Good morning from Paul & Graham!

Today's report is now finished.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £1bn. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk.

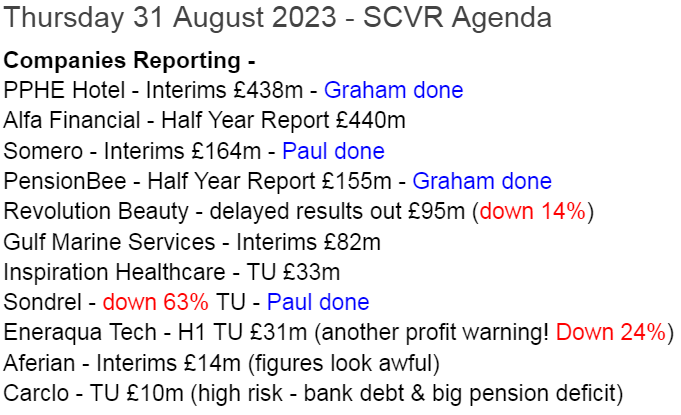

This is what we're planning on reviewing today -

Summaries

Somero Enterprises (LON:SOM) - Down 2% to 285p (£160m) - Interim Results - Paul - AMBER/GREEN

H1 results show profit down 30% on LY, with a sharp slowdown in its main market of USA. Outlook comments reassure though, in line with (lowered) expectations for FY 12/2023. Balance sheet remains bulletproof. I stress test the numbers for a recession, and it should remain profitable. Lots to like medium-long term, but due to shorter term macro uncertainty, I've moderated my view from green to AMBER/GREEN.

PPHE Hotel (LON:PPH) - Up 3% to £11.10p (£479m) - Interims (in line) - Graham - GREEN

This hotel operator reiterates the improved 2023 guidance that it gave in the recent trading update. Additionally, there is now the prospect of capital returns (buybacks/tender offers). The low valuation of these hotel assets interests me, but occupancy must keep improving.

Sondrel (Holdings) (LON:SND) - Down 62% to 21.25p (£19m) - Trading Update - Paul - RED

A hideous update from this chip designer, which has seen expected revenues all but dry up for H2, due to project delays. I think that leaves it in a precarious financial position, as there are some nasties on the balance sheet. The company reckons it has enough cash, but I disagree - expect a distressed placing at a discount. Looks like the fund managers were sold a pup, in this Oct 2022 IPO.

Pensionbee (LON:PBEE) - up 2% to 71p (£159m) - Half Year Report (in line) - Graham - RED

Forecasts are adjusted only slightly here and this online pensions provider continues to believe that it will hit monthly profitability (on an adjusted EBITDA basis) by the end of this year. I remain sceptical and view both the cash burn and valuation as sources of concern.

Paul’s Section:

Somero Enterprises (LON:SOM)

Down 2% to 285p (£160m) - Interim Results - Paul - AMBER/GREEN

Background - we like this laser-guided concrete screeding machine group, based in the USA.

Attractions include high profit margins, great cash generation, strong balance sheet, and generous shareholder returns.

Bear points are mainly the cyclicality of its market, with less equipment being purchased by customers in recessions. Graham also flagged increasing competition in his last report on Somero, after some nifty googling. Failure to meaningfully break into international markets after years trying, might also be seen negatively.

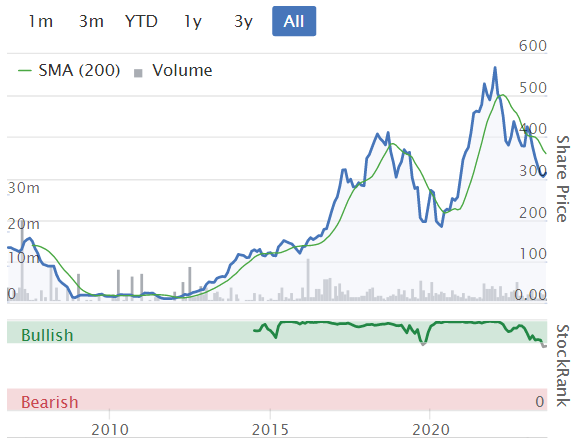

Momentum (in both share price, and declining broker forecasts) has been poor this year.

The StockRank sums it up perfectly - a quality business, at a value rating, but with poor momentum currently -

As you can see, forecasts have come down considerably, so today’s in line with expectations outlook comments are well below original expectations! That’s why the share price has fallen this year.

Key numbers for H1 -

Revenue $58.9m (down 14%)

Rest of World was fine, but USA (SOM’s main market by far) saw revenue down a hefty 24%, blamed on higher interest rates & tighter lending causing projects delays or pauses. Also an internal delay on production for one product line (since resolved).

H1 adj EBITDA down 28% to $17.3m

H1 profit before tax is down 30% to $15.6m

Outlook - expecting H2 to be slightly better than H1 -

Expected improvement in H2 2023, trading in line with expectations for 2023 revenues of approximately US$ 120.0m, EBITDA of approximately US$ 36.0m, and year-end cash of approximately US$ 32.0m..

The expected improvement in H2 2023 trading in the US compared to H1 2023, supported by the entry of the S-22EZ into full production, contributions from key international markets and positive feedback from customers, reinforces the Board's belief that 2023 results will fall in line with market expectations. With a healthy financial position, we remain committed to making sound strategic investments to deliver strong results and cash flows to our shareholders."

The StockReport also shows $120m revenues forecast for FY 12/2023, which becomes $0.44, or c.35p EPS. Giving a bargain PER of only 8.1x (at 285p per share at 08:15). Well, it’s only a bargain if you think this (reduced) level of earnings is sustainable, and won't get any worse. A deeper recession, causing a negative leveraged impact on SOM’s profits is one of a range of possible shorter-term outcomes.

It’s obvious from the P&L that the fairly high 57% gross margin that SOM achieves mean that there’s considerable operational gearing here. So a deeper drop in revenues would have a nasty impact on the bottom line. Although by my calculations, SOM would remain profitable even with a large further fall in revenues - falling to breakeven would need a c.50% drop in revenues (assuming gross margin %, and overheads remain unchanged). So there’s bags of headroom here to absorb a bad recession without any solvency or dilution worries (particularly given the strong balance sheet too). It’s always worth stress-testing accounts for all companies, to see what impact a recession would have. Some are finely balanced, but Somero is definitely not, it’s rock solid, even in a severe downside scenario.

Dividends - are generous, and a key reason to hold SOM shares. The interim dividend is held flat vs LY at $0.10. It mentions strong finances, and confidence in the H2 outlook as reasons why it has maintained the divi.

Share buybacks are just to offset dilution from share options, which the company is open about in the commentary - so these are really part of management remuneration, rather than adding shareholder value.

You have to fill in a simple form, to receive divis from US companies, which I did easily through my broker, when I held SOM shares.

Balance sheet - cash is plentiful, but well down on last year, at $25.2m.

Accounts receivable looks extremely low (which is good!) at $7.3m, indicating that SOM must be selling mainly for cash on delivery. Maybe it gets the cash quickly because hire purchase/leasing companies fund the products?

Inventories are up, at $21.4m (LY: $18.8m), which surprises me, as I’d expect lower revenues to be reflected in lower inventories too. Maybe there’s a little over-stocking here? That’s a good question to ask management on the next webinar. As long as inventories aren’t obsolete, then it shouldn’t be a problem anyway, so not that important.

Overall, the balance sheet is bulletproof, no issues here at all really.

Cashflow statement - cash generation is still good, but down on last year. Reduced profits, and a $4.8m reduction in creditors is partly to blame.

Modest capex at only $1.0m in H1.

The biggest items on the cashflow statement this year and last, are dividend payments. Somero is a big cash generator, which it mostly pays out to shareholders, making it an attractive investment I think.

Are the dividends sustainable? That depends on how trading & macro factors develop. For now, I would say yes, but in future who knows? A deep downturn would probably see divis cut, but you can say that for most companies.

Paul’s opinion - I like this company a lot. It clearly has a good niche, which is highly profitable. However, as we’ve seen before, it is susceptible to economic downturns, and we all remember how it came close to going bust after the 2008 recession. However, that was due to entering the recession with a weak balance sheet. It’s the opposite now, the company is conservatively financed, with net cash, so could comfortably ride out even a bad recession that halved revenues, by my calculations.

Today’s update reassures, with only a slight improvement on H1 needed to meet the FY 12/2023 numbers, and reasons provided as to why it thinks that is achievable. Although the comments about interest rates & reduced bank lending impacting H1 does worry me a bit, as those factors haven’t gone away - they’re getting worse. So an H2 profit warning does look a possibility here.

For that reason, I think we should trim our bullishness from green, to AMBER/GREEN, to reflect the macro uncertainty. That denotes that I like the company’s fundamentals and think it’s good long-term, but am worried about the shorter term picture, given that this type of company does tend to suffer badly in economic downturns. So holders of this share are, by implication, predicting a fairly soft landing for the US economy.

From the low, to the early 2022 peak, this share 50-bagged!

Sondrel (Holdings) (LON:SND)

Down 62% to 21.25p (£19m) - Trading Update - Paul - RED

We’ve not covered this company here in the SCVRs before, but a 62% drop today compels me to review what’s gone wrong, and get something into the system here, for future reference if subscribers want to quickly check what we think about it.

It’s a small, loss-making chip design company, which floated recently, in Oct 2022.

Sondrel (AIM: SND), the fabless semiconductor business providing turnkey services in the design and delivery of 'application specific integrated circuits' ("ASICs") and 'system on chips' ("SoCs") for leading global technology brands, provides a further update on trading ahead of the publication of the Company's interim results for the six months ended 30 June 2023 ("H1 2023") on 21 September 2023.

H1 revenues expected to be £9.3m, up 17% vs H1 LY.

H1 adj EBITDA expected to be £0.4m (up from £0.1m H1 LY).

Pleased with sales pipeline in the USA - 15 potential customers, with design/prototype revenues >$100m over 2 years - potentially - not contracted yet.

Production forecasts for live European projects are up 78% to $170m., giving confidence for FY 12/2024 and beyond.

That all sounds good, so why has the share price collapsed by 62% today?

Here comes the bombshell - a profit warning for H2 2023 -

3 projects have been delayed by 6-12 months, pushing them into 2024.

FY 12/2023 revenues to be “substantially below current market expectations” at £13m+

Corresponding impact on FY 12/2023 losses (no figure provided).

Cash position - no figures again, but it says -

The Company is confident that it has sufficient access to finance for the foreseeable future following its October 2022 IPO.

CEO is promising lashings of jam tomorrow -

"Our increasing traction in the important US market, strong sales pipeline and positive ongoing relationships with our existing ASIC customers provides us with great confidence in our medium-term target to grow revenues to over £100m and we will ensure that we keep updating shareholders as we make progress towards this goal."

Broker update - thanks to Cenkos, for quantifying the extent of the damage.

It’s a massive drop in forecast revenues for FY 12/2023 - previously £28.4m, now just £13.0m. Since £9.3m is reported for H1, that means H2 has almost dried up, to only c.£3.7m revenues expected.

This translates into a loss before tax of £(6.6)m for the current year FY 12/2023.

Forecast for 2024 assumes revenues will more than triple, and a move back into profit of £2.2m. That looks rather ambitious.

The forecast balance sheet looks very weak, with NTAV forecast for Dec 2023 at negative £(11.3)m. That doesn’t look tenable to me - it’s going to need another placing I think - will there be any appetite to pour more money into this serial loss-maker?

Paul’s opinion - this looks a disaster, no wonder the share price is down 62%.

It raised £17.5m (net of costs) in the Oct 2022 IPO, priced at 55p. It’s now 21p.

The founders (Curren family) owned 45% after the IPO, so are in control, hence delisting risk looks a potential worry now, and fund managers might want a mistake removed from public view?

Looking through its Admission Document, I’m surprised they were able to float this at all. Its historic numbers are terrible, with heavy losses each year. It had run up an insolvent balance sheet too, with negative NTAV of £(16)m, so the net IPO net cash of £17.5m only just eliminated the deficit of NTAV. Add further heavy losses this year, and I reckon the balance sheet is probably in poor shape again.

I note from the admission document that payables includes £6.8m of deferred creditors for software licences, payable over 3 years. How is that going to be paid?

The balance sheet at end Dec 2022 looks very peculiar, with large & unusual receivables and creditors.

I think this is looking financially distressed, hence I’m keeping well away from it. Another placing looks very likely to me, and could be on horrible terms.

The business model is clearly flawed - with project delays now putting the survival of the company in jeopardy (even though that’s not admitted in today’s RNS, it seems pretty obvious to me, after digging into the numbers in more detail).

It’s a total avoid for me, at any price - for gamblers only now.

Graham’s Section:

PPHE Hotel (LON:PPH)

Share price: £11.10 (+3%)

Market cap: £479 million

PPHE Hotel Group, the international hospitality real estate group which develops, owns and operates hotels and resorts, announces its unaudited interim results for the six months ended 30 June 2023 (the "Period").

I turned positive on this one in June, after reading the strong Q2 update. This change in stance was based on a belief that the company was on its way to pre-Covid performance levels.

Today we have full interim results:

Revenues +59% year-on-year to £180m, up 15.9% on H1 2019.

Average room rate £159.6, up 13% year-on-year, or up 31.2% on H1 2019.

For me, the key number is the 31% growth in the average room rate since H1 2019, i.e. since the last year pre-Covid. That should be plenty to match cost inflation over that timeframe (inflation since 2019 is around 25%).

Q2 room rates were much stronger than Q1 room rates, which bodes well for the rest of the year.

The next question is whether the hotels are full enough. Occupancy was 69.1% in H1 2023, versus 76.8% in H1 2019.

So there is still some room for improvement and of course it’s uncertain when/if those pre-Covid occupancy rates might be achieved again. But I think we are on a very encouraging trend.

Note that occupancy in H1 last year was only 48%, so last year’s figures do not provide a relevant or useful measure of PPHE’s “normal” performance.

Moving on to profitability: PPHE reports H1 2023 EBITDA of £45m. This is a huge improvement on last year but is only flat compared to the figure for H1 2019.

Statutory net income in H1 is very small and in truth only around breakeven (net income to PPHE shareholders only £1 million). This underlines my view that it’s not enough for the company to match 2019’s EBITDA. It needs to significantly beat it - which it can do if occupancy keeps improving.

Net realisable value (similar to NAV, and calculated using EPRA principles) is unchanged at £25.05 per share, using property valuations as of December 2022. Fresh valuations will be carried out at the end of this year. After taxes, the estimated net disposal value of the company’s assets is £24 per share.

These numbers are obviously far bigger than the current share price, reflecting mixed views on prospects in the hotel sector!

Capital returns: the company has noticed that its shares are cheap relative to estimated asset value, and might be about to take some action in recognition of this!

Given the strength of trading and confidence in outlook, the Board believes the Company is now in a position to return to its historical capital returns policy of distributing approximately 30% of adjusted EPRA earnings (reported at £1.06 in the twelve month period to 30 June 2023), while continuing to support investment in future growth opportunities. In light of the continued significant share price discount (c60% as at 31 August 2023) relative to EPRA NRV per share, the Board intends to consult with shareholders regarding the most appropriate and effective mechanism for such distributions to take place, including dividends, share buybacks, tender offers or a combination thereof. The Board looks forward to updating the market on this capital return policy in the near future.

New hotels - art’otel London Battersea is open, and four new hotels will open between October 2023 and H1 2024 (Belgrade, Zagreb, London, Rome).

Net fund - regulatory approvals obtained for the new €250 million European Hospitality Real Estate Fund.

Current trading/outlook - “strong trading conditions have been maintained through Q2 and into Q3 across all main market segments”. They continue to focus on room rates (to cover inflation) while also rebuilding occupancy.

There is no change to upgraded forecasts of £400m revenues and £120m EBITDA this year. This implies £220m of revenues in H2 (vs. £180m in H1).

Graham’s view

I’m remaining positive on this one for the same reasons as before: the discount to NRV and my belief that improving occupancy trends can take the company back to pre-Covid performance levels.

Additionally, today we learn that there is a possible catalyst in the form of share buybacks/tender offers, which could see the company manually helping to close the share price discount to NRV.

To provide some balance, here are some reasons for caution:

Cost of living issues may hurt affordability for the foreseeable future and prevent occupancy rates from improving to pre-Covid levels. Similarly, business travel might not reach the levels of 2019.

Statutory profits remain low here and if you look at the earnings multiple as calculated by Stocko, it’s expensive at nearly 18x.

Leverage is significant; gross bank borrowings are £850m/net bank borrowings are c. £700m, far higher than the market cap.

Perhaps I’m too optimistic but I still think that this one could prove to be a bargain, if we can get back to the assumptions of pre-2020:

Pensionbee (LON:PBEE)

Share price: 71p (+2%)

Market cap: £159m

(Disclosure: Graham is a shareholder in Hargreaves Lansdown (LON:HL.) which is a competitor to Pensionbee.)

PensionBee Group plc ('PensionBee' or the 'Company'), a leading online pension provider, today announces interim results for the six month period ended 30 June 2023 (1H 2023).

I have been negative on this stock (see here and here, with the share price around 95p-101p), and now we have interim results to mull over.

Key points:

Revenue +32% to £10.9m

Pre-tax loss £9m (H1 last year: £17m)

Invested customers +33% to 211,000

Assets under administration +38% to £3.7 billion

Cash position £14m (a year ago: £29m).

Both Liberum and Equity Development publish forecasts on this company.

Since March, there hasn’t been too much change in these forecasts: Equity Development have increased the full-year revenue estimate (£24.1m) but have also slightly increased the expected full-year EBITDA loss (£9m), due to higher costs.

It will be very impressive if the company can meet the profitability forecast: they already have an adjusted EBITDA loss of nearly £8m in H1. So adjusted EBITDA will have to improve to nearly breakeven in H2, if the full-year loss is to be only £9m.

This metric excludes substantial share-based payments of over £1m in H1 both this year and last year.

The CEO/Founder says they are “on track to deliver monthly Adjusted EBITDA profitability by the end of the year”.

Marketing spend - it’s worth honing in on this item. The company spent £6.8m on marketing in H1, much lower than H1 last year (£12.4m), which goes a long way to explaining the reduction in the financial loss this period. £50m has been spent on marketing efforts in total.

Outlook - guidance is reiterated. The £14m cash balance “leaves us well-placed to pursue a c. 2% market share target of the substantial £700bn UK transferable pensions market”. Adjusted EBITDA profitability is targeted in 2024.

Graham’s view

I can see that there is a defensible investment thesis here, based on the company reaching breakeven/profitability soon and then seeing its assets under administration grow from there with the help of both new customer recruitment and asset growth from the existing customer base.

However, I’m going to remain negative on this stock for two main reasons.

Firstly: the current £14m cash balance requires the company’s profitability to improve very quickly, or else additional shareholder support may be needed.

Remember that losses in 2021 and 2022 were greater than £20m each year. It may be turning the corner into profitability now, but it has little choice. And if the marketing budget needed to reduce further, in order to preserve cash, what repercussions would that have for growth? I just don’t think this cash balance is sufficient for shareholders to feel completely comfortable.

Secondly, on valuation. This is the company’s long-term goal:

…the Company is pursuing a market share of approximately 2% over the next 5-10 years (equivalent to about 1m Invested Customers, assuming an average pension pot size of £20,000-£25,000)

The revenue earned on those 1m invested customers is likely to be somewhere in the region of £150m (Pensionbee charges a fee of less than 1%).

Therefore, even in the best-case scenario where the company achieves its long-term goals, the revenue opportunity seems somewhat limited. If the market cap was (say) £60m I’d take a different view, but the market cap is closer to £160m!

So for me this company is both a little light on cash, given its ongoing spending needs, and its valuation is already pricing in quite a lot of success. So I’m continuing to give it the thumbs down.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.