Good morning from Paul & Graham!

Today's report is now finished.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

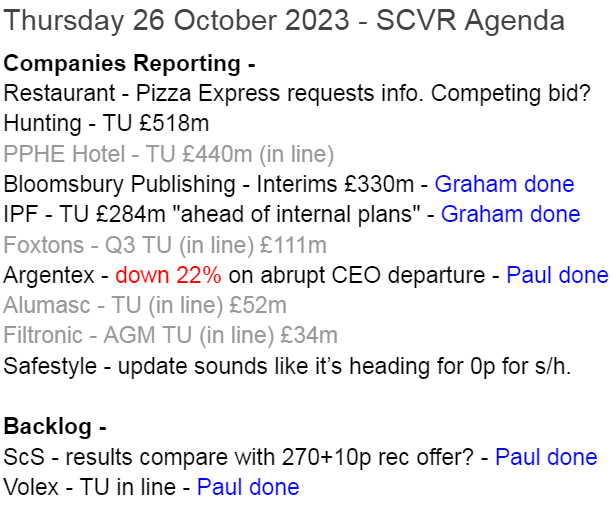

Summaries

SCS (LON:SCS) - 270p (£92m) - Preliminary Results FY 7/2023 - Paul holds - GREEN

I suspect the undisturbed share price (ie. if no takeover bid at 270p +10p divi) would have probably dipped from about 160p to maybe 150p on this update? That's because profit is down about 33%, and the outlook comments indicate a softening order intake recently. Hence shareholders are currently being offered a fairly attractive price relative to what it might have been without a bid. On balance I think the 270p+10p offer looks reasonably fair, given tough macro. Holders (including institutions) may hold out for more, but then run the risk of the deal falling through. Your money, your choice as to what to do if you hold.

Volex (LON:VLX) - up 1% to 285p y’day (£517m) - H1 Trading Update - Paul holds - GREEN

Another in line update, with customer destocking offset by good growth in other parts of the business. So much to like here - a successful business, growing strongly through a seemingly well-executed acquisition strategy, all for a PER of only about 10. I remain a firm fan of this share.

International Personal Finance (LON:IPF) - down 0.2% to 127.7p (£286m) - Trading update (ahead) - Graham - GREEN

This international group offering home credit, credit cards and online loans continues to perform “ahead of internal plans”. I remain impressed by its improving profitability and intrigued by the cheap valuation on offer, despite good share price performance in 2023.

Bloomsbury Publishing (LON:BMY) - unchanged at 404p (£330m) - Interim Results (in line) - Graham - GREEN

Solid interim results from this publisher which sells into both the consumer and the academic/professional markets. It has big ambitions to grow its “Digital Resources” business and is now less geared towards H2/Christmas seasonality. Appears to be a quality outfit.

Argentex (LON:AGFX) - down 22% to 75p (at 12:39) £85m - Board Change - Paul - AMBER

A sharp downward move today, on news of the abrupt departure and replacement of the CEO (and 12% shareholder). It's not clear what has happened. I quickly review the last interim numbers, which weren't bad, but sounded a bit wobbly on outlook. I'm guessing it might be limbering up for another profit warning perhaps? Too opaque at present, so I'll sit on the fence with AMBER. It's also not a sector I'm interested in owning either.

Paul’s Section:

SCS (LON:SCS) (Paul holds)

270p (£92m) - Preliminary Results FY 7/2023 - Paul - GREEN

Obviously we had the huge news this week, of an agreed (by mgt, but not shareholders) 270p takeover bid (plus 10p divi) from an Italian trade buyer, for this furniture retailer.

Allow me a moment to wallow in the glory here, as we’ve been saying here for as long as I can remember that SCS was a sitting duck for a buyer. That's because the favourable working capital dynamics of furniture retailing means that they sit on a whacking great cash pile, which continuously rotates (with some fluctuations), which could easily be stripped out and used for other purposes, and replaced with a seasonal overdraft. Which is exactly what larger competitor DFS has done for years. Amazingly, I even made a video about this, comparing the balance sheets of DFS and SCS, showing the obvious value sitting on a plate, ready for extraction, at SCS, but it’s buried somewhere in youtube and I cannot find it. Post a link if you can resuscitate it, as I want to look smug for a brief moment, to offset all the things I get wrong! (which is how small caps work).

At this stage, all that matters is - how much is the company worth based on the fundamentals and outlook, and how does that compare to the quick exit price of 270p + 10p divi? (takeover bid, or market sale). It’s a simple choice, and of course small investors have the luxury of being able to sell some or all in the open market immediately. I like selling half sometimes, to keep my options open, in bid situations, and to claim victory irrespective of the final outcome!

Others have pointed out that the bid announcement didn’t seem to have any declared support from institutions, and mgt shareholdings are shockingly trivial, especially galling given their greed with excessive remuneration (for lacklustre performance I’d say).

One investor pointed out to me that any bidder would have a c.10% instant boost to profit by clearing out overpaid management - a point that is backed up by the figures, so difficult to argue with. Do they think they’re running Marks & Spencer or something?!

Shareholding structure matters most in takeovers. Here (below) we can see there are 3 significant institutions, who don’t seem to have backed the deal publicly anyway. Although I doubt mgt would have recommended the deal without at least tacit agreement from major shareholders.

Is this a case where the 270p deal (+10p divi that people would have got anyway, so it’s not really part of the takeover price) is out there in the open now, and institutions might be hoping for a higher competing bid? Quite possibly I’d say, although SCS might be too small to attract much interest from private equity, other than niche players? Who knows? It’s all exciting guesswork at this stage.

The danger of course is that if shareholders reject the takeover deal, then the share price could crash, and never recover - as happened with the rejected Stonegate offer for Revolution Bars of course at over 200p, which is seared on my memory, and has now lost over 98% of that price, years later. So sometimes it can be a big mistake to reject a takeover deal.

The other question is whether the Italian trade buyer can be persuaded to sweeten the offer, given that everyone knows it’s paying for a lot of the deal using SCS’s own cash pile, something I’ve been shouting about for years! (you do start to doubt your own sanity sometimes with things like this, when nothing happens for years).

OK, that’s the background. Now it’s time to erase our memories, like they did on Blakes 7 when dealing with alien species rather than UK small cap takeover bids, and look at the numbers afresh, pretending that there hasn’t been a bid. How would the market have reacted to these numbers, if the share price had been at an undisturbed pre-takeover bid 160p?

ScS, one of the UK's largest retailers of upholstered furniture and floorings, is pleased to announce its audited preliminary results for the 52 weeks ended 29 July 2023.

Good that the numbers are audited (as expected).

It splits out the losses from a small acquisition (called Snug), so underlying numbers are most relevant, with £9.2m underlying PBT for FY 7/2023, down 33% on LY (FY 7/2022).

That’s not bad, given how tough macro, and consumer sentiment is, and SCS’s mkt cap is only £92m.

Share buyback of £7m completed, so the share count has now fallen a lot since 2019.

Balance sheet - a key point, as we’ve discussed here many, many times!

NAV is £46m. Take off £4m intangible assets, and NTAV is £42m - good, but under half the £92m market cap now.

Lease entries suggest it has an issue with some loss-making sites: RoU asset £89m, liabilities of £101m. Actually that’s not too bad, so not a big worry.

Cash pile of £69.5m, with no interest-bearing debt. At 76% of the market cap, this is enormous! As I've always, correctly, said, a bidder could remove this cash and use it to repay bridging finance, and that would pay for most of the purchase cost of buying SCS, using SCS’s own cash! If the buyer is soundly financed, it would have no trouble then arranging some debt on top of that, similar to what DFS has done with its own balance sheet, and hey presto, anyone with a decent credit history could buy SCS for nothing! It’s bonkers really.

All of this only unravels if credit dries up - which is exactly what happened in 2008, when SCS went bust. I looked back at the numbers, and was shocked to discover that SCS looked healthy in 2007. But when the banks withdrew credit, its favourable working capital cycle literally froze, and it went bust. Something to remember, if you invest in any company that relies on customers paying before creditors have to be paid. We saw an inkling of this this week with Mission (LON:TMG) actually, when its net debt shot up because customers have stopped being generous with up-front cash payments - no doubt because customers CFOs are saying, hang on I can earn 4% on that cash, stop throwing it around like confetti to our suppliers.

This is why you need to really look hard at all parts of balance sheets, not just the year end probably window-dressed numbers.

Bottom line though with SCS, is that I reckon its cash pile is likely to be pretty safe, and it’s c.£70m. That could, and maybe will, pay for most of the £92m acquisition price, and the Italians could then slap on a £30m overdraft, and they’re laughing all the way to the Trevi Fountain! They’ve bought SCS for nothing!!

This is no revelation, hence why I suppose SCS’s institutions don’t want to back this deal. They probably want something better to come along, and it might. Or it might not.

Outlook - cash fell from £70m to £57m at end Oct 2023.

Also note apparently slowing demand recently.

Although this can be fine-tuned with marketing spend, which reaches a crescendo around Boxing Day of course, as we oscillate between egg nog, James Bond, Mary Poppins, and dreaming of how much better social housing might look internally with a new SCS sofa at unbelievable never to be repeated, half price offers that they do most of the time.

I’m only pulling your leg! Some of these designs actually look quite nice, and prices low enough to see a new sofa as a regular, not big-ticket purchase maybe?

Paul’s opinion - tricky one isn’t it! We all knew the prevailing 160p share price was absurdly cheap, but it pertained for a long period of time. This is due to a structural mis-pricing of UK small caps currently - it’s more about supply and demand for the shares, than the value of the companies.

Meanwhile, private equity and trade buyers, are picking off the ones they want, at premium prices. This is a fabulous opportunity for stock pickers. I cannot remember ever seeing anything like it actually, in my 25+ years in the small caps market.

Stockopedia subscribers can discuss in the reader comments what you want to do, and how to make your own buy/sell decisions - sell now for a bankable profit, or hold for an improved offer? (but risking that it falls through).

I reckon that SCS shares probably would have fallen a little, to about 150p, on today’s wobbly outlook comments, if there had not been a takeover bid.

So the 270p takeover bid is offering you the chance to bank a fat profit compared with a depressed market valuation. Of course we can all see that longer term SCS is worth more than 270p, but maybe not that much more I'd say. It only peaked just over 300p in a roaring bull market in 2021.

On balance then, I’m inclined to sell my own very small SCS shareholding, and recycle the money into any number of other ludicrously cheap shares. Then we get a double benefit.

Or, we could sit and wait for an improved offer on SCS, which may happen.

Selling half also sounds a sensible option to me.

Let me know what you think!

Volex (LON:VLX) (Paul holds)

Up 1% to 285p y’day (£517m) - H1 Trading Update - Paul - GREEN

Volex (AIM: VLX), the specialist integrated manufacturer of critical power and data transmission products, today issues an update on trading for the 26 weeks ending 1 October 2023 (the "Period" or "H1") and the cyber security incident announced on 9 October 2023.

This is one of many small-mid caps that tends to drift down between announcements, as people worry about macro impact on its trading. Then we get in line updates each time. It’s the same this week, we’re reassured -

The Group continues to maintain strong financial momentum and is well positioned to achieve full-year results in line with market expectations1,2…

2. The Company has compiled forecasts from four analysts with current market forecasts for the 52 weeks ending 31 March 2024 for revenue to be in the range of $849.8 million to $891.0 million, with a consensus of $864.6 million, and for underlying operating profit to be in the range of $82.3 million to $87.0 million, with a consensus of $84.3 million.

Excellent, very clear reporting there. Hats off to owner/manager Nat Rothschild for building a significant sized, and decently profitable group here.

Remember that Volex was quite a mess years ago. I can remember being initially sceptical about its turnaround, but then turning positive on it possibly around 2019 from memory, when the figures really began to strongly improve.

Since then, Volex has been absolutely transformed through a turnaround, and it seems an effective, value-building, disciplined (not over-paying) bolt-on acquisitions strategy.

Revenue growth in H1 of 4% is quite modest, but that’s organic, and against a strong comparative.

Customer de-stocking is mentioned, an important point of general read-across that I’ve spotted other companies mention too - higher interest rates mean that companies generally want to reduce cash tied up in receivables and inventories. Improving supply chains also mean that companies feel safer to run down inventories back to more normal levels.

I’m impressed that Volex seems to have been able to ride out and offset this destocking -

This has been more than offset by strong demand in Medical and Complex Industrial Technology supported by better availability of key components. There is evidence of de-stocking slowing in some channels, as order patterns are starting to normalise, particularly in Electric Vehicles.

Major recent acquisition $195m - of Murat Ticaret - positive-sounding comments on this. It will contribute 7 months to the P&L for FY 3/2024.

Debt - “covenant leverage” of 1.3x looks fine to me, and would only become an issue if trading fell off a cliff. Also I cannot imagine that the owner/manager called Rothschild would have a lot of trouble arranging bank facilities!

Cyber incident - we have to trust management on these things, but I don’t see (or even hear) any alarm bells ringing here -

… there is not expected to be any material adverse impact to revenue or underlying operating profit as a result of the incident. Costs for the recovery and remediation of systems are anticipated to be approximately $2 million, which will be reported as an exceptional item in the second half of the year.

Hopefully they’ll now have bulletproof IT protection going forwards, as far as it can be done.

Outlook - most companies are sensibly sounding cautious in their outlook statements, given all the macro trouble, and risk.

Volex sound pretty upbeat to me, and I trust what management say here, as their track record is good. Also, well-chosen acquisitions can be a nice way to mop up any shortfalls in performance elsewhere - so rising debt needs to be considered against rising earnings.

I like that Volex has a good spread of sector exposure too, which seems to smooth out peaks and troughs. It’s all sounding encouraging to me -

Volex delivered a robust performance during the first half of the year, despite the challenging backdrop, whilst executing its most significant acquisition to date.

The Board remains optimistic of a number of potential near-term sales opportunities to make further progress in the second half of the year, and remains on track to deliver full-year results in line with market expectations.

That’s very good actually, given tough macro.

Paul’s opinion - I hold a small position currently. I really must buy some more. It’s GREEN again.

The forward PER of 10.3x seems modest, considering the excellent track record here, and no signs of any impact from macro problems. Could it warn on profit in future? Possibly, I don’t know. Hopefully the nice exposure to growing sectors could continue to mop up softness in other areas, who knows?

This is hard to argue with, and a forward PER of 10x seems distinctly undemanding -

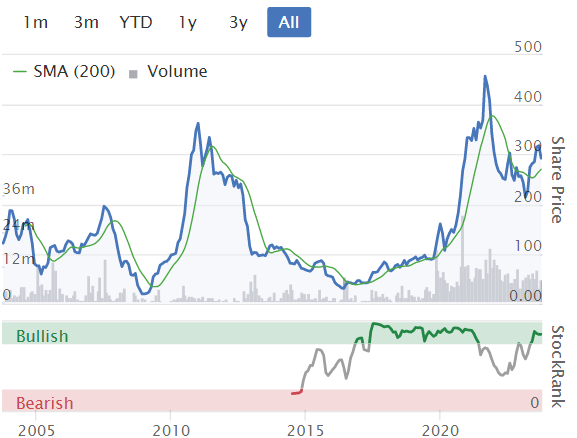

Argentex (LON:AGFX)

Down 22% to 75p (at 12:39) £85m - Board Change - Paul - AMBER

A severe negative reaction this morning, to the abrupt departure of its CEO - although I’ve just had to edit the bit above to change it from -29% earlier this morning, to -22% now, so it’s found some buyers since the initial plunge.

Argentex Group PLC (AIM: AGFX), the service-led, tech-enabled provider of currency management and payment services to international institutions and corporates, announces that Harry Adams, Chief Executive Officer, has left the Company with immediate effect.

An interim CEO, Jim Ormonde, who seems to have relevant sector experience, and has acted previously as a consultant to AGFX, is appointed interim CEO.

This seems rather odd, and suggests to me some kind of board room bust up, especially with a replacement (interim) CEO already on hand.

Looking for more clues as to what’s going on, the Chairman is quoted today in the RNS as saying -

"We have recently conducted a review of Argentex's strategy and have identified a number of areas of focus to ensure the continued growth of the business. Jim is an experienced operator with a strong track record in successfully scaling technology businesses and I am pleased that he has agreed to step up and lead the team to start the important process of implementation."

This all suggests to me that things can’t be going well.

Interim Results were published on 13 Sept 2023, for the 6-months to 30 June 2023.

We didn’t cover them at the time, so I’ve had a quick look now.

H1 numbers look fairly good, with revenue up 28% to £25.0m, and PBT up 12% to £4.8m. Remember that’s just for a half year.

Balance sheet - looks decent with c.£40m NTAV at 30 June 2023.

Outlook - indicated “more challenging trading conditions” post period end, but still positive at +20% revenue growth. Indicated “a greater season reduction in market activity”, whatever that means - typo possibly with “season”, did it mean seasonal perhaps? Trading in line with full year expectations.

Paul’s opinion - I can’t see anything wrong with the interim numbers, other than saying that growth seemed to be slowing, with no particular reasons provided - must be competitive pressure I suppose.

I can see why the market has taken fright at the sudden CEO (Harry Adams) departure, and others have commented that he is a major shareholder at 12.2%, which creates uncertainty over his intentions with that shareholding - could it create an overhang perhaps?

I baulk at valuing this share on the existing 9.06p broker consensus, as this has a whiff of impending profit warning about it, which is what the share price is saying too.

It’s too uncertain for the time being, so I’ll stick with AMBER which we viewed it as when last looking, in Jan 2023.

I’m not keen on the forex & payments provider space, as there are so many companies active in this area, and I don’t have the knowledge or sector experience to sort the wheat from the chaff.

Indeed we saw yesterday with Cab Payments Holdings (LON:CABP) (I’m ashamed to admit I caught the falling knife there yesterday at 60p, with my punting segment of money, which is not looking at all clever now it’s struggling to hold 50p) - how quickly the wheels can come off when something unexpected changes. Which raises the no.1 investing question for all companies - are profits sustainable?

All these companies claim to have great technology, and seem to be exploiting a gap in the market for forex that the big banks seem happy to let them enjoy. There seems to be lots of competition, and new entrants, things constantly changing, etc, so I just don’t know where to start with this sector. Hence why I’m happy to completely ignore it.

I imagine we might see a weak trading update, possible profit warning from AGFX once the new CEO has got his feet under the desk. Then a revised strategy, maybe slowing the rapid expansion & headcount growth, and cost-cutting, at a guess?

At this stage it’s impossible for me to value, so I’ll just file this under “don’t know” - AMBER.

Shares have almost halved from the highs in the spring of this year -

Graham’s Section:

International Personal Finance (LON:IPF)

Share price: 127.7p (-0.2%)

Market cap: £286m

This is an unsecured lender to customers primarily in Eastern Europe and Mexico. Its shares remain “cheap” despite decent share price performance over the past year:

I’ve viewed it as a high-risk, high-reward financial stock and liked what it offered shareholders at a cheap valuation: e.g. see the SCVR comments in August and in April.

Today we have a Q3 trading update with good news: “the group has continued to perform ahead of internal plans”.

Growth figures:

Customer lending fell 1% year-to-date as the home credit business in Poland has declined due to new regulations. Excluding Poland, lending is up 11% year-to-date. Lending in Poland was down 23%.

Despite lower lending, overall customer receivables at constant exchange rates rose 4% year-on-year to £875m. (A loan book can grow even if the volume of new loans is falling!).

Poland: IPF has issued 100,000 credit cards as it changes the business model to deal with the new regulations. Half of these cards were issued in Q3 alone!

CEO comment excerpt:

Credit quality is very good throughout the Group, and our balance sheet and funding position remains robust. We continue to make good progress in raising new funding and refinancing our existing facilities which will support our future growth plans.

A key performance indicator is the revenue yield: this is revenue divided by average receivables and we can think of it as the annual interest rate that IPF charges on its entire loan book. This KPI is now 54.8%, up 4 percentage points compared to last year.

Repayments: the annualised impairment rate is 12%, versus 8.5% a year ago. This is “fully in line with our expectations as impairment rates normalise and we continue to grow our business

Once again, IPF says it has not seen “any discernible impact from the cost-of-living crisis on customer repayment performance”.

Profitability: IPF’s profit margin continues to improve as the cost-income ratio falls from 63.9% all the way down to 56.7% year-on-year. The medium-term target for this ratio is 52%-54%.

Definition:

The lower this goes, the better!

Balance sheet: IPF has borrowings of £519m with available liquidity of £100m.

Today it announces that it wants to issue a new bond that will be available for retail investors on the ORB. It has an old 7.75% retail bond expiring in December 2023 - half of the holders of that bond already swapped it for a new 12% bond expiring in 2027. It seems that it wants to make a fresh offer to holders of the December 2023 bond (about £40m is left outstanding).

More importantly, IPF is already looking at ways to refinance its €340 million 9.75% Eurobond, maturing in November 2025.

Outlook

We will continue to maintain a cautious approach to lending given the uncertain macroeconomic landscape and maintain tight cost control across the Group to drive cost efficiencies.

Our strong performance through the first three quarters of the year, together with our robust balance sheet and funding position, gives us confidence in delivering a good performance for the year as a whole and provides the foundation for delivering further strong growth in 2024.

Graham’s view

I remain a fan of this business, although I acknowledge that it’s high-risk. The company’s debt is rated junk by the agencies and some investors will feel much safer owning IPF debt rather than equity. Maybe the risk:reward is even better with the debt: earning 12% interest as a lender to this company doesn’t strike me as a bad deal at all. I’ll be curious to see what price the new proposed retail bond achieves.

The company is still operating at a much safer level than it feels it is able to: it is actually hoping to take more risk as it continues to grow, in a manner that boosts profit margins and returns on equity.

The most recent balance sheet (June 2023) showed equity of £463m, or tangible equity of £410m. That compares with a market cap today of only £286m.

The share price hasn’t grown today despite another positive update, but the market may have already priced in the good news in recent months:

I remain very interested in this share and I’m not the only one: the StockReport gives it an extraordinary StockRank of 98:

Bloomsbury Publishing (LON:BMY)

Share price: 404p (unch.)

Market cap: £330m

Bloomsbury Publishing Plc (LSE: BMY), the leading independent publisher, today announces unaudited results for the six months ended 31 August 2023.

This publisher of Harry Potter has given solid interim results.

Highlights:

Revenue +11% to £137m

Adjusted PBT +11% to £17.7m

Actual PBT +8% to £14m

Only modest adjustments being made to the profit figures - I like to see it. The “highlighted items” add up to £3.7m and are the normal collection of amortisation, restructuring and acquisition costs.

Consumer division: revenue +17%, adjusted PBT +26% to £11.2m.

Demand for Harry Potter “remains strong” (I presume this means not growing)

Non-consumer division: revenue +2%, adjusted PBT falls 17% to £5.9m.

Dividend plans are unchanged except that reduced seasonality enables more of the full-year dividend to be paid now, rather than at the end of the financial year.

The company helpfully lays out its strategic goals for each division, plus a range of other goals related to growth, employees and sustainability.

Some of these goals look rather undemanding (e.g.”to ensure that new children discover and read” Harry Potter every year) but it’s a helpful layout all the same.

One of the more interesting goals is to see Bloomsbury Digital Resources (BDR) achieve 40% organic revenue growth over five years to 2028, reaching approx £37m turnover.

Expectations: revenue £273m, adjusted PBT of £32.5m. As pointed out by jonno in the comment thread below, this implies no growth in H2 over H1, so it may be conservative. The company does emphasise that it is now less weighted to Christmas (which occurs in H2) but I tend to agree that H2 should be better than H1.

Net cash: £39m, versus £41.4m a year ago. Lots of cash is tied up in receivables of one form or another, which have grown from £115m a year ago to £121.7m.

Outlook: confident of achieving market expectations.

Excerpt:

Our digital strategy anticipated the structural change in the academic market from print to digital learning; a trend which has accelerated and which gives us further confidence in our BDR strategy. Our strategy and acquisitions mean that we have been well placed to capitalise on the market growth to date as academic institutions pivoted at pace to digital learning.

Graham’s view

I see that Paul gave this one a brief comment in July, also covering it in June.

Earnings momentum has been positive:

This is not a company I’ve covered regularly myself but I’m happy to maintain the positive stance suggested by Paul - it appears to be a properly profitable company, of decent quality, and not overly expensive.

Cash flow looks lumpy to me but perhaps that is to be expected as investments and inflows don’t all happen in lockstep.

Here’s a three-year chart:

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.