Good morning from Paul & Graham! Many thanks to Roland for covering a couple of days off for me, with excellent service maintained I'm sure you'll agree!

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices). My video explaining/reviewing it.

My other video (June 2024) - How to screen for broker upgrades on Stockopedia.

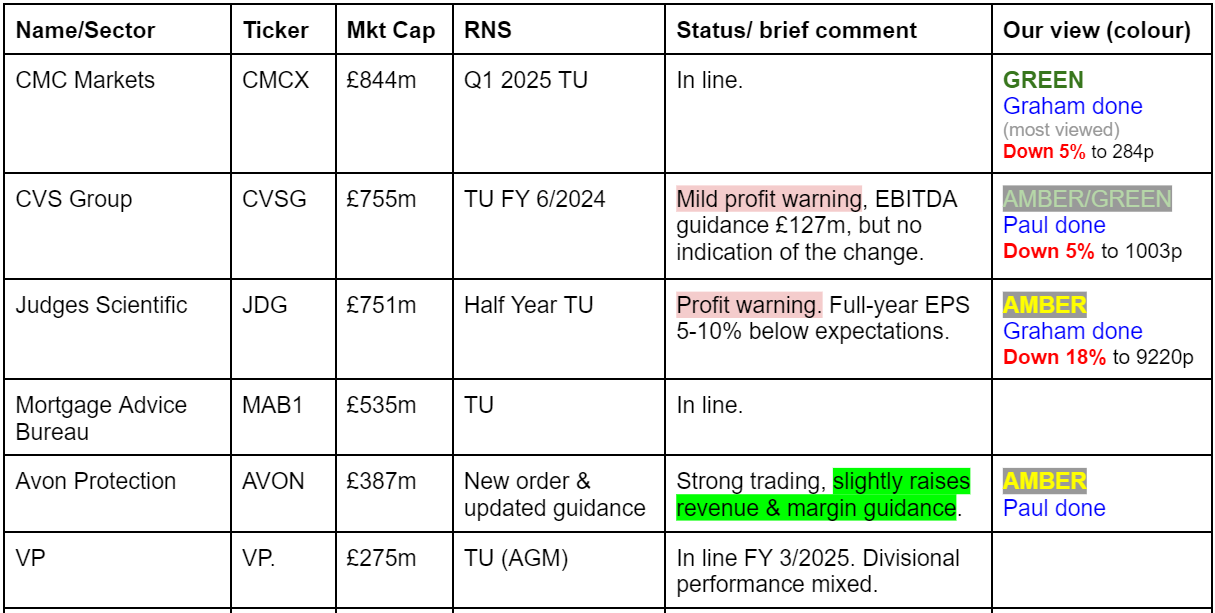

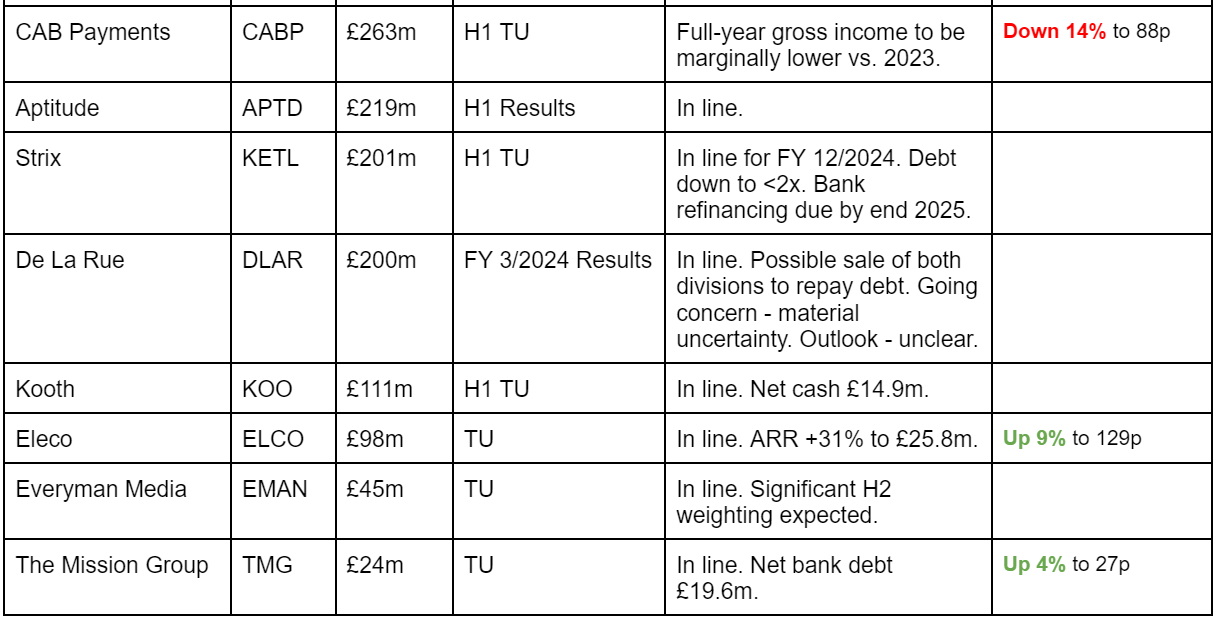

Companies Reporting

Other mid-morning movers (with news)

Novacyt SA (LON:NCYT) - up 20% to 55p (£38m) - H1 Trading Update - Paul - No View

Quite complicated, with various moving parts, so this is a special situation. Some interesting elements to today’s update, including a large cash pile remaining after settling its dispute with the UK Govt (health dept). Reckons it should get a big VAT refund on invoices which will now not be paid (makes sense to me). Lots of cost cutting since acquiring Yourgene.

Could be worth a fresh look perhaps?

Indivior (LON:INDV) - up 17% to 966p (£1.29bn) - H1 Results & $100m Share Buyback - Paul - No view

I flagged this as potentially interesting to research, after a sharp fall on 9/7/2024.

Today the market responds very positively to H1 results and a big share buyback.

It says Q2 was in line with reduced guidance. Expects settlement of litigation.

Today’s update strikes a much more positive tone, eg -

“While 2024 has proved to be a more challenging year than we had anticipated, we remain highly confident in the underlying fundamentals of our business and strategy, and that we are on a clear path to create substantial shareholder value. Reflecting our confidence, we are today announcing a new $100m share repurchase program which we intend to execute over an accelerated time frame."

I remain of the (uninformed!) view that this share looks potentially interesting. It remains highly profitable.

Cyanconnode Holdings (LON:CYAN) - down 8% to 7.6p (£22m) - FY 3/2024 Results - Paul - RED

CyanConnode Holdings plc (AIM: CYAN), a global leader in Narrowband Radio Frequency (RF) Smart Mesh Networks, announces its audited results for the year ended 31 March 2024.

This is a jam tomorrow that always seems on the cusp of great things, but never quite gets there.

Revenue growth is quite impressive, up to £18.7m in FY 3/2024.

Gross margin seems to fall almost every year, and was only 30%

It’s another thumping loss, of £(4.2)m at operating level.

Almost out of cash again.

Reckons it can raise bank loans in India. A Director has lent it £400k as an advance on a tax credit.

“Material uncertainty” in going concern note.

Receivables on balance sheet are far too high - red flag.

Paul’s opinion - very high risk, its finances are obviously on a knife-edge. Why get involved, when it could go bust, or do a highly dilutive equity raise? Bulls have to just hope that the supposed big orders come in, and even then it would probably need more equity for working capital. Too risky, why get involved when it’s a complete gamble? Occasionally one of this type of share multi-bags, but far more often they grind down to nil.

Summaries

Avon Protection (LON:AVON) - unch 1,278p (£387m) - New order & updated guidance - Paul - AMBER

Today's update is a modest increase in profit guidance of c.3-4% if I've done my sums right. That's not enough to get me interested. Shares have already more than doubled in 18 months, despite no increase in forecasts, so it's now on a rich valuation which I'm struggling to understand. Bulls must be confident there are further improvements in trading in the pipeline.

Judges Scientific (LON:JDG) - down 19% to £91.81 (£510m) - Half Year Trading Update - Graham - AMBER

Full-year EPS will miss forecasts by 5-10%. The decline in the share price today reflects that miss and also takes some of the air out of the earnings multiple. But with huge clouds hanging over the business in China/Hong Kong and declining quality metrics, I would be wary about investing at this valuation.

CVS (LON:CVSG) - down 1% to 1,040p (£766m) - FY Trading Update - Paul - AMBER/GREEN

A familiar problem here trying to interpret an unclear trading update, without access to any broker updates. I've managed to piece it together, as looking like a mild profit warning. The share price has barely budged, so it looks as if maybe the downside risks are priced-in? Various issues, including the ongoing CMA investigation into vets over-charging and lack of price transparency & competition. Who knows how that will end? I'm taking a risk here, but think there could be more upside than downside, hence AMBER/GREEN.

CMC Markets (LON:CMCX) - down 0.7% to 297.5p (£833m) - Q1 2025 Trading Update - Graham - GREEN

The range of possible outcomes for FY March 2025 remains very wide, as it’s too early to predict customer trading activity at this point in the financial year. But signs are looking positive for reduced costs and with a successful launch of the tie-up with Revolut. Still plenty to excite investors here in my view.

Paul’s Section:

Avon Protection (LON:AVON)

Unch 1,278p (£387m) - New order & updated guidance - Paul - AMBER

This has been an interesting situation. Shares have more than doubled since the Oct 2023 low c.600p, and I think it’s become quite a crowded trade, with lots of PIs getting involved, backing a turnaround. However, the impetus for the share price doubling has been a PER re-rating of the shares, not an increase in earnings forecasts - as you can see below -

In this type of situation, investors are clearly betting on the company beating forecasts.

I can’t find anything more recent, but a note from Zeus dated 23/5/2024 is titled, “Good momentum but valuation full” at 1378p. The market price is now at 1278p. Zeus had a forecast of US$0.501 adj EPS back in May, for FY 9/2024. That was actually a reduction on the previous year’s US$0.58 EPS actual.

Note the currency! I just had to re-write this section, as I originally misread the EPS figures as being in pence, and got nonsense results out.

Today’s news is positive -

Follow-on order for $19.5m - compares with forecast revenues of $269m for FY 9/2024. Was it in the forecasts? That’s not clear.

Good visibility (I assume this means for the combat helmets part of the business) -

“This gives good order cover well into FY2026.”

“Overall trading has continued to be strong…”

Guidance is raised - thankfully giving the previous guidance too, which is crucial, yet often omitted by some companies -

If I work out the effect, it doesn’t look that great, because Zeus’s May 2024 note already had in adj operating profit margin of 10.7%. So raising that to say 11.1% would only add $1.0m to Zeus’s existing forecast, from $30.5m to $31.5m adj operating profit. Nothing to get excited about, and barely worth RNS-ing. Maybe some other brokers had lower estimates though?

Just realised I forgot to add on the extra 1% revenue growth, but that’s only a couple of hundred £k in operating profit, so not material.

Overall then it looks like a c.3-4% increase in forecast earnings. That still leaves the PER very high.

Here were last night’s valuation metrics -

Management sound upbeat -

“Jos Sclater, CEO of Avon Protection plc, said:

"Our market leading protection technologies and contract frameworks position us well in the current geopolitical environment.

We have successfully rebased the business to create a fitter, stronger organisation and it is encouraging to see the benefits of our transformation plan and continuous improvement culture drive improved financial performance.

We still have a lot of work to do but are increasingly confident that our strategic initiatives will enable us to meet our medium term targets."

Paul’s opinion - I don’t know the company in any detail, so I can only go by the forecasts, which don’t really impress me. Certainly not enough to justify paying anything like a PER of 25.8x forward earnings. Or slightly less once today’s modest upgrades go through.

Bulls must have done more research, and become comfortable with the idea that prospects are better than brokers are currently forecasting. That’s the only reason I can see for paying this much for a company with a lacklustre track record, and not madly exciting current forecasts -

Hopefully for the bulls, performance will beat expectations - it needs to, to justify the current price, let alone provide further upside. Good luck with it! Please remember all we do here in the SCVRs is assess the facts, figures, and forecasts on any given day. We’re not trying to foretell the future, that’s your job! So if you think AVON will thrash forecasts, then that’s your bull case, let’s hope it works out for you. I don’t see attractive risk:reward here, so will sit on the fence with AMBER again.

Can AVON shares get back to former glories? It's possible, since there's not been any dilution over this period -

CVS (LON:CVSG)

Down 1% to 1,040p (£766m) - FY Trading Update - Paul - AMBER/GREEN

CVS, the UK listed veterinary group and a leading provider of veterinary services is pleased to issue the following update on trading for the financial year ended 30 June 2024 ("FY24")1, other business developments and Board changes. The Group expects to announce its FY24 preliminary results on 26 September 2024.

The big story here was shares crashing on news of the Competition & Markets Authority (CMA) launching an investigation into the UK vets sector being taken over by price-gouging corporations. Anyone who’s got a pet will know how much more expensive vets have become over the years, as they’ve turned from local practices, into corporate branches.

Key points today -

LfL sales growth has slowed from 7.3% last year (LY) to 2.9% this year.

Problems? Cyber incident in April 2024, softer demand, adverse publicity (re CMA), cost of living.

These caused an estimated reduction in LfL sales from 4.1% to 2.9%, so not a disaster.

Adj EBITDA margin at “lower end” of stated 19-23% range.

Overall - this sounds like a profit warning, but since it doesn’t provide any detail of what the previous guidance was, we’re in the dark. This is a recurring problem with lots of companies. What we need is a simple before/after guidance section. Isn’t that obvious? Instead CVSG has made it really difficult for me to find out the financial impact (if any) of today’s update. That cannot be seen as good reporting.

“As such the Group expects to report FY24 Adjusted EBITDA4 of c.£127m (unaudited)”

Looking back at its H1 numbers (to 31/12/2023), adj EBITDA was £63.0m, and 19.1% of revenues.

So the latest FY 6/2024 guidance of £127m implies a very similar H2 result of £64m adj EBITDA.

Last year (FY 12/2023) showed equivalent adj EBITDA of £57.8m in H1, and £63.6m in H2.

Therefore it seems that the H2 weighting of last year hasn’t happened so much this year, implying a profit shortfall of about £5m in H2 this year, would be my guess.

That’s as far as I can go with incomplete information, so it looks as if today’s profit warning is only mild. The barely-moved share price confirms the above.

Other points -

International expansion (esp Australia) is on a big scale with £82m spent on 28 sites this year.

Leverage has increased, and was 1.5x EBITDA at 30/6/2024. Its target is under 2.0x. Plenty of liquidity, through undrawn facilities of c.£165m.

Capital allocation policy is reiterated (see RNS for the details).

Net bank debt is growing and quite hefty, although not a cause for alarm at this stage (assuming the CMS investigation doesn’t deliver a hammer blow) -

“Net bank borrowings as at 30 June 2024 were £168.0m (31 December 2023: £129.2m, 30 June 2023: £74.0m).”

CMA - will grind on for a while -

“Competition and Markets Authority

The Group, continues to support the CMA with their market investigation and has responded to a number of detailed information requests. The Group also held a "teach-in" session with the CMA on 24 June 2024 and has arranged site visits for 31 July 2024. The market investigation is expected to conclude by November 2025 with an interim update expected from the CMA in April or May 2025.”

Outlook - headwinds, but it’s powering on with its (partly) debt-fuelled expansion -

“CVS has strong long-term prospects and great people. The Group is facing short-term headwinds with the recent cyber incident and modernisation, softening demand and the ongoing process with the CMA. The fundamentals of the sector remain very strong with an increased population of pets, pet life expectancy increasing and continued advancements in the provision of clinical care.”

Balance sheet - is weak, but that probably doesn’t matter, since it’s a cash generative business.

It’s using more than all its cashflows for capex and acquisitions, with the gap being funded through increased debt.

This leaves a balance sheet increasingly laden with intangible assets. Leaving a NTAV deficit of £(55)m at 31/12/2023.

This is not necessarily a problem though, unless something really bad transpires from the CMA investigation. Just bear in mind that an adverse outcome from that regulatory review would leave a fairly highly indebted group with nothing in NTAV support.

Valuation - simplifying it to EPS, the StockReport shows the latest consensus at 92.9p for FY 6/2024, which has been in a gentle downtrend. So it looks as if all the acquisitions of overseas sites are not managing to offset a decline in UK earnings. That worries me a bit, because the increased levels of debt are incurring higher finance costs.

The PER is c.11.2x which looks cheap, although adjusting for the increased debt would probably move it up to about c.13x. Possibly still cheap, but there needs to be a discount for the regulatory uncertainty from the CMA.

Note that divis are negligible, because it’s using all the cashflows to reinvest in capex, and buy up new sites. I wonder what the regulatory framework is like in Australia?

Paul’s opinion - overall, I can see that this share might have appeal in the hope of the CMA investigation delivering (as expected) a requirement for increased transparency over fees, and some other small measures. Hopefully that might not impact profits or cashflow very much, which would then open the door for CVSG shares to re-rate onto a higher multiple maybe in 2025?

A bad outcome from the CMA might require CVSG to dispose of some of its UK sites, or face onerous measures of some kind. I’d like to know the market share figures for CVSG and MediVet in the UK, which seem the dominant corporate vets groups.

On balance I’ve decided to go AMBER/GREEN here, as regulatory hurdles can usually be accommodated without disastrous consequences, and I think a forward PER of 10.6x probably gives an attractive enough discount to make this worth a slightly above average risk punt, for a 1-2 year potential recovery.

Let me know what you think! Have I taken leave of my senses, do you see more risk or reward here?

Before signing off, I should emphasise that most of us are fully aware that vets are highly trained, and do a great job, nobody is quarrelling about that. It's the corporate structures, and associated greed, that are the issue.

Graham’s Section:

Judges Scientific (LON:JDG)

Down 19% to £91.81 (£510m) - Half Year Trading Update - Graham - AMBER

I’m afraid we have a profit warning from this old favourite of ours.

If you check the archives, you’ll find that I’ve been anxious about this share in recent times. Most recently, I gave it an AMBER in March 2024. Indeed, I’ve been nervous about this valuation, and neutral on JDG stock, since it first approached £600m back in March 2023.

The latest news is that H1 trading has been “subdued against a backdrop of difficult market conditions and versus record prior year comparatives. The challenging environment has caused mixed trading across our Group.”

Key bullet points:

Order intake down 4% vs H1 2023.

Orders: China/Hong Kong down 65% (!), North America down 9%, Europe +2%, Rest of World +34%.

Revenue down 3% vs H1 2023 (only down 9% in China/Hong Kong. There is a lag between order intake and revenues).

Earnings per share is down by a fifth vs H1 2023, with cash conversion “below the levels traditional for Judges”.

Outlook includes a reminder that Geotek’s latest contract will not produce any recognisable revenue in the current year.

Geotek was acquired for £80m in 2022, being the largest ever acquisition by Judges. It is prone to generate lumpy revenues, implying that Judges’ future results could be noticeably more volatile than they were in the past..

The outlook concludes as follows:

Despite the expectation of an improved second half, the Board no longer expects the Group's performance to recover sufficiently to enable us to deliver a year-end performance in line with current market expectations*. As a result, the Board now anticipates earnings per share to be between 5 and 10% below the consensus.

The Group still maintains a healthy order book, and a solid financial position, which gives the Board confidence that the subdued performance of the first half doesn't hamper the Group's continuing strategy.

While I don’t doubt that the company has good control over its finances, I should point out that net debt as of Dec 2023 was £45m. As Judges has grown, it has grown more comfortable with using larger bank facilities.

A recent RNS from the company announced that its bank facilities were now £140m (£90m RCF + £50m accordion).

Consensus expectations were for Adj. EPS of 384.6p. The new range of possibilities is therefore 346p - 365.4p.

Graham’s view

My concerns here have been two-fold. A) A highly demanding valuation. B) Deteriorating quality, making the valuation particularly difficult to justify.

Today’s near-20% fall in the share price has taken some of the air out of the valuation, but EPS is missing forecasts by up to 10% anyway. So it’s still commanding a hefty multiple at this level, on revised earnings:

Indeed, I calculate that the PER on current-year earnings is now 25x - 26.5x. That could be a price worth paying if you are happy to look past 2024 and see Geotek’s next contracts providing a boost to revenues and profits from 2025.

But the overall Judges group is bigger than Geotek, and overall order intake is remarkably weak, particularly in China/Hong Kong.

The broker note from Zeus suggests that tough local competition is the reason for the fall-off in orders in that geography. This is a theme we’ve seen before, as China has its own unique approach to intellectual property rights. We’ve seen before that Westen companies sometimes find that their competitive advantage doesn’t last in that market. And this is not something that can typically be reversed: when the competitive advantage is gone and replaced by local Chinese businesses, it doesn’t come back.

Putting China to one side, some short-term weakness in global orders wouldn’t matter too much if Judges could still make acquisitions at attractive valuations that moved the needle. But I think the jury is still out on that (excuse the pun).

The acquisitions completed in H1 2024 were Luciol Instruments (priced at CHF 2.5m / £2.2m) and Rockwash Geodata (priced at up to £6m). These were attractive deals at single-digit earnings multiples, but surely deals of this size will struggle to make a big difference to the fortunes of a group valued at over £500m.

Therefore, I have to retain my cautious approach here and stick with a neutral stance. What Judges has achieved over the years is fabulously impressive. But with weak order intake, small acquisitions that probably can’t move the needle, and declining quality metrics, I would still have my doubts about whether the current valuation can provide an attractive entry point for investors.

Stockopedia’s graphics illustrate how a stock that used to sometimes trade at “value” entry points, no longer does so:

CMC Markets (LON:CMCX)

Down 0.7% to 297.5p (£833m) - Q1 2025 Trading Update - Graham - GREEN

This is a simple trading update: Q1 performance (April to June) has been in line with expectations.

The new partnership with Revolut is highlighted:

The initial onboarding of Revolut clients has commenced and some clients are now live and trading. Further details will be provided at our half year results in November as the partnership picks up momentum and develops over the coming months. This exciting and important partnership reinforces CMC's position as a market leader and innovator in the B2B fintech space through technology and our API ecosystem.

Unchanged Guidance is for net operating income of £320-360m (last year: £332.8m).

Costs excluding bonuses and non-recurring charges will be c. £225m.

The corresponding costs figure last year was higher at £237.2m: one of the reasons for CMC’s enormous share price gains in 2024 has been its ability to cut costs. On that point, it says today that it “remains focused on opportunities to drive additional cost efficiencies”.

Bonuses and non-recurring charges also need to be considered, on top of the base costs figure.

Last year, bonuses (“variable remuneration”) were £18m. They were £17m the year before.

Non-recurring charges last year consisted of a £12m impairment.

CMC’s presentation of its profits is usually quite clean and I’m hoping for another reasonably clean set of numbers this year, without any excessive or unreasonable non-recurring charges. Redundancy costs are likely to appear prominently.

Graham’s view

Based on the numbers above, there remains a very wide range of possible outcomes for FY March 2025.

At the low end, perhaps we should see an operating profit this year (excluding non-recurring charges) of at least £75m. At the high end, it could be £115m+.

After taxes, the consensus figure on Stockopedia suggests that net income could be £49.3m. Clearly there should be scope to beat that if net operating income is at the higher end, but it’s too soon to tell.

It’s worth noting that interest rates are a factor as CMC earns income on client deposits and on its own cash (£35m earned in FY March 2024). That might not be a big factor in terms of FY March 2025 but for future years, the path of interest rates certainly needs to be taken into account.

Finally the tie-up with Revolut, announced in June, strikes me as something with the potential to be huge for CMC. The initial product set includes FX, Index, Commodities, Treasuries and Equity CFDs.

I am a heavy user of Revolut, although I’ve commented publicly before that I do have some risk-related concerns that, until they are resolved, would prevent me from trusting it with larger deposits. But those concerns are probably irrelevant when it comes to the partnership with CMC - from the point of view of CMC, I would say this is a very exciting opportunity to expand the usage of CMC’s trading infrastructure. Hopefully we can learn more about this partnership very soon.

On balance, I’m happy to maintain my positive stance here.

It’s true that the PER is now arguably demanding:

However, the company reported net assets of over £400m as of March 2024, mostly tangible. Within this figure “own funds” were £325m and straight cash was £160m. So I think there are plenty of liquid assets to help support CMC’s valuation, even over £800m.

Even the algorithms don’t think that the value on offer here is all that bad. And they give a nearly perfect Quality score!

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.