Good morning, it's Paul here with the SCVR for Thursday.

(As usual, this is initially a placeholder post, for readers to add your comments from 7am, as I write the article section by section throughout the morning/afternoon. We aim to get most of the report done by 1pm.)

Estimated completion time today - 4pm (as I don't have anything else on today, I'll spend most of the day on this).

Edit at 16:55 - I've been delayed, due to feeling tired & stressed, probably like many of you too. It's not much fun watching our portfolios tumble. So I'm re-starting now, with 2 more companies to add. Revised finish time is 7pm.

Edit at 19:12 - today's report is now finished.

My thinking on coronavirus has, if anything become even more bearish. I've been watching quite a lot of CNBC this week, for views from across the pond. It strikes me that financial people seem incredibly complacent about the impending pandemic of coronavirus. One commentator even said he thought this could all be over (as in no longer an issue) in a fortnight! When you think through the consequences, of even a few months disruption, it's actually very serious. Lots of smaller businesses could fold, contract wins could be delayed or cancelled in many sectors, and the inevitable cost-cutting would result in higher unemployment, hence weaker consumer spending, hence recession. I think it's a big mistake to imagine this as a short term blip. Once things start to snowball downhill in a recession, it's difficult to stop.

That said, Governments can borrow at historically cheap rates (e.g. US 10 year is only 1% - which seems crazy for a country that is already borrowing at an alarming level).So maybe they can keep throwing money around like confetti, and keep it all propped up? I think we're globally building up conditions for another massive credit crunch, and major recession, once this credit bubble pops. Subjectively, to me conditions seem even more extreme than before the 2008 Great Financial Crisis.

I think things look poised for coronavirus to trigger recession, in the UK, USA, and many other countries. That's only my opinion, based on the evidence we currently have, and could of course, as with any opinion, turn out to be wrong. Let's hope I am wrong.

As such, I think we can tear up broker forecasts for 2020, and I'm very reluctant to buy anything right now - because we don't know what earnings are going to be, hence they're impossible to value. Remember that after the 2008 GFC, earnings didn't snap straight back. Generally they take years to gradually re-build back to pre-crisis levels. Therefore I'm not at all convinced that riding out this crisis is a good strategy. Although that's what I'm doing with my ungeared SIPP, because the individual stocks are things that I think should out-perform. Remember that a low forward PER often means that earnings forecasts are too optimistic.

I remember in 2007, small caps did really badly, and I decided to just ride it out. That turned out to be a disastrous decision, as my (geared) portfolio was wiped out completely, and became negative in 2008. Therefore I'm paranoid about gearing now. The most successful investors I know had generally moved into cash in 2008, and that's the best way to ride-out major market downturns. I certainly think the big rebounds we're seeing intermittently now, could be good opportunities to sell.

Flybe - a sad postscript, with Flybe falling into administration overnight. It's been struggling for years, with never-ending turnaround plans, which we followed closely here, never seeming to deliver the goods. I hope that the administrators are able to sell off some viable parts of Flybe, because some of the UK's regional airports are almost entirely reliant on Flybe (e.g. 95% of flights from Southampton). I wonder if the Govt took into account all the knock-on impact of allowing Flybe to fail, in terms of indirect job losses?

Indigovision (LON:IND)

Share price: 232p (up 20% today, at 08:55)

No. shares: 7.34m

Market cap: £17.0m

An old friend, this share (I used to own 8% of the company, back in 2004!) - a Scottish based digital CCTV specialist.

Results today look good (as was previously flagged in a positive trading update);

- Revenues up 9.2% to $50.2m

- Adj EPS 31.5 cents - a huge improvement on last year's -4.1p loss

- Good gross margin of 57.7% - hence this business has lovely operational gearing, when sales rise

- High R&D spend - also a positive thing

- Net cash $2.2m

- Dividend reinstated at 2.0p

- Cashflow also good, mainly spent on a small acquisition

- Balance sheet looks quite strong overall, although both receivables and inventories seem high

- Outlook - nothing specific, just says they're confident

.

My opinion - it's great to see a decent turnaround here.

How to value it? Very difficult. If we're heading into a recession, then projects could dry-up again, and profits plunge. That's what happened previously, in 2004-2008 it 30-bagged on the upside, then gave back most of that in the recession.

.

Airea (LON:AIEA)

Share price: 43p (up 12% today, at 10:54)

No. shares: 41.4m

Market cap: £17.8m

The group remains focused on the design, manufacture, marketing and distribution of floor coverings.

Today's results announcement covers the year ended 31 Dec 2019.

I'm rather under-whelmed by these figures, and am surprised the share price is up today.

- Revenue flat at £19.2m

- Pre-exceptional operating profit down 28% to £2.17m. The company blames about half this fall on Brexit preparations.

- EPS not comparable, as LY had a P&L tax credit.

- EPS of 3.8p = PER of 11.3

- Balance sheet - includes £3.6m investment property (nice to have), £3.0m cash, strong current ratio, and £1.5m pension deficit

- Pension deficit of £1.5m, but deficit recovery payments of £400k p.a., so under-stated liability really. I would offset rental income on investment property against the pension deficit recovery payments, thus easiest to ignore both for valuation purposes

.

My opinion - looks priced about right.

.

Hyve (LON:HYVE)

Share price: 63p (down 11% today, at 10:54)

No. shares: 815.8m

Market cap: £514.0m

Hyve Group plc is a next generation global events business whose purpose is to create unmissable events, where customers from all corners of the globe share extraordinary moments and shape industry innovation. Hyve Group plc was announced as the new brand name of ITE Group plc in September 2019...

I was only thinking to myself yesterday, I wonder how ITE is getting on - presumably very badly, since exhibitions are likely to be cancelled. Coincidentally, it's popped up here under its new name Hyve. The share price is already heavily down, as you would expect. Although as with so many other shares, the recent plunge has only given back fairly recent gains (in the last year, in this case, but many other shares have only given back 6 months gains);

.

My summary of today's update -

- Significant disruption - many events cancelled or postponed

- Management acting to mitigate

- Travel & large gatherings restrictions from Govts having an impact

- £16-18m profit hit in 2020, seen as one-off

- Situation could change

- Refinanced in Dec 2019, operating within covenants & has headroom

To put this into context, the last reported full year accounts show profit of £55.8m, but most of the was created from large adjustments. Hence more work would be needed to clarify what all those adjustments are, and if they are fair. I'm not considering a purchase, so can't justify spending the time on it.

The last reported balance sheet was pretty horrendous actually, with NTAV heavily negative, at about -£158m.

Since the year end, it has (with terribly unlucky timing) acquired some other events, part-funded with a placing.

My opinion - more work needed, but my initial review leads me to believe that the financial position here looks precarious.

The problem is that it has a very weak balance sheet. As the deferred income unwinds, and cashflow dries up from cancelled events, that's likely to put a lot of strain on a weak balance sheet. The key thing to investigate would be the terms of the bank facilities, and covenants.

If coronavirus blows over fairly soon (say by the summer), then I could see this company/share recover. However, if it's worse than that, or comes back again in the autumn, then this company looks badly exposed, due to its weak balance sheet.

Franchise Brands (LON:FRAN)

Share price: 130p (up c.4% today, at 11:55)

No. shares: 79.5m

Market cap: £103.4m

Franchise Brands plc (AIM: FRAN), a multi-brand franchise business, is pleased to announce its full year audited results for the year ended 31 December 2019.

I've reviewed the figures, but not read all the commentary. Here are my notes;

- Adjusted profit before tax up 27% at £4.07m

- Nicely presented figures, clearly showing the adjustments, which look OK, and are not excessive

- Adj EPS up 29% to 4.34p - a PER of 30.0 - looks high to me

- Balance sheet - a bit thin, at negative NTAV of -£7.1m - although this could be justified due to having a strong stream of monthly recurring revenues from franchisees

.

My opinion - due to the macro picture, I'm now looking at every share with a view to what the downside scenarion might, be if we go into recession.

I imagine a lot of FRAN's services should hold up well in a recession (e.g. a blocked drain would still need to be cleared). Downside risks might include increased bad debts from franchisees going bust? Possibly lower sales of new franchises, which generated about £2.0m of (probably high margin) revenues in 2019 - representing a sizeable proportion of total profits. Thin balance sheet not ideal if we're going into a downturn.

Overall, I have to say that, in the current circumstances, I think the share looks priced a bit too aggressively for me. That said, if it can meet forecast of 6.0 EPS for 2020, then the PER would come down from 30 to about 22, which looks a bit more bearable.

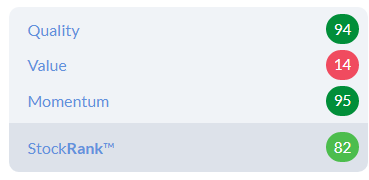

Stockopedia shares my concern about valuation, but rates the business highly for quality & momentum;

.

Hostelworld (LON:HSW)

Share price: 80.5p (down 16% today, at market close)

No. shares: 95.6m

Market cap: £77.0m

Hostelworld, a leading global OTA focussed on the hostel market, is pleased to announce its preliminary results for the year ended 31 December 2019

OTA - what's that? Must be online travel agency. What is gained by using an abbreviation that may not be familiar to everyone? Good announcements should be as jargon & abbreviation-free as possible. Or at least if you must use them, then explain them in the first instance.

I'm interested in looking at travel companies at the moment, because some may be nice opportunities to catch a rebound, when coronavirus starts to retreat. Others may be basket cases, if they're not able to absorb the financial pain of maybe a whole season of drastically reduced customer activity.

Checking my notes from last year, here, I see that HSW has published its 2019 results today, about a month more quickly than last year. I wasn't impressed with its 2018 results, coming to the conclusion that it had gone ex-growth, and was in a very competitive market. Good job, as the shares have more than halved in the last year, and were in a clear downward trend even before coronavirus came along recently to accelerate the downturn;

.

The optimistic PR-speak at the top of the announcement (yesterday) of 2019 results, trumpets;

EBITDA in line with guidance, underpinned by a return to net bookings growth during the latter part of H2 2019; and significant opportunities for future growth identified

I'm sure coronavirus will have nullified that, let's see what we can find. I'll do CTRL+F for "coronavirus". Here it is;

Outlook -

While we entered 2020 with positive momentum, trading since late-January has been challenged by the outbreak of the COVID-19 virus which is having a significant impact on global travel demand, within Asian markets and more recently within the European market.

As the Coronavirus has spread from region to region, we have observed a material reduction in bookings and an increase in marketing cost as a percentage of net revenue. This has been driven by a significant reduction of bookings from free channels, an increase in longer lead time cancellations across all channels and an increase in investment in paid channels to partially offset the bookings decline in free channels.

Given that the depth and duration of the virus outbreak is impossible to forecast at this time, we are unable to calibrate its effect for the balance of the year; however, if near term trends were to persist to the end of March we estimate the impact to EBITDA to be in the range €3m to €4m for Q1'20.

With continued tight cost control and our strong cash generative characteristics, the Group remains resilient in volatile market conditions.

This does beg the question of whether it is worth spending on marketing, at a time when customers are unlikely to want to travel?

To put the E3-4m Q1 profit hit in context, if we assume that would reflect a new, lower run-rate, then we're looking at a range of £12-16m reduced profits for 2020. The actualt adjusted profit before tax for 2019 was £16.0m. Therefore, to my mind, this implies that the company is effectively now operating around breakeven (I've ignored seasonality there).

There's no point in me analysing the 2019 numbers any more, as they've gone out of the window, due to coronavirus. The only thing that matters is;

Is it going to go bust? - for all travel companies, this boils down to two things;

1. To what extent can costs be reduced? Airlines/Cruiselines are in the worst situation, with high fixed costs. But online platforms are probably in the best situation, since many costs (e.g. marketing is the biggest one) are variable, at short notice.

2. Can the balance sheet withstand at least several months of drastically reduced custom? So ideally here we're looking for net cash, and bank facilities with plenty of headroom, and light, or no covenants, and a supportive attitude from the bank.

Looking at those in turn, re costs, note 4 discloses that marketing spending was £32.4m in 2019. Staff costs made up the second highest category of spending, at £16.9m. Put those variable costs together, and the £49.3m total makes up nearly 78% of all administrative expenses. This is excellent news - i.e. HSW has a largely variable cost base, and hence should be able to reduce its outgoings rapidly & considerably, to suit reduced customer activity.

What about the balance sheet? That's in good shape too, with no interest-bearing debt, and a £19.4m cash pile. Therefore, providing costs are cut back, and there's loads of marketing spend to be reduced if needs be, then I don't see any risk of the company going bust.

My opinion - the main problem with HSW, is that it was struggling against lots of competition to begin with, and seemingly losing market share.

Therefore, even though I am confident it should survive pretty much any level of downturn in travel, by cost-cutting, I don't think it's ultimately a very good business, even when things do get back to normal. So why would I want to buy it? Only if the share price got so low, that it was practically being given away. I'm thinking maybe 20p per share. Then it would be a steal. But with the price in freefall, and the newsflow re travel sector getting worse by the day, I can't see any rush to get involved here now, if at all.

That's it for today. See you tomorrow!

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.