Good morning, it's Paul & Graham here, as usual!

I forgot it was a leap year, so happy 29th February, and good luck with any marriage proposals!

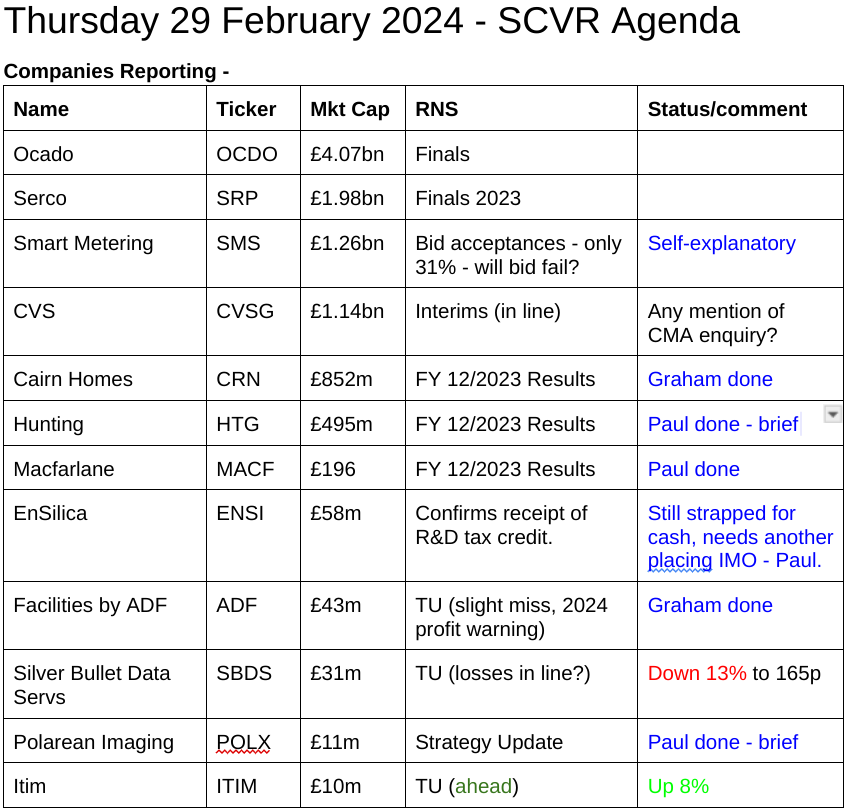

Today's report is now finished.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom),

Paul's 2023 share ideas, with live prices.

New SCVR summary spreadsheet from July 2023 to date, updated at weekends (very useful quick reference tool, search for ticker using CTRL+F). Hover over cell for pop-up notes.

Frozen SCVR summary spreadsheet for calendar 2023.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Other mid-morning movers (with news) -

Wincanton (LON:WIN) - up 18% to 600p - New cash bid at 605p!

Terrifically exciting news here - a new bidder (US logistics co GXO) has blown away the existing 490p offer from CEVA Logistics. Sky also reported that Clipper was sniffing around here too. GXO says it has 28% support already. Interesting detail in the announcement shows that the price is 11.9x IAS17 EBITDA, but £45m anticipated synergies (seems a lot!) brings this down to only 7.0x. GXO’s own StockReport shows that its shares are valued at 10.8x EBITDA, so I can see why this deal stacks up. Yet again, we’re being shown how UK small-mid caps are just too cheap! Rich pickings to be had, as this deal demonstrates.

Renalytix (LON:RENX) - up 12% to 33.5p (£33m) - FDA approval for its kidney tests. Good news, but there’s the small matter of the company being almost bust! Huge losses have burned through the cash pile, with only a scrap remaining at Dec 2023, probably down to almost nothing by now. Interims issued 15/2/2024 make grim reading, with “substantial doubt” over going concern. Urgently needs a large fundraise. Harwood own 10%, will they help refinance it? Maybe, but I wouldn’t want to be a hapless small shareholder - your risk of dilution/wipeout looks extremely high. So until it’s refinanced, it has to be bright RED, as currently super-high risk of insolvency/big dilution. Let’s hope it turns out alright, but I definitely wouldn’t want to risk my own money on something with such adverse risk:reward.

Howden Joinery (LON:HWDN) - up 8% to 837p (£4.6bn) - FY 12/2023 results are in line. PBT down 19% to £328m, down 15% if adjusted for week 53 costs. Outlook - encouraging start to 2024, with revenue rising, and “confident” overall. Strong bal sht, talks about returning surplus cash. Looks a nice business, with decent margins, although not an obvious bargain on PER of 16, compared with a lot of the small cap building supplies companies which are much cheaper (albeit lower quality).

Drax (LON:DRX) - up 9% to 456p (£1.75bn) - FY 12/2023 results show big rise in profitability. Outlook for 2024 in line. Increased divis. StockReport shows fwd PER only 3.8x and 6.1% yield. So worth a closer look, although obviously it’s a complicated business & energy market - profits may not be sustainable long-term at current elevated levels? It needs careful research I think, no opinion from me, but some attractive headline numbers do look interesting. Recent press accusations of burning the wrong type of wood also needs looking into.

Avacta (LON:AVCT) - down 31% to 51.8p (£146m pre-dilution) - drops on news of a 50p placing to raise c.£25m, 18% increase in share count. Co says this raise gives it 2 years cash runway to develop cancer treatment.

Hemogenyx Pharmaceuticals (LON:HEMO) - down 23% to 1.92p (£22m pre-dilution) - raises $4.2m in 2p placing, to fund leukemia treatment. It hasn’t even reached phase 1 trials yet, so this won’t be the last fundraise I would suggest.

Polarean Imaging (LON:POLX) - down 17% to 4.25p (£9m) - Strategy Update - as if on cue, this serial disappointer pops up. “Notoriously lengthy process” of 18-24m to sell into hospitals. Cost cuts done mid-2023, $6.1m cash left at Dec 2023. Cash runway extended a bit from Jun 2024 to Oct 2024. Refinancing - minimum needed is $10m, with $7.6m committed from 3 named investors, but on unknown terms. Will need another $20-25m additional funding to reach profitability by late 2027. Paul's view - I got excited about this project in the last bull market, and got it hideously wrong. Management under-funded it, and existing equity is now almost worthless, as everyone could see it needed more cash. Who knows what terms will be for this latest raise, no pricing is indicated. Whoever is providing the next funding round can call the shots, so existing equity could easily be diluted away to nothing unless instis stand their corner and decide to be kind to small investors. Such a pity it’s been so badly managed, as the project itself looks good long-term. AIM is the wrong place for this type of business.

Hunting (LON:HTG) - up 10% to 330p (£545m) - FY 12/2023 Results - the share price has seen an accelerating rise this morning, catching my attention. “EBITDA, ahead of previous guidance provided, and increased by 98% to $103.0m.” “$83.1m of previously unrecognised deferred tax assets recognised at year-end.” Adj PBT up from $10m to $50m - impressive. Superb balance sheet. This looks interesting! Not a detailed review, but I’ve seen enough to say this seems worth a closer look.

Zoo Digital (LON:ZOO) - down 10% to 23.25p (£23m) - no RNS today, but I see Canaccord reduced from 11.98% to 10.95% yesterday - they can be brutal sellers when they lose confidence in a share. Also possible read-across from ADF profit warning today? ZOO doesn’t interest me, but people keep hoping it might recover from the ending of the industry strikes.

Fundraises Generally

A pattern seems to be emerging, where speculative companies run out of cash, then they pump the share price with upbeat-sounding RNSs. Shortly afterwards they announce a discounted placing into any subsequent share price rise. Private investors speculating on these shares, buying the price rises, seem to be lambs to the slaughter.

It doesn't seem right to me that shares are still trading, when the company is secretly offering discounted shares to larger investors in placings. It's often obvious from the share price that news has leaked. We really do need the rules changed (and/or enforced), so that shares are suspended when any company decides to do a fundraise. Also we need quicker, cheaper mechanisms for companies to raise cash.

In the meantime, there's a simple way to avoid being clobbered by a discounted placing - don't buy or hold any share where the company doesn't have a cash runway of well over 12 months. Ideally investments should be companies which are profitable and cash generative, hence won't ever need to raise more cash just to keep the lights on.

Jam tomorrow/ blue sky shares are a graveyard for optimistic investors, avoiding these things has been the biggest boost for my personal portfolio returns. That said, the odd one multibags, which is what excites people.

If we invest in jam tomorrow companies, the risk is that we get sucked into throwing good money after bad, by averaging down to lower our average buy price after each piece of bad news. I've heard some horror stories of gullible investors throwing away large amounts of money doing this. My current view is that if the original business plan has gone badly wrong, and there's a clear need for additional funding, then I need to just admit I got it wrong, and sell up. I can always revisit it later, once the funding has been sorted out by someone else, once risk:reward might have improved to looking favourable, as stale bulls throw away their shares for next-to-nothing. I'd much rather be averaging up into a rising share price on the back of positive news. Chasing a falling share price, in the hope that there will be salvation from a sudden turnaround does occasionally work, but who can time these things? Speculative stuff often falls way further than anyone anticipated, even to zero.

Anyway, all good reasons to try to avoid pretty much all the cash burning, loss-making companies. It's so risky, and like searching for a needle in a haystack.

Summaries of main sections

Facilities by ADF (LON:ADF) - down 11% to 47p (£38m) - Trading Update (profit warning) - Graham - BLACK (profit warning) - on fundamentals: GREEN

Cavendish has written down 2024 estimates as ADF reveals that the 2023 strikes will have some knock-on effects in H1 of the current year, as schedules have had to be reorganised. I tentatively take a positive stance, looking for performance to pick up again in 2025.

Macfarlane (LON:MACF) - 123p (pre-market) £196m - Results FY 12/2023 - Paul - GREEN

One of my favourite value/GARP shares. Comes up with the goods, with decent 2023 figures, I go into a fair bit of detail below, and find everything satisfactory. Looks a nice long-term, boring, but good value share to me.

Cairn Homes (LON:CRN) - down 1% to 126p (£817m/€954m) - Results FY 12/2023 - Graham - GREEN

This housebuilder confirms 2024 guidance with a target ROE of 15% and continued strong growth in revenues and operating profits. It will soon have completed its second €75m share buyback. I’m very impressed by its performance and goals, and maintain my positive stance.

Paul’s Section:

Macfarlane (LON:MACF)

123p (pre-market) £196m - Results FY 12/2023 - Paul - GREEN

Through its two divisions, Macfarlane Group services a broad range of business customers, supplying them with high quality protective packaging products which help customers reduce supply chain costs, improve operational efficiencies and sustainability and enhance their brand presentation.

Shore Capital helpfully updates us today, saying these numbers are c.4% ahead of expectations.

I’m pleased to see MACF has for the first time added adjusted numbers to its highlights table. This was a glaring omission in the past, and didn’t make sense, showing only the unadjusted figures, which were out of step with the adjusted figures published by its own broker. So this is great to see, and saves me the trouble of having to manually adjust the figures for goodwill amortisation mainly.

The only figure missing below which I would have liked, is adj EPS (which Shore Capital calculates as 12.8p [up 6% vs 2022]- this is the key number that I use for valuation purposes) -

The company summarises performance neatly here -

Group profit before tax in 2023 was ahead of the previous year. This profit growth has been achieved through the completion of three high quality acquisitions, effective management of input prices, good progress in Europe and stronger new business momentum which has offset weak customer demand in the UK and Ireland, sales price deflation and inflation in operating costs.

Adjustments - as this is a new (and welcome) way of presenting the figures, I’ve checked the note (see below) and it’s simple, and perfectly reasonable. So I’m happy to value MACF shares on the adjusted figures, which also makes it consistent with how other companies are valued too, and shows us the true underlying trading performance of the business in my opinion -

Valuation - at 123p/share, and 12.8p adj dil EPS, the PER is only 9.6x - good value, but packaging shares seem to be lowly rated generally.

Shore has a slight fall to 12.4p forecast for FY 12/2024, which is due to a full year’s higher tax charge. Note that the higher 25% corporation tax rate is now suppressing EPS growth temporarily at most companies - so it’s quite normal to see PBT up, but EPS slightly down, due to higher tax charges. We could see a similar effect next year, as the full year impact of 25% corp tax compares with only a part year of higher taxes in calendar 2023.

Basic and diluted earnings per share were 9.44p per share (2022: 9.89p per share) and 9.34p per share (2022: 9.78p per share) respectively largely due the higher tax rate of 23.5% in 2023 (2022: 19.0%).

Balance sheet - cash & liquidity all looks fine -

Net bank funds were £0.5m on 31 December 2023, following a net cash inflow of £4.0m in the year, even after £16.6m (2022: £11.9m) of investment in acquisitions and capital expenditure.

· The Group is operating well within its bank facility of £35.0m and relevant covenants which run until 31 December 2025.

· Pension Scheme surplus of £9.9m at 31 December 2023 (31 December 2022: £10.2m). Following conclusion of the 2023 triennial valuation nil contributions are required from 1 January 2024 forward.

NAV is £115m, but the biggest number is goodwill & similar of £87m, which I always remove. That gives NTAV of a modest £28m, which includes £9.9m pension surplus, which I would usually also remove, unless there’s a clear route to receiving the surplus in cash. On this it says -

The Group is working with trustees to prepare the scheme for buy-out. This process is not expected to be completed during 2024.

I’m assuming that would probably not involve MACF receiving much, if any cash, but do leave a comment if that assumption sounds wrong. I’ve searched through the RNS today, and can’t find any more detail on the pension surplus. It’s good news anyway, as no further deficit recovery payments are needed.

The rest of the balance sheet looks fine to me, with no funnies. Inventories in particular look lean (good), and receivables under control vs revenues. Which adds to my perception that the CFO is running a tight ship here. Prompt reporting of 12/2023 figures today reinforces that view.

Cashflow statement - is lovely, and benefits from some favourable working capital movements (reduced inventories & receivables).

MACF generated about £26m of post-tax cashflow (after I adjust to deduct lease financing costs). Of this, the main uses were acquisitions £14.5m, divis £5.5m, and a little capex of £2.2m. That’s it! MACF is a really simple business to understand, with nice clean numbers.

In some ways I find cashflow statements clearer than P&Ls, and we should generally focus more on cashflows (some investors don’t seem to even read them) - because it’s much harder to hide the truth on a cashflow statement, than on a P&L.

Outlook - nothing exciting, but nothing alarming either -

We expect the year ahead to remain challenging due to uncertainty over customer demand. However, we are confident that we will continue to make progress in 2024 through strong new business momentum, a well-developed pipeline of potential acquisitions, the continued effective management of input prices and operational efficiencies…

However, our strategy and business model have proved to be resilient and despite these challenges we expect 2024 to be another year of growth for the Group.

I feel that the way MACF sailed through the pandemic, and the energy/cost of living crisis more recently with barely a scratch, proves this is a resilient business model, and it appears well managed. So I’m not worried about macro downside risk.

Paul’s opinion - I wanted to dig into MACF’s numbers properly, because it’s one of my favourite value/GARP shares, and is on my 2024 top 20 shares ideas list (doing well so far, but it's early days). I’m not necessarily expecting anything barn-storming from MACF, but overall it seems an excellent value GARP share. It’s making apparently good acquisitions, which it’s mainly self-funding from own cashflow generation. There doesn’t seem to have been any dilution since 2017, yet profit & EPS have roughly doubled since then. Despite all the chaos of pandemic, energy, soft GDP, etc. To me, that is the mark of a good business, with capable management.

Shareholders also get a c.3% dividend yield too. Not overly generous, but that’s because most of the cashflow is funding bolt on acquisitions. So management always has the option to stop acquisitions, and pay out divis in high single digit %. It's that high dividend paying capacity which is more important to me than the actual yield, taking a long-term view.

I think this share is best seen as a nice long-term investment for very patient investors who are not going to get itchy fingers if it’s not multibagging overnight!

The fragmented shareholder register means it could attract takeover interest too - someone could offer a 30% premium and still end up getting a bargain.

Overall, it's an easy thumbs up from me, as a decent long-term investment idea - GREEN.

Graham’s Section:

Facilities by ADF (LON:ADF)

Share price: 47p (-11%)

Market cap: £38m

This is “the leading provider of premium serviced production facilities to the UK film and high-end television (“HETV”) industry”.

I tend to associate it with actor’s trailers but there are several other vehicle types provided by ADF.

Today’s trading update is for 2023:

Revenue £34.8m (market expectation: £35m, previous year: £31.4m)

Adj. EBITDA £7.3m (market expectation: £7.5m, previous year: £7.9m)

2023 saw a record H1 performance, but then H2 was disrupted by the writer and actor strikes (we discussed this issue quite a bit last year - overview by Paul here. Wikipedia article here).

Outlook for H1 2024 is “significantly ahead” of H2 2023, although we can’t expect another record performance as we had in H1 2023:

Notwithstanding the end of the Strikes, the impact on the film and HETV industry has carried on into H1-FY24 with film and TV producers having to reorganise the schedules of all relevant parties (studios, cast, crew, ancillary services etc), which is proving challenging at short notice. This has meant there will be a one-off reduction in utilisation in H1-FY24 before returning to a full second half, more in line with pre-strike levels. The Board will provide further guidance in this regard on publication of its audited full year FY23 results.

CEO comment:

"Our performance in FY23 demonstrates the Group's resilience with a strong first half countered by the first joint strike of Hollywood actors and writers in over 60 years. The effects of the strikes will continue to be felt through the first half of the current year, but we will carefully manage our cost base during the period. The long-term market dynamics remain very much in ADF's favour with continued high levels of investment in the UK HETV industry and the Board is confident that we will return to pre-strike order levels and beyond as conditions normalise."

Graham’s view

As Paul said last year, in reference to ADF, the obvious time to buy is when something temporarily impacts performance - this is a lesson that’s useful for any share. Essentially there are two things to figure out:

a) is the problem temporary, not recurring?

b) putting the temporary problem to one side, is the company a good long-term hold?

In the case of ADF, I feel confident in saying that the strike was a temporary problem and is unlikely to recur regularly. ADF’s CEO has pointed out that it was the first joint strike by writers and actors in over 60 years. Yes, it dragged on for a long time. But I would be shocked if strikes of this magnitude and duration became a common occurrence in the industry.

As for whether or not ADF is a good long-term hold? I haven’t got such a strong view on this. I can’t see any competitive “moat” in the provision of these vehicles and even in the absence of strikes, I expect that demand would be volatile.

I should also mention that estimates have been revised lower today, in response to the new 2024 outlook. Cavendish have reduced their revenue forecast for ADF from £58m to £47m, and their adj. net income forecast from £7.6m to £5m.

So the stock is currently trading at about 8x adjusted earnings for the current year, these forecast earnings being depressed by the knock-on effects of the strikes.

I’ll tentatively take a positive stance on ADF shares, hoping that performance will normalise in H2 of the current year and that 2025 will be entirely normal, allowing for performance to improve.

This stock IPO’d at 50p in early 2022. Today’s share price gives investors a small discount to that level:

Cairn Homes (LON:CRN)

Share price: 126p (-1%)

Market cap: £817m / €954m

We already covered the trading update from this housebuilder in January. I’ve been positive on the stock due to its very strong order book, a reasonable valuation and a declining share count as it buys back its own shares.

Today we have the actual full-year results for 2023, with the following highlights:

Revenue +8% to €667m, at a slightly improved gross margin (22.1%).

Operating profit +10% to €113m

ROE improves from 10.8% to 11.3%

I always appreciate seeing a company use its ROE or its ROCE as a key indicator - this doesn’t happen enough.

Cairn’s net debt was almost unchanged year-on-year at €148m. This was very much the company’s choice: they returned €75m to shareholders during the year in the form of a share buyback.

In 2024, they already announced and began a new €75m buyback. Most of this new buyback has been carried out already; it is expected to complete “in the coming months, at which point the company will issue a further capital allocation update”.

CEO comment excerpt:

Our sustained positive momentum has carried through into 2024 and strong sales since the beginning of the year has seen our closed and forward order book growing further to 2,473 new homes. We continue to invest heavily in work in progress as we ramp up delivery across our 20 active construction sites. Cairn will deliver another year of strong growth in volumes, revenue and profitability.”

The forward order at the end of 2023 was 2,350 homes. I’m not sure how sustainable this is, but it’s great to see that it’s continuing to grow and is now nearly 2,500 homes, with sales value c. €950m.

Economic backdrop - this is thought to be “supportive” with falling inflation, nearly full employment, strong consumer spending and a growing population. The cost of living crisis is very real but from a housebuilder perspective, there is plenty of demand for new homes and political support for new construction.

I’ve noted before that Ireland could arguably support 60,000 new homes p.a. Cairn has this to say:

There continues to be a significant structural demand for new homes and despite the delivery of 32,695 new home completions in 2023, the highest since 2008, the Housing Commission estimates that c.42,000 – 62,000 new home completions are required per annum.

There will be a general election in Ireland at some point in the next twelve months, and housing will be one of the biggest topics due to widespread concern around a shortage of accommodation of all types. This surely can’t be a bad thing for housebuilders!

Outlook

The order book already mentioned supports the FY 2024 outlook, “with the Company poised to deliver another year of exceptional growth in volumes, revenue and profitability”.

The company has an ROE target of 15% (more companies should have this!) which it expects to deliver this year.

2024 guidance is re-confirmed:

c. 2,200 units (2023: 1,741 units)

Operating profit €145m (2023: €113m)

Graham’s view

I remain seriously impressed by Cairn’s financial performance. It’s clearly very focused on ROE, with buybacks serving the dual purpose of a) exploiting a good value share price for the benefit of all shareholders, b) keeping the balance sheet efficient, so that the ROE target of 15% can more easily be achieved.

Of course this does elevate the risk levels and means that investors need to be that much more vigilant. It would be more impressive if the company could hit ROE of 15% while in a net cash position, rather than with net debt of nearly €150m.

But with operating profit guidance of €145m, the debt load should be manageable.

Let’s check the overall share of the balance sheet:

Total assets slightly over €1 billion, with the vast majority of assets being inventories classified as current assets.

Total liabilities €280 million, including €170m of gross loans and borrowings.

Total equity €757m

Cairn has a 35 site land bank with 16,300 potential units. While I would guess that €757m is quite a low estimate of the true value of Cairn’s assets, the difference will be reflected in future profits.

Putting it all together, I’m comfortable to maintain my positive stance on these shares at a market cap equivalent to c. €950m.

It’s no longer that bargain that it was, now trading at a price to book value of around 1.3x:

Maybe it has already reached fair value, but I’m still excited to see what might happen as the company continues to reduce its share count.

The buybacks achieved tremendous value last year. This year, they are still happening at an attractive PER or earnings yield:

Of course all housebuilders will suffer in the wrong economic conditions. But if I was picking up a housebuilder today, it would be on the assumption that we are not about to get an economic hammering. And I would want either a very cheap housebuilder (at a discount to book), or one that is high-performing and still not overly expensive. Cairn could fall into that second category. And if the share count keeps falling while profits remain robust, then shareholders should do well, even from current levels.

So I’m still positive on this one, but there is a level where I would switch to neutral. That would probably be at a price to book value of anything above 1.6x, i.e. if it reached as high as 200p over the next six months.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.