Good morning, it's Paul here.

Thanks for the positive comments yesterday. Things work much better when I'm at home, on the south coast, and can properly devote my energies to these reports. It all goes haywire when I'm in London, so will keep away from the capital, for the time being, and certainly in this heatwave.

To catch up on a couple of things from yesterday;

Empresaria (LON:EMR)

Share price: 68.5p

No. shares: 49.0m

Market cap: £33.6m

I remember when some friends and I met management of this small, international staffing group, about 4 years ago. We came away with the idea that it was good value, and I bought some stock at about 56p. Anyway, it's largely done a Grand Old Duke of York since - as so many shares do actually. Perhaps we like to kid ourselves that we have great insights, but in reality, we often just get lucky in catching an upward surge in share price, that subsequently reverses.

One issues that bothers me with Empresaria, is the unexpected departure of the former CEO called Spencer Wreford. At company meetings (he was previously CFO) he seemed to be in control of the facts & figures. So why did he suddenly leave on 27 June 2019? That bothers me.

Today's update seems to mention numerous divisions, for such a tiny market cap company. Does that really make sense, to have all these different small subsidiaries, in different countries? I struggle to see the logic of such a business model.

Trading - the last sentence sounds reassuring;

As expected, adjusted profit before tax for the first half is anticipated to be approximately £3.7m (2018: £4.7m) excluding the costs associated with the previous CEO stepping down in June 2019 which have been treated as exceptional. This reflects the lower starting position of businesses in Germany and Japan along with the impact of Brexit uncertainty in the UK and a higher central cost base following the investments made in the second half of 2018.

The Board is positive about the prospects for the second half of the year and the Group remains on course to deliver adjusted profit before tax in line with market expectations.

Net debt - I've tried very hard, but have never really got my head around the various elements of this, and whether I'm comfortable or not.

My opinion - tricky one. It looks very cheap - a forward PER of only 5.5.

But, the staffing sector is very much out of favour. Look how much larger Staffline (LON:STAF) (in which I recently took a long position) collapsed from c.1400p to a 100p emergency fundraising. That was a rapid & unexpected unravelling. Different business model, but even so.

I really cannot see any reason to buy into a tiny, illiquid, staffing company, right now - when the economic situation is looking uncertain.

I bought some STAF in the 100p placing, and have topped up a bit since, as a Singapore-based staffing company with pots of cash, appeared with a 7% holding in STAF recently. That's looking a bit of a special situation. I wouldn't want to buy any other staffing company right now, due to macro worries.

Aston Martin Lagonda Global Holdings (LON:AML)

Down again, by 25%, to 775p, on a poor trading update.

I'll take a look at the next figures when they come out.

It floated recently at about 1900p, which looked racy at the time.

As a former AM owner (DB7) myself, you never forget the branding, the leather, stitching, and wonderful Cosworth 6 litre V12 engine roaring into life after pressing the big red knob. Tramps shouting "Noice car mister!", and wanting to shake your hand, and absolutely no envy or hatred from anyone, of the sort that Porsche owners have to endure & ignore on a daily basis! (tongue is in my cheek here, by the way!! :)

That doesn't necessarily mean the shares are any good though. AML has so far struck me as a bull market top type of float. But I would never short it, as some mad, oil-rich car buff could always come along and buy it for a silly price.

Marston's (LON:MARS)

Down 11% on a trading update. I only mention it, as EI (LON:EIG) recently had a takover approach at c.38% premium. So the pubs sector does look ripe for consolidation. Might be worth a look?

accesso Technology (LON:ACSO)

Talking of possible takeovers, this share went up 43% yesterday, on news that it's had approaches, and is putting itself up for sale.

As mentioned before, PE/VC groups are awash with cash, and seem prepared to pay sometimes amazingly high prices. So I think this is an interesting area of the market to look into - i.e. bombed out tech shares in the UK, that might attract bid interest.

I've always found this company almost impossible to value. It's never really made much, if any, free cashflow, but nobody seems to care. With so much cheap cash sloshing around, and a tech boom that is starting to make 1998-2000 look like a warm up, anything could happen.

Cobham (LON:COB)

An agreed takeover bid, at £4bn, a 34.4% premium to yesterday's price. The bidder is an American private equity firm. This is very interesting, because press reports are saying that venture capital & private equity have literally trillions of dollars of cash sloshing around, looking for acquisitions. That should provide rich pickings for investors who are able to identify takeover targets (or more likely, just get lucky).

It is also food for thought for us, in that deals are happening in the UK, with Brexit seemingly not a concern. If the big players are not concerned about Brexit, why should we be paralysed with fear about it? There's the risk that sitting on the sidelines in cash, could mean missing out on takeover deals.

Low & Bonar (LON:LWB)

Another deal to quickly report on, before I get on to today's trading updates & results.

When I last reported on LWB, I concluded that the high levels of debt, and profit warnings, made it too high risk.

Today the group announces the sale of a subsidiary for £15.4m, which will help reduce net debt somewhat. It might be worth looking at this afresh, once debt has been brought down further.

VP (LON:VP.)

Share price: 800p (down c.3% today, at 13:56)

No. shares: 40.15m

Market cap: £321.2m

Trading statement (AGM)

Vp plc, the equipment rental specialist...

It's short, so here is the full statement today;

"Trading in the new financial year has been broadly in line with management expectations. The core UK markets of infrastructure, construction and housebuilding have continued to be supportive, although we have seen some geographical variance in demand, particularly in London and the South East, where market conditions have been more subdued. Our International division has also had a satisfactory start to the new trading year.

Notwithstanding an element of uncertainty in the wider economic outlook, we believe that the Group remains well positioned to make further progress in the current financial year."

Translating that into plain English, this is what it says to me;

- Trading is a little below expectations, and

- We're not quite confident enough to say that we'll meet market expectations for the full year, but it probably won't be far off.

With the share price only down 3%, it looks like they got away with it!

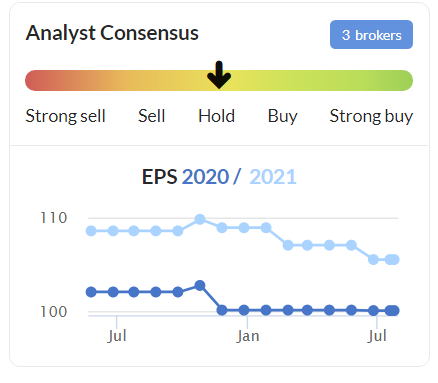

Broker consensus - note that this marvellous little graph has been improved in the new Stockopedia site, and now includes 2 years' consensus estimates & how they've moved over the last year;

Notice how the 2021 forecasts have been edging down (the light blue blobs/line).

Note from the 2 year chart (below) that the share price has already fallen c.36% from last summer's peaks of c.1250p;

Also note above, how the new Stockopedia site (which I'm experimenting with) also now includes the historic levels of the StockRank. That's really handy. As you can see, the Stockopedia computers have moved from being very positive about VP, to now only middling (StockRank of 54).

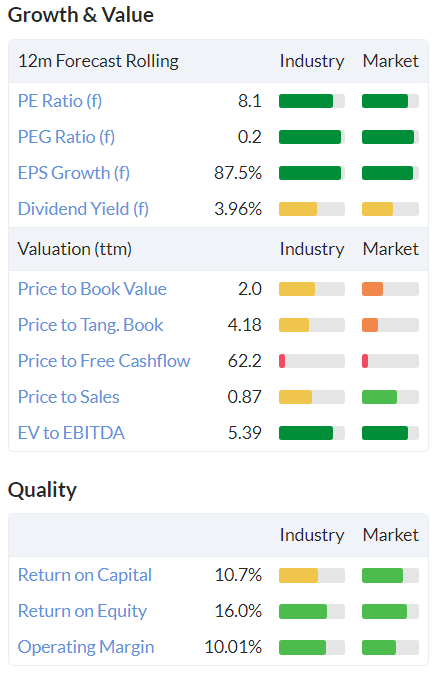

Valuation - is starting to look more attractive now. The forward PER is only 8.1, whereas this share normally trades a good bit higher than that. This must reflect worries about the outlook for the UK economy (is a recession coming?), and whether it can meet forecasts (which are maybe a little challenging now?)

My opinion - It's important to note that equipment hire companies suffer badly in recessions, as work dries up, but costs remain fixed. Therefore, my instincts tell me that this is absolutely not the time to be buying anything in this sector. It might even be a time to think about putting on some small short positions, if you think a recession is coming? (Great care is needed though, shorting is best left to professionals, as the downside risk is open-ended).

The trouble is, we just don't know where we are in the economic cycle. It feels like we might be near the end of this economic recovery. But with interest rates seemingly permanently near zero, the old rules seem to have gone out of the window. My feeling is that slowdown is more likely than continued growth, at least in the short term (next year), but that could easily change any time.

There's a cloud hanging over VP regarding a Competition & Markets Authority investigation into "suspected anti-competitive conduct as regards the supply of groundworks products in the UK", that is underway. That's another reason why the share price is depressed. Who knows what the outcome might be, and if negative, what the potential costs & fines might be? I don't like to hold any share which is in a situation like that, as I don't have the expertise to accurately assess the risk - thus making it impossible to value this share accurately.

A possible read-across from recent results from groundworks contractor Van Elle Holdings (LON:VANL) yesterday - it reported sharply lower profits, and "uncertainty & volatility" in its markets - project delays, due to Brexit uncertainty, and the liquidation of Carillion. That seems to tie in with what VP is saying today about a slowdown in London & the SE.

Overall then, I think it's safest to watch this one from the sidelines.

Gordon Dadds (LON:GOR)

Share price: 153.5p (up 9% today, at 15:21)

No. shares: 28.8m

Market cap: £44.2m

Gordon Dadds Group PLC (AIM: GOR), the London-based acquisitive legal and professional advisory business, is pleased to announce its audited results for the year ended 31 March 2019.

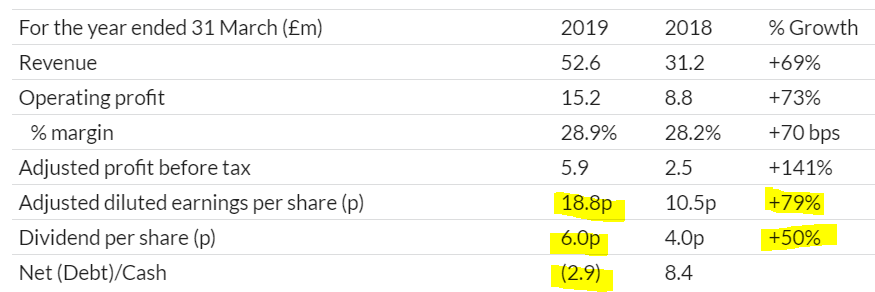

This share was flagged up in the comments section below, by Andrea34l - who pointed out that the results look strong. The highlights certainly look good, although this must be driven by acquisitions to achieve such a big uplift in revenues & profit;

Comments on the above;

- That's a huge increase in EPS to 18.8p - a PER of only 8.2

- Divis up 50%, and a yield of 3.9% - good for an acquisitive group (as they usually only pay small divis, in order to fund growth)

- Modest net debt too - so it looks like this group has avoided the pitfall of taking on too much debt, to fund an acquisition spree.

So far so good, I like the look of this already!

Is there a catch, yes of course! If it looks too good to be true...

The main catch is that there's a ton of deferred consideration, around £29m, plus more since the year end, which is payable in c.3 years.

Balance sheet - is terrible. -£21.7m NTAV even after recent fundraising.

My opinion - a classic example of "rainmakers" locked in for 3 years, cashing in on nice deals, who would then be free to leave, and take future profits with them.

All done for today, thanks for dropping by.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.