Good morning, it's Paul & Graham here!

Right, we're all done for today. I'm off to 'spoons for some fish & chips, as I enjoyed it so much on yesterday's mystery shop.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

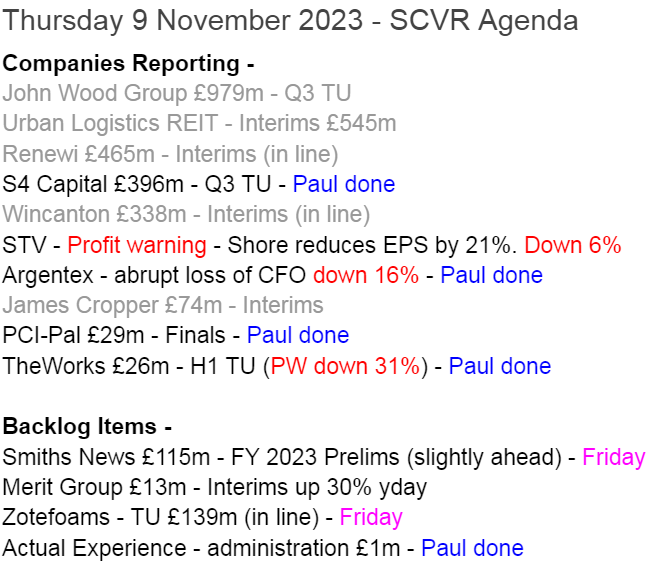

There's a fair bit of news today, so we obviously won't be able to cover everything, here's the list - I've greyed out some "in line" updates that don't look very interesting -

Summaries

S4 Capital (LON:SFOR) - Down 13% to 58p (£341m) - Q3 Trading Update (profit warning) - Paul - BLACK/RED

Another profit warning from Sir Martin Sorrell's mainly US-based digital advertising group. It's expanded too fast, run up too much debt, and profits & cashflow look suspect, coming from many & large adjustments. I remain highly sceptical.

Actual Experience (LON:ACT) - jam tomorrow company goes into administration. Closing our notes on it below, with some brief observations.

Argentex (LON:AGFX) - down 18% to 65p (£73m) - CFO Resignation - Paul - RED

What on earth is going on here? Shares in this FX company tumbled 22% to 75p on 26 Oct 2023 (we covered it here) on news that the CEO (12% shareholder) had abruptly resigned, with no explanation as to why. I speculated that, based on a wobbly outlook comment in the last interim numbers, there could be a profit warning brewing possibly?

Today, just 20 days after the CEO walked (or was kicked?) out, the CFO has also resigned!

Paul’s opinion - shareholders need to be told what’s going on. I think the Chairman should now feel obliged to be open and honest about why the company has lost both its CEO and its CFO in rapid succession. Obviously shareholders are going to be worried, and it’s not right to leave the owners of the company in limbo like this.

The last balance sheet looks OK to me, so solvency doesn’t seem to be an issue, unless there’s been some calamitous breakdown of internal controls/IT? That would be my main worry for risk, in a company that has large flows of money in & out.

We need answers, pronto!

Hollywood Actors Strike - the BBC reports that a “tentative deal” has been reached to end this strike, which has contributed to poor performance from several UK shares exposed to TV/film.

This seems to be the reason for the following price movements today - together with our last comments here on each company -

Videndum (LON:VID) - up 14% (SCVR 26/9/2023 - uninvestable for me, until it has refinanced)

Facilities by ADF (LON:ADF) - up 13% (SCVR 3/8/2023 - I concluded it might be worth a dabble, after PW)

Zoo Digital (LON:ZOO) - up 10% (SCVR 28/9/2023 - PW. Might be a turnaround once Hollywood strike ends?)

Nice trades there, well done to holders. It’s an unforgiving market though, and sellers often use the liquidity from good news to ditch more of their shares. Time to bank profits on the good news? What do holders think?

Works co uk (LON:WRKS) - down 31% to 27.6p (£17m) - H1 Trading Update - Paul - BLACK (profit warning) - AMBER/RED (on fundamentals)

Trading has deteriorated recently, as consumers rein in spending, and hence are forcing WRKS to discount more. Forecasts lowered to only £1.0m PBT for FY 4/2024. Looks a marginal business to me, worth very little I think.

PCI- PAL (LON:PCIP) - Down 7% to 41p (£31m) - FY 6/2023 Results - Paul - AMBER/GREEN

I weigh up the bull & bear points below, coming out moderately positive overall.

Paul’s Section:

S4 Capital (LON:SFOR)

Down 13% to 58p (£341m) - Q3 Trading Update (profit warning) - Paul - BLACK/RED

This is Sir Martin Sorrell’s digital advertising group, which we are most definitely not fans of here at the SCVR. We’ve reviewed its announcements 4 times this year (11 May, 9 June, 24 July, and 18 Sept), concluding RED every time, with the recurring theme being its weak, over-geared balance sheet (from too many acquisitions on an inadequate capital base), and complicated accounts full of adjustments required to conjur up adjusted profits. I see little evidence of what I would call genuine profit or cashflow.

To add to that list, we have another profit warning today, on top of continuously falling forecasts, which it now says it won’t meet.

Today’s update is, what I would call gibberish. This is supposed to be a communications company. Here are its headlines - can you make any sense of this, as I can’t! -

Thankfully, Dowgate Capital (via Research Tree) come to our aid in clearing the fog, many thanks to both.

Key points are -

Yes, it’s a profit warning. EBITDA guidance was 12-13.5% range (for FY 12/2023), it has today been lowered to 10-11%.

Heavy Q4 seasonal weighting, as in previous years (which introduces further risk I’d say)

Deteriorating revenue trend within 2023.

Dowgate forecasts 4.7p EPS for FY 12/2023 (previous forecast 6.7p), a PER of 12.3x

SFOR says larger clients are still showing growth, but smaller clients cutting back.

Note that most (79%) revenues come from the Americas.

Net debt £185m at end Q3. Expected to be c.£220m at Dec year end, due to the last deferred consideration payments being made.

Debt covenant seems loose at 4.5x, and Sir Martin doesn’t seem concerned about debt.

Hoping to see EBITDA margin return to “historic levels of 20%+”

Paul’s opinion - I very much dislike the numbers from SFOR - explained in detail here on 18 Sept 2023, when I dissected its interim results.

It strikes me as bizarre that SFOR is today talking about dividends and share buybacks in 2024, when surely debt reduction should be its priority?

What about a cyclical recovery then? The US tends to have short & shallow recessions (if it has one at all), so SFOR shares might come surging back if it starts reporting growth again. The trouble is, I don’t see any track record of proper profitability at SFOR, even when economic conditions were better. For that reason, I’m not at all convinced there’s a good company here, as there’s no evidence of it as yet.

So it’s another thumbs down I’m afraid. There could be a trading bounce in this share at some point, but on fundamentals it looks very poor I’m afraid. It’s not cheap either, with an enterprise value of c.£560m, even after its collapse in share price, losing c.93% from the bonkers Aug 2021 peak.

Generally speaking, I’m not a fan of startups where some star manager tries to recreate former glories. It’s surprising how often they’re not able to do it, especially when macro conditions are tough. Yet investors are asked to pay up-front with a lofty valuation before anything has been achieved. Risk:reward has turned out to be very poor on SFOR. So far anyway.

Actual Experience (LON:ACT)

Shares suspended - gone into administration - Paul

Another one bites the dust. I remember when ACT floated in 2014, as an excited fund manager rang me and told me what an amazing company it is, and to buy some shares almost at any price. The story was that it analysed the user experience of websites, thus making them better.

As you can see below, its financial performance was hopeless, with revenues not getting above £2m pa, and losses typically of £5-7m pa. It burned through a decent cash pile, then had to start doing more placings.

Investors have obviously now declined to pour more money in, and the company has gone into administration.

Yet another AIM story stock that promised the world, and failed to deliver.

Keeping away from loss-making story stocks (where there’s no proper business) has got to be one of the key investment lessons that some of us need to re-learn every few years! I have to constantly remind myself of this, with my latest lesson re-learned being the WANdisco fraud last year.

Works co uk (LON:WRKS)

Down 31% to 27.6p (£17m) - H1 Trading Update - Paul - AMBER/RED

The Works, the multi-channel value retailer of arts, crafts, toys, books and stationery, announces an update on trading for the 26 weeks ended 29 October 2023…

Not good, this update. It says “consumer demand has softened further” in the last 9 weeks.

“High degree of uncertainty” over forecasting for the key Christmas season.

Revised guidance - good clarity of reporting here -

Taking into account the level of uncertainty with regard to sales, and our expectation that it will be necessary to continue to maintain a higher than planned level of discounting to remain competitive, we have revised our estimate of the likely full year result for FY24, and now expect that the pre IFRS 16 Adjusted EBITDA will be approximately £6.0m.(2)

(2) | The Company compiled estimate of the market's expectation for the FY24 pre IFRS 16 Adjusted EBITDA result prior to this announcement was approximately £10.0m. |

Looking back at the FY 4/2023 results, it made £9.0m adj EBITDA, but £10.1m adj PBT, which looks wrong, as PBT would normally be lower than EBITDA. A footnote said -

The FY23 Adjusted PBT is greater than the pre IFRS 16 Adjusted EBITDA because of the effect of IFRS 16. We would normally expect the Adjusted PBT to be less than the pre IFRS 16 Adjusted EBITDA. Please refer to page 14 of this report and note 3 of the condensed financial statements for further information. |

I can’t follow this, so have no idea what is the significance of EBITDA being higher than PBT.

It’s not worth spending time on trying to figure it out, as I’ve no intention of investing in this share anyway.

There was a very long going concern note in the FY 4/2023 accounts, which included a “material uncertainty” - I normally try to avoid investing in anything that has such a warning, as it indicates high risk of dilution or insolvency in a downturn.

Liquidity - this sounds OK, I don’t expect WRKS to go bust any time soon - unless it has a really dire Xmas season -

The Group had net bank borrowings of £2.5m at the Period end, reflecting the build of stock prior to the peak trading season, and the corresponding low point in cash levels. There was £17.5m of headroom within our £20.0m bank facility.

The last balance sheet had negligible NTAV, and the lease entries show a large deficit, so there must be lots of loss-making shops.

Paul’s opinion - this is a marginal business, that is worth very little, in my opinion.

It’s done well to survive the pandemic, thanks to generous taxpayer support of course. But it looked a marginal business pre-covid too, remember the shares were a dismal float in 2018, and lost about ¾ of their IPO value before the pandemic even began.

I wouldn’t rely on the dividends, as I think this business has little dividend paying capacity.

The bull case is that management seem to have done some good things, and kept the business going, but it’s barely trading above breakeven now - Singers kindly crunch the numbers, and now forecast only £1.0m adj PBT (down from £10.1m LY) for FY 4/2024.

It should manage to get back into a net cash position by year end next year, due to seasonal cash flows.

Where’s the upside going to come from? Maybe if energy costs reduce considerably, and wage growth moderates, and consumers start spending more, that might help get it above breakeven in future?

Overall it just looks a low quality business that’s probably going to mainly be focused on survival, rather than creating any shareholder value.

So for me, it’s going to have to be AMBER/RED, after this latest profit warning, and less than sturdy finances. There are plenty of other more profitable retailers, on reasonable valuations, so why scrape the barrel with this?

PCI- PAL (LON:PCIP)

Down 7% to 41p (£31m) - FY 6/2023 Results - Paul - AMBER/GREEN

PCI-PAL PLC (AIM: PCIP), the global provider of secure payment solutions for business communications, is pleased to announce full year results for the year ended 30 June 2023

Headline -

Strong Growth with Record New Business

I’ve had a quick review of these figures (and commentary), this is how I see it -

Bull points

Strong organic revenue growth +25% to £15.0m

Forecast revenue growth (28-30%) for FY 6/2024, and maiden profit.

High gross margin of 88%, and high quality recurring revenues (86% of total)

Clean going concern note.

Liquidity just about enough, if £3m (undrawn) RCF remains available, plus £1.2m cash.

Bear points

Adj PBT is stubbornly still loss-making, at £(2.3)m, only slightly down from £(2.9)m LY

Heavy costs of patent legal dispute are excluded from that, so total LBT is £(4.9)m

Patent case won in the UK, but still ongoing in USA, expected summer/autumn 2024.

Balance sheet is weak, I think it would benefit from a £3-5m placing.

Paul’s opinion - it’s quite rare to find a strong organic growth software company, with high margins and recurring revenues, at only £31m market cap.

They’re running it a bit tight for cash, and the costs & distraction of the US patent action are still ongoing. If that works out favourably though (and the UK patent case win is a nice plus), then I could see this share re-rating in a future bull market.

It could become a bid target possibly? We know that bidders in the software area like recurring revenues, and are often prepared to pay up with racy valuations.

Quite a volatile share price this year -

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.