Good morning from Paul and Graham! We are wrapping up now (1pm). Have a good day!

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices). My video explaining/reviewing it.

My other video (June 2024) - How to screen for broker upgrades on Stockopedia.

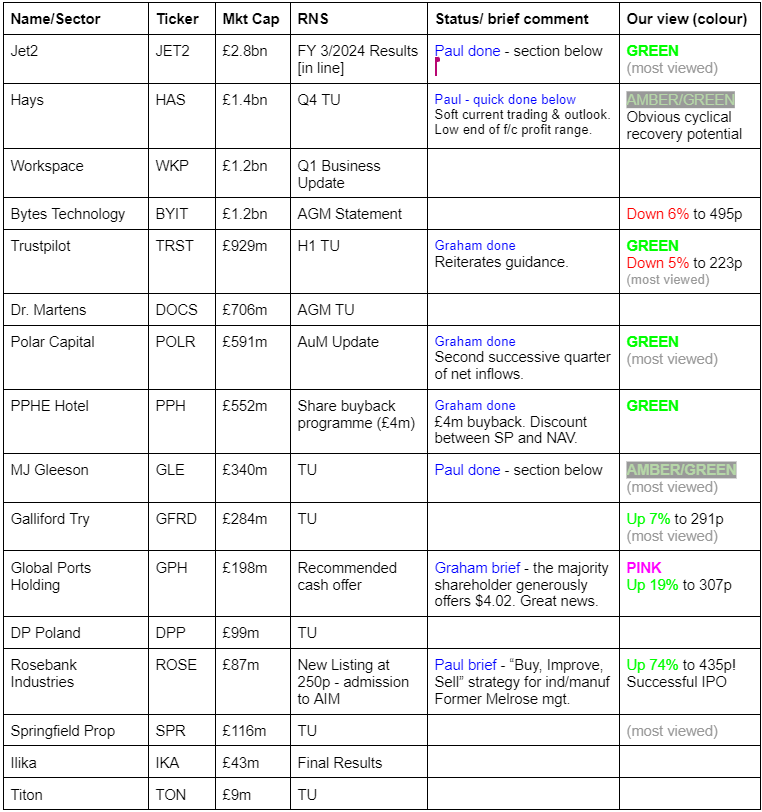

Companies Reporting

Summaries

Jet2 (LON:JET2) - up 2% to 1311p (£2.81bn) - FY 3/2024 Results - Paul - GREEN

In line FY 3/2024 results, and it also says YTD trading for FY 3/2025 is in line. Although it notes people are booking holidays later, so it declines to give detailed guidance. Smashing balance sheet with loads of cash now earning interest that accounts for 31% of profit. I cannot fathom why this quality company is so lowly rated, shares look a bargain to me.

MJ GLEESON (LON:GLE) - down 2% to 576p (£336m) - Trading Update - Paul - AMBER/GREEN

A small profit miss, caused by a big land sale slipping into the new financial year. FY 6/2024 has had its challenges, but GLE remains a superbly well-financed business, with good growth drivers in hand. I also like its niche of compact, cleverly designed affordable houses. My main worry is if the new Govt hikes property developers tax. GLE shares possibly a little toppy in the short-term, but still good value longer term.

Quickish Comments

Polar Capital Holdings (LON:POLR) - up 3% to 597p (£606m) - AuM Update - Graham - GREEN

I covered Polar’s full-year results recently. Relative to its AuM, it’s about twice as expensive as other fund manager shares. However, I think the reasons for this are convincing. Today, we are reminded of these reasons as the company posts a 7% increase in AuM in a single quarter.

The company benefited from net inflows of £0.6bn in Q1, and also from positive market movements of nearly £1.0bn. AuM increases from £21.9bn to £23.5bn.

The full-year results gave us an early snapshot into Q1, with the news that net inflows from 1st April to 14th June were £197m. Given that Q1 finished up with net flows of £0.6bn, the last few weeks of the quarter must have been very successful indeed.

CEO comment says there has been “continued demand for a broad range of our funds”, though most of the net inflows were driven by Emerging Markets and Asian Stars - this team has recently won an award for Emerging Markets Manager of the Year, and their US mutual fund has been upgraded by Morningstar.

Against this positivity, the CEO notes that “many investors are still grappling with multiple geopolitical and market risks, and therefore the potential for further redemptions remains”.

Graham’s view: I was already very positive on this stock, so I’m pleased to see that it is now putting together a series of net inflows. Long may this continue!

Analyst Paul Bryant at Equity Development has left his forecasts for Polar unchanged as it is still so early in the year, and there is that ongoing risk of net redemptions. However, the company has already, as of the end of Q1, hit his target AuM for the financial year-end (March 2025).

POLR is more expensive than some others in the sector but I believe it still offers value at this level, given its outperformance. I’m happy to be GREEN and happy for its continued participation in my best ideas list this year.

Trustpilot (LON:TRST) - down 5% to 224p (£935m) - 19% constant currency bookings growth - Graham - GREEN

This is an H1 trading update and it confirms that H1 revenue growth is expected in line with expectations at 17% (at constant currency exchange rates).

Bookings (the lead indicator of future revenues) are also strong, with 19% growth (at constant currencies). Momentum is particularly strong in North America (+23%).

Net cash is $76m, down by $16m but this is after a $20m share buyback. More share buybacks have been enabled by a restructuring of the balance sheet figures.

CEO comment: pleased with strong and strategic/operational progress. New product features released in April. Reiterates guidance of “mid-teens constant currency revenue growth and margin improvement for the full year”.

Graham’s view - the share price may be lower today but just look at how far we’ve come year-to-date:

I continue to believe that this company has a genuine moat, in that no other review service has anything like the brand recognition or the “trust” that this one does, when it comes to reviewing larger businesses.

There are bearish arguments against the stock, and I tried to outline some of them in March. Today’s update doesn’t provide any insights into customer numbers, and there is a continued risk that existing customers may at some point soon be unable to prop up revenue growth any further (the number of customers only grew at 4% last year).

As for valuation, it’s still too soon to value this on earnings. Price to sales is 7x, about. It’s no longer the bargain it was before. But I’d sleep much easier owning this one than I would owning NVIDIA at a price to sales ratio of over 40x! I’ll keep my positive outlook on Trustpilot for now. If price to sales was over 10x for example, or if revenue growth slowed down, I would be forced to adjust my stance.

PPHE Hotel (LON:PPH) - down 1.5% to £13.10p (£552m) - Share buyback programme - Graham - GREEN

I appreciate that buybacks are a controversial topic, but this strikes me as a decent little announcement from PPHE Hotel Group. As I mentioned last year, the company’s official valuations of its assets come up with much bigger numbers than the share price suggests. Paul also reviewed the stock in Jan 2024, taking an AMBER/GREEN stance.

The most recent full-year results (to December 2023) suggest a disposal value of the company’s assets of £26.72 per share (I believe this is a pre-tax number), up from £25.17. Despite higher interest rates, the company’s strong trading and outlook resulted in higher valuations of its properties.

Some might argue that these valuations are fictitious and not relevant to the investment case here. After all, unless the properties are sold at these valuations, how do they benefit shareholders? That is fair enough, but one way that the company can respond to the situation is by buying back its own shares at their discounted level. Today, PPHE says (emphasis added):

As set out in the Group's full year results to 31 December 2023, the Group's EPRA NRV per Ordinary Share stands at £26.72 which is a substantial premium to the current share price. In light of the current share price discount relative to the EPRA NRV per Ordinary Share, the Board believes it would be in the best interests of shareholders to return a portion of capital to shareholders by means of the Share Buyback Programme.

Unfortunately, it is only a £4m buyback announced today, less than 1% of the company’s market cap. PPHE is carrying significant borrowings (gross debts £893m as of December 2023) and therefore it doesn’t have the flexibility to spend huge sums on buybacks. Even so, I think this is an interesting development. In March, the company already spent nearly £4m on another small buyback.

Perhaps the company is going to carry on in this manner, mopping up small parcels of stock as the funds become available to do it? A few million here and a few million there - it could add up to a substantial number by the end of the year!

Graham’s view - I’m happy to keep my positive stance here as the company continues to enjoy improving operational KPIs, and I appreciate its efforts to address the discount between its share price and its fair value NAV per share. The most recent trading update in April left expectations for the full year unchanged and showed continued improvements in both occupancy (from 66.9% to 71.3%) and in revenue per available room, although average room rates did drop back or as the company says “normalised”, as expected.

Hays (LON:HAS) - up 2% to 91.3p (£1,445m) - Q4 Trading Update - Paul - AMBER/GREEN

Net fees sharply down in all regions in Q4 (Apr-Jun), mirroring the profit warning from similar sized recruiter Pagegroup (LON:PAGE) on Tuesday this week. “Challenging” market conditions, “low confidence” and delayed decision-making by clients. Driving productivity and controlling costs. Near-term expecting conditions to remain challenging.

“I know we can deliver substantial profit growth once our end markets recover…”

“Despite a more difficult quarter, our cost actions mean we expect FY24 pre-exceptional operating profit of c.£105 million, around the bottom of the market consensus range*

*Bloomberg consensus operating profit range for FY24 is £106.0m to £113.0m”

Net cash £55m is strongly up from net debt £20m 3 months earlier. Of course recruiters generate cash when business slows down, because receivables shrink. Bad debts remain at historical lows.

Paul’s view - it’s an obvious cyclical recovery sector and share, so I see it as simply choosing which recruitment share to buy, or even buy a selection of the better ones that offer attractive value. I could see HAYS rising c.50% once recovery is underway, and its finances look OK (£363m NTAV at Dec 2023). Quite attractive, so I’ll go with AMBER/GREEN.

Paul's Section

Jet2 (LON:JET2)

Uup 2% to 1311p (£2.81bn) - FY 3/2024 Results - Paul - GREEN

One of my favourite value/GARP mid-caps. Checking our previous notes here -

23/11/2023 - GREEN - 1084p - very bullish review from me, flagging value, H1 results.

15/2/2024 - GREEN - 1377p - positive TU, forecasts raised.

24/4/2024 - GREEN - 1404p - TU - FY 3/2024 in line, profit 33% up on LY. Pricing in Apr & May more competitive. Too early to give FY 3/2025 guidance.

Today’s results - impressive figures here, and a 33% rise in profit looks in line with the last update -

Canaccord’s note today (many thanks!) is using an adj diluted EPS of 170.4p, so I’ll use that. This is a PER of only 7.7x! That’s remarkably cheap in my view, assuming that level of earnings is sustainable, let alone capable of growth.

Forecast changes are very minor, so not significant (FY 3/2025 EPS raised 0.2%).

Current trading - looks OK -

“Year to date the business is trading in line with management's expectations.”

It repeats the line that it’s premature to give guidance for FY 3/2025, due to peak summer season not being complete. Many customers are booking holidays close to departure date. Pricing is “showing a modest increase”, but only partly offsetting cost increases. Despite tough macro, it says holidays are a high priority for customers.

Balance sheet - very strong. NAV is £1,409m, with only £27m intangible assets to come off, so NTAV £1,382m, or 49% of the market cap. No issues here, this is a very well funded business - good because sector risk is obvious - another pandemic, or planes grounded due to other factors. So I want to see a big cash buffer, which is the case here. Note also that finance income is massive, as JET2 sits on substantial customer cash, plus its own, earning interest on that now - finance income was £160m in FY 3/2024, that’s 31% of profit. So it’s quite an interest rate sensitive share.

Paul’s opinion - it’s a wonderful share! A terrific, differentiated business (low cost, flying from secondary cheap airports, offering full package holidays and flight-only options, great brand name & loved by customers, with a brilliant long-term track record - shares have multibagged).

Yet you can buy it for a PER of only 7.7x - how does that make sense? Only if you expect earnings to fall in future, but why would they? Forecasts show continuing revenue growth, but flat profits, so maybe it has reached peak margins, and might see margins squeezed in future?

So it would be worth doing deeper research to look at what the downside risks might be, and the competitive landscape, with Ryanair being the obvious threat. Based on these highly attractive numbers, I remain keen on this value share, and think it looks significantly under-priced. So it’s another GREEN from me.

MJ GLEESON (LON:GLE)

Down 2% to 576p (£336m) - Trading Update - Paul - AMBER/GREEN

MJ Gleeson plc, the leading low-cost housebuilder and land promoter, issues a trading update for the year ended 30 June 2024 (the "Period").

Results expected to be broadly in line with expectations following Gleeson Homes' robust performance and Gleeson Land planning delays

Gleeson Partnerships signs first agreement

Slightly below expectations is a bit disappointing. Singers (many thanks) says the shortfall is about £1m, with actual profit now c.£24m.

There had been previous forecast cuts too (unlike the largest housebuilders, which have seen this graph below flatlining). And of course the sector standout performers are the Irish housebuilders, Cairn Homes (LON:CRN) and Glenveagh Properties (LON:GLV) which are trading their socks off (esp Cairn), mentioned here recently.

Here’s Gleeson -

The actual profit being slightly below already reduced forecasts, is not a good look.

However, digging into the detail, the core Gleeson Homes division did alright, with completions up 3% to 1,772 new homes. Operating profit of c.£30m is ahead of expectations.

The problem is at Gleeson Land, where a “significant disposal” has been deferred into the current year FY 6/2025. This has caused profit to be way below expectations at £2m (Singers forecast was £7.5m). I can forgive that, it’s not a big deal being a timing issue, providing there are no undisclosed problems.

Cash - net cash at 6/2024 year end was £12.9m, which is good. I have no balance sheet worries, as GLE has a bulletproof balance sheet. Last reported NTAV was £287m, supporting 85% of the market cap. Or put another way, price to book value is 1.17x, which I think is still attractive, although we did have the opportunity to buy housebuilders at good discounts to NAV at the low points in the last two years, where they were absolute no-brainers (I put GLE on my top 20 share ideas for 2023 at c.344p, now up 67%). It’s funny isn’t it, at market lows, the bargains are staring you in the face, but many of us are too terrified to buy them!

Partnerships - this is very interesting. GLE is aiming to roughly double the size of the business, and do more partnership type deals (taking a leaf out of Vistry (LON:VTY) ‘s book). That’s a great, and pretty obvious idea, that could nicely drive profit growth. The first deal has been signed, with more in negotiation.

Outlook - sounds positive, with other housebuilders saying similar things about an improving outlook -

Gleeson Homes' sales rate over the last six months was steady but less vigorous than expected as a consequence of deferred expectations around interest and mortgage rate reductions. Looking ahead, the Board expects that, as rates start to fall, demand for new homes will strengthen through FY2025.

The Board remains confident of its medium-term objective as growth accelerates into FY2026 from the multiple outlet openings scheduled in FY2025.

With a good number of prospects, and in a more stable operating environment, Gleeson Land is confident of a strong performance in FY2025.

It makes positive comments (unsurprisingly!) about the new Govt’s stated aims for increased housebuilding.

Paul’s opinion - it’s been a wobbly year for GLE, with a profit warning in Jan 2024, reduced forecasts, and now the slippage of a land sale into the new year. However, I think the positive outlook outweighs these issues, and the valuation remains attractive to me, even after a strong recent run.

My main reservation is a political unknown, on how the new Govt will approach taxation for the housebuilders. They must be an obvious target for windfall taxes, or maybe even a new property developers tax, or increase in the 4% existing RDPT surcharge. My guess is that this 4% rate could see a significant increase (10% or more maybe? Possibly in stages?), as the new Govt is boxed on election pledges, yet desperate for more money to spend on (necessary) improvements in public services. And let’s be honest here, the huge profits made in the housebuilding sector, and the big shareholder returns, are crazy. Especially given that the quality of many new houses is lamentable. Huge profits for shoddy houses, is an obvious target for higher taxes. I’m turning socialist here!

So personally I won’t be chasing up the GLE share price for now, and expect it might slip back a bit as euphoria over the drive to build more houses could easily be derailed by higher taxes, but that’s unknown at this stage. Personally I’d want a share price of 500p or less to motivate me to get involved here. We’re not traders though, so on fundamentals I’m happy to remain at AMBER/GREEN, even though I think the price is maybe a little ahead of itself in the short-term.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.