Good morning from Paul & Graham! Today's report is now finished.

Agenda -

Paul's Section:

Unbound (LON:UBG) (I hold) (£11m) - this is the second "in line with expectations" trading update since Unbound became a separately listed company (using the former Electra PE listing). Change of NOMAD looks positive. Marketplace strategy for third party brands is launching imminently. After a lamentable start in terms of share price since listing, I now see probably more upside than downside, so am happy to stick with it. Sorry this share has been such a lousy idea so far, but it has potential I think.

Hunting (LON:HTG) - a trading update which sounds positive, but has caused an 18% share price fall. The problem seems to be that some broker forecasts (which we can't access) were too high. That doesn't come across at all in the positive-sounding commentary from the company, which seems a bit misleading. It seems a lot of company for the market cap, currently trading just above breakeven, but with good sector tailwinds meaning profit is set to increase. Looks interesting, for sector experts to check out maybe?

Carclo (LON:CAR) - results for FY 3/2022 look superficially good at the headlines, but digging into the detail shows that liabilities to the pension scheme, bank debt, and heavy capex, mean shareholders are very unlikely to see any income. The equity looks worthless to me, nothing more than an option on a big turnaround.

Graham's Section:

Wynnstay (LON:WYN) (124m) - this agricultural supplier confirms that it had an excellent H1. Revenues soared due to inflation, and the company made exceptional profits from selling its fertiliser stock, where the price had skyrocketed. Profits are expected to normalise in H2 and next year. This stock is a dividend hero where risk management has enabled it to trade profitably, nearly every year. While the valuation is increased, I would suggest that a multiple of c. 13x is not overly expensive for someone who wishes to build a long-term position.

MS International (LON:MSI) (£49m) - This company pays its directors very well, but external shareholders have also been rewarded handsomely as the share price is back near its all-time high, and a long stream of dividends have been paid out by this cash-rich company. The underlying businesses are involved in a range of heavy activities including gun cannons for ships, forgings and petrol station construction. MSI’s successful long-term track record speaks for itself and its lack of interest in investor relations is endearing.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul’s Section:

Unbound (LON:UBG) (I hold)

29p (before market opens)

Market cap £11m

Trading Update & Change of NOMAD

This listing was previously Electra Private Equity, but was recycled to become Unbound Group from 1 Feb 2022, containing the last remaining investment of Electra, namely Hotter Shoes - comfy shoes for older women. It restructured in the pandemic, closing most of the stores, and is instead focusing online, and has a growth strategy to broaden its product range into other complementary products & services focused on affluent pensioners - arguably a big & underserved market.

There’s been hardly any interest in the shares so far, because the company and its advisers have largely ignored private investors, who are the market for the shares of an £11m market cap company - who else is going to buy the shares owned by Instis that don't want to own something this tiny? Although I did watch a webinar, which didn’t go down too well - too much corporate speak and trendy buzzwords, and not enough substance, in my opinion.

Still, it’s early days, and new companies that list need to be allowed time to find their feet. It’s a marathon, not a sprint, after all.

Its trading update on 12 May 2022 sounded encouraging, but nobody seems to be interested, with the share price continuing to be weak.

Trading Update today - this sounds OK, but no indication of what market expectations are, which is not helpful, particularly for a newly listed company, with very little research out there, and investors unfamiliar with it -

Following the Q1 trading update issued on 22 May 2022, the Company confirms that Hotter continues to trade in line with the Board's expectations for the year ending 5 February 2023.

Valuation - there’s a commissioned research note from Edison dated 16 May 2022, which pencils in these estimates for the current year FY 1/2023:

Revenue £59.5m

Adj PBT £2.0m

Adj EPS 3.8p (PER of 7.6, if achieved)

Divis: nil

So it’s a significant business, and profitable, with Hotter Shoes being a very well-known brand with the over 55s. I've mystery shopped it, and the shoes are nice enough, and quite comfy. Although mens' shoes are only a small proportion of sales, the main market is older ladies.

The trouble is, we haven’t seen any “clean” numbers yet. The last Annual Report shows all the figures from the previous investment business, Electra PE, so it’s difficult at this stage to see how Unbound will look as a standalone business. Maybe that's an opportunity at a market cap of just £11m? Once more investors are familiar with the story, then it could re-rate (once markets generally have found a base), possibly?

The Edison forecast shows a rather weak balance sheet, with NAV of £1.4m at 1/2023, and that is negative NTAV once £4.6m intangible assets are eliminated, NTAV: £(3.2)m. I'm worried that it might have been floated with too much debt, so that needs clarification.

Platform Launch - I’m a bit confused by this, as it doesn’t clearly spell out what this platform actually is? Is it a website? I think so, it sounds like a marketplace type website, which will host other brands, as well as Hotter Shoes.

Starting from 28th July 2022 through to October 2022, the Group will onboard 14 partner brands which will be sold on its new platform. These will be followed in due course by expansion into other areas including wellness and its own Unbound Group brands.

The Group is delighted to announce the following 14 brands, across apparel and specialist footwear categories:

· Apparel

- Rohan, Asquith of London, Boody, Noa Noa, Part Two, Kaffe, Soaked in Luxury, Cream, and Lakeland Leather

· Footwear

- Birkenstock, Muck Boots, Geox, Sketchers and Hush Puppies

It is therefore expected that the introduction of these brands to Unbound Group will benefit from greater engagement and an uplift in cross and up-sell opportunities.

Garden Centres - concessions (stores within a store) is called a “key channel as a low cost and flexible retail format”, with 2 more having been opened.

New NOMAD - out go Stifel (NOMAD) and HSBC (joint broker), who are completely inappropriate for a micro cap, and have been useless judging from the share price performance (and probably expensive too).

In comes Singer, as the new sole broker/NOMAD. Hopefully Singers will get some decent research up on Research Tree, and promote the shares to their clients, to clear any overhang.

The company also needs to get the word out, by appearing regularly on investor platforms such as Mello, PIWorld, InvestorMeetCompany, etc, explaining what they do (preferably without a lot of trendy buzzwords - plain English is so much better, and more credible), and running through the numbers.

My opinion - I’m sorry this has been such a lousy share idea so far. The jewel in the Electra crown was always TGI Fridays, but that’s been a dog too, with a consumer downturn smashing the whole hospitality sector. The demerger was completely botched, in my opinion - because the brokers failed to line up buyers for the shares in enough number to mop up the Instis who wanted/needed to sell. Anyway that's history now, it's the future that matters.

I saw Unbound as an interesting little business, and still do. Hotter Shoes is a strong brand name (ask some pensioners, they all know it!) who value the comfiness of its shoes, and the specialist fits & sizes, so there is a point of difference, which enable it to generate high gross margins.

The shoe components are made in China, then boxed up flat, and shipped over to be assembled in the UK, allowing it to proudly wear the Made In Britain flag, which is a nice selling point I reckon. This is also efficient for freight, as the parts are compact, as opposed to competitors importing finished shoes, where imports are bulky, with each pair of shoes being mainly “a box of air” to quote previous management at Electra.

Unbound now has two in line with expectations trading updates under its belt, and with the share price this bombed out, I reckon we’re probably over the worst now.

Valuation looks very low, and there could be decent upside from here. Hence I’m tempted to average down - because the very weak share price looks down to market sentiment, not the fundamentals.

At this stage, I’m not convinced by the multi-brand strategy, and want to see some results from that before adding anything into the valuation. Although it’s free upside, if it works. The multi-brand strategy has been set up to involve very little investment from Unbound, so risk:reward looks OK.

Overall - I see more upside than downside, if we’re patient.

At this stage, I would be sceptical of the StockRank, because we've not yet had clean numbers through for Unbound, hence the computers are using some of the defunct numbers relating to Electra, as it was the same listing.

EDIT: I've got a Q&A booked with the company this afternoon, so will update this article below with responses to some queries which have arisen in the reader comments, and from me. Watch this space!

Sorry, I was too tired to type up my notes, will do that tomorrow. But in a nutshell, I had a good chat with the company, and I was correct in my comments below. The new ventures are all drop-shipping, with no purchases of inventories, and limited marketing spend. End of Edit.

.

.

Hunting (LON:HTG)

224p (down 18% at 10:18)

Market cap £370m

Trading Update (profit warning)

Hunting PLC (LSE:HTG), the international energy services group, today issues a pre-close trading update, ahead of its Half Year Results to be issued on Thursday 25 August 2022.

H1 is the 6 months ending 30 June 2022, within FY 12/2022.

This is perplexing to me, as the trading update seems to read positively, yet the share price is down 18%. Clearly I’ve missed something!

Arden helpfully update us today, also thinking the update is positive, and upgrading its forecasts. Although Arden notes that its $46.3m EBITDA forecast for FY 12/2022 is well below broker consensus of $60m, so it sounds as if other brokers might be dialling down their forecasts today. Obviously as we’re seen as pond life by many people in the city, we don’t have access to other broker notes.

Another problem seems to be that, as a capital-intensive business, Hunting has big depreciation charges. So $46.3m EBITDA forecast only turns into $6.8m PBT - barely above breakeven for revenues of $614m in FY 12/2022.

Lots of things look good for this company -

- Strong balance sheet, with net cash,

- Good order book,

- An improving trend of profitability.

Macro factors look to be moving in Hunting’s favour for now, especially an energy crisis where the price of oil has shot up and energy security is now the biggest issue facing Govts like Germany, which foolishly became dependent on energy supplies from a despotic, kleptocratic, corrupt, evil regime in Russia.

Fossil fuels look to be necessary for decades to come, as renewables take time to implement. Hence that could be good for oil services providers like Hunting?

My opinion - I think this share is for sector experts. Hunting could be entering interesting value territory, if you think the higher oil price is likely to stick, which would logically stimulate more drilling from producers, needing more services from Hunting.

I don’t have enough knowledge to determine whether today’s sell-off might be a buying opportunity or not, but it looks a lot of company for the money, and is benefiting from positive macro sector trends. Could be worth a closer look?

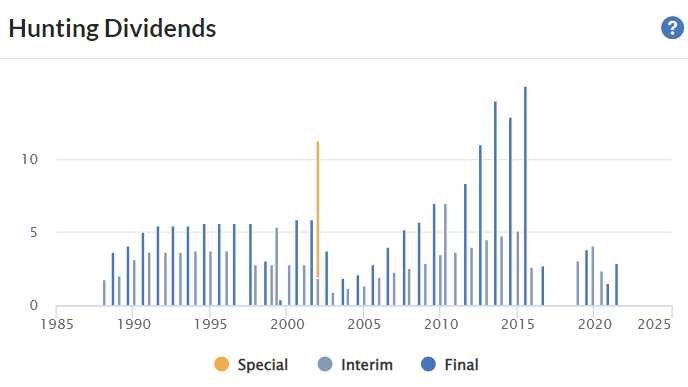

Divis long-term have been impressive, although patchy of late, as with many companies -

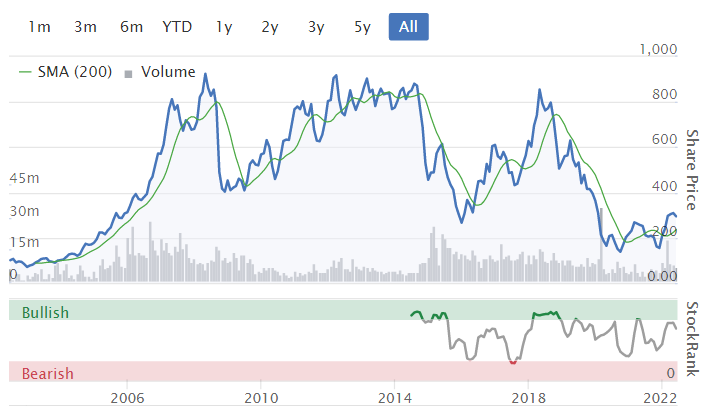

It's been volatile in the past, as I would expect for a company where profits are geared to the oil price -

.

Carclo (LON:CAR)

25p (up c.13% at 11:51)

Market cap £18m

This share looks superficially cheap, but as you dig into the numbers, it quickly becomes clear that it’s not cheap at all.

This table looks good for FY 3/2022 vs FY 3/2021 -

.

Trouble is, half the operating profit disappears in finance charges of £3m.

So adj PBT is only around £3m.

Here are the problems, and they’re big problems -

Pension deficit - Is shown on the balance sheet as £26.0m, down from £37.3m a year ago. Sounds not too bad? Think again! The actuarial deficit (which is the one that cash payments are calculated on) is estimated at £82.8m. Look at the scale & duration of the deficit recovery payments -

A schedule of contributions with the pension trustees is in place through to July 2023; beyond this a schedule of contributions for £3.5 million annually is in place until 31 October 2040.

Remember that deficit recovery payments do not go through the P&L. So this is a cash outflow that uses up more than all the annual profit.

Is Carclo going to be able to consistently generate £3.5m surplus cashflow every year, for the next 18 years, to fund this huge liability? I have my doubts. Investors must believe CAR can generate substantially higher profits & cashflows than it manages currently, to make the equity worth anything at all. And/or that the pension deficit melts away over time, which is possible in favourable conditions, with lots of variables to consider. As things stand, the business really only exists to service the pension scheme’s demands, and the next call on its cashflows after that would be bank debt reduction.

Hence little to no scope for meaningful divis, possibly ever.

Capital-intensive - note the balance sheet contains £47m of tangible fixed assets, and capex during FY 3/2022 was very high, at £9.7m (LY: £10.4m) - these figures taken from the commentary. Although the cashflow statement shows lower spend on capex, of £4.9m (LY: £7.3m), so that’s confusing.

Total fixed tangible assets are large at £47.0m. I’ve checked the last (FY 3/2021) Annual Report, and interestingly £23.6m of land & buildings are held at cost. So a key question to ask is, what are these properties, and how much are they worth now? This could explain why the bank & pension scheme are happy to let the situation roll, because this could be significant asset-backing, which in a downside scenario could be sold to pay off the bank & better fund the pension scheme?

More information is needed here. If anyone speaks to the company, then do ask about the market value of freehold property, as that could greatly improve risk:reward, if it’s a big asset.

Going concern note says the group has enough liquidity headroom, but of course that relies on the banks & pension trustees continuing to play ball. The severe but plausible scenario looks quite mild to me, modelling only a 5% fall in sales, and 1% fall in gross margin. In a recession, I would suggest the downside scenario could be worse than that, possibly?

Anyway, on the assumptions used, the going concern statement gets a tick in the box, which reassures somewhat.

Refinancing - is still pending. I’m amazed that the bank & pension scheme haven’t already required the company to raise more equity from shareholders. That’s still looking a high probability, so the dilution risk remains -

The Group, the bank and the pension scheme trustees are actively engaged in negotiations over the refinancing of the bank debt beyond the current expiry date of 31 July 2023 and over the updated schedule of contributions. The parties are committed to a plan to finalise these by 31 July 2022 and the Directors have an expectation that this will be achieved.

My opinion - as you can see, this is a complicated, special situation.

It’s not a bad business, and without any pension deficit or bank debt, it might be worth perhaps £40-50m market cap. The equity is actually worth £18m. So it’s a bargain surely? No, because the difference of £22-32m is actually far less than the net debt (£21.5m), and pension scheme (£26m accounting deficit, £83m actuarial deficit) combined.

Therefore I would argue the equity looks worthless as things stand now. It’s more an option, on the situation improving.

If trading improves, that would boost the enterprise value of the business, and its cash generation. It might then be able to reduce the bank debt, as well as servicing the pension deficit recovery payments of c.£3.5m p.a. for the next 18 years.

Another angle on things, might be that the pension deficit could reduce considerably. Higher interest rates tend to reduce pension liabilities, but higher inflation must push up liabilities the other way, depending on what the scheme rules are for index-linking pensions paid out.

It’s complicated.

Investors who just simplistically look at the low PER, and imagine that’s all there is to it, are completely missing the point here, and likely to be disappointed if they think it’s an overlooked multibagger waiting to happen. It's cheap for a reason.

The reality is that there’s unlikely to be any cashflow heading to shareholders any time soon, if ever, because it’s all needed to fund pension deficit recovery payments, reduce bank debt, and fund capex. Hence a thumbs down from me, as a serious investment.

Graham’s Section:

Wynnstay (LON:WYN)

- Share price: 608p (pre-market)

- Market cap: £124m

This agricultural supplier released interim on Tuesday. Readers have been mentioning it in the comments (thanks as always for the suggestions!), so I thought I’d circle back and have a look.

This company helps us to see where food inflation is coming from, because farmers will ultimately say that the prices they pay (to companies like Wynnstay) have gone up, too.

The company has two major divisions: agriculture and merchanting.

Let’s see what has happened at Wynnstay for H1 (six months to April 2022):

· Revenue +34% to £335.66m.

Wynnstay tells us how much of the revenue increase was driven by inflation, and it is well over 90%.

Some of the revenue increase also came from an acquisition which completed in March 2022. This acquisition brought a poultry supplier into the group.

· Pre-tax profit +78% to £9.56m.

· Net debt £7.6m after the acquisition (£9.5m cash paid upfront).

· Modest increase in dividend.

It’s crucial to know that a portion of the H1 profits can’t be repeated, as Jack wrote previously.

Fertiliser prices rocketed due to the shortage of natural gas, which meant that Wynnstay’s existing fertiliser stock became far more valuable. This helped profits at the agriculture division to almost treble.

At the smaller merchanting division, revenue was up by 5%, and adjusted operating profit up 26%. This is a more realistic and sustainable level of growth!

Outlook – “trading conditions remain positive – underpinned by firm farmgate prices”.

The exceptional gains are not expected to repeat, but the company says it is “well-placed to achieve growth prospects”, and continues to hunt for acquisitions.

Analysis

Wynnstay talks about strong sector sentiment: farmers are paying a lot more for fuel and energy, but are also benefiting from large price increases for beef, lamb and grain, with milk and egg prices also rising. There doesn’t appear to be any lack of confidence on that front.

I get the impression that Wynnstay is very focused on risk management, and is not interested in speculating on which way commodity prices will go.

It talked previously about having an “absolute unit margin model”. This means striving to collect a fixed margin on product sales to customers, regardless of the direction the product price has moved.

For example, Wynnstay’s grain trading division uses forward contracts to hedge itself against falls in the value of its grain stock. That resulted in “very significant margin calls” in H1. If it was merely betting on grain prices increasing, it would not have to bother with any of that!

The exceptional gain from fertiliser stock was clearly unhedged, and maybe that’s one product where the company will not be hedging (it would have to get involved with natural gas contracts, which may not be worth the effort).

My view

I’ve never written about this company before, because I’ve tended to avoid anything to do with agriculture – on the basis that I can’t predict the prices of most commodities!

Fortunately, I get the impression that Wynnstay is not attempting to predict commodity prices, either. When I comb through its financial history, I find a very long history of profitable trading, which suggests real expertise in risk management.

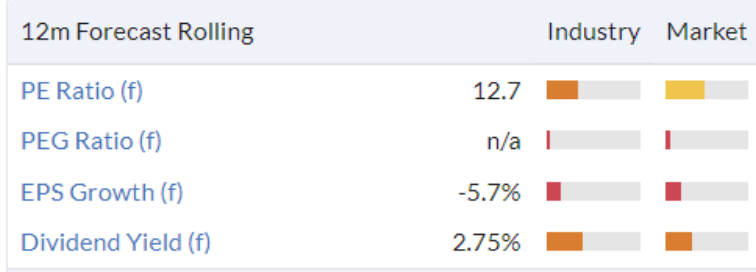

Analysts are forecasting adjusted EPS of 45.5p in FY October 2023 (a more “normal” year of profits than the current financial year). This gives an adjusted PE ratio of around 13x, the same results as Stockopedia’s calculation provides:

The stock is a dividend hero, with dividends being paid out during Covid and a dividend stream stretching back over 15 years.

When I spot a dividend hero on AIM, I always think that I must have found something special. This is the junior market after all, containing some of the most speculative and high-risk companies. But then occasionally you spot a company which has been faithfully sending its shareholders cheques, year in and year out, like a boring big-cap does!

The balance sheet does now have some RCF debt, and there is an element of trust involved in the company’s ability to manage working capital. Management report that there are now “significantly higher working capital requirements”, as a result of the inflation that has occurred.

A quick check of the balance sheet confirms that working capital needs are indeed very significant. For example, the company has over £100m in receivables. That’s not far off its market cap, and nearly a third of sales!

But financial debt is low, and tangible net assets are significant (c. £90m). Overall, the big picture view of the balance sheet is good. Hopefully, the dividends will continue to roll into shareholders’ accounts.

I’m inclined to have a positive view of this stock. It’s not cheap, but if I really liked it, I wouldn’t worry too much about the earnings multiple. The company will hopefully still be thriving in five or ten years, and paying a little bit more for it now would make a huge difference to returns.

Hopefully the company can bring us good news later this year, and tell us that food inflation has cooled down. But somehow I doubt that it will!

.

MS International (LON:MSI)

· Share price: 300p

· Market cap: £49m

The last time this was covered in the SCVR was by me, in 2018! Thank you again to readers for mentioning it in the comments and reminding us to cover it.

After a long track record of profitability, MSI did suffer a blip, in 2020, but has come roaring back and its shares are back near their all-time highs.

One of the first things you notice about this company is its barebones investor relations website. Despite being a listed company with a value of nearly £50m, it hasn’t wasted any money on web design. In my book, that’s a good thing!

Some people are turned off by a company that puts zero money into its investor relations efforts. But when a company acts this way, that’s often because it doesn’t need to raise funds and doesn’t care very much about its stock price. These are both indicators of a good investment!

Excluding the blip in 2020, MSI has been consistently profitable for twenty years. Dividends have been paid every year since 1993. And the number of shares outstanding has only fallen over time.

This history proves that it’s not a company that has needed to get the begging bowl out to investors. So why would it waste money on a flashy website? It doesn’t need to sell a story.

What it does - MSI designs, manufactures, and provides related services for heavy equipment in defence, fork-arms for forklift trucks, and petrol stations.

The stock might not ever find itself held by “ethical” portfolios, as its products include a range of gun systems.

Results - FY April 2022 was a brilliant year for the company. Revenues increase 21% to £74.5m, and pre-tax profits improve to £5.97m (from £1.59m).

This is not the best ever result for the company, but you have to scroll all the way back to 2012 to find a better bottom line.

Balance sheet equity improves to £38.6m, with zero financial debt and cash rises £18.1m.

For a review of divisional performance, I’m happy to point you to this comment from a reader (illiswilgig -Mark) on Wednesday.

In summary, the key points are:

· Defence. Working towards a major contract with the US Navy. “All trials are going to plan and positive progress is being made.” A new UK manufacturing facility is in the final stage of completion, and a new resource in the US is also being established, “to support our perceived growing defence opportunities in the United States”.

· Forgings. This Doncaster-based business has won many customers “that had previously procured product from China”.

· Petrol station superstructures. This construction business exceeded revenue forecasts, though was disrupted by material shortages and price inflation had a big impact.

Outlook summary:

We believe that we have placed each of our businesses in a strong and exciting position within the markets which we serve. Close monitoring of performance and further support in the development of new products and services will, no doubt, bring further rewards.

My view

This resembles a private company in the short annual results statement, the absence of investor relations efforts, and the heavy insider ownership.

Executive Chairman Michael Bell owns 17.5%, Ms. Adrienne Bell owns 13.6%, Finance Director Michael O’Connell owns 9.2%, and a former director own 10.6%.

Total director remuneration last year was c. £1.6m, about the same size as the pre-tax profit for last year and more than the amount paid out in dividends.

But this year, given the improved performance, there should be a much more favourable balance of profits vs. director pay.

Overall, I retain a positive view on MSI. It has a StockRank of 90, as the Stockopedia computers also find plenty to like:

The quality is a little low for my tastes, and predicting contract wins is difficult, to say the least. I wouldn’t bet the house on it, but I’d consider it as part of an AIM dividend portfolio:

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.