Good morning from Paul & Graham!

Today's report is now finished. Apologies for it taking longer than usual.

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices). My video explaining/reviewing it.

My other video (June 2024) - How to screen for broker upgrades on Stockopedia.

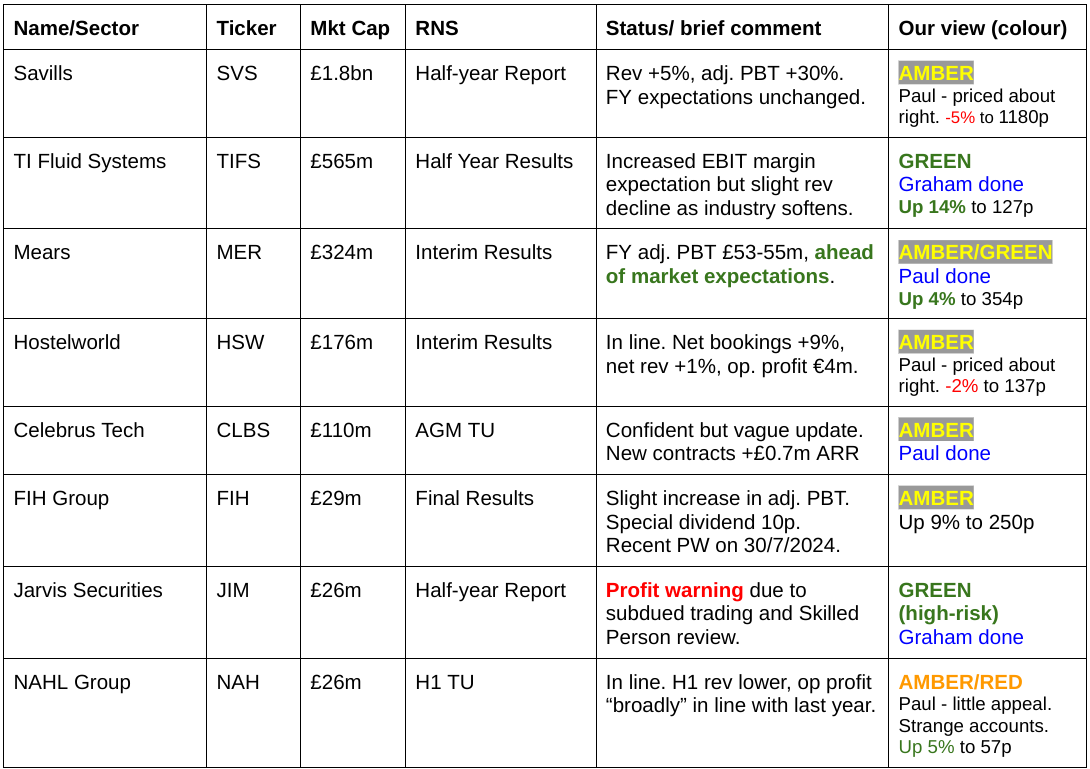

Companies Reporting

Summaries

Jarvis Securities (LON:JIM) - down 20% to 47p (£21m) - Half-Year Report - Graham - GREEN (high-risk)

It’s a profit warning to add insult to already-injured JIM investors. Costs associated with the Skilled Person Review have increased, restrictions on the company’s ability to trade remain in force, and trading volumes remain subdued. The company’s broker has now withdrawn estimates and its valuation of the stock. Clearly this is a high-risk situation with a wide range of possible outcomes, but I don’t wish to change my GREEN stance on the stock as we are on the cusp of finding out the conclusions of the regulatory review.

TI Fluid Systems (LON:TIFS) - up 10% to 123.2p (£619m / €719m) - Half-Year Results - Graham - GREEN

Some pleasant news here with respect to profit margins and ROCE as the company battles through a period of soft demand from its customers. I am leaving my long-term GREEN stance unchanged as I think the share price may be artificially low due to concerns about private equity selling down their old stake in this business, rather than more substantial problems.

Celebrus Technologies (LON:CLBS) - unch 280p (£110m) - AGM Trading Update & Contract Win - Paul - AMBER

This AGM update doesn't tell us anything about trading, other than that management say they're confident. Contract wins announced are only £0.7m ARR. So it's looking a bit flat to me. I like the company, and its cash-rich balance sheet, but think it needs something more exciting to propel shares even higher. So I'm shifting down a notch from amber/green to AMBER, to reflect the strong share price rises already, and a rather vague update today.

Mears (LON:MER) - up 4% to 354p (£340m) - Interim Results - Paul - AMBER/GREEN

Impressive H1 results, and broker upgrades to forecasts. There are some one-off contracts for housing asylum seekers, which are expected to normalise in 2025, so I think it makes sense to use the 2025 forecasts for valuation purposes. This gets me towards the upper end of what looks reasonable. However, the really impressive cashflow, funding big share buybacks (a remarkable 12% reduction in share count!) and decent divis on top, swings me towards keeping a favourable opinion at AMBER/GREEN.

Paul’s Section:

Mears (LON:MER)

Up 4% to 354p (£340m) - Interim Results - Paul - AMBER/GREEN

Mears Group PLC, the leading provider of services to the Affordable Housing sector in the UK, announces its interim financial results for the six months ended 30 June 2024 ("H1 2024").

Excellent first half performance and positive outlook

Impressive highlights here - note in particular the gold standard of reporting average daily net cash - all companies should do this, as it shows the reality of a company’s cash position, not a year end one day snapshot (that can be so easily window-dressed).

Also note the huge 12% reduction in share count through large buybacks -

The obvious questions are: what is driving the improved profitability, and is it sustainable?

Whatever they’re doing it’s clearly working well -

Outlook for FY 12/2024 is ahead of expectations, although it sounds as if there might be some one-off boost to profit this year from asylum related housing contracts, which are expected to normalise in future. It has bought some properties for this contract, and says it will be doing sale and leasebacks to recycle the capital. So we need to be a bit cautious about valuing this share on a PER basis in what might possibly be a peak earnings year.

Broker updates - many thanks to Panmure Liberum, whose note today raises FY 12/2024 estimated adj PBT by +10% from £50m to £55m.

In EPS for FY 12/2024, this is old: 37.0p, new: 42.1p.

PL’s note also gives a full explanation of the expected impact of normalising the asylum contract, baked into its 2025 forecasts, which get a boost today mainly due to the share buybacks reducing the share count substantially.

FY 12/2025 forecasts are amended today, old: 28.9p, new: 31.4p.

Historically, Mears shares tend to trade in a PER range from about 7x to 13x, which based on 2025 forecast gives me a share price range of 220p to 408p.

Today’s price is 354p, which is towards the upper middle end of my valuation range.

Some investors might strip out the cash, to give a higher rating, although I’d be a bit careful about that, as the balance sheet is not especially strong. NAV of £187m includes £128m of intangible assets, so NTAV of only £59m.

Paul’s opinion - it’s a nice business, performing well.

Cashflow has been very good, funding dramatic share buybacks, and paying decent divis too, not something you see very often on this scale.

Hence even though I think the shares look priced about right, the cashflow & big shareholder returns swing it positively for me to remain at AMBER/GREEN. There could also be potential upside, if the asylum housing contracts get rolled over in some way - that problem doesn’t seem to be anywhere near resolved, based on general media reports, so maybe Mears might continue to benefit from it?

Shareholders have done remarkably well, so maybe it needs to consolidate for a bit before making another attack on 400p? Who knows!

Note the StockRank is jammed on maximum!

Celebrus Technologies (LON:CLBS)

Unch 280p (£110m) - AGM Trading Update & Contract Win - Paul - AMBER

Celebrus Technologies plc (AIM: CLBS, "the Group", "Celebrus"), the data solutions provider…

Surely they could have come up with a better description than the above!

There’s a more detailed company description further down, but this is not very well written either. It seems to be mainly about data analysis to prevent fraud, and for marketing, and customer loyalty purposes -

“As a disruptive data technology platform, Celebrus is focused on improving the relationships between brands and consumers via better data. Celebrus redefines what digital identity verification means to power both next-level marketing and fraud prevention use cases. Deployed across 30+ countries throughout the financial services, healthcare, retail, travel, and telecommunications sectors, Celebrus automatically captures, contextualizes, and activates consumer behavioral data in live-time across all digital channels. Through the addition of behavioral biometrics and AI, Celebrus empowers brands to detect and prevent fraud before it occurs. To ensure that brands can begin to improve those relationships quickly, Celebrus Cloud activates the Celebrus platform efficiently for brands in a single-tenant, private cloud implementation.

The Group has offices in the UK, USA, and India with key talent in all markets to drive the growth of the business…”

Today’s trading update doesn’t really say much about trading, and keeps it all vague, without specifically stating if it’s trading in line with expectations or not.

“Recent contract progress adding to confidence in FY25 and beyond”

This year is FY 3/2025.

An attractive looking one-year chart - which looks on its way to doubling from the Oct 2023 lows -

Zooming out to five years, we’re about mid-way in the range, now in a nice up-trend. There has been about 15p in total divis paid over the last 5 years on top -

Graphical history below shows CLBS has been profitable throughout, but disappointed for several years with falling profits, but this is now recovering -

Going into the detail, see what I mean about this being vague -

“growing pipeline across a range of end markets and is highly confident in the Group's strategy to deliver growth and create significant shareholder value in the coming years…”

Contract wins only total £0.7m ARR, so not material to a group with c.£35m pa revenues.

Selling strategy is now focusing on particular industry verticals.

Broker update - given that CLBS itself tells us very little today, more information can be found in a note published today by Canaccord (many thanks to them). I hope they don’t mind me including this small excerpt below giving the key forecast numbers. It says in the commentary that these forecasts might be conservative -

[courtesy of Canaccord]

Valuation - at 280p/share I make this a PER of 22.4x - not exactly a bargain, especially given that the next two years are only forecast to have modest earnings growth.

Remember though that CLBS sits on a healthy cash pile, so there’s an argument for subtracting this (worth about a quarter of the market cap) for valuation purposes. Although if doing this, you would also need to reduce your earnings figure, to subtract the interest income on the cash pile.

Paul’s opinion - I’m listening to the webinar on InvestorMeetCompany at the same time of typing this. It doesn’t scintillate.

I admire CLBS, and have a generally positive view of the company - profitable, cash generative, and with a healthy balance sheet.

What concerns me, is that the business never quite seems to achieve its potential. Growth seems fairly pedestrian, and there must be any number of specialist data analytics companies out there competing.

That said, AI and data analysis are hot investment areas at present, so it looks as if CLBS is re-rating as the sector becomes more fashionable.

Is CLBS going to be a big, multibagging winner? I can’t currently see any evidence of that. So owning this share is more about hoping that contract wins might accelerate in future, beyond the small wins announced today, which barely move the dial.

Previously I’ve been amber/green, but given the share price has gone up a lot, and that there’s nothing particularly exciting in today’s update, I feel easing down to AMBER makes sense. If we get some better future newsflow, then I would shift back up to a more positive stance.

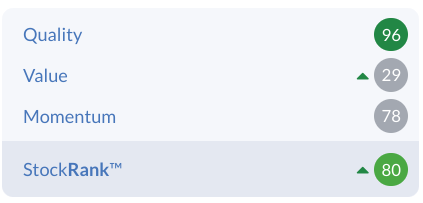

Quality & Momentum scores are high, but Value is low -

Jarvis Securities (LON:JIM)

Down 20% to 47p (£21m) - Interim Results - Graham - GREEN (high-risk)

This one has unfortunately been a horror show for investors over the past few years:

Today’s results are yet more bad news, with a fresh profit warning.

The financial headlines are as follows:

Revenue down 12% to £6.5m

PBT down 29% to £2.7m

Cash under administration (key source of interest income) down 15.5% year-on-year.

A regulatory intervention has been responsible for most of the doom and gloom here, with a Skilled Person Review ordered by the FCA.

The “Skilled Person” is now in Phase 2, which means they are reviewing the remediation work carried out by Jarvis in response to previous findings. This is expected to be completed “by Q4 2024”, and will include a final recommendation from the Skilled Person. So it is starting to sound as if Jarvis could be approaching the end of this saga.

Profit warning:

Due to subdued trading volumes; the increasing costs of the Skilled Person review; the costs of the associated remediation work and the ongoing impact of the VREQ [GN note: voluntary restrictions] on the Company's Model B clients, the directors anticipate that the trading for the full year ending 31 December 2024 will be significantly below market expectations.

Financial statements: everything is moving in the wrong direction on the income statement, as you’d expect, but the PBT margin is still a remarkable 42%. Many companies can only dream of earning a profit margin like this but for JIM, it’s not a great result.

The balance sheet remains small and efficient with tangible equity of about £5m.

Cash flow is always pretty good and again most PBT has been converted into free cash flow.

The company’s cash balance increased by £400k despite paying £1.5m of dividends to shareholders (admittedly they had paid out twice as much in dividends the previous year)..

Dividends: in a separate RNS, Jarvis declares a 1p quarterly dividend. The corresponding dividend last year was 3p.

Estimates: the company’s broker Jarvis has withdrawn its estimates and valuation for JIM, “pending the outcome of the remediation work expected in Q4”. So there is no official guidance. Previous estimates from WH Ireland for 2024 suggested there would be adj. PBT of £6.3m.

Graham’s view

Perhaps it is foolhardy to express an opinion when the company’s own broker no longer wishes to do so.

However, I continue to stubbornly think that JIM can pull through this, even if the profit result for the current year turns out to be very poor.

H1 PBT (with no adjustments) is already £2.7m. In H2, I would suggest that trading volumes are unlikely to be much more subdued than they already were. The interest rate cut from the BOE is only 0.25% thus far. And the Skilled Person Review and its associated costs have been with the company for a long time already. Admittedly these costs are increasing, but they won’t last forever.

Putting it all together, I would still humbly and cautiously suggest that we should still end up with a PBT result for the full year that is significant in the context of a £21m market cap.

The wildcard risk is the final recommendation of the Skilled Person, and then the final decisions by the FCA. Will JIM’s “Model B” business be permanently restricted? Will the company suffer fines? Will the company’s reputation among retail investors be damaged?

These are impossible questions to answer and so there is probably no point in making estimates for 2025.

I am willing to make one prediction: I think the FCA is likely to have a strong opinion on JIM’s interest income on client cash (see here). How ironic that it may start clamping down on this just as interest rates start to fall.

Checking my previous comments on JIM, I must acknowledge that this is one I’ve got wrong - I’ve been positive on it, and the share price has disappointed.

Feb 2024 - I was positive at 68p.

Nov 2023 - I was positive at 56p.

August 2023 - I was positive at 125p

March 2023 - I was positive at 139.5p

Sep 2022 - I was positive at 94p.

What have I got wrong? Several things, but mainly:

Not realising how long the Skilled Person Review would take

Not realising how expensive the Skilled Person Review would be for JIM.

However, the FCA still hasn’t revealed its cards. The final outcome remains unknown.

For this reason, I don’t think I can change my positive stance. JIM might yet walk away from this controversy with a few bruises but with its business more or less intact and with a £21m market cap that doesn’t make any sense. We simply don’t know.

Perhaps we need Paul to pipe in with a more sensible view, but I’m staying GREEN on this one - while admitting that it’s high risk with a wide range of possible outcomes.

The experience of following this saga has taught me one thing - when I hear the words “Skilled Person Review”, I am now far more cautious about the company that is getting one. If I could go back in time, I would have turned AMBER when this news was announced for JIM way back in Sep 2022. But nearly two years later, with the process presumably reaching a conclusion, and with a much cheaper valuation, it doesn’t make sense to me to change my stance now.

TI Fluid Systems (LON:TIFS)

Up 10% to 123.2p (£619m / €719m) - Half-Year Results - Graham - GREEN

TI Fluid Systems plc (TIFS), a global industry leader in highly engineered automotive fluid storage, carrying and delivery systems and thermal management products and systems, announces its results for the six months ended 30 June 2024 (the 'period').

Let’s review progress here. It’s been a while - see Nov 2023.when the company was trying to recover back to the financial performance levels of previous years.

Highlights from these H1 results:

Revenue down 1.4% to €1,719m

Adj. EBIT +4.8% to €135.5m

Actual EBIT up by less than 1% to €95.8m.

A small acquisition in Sep 2023 has boosted revenues and so I believe the organic growth rate is a little worse than what is shown above. It would have been helpful if the company had adjusted out the additional revenues from this acquired business.

The acquired business (“Cascade”) was expected to generate €35m of revenues in 2023, so that’s about 1% of full-year revenues at TIFS.

ROCE: TIFS helpfully calculates its own adj. ROCE, and comes up with 25.4%. That’s a great score and better than H1 last year (21.7%).

Stockopedia calculates ROCE for last year as only 10%, however, so there’s a big gap between adjusted and unadjusted numbers.

Debt and leverage: net debt is significant at €682m (almost as high as the market cap), with little change year-on-year.

As I’ve noted before, TIFS management seem to be comfortable with this level of debt. They calculate a leverage multiple at 1.7x (excluding leases). Including leases, the leverage multiple is 2.1x. In my book these are high levels but are probably manageable.

The company certainly thinks they are manageable with €69m of capex spend in H1 described as “modest”, a €23m dividend payment during H1, and €22.5m spent on share buybacks (out of a planned €40m). The company is clearly happy to splash the cash around for shareholders, and they describe their balance sheet as “strong”.

Total gross debt is over €1 billion, mostly in the form of a fixed rate bond maturing in 2029. Other bonds are floating rate and mature in 2026. The bonds apparently do not have any significant covenants.

Free cash flow was negative in H1 but this includes seasonal outflows of working capital that should reverse in H2.

Outlook sounds positive, here are some snippets:

Our first half performance demonstrates TI's fundamental strengths. Our propulsion agnostic portfolio and geographic and customer diversification underpin our resilience. Our ability to deliver further margin expansion despite volume and labour inflation headwinds reaffirms our confidence in returning to a double-digit Adjusted EBIT margin in the mid-term…

As a result, we are increasing our full year Adjusted EBIT margin expectation to above 7.6% notwithstanding a slight decline in revenue at constant currency due to the recent softening of the 2024 industry outlook…

Graham’s view

This is another tricky situation to assess.

Just look at the valuation multiple the market has assigned to this company:

A clue as to why the valuation is so low might be found in the shareholder register:

That’s nearly 40% of the company held by funds that don’t seem particularly able or willing to continue holding it.

As noted by Paul in March, BC Omega is a Bain Capital fund. Bain brought TIFS to IPO in 2017, and I imagine they are frustrated that they still hold so much of it. The share price has not cooperated with their exit plans:

The second name on the register, Liontrust Asset Management (LON:LIO) is a name we discuss regularly here. Suffering a low series of outflows from their funds, they should also be viewed as shaky hands, although they are less dramatic sellers than Bain.

As the problem of weak holders has nothing much to do with the business, I don’t think it should affect my stance here.

The company’s approach to debt and leverage does leave me a little concerned, even if management aren’t worried. But for investors who are willing to accept the financial risk associated with the debt load, there is a lot of business for sale here at a £620m market, or a £1.2 billion enterprise value. I’ll leave my GREEN stance unchanged, betting that the share price reflects the overhang of sellers rather than more fundamental problems with the company.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.