Good morning, it's Paul & Graham here.

Mello - Results Special - It's free! There's a mammoth Mello show starting at 13:00 today, with interesting companies eg. Journeo (LON:JNEO), Equals (LON:EQLS), accesso Technology (LON:ACSO), Property Franchise (LON:TPFG) presenting, and yours truly doing a roundup of recent results. I don't think anyone is expected to watch the whole thing! I tend to put on my headphones, and drift in & out of online shows.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom),

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

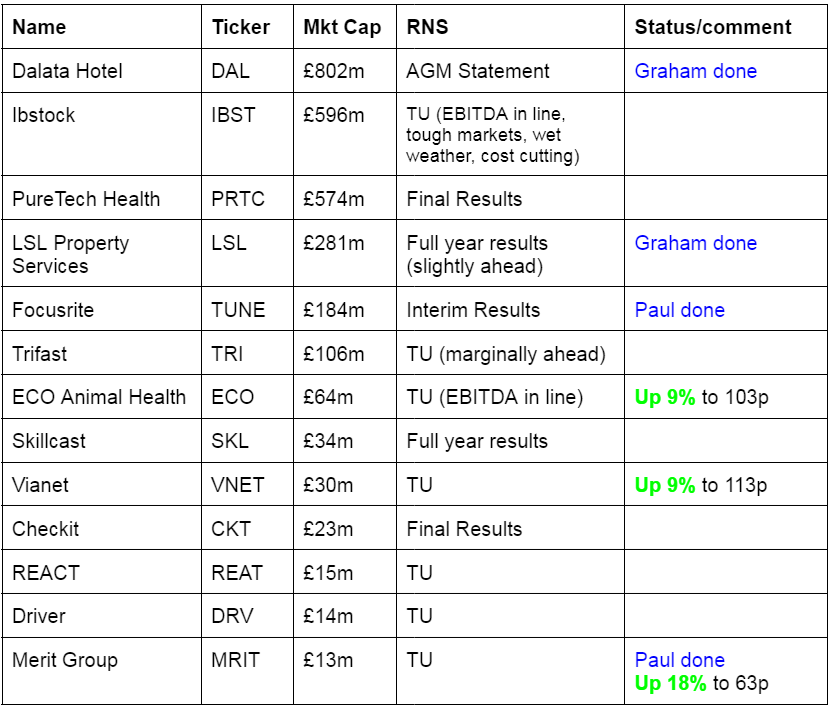

Companies Reporting

Other mid-morning movers (with news) -

Kromek (LON:KMK) - up 9% to 7.65p (£49m) - Contract Win - Paul - RED

Kromek Group plc (AIM: KMK), a leading developer of radiation and bio-detection technology solutions for the advanced imaging and CBRN detection segments, is pleased to announce that it has been awarded a contract, worth up to $2.9m, from a US federal entity for the provision of nuclear security products.

The contract, which is from an existing customer, covers the provision of the Group's D5 RIID, D3M and D3S-ID wearable high-performance radiation detectors. The Group has received a $358k order under this contract for immediate delivery, with up to $2.5m to be awarded over the next 24 months.

Paul’s opinion - It’s not clear from the above if this is a proper contract, or just a small initial order with the hope that more will follow? KMK has such a bad history, 10 years of missing forecasts, and multiple fundraisings, that people who give it the benefit of the doubt tend to regret it. Even the latest forecasts show it nowhere near profitability, even if it reaches the target revenue growth. Despite a fundraising, its last balance sheet showed net debt. I wish it well, but there’s no evidence this is a viable business as yet. Hence it has to be RED.

Merit (LON:MRIT) - up 18% to 63p (£15m) - Trading Update FY 3/2024 - Paul - AMBER/GREEN (speculative)

This has been listed many years, and used to be called Dods Group.

Merit Group Plc (AIM: MRIT), the AIM-listed data and intelligence business, today issues an update on trading for the financial year ended 31 March 2024 (FY24).

Trading has been good - with a long-awaited return to profitability.

The Group expects to report revenues in FY24 of approximately £19.9m (FY23 £18.6m) and Adjusted EBITDA1 of around £4.0 million (FY23 £2.7m), approximately 10% ahead of market expectations2.

Based on the unaudited management accounts, Profit before Taxation and non-recurring items for the year ended 31 March 2024 is expected to amount to £1.2m (FY23: Loss of £0.2m), the first Profit before tax for the year reported since FY18. The Group had net debt of £1.9m as at 31 March 2024 (31 March 2023: £2.6m).

Our current activities are focussed on further revenue and earnings growth in the new financial year."

Paul’s view - I’ve not looked at this since 2019, so am out of date. I see the bounce back into profit was achieved in H1, announced in Nov 2023. It was talking about using AI long before it became fashionable, on checking my notes from 2019.

My main question is how scaleable the business is? In particular its political intelligence division looks very niche. Weak balance sheet at 9/2023, could need a placing to bolster things?

I’d say this looks worthy of a closer look, on the basis that it seems to genuinely use AI and data analytics, makes a small profit, and could re-rate as a sexy AI share in future, perhaps?

Cordel (LON:CRDL) - up 13% to 4.3p (£9m) - Contract win - Paul - AMBER/GREEN (speculative)

It’s won a “12-week paid trial” from a “major national railway” in Asia. Doing a little digging, I like the sound of the product here - it’s camera-based computer systems that are fitted to trains, and they automate various activities such as checking for obstructions on the line, and other analytics, reporting back to customers with actionable reports. It has customers in several countries. Sounds clever, and scaleable. Revenue doubled to £2m in H1, so the product obviously works. Note it also received grant income of £409k in FY 6/2023, another sign that it has something credible, in my view. Cash looks tight, so a placing is possible, and as with all nanocaps there’s de-listing risk.

Paul’s opinion - for people like me who like the odd nanocap punt, this one might be worth a closer look perhaps.

Inchcape (LON:INCH) - up 8% to 779p (£3.20bn) - Q1 Results - Paul - AMBER

This international vehicle distributor recently sold off its UK retail operations for £346m.

The market clearly likes its Q1 update today. It says Q1 has been positive. Outlook is reiterated, doesn’t sound very good to me - “moderated growth in FY 2024”, but higher growth expected medium to longer term.

Paul’s view - valuation metrics on the StockReport look attractive, PER 8.2x, and 5.1% dividend yield. So it might be worth a closer look maybe? Shares have oscillated in a sideways trend for the last 10 years. Doesn’t excite me, so I probably won’t do any more research on this.

It’s surprising to see large caps on the top movers list, but here we are, very briefly -

Anglo American (LON:AAL) - up 13% to 2,491p (£33bn) - possible bid approach from BHP, and AAL considers selling De Beers diamond unit.

AstraZeneca (LON:AZN) - up 6% to 12,024p (£186bn) on Q1 Results.

Unilever (LON:ULVR) - up 5% to 4,066p (£102bn) on Q1 Trading Update.

That must have helped the FTSE 100, up 55 today to 8,090 - I haven’t got used to it starting with an 8 yet!

Summaries of main sections

Tortilla Mexican Grill (LON:MEX) - 44p (£17m) - FY 12/2023 Results - Paul - AMBER/GREEN

Made a £1.1m loss before tax in FY 12/2023, but this masks good cashflow (pre expansion capex). Balance sheet looks OK, with plenty of headroom on 2026 Santander facility. Should be scope for profit to improve as cost of living crisis recedes, and energy/food inflation ends. Looks too cheap to me, for a national chain with a good brand, and decent products. My target is c.100p exit, maybe through takeover?

Gear4music (HOLDINGS) (LON:G4M) - up c.5% to 145p (£30m) - FY 3/2024 Trading Update - Paul - AMBER

Traded in line, but net debt has come in much lower than anticipated. I would need to see the full numbers to see how much is due to de-stocking, and how much is just seasonal. Modest profits, but cost-cutting in H2 may be setting up an improvement for FY 3/2025. Maybe priced about right, or could be more upside, I'm not sure!

Tracsis (LON:TRCS) - down 3% y’day to 820p (£248m) - H1 Results - Paul - AMBER

H1 profit fell, but it's been saying for a while that profit would be H2 weighted. As before, I like the business, but find the valuation too high.

Supreme (LON:SUP) - up 3% y’day to 125p (£145m) - Year End Trading Update - Paul - GREEN

In line results, show profit doubled on last year. Shares look very cheap, but uncertainty/aversion to its main profit generator being vaping products. Has paid off all its debt, and looks set to make more acquisitions of new products or companies. Has to be green as it's so cheap.

Sanderson Design (LON:SDG) - down 4% to 99p (£71m) - FY 1/2024 Results - Paul - GREEN

I see these results as being resilient, considering a consumer downturn. Strong licensing performance saved the day. Bulletproof balance sheet. Sensible strategy from management. Shares look too cheap to me, although some risk of possible profit warning?

Focusrite (LON:TUNE) - down 9% to 335p (£198m) - H1 Results - Paul - AMBER

Weak H1 numbers, but it reckons an H2 weighting means it should hit (reduced) FY 8/2024 forecast - as we know, H2 weightings can be a deferred profit warning sometimes. I flag some balance sheet & cashflow issues below too. I'm shifting down a gear to AMBER for now, and we'll see how things pan out.

LSL Property Services (LON:LSL) - up 4% to 280p (£291m) - Full year results - Graham - AMBER/GREEN

Exciting times at LSL after a wide range of changes to its makeup and structure, with the overall goal of becoming a focused, capital-light B2B group. After a couple of “ahead” trading updates, it now treats investors to a £7m share buyback. I certainly view this one as being worth researching in greater detail.

Dalata Hotel (LON:DAL) down 0.5% to 372p (EUR €934m) - AGM Statement - Graham - GREEN

A very confident and positive AGM statement from this hotel owner and operator, noted for its Clayton and Maldron brands. It does acknowledge that there has been some weakness in the first few months of the year in the Irish market. With many key months ahead, there is plenty of time for this to turn around.

Paul’s Section:

Tortilla Mexican Grill (LON:MEX)

44p (£17m) - FY 12/2023 Results - Paul - AMBER/GREEN

Tortilla Mexican Grill ("Tortilla"), the largest and most successful fast-casual Mexican restaurant group in the UK, is pleased to announce its Annual Results for the 52 weeks ended 31 December 2023 (the "Period").

I had a quick look at these results early yesterday morning, and jotted down the key points -

Revenue up 14% to £66m

Loss before tax of £1.1m (slightly worse than 2022 of £0.9m loss)

Current trading: in line with expectations. Letting some unprofitable delivery business go.

Net debt looks fine at £1.3m, with gross debt £3m of a £10m Santandar facility (to Sept 2026)

Clean going concern statement.

NAV: £2.9m, including £2.6m intangibles, so NTAV £0.3m (error corrected, my apologies) - adequate I’d say, but not strong.

Paul’s opinion - what’s the attraction here then? Tortilla (which also owns Chilango) is the UK’s largest Mexican-style tortilla fast food chain. The product is very tasty, and reasonably priced. I reckon this could be the low point for earnings, hit by: consumer downturn (now reversing as real incomes move positive), spike up in energy & food costs. Big rise in living wage is another headwind. It also has a successful franchising arrangement, and international franchise expansion planned, which is telling us that the format works (or the franchisees wouldn’t want to open more stores). So a cyclical recovery, and for me I’d be happy with an exit (possibly from a takeover bid) at c.100p. Is it the best business in the world, no of course not! But it’s too cheap at 44p I reckon. Recently we saw an institutional overhang placed with some shrewd investors, causing a burst of excitement. Cash generation is good, even when you adjust out all the IFRS 16 nonsense. By my calculations it generated £3.8m in positive cashflow, before spending £4.5m on (mostly expansion) capex. Debt isn’t a problem. Overall, these numbers are better than I expected.

Another over-priced 2021 IPO -

Gear4music (HOLDINGS) (LON:G4M)

Up c.5% to 145p (£30m) - FY 3/2024 Trading Update - Paul - AMBER

Gear4music (Holdings) plc ("Gear4music", "the Company" or "the Group"), the largest UK based online retailer of musical instruments and music equipment, is pleased to announce its Board succession plan.

Board succession - Non-Exec Chair, Ken Ford, is retiring after 9 years. Founder/CEO Andy Wass is becoming the new Chair. Existing Chief Commercial Officer Gareth Bevan is becoming the new CEO. Neil Catto (former BOO CFO, and now with Revolution Beauty) joins as a new NED.

Year-end Trading Update - for FY 3/2024.

Sales down 5% to £144m - as expected, due to strategy to prioritise profit, not revenue growth.

“Net debt reduced significantly to £7.3m at 31 March 2024 (31 March 2023: £14.5m; 31 March 2022: £24.2m), ahead of market expectations*”

EBITDA expected to be in line with market expectations*.

* Gear4music believes that current consensus market expectations for the year ended 31 March 2024 are revenue of £144.1 million, adjusted EBITDA of £9.8 million, adjusted profit before tax of £1.3 million, and pre-IFRS16 net debt of £11.6 million.

“Planned cost reductions delivered during FY24 H2 will support further net debt reduction and profitability improvements”

I’ve moaned before that EBITDA is particularly meaningless here, so it’s good that fairly recently the company also started disclosing the much more modest level of adj PBT, as above.

As readers commented yesterday, it’s the debt reduction that’s the most important aspect of this update.

Net debt was £18.1m at 30/9/2023, and is now down to £7.3m, although I think there’s probably some seasonality in that movement. I’d need to see the full balance sheet and cashflow, to properly analyse this, but it’s moving strongly in the right direction.

Paul’s opinion - not bad. The days of smaller eCommerce companies being given massive valuations are long gone, unlikely to ever return. I think now investors see these as low margin companies, up against a lot of competition. It’s only made £1.3m adj PBT in FY 3/2024, and still has some debt, so a £30m market cap doesn’t look especially cheap to me.

Singers is forecasting a big uplift in PBT to £2.7m in this new year, FY 3/2025. If that is achieved, then I could see upside on the current share price. I’d like to better understand why Singers thinks PBT is likely to more than double in the next year? Sounds like it’s due to cost cutting. The trouble with that, is it tends to only give a one-off boost to profit.

On balance, I was AMBER last time (on 17/11/2023), and with the share up about 20% since then, G4M shares look priced about right to me, so I’m happy to stick with AMBER. Risk has reduced nicely with reduced debt, but some of that reduction might be seasonality. So I’m happy with the risk side of things, which is now acceptable. I’m just not convinced that the reward side of the equation, the upside on this share, is big enough to get me excited about it again. It wouldn’t surprise me to see G4M shares continue an uptrend, maybe getting to 200p later this year, but what happens after that? Maybe I’m being too cautious here, and amber/green could be justified, given that G4M has done all the right things in the last year or so - cutting costs, focusing on margin not just revenue growth, and debt reduction from lowering inventories.

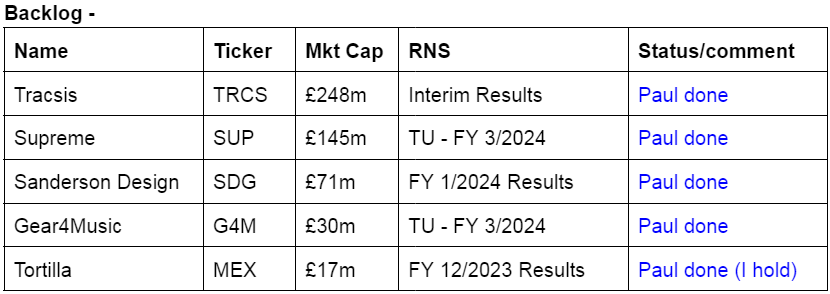

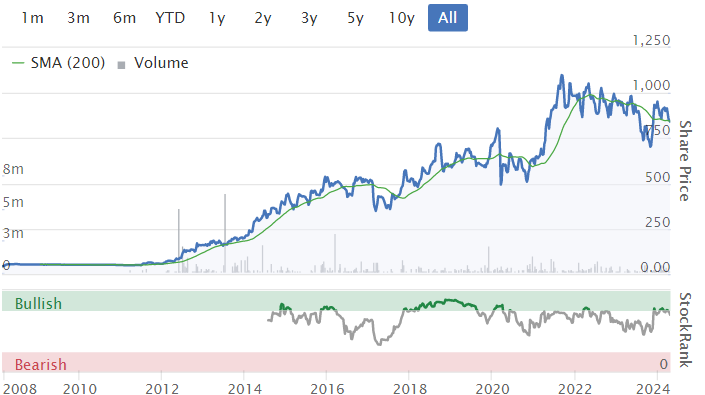

Note the pandemic boom & bust. Looks like it's put in a floor over the last 2 years. Also note there's been no dilution since it listed in 2015 -

Tracsis (LON:TRCS)

Down 3% y’day to 820p (£248m) - H1 Results - Paul - AMBER

Tracsis plc (LSE: TRCS), a leading transport technology provider, is pleased to announce its unaudited interim results for the six months ended 31 January 2024.

Rather uninspiring, was my reaction to the numbers, and a rather flat management presentation online.

H1 revenue down c.7% to £36.6m, with only about a third being recurring revenue.

Adj EPS down 36% to 10.3p.

Statutory EPS was a small loss.

H2 weighting to profit, it says.

Broker update - thanks to Cavendish, showing forecast of 39.8p for FY 7/2024. Therefore that means it’s expecting H2 to be 3x the actual H1 EPS result of 10.3p, which seems a challenge, increasing the risk of a profit warning if it doesn’t convert the pipeline into deals as expected.

Also this forecast is only a whisker above actual adj EPS of 38.5p achieved in FY 7/2023.

Yet we’re being asked to pay 20.6x forecast earnings. That seems too expensive to me.

Balance sheet - looks sound, and management said all the deferred consideration creditors have now been paid. So expect more acquisitions they say.

NTAV is fairly modest at £13m. Net cash is healthy at £16.8m.

Paul’s opinion - I can’t get excited about this. As we always say, Tracsis looks a decent collection of rail/transport related IT businesses. Although there seems little organic growth, and H1 actually went backwards. So why would I pay 20.6x earnings for this? The valuation seems too high to me. Clearly bulls are betting on the future growth improving. I don’t know whether that will happen or not, so there’s too much guesswork involved for me, and I’m generally not a fan of H2 weightings, better avoided I think due to the heightened risk of missing forecast. Although it has been consistently stating for a while that this year would be H2 weighted.

So it’s not for me, but good luck to holders. It’s quite a nice company, just not priced attractively at this stage, the way I see it. So let’s stick with AMBER, as we viewed it the last three times, in Aug 2023, Nov 2023, and Feb 2024. Nothing much has changed over that time.

Long-term chart below shows a 10-bagger from 2011 to 2016, but gains have been more pedestrian since -

Supreme (LON:SUP)

Up 3% y’day to 125p (£145m) - Year End Trading Update - Paul - GREEN

Supreme PLC (AIM: SUP), a leading manufacturer, supplier, and brand owner of fast-moving consumer goods, is pleased to provide a trading update for the twelve months ended 31 March 2024 ("FY24" or the "Period"). Audited financial results for the Period will be announced on Tuesday, 2 July 2024 ("Final Results Announcement").

The main money-spinner is vaping products, which some of us don’t want to invest in. I won’t go over that ground again, as we’ve discussed it a lot in the past here, and everyone has had their say.

Impressive headline -

Record financial performance, almost doubling Adjusted EBITDA1 to at least £38 million

Note the superb track record of big forecast increases -

Broker note - thanks to both Shore and Zeus. Zeus says £38m adj EBITDA is in line with expectations, and turns into real profits (adj PBT) of £32.9m, which is 19.9p adj EPS. Therefore the FY 3/2024 PER is only 6.3x. Clearly this is due to investor uncertainty about the future for vaping products. Zeus says forecasting is tricky, and currently it is forecasting a fall to 18.2p adj EPS for FY 3/2025.

Cash - no figures provided, but it says net bank debt has been paid off this year.

Acquisitions - it’s considering complementary products & companies to acquire.

Paul’s opinion - it’s very cheap, if current level of earnings can be maintained longer term, which is the bit we don’t really know for sure. The numbers are so good, I have to view it GREEN, but it’s not a stock I would personally want to own, due to the vaping issue.

Sanderson Design (LON:SDG)

Down 4% to 99p (£71m) - FY 1/2024 Results - Paul - GREEN

Sanderson Design Group PLC (AIM: SDG), the luxury interior furnishings group, announces its audited financial results for the year ended 31 January 2024.

SDG has some impressive historical brands, and a huge design archive, eg William Morris. It manufactures wallpaper and fabrics, and also licences its designs to fashion and interior furnishing companies, which is increasingly important to profits.

Demand has been struggling a bit in recent years, but CEO Lisa Montague has rationalised product lines, stripped out costs, and protected profitability pretty well considering, in my view.

Strong licensing income saved the day in these results.

I enjoyed the reader comments here yesterday, with a variety of interesting bull & bear views on SDG from you, all food for thought!

Considering tough macro, I find these figures quite decent -

The share price of only 99p means we’re only looking at a PER of 7.2x - that strikes me as very cheap.

Outlook - no sign of a cyclical recovery as yet -

"Trading conditions overall are expected to remain challenging in the year. The Board remains focused on its strategic growth drivers, including North America and licensing, and remains confident in the business's agility to navigate further market uncertainties, supported by the Company's strong cash position. The Board's expectations for the current year's performance are unchanged."

Webcast of results recording is available on SDG’s website here. I’m listening to it now in the background. It feels a little flat compared with previous more energetic presentations, does that matter though?

Balance sheet - is very strong. NAV of c.£87m becomes NTAV of £60m, which includes £16.3m of net cash. The current ratio is very strong at 3.33 - this is a very conservatively financed business with no gearing, so I would say solvency & dilution risk are close to zero. This is a sleep soundly share for value investors.

Note that the pension scheme is still cash hungry, with the cashflow statement showing £2.3m pa contribution to pension schemes.

Paul’s opinion - I find the current market cap an extremely gloomy valuation for a decent business, that is weathering the consumer downturn very well I think (thanks to surging licensing revenues).

I was amber/green last time, but with shares now just below 100p, I think it’s too cheap, so will go up to GREEN.

There are risks of course. Some of the licensing revenues are lumpy, so we can’t guarantee every year will produce resilient profits. A profit warning at some stage is entirely possible.

I think the value of the brands & archive, could be worth more than the current market cap. So for patient investors, I think this could be a fairly decent investment in the long-term. It seems well-managed too.

A volatile share that does big movements -

Focusrite (LON:TUNE)

Down 9% to 335p (£198m) - H1 Results - Paul - AMBER

Focusrite plc, the global music and audio products company supplying hardware and software used by professional and amateur musicians and the entertainment industry, today announces its half year results for the six months ended 29 February 2024 ('HY24').

The highlights table below reveals an unhappy H1 performance with adj EPS (my preferred measure) down 57% on H1 LY.

Also note that net debt has risen a fair bit, which it blames on seasonal stocking-up - although it has since come down a bit in April -

…net debt has now reduced from a net debt position of £27.3 million reported at the end of H1 to approximately net debt of £25.1 million at 22 April 2024.

Adjustments are reasonable in my view - being almost all related to amortisation of goodwill. It is customary to adjust out that non-cash item, and I’m fine with that, as I always eliminate all intangible assets anyway, hence the related amortisation charge would also be eliminated.

Outlook for the full year sounds OK (in line), although we don’t tend to like H2 weightings as they can sometimes be wishful thinking, and develop into a profit warning -

Though the industry outlook, particularly for Content Creation, remains tough, we remain encouraged by our product registration data which is comfortably outperforming the market.

The sustained robust performance of our expanding Audio Reproduction division offers a positive counterbalance to the ongoing headwinds in Content Creation.

With a series of planned product launches in the coming months and a continued emphasis on our strategic growth initiatives, which will lead to a greater weighting of sales in the second half, we remain confident of meeting our full-year expectations."

Note below that broker forecasts have come down a lot, with the biggest lurch down being the most recent after its March 2024 profit warning -

FY 8/2024 forecast is now 25p, and it did 7.7p in H1. Therefore 17.3p is needed in H2 to hit target. That’s quite a big jump up from H1, but might be achievable, as it mentions new product launches in H2. Subjectively, I feel that the chances of another profit warning here look medium, so I’d want a lowish forward PER to compensate for that risk - say 10-12x, which on 25p EPS gives me a target share price of 250-300p (versus 335p at time of writing - so a little bit above what I would be comfortable with).

My previous notes show that TUNE was trading in line on 19/1/2024, but issued a profit warning on 18/3/2024 - I commented at the time that the plunge to 272p looked overdone, and that a bounce was possible. It did rebound, but so far today’s H1 results seem to have left investors cold, with some of that previous bounce being given back.

Broker notes - we don’t get any - a glaring gap in TUNE’s investor relations. So all we’ve got to rely on is the broker consensus numbers, which usually update quite quickly. Hence I don’t know what the premium brokers are telling their favoured clients today. Often when a share price drops sharply, despite an in line update, it can be because brokers have slipped out downgrades without telling us plebs. It’s not a level playing field, is it? This area needs urgent reform.

Going concern - some interesting explanations of how they’ve reviewed the finances, and stress tests, etc. These sections are very useful, well worth reading, and I’m trying to remember to always read the going concern note at all companies with debt.

It gives itself a clean bill of health, with supporting (credible I think) explanations.

Balance sheet - intangible assets are £87m, so deducting those from NAV of £118m, gives NTAV of £31m. We could deduct the £10m deferred tax too, which would adjust NTAV up to £41m, which is about right for the size & type of business, I feel.

My concern is that inventories of £55m seem much too high. Note that H1 cost of sales in the P&L was £42m, so it’s holding well over 6 months’ sales within inventories. Normally I would expect inventories to be maybe 1-2 months’ sales. This is costly, because there’s £36m of bank loans in current liabilities, effectively funding this considerable over-stocking.

The danger with excessive inventories is not just that it’s costly to finance now interest rates are higher, but also that there could be slow-moving, or impaired items within inventories, that get a provision made against them at the year end audit, or have to be cleared at low (or negative) margins to shift them.

This is a worry. TUNE needs to explain what it’s doing to reduce excessive inventories.

It does reassure on this issue in the commentary though, so hopefully this is just a timing issue, and not something more serious -

Net debt3 of £27.3 million (HY23: net debt £13.2 million) has increased due to higher working capital levels, with higher stock in Audio Reproduction to support growth and higher debtors in Content Creation both of which are expected to largely reverse in the second half of the year.

Cashflow statement - more than all the cash generated is absorbed into working capital, with a big reduction in trade creditors in particular. This looks like normalising trade creditors from a spike up at the last year end six months earlier, so nothing to be concerned about, but combined with the excessive inventories, this is why net debt has risen.

A key point, mentioned before, is that TUNE capitalises a ton of development spending on product innovation, patents, etc - £5.1m in H1 alone (up on prior year). See note 8. Hence why EBITDA is meaningless here. It has to run to stand still, with continuous product development.

Paul’s opinion - tricky one this. I moderated from green to amber/green after the March 2024 profit warning, but am thinking whether I should moderate further to amber, given the poor H1 results, unconvincing outlook (with H2 weighting), and balance sheet & cashflow issues (which hopefully are only temporary).

It’s now looking obvious that the big surge in pandemic sales was a one-off, that has reversed. Hence the share price should be much lower than the highs reached at the bull market peak in mid-2021.

Another risk is that I go cool on what is fundamentally a decent owner/managed group, just near the low point, then end up kicking myself as it strongly recovers in future - I’m sure we all know that feeling well!

Bottom line, I cannot predict the future, and can only go by the facts & figures as of today. That means logically I have to go with AMBER for now, and will happily revise that up once trading starts to improve.

Or an alternative view would be to just ride out the softness in trading this year, taking a longer term view.

Almost a round-trip in share price since since Dec 2014 AIM listing -

Graham’s Section:

LSL Property Services (LON:LSL)

Up 4% to 280p (£291m) - Full year results - Graham - AMBER/GREEN

This is “a leading provider of financial services, surveying and valuation and estate agency services”.

It had a positive trading update in March, covered by Paul.

After a difficult 2023, improvements in the health of the housing market are flowing through to better performance for LSL:

The mortgage and housing markets were significantly disrupted in 2023, impacting the financial performance of the Group. However, following a positive final quarter of 2023, the preliminary results are slightly ahead of expectations. Momentum has continued to build further in 2024, particularly in our Surveying & Valuation Division. Over the first quarter, Underlying Operating Profit was materially above the same period in 2023, reflecting the benefits of the Group's transformation programme completed in 2023 as well as improving market conditions.

Net cash was £35m at year end - a very healthy level for a company of this size, and LSL today announces a share buyback for an initial amount of £7m. That’s only a little more than 2% of the market cap, but it’s a good start.

CEO comment snippets:

"2023 marked a period of significant progress in our transformation to a higher margin, less capital-intensive business that will perform more consistently through market cycles…

"Following this significant restructuring, LSL is now a more streamlined, agile Group comprising three market leading businesses with high return and organic growth opportunities that are well positioned to capitalise from the recent recovery in the housing and mortgage markets….

Some key bullet points regarding the company’s actions:

Converted an owned estate agency to franchisees. - excellent! The franchise business model is a huge success elsewhere, e.g. Property Franchise (LON:TPFG).

Separated off its B2C businesses into Pivotal Growth, a joint venture. LSL’s core activities are now focused on B2B.

Sold a London estate agency brand “which did not fit into our overall franchising strategy”.

Bought a mortgage network (Feb 2024).

Result of the above: annualised cost basis reduced by a remarkable £140m.

Of course revenues will also reduce, e.g. converting an estate agency to a franchise business model will mean sharing profits with the franchisees.

The company states that it believes its weighted average cost of capital is 12% - I find that few companies will publicly state this. Good transparency! It means that if the company can’t earn a return of more than 12% on investments, it should instead return the surplus cash to shareholders.

Dividend is unchanged at 11.4p for the year.

When you have a long verbal commentary at the beginning of a results RNS, it’s often the prelude to very bad numbers. This is the results table for 2023:

The company emphasises that the like-for-like revenue decline was only 10%, not the 34% shown above. Given the mortgage market troubles, this is understandable.

Current trading and outlook

As noted at the top, mortgage market conditions have improved in 2024. The company continues:

It was against this background of improving activity and Group trading that we issued a trading update on 6 March, since which time trading has remained ahead of expectations. At the end of Q1 2024, Group Underlying Operating Profit was materially ahead of the same period in 2023. This improved trading reflects better market conditions as well as the benefits of the new Estate Agency franchise model, improved lender contracts, and our decision to retain surplus capacity throughout the second half of 2023 in our Surveying & Valuation business.

Although we retain a degree of caution, inflation data still suggests that interest rates will reduce in 2024, which would help support our markets. This, together with the strong performance since our recent trading update on 6 March, reinforces the Board's confidence, and our expectations for full year Underlying Operating Profit have increased further.

Estimates for FY Dec 2024 have increased again at Zeus. They have increased their revenue estimate by 2.5% to £164m and their adj. EPS forecast by 14% to 18.6p. The current share price 280p divided by 18.6p implies an adjusted PER of 15x.

Graham’s view

This company hasn’t interested me too much before, but I’m sitting up and taking notice of today’s results.

We have:

A rational capital allocation policy, including an explicit WACC and a commitment to returning excess cash to shareholders, starting with a £7m buyback.

A business model I really like - the franchise estate agency model.

Possible comparisons (with thanks to Zeus for mentioning it) with another business model I like at Mortgage Advice Bureau (Holdings) (LON:MAB1).

Developments here suggest that LSL is now a much higher-quality business than it was before, implying that a PER of c. 15x makes good sense.

I’m therefore maintaining Paul’s AMBER/GREEN stance.

Dalata Hotel (LON:DAL)

Down 0.5% to 372p (EUR €934m) - AGM Statement - Graham - GREEN

Dalata is “the largest hotel operator in Ireland, with a growing presence in the United Kingdom and Continental Europe”.

After Jet2’s statement yesterday suggested a little softness in pricing for their package holidays and flights, let’s look at the travel industry from a different angle with this share.

Dalata has 53 hotels with a total estimated value of €1.7 billion and 2023 revenues of over €600m.

2023 saw new properties added to the portfolio in Amsterdam, London and Edinburgh.

2024 will see new hotels in Liverpool, Brighton, Manchester and London.

So how is 2024 going so far? Here is an excerpt from the AGM statement.

(RevPAR = revenue per available room.)

2024 has commenced with good performance for our UK portfolio which is expected to achieve modest RevPAR growth on January to April 2023. We also continue to see healthy levels of corporate demand across all regions.

As reported during our full year results in February, there has been lower levels of trade in Ireland…

RevPAR for the Group is expected to be 4% behind 2023 for the period of January to April on a ‘like for like’ basis.

As we look ahead, we remain optimistic in our outlook for the remainder of the year where trade typically is driven by stronger seasonal factors…

The Group has considerable firepower available for further growth in line with our ambitious and disciplined growth strategy. We remain focussed on growing in 11 key cities in the UK and establishing a presence in targeted large European cities with a strong mix of corporate and leisure demand.

Graham’s view

It’s not a great start to the year, but with eight months left there is plenty of time for things to pick up.

When it comes to the bigger picture, I appreciate Dalata’s ambition to expand and I’m a fan of their Clayton and Maldron brands.

The value metrics here strike me as potentially tempting for new investors:

When I last looked at this share, back in August 2023, I gave it the thumbs up.

With the share price unchanged, I’m inclined not to change my view. The company’s expansion plans will bring financial risk but after generating net income of €90.2m in 2023 (which does not include revaluation gains on property of €92m), and free cash flow of €133m, I would say the company is entitled to expand.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.