Good morning, it's Paul & Jack here with the SCVR for Thursday. Today's report is now finished.

Agenda -

Paul's Section:

Foxtons (LON:FOXT) - the London-based estate agent reports surprisingly robust London housing market, with lettings and sales recovering strongly - including rents back up to pre-pandemic levels. That's encouraging for a wider recovery in London activity I reckon, although it remains to be seen how many office workers will continue working from home?

Various Eateries (LON:VARE) - an expanding chain of all day "clubhouse" type bar/restaurants called Coppa Club. There's a bit too much PR spin in today's update for my liking. LFL sales are good, but it glosses over the benefit from temporarily lower VAT, and fails to mention its related party debt, preferring to only mention gross cash - selective reporting that raises my hackles. Market cap of £72m looks a stretch, given that it only has 12 sites, and no track record of profitability yet. But, both customers and investors like new formats, for a while.

Filtronic (LON:FTC) - a reassuring update, in line with expectations for FY 05/2022. Trouble is, the expectations are for only £0.5m profit. No divis for years, and lumpy performance, makes me struggle to understand why anyone would want to own this share. Do explain in the comments section, if there's something great about Filtronic which I've missed.

Virgin Wines Uk (LON:VINO) - results for FY 06/2021 look good, especially when £3.5m IPO costs and pre-IPO finance costs are adjusted out. Growth has slowed from c.30% to c.13% in the new financial year though, now that tougher comps are annualising. Valuation is probably a bit higher than I personally would want to pay, given likely slower growth in future. But overall, it looks a decent company.

Jack's Section:

Inspecs (LON:SPEC) - vertically integrated eyewear and lens manufacturer. Recent IPO that has since made a large acquisition, transforming the revenue profile, but margins are low and the company is loss-making, so wider supply chain issues and cost inflation could be a concern.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to cover trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul’s Section:

Foxtons (LON:FOXT)

48p (pre market open) - mkt cap £154m

Foxtons Group plc (LSE: FOXT), London's leading estate agency, today issues its trading update for the nine months ended 30 September 2021.

“Strong performance” in all business areas

Lettings - revenue strongly up on 2020. Also up on 2019, but only because the £7.1m contribution from an acquisition kicked in for 2021. Stripping this out, lettings revenue was actually down 5.2% on 2019, which they don’t draw attention to!

Sales - a strong recovery here, although £4.8m of the increase is due to an acquisition.

Mortgage broking - has also recovered.

.

.

London lettings market - has fully recovered, which really surprised me, but seems really encouraging about life returning back to normal -

As a result of the Covid-19 lockdowns in 2020 and the early part of 2021, the lettings market in London started the third quarter with an excess supply of listings and with rents in the first half of the year down 9% on pre-pandemic levels. This trend has largely reversed during the quarter, with lettings listings now at historically low levels and rents having returned to pre-pandemic levels in August and September.

House sales - good news here too, this is also better than I would have expected at this stage. The worry was that the market would shudder to a halt when the Stamp Duty holiday was phased out, but that does not appear to have happened -

At the end of September, the sales commission pipeline, based on the value of properties 'under offer', was broadly flat with the same point in 2020 and up over 20% on September 2019. This provides confidence that the increase in sales market transactions in London is not just a function of temporary stamp duty relief. Although we don't have full visibility on future market volumes, the pipeline is encouraging and indicates that revenues in Q4 will be ahead of 2019 levels.

Cash sounds healthy at £24.5m, and it’s doing share buybacks.

Outlook - nothing is said today about performance vs market expectations, but I would imagine the scene is probably set for forecast beating 2021 results in due course.

We have good momentum going into the fourth quarter, with rents back to 2019 levels and an under offer sales pipeline that is significantly ahead of 2019 levels."

My opinion - this update strikes me as a lot more positive than I would have imagined, although the acquisition has made a big contribution. There’s clear evidence here of London’s property market returning to normal, especially with rents having risen back to pre-pandemic levels.

Annoyingly, the company declines to tell us how it’s performing against market expectations - that’s so irritating, because that’s the key information trading updates are meant to give us! So simply ignoring that requirement is not good enough.

However, reading between the lines this looks like Foxtons might report ahead of expectations once Q4 is in the bag, possibly?

Are the shares cheap? It’s only forecast to make £3.85m after tax earnings this year, but I’d say a higher number is now looking likely. Plus it has a strong balance sheet. So the £154m market cap doesn’t look extortionate, but not cheap either.

The trouble is, Foxtons was struggling pre-pandemic, and hasn’t made a decent profit since 2016. I’d need more information on how it’s reduced its lease liabilities, as all those central London showrooms must be expensive.

I imagine today’s update is likely to be well-received by the market today (am writing this pre market open). FOXT shares strike me as more of a short term recovery trade, rather than a good long-term holding.

.

.

Various Eateries (LON:VARE)

81.5p (up 6%, at 08:58) - mkt cap £72m

Preamble - this is a bar/restaurant group which floated in Sept 2020, with well-known sector expert management. I think it’s now an established fact that recent (2020-21) floats have generally been over-hyped & over-priced. Hence the more interesting-looking ones go on my watchlist, and I’ll wait for them to come down to more realistic valuations.

So far, so good, in this regard with VARE -

.

Another problem, is that floats are often too early stage, with stellar early growth being extrapolated out, to justify a toppy valuation. Often fuelled by one-off gains during the pandemic. Parsley Box (LON:MEAL) is the obvious example of that. I was worried that Virgin Wines Uk (LON:VINO) might be similar, but today’s results from it look quite good, and I’ll be reporting in more depth on VINO later today.

Both Various Eateries (LON:VARE) and Nightcap (LON:NGHT) seem too early stage to me. They have celebrity management, with a pot of money to go and open some new bars. The trouble is, there’s not enough track record to be able to value the business accurately yet.

The problem for investors is that any newly fitted-out bar, regardless of concept or branding, will attract customers. Why? Because people are paying about 4-5 times supermarket prices for the drinks, and hence are paying for attractive surroundings within the bar, and hopefully good service & food, and a fellow clientele that suits them - smart bars attract smart people.

That all works great from day 1, with a spangly new fit-out so new bars pretty much always trade well to start with. However, over time the fixtures & fittings begin to wear out, not many bars are properly maintained to continue looking new, and gradually the punters drift away to whichever new bar has opened nearby and looks/feels more attractive.

Therefore if we value an expanding bars group on multiples of site profits from brand new sites, we’re probably over-valuing it. It would make more sense to estimate average profitability (lower) over the 5-year life of the fittings.

This was fundamentally the problem with Revolution Bars (LON:RBG) (I hold) a few years ago, which is being fixed under new management (refurbs now resuming, and delivering a good ROI). Old management had a 7-year update cycle for the capex, which was too long - it should have been 5-years, and with better refreshes during that 5 year period too. Hence many of the bars became tatty, and lost some of their customers, with management instead focused on new site expansion. Not good, when you’re heavily operationally geared with a gross margin in the 70%’s - any downturn in sales has a painful drop-through to profitability.

This is why I’m reluctant to pay top dollar for the newness of VARE and NGHT - I’d like to see more of a track record, and see how its sites trade once they’re say 3 or 4 years old. Also, with both companies, their concepts seem nice enough, but not exactly earth-shattering, and can be easily copied by competitors.

Another one is Loungers (LON:LGRS) (I hold), which does look interesting, as they’re widely regarded as best in class operators, and seem to be doing an effective roll-out of new sites. That said, it is too expensive for me to want to expand my existing (tiny) position there.

Having said all of the above, I can understand why plenty of investors don’t like investing in the hospitality sector at all! As well as the companies mentioned above we also have a variety of large pubcos to choose from. The only one that seems properly differentiated to me, is J D Wetherspoon (LON:JDW) - I enjoyed reading its latest results with typically punchy (and sensible) commentary from Tim Martin.

Listening to Rishi Sunak’s Budget yesterday, it does sound as if Tim Martin’s views have made some inroads into the way the Govt thinks. The sector newsletter today, from Propel, commented on this, with industry insiders saying there seems to be a change of tone from the Government from anti-pub (overseeing many closures, mainly due to cost advantages enjoyed by supermarkets), towards a recognition that well-managed pubs can have a positive community role, compared with the alternatives.

This is what VARE says today.

Various Eateries plc, the owner, developer and operator of restaurant, clubhouse and hotel sites in the United Kingdom, announces an update on trading following the end of its financial year, the 53-week period to 3 October 2021.

Coppa Club delivers strong like-for-like sales

Coppa Club is its main all-day bar/restaurant/clubhouse format. It looks very attractive, with obviously expensive fit-outs - I wonder how often those posh settees will need to be re-upholstered?

Sales since re-opening -

The Group's trading performance since the recommencement of trading on 12 April 2021 has been very encouraging.

Like-for-like revenue across the Coppa Club estate was up +21% from full reopening on 17 May through to 3 October 2021 against the same period in 2019 (pre-Covid).

Several Coppa Club sites delivered record sales months.

That’s good, but we know from other operators that there’s good pent-up demand at the moment, which won't last forever.

Also when VARE last reported LFL sales, 17 May - 20 June 2021 the uplift was higher, at 28.3%. That implies that July-Sept must have been below the +21% reported above for the longer period.

Also, VARE doesn’t mention the benefit from temporarily reduced VAT at the moment. This is having a significant benefit to LFL sales. Some other operators have split out this benefit, which I think VARE should have done too, otherwise there’s a risk that the sales uplift is over-stated from commercial reality.

There’s speculation that the reversion of VAT back to normal might be deferred by the Chancellor but I don’t recall the Budget saying anything about this yesterday (although I was having a nap during the first few minutes).

I’m not really interested in VARE’s Italian themed restaurant, Tavolino, which just looks a me-too type of format. I doubt whether that’s likely to make much difference to the long-term outcome of this investment, Coppa Club seems the important bit.

Cash -

The Group's balance sheet is solid with cash at bank of £19.7m as at 3 October 2021.

I’ve checked the last interim results, and what the company fails to disclose today, is that it also has £12.5m in related party loans. So that makes the net cash figure much lower, at £7.2m

I don’t like selective reporting of numbers like this - it’s dishonest by omission - the full picture should be presented, which means disclosing cash, and debt. We like complete transparency here at the SCVR, that's what builds investor trust in management. So VARE achieves a "must try harder" score from me for transparency.

Coppa Club is now operating 12 venues, not many for a £72m market cap company. The 2 most recent openings are said to be trading ahead of budget.

2 more sites are opening fairly soon, with more in the pipeline. So this is very much a roll-out investment.

Outlook comments reflect what we’re hearing from other operators - a good time to be expanding, but with uncertainty & cost pressures. More sites are expected to be available when the rent moratorium ends. Living wage going up 6.6% to £9.50 won't help the sector either.

Valuation - this is the tricky bit! As it’s so early stage, with newly opened sites there’s no track record to value the company on. So it’s largely guesswork. That completely puts me off.

I’ve seen a note from WH Ireland this morning, but it doesn’t seem to have forecasts in it.

Also, what if broker forecasts are wrong?

The market cap of VARE is considerably more than Revolution Bars (LON:RBG) (I hold), but we don't know if VARE is profitable, and if so, how much? Therefore it’s total guesswork at this stage, which is not how I like to invest. The valuation is entirely based on expectations of future profits, as yet unknown.

Whereas with RBG, I can deduce from the last 2 updates that it generated over £8m in free cashflow in just 3 months after full re-opening, and has paid off all its debt, now holding net cash, and is also in expansion mode. It’s got a chequered past, but so what? I’m not buying the past, I’m buying the future.

Therefore, at this stage, I don’t have anywhere near enough information to judge VARE. But paying £72m for a business with only 12 bars & 1 restaurant, and c.£7m in net cash, looks a considerable stretch to me. I'll monitor progress with interest, and as the facts build, then obviously my opinions in future will reflect that.

Have any readers visited Coppa Club sites? If so, do please post your comments.

.

Filtronic (LON:FTC)

11.8p (down 7% at 10:10) - mkt cap £25m

Filtronic plc (AIM: FTC), the designer and manufacturer of products for the aerospace, defence, telecoms infrastructure and critical communications markets is pleased to provide the following update ahead of its Annual General Meeting being held later today at 11.00am.

The Group's trading performance in the opening months of FY2022 is in line with internal forecasts and shows a healthy improvement on the prior year. Therefore, we remain confident of delivering results for the full year in line with market expectations.

It needs a footnote to say what market expectations are, but there isn't one.

In its absence, I had to look up the numbers in Finncap’s update note today - for FY 05/2022 they’ve pencilled in £18.0m revenues, £0.5m adj PBT, and 0.2p adj EPS - very small profits, which leave me wondering why this company (with erratic historic performance) is valued as high as £25m? If it’s only going to deliver £0.5m adj profit, then I would struggle with a valuation of £5m, let alone £25m.

Maybe investors are hoping for out-performance, and future growth?

My opinion - there doesn’t seem to be anything of interest here that I can see.

Why is Filtronic a listed company? I’ve followed it for years, and nothing much seems to happen. Performance goes up for a while, then goes back down again. It seems to depend on the life cycle of its products, and lumpiness of orders. So how are we supposed to value its future prospects? Maybe there's a blockbuster product in the pipeline?

There don’t seem to have been any divis for the last 5 years. I’d rather invest in something that’s a reliable cash cow, making loads of profits & paying it out in divis, e.g. Somero Enterprises Inc (LON:SOM) (I hold). Why would anyone invest in Filtronic, in preference to Somero? I’m completely baffled by that idea! Maybe there’s some (well) hidden depth to Filtronic which has eluded me?

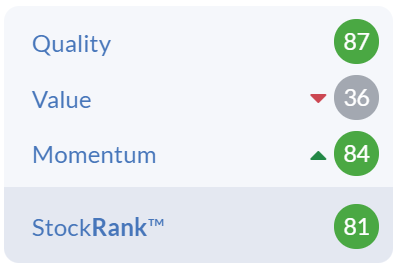

The StockRank is surprisingly high, so perhaps there might be something good here?

.

Virgin Wines Uk (LON:VINO)

194p (up 5%, at 11:32) - mkt cap £108m

This looked quite an interesting float in March 2021, so I’ve been following it with interest - wondering if the strong growth which formed the basis for the float was a pandemic one-off or not? That’s pretty much what happened with Parsley Box (LON:MEAL) so it’s something to be wary about with recent floats. There’s always a risk with every float, that the people who know the business best might be taking advantage of favourable circumstances to part-sell it at an over-valuation, on unsustainably good figures. It happens so often, that no wonder many seasoned investors are highly sceptical about IPOs, with good reason.

As always though, here at the SCVR, it’s the numbers (and outlook) that do the talking, so let’s take a fresh look.

Virgin Wines UK plc (AIM: VINO), one of the UK's largest direct-to-consumer online wine retailers, today announces its audited Annual Results for the year ended 30 June 2021 ("FY21").

Strong growth across all sales channels

Here are my notes -

Revenues £73.6m, up 30% on FY 6/2020 - remember VINO is a beneficiary from lockdowns, as it’s selling wine online, so the prior year comparative would only have had c.3 months pandemic benefit, whereas FY 06/2021 had some level of pandemic benefit throughout. So I think this will have boosted that 30% growth number somewhat.

Q1 in the new year, FY 6/2022 confirms this, with revenue growth slowing to +13.3% - so this is probably a more realistic growth rate to forecast for the future. Any growth is good though, showing that the business seems to be hanging on to the new customers it acquired during the pandemic.

Gross margins quite low, at 31.6%, due to there being a great deal of well-established competition, both physical and online. So it’s not a particularly attractive sector, in my view. Although I would imagine the returns rate on wine is probably very low, and the average transaction value is quite high, both factors which make a lower gross margin more workable. The cash profit on each case is probably quite good, similar to the business model of Gear4music Holdings (LON:G4M) (I hold) - lowish margins, but big basket size, and not many returns. Compare that with fashion, which is a much higher gross margin but a high returns rate destroys a lot of the benefit from that high margin.

Virgin Wines isn’t really doing anything new, they’re just trying to do things well, with a (third party) brand name that has some attractions.

Adj. EBITDA of £7.0m (up from £4.8m LY) looks good, at 9.5%

Reported profits (are much lower and presented badly in the highlights I think, because the £3.5m IPO costs and the pre-IPO finance charges on private equity debt (since repaid) should have been adjusted out - bit of an own goal here in how the numbers are presented.

To demonstrate the point, there’s a table further down which gives a better explanation as to why reported profits are much lower than EBITDA, and it’s unusual costs which don’t apply going forwards, so can legitimately be adjusted out -

.

The way I look at profit, I’m trying to work out what the true underlying profit is, with the new listed company structure & debt, and ignoring any one-offs like IPO costs.

So I’m happy to start with the £7.0m EBITDA then deduct £0.9m amortisation & depreciation (the amortisation relates to capitalised development spend, so should not be ignored).

That arrives at £6.1m adjusted profit before tax, which is a respectable figure.

Personally I’m now factoring in higher future corporation tax at 25%, which it will be rising to, hence I get to my workings of Profit After Tax (earnings) of c.£4.6m - that compares with a market cap of £108m, so a FY 06/2021 adjusted (by me) PER of 23.5 times - not unreasonable for a growth company.

Supply chain - the company makes reassuring noises on this big current issue, and says t brought in stock early for the Christmas trading peak. I wonder if VINO might benefit from people ordering their Xmas stashed of booze earlier, due to worries about perceived shortages?

Balance sheet - looks fine to me. Remember some of the gross cash is the “wine club” funds belonging to customers. So there will be a corresponding creditor to reflect that.

My opinion - I was half-expecting to find some holes in these numbers & outlook, but to be fair, it all looks pretty robust to me. The valuation’s a little warm for my personal tastes, given that growth has now slowed down to 13%, and there’s always going to be customer churn, thus requiring continuous marketing & special offer costs to attract new customers.

As you might expect, I’ve tried out the service myself, and it’s pretty good. The wines were OK, nothing special if I’m honest. Also, it didn’t take me long to realise that the supposed savings from the wine club “interest” are giving with one hand, and taking from the other. I think that there’s probably better overall value sniffing around the supermarket websites, looking for special offers on wines you particularly like, if you can be bothered.

Wine is heavy to buy, so there’s a lot to be said for ordering online and having it delivered. But you can do that from Waitrose, Tesco wherever. Is VINO doing enough to make them a compelling place to buy your wine from? No, I don’t think so. Probably the only truly different player in this sector is Naked Wines (LON:WINE) but I’ve never liked the numbers or valuation there.

Overall, VINO looks a reasonable share to hold, I’m certainly not negative on it, and these numbers are pretty good. I just don’t see enough growth, or an attractive enough valuation, to motivate me to buy this share at the moment, when there are better bargains around from recent small cap sell-offs.

Results webinar - is today at 16:30 on InvestorMeetCompany. Should be interesting, management come across well I think, on previous presentations. They seem grounded & are hands-on entrepreneurs, which is my preference (not plummy-voiced financial engineers in fancy suits!)

.

Jack’s section

Inspecs (LON:SPEC)

Share price: 389.8p (-0.05%)

Shares in issue: 101,290,898

Market cap: £394.8m

Inspecs is a recent IPO that has done rather well, with the share price nearly doubling from 195p to 389.8p over the past 18 months.

The company has built up a vertically-integrated eyewear frame and lens platform, which manufactures products in house for supply to a global network of retailers and brands. It sounds interesting but the concern I have is over pricing power and margins.

Is the manufacture of frames and lenses really where the value is here? It would have to be with the brands, you would think. Margins have been fairly choppy despite annual revenue in the tens (and now) hundreds of millions.

So it’s possibly a more commodity-like market where economies of scale, low costs, and vertical integration are key to outlasting competition.

Essilorluxottica is worth some £63bn though, with operating margins of around 12%, so perhaps this is too harsh a view. There must be some kind of competitive advantage to be gained in this business. Perhaps through a mix of scale, low cost base, and established retail and brand partnerships.

Revenue for Inspecs has jumped recently - clearly a significant acquisition (Eschenbach) - signalling ambition. The important point is whether revenue growth can translate into sustainable value creation for shareholders.

Shares in issue have increased from 71m in 2017 to 101.3m today, while net debt has also risen from about £4m in 2016 to £35.7m. Not necessarily bad things in isolation, but it does show that growth so far is not being organically funded, which is worth bearing in mind.

The group's strong trading performance delivered in the first half has continued into the third quarter with unaudited revenues for the nine months to 30 September 2021 of $185.0m (six months to 30 June 2021: $125.7m). The Board remains cautious of headwinds in the fourth quarter as COVID-19 continues to impact the global supply chain, but the group remains confident in its full year outlook and notes the 2022 order book is in line with management's expectations.

Conclusion

I thought that was the headline comment of a longer piece, but the above is actually the entire update. I suppose many companies don’t even report a Q3 update but there’s still obviously not much to go on here.

Reverting back to the interims from the 8th of September, the group reported revenue up from $16.7m to $125.7m, a gross margin of 44.9%, underlying EBITDA of $17.7m, and a reported loss before tax of $2.6m.

It’s hard to build a vertically integrated, multinational business but Inspecs looks to be doing that. It is not yet profitable but I suspect reaching a certain scale is key here. If it can achieve that, then it could do well. I haven’t looked at it properly since May 2020, when the share price was around 190p. Since then the significant Eschenbach acquisition has fundamentally changed the proposition, resulting in a larger business with more shares in issue.

From the interim results:

We continue to work on further acquisitions with our advisors, as the enlarged Group now has many additional opportunities available to it.

The group needs to scale up and realise some margin gains. It looks more cash generative now, with net operating cash flow of $15.4m compared to -$2.5m. It could continue to scale and reach sustainable profitability, but today’s environment of rising costs and logistical issues means the short term risks have increased, so that’s enough to keep me neutral here for now.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.