goes wrong?

It’s GREEN again.

Dunelm (LON:DNLM)

Up 1% to 1,202p (£2.4bn) - Q1 Trading Update - Paul - AMBER

Annoying “trading update” that doesn’t pull together the detail into a clear overall view. So they don’t tell us whether they’re behind, in line, or above market expectations.

We’re left to assume that it’s probably in line with expectations, due to -

Q1 revenues up 3.5% (total, not LfL) - “driven by increased volumes”.

“Digital” sales of 37% is meaningless, as it includes in-store sales done on a tablet.

Gross margin up slightly, 20 bps, guidance unchanged at 51-52% for FY 6/2025.

“Volatile trading conditions”, with no further explanation of what that means.

Claims to be increasing market share.

Vague outlook comments.

Paul’s view - as mentioned last time (here 13/9/2024), Dunelm is clearly a good business, making reliable profits on a good margin, from out of town sheds on retail parks (which are cost-efficient). The main attraction is the 5.1% dividend yield, which pays out most of its earnings. EPS growth looks fairly pedestrian now, and a PER of 15x looks about right. The rate of new site openings is slow now. I’m wary of all companies that get things manufactured cheaply in China, and sell them in the UK, because the Chinese are developing an appetite for selling direct, at remarkably low prices, to UK consumers. Overall then, DNLM looks OK, but not exciting either in terms of growth, or valuation.

EDIT: a friend has messaged to point out that DNLM also pays regular special divis in Feb/Mar each year, which are often enough to be considered normal. That's a good point, so I checked the StockReport's dividend data, which shows the historical yields of interim+final, but not the specials. Whereas the forecast yield shows about a 50% uplift, so that looks like it might include an allowance (maybe too low?) for possible special divis too. Anyway, it's worth checking this, as the yield could be more generous than I thought. On further digging, we think one broker might be forecasting a special dividend, but not the other, as the consensus seems to be about halfway between. Anyway, bottom line is that the forecast including special divis is about 6.5%, higher than the 5.1% forecast.

He also mentions that the pace of new site openings is accelerating, a good point.

Applied Nutrition (APN)

Up 3% to 144p (£360m mkt cap) - First day of dealings - Paul - AMBER/GREEN

Activities - sports protein drinks, sold internationally.

Dealings have started this morning for this IPO, key points -

Priced at 140p (£350m mkt cap) - lower end of 136-160p indicated ranged (in prospectus)

250m total shares in issue.

Selling shareholders sold 137.4m shares.

No new shares issued, this placing is entirely of existing shares to raise c.£198m for sellers.

Main 3 sellers are: CEO/Founder, drops from 53.5% to 30.0%, COO drops from 9.4% to 5.0%, and JD Sports, drops from 31% to 5%.

Main market listing.

Sponsor & bookrunner: Numis.

IPO documents are here.

Fast-growing, and high margin business -

I make that 2024 earnings (assuming 25% tax), stripping out the IPO costs of about £19.3m. Divide by 250m shares = EPS c.7.7p, so the PER at 140p looks about 18.2x - that seems reasonably priced to me, assuming profit growth continues.

Guidance is for £100m revenues FY 7/2025.

Balance sheet at July 2024 looks strong. Very little fixed assets (is manufacturing outsourced?). Net cash of £18m. So it clearly didn’t need any fresh cash to be raised at IPO, financing looks more than adequate as is.

Paul’s view - this seems a reasonably-priced, well financed IPO. The big question is obviously why do the founder/CEO and COO want to cash in almost half their chips, if everything is so good?

Anyway, based on the figures provided, I think this looks moderately interesting, although I hardly ever touch IPOs, as they so frequently go wrong, often quite badly. On first impressions, I’ll give it AMBER/GREEN - worth a closer look.

Bloomsbury Publishing (LON:BMY)

Up 7% to 731p (at 09:23) £596m mkt cap - H1 Results & FY upgrade - Paul - GREEN

Bloomsbury Publishing Plc (LSE: BMY, "Bloomsbury" or "the Company"), the leading independent publisher, today announces unaudited results for the six months ended 31 August 2024.

Outlook -

“Following our strong performance in the first half of this year and good trading in September and October, we now expect trading for full year 2024/25 to be ahead of the current consensus2 expectation."

2 The Board considers consensus market expectations (before this publication) for the year ending 28 February 2025 to be revenue of £319.3m and profit before taxation and highlighted items of £37.5m.

How much ahead? A note from Radnor has just come through, upping PBT expectations for FY 2/2025 by 6% to £39m, and 35.7p EPS.

This looks a low forecast, but as BMY has explained before, H2 this year doesn’t have any new releases from Sarah J Maas (best-selling fiction author), and they’re up against strong prior year comps. Even so, it looks to me as if there could be further upside on the new forecast. Last year’s result was higher, at 46.6p, due to the exceptional success of Sarah J Maas.

Note that BMY spent its cash pile on its largest acquisition to date (£65m), of Rowman & Littlefield’s academic publishing business. This seems to have been acquired in late May 2024 so would have contributed June-August, 3 months into the group’s H1 P&L. It contributed £7.2m revenue into the group’s H1 results, boosting organic revenue growth of +26%, to total revenue growth of +32%.

These headline numbers for H1 are undoubtedly superb -

The academic division is not performing well, with customers facing budgetary constraints. Its H1 profit fell by 12% to £5.2m, and even that was heavily adjusted up due to one-off costs incurred in the large acquisition.

The consumer division is the powerhouse of group profits, and seems to hinge heavily on Sarah J Maas and JK Rowling. No profit per author is given, but this statistic stands out -

“Bloomsbury has sold more than 55m of Sarah's books in English worldwide”

Should we be seeing BMY as essentially a two trick pony, having got lucky by signing 2 bestselling authors? Or should we admire its vision for having spotted these authors early, and securing what seems to be multi-year almost annuity type profits? (27 years so far for JK Rowling). It also mentions that new releases from Maas also tend to trigger increased sales in the back catalogue.

BMY calls its H1 results from the consumer division as “stellar”, rightly so -

“Profit before taxation increased to £21.2m (H1 2023/24: £11.0m).”

This makes the rest of the business look like a sideshow, so the profit concentration in just two authors does worry me somewhat. Hence why personally I wouldn’t want to chase up the earnings multiple too high.

Balance sheet - NAV is £203m, less intangible assets of £75m goodwill plus £63m other, gives NTAV of £65m. You could argue that the relationship with the two key authors are huge off balance sheet assets. I’d be interested to better understand the contractual relationships between key authors and BMY. Could they jump ship and move to a different publisher if offered better terms, once their exclusivity period ends? If so, that could be a serious hidden risk, so we need to know.

BMY has spent its large net cash pile on the latest acquisition of £65m. Note the appearance of £28.4m in long-term “borrowings”. This is more than offset by cash of £38.1m, so it’s a comfortable position of now modest net cash.

BMY has done a total of 34 acquisitions, so this company is best seen as a self-funding buy & build share. It’s difficult to determine if every acquisition has been a success or not, since newly acquired companies are absorbed within the whole group.

Nobody can argue with the overall results though! -

Paul’s opinion - we like BMY shares a lot here at the SCVR, and review it positively every time. I moderated from green to amber/green last time in July, since at 710p on the valuation starting to look stretched. I needn’t have worried though, as today’s ahead of expectations update has recovered all the recent slippage, and powered further up to 731p at the time of writing.

What might earnings be in future? Providing nothing goes wrong with the 2 key author relationships, then I think we could probably value BMY shares on roughly 40-50p possible future EPS. So at 731p/share I get a PER of between 14.6x and 18.3x. I think that looks a reasonable valuation.

I’m not convinced that the academic, and other areas are interesting. BMY shares are all about the stellar growth from two key fiction writers. All the evidence suggests that these are long-term winners, not a flash in the pan. Although some reviews for Maas do say that her plots and characters are very similar. I wonder how long she can keep churning them out? I mystery read one of her books, and couldn’t manage more than a chapter, so I have no idea what the appeal is, but the appeal is real - they’ve sold 55m of her books, which is all that matters.

AI is another interesting area. I wonder how long it will be before best-selling books are written by computers? It could already be happening for all we know! Could that be an opportunity for BMY? After all, not having to pay anything to best-selling authors could work wonders for its margins.

Overall, I’m tremendously impressed with how well BMY is performing, and its habit for beating expectations. With a valuation that looks reasonable again on forecasts that may be beatable, it’s best to shift back up to GREEN I think.

Powering ahead despite difficult market conditions this year -

Long-term, note how BMY went nowhere for years, with all the share price appreciation starting in 2020 -

Graham’s Section:

Luceco (LON:LUCE)

Unch. at 148.2p (£238m) - Q3 2024 Trading Update - Graham - GREEN

Luceco plc…, the supplier of wiring accessories, EV chargers, LED lighting, and portable power products, is pleased to provide the following update for the three months ended 30 September 2024…

This update is in line with expectations.

Many thanks to Luceco for including the consensus in the update: adj. operating profit for 2024 is expected at £26.5m (analyst range: £26-27.2m).

Key bullet points for today:

Q3 revenue growth 3%, but on a like-for-like basis it’s down 3.6%.

Q4 order book “supports LfL revenue growth expectations for the second half”.

M&A: a £30m acquisition was announced on 30 Sep. Luceco bought CMD, a manufacturer of commercial wiring accessories, and “continues to review a healthy pipeline of M&A opportunities”.

Outlook: total revenue growth of 10% including positive LfL revenue growth in H2.

They are optimistic on residential RMI (repair, maintenance, improvement) given recent growth in UK property transactions, and are excited by new product launches in EV chargers.

CEO comment:

Luceco continues to deliver growth despite a challenging market backdrop and we are excited by the recent acquisition of CMD, a market-leading manufacturer of wiring accessories for the workplace. Improving market sentiment underpins our belief that 2025 will see a return to more normalised growth in our markets. The Group's diverse portfolio and channels have contributed to the good trading performance in the year to date and our profit expectations for the full year remain unchanged."

Leverage multiple is 1.8x, within the target range of 1-2x. By conventional wisdom, this is a reasonable amount of leverage and they expect it to fall towards the middle of their target range by the end of next year. Net debt is £67m.

Graham’s view

Roland covered this one recently but before the acquisition of CMD was announced.

I’ll have to ask him what he thinks of this deal.

At first, the price (£30m) seems a little high compared to CMD’s last-reported EBITDA (£4m). Because often, only a fraction of EBITDA converts into after-tax net income.

However, I’ve fished out CMD’s annual report for 2023 and found that it did convert almost all of that EBITDA into net income:

Having seen this, the price paid for CMD doesn’t worry me too much.

Overall, I don’t have a strong view on LUCE. Therefore, for the sake of continuity, I’ll leave Roland’s GREEN stance unchanged after today’s in-line update.

I must say that I’m impressed by the quality metrics for this company, given the sector in which it operates. Luceco has apparently cracked the code of how to manufacture in China, where they have a wholly foreign owned enterprise rather than a joint venture. Impressive!

International Personal Finance (LON:IPF)

Down 5% to 135p (£293m) - Q3 2024 Trading Update - Graham - GREEN

We have a solid Q3 update from this lender, and the outlook remains in line with full-year guidance.

Guidance is for full-year adj. PBT of £78-82m.

Excluding Poland, customer lending has grown 7% year-on-year.

Even better, the impairment rate continues to fall, reaching 9.2%, “well below our target of 14% to 16%”.

As explained by IPF management in July, their growth ambitions in Mexico and more broadly mean that they are happy to take on a significantly higher impairment rate. But so far, they have not needed to do so!

Poland: is now growing year-on-year after a big change in regulations that shrank the business. Q3 lending in Poland is up 4%, and Polish receivables have stabilised at £180m.

Latest annualised metrics (excluding Poland):

Revenue yield (revenue as a percentage of the amounts owed by customers) - is within the target range of 56% to 58%.

Cost-income ratio (costs excluding interest expense, dividend by revenue) - is too high at 55.1%, compared with a target range of 49% to 51%. I would like to read more about how they will address this, but I guess I’ll have to wait until the full-year results.

Leverage has increased slightly as the company recently carried out a £15m buyback and there has been some depreciation of the Mexican peso.

Regulatory update - no material impact expected from new cost of credit cap in Romania. Engaging with the regulator in Poland to issue more credit cards.

CEO comment excerpt:

"Our financial performance in the third quarter continued to be strong, with good growth in customer lending and receivables, as we implement our Next Gen strategy. The demand for our expanding portfolio of credit and insurance products is robust, and we continue to see very strong repayments and credit quality.”

Graham’s view

I’ve been banging the drum for this stock for some time now.

Yes, IPF carries quite a lot of risk for investors: consumer credit risk, foreign exchange risk, regulatory risk, and the company itself is leveraged (with an upgraded but nevertheless below-investment grade credit rating of BB).

In exchange for that, it offers a tempting valuation that includes a high dividend yield:

And a perfect StockRank:

And it passes two bullish stock screens, including a Growth Investing checklist:

The trend in EPS expectations has been reasonably stable:

Obviously it won’t be for everyone and given the sector I don’t expect that it’s going to be a bulletin board favourite any time soon. But the risk:reward on offer continues to look attractive to me.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.