Good morning from Paul & Graham!

Today's report is now finished.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk.

I'm not sure how many of these we'll manage to do today, as I have to finish early today, but tomorrow is catchup day! (including ME International (LON:MEGP) which I want to cover, and readers have requested) -

Summaries

Camellia (LON:CAM) - £60.25p (unch) (£168m) - AGM Statement - Graham - GREEN

This agriculture producer has been having a difficult year or two with rising costs and unfavourable commodity prices. What makes it interesting is its stated intention to dispose of its miscellaneous collection of non-core assets, and perhaps to buy back its shares.

Altitude (LON:ALT) - 45.35p (+8%) (£32m) - TU at least in line - Graham - GREEN

This stock continues to intrigue me with very fast revenue growth from the US education sector and contracts whose nature is not yet entirely clear. The company is now a US Apple Authorised Campus Store provider. Something interesting is happening here. Speculative.

Paul’s Section:

Backlog Items (quick comments) -

IG Design (LON:IGR)

147p (£143m) - New debt facilities - Paul - AMBER

This slipped through the net on Monday this week, but it’s quite important so I’ve circled back to it. IGR is a high revenues, low margin seller of wrapping paper, and cards/gifts. The wheels came off when supply chain disruption & cost inflation destroyed its profit margins during the pandemic. Roland wasn’t impressed at what looked like another profit warning here in April 2023.

My main concern was the lengthy delay in agreeing new bank facilities, which suggested to me there was a considerable risk that a dilutive equity raise might be needed. That risk seems to have been removed with this bank refinancing, so I’m a lot happier with this share now.

As I pointed out here in my Nov 2022 review of its interim results to Sept 2022, the balance sheet is actually strong, but large seasonal working capital spikes require a bank facility. Banks like lending for seasonal spikes, as they get their money back reliably when customers pay their invoices after Christmas.

It’s not clear from the update if facilities have been increased or decreased, we’ll find out more when results come out on 20 June 2023.

Paul’s opinion - this share is looking interesting again, now the main financial risk looks to have been resolved, with new 3-year bank facilities.

The bull case on IGR is very simple - if it can rebuild profit margins back to historic peaks of c.4-5%, then on c.$1bn revenues, that would give a nicely profitable business, probably worth several times the current market cap of £143m. So it’s up to you to decide how feasible you think that margin recovery is. Personally I don’t have a strong view either way, we’ll see what the next results look like in a fortnight or so.

PCI- PAL (LON:PCIP) - 58p (£38m) - says its opponent in patent case, Sycurio, breached confidentiality agreement in April 2022. It's not clear what that entails, with PCIP vaguely saying it's consulting lawyers, and this "may or may not lead to further legal action against Sycurio or other recipients of the information". The patent case has been ongoing for a while now, so until that's resolved our stance here remains AMBER

DX (Group) (LON:DX.) - settles dispute.

Midwich (LON:MIDW) - £50m placing, for acquisitions.

Mirriad Advertising (LON:MIRI) - down 20% to 3.05p - terrible cash burn in FY 12/2022 accounts published yesterday. Did a £6.3m placing recently, so had £7.5m at end Q1 2023. It reckons it can make this last until June 2024 through cost-cutting. Outlook comments sound like a profit warning. Hoping for an improvement in H2 2023. Paul’s view - it looks a complete basket case, very much in the last chance saloon, in fact it’s fighting the bouncers to avoid being thrown out!

Anpario (LON:ANP) - announced a tender offer for 4m shares, at 225p per share. That’s quite significant, at nearly 17% of the total shares in issue (24.1m). This is returning £9m in cash to shareholders.

Tristel (LON:TSTL) - we’ve been waiting years for FDA Approval, which has finally been granted. Shares have shot up to 408p, but if Polarean Imaging (LON:POLX) is anything to go by, this might be a good time to take some money off the table. Although to be fair, TSTL is already nicely profitable, whereas POLX is a blue sky project. TSTL has 20-bagged in the last 10 years, highly impressive - although some of it has been due to multiple expansion. If it gains big market share in the USA, then the high PER could be justified, time will tell!

888 Holdings (LON:888) - this gambling share shot up 26% yesterday to 101p/share. Important new shareholders announced.

N Brown (LON:BWNG)

24.5p (£114m) - Final Results - Paul - AMBER/RED

Full year results for the 53 weeks to 4 March 2023, so I’ll call that FY 2/2023.

This is an accident-prone online retailer that tries to make money from extending high cost / high default extended payment terms to retail customers. Its large receivables book is partly financed from bank borrowings.

Here are my notes from reviewing the numbers last night -

CFO changed, but previously announced, so looks planned.

Poor profits, adj PBT down 83% from £43.1m last time, to £7.5m this time

EBITDA is meaningless, due to heavy capitalisation of IT spend, and big finance charges, but it reduced 40% to £57.3m.

Statutory loss before tax is awful, at £(71.1)m vs profit of £19.2m LY.

Adjustments are mainly £53m impairment of non-financial assets, and an additional £26m cost of the Allianz litigation, which was settled for £50m cash in Jan 2023. It’s impressive that BWNG was able to absorb this substantial cost, seemingly without causing financial distress.

Adj net debt rose from £259.4m to £297.4m.

Liquidity looks OK, providing the borrowing facilities remain available to it.

Outlook comments sound weak, so another poor year (maybe worse?) is likely.

Ownership structure - it’s controlled by the Alliance family, with Mike Ashley thrown in for good measure with 17.6% (Frasers). Together they hold c.75%, so there is potential risk to small shareholders here, who might get sidelined if the big shareholders strike a deal maybe? That’s exactly what happened at similar, collapsed company Studio Retail, which Ashley bought for £1.

Customer receivables book is £481m, which is after taking a £122m write-off in 2023. Results are closely tied to the large bad debt charges - what if the assumptions are wrong, and bad debts balloon in a consumer downturn?

Pension accounting surplus of £20m, so potential investors would need to check what the actuarial position is, as accounting surpluses can often actually be real world deficits.

Customers were charged high interest fees of £222m, but £122m of this was written off - I really dislike high cost / high default lending, because honest people get ripped off, whereas dishonest people get free clothes! Lily Savage used to do a good routine about ordering loads of stuff from the catalogue, then moving house!

Balance sheet - despite all the negatives, BWNG is still well set up (providing its lenders play ball, which they might be reluctant to, in a recession, providing funding for what is effectively a sub-prime lender).NAV: £391m, less £58m intangibles = NTAV £333m. That’s about 3-times the market cap. So shareholders are either getting a bargain, or BWNG is just tying up a large pile of unproductive assets? I can’t decide which it is, I’m afraid!

Going concern note is extensive, and reads convincingly.

Paul’s opinion - I thoroughly dislike the business model, but cannot ignore the massive discount to NTAV. The trouble is that companies like this, with a very large sub-prime lending book, can turn out to be a disaster in a recession. I remember the numbers for Studio Retail (previously Findel) looking tempting, and briefly owned some myself. A fortnight after I got cold feet about a trading update expressing the need for more funding, it went bust! The published numbers were basically a work of fiction. So the lesson from that debacle was that a huge receivables book can hide a multitude of sins.

BWNG is very much more strongly financed than Studio Retail was, and it’s impressive how it absorbed a £50m hit from the legal dispute with Allianz.

Ultimately, for me, it’s the ownership structure that’s the deal-breaker. I wouldn’t want my investment to hinge on a controlling family, and Mike Ashley. Also there are no dividends (it used to be a generous divi payer, but not any more), and the business just looks fundamentally poor now, trading barely above breakeven. The only redeeming feature is the huge discount to NTAV. There’s nothing else that appeals at all. So I think it has to be AMBER/RED.

Not the most inspiring of long-term charts -

Churchill China (LON:CHH)

Up 2% to 1400p (£154m) - AGM Statement - Paul - AMBER

Churchill China plc (AIM: CHH), the manufacturer of innovative performance ceramic products serving hospitality markets worldwide…

This sounds reassuring - no weasel words here, just a clear indication that things are on track -

"Trading remains in line with our expectations, with export markets continuing to perform well. We have made further progress on our initiatives to improve margin, whilst continuing to invest in our established strategy and remain on track to achieve our full year profit expectations."

Paul’s opinion - I remain permanently perplexed as to why CHH shares command a high rating, often a PER of 20+. Stockopedia is showing a fwd PER of 17.5x, an earnings yield of 5.7% - that would have looked attractive when interest rates were zero, but it’s no longer attractive when bonds or cash can provide a similar or higher yield. CHH pays out about half its earnings in divis, so the divi yield is about 2.9%. That doesn’t excite me.

It would have been interesting to hear more detail from the company about supply chain, inflation, energy costs, etc.

I recently read that about a third of UK hospitality businesses don’t expect to survive the next 12 months. Let’s hope that’s wrong, but it doesn’t sound like a good macro backdrop.

So if you find this share attractive, it probably rests on a belief that CHH could beat forecasts, which it might, I don’t know. Obviously we can’t look into the future and tell you how companies are going to perform in future, as nobody knows.

They serve different markets, but the valuation anomaly between CHH (fwd PER 17.5x) and PMP (I hold) on 7.3x looks too wide. They’re both fairly good companies though, and my only concern with CHH is valuation, which looks a bit too high. Hence I'll stick with PMP.

CHH has a very good long-term shareholder value creation track record, as you can see -

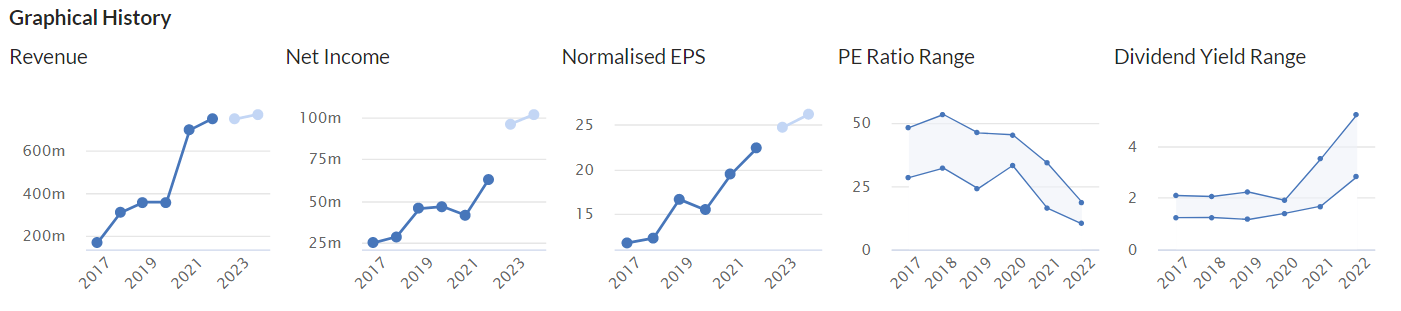

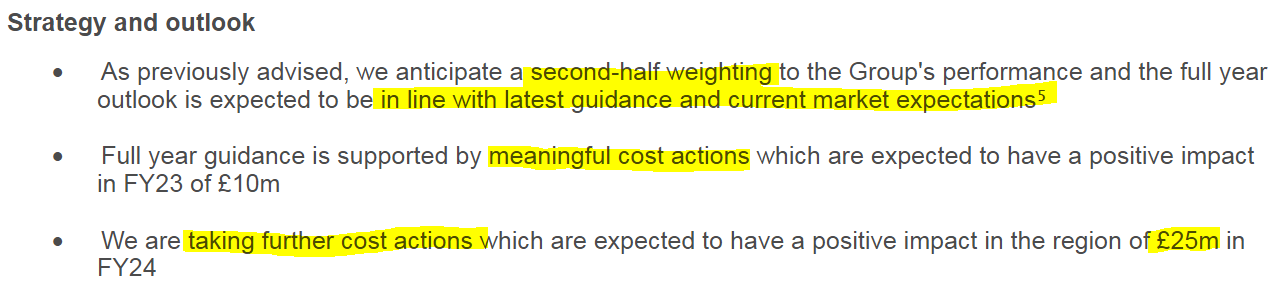

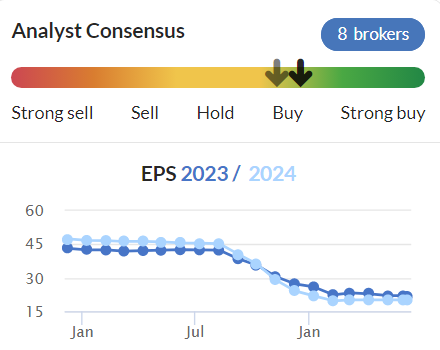

RWS Holdings (LON:RWS)

Up 6% to 240p (£939m) - Interim Results - Paul - GREEN

Not a company I’m terribly confident about analysing, but I took a stab at it here on 27 April 2023, concluding that 266p might be a good entry point, with the valuation looking a lot more appealing after a mild profit warning. It’s drifted down further since then, to 240p this morning, with the StockReport showing very good value at fwd PER of 8.9, and a divi yield of 5.5%. It wasn’t long ago that this was a highly rated growth stock. I wonder if AI might be one of the reasons this share has lost its appeal to investors? Although earnings forecasts have been in a downward trend for some time -

Despite the lowered forecasts, the long-term trend still looks very nice to me, and look how valuation measures in graphs 4 & 5 have become significantly better value -

A quick skim of the interim numbers today -

Revenue £366m for H1, up 2.5%

Adj PBT £54.4m, down 10% on LY, but slightly ahead of guidance provided of £54m, in its H1 trading update recently. So that’s fine.

Adj EPS in H1 is down 11% to 10.6p, so it needs an H2 weighting (as previously indicated) to achieve forecast of 24.6p for FY 9/2023.

Net cash £57.8m, slightly ahead of guidance, so again that’s fine.

Outlook - confirms full year guidance, and more cost-cutting -

A lovely footnote too -

The latest Group-compiled view of analysts' expectations for FY 2023 gives a range of £741.6m-£751.2m for revenue, with a consensus of £747.1m, and a range of £121.3m-£128.3m for adjusted profit before tax, with a consensus of £126.6m, and a range of 23.3p to 25.1p for adjusted EPS, with a consensus of 24.7p.

It also mentions AI, “already extensive users….” - so the key question for RWS shares seems to be whether investors will perceive AI as a positive, or a threat? Or a bit of both, who knows?

For the full year, with the benefit of new client wins, the expected phasing of the impact of the Unitary Patent , the impact of new product launches and further revenues from our growth initiatives, we anticipate an acceleration of organic growth in the second half, delivering a performance in line with current market expectations.⁷ We are encouraged to see a much more exciting M&A pipeline in the last six months which provides us with attractive opportunities to deploy our cash and we are at an advanced stage with a number of bolt-on opportunities.

Share buyback of £50m announced, that’s clearly a positive for sentiment. I like buybacks when shares are on cheap valuations.

Balance sheet - looks fine to me, even when the huge intangible assets are written off.

Paul’s opinion - I think this looks very good value, for a high quality company. There’s always a risk with an H2 weighting being anticipated, which is probably why the fwd PER is only about 9x.

On a quick review only (you need to do the detailed research, if it floats your boat!), I see this share positively, hence my opinion on the traffic lights is GREEN.

Crest Nicholson Holdings (LON:CRST)

Down 4% to 240p (£617m) - Interim Results - Paul - GREEN

Results cover the 6 months to 30 April 2023.

H1 revenue is down 22% to £283m

Adj PBT down 60% to £20.9m

This period was obviously hit by the disastrous mini-budget in autumn 2022, the cost of living crisis, and big increases in interest rates, all of which is well known, and has been baked into much lower forecasts, as you can see -

CRST’s CEO gives a nice summary of the current position for the new houses market -

As we traded through the period, confidence started to return and this has been reflected in our trading metrics, which have sequentially improved throughout the period. Unemployment remains low and mortgage availability remains good albeit at more expensive rates. The ongoing lack of housing supply is continuing to support house prices and these factors are also driving strong levels of rental inflation. The economic case for buying a home therefore remains compelling, but for many first time buyers the higher cost of borrowing and the cessation of Help to Buy are prohibitive to realising this ambition. If interest rates continue to rise, and remain elevated for a sustained period of time, this will undoubtedly exacerbate this issue even further and start to impact demand and confidence again. We continue to call on Government to recognise this challenge and provide further support to these potential homeowners.

Balance sheet - NAV £877m, less intangibles of £29m, gives NTAV of £848m, well above the market cap of £617m - so the stock market is assuming that house & land prices will fall significantly. Threat or opportunity? That’s up to each investor to decide.

My main point is that CRST’s balance sheet is absolutely bulletproof, and even if property prices were to absolutely plummet, CRST would remain in a positive NTAV position.

It even has net cash, which is completely different to previous housing crashes, when housebuilders were deeply in debt.

Therefore patient investors can anticipate a housing recovery in due course, without having to worry about solvency or bank debt. That’s one of the reasons I like this sector, although recent excessive hikes in interest rates look set to do a lot of damage. So I’m not rushing to buy at the moment.

Paul’s opinion - I think this is one of the better value housebuilding shares. As you can see from the sector here, CRST has one of the deepest discounts to NTAV (P/TB).

Maybe in the short-term, the sector needs to sell-off a bit more, to reflect the big recent moves up in mortgage rates? Catalysts for a rebound might be some form of reintroduction of Help To Buy, which CRST mentions it is lobbying for. How it all pans out, we don't know. I'm more wary now, as I think we're heading into a recession possibly. Hence why personally I'm watching, rather than buying housebuilder shares.

The long-term chart is looking tempting though, and remember that cyclical shares often recover before an economic recovery has begun -

Graham’s Section

Camellia (LON:CAM)

Share price: £60.25

Market cap: £168m

This company has been a bizarre value trap for many years, but its share price is up 20% over the past week as the market now seems to think that it might finally be in play.

I did mention the stock in December, when it announced a disposal and a planning application for Linton Park. Linton Park is now for sale.

Here’s a long-term chart to show you five years of disappointment for “value” investors:

A six-month chart emphasises the impact of recent news:

On Tuesday, the company announced the agreed sale of one of its investments for c. £80.4m, translated from US dollars.

The investment is a minority holding in a Bermudian insurance company (!) and its disposal “represents a further step in Camellia’s policy of divesting non-core assets”.

The sale price is a significant premium to Camellia’s share of the insurer’s net assets (£61.5m) and the value of Camellia’s BF&M shares according to the Bermuda stock exchange (£60m).

This excerpt from Tuesday’s announcement strikes me as important:

…the receipt of the funds realised by this sale, together with funds raised from the disposal of other non-core assets, will enable the Company to accelerate its development programme and continue to diversify its agricultural production by crop and geographic location. The Board considers Camellia's shares to be significantly undervalued and, in the event of any surplus funds arising, will also therefore consider the merit of returning these to shareholders by means of a share buy-back…

This morning brings an AGM trading statement from the company.

The Group continues to focus on its core Agriculture operations and is divesting non-core assets as appropriate opportunities arise.

Trading outlook - see here for an overview of Camellia’s agricultural activities.

Trading in 2023 has been “mixed albeit it remains very early in the season for a number of our major businesses”.

Adjusted operating profit for the company’s agricultural operations were £15.8m last year, and the company now expects that “adjusted profit before tax for 2023 will be below that of 2022”. There are various reasons for this, including:

Macadamia prices have reduced further and they “remain under significant pressure”.

Tea prices are below last year, “principally on account of the lack of foreign exchange in the major consuming countries of Egypt, Pakistan and Iran.”

Energy and fertiliser costs, and wage pressures.

Graham’s view: I’m giving this stock the green light as it had balance sheet equity of £369m in December 2022 (excluding minority interests). Since then it has agreed to convert one of its investments into £80m of cash, at a premium to its balance sheet value. So the market cap of £168m seems too low to me.

Of course there is no absolute guarantee that the company will receive the agreed £80m, and there is definitely no guarantee that the company will use the proceeds wisely. It’s also unknown how long it will take the company to dispose of the rest of its non-core assets. But at least it has signalled the intention to do so - which is more than can be said of many other value traps.

Altitude (LON:ALT)

Share price: 45.35p (+8%)

Market cap: £32m

Altitude Group Plc (AIM: ALT), the leading end-to-end solutions provider for branded merchandise, has experienced a strong year of trading and has consequently enjoyed multiple upgrades for the full financial year ending March 31, 2023 ("FY23"). The Group is further pleased to announce it expects results will be at least in line with market expectations representing a minimum year-on-year increases in Revenue of c.49% and Adjusted EBITDA of c.74%.

After a horrible collapse in 2019, this share has been a pleasant one for holders over the past year or so.

The new financial year, FY March 2024, is also off to a good start and is tracking “significantly” ahead of last year.

The mysteriously titled “adjacent market programme” remains important to growth - I think this is primarily the sale of branded apparel to schools and/or universities, but Altitude hasn’t taken a Plain English approach to explaining what this is. They do say that they intend to provide further detail about it at some point after September 2023, after contracts have rolled out..

In addition, they say that their adjacent market programme has resulted in them becoming a US Apple Authorised Campus Store provider. It strikes me that there must be a lot that they haven’t told the market yet about what they are doing (perhaps for competitive reasons).

Cash remains thin but adequate. £1.2m plus an undrawn $1.7m credit facility.

CEO comment:

We are pleased with the continued momentum and positive start that we are experiencing in the early days of our current financial year. Management is focused on execution and delivery across all programmes, with particular attention to the roll-out of our disruptive AMPs.

Estimates from Zeus are unchanged including £26m of revenue in the current financial year (FY March 2024) and £35.6m next year.

Graham’s view

I’ll continue to give this stock the thumbs up. I must reiterate that it’s far more speculative than the type of thing I usually like, but the positive momentum and the price to sales multiple (circa 1x depending on the timeframe you use) keep me on board.

Altitude might not be generating the high-quality “marketplace” revenues that I hoped it would, but I still think that something interesting is happening with its adjacent market programme. This stock is not recommended for widows and orphans.

Sopheon (LON:SPE) - down 5% to 591p (£63m) - AGM Statement - Graham - AMBER

This software company has issued a brief review of 2022, describing how acquisitions increased its product set from one to four, growing its addressable market. ARR grew 17% to $24m. The company says that organic growth would have been 10% at constant exchange rates, and that total contract value was boosted by the company’s largest ever deal (signed with the US Navy).

See here for my March comments on the company. I took a neutral stance, arguing that the company was cheap for a software biz but that there were some potentially valid reasons for it to trade cheaply - limited organic growth, the capitalisation of costs putting a question mark over profitability, and the lumpy nature of contracts.

We now have an update for FY December 2023. ARR has improved to $25.7m, and net cash is up slightly to $22m. This sounds promising:

Management's confidence in our expected full year outturn is underpinned by a sales pipeline that includes major extensions with existing customers, alongside new prospects.

Estimates - analysts at finnCap and Progressive have reiterated forecasts.

Graham’s view - no change to my view, I’m neutral on this one as I wait for signs of improving quality and/or growth to justify a higher valuation.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.