Good morning from Paul & Graham!

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

** New SCVR summary spreadsheet for calendar 2024 ** This is the live one! (updated 26/8/2024)

Archive - SCVR summary spreadsheet for calendar 2023.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices). My video explaining/reviewing it.

My other video (June 2024) - How to screen for broker upgrades on Stockopedia.

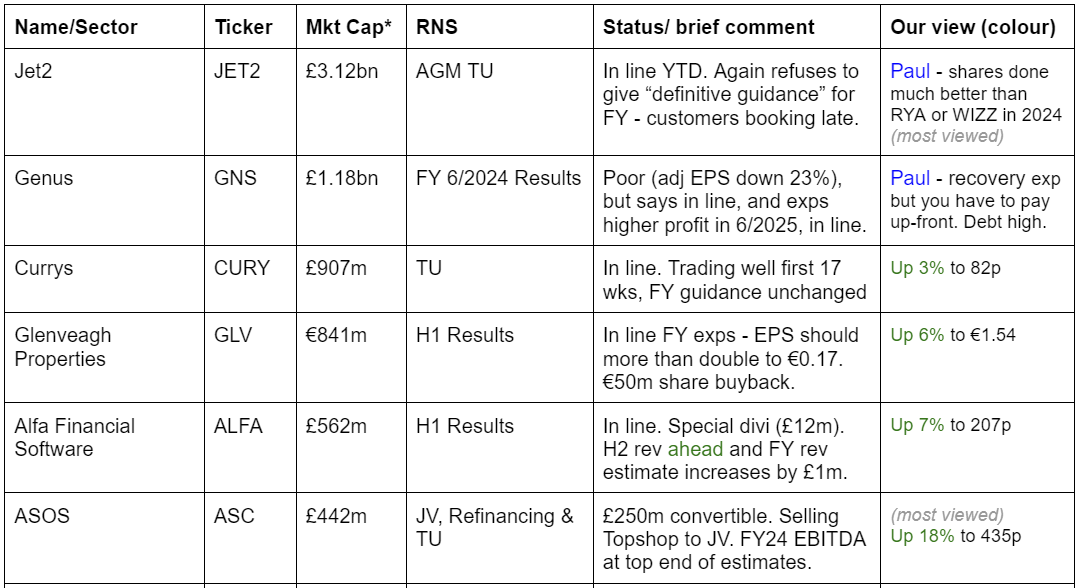

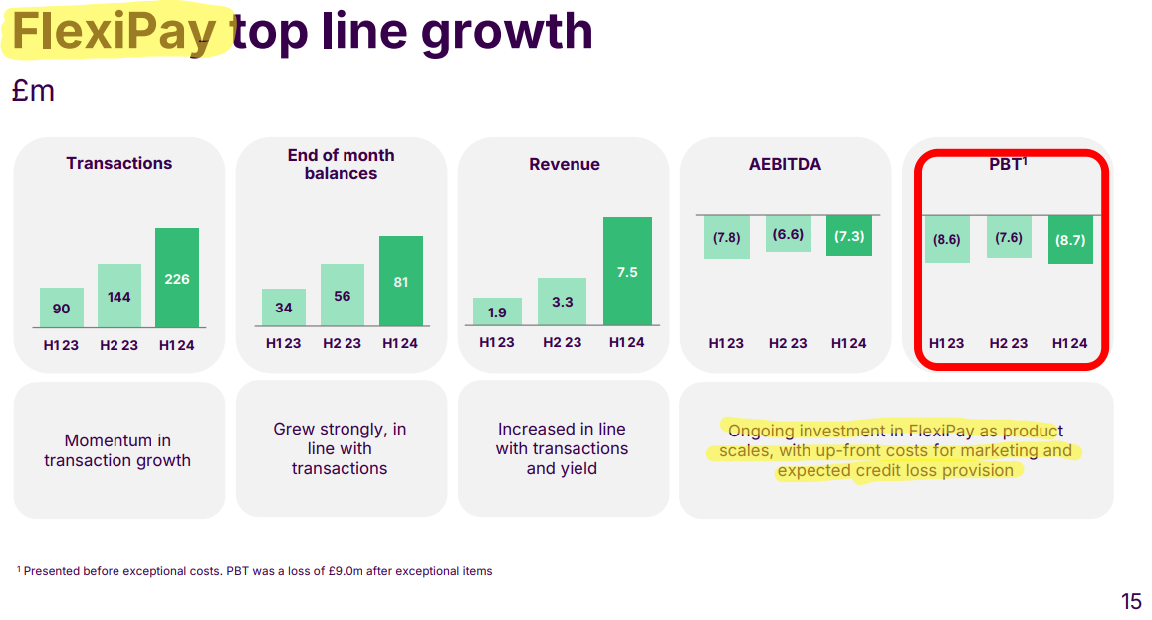

Companies Reporting

Summaries

Carclo (LON:CAR) - up 9% to 33.3p (£24m) - Trading Update - Graham - AMBER/RED

An encouraging update from this indebted manufacturer/engineer of high-precision components. It is trading in line and expectations are unchanged for this year and next year, as it returns to profitability. I’m upgrading from RED as renewed profitability should keep the lenders away in the short-term but the large overhang of liabilities, particularly the pension liability, requires me to stay cautious.

Funding Circle Holdings (LON:FCH) - up 25% to 114p (£419m) - H1 Results - Paul - GREEN

I'm late to the party here, but did tentatively like it on 25/6/2024. This has been an impressive turnaround, and moving into profit now (well, just above breakeven to be more accurate) is impressive - concept proven, and growing strongly, which is exactly the type of growth share I like. Is it reasonably priced though? Who knows, it's impossible to value at this stage. There's a big cash pile still, and buybacks are extended. Looks a good opportunity to me, but I have no idea how to value it.

Churchill China (LON:CHH) - down 9% to 985p (£108m) - H1 Results - Paul - AMBER/GREEN

Flat vs LY H1 numbers, with a slightly hesitant edge to the in line outlook comments. Hence a tinge of worry about a possible H2 profit warning, if the usual seasonal uplift doesn't happen. On the upside, it's a nice quality business doing >10% PBT margin, very well respected products & brand, with a lovely strong balance sheet. So I'll stick at AMBER/GREEN but with some reservations.

Paul’s Section:

Funding Circle Holdings (LON:FCH)

Up 25% to 114p (£419m) - H1 Results - Paul - GREEN

A strongly positive market reaction, that has just put £84m onto the market cap today (we manually recalculate the market caps in the line immediately above this one, to reflect the daily move at the time of writing, but we leave them at last night’s close, on the companies reporting list at the top).

The original business model of this lender to SMEs didn’t work, so I dropped coverage in 2019. However we’ve resumed coverage this year (here on 25/6/2024), as a remarkable turnaround seems to be underway. The loss-making US business was sold for £33m, and it’s focused on the UK business, which was stated (on 25/6/2024) to be -

“...on track to be profitable in H2, in line with our guidance. Over the medium term we expect net income growth of 15-20% CAGR with PBT margins of >15%.”

Further attractions are share buybacks this year, and a strong balance sheet with plenty of net cash.

I concluded in June that it was interesting, and worth a closer look - which corresponds with AMBER/GREEN, although I didn’t give it a colour at the time, due to not being confident I’d done enough work on it, due to time constraints.

H1 Results today (6 months to 30 June 2024).

I really like the format of this announcement, as it starts with a summary from the CEO, giving the main points - which are positive - ahead of exps, and upgrades to FY guidance -

“We are delivering on the plan I laid out in March to be simpler, leaner and profitable whilst continuing to show strong growth. In May, we simplified and streamlined the business to deliver £15m annualised savings in 2025 and in July we completed the sale of our US business for a gain of £10m.

The first half was stronger than our expectations with annual revenue growth of over 30%; 12% up on H2 2023. We were profitable a half earlier than we set out in our guidance in March and are today upgrading our guidance to be profitable for the full year (versus prior guidance of H2 profitable).

We are reaffirming our medium-term guidance of 15-20% revenue growth and PBT margins of more than 15% and continue to be excited about the long-term growth and profitability of the business as we execute against our plan.

We will commence a further share buyback of up to £25m following the conclusion of the existing £25m share buyback.”

This is a handy table, showing sequential 6 month periods -

So it’s only really a slightly above breakeven result for H1 this year, nothing to get too excited about.

That’s decent top line growth, of +32% vs the year earlier comparator, so it’s not just cost-cutting that’s driving improved trading.

Cost-cutting has been big though -

“Progressed cost-efficiency actions, to deliver c.£15m of annualised benefit in 2025 and, together with the US sale, reduced total headcount to c.760 (Dec 2023: c.1,100).”

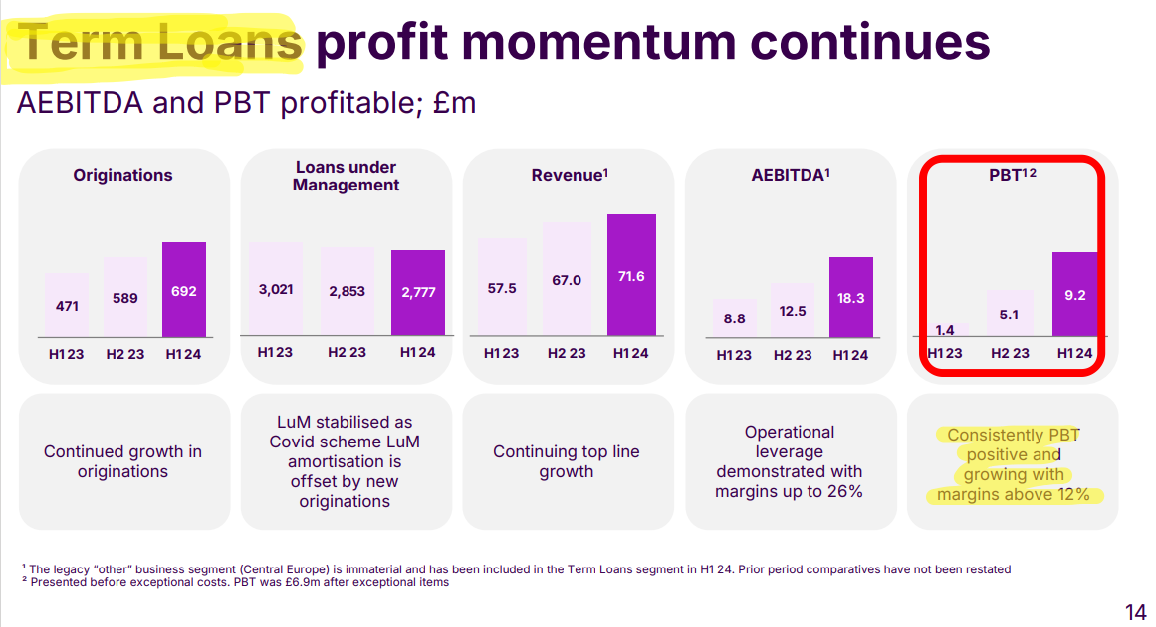

Another useful table here - the presentation of these results really is excellent, very clear - which shows us that the core business is making decent margins, but supporting a rapidly growing but still loss-making division (FlexiPay) -

CFO change - looks orderly, and previously announced, so probably not a concern.

Webinars/broker notes - I see FCH did an InvestorMeetCompany interims presentation this time last year, on 25/9/2023, so hopefully they might do an update this year too. There is an institutional/analyst meeting at 09:30 this morning, and the RNS says a recording will be available on FCH’s website, so I might listen to that later. Although analyst meetings can be a bit granular, asking obscure questions so they can fine tune their spreadsheets.

We’re in the dark already, with no broker notes available on Research Tree. Clearly FCH needs a better approach to communications with private investors. How can I buy the shares if I’ve not been able to read a broker note explaining the business, and all its moving parts, and providing forecasts? It’s a lot harder & time-consuming without that information.

The H1 slide deck is here on its website.

Business model - FCH seems to be mainly an arranger of loans, through its technology platform, with only a small lending book on its own balance sheet. That seems a decent and scalable proposition, especially now it’s moving into (modest) profit, and still has a ton of cash on the balance sheet - arguably not really needed now, if it’s only an intermediary, hence why using some of it for buybacks seems sensible.

Several shrewd fund managers and other commentators have talked bullishly about the potential for FCH to re-rate as a technology platform that is now taking off, having achieved at least breakeven, and targeting higher profit margins in future. I must admit, I find that argument quite compelling. I can’t stand loss-making start-ups, as so many fail, but FCH seems to have transitioned to an actual business that is now concept proven, growing strongly, and still sitting on plenty of cash.

Also, there was so much advertising done in the past, that most people will know the Funding Circle brand name - a real world intangible asset that would cost many millions, and time, to replicate.

Paul’s opinion - I’ve already spent half the morning digging into this, and don’t think it’s necessary to dig any further into or write about more detail, as the investing case is now obvious. It’s a growth share that's reached breakeven, with good reasons to expect that it should move into useful profits in the coming years. The brand is very well known, and it looks to be in the process of being re-rated as a technology platform, which as we know can command remarkably high valuations.

I have no idea how to value this share because you can’t use conventional value-style metrics at this stage with a growth company. Overall, I see an interesting situation here, as mentioned in June.

I need to do more research, but am happy to flag the opportunity positively with GREEN. Although I have no idea how to value FCH shares at this stage.

It's now a 5-bagger in just 6 months!

Although still a long way below the inflated IPO valuation, when it wasn't concept proven or profitable. There hasn't been a lot of dilution (and reducing with buybacks), so I would argue risk:reward now is far better than it was at IPO.

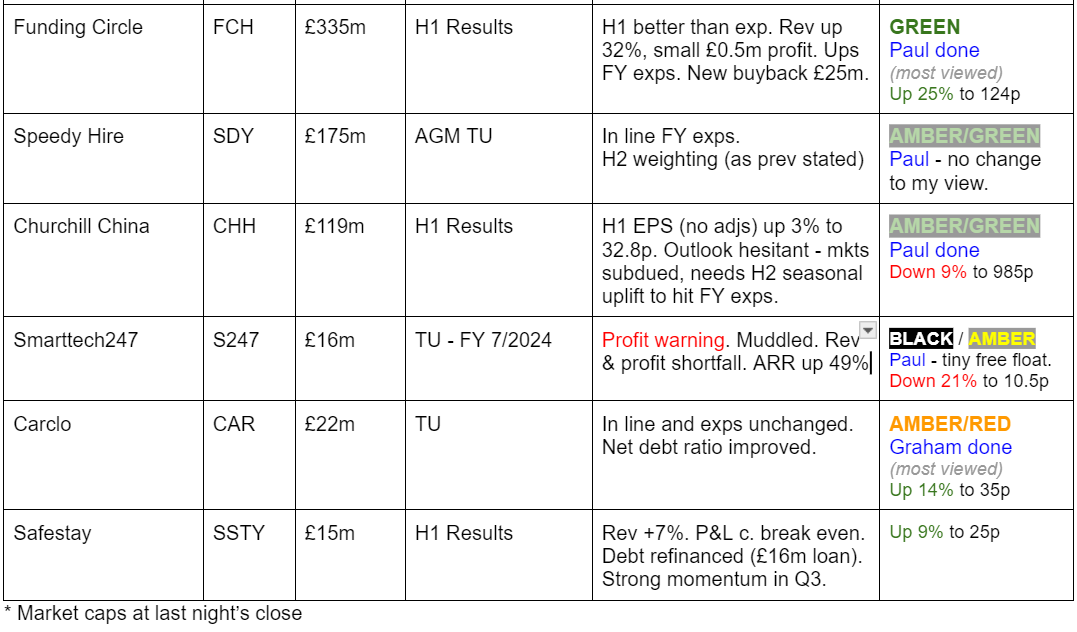

EDIT: another point which I didn't properly develop above, is that the Term Loan ("TL") division is actually nicely profitable, but this is obscured by losses in the developing FlexiPay ("FP") division. So there's a strong argument for using a sum-of-the-parts valuation, and giving TL a decent valuation, then say FP is worth nothing for now. Or give FP a speculative valuation if you think it could be come more profitable in future. Here are the slides that spell out this point nicely - and remember these are only half-year numbers -

Churchill China (LON:CHH)

Down 9% to 985p (£108m) - H1 Results - Paul - AMBER/GREEN

Churchill China plc (AIM:CHH), the manufacturer of innovative performance ceramic products serving hospitality markets worldwide, is pleased to announce its Interim Results for the six months ended 30 June, 2024.

Unremarkable results table below, and note the modest profit growth came from reinstating prior year numbers downwards -

Margins are quite good, that PBT is over 10% of revenues.

“Factory cost of production was broadly static during the period with increased input costs from labour and raw materials being offset by the reducing costs for energy. The focus on improving efficiency and yields continues and as a result the overall profit margin slightly increased.”

Outlook - sounds a bit hesitant, with the possibility of a H2 profit warning maybe? - but as it says, seasonally it does usually see an upturn in H2, so could be nothing to worry about. Any qualification to the in line with expectations comments is bound to raise investor anxiety as a possible early sign of trouble ahead -

“The Board believes that the Company is well positioned to take advantage of a return to confidence in our markets when that happens but continues to see subdued activity in our key European markets. As such, we remain dependent on the stronger demand normally experienced in the final four months of the year to meet our full-year expectations.”

Balance sheet is very healthy, with £60m NTAV. There’s no bank debt, and it owns freehold property in the books at depreciated cost of £12m. I wonder what the market value of the land/buildings might be? Often that can be a hidden asset for elderly companies like this. Accounting standards should be changed to require freeholds to be shown at a prudent market value, in my view.

This snippet from the 2023 annual report is interesting in reinforcing why freeholds are such a nice thing for companies to own - greatly improving risk:reward for investors, although some investors see this as old-fashioned and “inefficient”, which is crazy in my opinion -

Cashflow - wasn’t good in H1, but seems to be because of working capital movements (that should unwind), with receivables up, and trade payables down in H1 vs 6 months earlier, which absorbs cash in the short term. That’s something to check at the next year-end, to hopefully see this factor reverse.

Broker updates - nothing available to us plebs. So we’ll need to keep an eye on the broker consensus data, to see if anyone slips through a downgrade, which wouldn’t surprise me given the hesitant sounding outlook comment.

To be on the safe side, I’d be happier taking say 10% off the existing 2024 EPS consensus of 79.6p, so let’s call it c.70p. At 985p/share that gives me 14.1x, which looks a fair price.

Paul’s opinion - looks priced about right. Lovely strong, ungeared balance sheet. You’re getting the upside in a possible sector cyclical recovery in for free.

I’d say that’s moderately interesting. I was AMBER/GREEN last time on 5/6/2024 at 1,115p, and here we are with shares 12% cheaper now at 985p, and not far above the covid lows. I am worried about a possible H2 profit warning, so probably won’t be diving in myself, but it is quite a nice business, making decent margins, with balance sheet safety, so it’s better than just vanilla amber. Hence I can (just about) stretch to AMBER/GREEN again.

The 10-year chart below shows the current price is half the pre-covid, and post covid bounce peaks. There's been no dilution either, with still only 11m shares in issue, so maybe there's an opportunity here? That said, it's also looking ex-growth on earnings now, so maybe the de-rating onto lower PER is justified?

Graham’s Section:

Carclo (LON:CAR)

Up 9% to 33.3p (£24m) - Graham - AMBER/RED

Carclo describes itself as “the leading global provider of high-precision components, offering comprehensive services from mould design, automation and production to assembly and printing, serving the life sciences, aerospace, optics and tech sectors”.

Paul gave it a RED in April, noting high financial risk due to net debt of c. £19m, plus leases, plus a pension deficit. So as Paul said, it had the potential to be a zero, or a multi-bagger.

Fortunately, the company has delivered for its shareholders so far this year. Here are the key points from today’s AGM trading update.

Performance is in line with expectations.

The net debt to underlying EBITDA ratio has been “further improved” (numbers not given).

Expectations for FY25 and FY26 are unchanged, “with margin expansion anticipated to continue as the Group starts to see the full benefits of the operational optimisation process, continuing our journey toward our strategic goals of 10% return on sales and 25% return on capital employed”.

Let’s check some estimates.

In July, Panmure Liberum published forecasts for FY25 and FY26 as follows:

2025: revenues £133m, underlying PBT £2.4m

2026: revenues £146m, underlying PBT £5.2m

As you can see, this is a low-margin business - implying that small differences in the cost structure can have an outsized impact on the P&L. Carclo has been in restructuring mode since 2022, and its efforts are being rewarded with a return to profitability.

A reminder of the financial track record here:

Other bits and pieces from today’s update:

US manufacturing restructuring is ahead of schedule, with new leadership teams driving the expected enhancement in margins.

EMEA manufacturing is now focused “on the next phase of operational improvement”.

Graham’s view

This has been a multi-bagger year-to-date, as the worst-case scenario of short-term insolvency/administration has become less likely:

That’s the problem with these high-risk shares: RED might be justified on a risk basis, but if the company pulls through, the shares can perform fabulously! (This is also why shorting is so dangerous.)

So is Carclo out of the woods now?

I’m not a sector expert here, so I will look at the estimates and try to reach a reasonable conclusion.

The net debt estimates for March 2025 is £28m, falling to c. £26m by March 2026. This figure includes leases.

The annual interest bill is running at about £5m. That includes the interest on bank loans, notional lease interest, and interest on the pension liability.

The pension deficit was last recorded at £83m, with a new calculation due this year.

Given the size of these numbers, I don’t see how I can have a positive or even a neutral stance on these shares.

Adding the market cap, net debt estimate and pension deficit gives an enterprise value of £135m. This could and probably will come down with the new pension calculation, so let’s say the enterprise value is £120m.

That’s 12x the EBIT estimate for FY March 2026 (£10m).

Even for a manufacturing business that’s better-than-average and not overly leveraged, I’m not sure I could justify that valuation.

For a manufacturing business whose quality is uncertain and which is highly leveraged, I can’t justify it.

Therefore I’m going to go AMBER/RED on this. I’m upgrading from RED as the immediate risk of insolvency does appear to have reduced, thanks to improved profitability. But it remains much riskier than the typical stock we look at here.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.