Good morning from Paul & Graham!

Today's report is now finished.

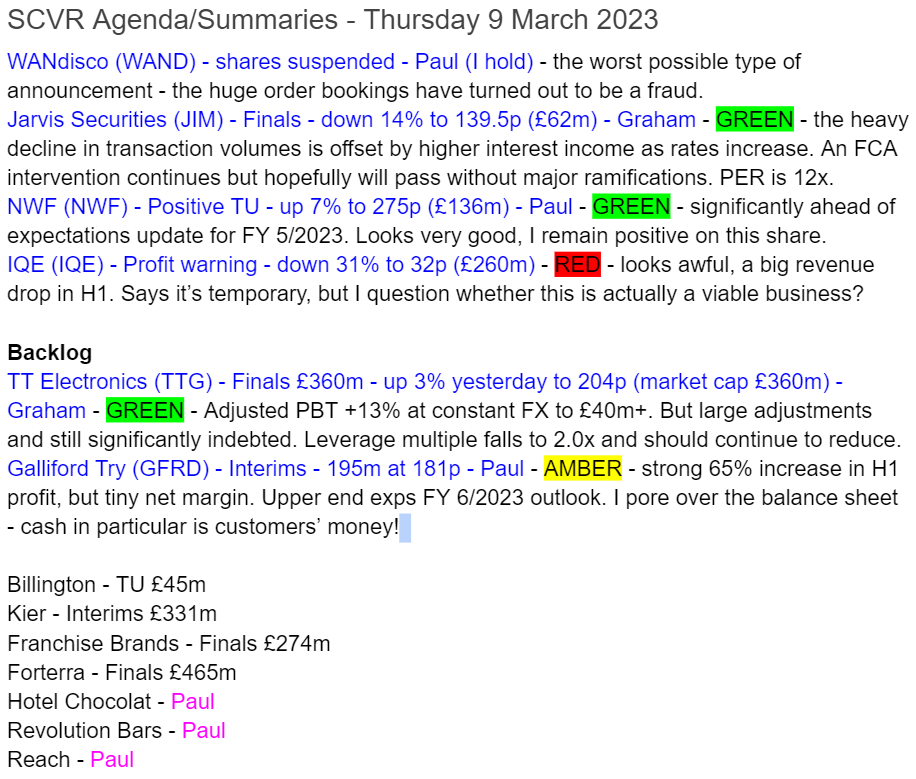

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

I'm still reeling from the bombshell announcement of fraud at WANdisco (LON:WAND) - that's about a 10% hit to my portfolio. Once I can gather myself together, we'll start working our way through this list.

Update at 12:40 - I think we'll leave it there for today.

Paul’s Section:

NWF (LON:NWF)

Up 7% to 275p

Market cap £136m

Trading Update (significantly ahead)

NWF Group plc ('NWF' the 'Company' or the 'Group'), the specialist distributor of fuel, food and feed across the UK , today provides a trading update for the current year ending 31 May 2023.

A lovely update today -

Whilst final quarter trading continues to be subject to seasonal factors, the strong year to date performance together with the supportive backdrop entering March means that the Board now anticipates the Group's full year result to be significantly ahead of market expectations1 with full year headline profit before tax2 not less than £17.5 million .

1. Company compiled consensus headline PBT of £12.3 million; information for investors including analyst consensus forecasts, can be found on the Group's website at www.nwf.co.uk

That’s a lovely, substantial beat against forecast.

Looking at my SCVR summary spreadsheet, it says that on 1 Feb 2023 we flagged “NWF 225p - record H1 results to 11/2022. Outlook v confident - a beat coming?”, but annoyingly I cannot find the actual article here with that in it, which seems to have disappeared. I rated it green anyway. Previously Graham was only amber on 22 Dec 2022, despite H1 results being ahead of expectations, a bit stingy!

Today’s substantial beat against expectations should bring down the forward PER, once analysts have updated their models. The valuation looked reasonable beforehand, so the PER should now drop further, down to about 10 perhaps?

My opinion - remains positive. The shares have gone up a lot recently, which looks based on a firm foundation - providing of course that higher profits are sustainable, which they might not necessarily be - note that similar competitor Wynnstay (LON:WYN) recently posted superb figures, but emphasised that the big profit was one-off in nature. So that would need careful checking, to reassure yourself that you’re not buying into a spike.

We’ve discussed here before (writers, and reader comments) that NWF has a very solid long-term track record, and is a reliable dividend payer too. So it looks a decent value share, and more so after a lovely update today.

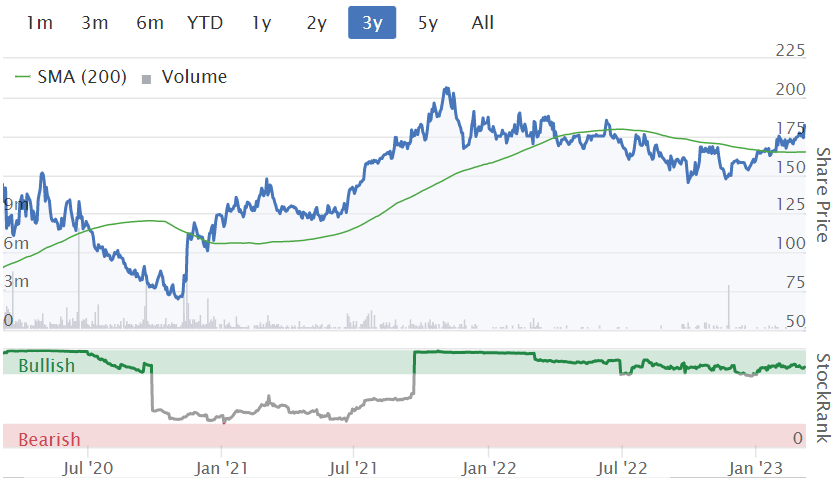

Stockopedia loves it, with a StockRank of 98.

£IQE

Down 31% to 32p (mkt cap £260m)

Trading Update (profit warning)

This company makes products for the semiconductor industry. Shares have now given up all the recent "everything rally" gains, and are back down to similar lows as last autumn.

Today it says that FY 12/2022 results are unchanged from the update on 16 Jan 2023.

The problem is with FY 12/2023 -

Weaker demand in H1 2023, with revenues expected to be £30m down on H1 LY (which was £86.2m revenues), implying a 35% drop to only £56.2m revenues in H1 2023. That’s awful, because it was loss-making in H1 2022, so apply a 35% revenues drop, and that suggests a hefty loss is likely this year.

This drop in demand (which it says is sector-wide) is temporary, and should return to growth in H2 2023 (based on talking to customers, and the pipeline).

Outlook - it says growth will come in 2024 from diversifying into new products, which to me implies that the existing products are a dead loss.

My opinion - I was negative (red) on this share previously on 16 Jan 2023, and today’s update just reinforces that negative view. I cannot see any attraction to this share whatsoever, and it still looks greatly overvalued. Is it a viable business at all, I wonder? Looking through the last accounts again, IQE strikes me as a capital-intensive business model, that doesn’t actually generate any returns from its assets. Shareholders get nothing in divis, as there’s no free cashflow being generated, over the long-term.

I cannot imagine any reason why anyone would want to hold this share. There's not even any jam tomorrow excitement that I can see.

WANdisco (LON:WAND) (I hold)

1310p (shares now suspended)

Market cap £906m

WANdisco (LSE: WAND), the data activation platform, provides the following revision to its anticipated trading performance and financial position.

An absolute nightmare announcement to wake up to here. The worst possible scenario has just been announced - that the growth in sales orders & revenues looks to have been fraudulently misstated, supposedly by a senior sales person -

Following investigations undertaken by the CFO and CEO, and as reported to the Board of Directors of the Company (the "Board"), significant, sophisticated and potentially fraudulent irregularities with regard to received purchase orders and related revenue and bookings, as represented by one senior sales employee, have been discovered. These irregularities give rise to a potential material mis-statement of the Company's financial position.

It gets worse -

The identification of these irregularities will significantly impact the Company's cash position and lead to a material uncertainty regarding its overall financial position and significant going concern issues.

The Board now expects that anticipated FY22 revenue could be as low as USD 9 million and not USD 24 million as previously reported.

In addition, the Company has no confidence in its announced FY22 bookings expectations.

As a result, the Company has requested that its shares be suspended from trading on AIM while it conducts an investigation with its external legal and professional advisers into the nature of this activity and its true financial position.

My opinion - Well that’s it. This is so bad, that it’s probably game over, or not far off, for this share. The £900m market cap was entirely based on the impressive bookings growth that I’ve been reporting on here since last summer. It never occurred to me that the contract wins could have been bogus, but that now appears to be the case.

The big question is whether it was really a salesman acting alone, and if so, how on earth was that not picked up earlier?

The CEO was in the City only last week, talking to investors, super-bullish, talking about a US listing, and expecting to achieve sales of c.$100m this year, rising to $500m fairly quickly. I mentioned here that he was incredibly bullish, but it now appears to have been hot air.

Unfortunately holders here will, I suspect, have to brace for a 90-100% loss on this share.

Sceptics were right to be sceptical. What a disaster.

Galliford Try Holdings (LON:GFRD)

182p

Market cap £196m

This is a building & infrastructure group, focused mainly on public sector projects - which is probably quite a good place to be, in times of uncertainty over private sector projects.

I ran through the H1 figures yesterday, here are my notes of the main points -

H1 revenue £679m (up 14%)

PBT is up 65%, but tiny as a percentage of revenue at just £11.7m

FY 6/2023 profit expected to be at top end of expectations.

Doing share buybacks.

Good divis of about 5% yield

Big order book of £3.5bn

Good visibility, with 95% of FY 6/2023 revenues secured, and 79% of next year.

Average month end cash of £154m, but this is an illusion, as it’s more than offset by huge creditors. So none of it is surplus cash, it’s all arisen due to timing differences (getting paid in advance by customers). So be careful attributing too much (if any) value to this cash pile of customers’ money!

There’s some value to PPP investments.

Balance sheet is quite good, with NTAV £127m.

A fair bit of dilution from options, total 8.0m shares (108m shares currently in issue).

Note 13 - I draw your attention to a large legal dispute with a customer, which introduces uncertainty. I don’t fully understand what risk:reward here is, but want to draw it to your attention anyway - companies are always confident about their own position, but courts don't always agree, so this would need careful scrutiny before buying any GFRD shares.

Working capital - to demonstrate how the cash pile is more than offset by trade creditors, here are the numbers -

.

It’s important to understand the above working capital position. As you can see, current assets total £463.2m, which is cash, and things (mainly receivables) that will turn into cash shortly.

But current liabilities (i.e. cash that will be going out) is higher, at £513.9m.

The net position on working capital is therefore actually a deficit, of £(50.7)m.

So the big £195.8m cash pile is not actually surplus cash, it’s just cash that GFRD is temporarily sitting on, due to the timing difference of money coming in before it goes out again.

That’s a nice position to be in, providing you can keep those plates spinning.

In a wind-down type of situation, if you imagine that the business suddenly stopped operating, then that working capital would all unwind into cash, leaving a £50.7m shortfall.

Now that’s not going to happen, but it does highlight the risk, if for example, new contracts do not involve such generous payment terms as previous contracts. It’s a risk, that the cash pile could melt away, if contract terms became less favourable in future anyway. For that reason, I would attribute little, if any, value to GFRD shares from the cash pile.

My opinion - on a positive view, GFRD seems to be trading well, and says that it wants to raise its tiny profit margin in future, which could trigger a re-rating if successful.

On a negative view, it’s taking on complex contracts, and only eking out a miniscule profit margin. So the risk of even one big contract going badly wrong, could easily wipe out profits.

Not many people invest in this type of low margin contractor, because so many of them have gone bust in the past. I don’t touch this sector personally, but there’s nothing obviously wrong with GFRD, and performance has been better than last year, so I’ll view it as neutral (amber).

Also, it could earn interest on the cash pile in future, which might boost profits.

Stockopedia's computers like it, with a high StockRank.

Graham’s Section:

TT electronics (LON:TTG)

Share price: 204p (+3% yesterday)

Market cap: £360m

This manufacturer of electronic components reported numbers for 2022 yesterday, which were ahead of expectations.

Unfortunately, there are no broker notes for TT on Research Tree. TT is a main market-listed company whose brokers are Numis (LON:NUM) and Barclays (LON:BARC) .

However, according to Stockopedia, the adjusted EPS estimate for 2022 was 16.5p. TT produced adjusted EPS of 18.2p yesterday.

Key points:

Revenues +22% at constant FX to £617m

Adjusted operating profit +19% at constant FX to £47.1m

Adjusted PBT +13% at constant FX to £40.4m (market expectations were previously £35.4m - £39.8m)

The growth percentages are all significantly higher if you don’t adjust for currency fluctuations, as the company benefited from its international exposure.

Unfortunately, there are some other major adjustments to these figures as certain costs were kept away from the headline numbers. These costs add up to over £50m and include:

“Restructuring and other” - £20m

“Asset impairments” - £23m

“Acquisition and disposal related costs” - £7m

The quickest way to check if the exceptional items are truly exceptional is to see what they added up to in the prior year.

In the case of TT, they added up to £15m last year.

If we go back one more year to 2020, they added up to £20m.

I would therefore be inclined to treat c. £20m as the baseline figure for the adjustments we should normally expect, until TT starts to produce cleaner results with fewer adjustments than that.

If we took the view that £20m of the exceptional items were therefore non-exceptional, then adjusted PBT becomes only £20m, not £40m. You don’t need me to tell you that’s an important difference!

The really unusual item was the impairment of the company’s Internet of Things Technology Products business:

This impairment is shown within the Power and Connectivity division and is linked to an increase in discount rates, coupled with revised forecasts for the business in the context of a weaker macro-economic environment and impact of the evolution of the COVID pandemic on the potential demand for COVID testing.

Looking further into the small print, the company warns that additional impairments of this business may be required in future. It still has £10m of goodwill on TT’s balance sheet.

Overall, TT has goodwill of £155m and other intangible assets of £54m on its balance sheet. After excluding them, tangible equity is £88m.

Let’s get back into these results and try to understand company performance a little better:

Book to bill ratio 118% - excellent order intake, replacing fulfilled orders.

Adjusted operating margin of 7.6%, up from 7.3% last year.

Organic revenue growth is 20%, most of which is driven by higher volumes rather than price increases.

Return on Invested Capital up 140 basis points to 10.5%.

Outlook sounds bullish:

“Continued order momentum through Q4 resulting in circa 90% of planned 2023 revenues covered at the end of December…

Strong free cash flows and a continued reduction in leverage expected in 2023

Disciplined approach to pricing of the order book, continued growth of the business and actions taken in 2022 underpin our confidence in further progress in 2023.”

The CEO comment mentions “unprecedented visibility” thanks to the strong order book.

Leverage reduced to 2.0x, as planned and as promised. It was 2.4x back in June 2022. The company’s target range is 1.0x-2.0x.

Net debt at year-end was £138m.

I suspect that excessive leverage was partly responsible for this stock’s sell-off last year - see my comments in November. TT is confident that leverage will remain on a “downward trajectory”, “as EBITDA increases and as we deliver a material step-up in free cash flow in 2023”.

My view

TT has done as I hoped it would. It has kept up its order momentum and succeeded in reducing its leverage multiple. It has thereby, in my view, proven that the sell-off in H2 last year was unjustified.

Does it still represent good value at this level? Well if you go by the earnings estimates, it’s still cheap:

However, when you consider the significant adjustments involved in the earnings, the value is more questionable.

And the debt burden, while under control, is another factor that investors need to allow for.

I’m tempted to switch my rating from Green to Amber, on valuation grounds, but there is an old saying about letting your winners run. I can’t fault this company’s recent performance. So I will let it stay Green for now.

Jarvis Securities (LON:JIM)

Share price: 139.5p (-14%)

Market cap: £62m

Despite the share price fall today, Jarvis shares are still nearly 50% higher than they were when I covered them last September.

The market dumped JIM shares back then on news of an FCA intervention to review the company’s custody and settlement services. Among other things, Jarvis was forced to hire regulatory consultants and to stop taking on any new clients at this wing of the business.

Today’s results contain the following information regarding this matter:

We are severing ties with a number of our model B clients whose businesses do not meet the risk tolerance at Jarvis and fall outside of our more restricted outsourcing model. Whilst limiting the business activities in the short term, it was felt necessary to ensure that the business would thrive in the longer term. We have made and continue to make enhancements to our Model B and retail client onboarding procedures and monitoring to ensure that they are in line with market practice and meet that expected of us by the regulator.

This issue is far from resolved but based on the share price recovery since September, I guess the market agrees with my suspicions that it is not a fatal problem for the company.

The Chairman says: “This review is still ongoing and we expect to provide an update shortly.”

Let’s see how the company has performed in FY December 2022:

Revenues down 12% to £12.6m

PBT down 20% to £6.1m

These are some of the cleanest, simplest accounts you’ll find. No adjustments and nothing added to confuse investors.

Here is how the company makes money:

Note the enormous contribution of interest income, which exceeded commissions in 2022 as interest rates rose and as transaction volumes declined.

Jarvis is an example of a cash-rich business that can benefit from higher rates, as shown in the table above.

However, Jarvis itself only owns around £4m of cash. The interest shown above has been earned on client money. Or in the words of Jarvis itself: “The group derives a significant proportion of its revenue from interest earned on client cash deposits”.

The Chairman says “there are still further gains to come in the future” for interest income, as more funds mature.

One of the big imponderables at Jarvis is the identity and creditworthiness of its interest-earning investments. All we know for sure is that:

In accordance with FCA requirements, deposits are only placed with banks that have been approved by our compliance department.

Investors in Jarvis are, to some extent, trusting that management are investing client money prudently.

For what it’s worth, I do believe that management are extremely well-aligned: Andrew Grant is the founder and the largest shareholder (owning 37%), and he remains the Chairman today. If there was a problem, he would be the first to suffer. A lady who shares the same surname is the second-largest shareholder, owning 14%.

There has never, to my knowledge, been any loss associated with how client money has been invested in the past.

Let’s get back to Mr. Grant’s commentary to reflect on how the business has performed in 2022, and the likelihood of a recovery in 2023:

General share transaction volumes remain below average across the whole industry so we have seen a reduction in line with that. The Covid pandemic brought significant volatility to the market between 2020-21, and a flurry of corporate activity after lock down as IPO activity increased. This has largely died down and been replaced by a steadily declining market, which is not ideal for transaction volumes.... There are indications that the market may have now turned, as market indices have turned positive and central banks signalling that interest rates may now have peaked or the rate of increase will slow.

My view

I’m going to give this company the thumbs up. Although I may be suffering from bias as a former shareholder and customer.

I understand their retail proposition very well and I think there is still a place for them in the marketplace as an extremely cheap and simple broker. That being said, they probably could afford to modernise their offering a little more.

I also note that they earn exceptional margins and ROE. This is a long-running feature of the stock and makes it, in my view, one of the highest-quality performers in the UK micro-cap landscape:

They have earned net income of £5m in a somewhat disappointing year, putting the shares on a PER today of only around 12x. It’s not often that such a high-quality business can be bought at that multiple, although Jarvis itself does trade at 12x from time to time:

There are two major risk factors, in my view.

Firstly, there is the risk that their retail offer eventually becomes uncompetitive, despite their low fees, due to the lack of modernisation and the entrance of new competitors in the landscape (think of the likes of IG group (LON:IGG) - in which I have a long position - who have entered the share dealing space in recent years).

There is also the risk that client funds have been invested in ways that would make investors uncomfortable, if full information around these investments was made public.

Despite this risk, I’m going to give Jarvis the benefit of the doubt (a dangerous thing to do, I know). They have been around for a long time and again, I think they are exceptionally well-aligned.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.