Good morning from Paul & Graham!

Today's report is now finished (EDIT: sorry forgot to add Liontrust Asset Management (LON:LIO) - that's now up too)

General Election in the UK today, and Independence Day in the USA. Will the excitement never end?! I'll have to dream up something witty to say to my recently-discovered American cousins, to congratulate their ancestors for jettisoning the colonial yoke. Maybe I should apologise again for us burning down the original White House in 1814, and pass it off as an accident, or error of judgement?

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices). My video explaining/reviewing it.

My other video (June 2024) - How to screen for broker upgrades on Stockopedia.

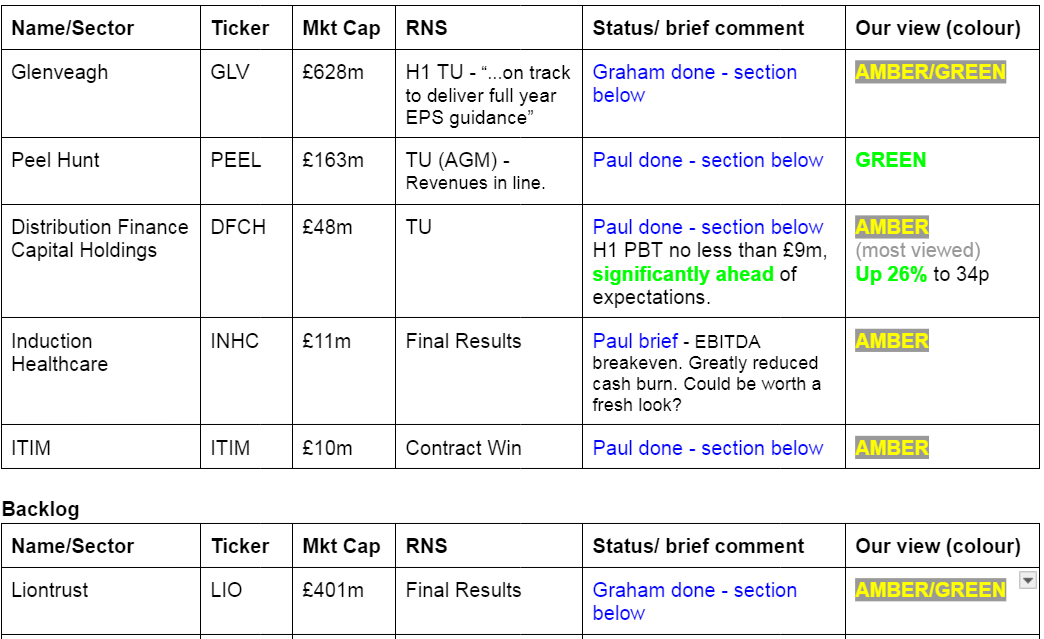

Companies Reporting

A quiet day again today.

Other mid-morning movers (with news)

Smith & Nephew (LON:SN.) - up 7% to 1,057p (£9.2bn) - an unusual move up from this large cap maker of medical equipment products. The newswire says it’s due to an activist called Cevian disclosing a 5% stake.

This actually looks quite interesting. SN. has been in a downtrend since 2019, halving from c.2000p to c.1000p. Yet some key numbers on the StockReport show some value characteristics here, and quite good quality measures - eg fwd PER 12.3x, 3.2% yield, P/TBV 9.8x.

Paul’s view - none, as I haven’t properly researched it, but some of the figures look quite attractive, and I can see why an activist might want to shake up performance. Possibly worth you taking a closer look, hence why I’m flagging it.

Summaries

ITIM (LON:ITIM) - 33p (pre-market) £10m - Contract Win - Paul - AMBER

A quick look below at a sizeable contract win for this tiny SaaS business. Looks interesting, but is already in the forecasts. I do a quick review below. One for my watchlist only at this stage.

Glenveagh Properties (LON:GLV) - up 3% to €1.32 (€753m) - H1 Trading Statement - Graham - AMBER/GREEN

We remain on track for full-year EPS of 17 cent at this home builder, giving a PER of just below 8x. The company does carry some debt but increased borrowings should unwind as sales are completed in H2. My impression of GLV remains as positive as ever; it does now trade at a premium to book.

Distribution Finance Capital Holdings (LON:DFCH) - up 26% to 34p (£61m) - H1 Trading Update [ahead exps] - Paul - AMBER

A nice spike up in share price today, but will it hold? The ahead of expectations mainly relates to writing back part of a bad debt provision, so I don't see this as being an improvement in underlying trading particularly. Discount to NTAV is probably justified, due to the inherent risks in alternative lending. But quite an interesting business, and I've enjoyed reviewing it!

Peel Hunt (LON:PEEL) - up 3% to 133p (£163m) - Trading Update (AGM) - Paul - GREEN

A slightly reassuring update, with Q1 seeing "tentative signs" of a market pickup. My view is the same as before - balance sheet supports 55% of the market cap, and there should be a cyclical recovery in earnings at some stage.

Liontrust Asset Management (LON:LIO) - 623p (£404m) - Final Results - Graham - AMBER/GREEN

Switching my stance on this one from GREEN to AMBER/GREEN as I’ve grown weary of trying to understand this fund manager’s strategy, and the latest results statement contained yet more points which seem controversial to me, including nearly £6m spent on “target operating model restructure”. No thanks!

Paul's Section:

ITIM (LON:ITIM)

33p (pre-market) £10m - Contract Win - Paul - AMBER

itim Group plc, a SaaS based technology company that enables store-based retailers to optimise their businesses to improve financial performance…

I’ve been keeping an eye on this minnow, which looks potentially interesting, if it can scale up.

Shares are illiquid, as it’s tiny, and the top 2 holders control it with 56% combined - owner/manager, and possibly the owners of River Island, the Lewis Family? Or the Lewis’s could be a “gospel and bluegrass” musical group according to Google. Clear de-listing risk there if the share price remains in the doldrums, I imagine.

Today’s contract win is another good one (earlier this year it won/renewed notable contracts with Quiz, and Majestic Wine) -

“...pleased to announce that it has signed a five-year multi-million-pound contract with Assaí Atacadista ("Assaí"), the largest Brazilian wholesaler, with more than 300 stores. Founded in 1974, Assaí distinguishes itself by offering a diverse range of products at competitive prices, serving both businesses and end consumers.”

“Under this agreement, Assaí will leverage itim's UNIFY Price & Promotions Optimisation solution powered by Profimetrics AI to refine its pricing strategies and boost competitiveness, reinforcing its commitment to quality and affordability.”

Assai shares are NYSE listed, and seem to be doing badly, making new lows recently.

ITIM seems to have an impressive presence in Brazil - how come, I wonder?

“It now is being used by 20 retailers globally and by 6 of the top 10 Brazilian retailers, underlying its capability of adding retail value.”

No change to forecasts, per WH Ireland, and confirmed in today’s news release -

“The execution of this contract is in line with the Company's financial expectations for the current financial year.” [FY 12/2024]

Paul’s opinion - it seems impressive that a tiny UK software company has signed up a large retail/wholesale business in Brazil. That suggests to me ITIM’s software must be good. Why Brazil though?

See SCVR 1/3/2024 for a review. I concluded that the balance sheet needs strengthening, so I’d expect a small placing at some stage. Ignore EBITDA as it’s nonsense, due to high (c.£2m pa) capitalisation of development spending. So the company is actually loss-making still on a real world basis of PBT.

A big recent contract win with QUIZ might be a mixed blessing, as I think QUIZ is looking very wobbly. Although with wealthy (thanks to its overpriced IPO) family backers, I imagine QUIZ is more likely to de-list than go bust, so hopefully should be able to honour its contractual terms with ITIM.

I’ll keep ITIM on my watchlist for now. Note that spikes up on contract news tend to dissipate quite quickly, so I won’t be chasing it up on any rise today. The time to buy (if at all!) would be after a long drift down. It’s another over-priced 2021 float, that has been a disaster so far, but some of these could be interesting opportunities, you never know!

Distribution Finance Capital Holdings (LON:DFCH)

Up 26% to 34p (£61m) - H1 Trading Update [ahead exps] - Paul - AMBER

This specialist lender is normally covered by Graham and Roland, but Graham’s busy on other things today, so I’ll (Paul) give it the once over.

Previously -

29/11/2023 - down 30% to 18p on a profit warning, caused by a loss revealed on a large overdue loan. Roland went amber/red, saying it was a special situation only. This was actually the low in the share price as it turned out.

18/3/2024 - up 9% to 28p, on an ahead of expectations TU for FY 12/ 2023, moved up to amber by Graham.

Today - I can see from the StockReport that there was (as of close yesterday) a large 50% discount to NTAV, and a low forward PER of 5.8x, no divis though. So some nice value characteristics there.

Distribution Finance Capital Holdings plc, a specialist bank providing working capital solutions to dealers and manufacturers across the UK, is pleased to provide a trading update for the six months ended 30 June 2024.

An excellent headline -

“Continued momentum with full year results now expected to be significantly ahead of market expectations”

This is quite a big business for £61m market cap, eg -

New loan origination in H1 up 17% vs LY H1, at >£709m

Loan book at 30/6/2024 £600m, i[ 16% on LY, and suggesting it has rapid turnover of loans (given new loans originated is higher at £709m)

They provide vehicle stocking loans to dealers, on a short term basis (average loan 149 days).

Bad debts don’t sound a problem at all currently, which is obviously the main risk (and fraud) for this type of lender -

“In spite of the challenges of the macro-economic and higher interest rate environment, the Group's overdue accounts have continued to perform well and ahead of expectations through the period… The Group's total arrears balance represented c0.5% (H1 2023: 2.5%) of its entire loan book.”

Although bad debts can come out of the blue with this type of lending. Also I worry that bad debts could also be large, if a dealer group with multiple sites went bust. So it would be good to know the maximum exposure to say, each of the top 10 biggest borrowers.

Overall trading sounds good -

“In light of the strong performance during the six month period, the Group's underlying trading performance is expected to be ahead of market expectations for the full year, driven by stronger net interest income, lower impairments and loss provisions and stronger cost control.”

RoyalLife - this must be the large £10m impairment mentioned late last year. It says today £4.7m is in the process of being recovered, subject to asset sales mainly in 2025 - hence a write-back to profit.

Revised guidance -

“Given the Company's strong underlying operational and financial momentum and the financial recovery in relation to RoyaleLife, the Group expects to report a pre-tax profit for the six month ended 30 June 2024 of no less than £9.0m, which is significantly ahead of its expectations and more than the entire FY23 outturn of £4.6m. Accordingly, the Group expects its full year outturn for 2024 to significantly exceed market expectations.”

Entry into hire purchase funding is expected in 2025, a significantly larger addressable market, it says. Subject to regulatory approval.

FY 12/2023 Results - I’ve had a quick skim of the numbers. It makes a good lending margin, with £60m income (“interest & similar”) and only £22m in interest costs. However the resulting £38m of net interest income is largely consumed by £22m costs (mostly staff), and £12m impairments, leaving only £4.6m PBT. Since they over-provided for the RoyalLife bad debt, then we could perhaps adjust 2023 PBT up to c.£9m. Hence today’s news of profit rising from £4.6m in 2023, to £9.0m in 2024, isn’t reality in my view, it’s just been driven by being over-cautious in bad debt provisions in 2023. It’s good that the policy is cautious, but this is not really profit growth in my view, when a company is essentially making a prior year adjustment.

Balance sheet at 31/12/2024 - looks fairly strong actually, with c.£100m NTAV, well above the £61m market cap (allowing for today’s +26% share price move). It had most of its NTAV in cash, at £90m. Customer loans are by far the biggest asset, at £568m. Liabilities are overwhelmingly “Customer deposits” of £575m (see note 35).

Note 39 shows who it lends to, with the largest segment (lodges & holiday homes) incurring the £5-10m impairment -

I can’t find the maturity profile of the customer deposits (ie. cash taken from retail deposits, but it’s probably buried in the notes somewhere.

Paul’s opinion - I’ve spent long enough on this, so let’s wrap it up.

I never invest in alternative lenders, as sooner or later something always seems to go wrong.

There’s a lot of potential risk, particularly from fraud. I’ve mentioned this before, but c.1991 I worked as a junior for the insolvency dept of Price Waterhouse. One job was a receivership of a Rolls Royce & Saab dealership, which I found fascinating, as I was sent out on site, to help sort out the various problems. What we discovered is that some of the vehicles on finance to a lender like DFCH didn’t actually exist. I probed the staff, and they openly told me that to keep the business going, paperwork had been falsified, and funds borrowed, for quite some time. Eventually the dealer collapsed due to ongoing trading losses during that recession.

So my point is that within DFCH’s book there could be potential bad debts that only become apparent once a customer collapses. When the lender tries to recover the assets, sometimes they don’t exist, or have already been stolen or sold. Hence why lending that you would think would be 100% safe, may not be.

What about the risk of a run on depositors? I didn’t get round to looking at that, but since the business model is short-term lending of only about 5 months on average, then a run on deposits could even be manageable? So the terms of deposits would be very important to look into - eg if it attracts deposits from retail depositors and locks the money in for say 6 months or more, then a run on deposits wouldn’t actually be a problem in theory - they could just stop lending, and the cash would quickly roll in from borrowers repaying loans, to meet withdrawals by depositors.

It seems that DFCH makes about £10m PBT on a net asset base of about £100m. Hence valuing it at a discount to NTAV seems fair to me. Maybe the discount is a bit too big at the moment, so upside on this share might be that it gets closer to NAV, last stated at 55.6p. That’s 64% above the current share price. So it could go up if investor confidence improves, and buyers are not snuffed out by selling from stale bulls. Who knows?!

Superficially cheap on a balance sheet basis, but not a particularly good business, and lots of risk from the many moving parts, so I think it should be at a discount to NTAV.

AMBER feels right to me. Today’s 26% jump in share price looks possibly overdone, as the profit growth seems more from changes to provisions, not from improved underlying trading - although that seems obscured in the commentary.

Peel Hunt (LON:PEEL)

Up 3% to 133p (£163m) - Trading Update (AGM) - Paul - GREEN

Peel Hunt is a leading UK investment bank that specialises in supporting mid-cap and growth companies. It provides integrated investment banking advice and services to UK corporates, including equity capital markets, private capital markets, M&A, debt advisory, investor relations and corporate broking.

PEEL is probably best known to most of us as a broker that writes excellent research that we can’t get access to, due to the prohibitive price after the misguided MiFiD rules were introduced.

The year end is FY 3/2025, so it gives a brief Q1 update today. Here’s the whole thing -

“As reported in our FY24 Results Announcement on 13 June 2024, we have seen some improvement in the macroeconomic backdrop since the start of FY25, with tentative signs of a pick up in equity capital markets ("ECM") activity.

During the period, we have advised clients in relation to a number of ECM transactions, including acting as global co-ordinator on two IPOs executed on the London market, and we are encouraged by an increase in activity in both our Execution Services and institutional trading businesses.

Consequently, revenues for Q1 FY25 are ahead of the equivalent prior year period and in line with market expectations.”

That sounds reasonable in the circumstances, so mildly reassuring I would say.

Looking back at previous numbers, it made a small £(0.8)m loss in H1 LY.

H2 must have been worse, with a £(3.3)m FY 3/2024 loss.

These are not alarming numbers to me. It’s a highly cyclical business, so I can tolerate smallish losses in the depths of a bear market.

Balance sheet is strong, with NTAV of £90m at 31/3/2024, supporting 55% of the market cap today. So the small losses are not even putting a small dent in the balance sheet.

Paul’s view - previously I was GREEN on 3/4/2024 at 120p.

Further back, Graham was also GREEN on 5/12/2023 at 93.5p. Graham included PEEL in his top 10 ideas list for 2024, and it's up 17% YTD.

Our commentary each time here is the same - strong balance sheet, and cyclical upside in due course.

That remains my view today. You can’t value PEEL on a PER basis, as it’s modestly loss-making, but in this sector profits can explode upwards (on a reduced cost base) when proper bull markets get established.

It says in line with market expectations, without saying what they are, and we have nothing in our broker consensus figures either. Bit of a schoolboy error there! I think PEEL needs to come down occasionally from its ivory tower, and recognise that private investors do actually matter, as we create market liquidity and set the share price. Some brokers get that, and engage well with us. Suggestion - maybe PEEL could think about getting possibly just the front page of its research out to a wider audience, maybe with a week or two delay, so that the paying customers can justify the hefty cost of a subscription? If research only goes out to institutions, then there's no market liquidity - it's PIs who need to be engaged to get liquidity (and share hence prices) on the move, particularly when many institutions are still sellers (look at the two discounted secondary placings we saw last week, caused by a lack of market liquidity).

Brokers also need buyers in the market for their shares, to mop up all the employees selling their share options continuously, as is often the case in this sector. Those Ferraris don't pay for themselves!

I’ll stick with GREEN, but we don’t know what the size of the cyclical upside is likely to be, nor when it will happen, although I suspect we’re in the early stages of a bull market, despite recent softness.

Graham’s Section:

Glenveagh Properties (LON:GLV)

Up 3% to €1.32 (€753m) - H1 Trading Statement - Graham - AMBER/GREEN

It’s an H1 trading update (to the end of June) from this main market listed Irish home builder.

Before getting into the details, I should outline that the company has three divisions: Suburban (houses and low-rise apartments), Urban (apartments) and Partnerships (houses and apartments for government bodies). Suburban is by far the largest, accounting for more than three quarters of 2023 revenues, followed by Urban.

Key points:

800 units completed in H1. The full-year target is for 2,700 completions.

Order book is up 22% since 2nd May and includes 2,057 “suburban” units. “Strong visibility on deliveries and revenue in H2 2024.”

H1 revenue €150m (H1 last year: €172m), as over 500 of the completions in H1 already had most of their revenues recognised in prior periods.

Suburban margins are now over 20% thanks to “our enlarged scale, increased standardisation of product and processes, and continued integration of manufacturing” (last year: 19.3%).

Net debt increases to €250m (H1 2023: €182m), driven by work-in-progress “which will unwind as unit deliveries accelerate in H2”. So we should expect a quick reversal of this.

Outlook: full-year EPS guidance is reiterated at 17 cents (2023: 8 cents), ROE target 15%. Guidance has been pretty stable:

Some comments on strategy:

We continue to invest in accordance with our capital allocation priorities, notably in land where we are now seen as the partner of choice for landowners in attractive Suburban and Partnership led locations. A number of significant land transactions are now being explored in this regard.

These acquisition opportunities, should they materialise, are in highly attractive locations that are fully aligned with the ambitions of national and regional planning policy. These will also underpin long-term operational growth and optimal returns for shareholders, supported by our resolute focus on enhancing Return on Equity and our commitment to manage the size of the landbank to below €400m over the long term. Once our capital allocation priorities are satisfied, we remain committed to returning any excess cash identified to shareholders.

The CEO also provides some comments, noting that around 35,000 units are now being built in Ireland p.a. but arguing that 50,000 units p.a. should be delivered. I couldn’t agree more - in fact I think that’s on the low end of what would be a reasonable figure, given the current supply/demand imbalance. But of course it’s easier said than done - planning roadblocks, taxes (especially VAT), strict mortgage rules and high raw material costs all need to be managed and overcome to make that happen.

He finishes his comments with the following:

Glenveagh's ability to deliver great value, high-quality, sustainable homes at scale via our innovative and proven vertically integrated operation positions the business at the forefront of meeting the needs of a growing economy and rapidly expanding population, supported by motivated legislators and a strong fiscal position."

Graham’s view

I’ve only commented on this share a couple of times before. In September 2023, I gave it the green light at a share price of 97c. It originally came to my attention at 82 cents in January 2023..

Among other things, I have noted the company’s focus on ROE as a key metric, its declining share count, and low PE multiple.

Guidance for 2024 is unchanged since then in terms of EPS, and there haven’t been any more share buybacks to reduce the share count. The main change since September is that the share price is now €1.32:

So it’s no longer trading at the bargain bucket valuation it was before, although it does still have a single-digit earnings multiple:

Against its balance sheet, it now trades at a premium to book value, instead of a discount. Net assets as of December 2023 were €678m.

Overall, my view here is unchanged: I continue to view this as a high-quality home builder that works on attractive developments in the region around Dublin.

However, I’ll try to stay disciplined: in general, when a home builder trades at a premium to book value, I take a more cautious stance. Therefore, despite the strong momentum here, I’m going to revert back to AMBER/GREEN to reflect the fact that the shares are up 36% since I looked at them last.

Liontrust Asset Management (LON:LIO)

623p (£404m) - Final Results - Graham - AMBER/GREEN

Let’s do another catch-up report on a fund manager’s results.

Liontrust published its full-year results (for March 2024) towards the end of June, while I was away.

Headlines:

Gross profits down 19% to £186m (this number is similar in meaning to revenues).

Adj. PBT down 23% to £67.4m

Statutory loss £0.6m (it’s crucial to investigate the difference between this and adj. PBT - see below).

Dividend for the year unchanged at 72p.

Assets under management fell 11.5% to £27.8 billion by the end of the financial year (March 2024), and fell a little further to £27.25 billion as of 20th June.

Net outflows for FY 2024 were £6.1 billion - a shocking figure.

CEO comment: talks about “signs of a change in investor sentiment”, and outlines strategy:

The events of the last year have not reduced our belief in active management but have reinforced the need for Liontrust to expand our investment capability across asset classes and investment styles, broaden distribution and enhance the Group's operations. As we could not accelerate these developments through an acquisition, we have been pursuing them organically, through recruitment and investment in the business. These actions are ensuring we can drive the business forward and deliver on our strategic objectives.

You may recall that Liontrust made a failed attempt to take over the Swiss fund manager GAM last year (discussed in previous reports).

UK ISA: Liontrust was “actively engaged” with the government over the idea.

Adj. vs actual Profitability

The scale of the adjustments made to the profit figure this year was staggering: £68m, a high percentage of the company’s total market capitalisation!

Here’s a table from the footnotes explaining what happened:

To understand the £15.6m spent on “professional services”, you have to scroll back to a footnote within another footnote in the results statement.

It turns out that most of the professional services relates to the failed GAM acquisition, but £5.6m of it is described as “Significant costs relating to target operating model restructure”. This includes new software and various other costs.

Personally, I do not allow companies to write off costs such as this as exceptional, as to do so would invite companies to pretend they are profitable when they are not! So personally I would not allow this £5.6m to be adjusted out of costs.

Similarly, I wouldn’t allow staff severance/reorganisation costs to be adjusted out. The figure for FY 2024 is not so different from the figure for FY 2023, so is it really an exceptional cost?

Amortisation and impairment - many investors are happy to let these be adjusted out, as they are non-cash, but the huge impairment figures are a poor reflection on the company’s track record in acquisitions.

Overall, I do think it’s fair for the company to argue that some costs need to be adjusted out, but I think there is a middle ground to be found between what the company presents and the unadjusted statutory loss.

Graham’s view

As is usually the case with Liontrust, I struggle to find the company’s points of differentiation vs. other fund managers. For example, the Chairman describes Liontrust as having “investment styles that have been largely out of favour during this environment of interest rates remaining higher for longer than many expected”. He goes on to describe these styles and strategies as “quality growth, small and mid caps, sustainable investing, as well as UK equity”. Perhaps they are simply running too many strategies?

The company doesn’t seem to agree - on the contrary, they are seeking more diversification of the fund range. The GAM acquisition, too, would have added complexity. It all seems very counter intuitive to me.

They do say they have been merging funds “where we can produce economies of scale for the benefit of investors”. (It’s always important to bear in mind that when fund managers describe their historical returns, they often do not include poorly-performing funds which have been merged or shut down.)

As you can probably tell from my analysis of the company’s earnings adjustments, I’m also not entirely satisfied with the company’s presentation of its results. That’s nothing new: I’ve had questions about this going back to 2022.

I am still inclined to keep my positive stance on these shares due to their cheapness:

But as before, this is far from my top pick in the fund management sector. What I suspect they should do is allow themselves to merge or be taken over by a larger company. Instead they have preferred to be the acquirer, and this hasn’t worked out well for them up to this point.

On balance, I’m going to moderate my stance on this from GREEN to AMBER/GREEN. With different management, or with cleaner accounts and a simpler strategy, I could probably go GREEN again

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.