Good morning from Graham & Paul!

All done for today! See you tomorrow.

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

** New SCVR summary spreadsheet for calendar 2024 ** This is the live one! (updated 26/8/2024)

Archive - SCVR summary spreadsheet for calendar 2023.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices). My video explaining/reviewing it.

My other video (June 2024) - How to screen for broker upgrades on Stockopedia.

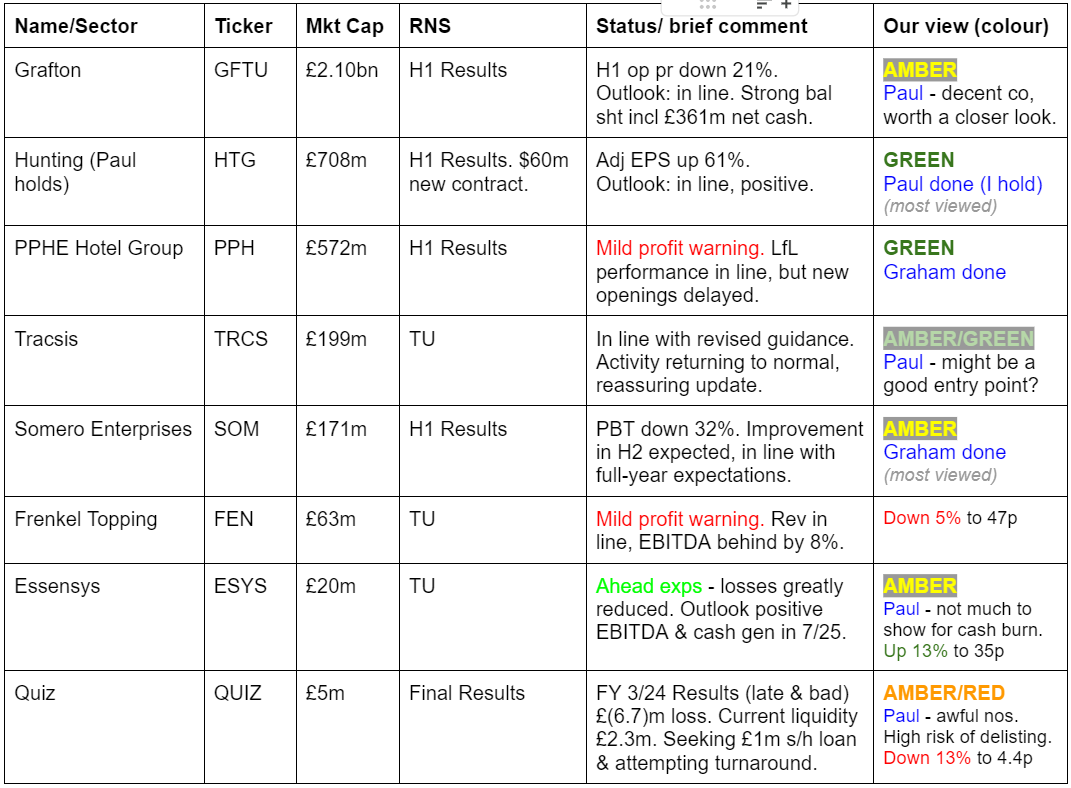

Companies Reporting

Summaries

PPHE Hotel (LON:PPH) - down 3% to £13.30 (£558m) - Interim Results - Graham - GREEN

This is a mild profit warning as a couple of PPHE’s new hotel openings have been delayed by supply chain problems. However, the existing portfolio has performed in line with expectations and the delayed hotels are expected to make a positive contribution from 2025. I remain intrigued by the valuation on offer here, although the market remains sceptical.

Hunting (LON:HTG) (Paul holds) - down 5% to 408p (£672m) - H1 Results & Contracts - Paul (I hold) - GREEN

Good H1 results, although there seems conflicting broker opinion on whether H1 was in line, or behind expectations. FY guidance (raised in July 2024) is re-confirmed. Superb ungeared balance sheet. I enjoyed the informative IMC webinar this morning. This looks a high quality business, with good IP & margins, and profits heading to c. double vs 2023 in 2024. I cannot fathom why the valuation is so modest, it looks obviously undervalued to me, and could attract a takeover bid.

Somero Enterprises (LON:SOM) - down 3% to 297p (£163m / $215m) - Interim Results - Graham - AMBER

Going back to AMBER on this one as I’m nervous about the company’s ability to hit full-year forecasts (revenue of $110m and EBITDA of $30m). International sales have plummeted in certain regions and the home market of North America is seeing sluggish sales, attributed to project start delays and interest rates. While I still think this stock has some attractive features, it hasn’t done enough to get the thumbs up from me.

Paul’s Section:

Hunting (LON:HTG) (Paul holds)

Down 5% to 408p (£672m) - H1 Results & Contracts - Paul (I hold) - GREEN

Hunting PLC (LSE:HTG), the global, precision engineering group, today announces its unaudited half year results for the six months ended 30 June 2024.

The headline numbers look good -

Decent H1 profit growth, combined with a reassuring in line outlook statement, so I expected (as did some brokers in pre-market indications) HTG shares to rise today, but instead they’ve fallen 5%. Why?

The news snippets on Stockopedia news are the first place to look, and we have this item indicating that Jeffries expected better H1 figures -

Full year outlook - is unchanged, and was raised in July 2024 -

“As noted in our July 2024 Trading Update, Hunting has raised its 2024 full-year EBITDA guidance to c.$134-138m, reflecting the impact of the Kuwait Oil Company ("KOC") orders to be delivered prior to the year-end, offsetting trading headwinds seen in the Perforating Systems product group. The KOC orders will continue to be worked through during H1 2025, which supports a positive outlook for the Group's trading well into 2025…

In summary, the Board remains comfortable with current market consensus with the overall outlook positive given the activity levels across multiple regions and product groups and the diversity of Hunting's portfolio.

H1 EBITDA of $60.3m actual, means H2 needs to deliver a higher $73.7m-$77.7m to achieve the July guidance. The way I look at it, they wouldn’t have raised guidance in July if unsure about achieving it, and it’s been reiterated today, so this supposed H1 miss doesn’t worry me. Also Canaccord says H1 was in line, so we have conflicting views from brokers today.

Watching the (excellent) IMC webinar this morning, management are clearly confident about the full year guidance, and mentioned that the order book supports their growth expectations for H2.

Perforating systems division (which makes things like explosive charges for drilling, mining) has been the problem area, with a poor H1 performance seeing profits drop sharply to not much above breakeven. This is due to soft demand in the US, so they have restructured it with fewer staff, and merging two facilities. This has masked superb performances in some of the other growth divisions. Watch the webinar recording for a run through the impressive performances in some other divisions, and the growth opportunities in higher margin areas, it certainly impressed me.

Strategic aims & targets (called Hunting 2030) are progressing as planned. Eg, EBITDA margin has already risen to 12%, with a target of 15%+

Broker note - thanks to Canaccord for its update. It says H1 results were in line, different to Jeffries who expected higher figures seemingly.

For FY 12/2024 Canaccord estimates adj & diluted EPS of 42 US cents (over double 2023 actual), so 31.8 pence = PER 12.8x

Another big rise to 61 US cents is pencilled in for FY 12/2025 (given the record order book and big Kuwait contracts that looks feasible) or 46.2 pence, giving a 2025 PER of only 8.8x - that’s clearly the wrong price for a decent quality business, in my opinion, with no debt too (it’s expected to have £30m net cash at year end).

Balance sheet - I don’t like the way Hunting reports a summary, and you have to click through a link to get the full accounts. That’s not good practice, why would any company do this? Anyway it doesn’t matter because the balance sheet is absolutely superb. NAV is $971m, including intangible assets of $194m, so NTAV is $777m, or £589m. That supports almost all the market cap of £672m. I think this makes HTG vulnerable to a private equity bid, since they could finance maybe half a £1bn takeover bid (c. 50% premium) by loading it up with debt. So I would say the chance of receiving a takeover bid here looks quite high, an added attraction for private investors/traders. But that’s pure guesswork of course.

Cashflow statement - nothing untoward. There was a build-up of working capital in H1, but management say this should improve in H2.

Paul’s opinion - I think there’s lots to like here, having spent most of the morning going through it all. The IMC webinar today was really informative, so I urge you to look at the recording once it’s up (probably tomorrow). It was only 30 minutes, but gave an excellent overview of the group, and its performance, and some Q&A too. I took notes, and always write a conclusion about my view of mgt, and what to do with my holding. In this case I’ve noted down: CEO & CFO both good, and buy more! Obviously as always just my personal view, not a recommendation, as we do our own research here, and take responsibility for our own portfolios.

I cannot see why the market is only giving this decent quality business, making improving margins, with a bulletproof almost debt-free balance sheet, a 2025 PER of only 8.8x? It just seems the wrong price. Maybe there are worries about sustainability of higher profits, or dollar strength, and the cyclical nature of the oil/gas markets which produce over 90% of Hunting’s revenues? For me that is offset by the specialist & innovative nature of HTG’s products, eg N.Sea contracts announced today are really interesting, where HTG has spent several years developing a specialist method of extending the life of oil wells, and efficiently extracting the remaining resources from older oil wells. HTG has over 500 patents protecting its tech, hence the decent & improving margins. That sounds lucrative. It’s now started winning some decent sized contracts oil recovery, eg $60m over 5 years announced separately today. That could have obvious growth potential. Similar things were said about other divisions, where HTG also has proprietary, and high margin products & services.

This looks very good I think, and cheap, so it’s a shiny bright GREEN from me. Bear in mind I hold personally, and want to buy more when funds are available, so I am clearly biased. Or to put it more accurately, I think it’s really good, so have backed my view with my own money.

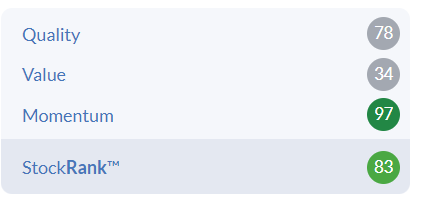

Stockopedia likes it too, so it gets approval from man & machine. Nice looking chart too.

As the CEO pointed out today, last time revenue & profit was at the 2025 expected level, the share price was double the current level. There hasn't been any dilution either. All of which reinforces my view that this share maybe has medium term potential to recover further to possibly 600-800p in due course? Who knows though, anything can happen with shares, as you know!

Graham’s Section:

PPHE Hotel (LON:PPH)

Down 3% to £13.30 (£558m) - Interim Results - Graham - GREEN

This hotel owner-operator has been enjoying a pleasant recovery in financial results in the post-Covid era and is now making record revenues:

The share price still has some distance to travel, to get back to the levels of early 2020:

Here are the highlights from today’s interim results:

Like-for-like revenue up 4.3%, total revenue up 6.1%. London flat, all other territories growing.

Like-for-like EBITDA up 10.9%, total EBITDA up 7% (negatively affected by new hotel openings).

Like-for-like revenue per available room (RevPAR) was very slightly lower at £109.9 (LY: £110.3). This key metric has declined due to average room rates falling (down 4.4%), offset by higher occupancy (from 69% to 72%).

Interim Dividend: increases from 16p to 17p.

Net reinstatement value (NRV) per share (a standard measurement of balance sheet value): declines slightly due to FX movements and dividend payments, but at £26.24 is still nearly double the share price.

As we covered here in July, PPHE thinks that a good response to the share price discount vs NRV is to buy back its own shares, and has launched a £4m buyback, the second of the year.

New hotels: a £300m pipeline is being delivered - in London, Rome, Zagreb, Belgrade and Berlin. Planning approval received for another new London hotel (South Bank).

Current trading/Outlook

The key sentence here is:

Excluding new openings in the year, the Group's like-for-like1 performance remains in line with expectations.

New openings are being held back by “certain supply chain issues”, causing delays to openings in London and Rome. Positive EBITDA from these projects will therefore not commence until 2025.

Graham’s view

Readers will know that we don’t cover hotel chains very often here (the other one I like to review is Dalata Hotel (LON:DAL)). But the asset value here has caught my attention, and the 50% share price discount to NRV says to me that someone is wrong: either the stock market is wrong, or the calculations are wrong.

NRV is designed to calculate the value of the company’s balance sheet, where properties are valued based on the cost of rebuilding them, not on historic cost. As of June 2024, this figure for PPHE stands at £1,117m (NRV is stated after deducting net debt).

The market cap of £558m says to me that the stock market thinks PPHE’s properties would probably not be worth rebuilding. This seems overly pessimistic to me.

There is admittedly some financial risk included with this company, which carries gross borrowings of £900m and net debt of £765m.

The H1 income statement shows that financial expenses (£19m) did eat up a large portion of the company’s EBIT or operating profit (£25.4m). After all expenses, the company did fail to make a positive PBT (I would prefer if PBT was the headline, rather than EBITDA).

I’m going to continue giving this one the green light, based on my belief that its assets are undervalued, but it does need to follow through with real profits if I’m going to keep my positive stance. Hotel openings are very expensive, and it takes time for them to deliver profitability, so personally I do think PPH deserves a grace period from investors as it delivers its £300m pipeline.

My big-picture view is that PPHE’s post-Covid recovery is succeeding:

Somero Enterprises (LON:SOM)

Down 3% to 297p (£163m) - Interim Results - Graham - AMBER

The numbers here are grim, as expected:

Paul covered Somero’s profit warning in July, when it became clear that the company was headed for a poor H1.

Let’s skip ahead to the outlook statement. Somero says that the non-residential construction market “remains healthy” and issues unchanged guidance:

The Company anticipates improvement in H2 2024 trading in compared [sic] to H1 2024, driven by a combination of new product revenue growth, including the launch of a third new machine, and an expectation of improved weather conditions. This confidence is supported by our primary means of gauging market health, which is direct feedback from customers.

As such, the Board remains confident that 2024 results will fall in line with the revised market expectations published following our 30 July 2024 Trading Update, with revenues of approximately US$ 110.0m, EBITDA of approximately US$ 30.0m, and year-end cash of approximately US$ 27.0m.

It’s a bold statement considering H1 revenues of only $51.8m and H1 adj. EBITDA of only $12.4m. To hit forecasts, the company will need H2 revenues of $58.2m and H2 adj. EBITDA of $17.6m.

Estimates: thanks to Cavendish for issuing a note today with confirmation that there is no change to 2024 guidance. For FY25, they would “conservatively assume a flat revenue year”.

CEO comment:

"I am pleased with how the Company has navigated the challenges presented by the first half of the year. While revenue decline in North America and Australia impacted performance, our focus on operational efficiency and the enduring nature of our long-term growth drivers ensure we are well placed for when conditions improve…

"Looking ahead, the resilience of the non-residential market gives us confidence that, as external challenges subside, our performance will improve…

Regional overview

North America - sales down 8%. Healthy project levels for customers, but “they are not operating at full capacity due to project start delays and pauses caused by elevated interest rates”. No mention of competition.

Europe - sales up slightly.

Australia - sales down 40% (from a low base).

Rest of World - sales down 39% (also from a low base).

Cash flow comment - operating cash flow was much lower ($2.9m vs £8.8m in H1 last year) and the company mentions an increase in inventories “as a result of lower sales unit volume and product mix”. Checking the balance sheet there was an almost $5m increase in inventories , from $19m to $24m.

Cash falls from $33m at the end of 2023 to $20.8m at the end of H1.

Graham’s view

I was happy with AMBER/GREEN last time, but my inclination currently is to be AMBER due to what I perceive as a significant risk of the company failing to hit full-year forecasts, with higher inventories being another warning in this regard.

For a company with a great track record of profitability and excellent quality metrics, this may be a little harsh:

However, I’m concerned that tougher competition may also be a reason for Somero’s difficulties. The company has been around for a long time and it hasn’t grown as much as I would have hoped - and now it’s going in reverse again. So I’m just not seeing enough here to get me excited about the prospects for investors.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.