Good morning from Paul & Graham!

Today's report is now finished.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom),

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

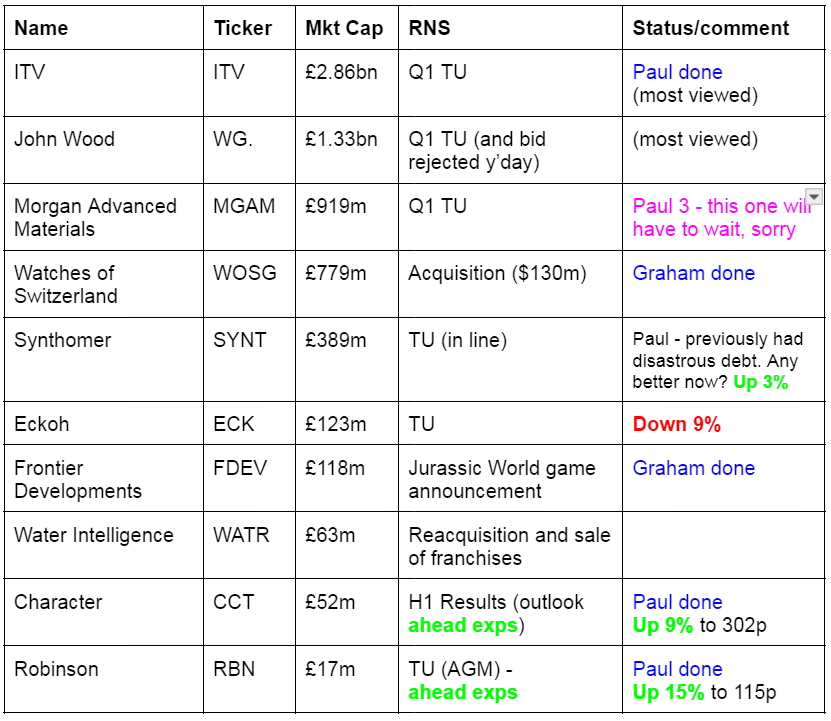

Companies Reporting

Other mid-morning movers (with news)

Airtel Africa (LON:AAF) - down 9% to 105.3p (£3.95bn) - Final Results FY 3/2024 - Paul - no view.

Telecoms & mobile money group, in 14 African countries. Commendably fast reporting of FY 3/2024 numbers. Moved into a loss, mainly due to adverse forex, esp Nigerian naira devaluation (which we’ve also seen hit other companies, eg CABP and PZC).

Not my cup of tea, with negative $(1)bn NTAV.

Light Science Technologies Holdings (LON:LST) - up 13% to 3.05p (£10m) - Distributor Agreement - Paul - AMBER/RED

I very quickly reviewed its FY 11/2023 results here yesterday. Still loss-making (albeit reduced loss) and a weakish balance sheet, so almost certainly another placing will be needed I reckon.

Today it announces signing of a distributor agreement in S.Africa, with no financial details disclosed. It relates to LST’s vertical farming products. Why does a £10m market cap group have 3 divisions? It seems a scattergun approach, from a series of small acquisitions, with inadequate financial strength to properly develop them, I suspect.

I’ve only just spotted that yesterday’s results contained a “material uncertainty” warning. Nearly all the revenue comes from its contract manufacturing business, with the other 2 divisions being blue sky.

I’m sticking with AMBER/RED, due to the risk of a discounted placing. So expect a flurry of rampy RNSs in the lead-up to the next fundraise! That’s the usual pattern with this type of company. Although note that Directors are big shareholders, a positive thing.

Summaries of main sections

Character (LON:CCT) - 276p (pre-market) £52m - H1 Results - Paul - GREEN

Ahead of expectations update for FY 8/2024. H1 results are much improved on last year's near-breakeven result. Notably strong balance sheet with plenty of cash and no interest-bearing debt. Good dividends, plus buybacks. Looks a decent value share to me, I like it. Although bear in mind historical performance can be erratic, but it always seems to recover from occasional profit warnings.

Robinson (LON:RBN) - up 23% to 123p (£21m) - AGM Trading Statement - Paul - AMBER

Ahead of expectations update, and Cavendish raises operating profit forecast by 20% to £3.0m. Although this is a misleading profit measure, as finance costs of £0.8m are ignored. The forecast PER is now 13.2x, which I feel is high enough for a low margin, capital-intensive business in a highly competitive sector.

Watches of Switzerland (LON:WOSG) - up 1% to 328p (£785m) - Acquisition of Roberto Coin Inc - Graham - AMBER/GREEN

A surprising acquisition in some ways as WOSG buys the US-based distributor of a jewellery brand. Looking into the details, I come away with a positive impression based on the price of the deal, WOSG’s ability to afford it, and the strategic reasons. WOSG shares are increasingly interesting to me.

ITV (LON:ITV) - up 2% to 75.6p (£3.02bn) - Q1 Trading Update - Paul - GREEN

A confusing and badly worded update, that doesn't tell us if they're trading in line with expectations or not. However, I'm delighted with the news that the pension scheme is now fully funded, which will free up a lot of cash for improving the already good shareholder returns.

Frontier Developments (LON:FDEV) - up 1% to 303p (£120m) - Jurassic World game announcement - Graham - AMBER

This video game developer and publisher has provided welcome clarity on its plans: a new game (name unknown) will be released in the upcoming financial year FY May 2025, then a Jurassic World game in FY26, and then another new game in FY27. The odds of success for shareholders seem finely balanced.

Paul’s Section:

Character (LON:CCT)

276p (pre-market) £52m - H1 Results - Paul - GREEN

Designers, developers and international distributor of toys, games and giftware

I’ve followed this toys company for many years, and my preconception is that shares usually look cheap or very cheap, but it has a rather erratic track record, and disappoints with profit warnings every now and then. It’s been a generous dividend payer in the past, and is doing buybacks too. There might have been question marks over management remuneration too, I vaguely recall.

H1 results are much improved on last year -

Revenue flat at £57.6m

Adj PBT (profit before tax) up 320% to £2.1m (from a low base last year)

Adjs are only small, and actually reduce profit this H1 by £154k.

Adj diluted EPS up huge % from almost nothing last year, to 8.7p this H1.

H1 dividend held at 8.0p, almost all of earnings, and uncovered by earnings LY.

Outlook - positive news here -

"The Group has a strong portfolio of products, underpinned by a strong balance sheet, and has a net cash position with substantial unutilised working capital facilities in place. On the back of our first half-year's performance and these signs of the Group's robust health, we anticipate profit before tax and highlighted items in respect of the full year to 31 August 2024 will exceed current market expectations. The Board is comfortable that the Group is on course to meet its targets."

Balance sheet - looks healthy to me. Inventories have reduced by £6m to £11.7m, with the benefit flowing half through to increased cash of £13.4m, and reduced trade creditors. Working capital looks very comfortable, with £25m net current assets. Put another way, the cash pile of £13.4m almost completely covers what they owe suppliers (£13.8m). There are no significant longer-term liabilities. So my verdict is that CCT is in rude financial health, meaning that there’s no solvency or dilution risk, and it has ample dividend-paying capacity, as it demonstrated last year with divis still paid despite not being covered by earnings. It’s not fashionable at the moment (where everyone seems to chase high ROCE), but I like the safety that a strong balance sheet provides investors with.

Cashflow statement - all looks fine to me, no issues. Note that share options charge is very low at £55k in H1, and £204k in FY 8/2023, certainly not excessive.

Broker update - thanks to Allenby for crunching the numbers this morning. It increases FY 8/2024 PBT by 10% to £6.6m. In EPS terms that is: OLD: 23.3p, NEW: 26.1p.

CCH shares historically have tended to only attract a high single digit PER. Is that fair though? I think a PER of about 12x seems fair here, so that gives me a share price target of 313p. That’s a bit above the current price, so there’s likely to be some upside here. A 10% rise in forecast earnings usually flows straight through to a 10% rise in share price on the day, so I imagine (I haven’t looked yet, as it’s funt o guess!!) we might end today c.300p, which would certainly not be a stretched valuation, especially when you take into account the very strong balance sheet, and generous divis, plus it has authority to do substantial buybacks - which I approve of where a share is cheap on fundamentals, and is not a diversion to cover up excessive management share options (as we saw recently at Trainline for example).

Paul’s opinion - I like it. GREEN.

Robinson (LON:RBN)

Up 23% to 123p (£21m) - AGM Trading Statement - Paul - AMBER

Robinson plc ("Robinson", the "Company" or the "Group"; stock code: RBN), the custom manufacturer of plastic and paperboard packaging…

New CEO - “in advanced discussions” to appoint someone.

Key points -

Jan-Apr 2024 revenues up 8% (volumes up 12%, prices down)

Improved gross margins and lower operating costs.

Profit ahead of 2023, but doesn’t say how much.

Surplus properties valued independently at £7.4m (about a third of the market cap) - further sales likely in the next year, some subject to planning approvals.

Net debt has risen by £0.7m since Dec 2023 year end, due to £1.1m of capex.

Outlook & profit guidance -

After strong performance in the first four months, the Company expects revenue for the 2024 financial year to be ahead of 2023 and current market expectations. With this additional revenue, full year operating profit (before amortisation of intangible assets and any exceptional items) is expected to be in the region of £3.0m (2023: £2.2m), this being ahead of current market expectations. We remain committed in the medium-term to delivering above-market profitable growth and our target of 6-8% adjusted operating margin.

I wish companies would stop reporting operating profit, because it ignores (often substantial) finance costs, which also these days post IFRS 16 can include significant property lease costs. We need to be told real profit, including all costs, so adj PBT is the number I want to see, not the misleading operating profit number.

In this case, RBN had £805k of finance costs in FY 12/2023, which is 27% of the guided operating profit of £3.0m above. So ignoring these real world costs is not good enough. It’s PRs probably trying to pull the wool over our eyes as usual, and trying to make the numbers sound better than they really are. Still, untangling their complicated webs of deceit does at least keep me busy!

Broker update - Cavendish issues a helpful update. Sure enough, this confirms that adj EBIT (operating profit) of £3.0m turns into £2.2m of adj PBT, which turns into adj EPS of 9.3p - up 24% on 2023, but flat vs 2022. So it’s not clear whether this is structural, sustainable growth, or just oscillating around the flat line?

This gives us a PER of 13.2x, which I think is fully up with events.

Paul’s opinion - I wouldn't get carried away with today’s news, the price looks high enough I think. The surplus property is good, but we’ve known about that for many years, these things take a long time to actually pay out. It covers net debt, so I doubt there would be much (if any) return to shareholders from property sales. Hence in valuing the shares, personally I net off the surplus property against elevated net debt, with a result that it’s neutral overall.

This is a low returns, capital-intensive business in my view. Performance is improving, but that’s after spending £4.0m in capex in 2023, and £2.6m in 2022. The products are low margin, and up against a multitude of competitors. Put those factors together, and I see little appeal in this share. There’s nothing actually bad about it, just a lowish quality business in a highly competitive sector, where I don’t see any competitive advantages or growth potential for its products. Surely there must be better places for our money? Overall then, I can’t muster any enthusiasm for this, but there’s nothing actually wrong with it, so AMBER seems about right. Also bear in mind RBN shares can be extremely illiquid. I remember getting stuck with a small position here a few years ago, and it was tricky to exit from. Hence I imagine there are likely to be plenty of stale bulls happy to use a big price move up as a selling opportunity.

Nice-looking chart though, and a good StockRank, so maybe traders might see more upside here, who knows?! -

ITV (LON:ITV)

Up 2% to 75.6p (£3.02bn) - Q1 Trading Update - Paul - GREEN

We stray into mid-caps where we see potential value. I reviewed ITV twice in Mar 2024 -

1/3/2024 - 64p - sells Britbox JV to BBC, to fund a big share buyback (9% of co). Low PER & high dividend yield. But cash hungry pension deficit.

11/3/2024 - 71p - Amber/Green - I was intrigued by FY 12/2023 results, and concluded it’s worth a closer look.

On to today’s news, Q1 (Jan-Mar 2024) -

This is by far the most significant news I think, on the pension deficit (previously a large drag on cashflow) is now in actuarial surplus, a big turnaround -

ITV Pension scheme in surplus following latest triennial valuation; removes a significant historic drag on free cash…Following the agreement of the latest triennial valuation we expect no future deficit contributions while the Scheme is in surplus, other than a small payment relating to a legacy asset-backed scheme. This removes a significant historic drag on free cash (refer to Note 6 for further details)...

The triennial valuation of the ITV Pension Scheme (the Scheme) as at 31 December 2022 has been completed. At the valuation date, the Scheme had a surplus of £83 million. This is compared to a deficit of £252 million at the previous valuation date of 31 December 2019.

As the Scheme is in surplus, there are no deficit contributions payable. The Group will continue contributing an annual payment of c. £3 million under the London Television Centre Pension Funding Partnership. The Group's pension deficit contributions for the year to 31 December 2023 were £40 million, and for the year to 31 December 2022 were £137 million.

Liquidity & net debt - looks much improved -

ITV continues to have good access to liquidity. At 31 March 2024, net debt was £272 million (31 December 2023: £553 million). ITV had total liquidity of £1,514 million, comprising total cash of £614 million and committed undrawn facilities of £900 million.

Outlook - doesn’t tell us what we need to know, ie how is trading this year vs market expectations? It mentions an H2-weighting, so maybe it’s trying to cover up a softer H1? -

With the continued strong strategic progress we are making, we remain on track to deliver our 2026 KPI targets.

As previously guided we expect to deliver a total of £40 million of cost savings in 2024 - made up of £10 million from our 2019 to 2025 cost savings programme and £30 million of additional in-year savings as part of our strategic restructuring and efficiency programme which we announced as part of the 2023 full-year results and are already executing upon.

Paul’s opinion - a very badly written trading update that gives a lot of fragmented detail, but doesn’t pull it all together with a conclusion - which is what we need, just saying whether or not they’re trading in line with expectations. When companies deliberately avoid stating this, it just makes me suspicious.

Broker consensus forecasts for both FY 12/2024 and 2025 have been drifting downwards for quite a while, which combined with the key gaps in today’s update, and talk of an H2 weighting, increases my unease that H1 results could disappoint maybe?

That said, the pension scheme deficit payments stopping, and greatly reduced net debt too, are highly positive. ITV now looks a really good income share, with forecast yield of about 6.8%, with scope for that to go higher I think, since not having to fund the pension scheme any more will free up plenty more for dividends perhaps.

I’ve not gone into all the details properly, so this is just a quick overview, and on that basis I think ITV shares look well worth investigating further, doing your own proper in-depth research.

I think the removal of pension cash outflows and moderate net debt, is enough to make me up my view from AMBER/GREEN to GREEN. Although I should stress that this is not based on deep research, just an overview.

Graham’s Section:

Watches of Switzerland (LON:WOSG)

Up 1% to 328p (£785m) - Acquisition of Roberto Coin Inc - Graham - AMBER/GREEN

It’s a large ($130m) acquisition announcement from Watches of Switzerland this morning.

Information on the acquired company, Roberto Coin Inc:

According to research by WOSG itself, Roberto Coin is “the sixth largest jewellery brand in the US by sales at retail value”.

Roberto Coin Inc “has exclusive perpetual rights to import and distribute Roberto Coin jewellery throughout the US, Canada, Caribbean and Central America”.

Roberto Coin is “delicately handcrafted jewellery with a unique ruby signature”. It’s currently available in 16 WOSG showrooms in the US.

For a moment, when I started reading this announcement, I was astonished that WOSG was buying a jewellery brand - but then I quickly saw that it was buying the right to import and distribute a jewellery brand, i.e. an expansion of its existing jewellery distribution rights.

The strategic rationale? The deal “builds on the group’s proven capabilities in showcasing luxury brands across both watches and jewellery”, particularly in the US.

Some of the specific reasons given:

Grow the wholesale business under the leadership of the existing President of Roberto Coin Inc, expanding the network of independent retailers and exporting outside the US.

Sell directly to the consumer using WOSG’s existing showrooms and websites. WOSG will benefit by buying directly from the Roberto Coin parent company in Italy, instead of having to lose margin by buying through Roberto Coin Inc.

Financials

Key facts:

$10m (out of the $130m total payment) is deferred for one year and contingent on profitability.

In 2023, according to unaudited figures, Roberto Coin Inc made PBT of $30.2m on revenues of $138.7m.

In 2022: PBT of $30.1m on revenues of $146.2m.

The US jewellery market shrank in 2023, so it’s not a surprise that revenues might have fallen. It is surprising (to me at least) that this had no impact on Roberto Coin Inc’s profitability.

If the unaudited figures are valid, it means that WOSG is only paying 5x PBT: surely there is a catch?

Funding: WOSG are borrowing to get this deal done. The leverage multiple (net debt/adj. EBITDA) increases to 0.8x, a level that would normally still be considered very safe.

As of the most recent interim results (to October 2023), WOSG reported having a net cash position.

WOSG CEO comment excerpt:

We have partnered with Roberto Coin for over a decade in the US, retailing its elegant jewellery in a number of our Mayors' showrooms. It is a hugely popular, growing brand, occupying a strong position in the market, underpinned by product quality, design creativity and imagination.

"We believe there is significant opportunity to leverage our proven retail expertise in luxury branded jewellery…

Graham’s view

Checking the archives, I last covered WOSG in February (share price at the time: 392p), when I said “the valuation is starting to look tempting”.

The WOSG share price has been decimated during the Rolex bust:

There has been no increase in the share count during this time, and indeed the company’s balance sheet has been reasonably strong, with lease liabilities being the only major risk factor.

Today’s deal does inevitably increase the risk associated with this share. However, I can’t argue that the company shouldn’t do it. It had an (admittedly small) net cash position, and after the deal it has a modest leverage multiple. So can it afford to do the deal? Based on current figures, yes.

Of course if trading were to continue deteriorating, this would change both EBITDA and the leverage multiple for the worse. But as things stand I would say that yes, WOSG can afford this deal.

Another (more controversial) way of looking at it is the percentage of WOSG’s market cap involved: $120m paid upfront is only about 12% of the current market cap. So WOSG shareholders could have funded the deal with additional equity, without suffering much dilution.

As for the valuation: I consider myself appropriately sceptical when it comes to unaudited figures, but I have no reason to doubt that Roberto Coin did generate $30m+ of PBT last year. On that basis, the $130m price tag appears to represent good value for WOSG (even if we acknowledge that Roberto Coin Inc is merely an importer and distributor).

And the strategic rationale? From an outsider perspective, that makes sense to me too. Luxury jewellery only represents about 6% of WOSG’s revenues (vs. 88% in watches), and I don’t see any harm in growing the jewellery side of the business.

Overall, therefore, this deal gets the thumbs up from me.

I’m going to very tentatively adjust my stance on WOSG from AMBER to AMBER/GREEN.

My reasons are:

I already thought WOSG might be approaching value territory earlier this year, and the shares are cheaper again now.

WOSG is deploying its balance sheet strength to achieve some non-organic growth and also diversifying the business in a reasonable way.

Risk levels here are more elevated than they were before, but the potential rewards for success are getting bigger too:

Frontier Developments (LON:FDEV)

Up 1% to 303p (£120m) - Jurassic World game announcement - Graham - AMBER

We had a trading update from FDEV on Tuesday, covered here.

In Tuesday’s report, I observed that this video game company didn’t seem to have many exciting title launches coming up soon, and that they were in desperate need of a big hit.

They have answered the call today with the announcement of a third Jurassic World game.

This news was badly needed. The first two Jurassic World titles were two of FDEV’s most successful ever games. With two and a half years having passed since the most recent version was launched, it seems that now is a good time to start working on the next one.

In the company’s words:

Following the major success of Jurassic World Evolution and Jurassic World Evolution 2, which released in June 2018 and November 2021 respectively, Frontier and Universal Products & Experiences have signed a licence for a third Jurassic World game which is scheduled for release in Frontier's financial year 2026 ('FY26'), between 1 June 2025 and 31 May 2026. In February 2024, Universal Pictures and Amblin Entertainment announced an all-new Jurassic World event film currently scheduled for release on 2 July 2025.

A nice example of the “film plus video game” formula.

And here is FDEV’s new plan for future title launches, explicitly laid out in an RNS for the first time I think:

Over the next three consecutive financial years, Frontier plans to release one new CMS game per year; the development of the unannounced own-IP CMS game for FY25 is on track and Frontier expects to announce the title in the coming months; the third Jurassic World game confirmed today is scheduled for FY26; and a third unannounced CMS game is planned for FY27.

As noted above, the company’s financial year finishes at the end of May. Therefore FY25 is FY May 2025; a new game (whose identity is yet to be revealed) will be released at some point during this period - I would presume that this will be at least several months before Christmas 2024?

Then we will have Jurassic World in the following financial year, and then another game the year after that.

Graham’s view

This RNS puts to rest many of my concerns around future title launches. I was concerned that FDEV didn’t have much in the works, but we now have confirmation of a new game in the upcoming financial year, with Jurassic World to follow.

This means that I don’t need to hop into the AMBER/RED or the RED category just yet. FDEV might yet pull some rabbits out of hats, in the form of some successful game launches, and we now have some welcome clarity on their plans in this regard.

There’s still a lot to play for: video game development isn’t cheap and I’ll be keeping a close eye on FDEV’s shrinking cash balance. But at least we now have a much better idea of what FDEV will be working on.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.