Good morning! Paul & Jack here with the SCVR. Today's report is now finished.

Agenda -

Paul's Section:

Cloudcall (LON:CALL) (I hold) - we're put out of our misery with a 81.5p cash recommended takeover bid, a 76% premium. What a relief!

Cambridge Cognition Holdings (LON:COG) (I hold) - £1m contract win is helpful.

Vertu Motors (LON:VTU) (I hold) - another profit upgrade! This is getting ridiculous!

Made.com (LON:MADE) - a profit warning, due to supply chain delays causing c.10% (£40m) of revenues to slip from FY 12/2021 into FY 12/2022. Does that really matter? I don't think so. The reason given is credible, as we know supply chain is problematic for everyone in the sector, and should sort itself out in time. A very interesting company, but personally I find the valuation too much of a leap of faith, as it's not yet reached profitability.

Victorian Plumbing (LON:VIC) - results for FY 9/2021 are excellent, but the sting in the tail comes with a negative outlook statement. Growth has stalled, and gross margins are falling hard, which I reckon could see profits fall 30-40%. That said, it looks good value now, at 99p. Tempting.

Jack's Section:

Dwf (LON:DWF) - legal and business services provider. Trading looks good, self-help initiatives have reduced the cost base and enhanced profitability, and the valuation appears modest. All in all, it looks interesting, although the financial health is borderline.

Porvair (LON:PRV) - looks like a sensible business in long term growth markets. The valuation is hard to justify right now, although the StockRank has recently improved (thanks to upgraded Quality and Momentum scores). For me, it’s one to watch in case the market ever presents a more attractive entry point.

S&u (LON:SUS) - I hold - confident update from family-run car and property lender. The valuation is reasonable, and the recent sell off does not tally with the group’s commentary. Long-term focused with a good dividend track record, and the stock is forecast to yield around 4.9%, so quite happy to hold.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul’s Section

Cloudcall (LON:CALL) (I hold)

47.5p (last night’s close) - mkt cap £23m

Recommended cash acquisition of Cloudcall

Hallelujah! We’re finally put out of our misery here, with a cash takeover bid at 81.5p, valuing the company at £39.9m - a 71.6% premium - not bad.

The buyer is Xplorer Capital LLC.

So far, shareholders with 23.9% have supported this deal - so it's not necessarily a done deal yet - I wonder if a higher competing offer might be a possibility? For this reason I’ll probably sit on my shares, rather than selling in the market.

My opinion - CALL has been a serial disappointer, missing forecasts repeatedly, and requiring never-ending cash raisings. That said, its product is quite good (I use it myself), and there’s always been potential here.

I don’t think loss-making minnows are suitable for the stock market. Returning to private ownership makes a lot more sense.

It’s so boring writing about this company, year after year, so I’m thrilled that it’s leaving the stock market. It’s only a small position for me, but a welcome little windfall anyway.

Cambridge Cognition Holdings (LON:COG) (I hold)

124p (last night’s close) - mkt cap £39m

£1.0m Schizophrenia clinical trial contract

Cambridge Cognition Holdings Plc (AIM: COG), which develops and markets digital solutions to assess brain health…

I was only thinking yesterday that the flow of new contracts seemed to have dried up at COG, so this £1.0m contract (over 3 years) is welcome news.

It’s repeat business from an existing customer, which I like. The more COG’s testing becomes embedded in pharmaceutical companies as a standard part of drugs trials, then the more repeating revenues it could earn - at high margins remember (about 80%, from memory) - this is very specialised work, with little competition, and major barriers to entry.

This continues to be an exciting area for potential further growth for the Company in the future."

My opinion - I remain positive on this share. The order book has shot up in the last year, and performance appears to have turned a corner. Valuation still looks cheap to me, assuming that improved performance continues, as it's had a number of false dawns in the past under old management. There seems a much more commercial focus under CEO Matthew Stork, who comes across well on webinars.

The share price drift in recent months just looks par for the course with the general bearishness in small caps across the market, so doesn't concern me.

Vertu Motors (LON:VTU)

69p (last night’s close) - mkt cap £245m

Good grief, the car dealership sector is absolutely on fire at the moment. It’s yet another upgrade today -

Further upgrade of expected trading performance for FY22

My summary -

Oct & Nov 2021 trading ahead of plan (and prior year)

Shortage of new cars, but not as bad as expected, and sold at higher margins

Positive customer demand, with strong order book

Used car also supply constrained, values high, but have plateaued - “starting to follow more normalised seasonal trends”

Abnormally high margins in used cars continue

Staff being paid more, to address vacancies, reduced but still above historic levels

Cautious re outlook

Profit guidance raised -

the Board now anticipates that the Group's adjusted profit before tax for the year ending 28 February 2022 will be no less than £70m (previously not less than £65.0m).

My opinion - this bonanza won’t last, as everyone knows, but it will be filling the coffers with cash, and strengthening the balance sheet.

I continue to see VTU as a prime candidate for a takeover bid, due to its sector-leading balance sheet strength, including lots of freehold property, which could be leveraged by a buyer.

Marshall Motor Holdings (LON:MMH) received a takeover bid recently, so the sector looks in play.

.

Made.com (LON:MADE)

126p (down 6% at 08:50) - mkt cap £493m

MADE.com is an online furniture retailer, which listed in June 2021. We’ve discussed it here before, but I can’t locate my notes on it. There was an interesting results presentation below, which also shows some product & explains the business model (of using external designers, and continuously launching new product)

(complete with a glorious French accent from the CEO!)

It seems to be a popular brand with younger people, who seem happy buying furniture online.

MADE has been loss-making historically, but scraped into a £1.0m positive EBITDA in H1 FY 12/2021, although H2 is now expected to be a loss of £(13)m to £(16)m EBITDA.

The investment case is that strong growth, if it continues, should trigger a move into profit, through scaling up & operational gearing. I think this share looks potentially interesting.

The share price is quite volatile this morning, and I’ve had to change the price above 3 times already.

Obviously the sector is experiencing supply chain delays & freight cost pressures - temporary factors, but nobody knows when supply chains & freight are likely to normalise.

Trading Update (profit warning)

MADE reconfirms gross sales guidance of +40% year-on-year

Supply chain problems have worsened in recent months, delaying stock intake, and therefore revenue recognition.

I was puzzled as to how they reconfirm “gross sales”, whilst then telling us revenues will be deferred into next year? The answer seems to be that “gross sales” isn’t actually revenue, it seems to be order intake, so the headline above is rather misleading I feel. The company should change its terminology to "order intake", instead of the potentially misleading "gross sales".

Things are clarified in this table -

.

As you can see above, it’s a profit warning, due to £35-45m of revenues slipping into FY 12/2022, due to late deliveries.

Does this actually matter? Not really, in my opinion. There’s not a problem with demand, and we know the industry-wide supply chain delays are something that cannot be helped. So personally I’m inclined to look through this profit warning, as something external, and temporary, so it’s not a big deal in my view.

Remember that we’ve seen before (e.g. with Scs (LON:SCS) (I hold)) that one year’s delays and disappointing profits, are a bonanza of profits in the following year, as pent-up demand is fulfilled. I suspect we’ll see the same pattern again from SCS, which has already told the market it is struggling to deliver on the increasingly large order book.

Logically, investors shouldn’t worry, or react to this type of news. But as we know, markets are not always rational, and I’ve noticed that we seem to be in a market where people over-react to predictable, obvious news. That is creating some nice buying opportunities in my opinion.

Outlook - this is not the clearest of statements, but the general gist seems to be that they’re expecting supply chain to improve in 2022 -

MADE has continued to deliver significant progress on its key strategic priorities as set out at the time of the IPO.

On supply chain, the group has built stock positions to deliver significantly better lead times to consumers for 2022 and beyond as orders placed with suppliers are now in or close to our warehouses.

The progress is based on foundational work already undertaken over the last 12-18 months, focusing on warehousing and logistics. Additionally, supply of goods from Vietnam has now returned to close to normal levels, with all key suppliers now operational.

MADE has continued to make great progress on its homeware proposition and now has more than 100 designer makers, artisans and small brands onboarded to the curated marketplace.

My opinion - even after recent falls, I feel the nearly £500m market cap is too high for me to make a leap of faith that this will become a profitable company in future. I can see why that should be the case, if growth continues, but we don’t know at what level growth would fizzle out, as most companies have a natural ceiling in terms of size, and market share.

So how do we value it? It’s not possible to value it accurately at the moment, it’s guesswork, which is a problem.

The growth story seems intact, even though FY 12/2021 revenues are now being guided 10% less than previous guidance. The reason given of supply chain delays is credible, and should reverse over time, maybe in 2022, which would turbocharge the 2022 results.

Overall, it’s an interesting company, but for me the valuation is still too high.

Another over-priced IPO -

.

Victorian Plumbing (LON:VIC)

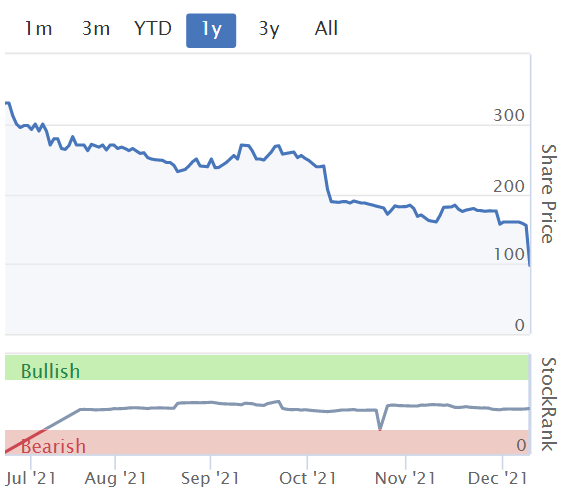

90.7p (down 42% at 09:36) - mkt cap £292m

Full Year Results (FY 9/2021)

This online (“digitally native”) bathroom retailer floated about the same time as MADE, and VIC has also been a flop, losing about two thirds of its value in just 6 months as a listed company. Institutions must be tiring of being stuffed with over-priced, opportunistic IPOs. A lovely gravy train for all the advisers, but are they killing the golden goose? I’d be surprised if there’s much appetite for any more IPOs given the poor performance of so many recent ones.

Here is the slide deck for the FY 9/2021 (which I refer to below) - easier to digest than ploughing through the RNS statement.

Results look really good, so why is the share price down 42%? It’s the wobbly outlook statement, which I’ll come on to, after some key figures for FY 9/2021 -

Revenue £268.8m up 29% on LY (last year)

Gross profit up 42% on LY, due to increased gross margin of 49% (44% LY)

Slide 11 shows massive marketing spend, of £69.7m (26% of revenue) - I like this, because it’s discretionary, although several online companies have recently warned about the sharply rising cost of online marketing, which could be a risk here maybe?

Adj EBITDA of £40.1m, up 53% on LY

Note exceptional costs of £9.4m (probably IPO costs), and £7.7m share based payments

Very good cash generation - see slide 14

Adj basic EPS is 11.0p (LY: 7.4p) - giving a PER of just 8.2 - a bargain?

Balance sheet - what strikes me first, is the very low level of fixed assets - PPE (property, plant & equipment) is only £1.7m, which makes me wonder if warehousing might be outsourced possibly?

Working capital looks OK, with a current ratio of 1.58, and includes a healthy cash pile of £32.7m

NAV is £30.8m, less intangible assets of £2.7m gives a healthy NTAV of £28.1m

Overall, a tick in the box here, with a sound balance sheet.

Cashflow statement - all looks fine, it seems a genuinely cash generative business.

Very little capex this year or last year, we like capital-light business models here at the SCVR, because it means there’s more cash available to pay divis.

Shares issued of £11.2m was primarily to pay £9.1m in exceptional costs of IPO.

Outlook - this has clearly spooked the market.

Slide 26 shows how the company is now struggling to achieve further revenue growth on the exceptional pandemic-fuelled growth of last year - something we’re hearing from many eCommerce businesses.

Investors have to decide whether it’s gone ex-growth, or the 2-year growth rate (bottom graph below) is likely to continue. That’s a tough call - nobody knows. I do worry that it looks as if VIC might now be running to stand still? There again, its massive 26% of revenues marketing spend, means that it might be able to crush the competition?

I’ve highlighted below the things that are a concern - growth has now stalled, gross margins are falling, and marketing spend sounds like it might be rising even more?

.

.

.

The issue with gross margin means that they’re saying it’s likely to drop from 49% back down to 44%. That means an annualised reduction in profits of £13.4m (5% of £268.8m revenues).

I make adj PBT £36.8m for FY 9/2021 (£40.1m adj EBITDA, less £3.0m depreciation & amort, and less £0.3m finance costs)

Therefore, the lower gross margin of 44% would reduce adj PBT from £36.8m to £23.4m - a future fall in profits of 36%

That could be exacerbated by increased marketing spend, which seems to be what they’re saying. The very low PER is now making more sense - because profitability is not sustainable at the reported level, and looks set to fall considerably, as gross margins fall.

The key question is, what is the long-term, sustainable level of gross margin?

Also, is all that marketing spend being spent wisely? Spending £69.7m on marketing, whilst seeing growth slow down to nothing (in the most recent 2 months) does call into question the wisdom of spending so much. It also seems likely that the business would be in steep decline, if it wasn’t spending huge amounts on marketing - not good.

My opinion - I need to caveat this by saying it’s the first time I’ve looked at Victoria Plumbing, and I haven’t read the Admission Document yet.

However, I’ve digested enough from today’s results to realise that the business was clearly floated opportunistically, when it was riding a wave of strong pandemic-related demand, and achieving unsustainably high margins. The selling shareholders are laughing all the way to the bank, having trousered £286m by selling 109.1m existing shares in the IPO, at a price of 262p. The share price is now 99p (down 62% on IPO), having recovered somewhat from this morning’s low.

On balance, I think this share is starting to look decent value, providing you realise that the next accounts are likely to show a sharp fall in profitability. It’s tempting to have a dabble at the current bombed out price of 99p. Although if fund managers are sellers, then the price could remain bombed out for a long time.

.

Jack’s section

Dwf (LON:DWF)

Share price: 110p

Shares in issue: 325,352,865

Market cap: £357.9m

DWF is a global provider of legal and business services. In May, the group moved from its previous five divisions (Commercial Services, Insurance Services, International, Connected Services and Managed Services) into a more simplified structure.

Now, operations are split into three groups:

- Legal Advisory - including restructuring, corporate, dispute resolution and more,

- Mindcrest - outsourced and process-led legal services, and

- Connected Services - a selection of other business services, including forensic accounting and auditing

Together, these support DWF's single ‘Integrated Legal Management’ approach, which combines the services to deliver bespoke solutions.

Shares have been treading water since its rerating after the Covid crash, and they look modestly valued on a forecast PER of 10.1x.

Highlights:

- Net revenue +3.4% to £173.3m,

- Gross profit +7.1% to £89m, gross margin up from 49.6% to 51.3%,

- Adjusted EBITDA up from £24.7m to £31.3m,

- Operating profit of £13.6m, up from a loss of £8.9m,

- Diluted earnings per share up to 2.8p from a loss of 4p,

Revenue growth comes from all three of the group’s businesses. The ‘integrated legal management approach’ of providing services from two or more divisions has gained further traction with a year-on-year increase in both the number of clients and percentage of fees generated. This sounds like a good way for DWF to differentiate itself in the marketplace.

Management is increasing its focus on growth in Mindcrest and Connected Services over the medium term, through a combination of organic growth opportunities and potential M&A. In Mindcrest, the focus is on investing in high quality scalable processes, technology and infrastructure.

The bolt-on acquisitions of BCA and Zing in HY22 have contributed to strong growth in Connected Services. Management has identified further M&A opportunities here.

Free cash flow in the period is down from £19.5m to £4.2m, but this is after the repayment of £5.4m of Covid deferrals, while the prior year was flattered by £10.4m of deferrals. Stripping those out suggests underlying free cash flows have risen slightly to £9.6m. There are still £6.3m of Covid deferrals remaining.

New business

In the period, we were appointed or reappointed to 13 legal panels or frameworks, including Hiscox and the Metropolitan Police. We also won new contracts with adidas and Capita Commercial Insurance Services, along with advising on high-profile cases such as the British Airways data breach litigation.

Outlook

The strong trading in HY22 is expected to continue in the second half of FY22 as the legal sector ‘enjoys sustained demand for services’, with the second half also expected to benefit from the normal marginally higher weighting of revenues.

The board has approved an interim dividend of 1.5p per share. The StockReport expects a total FY22 dividend per share of 6.34p, so either the company is not on course for that or is going to pay out much more in the H2 payment.

Balance sheet

Net debt is £77.2m (HY21: £58.5m). The increase is predominantly due to the repayment of the COVID deferrals, settlement of deferred consideration relating to previous acquisitions, and a one-off outflow for the restructuring of Australia (combined outflow of £24.8m). Net debt is expected to reduce by the end of FY22 to between £65m and £70m.

Aside from net debt, net tangible asset value is actually negative at -£7.2m. The current ratio of 1.46x looks ok, but cash of £24.2m is low relative to current liabilities of £142.6m. On balance, I’d want a stronger financial picture here, particularly given the M&A ambitions.

Conclusion

It has been more than six months since DWF introduced its new operating model, which has reduced costs and enhanced profits.

And the group’s shares seem quite cheap given the trading picture - like-for-like revenue is growing and gross margins have improved, leading to a ‘compelling step-change in profitability’. I’d like to see more substance to the balance sheet in the event that conditions take a turn for the worse, though. That might be what's weighing on the Quality Rank of 40.

Cash conversion also looks quite poor, and DWF does qualify for a short selling screen due to its borderline Z-Score. So the StockReport is flagging some areas to investigate further.

That said, the group does appear to trade at a discount to some of its listed peers and offers an attractive forecast yield of around 6.3%. All in all, it warrants a closer look given the management initiatives, improved profitability, and modest valuation.

A few legal services have come to the market recently: Gateley Holdings (LON:GTLY) , Rbg Holdings (LON:RBGP) , Keystone Law (LON:KEYS) - is that because there is a structural growth opportunity, or do insiders anticipate a market peak? There’s a debate to be had there.

Porvair (LON:PRV)

Shares price: 698p (unchanged)

Shares in issue: 46,169,175

Market cap: £322.3m

My immediate impression here is that Porvair is a quality company that is becoming a little expensive, so it will be interesting to see in the results today if there are reasons for justifying the 26.5x forecast PER and 2.6x forecast PEG.

Revenue and earnings per share have been steadily increasing, with the former up from £68.1m in 2011 to £145m in FY19 (the last non-Covid year, representing an annual growth rate of around 10%) and the latter up from 6.7p in 2011 to 23.9p in FY19 (CAGR of around 17%).

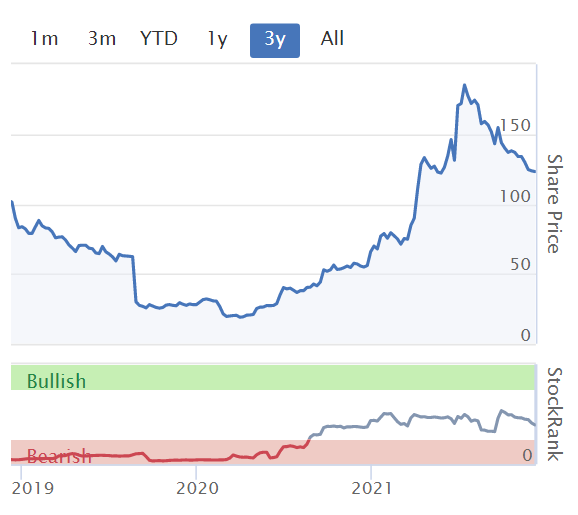

You can see below this has been a respectable longer term hold for patient investors.

The company itself develops specialist filtration, laboratory, and environmental technology businesses. Its divisions are Aerospace & Industrial, Laboratory, and Metal Melt Quality.

This is actually very short now I look at it.

Revenue for the year ended 30 November 2021 is expected to be 8% higher than 2020, with lower aerospace revenue offset by growth in laboratory, metal melt and general industrial segments.

Adjusted earnings per share are expected to be at the top end of market forecasts. Net cash at the year-end is expected to be £10.2 million (2020: £4.9 million) after capital investment, dividend payments and acquisition costs of approximately £9.5 million (2020 £6.5 million). Order books going into 2022 are healthy.

Preliminary results to be announced on Monday 31 January 2022.

Conclusion

The company itself sounds quite intriguing. Given the brevity of the update itself, it’s hard to comment on why the market is ascribing such a high earnings multiple to the stock though. That’s a shame, as it seems as though there’s quite a lot to like here on the face of it.

This is from the half-year results:

Looking ahead, the underlying drivers of growth for Porvair all remain in place: tightening environmental regulations; the need for clean water; expansion of analytical science; the drive for manufacturing efficiency; the replacement of steel and plastic with aluminium; and the development of carbon-efficient transport.

It all sounds positive, and the track record here over the years is encouraging. It’s just a shame that the stock looks so expensive - if I were to invest in such a company, I would want to do so at a point in time where it looks like you might benefit from a rerating as well as earnings growth.

Otherwise I suspect you’re looking to grow in line with earnings (and the 5y CAGR there is 3.86%), or less if there is a contraction in the valuation multiples.

S&u (LON:SUS)

Share price: 2,700p (+3.45%)

Shares in issue: 12,145,260

Market cap: £327.9m

(I hold)

This is a case in point concerning Porvair’s valuation: S&U has as good a long term track record as any small UK-listed company, but the forecast PER is just 10.9x compared to 26.5x for PRV.

FY21 earnings were knocked down a peg by quite conservative provisioning for bad loans. These could, in time, prove to be a tailwind for future earnings if S&U has been overly cautious here.

There are two businesses: Advantage Finance (sub-prime motor financing, by far the bulk of revenue), and Aspen Bridging (property bridging lender - new and growing).

Advantage Finance

Advantage is ‘rebounding vigorously both in profitability and in new business transactions’. There’s been an improvement on the record £38.3m of basic live collections in Q2, to £39.1m in Q3. This collections performance, along with ‘with continued associated lower than expected impairment provisions’, are the main drivers of improved profitability so far this year.

New business transactions have grown by over 30% year-on-year despite the lack of supply in the used car market. Advantage anticipates making increased net loan advances totalling over £140m in the financial year to 31st January 2022 (year to 31st January 2021: £102.6m).

Collection rates are better than ever, as the result of our tightened underwriting over the Covid period and industry-leading customer relations, which are reflected in Advantage's Trust Pilot rating of 4.7 out of 5. This means that customers are repaying at record levels. Those who never took a Covid related payment "holiday" are at 97% of due, whilst even those who did are now back to nearly 94% of due.

S&U is making a significant investment in digital marketing to drum up new business. It has also made customer journeys easier, with automated payments, open banking, and a self-service customer portal.

As a result, with the foundations of over 22 years of excellent profits and operational efficiency, Advantage is positioned for the great opportunities a fast-changing motor finance market presents.

Aspen Bridging

In less than five years, Aspen has grown its receivables book to over £60m. This is more than double last year, and transaction numbers to date are 38% up on a year ago.

S&U credits an ‘excellent profit increase in the period’ to maintaining margins in a competitive market and robust quality control. Levels of default are low and customers are settling within or just beyond the normal term of the loan.

Business volumes are increasing, and the group notes a significantly improved transaction to approval ratio. ‘This augurs well for the significant expansion planned over the next three years’.

Conclusion

I think the stock is mispriced at the moment and will likely rerate over the next three years, assuming stable market conditions. Earnings per share are set to fall slightly in FY23E, from 260p to 257p, but I suspect there is a better-than-average chance of realising long-term, sustainable earnings growth here. All in my opinion, of course.

The Coombs family runs S&U with a steady hand and prudent finances, which makes the growth prospects more enticing.

It’s also worth noting that the company is committed to paying out dividends, so this could be of interest to income investors at the current forecast yield of 4.91%.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.