Good morning from Paul & Graham!

Everyone still digesting the consequences of the Budget, I expect. I emphasise that this is a time for people to be taking professional advice from authorised financial (tax & pension, etc) advisers, for estate planning, etc, before making any changes, as it's already become clear that some of the IHT changes are complicated and have created some uncertainty.

In terms of shares, I think we should now see a wave of broker forecast cuts, because I don't believe that hefty extra wages costs (hike in minimum wage of 5%-16% in April 2025, and increased employers NICs from the rate going up and the threshold coming down) are likely to be already factored into forecasts. Hence why, for me anyway, retail & hospitality are out of my portfolio altogether for the time being until the dust has settled. Plenty of other companies are also likely to need to cut forecasts due to higher wages costs as other workers press for differentials to be maintained. Mitigation measures can soften the impact, but tend to take time to implement.

Looking for positives, I think the removal of uncertainty now allows many companies and individuals to press ahead with expansion or purchasing plans that might have been put on hold. Also the OBR says that the big increase in Govt spending will boost the economy, at least in the short-term. I'm toying with the idea of buying shares in the staffing sector, and building supplies sector, as this could be the turning point where the first signs of recovery might, just might begin to appear possibly?

Also I suspect that there's lots of investing cash on the sidelines, and with AIM losing half its IHT relief, and ISAs untouched, this could have been a lot worse. So I reckon conditions are now set up for a potential autumn rally in UK small caps - there we are, a bold prediction! This time of year is exactly when small caps began powerful rallies in several recent years.

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

** New SCVR summary spreadsheet for calendar 2024 ** This is the live one! (updated 6/9/2024)

Archive - SCVR summary spreadsheet for calendar 2023.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices). My video explaining/reviewing it.

My other video (June 2024) - How to screen for broker upgrades on Stockopedia. More stock screening strategies here (possible bargains?) - 21/9/2024.

Companies Reporting

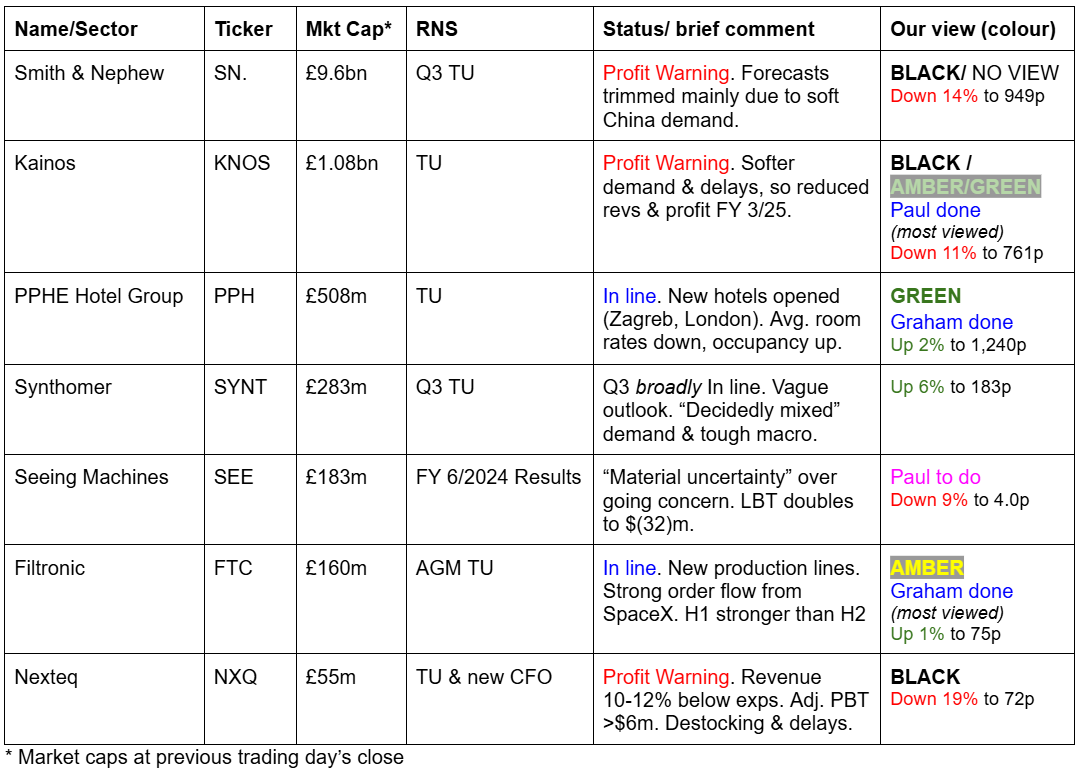

Summaries

Filtronic (LON:FTC) - up 3% to 76p (£166m) - AGM Trading Update - Graham - AMBER

These shares rose 17% yesterday in advance of an “in line” update. Advanced discussions are underway for more contracts that will hopefully feed through to earnings upgrades. As things stand, the shares trade on a PER of more than 20x.

Kainos (LON:KNOS) - down 14% to 734p (£929m) - Trading Update [profit warning] - Paul - BLACK / AMBER/GREEN

Profit warning with KNOS's usual vagueness, but Canaccord reckons we should expect at least a 10% drop in PBT for FY 3/2025 versus previous expectations. Bearish view - a former growth darling is now ex-growth, with profit actually falling. Bullish view - this is a bad year due to outside factors (public sector disrupted by election/budget) with growth likely to resume. My hunch is that there's a moderately appealing bull case tentatively appearing here. H1 results in 11 days time should reveal more.

PPHE Hotel (LON:PPH) - up 2.5% to £12.40 (£518m) - Trading update - Graham - GREEN

This hotel owner and operator is trading in line. Occupancy has improved to an impressive 81.5% although it’s not currently supported by higher room rates. New hotel openings in Rome and London will boost 2025. PPH continues to trade at a >50% discount to its standardised calculation of asset value.

Paul’s Section:

Kainos (LON:KNOS)

Down 14% to 734p (£929m) - Trading Update [profit warning] - Paul - BLACK / AMBER/GREEN

I’m no chartist, but looking at the full chart since this IT contracting group listed (main market) in 2015, my impression is that its days as a wonder, multi-bagging growth stock could be behind it maybe - we're seeing a lot of similar charts, peaking in 2021 and in a downhill trend ever since - reinforcing how over-priced UK small to mid caps got in 2021 -

The historical graphs below tell a similar picture, bearing in mind that forecast (lighter coloured blobs) will fall after today’s profit warning, the growth trend could now turn into a more flat trend. As growth 4 shows, that’s very much already been reflected in a big de-rating onto a more normal PER range, from the heady growth days 2-5 years ago when KNOS was rated on a PER of c.50x.

This is the big problem with growth companies - eventually growth stalls, and investors suffer a double whammy of lower than expected earnings, and an often drastically lower PER multiple. Hence why we have to watch our expensive growth stocks like a hawk, and sell at the first sniff of potential trouble I would suggest. Trouble is, then we often miss out on the next big leg up, so one way or another we’re always going to get some right, and some wrong!

Checking our previous SCVR notes here -

20/5/2024 - I moderately liked KNOS, AMBER/GREEN at 1179p, based on decent FY 3/2024 results, good outlook with more growth expected, which at the time seemed to justify a PER of 25x. Healthy ungeared balance sheet.

2/9/2024 - profit warning, which the company tried to cover up, saying trading was in line, but that was revealed to be untrue with an 8% forecast drop by Canaccord. Dishonest reporting means I now don’t trust management, so am unlikely to buy this share. The market wasn’t fooled though, with a 13% fall to 964p. I dropped a notch to AMBER.

Profit warning today - as mentioned first thing on our pre-market snapshots table above (updated throughout the morning), I could identify from KNOS’s update that this was a profit warning, but it was too vague to ascertain the financial impact. That’s just bad communications from the company (and bad advice from the brokers & PRs). Profit warnings should give precise (or at least a range of) numbers, in revised profit guidance (showing old and new) - basically just see updates from Next (LON:NXT) and copy them, is my advice to all companies & advisers. Anything below that high quality level of guidance is unsatisfactory, and makes life more difficult for investors, hence we’re less likely to buy or hold your shares!

All too often though we’re given a word salad of confusing facts & figures, without it being pulled together into an overall conclusion. That’s the route KNOS has gone down today. Thankfully Canaccord has come to our rescue with an update, many thanks for that.

Anyway, let’s try to make sense of today’s update.

“Kainos Group plc (KNOS), a UK-headquartered IT provider with expertise across three divisions - Digital Services, Workday Services, and Workday Products, today issues an update on trading since 2 September 2024 and updated guidance for the year ending 31 March 2025.”

Macro environment has softened demand and caused delays to customer decision-making (some related to the budget, and public sector).

Revised guidance (of sorts) -

“Considering these factors, the Board has moderated its expectations for the second half of the year and now expects that for the year ending 31 March 2025, we will deliver revenues moderately below current market consensus with the majority of the reduction flowing through to adjusted PBT."

The trouble with that, is a moderate drop in revenue may not be moderate by the time it’s flowed through to profit, due to high operational gearing here. So it’s confusing wording. Specifically, what is “moderate”, and “majority” only means over half. Put this together, and it could encompass a fairly wide range of outcomes.

They give us a footnote of what previous market expectations were, but no new numbers, as it’s shrouded in vagueness -

“* Note: Company compiled consensus is based on known sell side analyst estimates that were updated following the Trading Update in September 2024. The ranges are: Revenue £375.5m - £392.0m and Adjusted PBT £75.0m - £79.7m. The respective consensus figures are £388.8m and £78.8m. FY2024 reported revenue was £382.4m and adjusted PBT was £77.2m.”

Good bit - one part of the business is doing well, this sounds interesting - I wonder what margin it would make on the £200m ARR target? That’s quite a big number -

“Our Workday Products division continues to deliver growth, with a very strong performance recorded in the first half of the year. The July announcement of our expanded Workday partnership has further enhanced our growth prospects, reflected in our increased ARR target of £200m by 2030.”

What’s being done about it (the profit warning)? - this all sounds sensible, and pretty obvious -

“Whilst these changes to our expectations are about delays rather than cancellations, we nonetheless continue to be focused on maintaining prudent cost control measures, reducing discretionary spending, minimising our level of contractors, while reallocating staff to our current high growth areas in Workday Products and in the Healthcare Sector of Digital Services.”

Outlook - more vagueness -

“Notwithstanding this backdrop for FY2025, the Board continues to believe that we are well positioned in our core markets, which offer substantial growth opportunities in all our divisions and that we are maintaining the appropriate balance between investment for future growth, international expansion and profitability.”

Canaccord update - strangely, Canaccord raised KNOS shares to “speculative buy” just 2 days ago, saying that visibility of a recovery was improving.

I see from the detail of the Canaccord note that KNOS has won contract(s) for digital transformation in the NHS. Given yesterday’s budget gave the NHS (and many other public sector areas) promises of more money, then KNOS might be an interesting investment idea for more contract wins in the future, after a time lag for negotiation. So I am warming to the theme of increased public sector spending finding its way potentially to KNOS, and a resumption of growth, with maybe a re-rating upwards again in its PER multiple possibly?

Canaccord acknowledges that its recent positive update was ill-timed, but that the thesis of increased public sector IT spending remains intact. Maybe the broker isn’t that close to the company? Who knows, I’m not being critical of the broker, because their published research is hugely useful to us. It delays updating the forecasts until H1 results on 11/11/2024, but warns that the next set of forecasts will show a >10% reduction at the PBT level. Ouch. That means we could be looking at FY 3/2025 profit being down c.10% on FY 3/2024 actuals (previously forecast profit was flat).

EPS of 48p last year, could be down to more like 40-44p this year I think, which breaks the upward trend, as mentioned above.

Share buyback is announced, and we will get details in about a fortnight, when it published H1 results on 11/11/2024. It has a cash-rich balance sheet, so it's a good idea buying back shares now the price is lower.

Paul’s opinion - I’ve been critical about how KNOS handles profit warnings. However I’m warming to the idea that it’s probably just suffering delays from its public sector focus. That seems a reasonable explanation, given the recent election, and all the uncertainty over the budget. What we should now see is Govt departments able to budget, and make decisions, in a more favourable spending/investment environment. Hence I’d be happy to use c.40p as a base figure EPS in a problematic year FY 3/2025, with hopefully decent upside on that number in the following years, and maybe more positive updates rather than any more profit warnings?

So is the 734p current share price a bargain, as it’s c.18.4x my estimate of 40p cyclical low EPS? Not really. That’s not cheap enough to tempt me in at the moment, but I think there’s a fairly credible bull case building up here, in that next year could rise to say 50p EPS, and maybe 60p the year after, which you could probably value at say 15-20x, so 750p - 1200p share price range might be sensible with a 2 year view. That compares fairly favourably with 734p actual price today.

I think this share could be getting close to a bottom, so I’ll push the boat out here, and up a notch to AMBER/GREEN, particularly as it has a nice balance sheet with plenty of net cash too. It’s the sort of thing where I might dip my toe in with a starter position, then wait for the interims on 11/11/2024 to decide whether to buy any more, or ditch them for a small loss if more bad news comes out.

The newsflow could improve as we move into 2025, with new contract wins possibly providing a catalyst for the shares to break out of the current downtrend. That strikes me as a fairly sensible thesis, but nobody knows for sure at this stage.

Decent sized Director buying would be a good signal. They’ve been shy about buying in the past, more keen on banking the substantial profits on share options. I note that the CFO Richard McCann has an unusually large shareholding, dwarfing the other Directors, at 4.6m shares (worth £34m!) - maybe he wants to be the bean counter because many of the beans belong to him!?

Graham’s Section:

Filtronic (LON:FTC)

Up 3% to 76p (£166m) - AGM Trading Update - Graham - AMBER

This share rose by a remarkable 17% on no news yesterday. Today we have a positive AGM trading update. Let’s get into it.

Key points:

They have confidence in delivering results in line with expectations.

There has been strong order flow from SpaceX in H1 (June to Nov) including some retrofitting work. With the retrofitting work completing, H2 will not be as strong as H1.

They are adding two new production lines.

The update also provides some detail on engineering developments.

In relation to contracts:

We are in advanced discussions for some further contracts in the space and aerospace and defence market which we hope to provide updates on soon, and have enjoyed some smaller development contract wins in recent months. Of particular note are a couple of contract wins in the space market utilising our recent investment in plastic encapsulation machinery. Encouraged to purchase by our lead defence customer for sovereign capability, we are now seeing wider interest in the technology offering throughout our core markets.

Estimates: Cavendish have reiterated their forecasts. These continue to suggest a step-change in revenues and profits from FY May 2024 to FY May 2025. FY May 2026 is then expected to produce a very similar result to the prior year.

FY May 2025: revenues £40.5m, adj. PBT £7.7m.

FY May 2026: revenues £51m, adj. PBT £8m.

Graham’s view

This is one where I missed the boat as the shares have multi-bagged while I’ve been neutral.

We covered it in June, in July and in August. In August, Paul chose to go GREEN on it.

The StockRanks still see hardly any Value here (although they do see Quality and Momentum).

At the current level, it seems to me that the market is pricing in continued growth far above and beyond what has already been pencilled in for FY25 and FY26.

If broker forecasts are to be believed, the company will generate about 3p of adj. EPS in FY26. At a share price of 73p, we get an unusually high multiple for this industry.

The “advanced discussions” for further contracts are key: could they move the needle and lead to new upgrades? EPS momentum is certainly positive:

Or perhaps we won’t get another round of earnings upgrades for the next two years, but instead the blistering growth will continue again from FY27?

My difficulty is that I don’t feel able to predict the outcome here. Based on current valuation and what it is (a designer and manufacturer of telecoms components and subsystems), FTC looks overpriced. But I acknowledge that it has a prestigious partnership with SpaceX and that momentum is currently excellent.

I’m going to be stubborn and stick with a neutral stance here, embracing the uncertainty and seeing the potential for a very wide range of outcomes.

(Paul adds: I think that's a good summary, thanks Graham. FTC shares are expensive, but bulls clearly think it has upside to beat forecasts. I think the case for further orders & profit beats is pretty strong though, so for me it would probably be a more positive view, at AMBER/GREEN or GREEN. But I accept that involves some guesswork).

PPHE Hotel (LON:PPH)

Up 2.5% to £12.40 (£518m) - Trading update - Graham - GREEN

PPHE Hotel Group, the international hospitality real estate group which develops, owns and operates hotels and resorts, is pleased to announce a trading update for the three months ended 30 September 2024…

I stayed positive on this one despite a mild profit warning in August.

I also published an in-depth analysis of the company’s IMC webinar and a Q&A with the CFO - see here.

The shares have been range-bound since Covid, never getting back to their pre-Covid levels:

Here are the key takeaways from today’s Q3 update.

Like-for-like revenue growth is 1.8%. Total revenue growth is 5.1% due to new hotel openings.

Like-for-like average room rate is down 2.7% to £171.6. If new hotel openings are included, this is lower again, but I think it would be wrong to include them.

Like-for-like occupancy improved from 77.5% to 81.5%.

RevPAR (revenue per available room) gets a boost of 2.3% (like-for-like) thanks to the higher occupancy.

However, the room rate matters most when it comes to increasing profitability. There are many incremental costs to higher occupancy, but there are no incremental costs to charging a higher rate!

Therefore, I wouldn’t expect any significant gains in profitability as a result of these growth figures.

Hotels: Radisson RED Berlin is now fully operational and “is achieving excellent guest feedback”.

art’otel London Hoxton (an “art-inspired” hotel) is “nearing completion” with 90% of rooms in operation. It should fully open in Q4 2024.

art’otel Rome is now expected to soft open in early 2025.

The new London and Rome hotels suffered delays which led to the profit warning this summer. As of August, the Rome hotel was supposed to open in Q4 of this year, but it has been further delayed.

Outlook: in line with expectations.

Estimates: the researchers at h2Radnor have left their forecasts unchanged. These forecasts include adj. EPS of 118p in 2024 (about the same as 2023), rising to 128p in 2025.

Co-CEO comment excerpt:

Our commitment to delivering high quality assets and services is paramount and these latest openings are testament to our thoughtful approach to creating hospitality offerings destinations with lasting appeal.

The Group has a strong platform for continued growth, with newly opened hotels ramping up in performance, and we look forward to building on this momentum over the remainder of the financial year."

Graham’s view

I’m a fan of this one but I acknowledge that it won’t be for everyone.

It’s carrying over £700m of net debt (last seen at £765m) although this is forecast to reduce over the next two years.

The market awards it an earnings multiple that I would view as average or below-average, given the sector. But I guess some investors may find the hotel and hospitality sector more anxiety-inducing than I do:

Valuation isn’t all that easy. The company likes to focus on EBITDA. The CFO is adamant that depreciation does not reflect the economic reality, and puts forward alternative measures.

Personally, I like to focus on PBT/EPS whenever I can.

At the same time, there are standardised calculations of asset value for real estate companies. These suggest that PPH is worth £26.24 per share. The company has bought back £4m of shares in the market at a greater than 50% discount to this.

I won’t change my positive view on this as I think that regardless of which valuation is used: PER, NAV or EBITDA, the stock appears to offer decent value. Of course it would be better if the room rate was improving but at least occupancy is very firm. I’ll keep giving this one the thumbs up at this level.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.