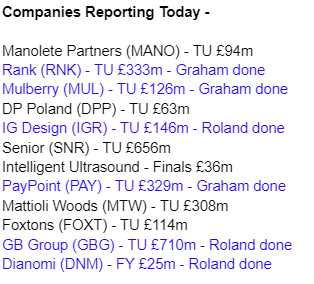

Good morning! Roland and Graham here to comment on this morning's releases.

10.20am: we're done! See you tomorrow.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Graham's Section

Mulberry (LON:MUL)

- Share price: 210p (-6%)

- Market cap: £126m

These shares rose 7% yesterday, in advance of today’s full-year trading update.

That might just be random white noise, however; the shares are illiquid as the company is 90% owned by the Ong family and by Mike Ashley’s Frasers (LON:FRAS) .

So there’s really only around £10m worth of Mulberry stock that is up for grabs for private investors.

This is a stock I like to follow as Burberry (LON:BRBY) is a core holding of mine, and the two companies share much in common.

Today we have a year-end trading update, informing us that FY March 2023 is in line with expectations.

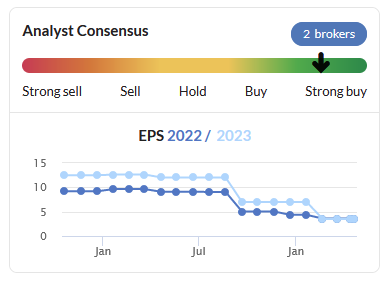

I note that the estimates for 2023 were cut about a year ago, and then stabilised:

According to Stockopedia, the company is expected to generate revenues of £155m and net profit of £7m for 2023.

Key points:

H2 was better thanks to a good performance in the UK and an improvement in China. I reviewed the poor H1 numbers in November.

Gross margin has been maintained (the gross margin achieved by these luxury companies is one of my favourite things about them!)

As previously announced, they acquired franchisee-run stores in Australia (they previously did this in Sweden).

New collection launched.

Net cash finished the year at £0.8 million, as the company “continued to invest in its global brand awareness and the development of its business model during FY23 and remains focused on investing for future growth”.

It must be spending quite a lot, as net cash was £25.7m at the end of the previous financial year.

They previously said that they had a £15m RCF and a £4m overdraft, so they should not find themselves running out of headroom in the immediate future.

Graham’s view

The level of cash burn is a concern and it cannot be written off as seasonality as the burn continued in both H1 and H2.

However, I’m going to dangerously continue to rate this stock positively, for the simple reason that I think Burberry should offer to buy it. Or even LVMH.

Burberry trades at nearly 3x sales, while LVMH trades at 5.6x sales. Mulberry? Less than 1x!

This sort of discrepancy only makes sense, in my mind, because Mulberry as a company is sub-scale. However, I believe that the Mulberry brand is still a powerful one, and could be strengthened in a larger group. Remember that the gross margins here are currently around 71% - that’s as good as Burberry and even better than LVMH!

This stock is a long-term disappointment but I do like it at this valuation:

PayPoint (LON:PAY)

- Share price: 458.6p (+1%)

- Market cap: £333m

Another year-end update for FY March 2023.

I last mentioned PayPoint earlier this year, in relation to its takeover of Appreciate.

Let’s see how it is doing now.

Adjusted PBT for the year just finished, excluding any contribution from Appreciate, is “at top end of range of market expectations”.

Some highlights that stand out to me:

Net revenue £125m (last year: £115m), excluding Appreciate.

Counter Cash (a cash withdrawal facility) rolling out successfully to retailers.

“Excellent volumes” at e-commerce service Collect+.

Appreciate Group renamed as Love2Shop and trading in line with expectations.

The CEO comment uses just slightly too much corporate-speak for my liking, but it does convey the optimism that he is trying to get across:

We are entering the new financial year in a materially enhanced position across the Group: a full-strength sales team delivering high conversion rates; healthy pipelines for our FMCG and integrated payments propositions; a business-wide partnership philosophy yielding further revenue opportunities; and a dynamic platform of innovative technology and solutions enabling integrated payments and commerce for our extensive base of clients, retailer partners and SMEs.

Graham's view

I’m a long-term fan of PayPoint. At this stage, maybe it could be argued that I’m biased in its favour and unable to look at it objectively and with “fresh eyes”.

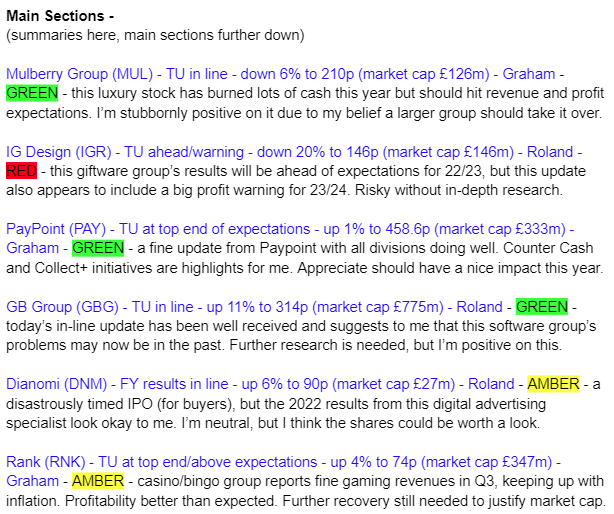

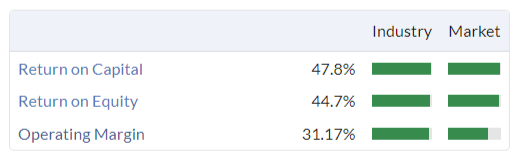

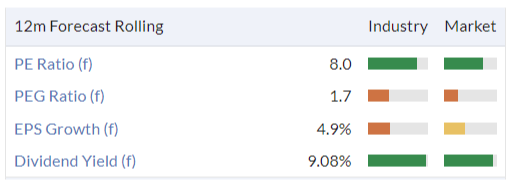

But just look at these quality metrics:

And look at these value metrics:

I liked it before it bought Appreciate, and then it bought Appreciate for what I thought was an attractive price.

And now it’s performing at the top end of expectations, and is firing on all cylinders in each of its trading divisions.

Admittedly its growth trajectory is quite limited, but I don’t think the point of it is to provide fast growth: the point of it is to generate high returns on capital and lots of cash, and pay this cash out to shareholders. As long as it keeps doing this, I’ll remain a fan.

Rank (LON:RNK)

- Share price: 74p (+4%)

- Market cap: £347m

This old name in gambling operates Grosvenor Casinos, Mecca bingo clubs, some Spanish casinos, and various gambling websites. See the list of assets here.

It had a miserable 2022 as its own operating costs ticked up and the cost-of-living crisis affected how much its customers were able to spend.

I see the share price hit a low in October. Could it have stabilised now, perhaps?

Today we have a Q3 update for January to March (year-end is June).

Key revenue points:

Like-for-like net gaming revenue +13% for the quarter

Like-for-like net gaming revenue +6% for the year-to-date

That’s a very nice improvement in Q3. The core business Grosvenor (responsible for nearly half of NGR) is up 15% for the quarter, “driven by growth in visitor numbers, with improved performance across London and the Rest of UK”.

The bingo clubs managed 9% growth while the websites managed 16%.

In the context of stubbornly high inflation that has only slightly reduced from its peak in October, and an ongoing cost of living crisis, these strike me as fine results.

To help explain them, the CEO points to “investments we have been making to improve the customer experience in our venues” and “the build out of enhancements to the customer experience on our prop

Outlook

As highlighted in previous years, the start of Q4 is traditionally a quieter period for our Grosvenor venues. However, due to the improved performance seen in Q3, the Board now expects the Group's underlying LFL operating profit for the full year to 30 June 2023 to be at the upper end or slightly ahead of the previously guided range of between £10m and £20m.

Graham's view

I’m going to hedge my bets and stay neutral on this one.

For an overview of some of the concerns people might have over this one, please see the archive - most recently, Roland’s thoughts in January.

The news that underlying LFL operating profit will come in at the upper end or even above the £10m - £20m range is extremely welcome, but actual net profits will be materially lower than that number and still not enough on their own to justify the current market cap.

In other words, the market cap is still pricing in a further recovery in trading as the cost of living crisis eventually recedes and profitability goes back to “normal”.

In boom periods, this company has indeed been highly profitable:

In my view, this stock has definite multi-bagging potential, but that potential rests to a large extent on macroeconomic factors that are difficult (impossible?) to predict.

In the meanwhile, the company reported cash of £90m offset by borrowings of nearly £80m in December, and it has substantial lease liabilities. In other words, its financial position is not as secure as it might be.

I’m a long-term fan of this business but the prospects here are cloudy and so I can’t take a more definitive view yet.

Roland's Section

IG Design (LON:IGR)

Share price: 145p (-20% at 08.10)

Market cap: £146m

an update on its financial performance for the year ended 31 March 2023, which is ahead of expectation.

This greeting card and giftware manufacturer is a former high flyer that’s lost its way somewhat since the pandemic. A turnaround is underway, with a new CEO, but today’s year-end trading update appears to be something of a mixed bag.

Today’s update covers the year ended 31 March 2023. Unlike a number of other companies we’ve covered here recently, IG Design has also included some guidance for the current year.

FY23 highlights:

Revenue of $890m expected for FY23 (-4% at constant currency).

International division revenue +10%, particular strength in continental Europe

US division revenue -10% due to lower volumes and exits from loss-making activities

Group operating margin 1.8% (+1.4% vs. last year)

Adjusted pre-tax profit of $9m - ahead of previous expectations

However, IG says that all of its businesses, except for those operating in continental Europe, experienced a year-on-year sales decline during the second half of the year (Sept ‘21 - Mar ‘22).

The company says that the macro and consumer environment was particularly challenging in the UK.

FY24 outlook:

Slim operating margins and high volumes mean that small changes in pricing and costs can have a big impact on profits.

IG does not expect the outlook to improve in the UK this year (my emphasis):

Due to the recently deteriorated trading, and very limited pricing expectations for Christmas 2023 in the United Kingdom, the Group is likely to incur a one-off, non-cash write-down to the historic goodwill value associated with certain businesses in that market. The Directors expect this to significantly impact the reported results for the year.

It looks like IG expects to struggle to deliver price increases this year to offset higher costs. Although this comment only refers to goodwill, a non-cash item, my reading of this is that it’s a significant profit warning for 2023/24.

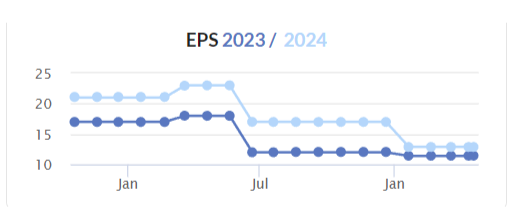

Broker forecasts were previously positive for the year ahead, but I expect these to be cut after today:

Financial position: IG Design is in the process of renewing its debt facilities. This is expected to be completed “in the near term”.

Although the company reports a year-end net cash position of $50m today, there are big seasonal swings in working capital as the group builds stock for the Christmas period each year.

Net debt was $74m at the end of September, so renewing its bank facilities on the best terms possible is a priority right now, I would say.

Roland’s view

I’m encouraged by November’s appointment of chief executive Paul Bal, who was previously CEO of former FTSE 250 firm Stock Spirits. As a former Stock shareholder, I think he was doing a good job before the group was taken over.

IG Design has been through boom-and-bust cycles before and may yet prove to be an attractive turnaround. However, I can see some significant risks for shareholders.

Although FY23 performance was ahead of expectations, today’s commentary suggests to me that margins will remain under pressure and could fall this year.

I think it’s possible, if not likely, that the group will report a loss for FY24.

The outlook for the UK market is clearly poor, while the US business is still in turnaround mode.

In addition, I think it’s safe to assume that IG Design’s new bank facilities will carry higher costs than its current facilities. This will add to pressure on the group’s margins and profits (if any).

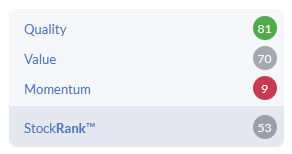

The StockRanks paint a strong picture here, but I suspect these numbers may fall after today’s update.

I’d need to do more research on IG Design to form a firm view on valuation or outlook. For now, I remain very cautious and would view this as a speculative turnaround.

GB (LON:GBG)

Share price: 314p (+11% at 09.30)

Market cap: £775m

Results in line with expectations

I’m a little surprised to see this identity protection and fraud prevention software group fall back into our remit at the SCVR.

Unfortunately, GB has become a textbook example of a falling star. But today’s year-end update is in line with expectations, so I’m keen to see whether the shares may be starting to look more attractive for a value-seeking investor like me.

Main highlights: today’s update covers the year ended 31 March 2023.

Results for the year are expected to be in line with expectations and the company has issued the following guidance numbers today:

Revenue: £278.8m (FY22: £242.5m)

Adjusted operating profit: £59.8m (FY22: £58.8m)

Adjusted operating margin: 21.5%

Net debt: £106m (FY22: £107m)

Revenue: the numbers above imply revenue growth of 15%, but this was boosted by acquisitions and some other one-time factors.

According to the company, “pro forma basis organic constant currency revenue growth” was 3.7% last year.

This fully adjusts for the impact of the two prior year acquisitions, including the associated FY23 deferred revenue haircut adjustment. It also adjusts for £4.2 million of revenue from US stimulus customers in the prior period and the full £15.4 million impact from the year-on-year decline in cryptocurrency customer revenues.

I’m not going to spend much time unpicking this as these factors all now appear to be in the past and unlikely to repeat.

Profits: GB’s adjusted profits are boosted by the exclusion of the amortisation charge on acquired intangibles. This is a standard (non-cash) adjustment, but because of GB’s acquisitive history, it’s also a very large adjustment.

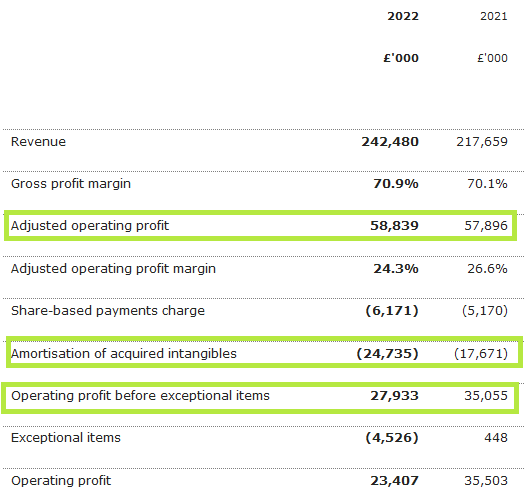

Last year, the exclusion of the amortisation charge masked a fall in statutory operating profit:

It’s up to individuals to decide which version of profit they find most useful – I think there are valid uses for both.

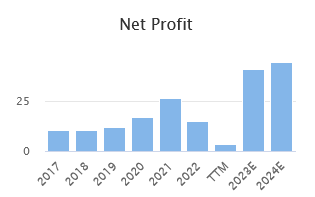

The question now is whether shareholders can expect a return to growth next year – and whether the shares offer value after falling by 70% in two years.

Outlook: today’s update does not include any commentary or guidance for the 2023/24 financial year. However, the company has previously said it expects headwinds in its US business to ease gradually this year.

In February, GB said it expected comparable revenue growth to rise gradually in FY24 to “high single digits” in the latter part of the year.

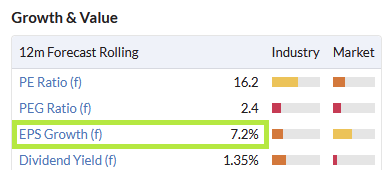

Given the absence of fresh guidance today, I’ll assume that consensus forecasts for FY24 will be largely unchanged after today. According to Stockopedia, a modest increase in earnings is expected this year:

Broker forecasts have been trending downwards over the last six months, so I hope to see this trend stabilise after today’s in-line update:

Roland’s view

Chief executive Chris Clark says that the group’s Location and Fraud businesses delivered “double-digit growth” last year.

I’m not very familiar with the company’s products, but assuming they remain current and competitive, I would expect this business to benefit from structural demand growth for many years to come.

Historically, the group has delivered high levels of cash conversion each year and steady profit growth. If this trajectory can be resumed, as forecasts suggest, I think the stock could be starting to look attractive at current levels.

Forecasts I can see elsewhere suggest GB Group may have generated about £40m of free cash flow in FY23. That would equate to a 5% free cash flow yield – reasonably attractive for a growth business, I think.

I’d want to do further research on this, but today’s results do seem encouraging to me.

It may also be worth remembering that the group attracted a takeover bid at a significantly higher level in September last year. This didn’t succeed, but it’s clear that other investors see value in this business, too.

Dianomi (LON:DNM)

Share price: 90p (+6% at 09.30)

Market cap: £27m

2023 has started well and in line with management expectations. As we move through the year, we believe that we are well placed to capitalise on a return of confidence amongst advertisers.

This digital advertising business floated on AIM in May 2021. Like (almost) all IPOs, the timing appears to have been better for sellers than buyers.

Nevertheless, the business appears to be cash generative, with a very solid balance sheet.

I’m also encouraged by Stocko’s Contrarian rating for this business, which indicates high quality and value scores and low momentum. A potential bargain?

Paul commented briefly on Dianomi in December, so I’ll follow up with a look at today’s results, so that we can start to build our record of coverage here – very useful for tracking the evolution of a business.

What it does: Dianomi provides contextual advertising for digital publishers, specialising in premium finance and lifestyle brands. The company lists Goldman Sachs, EY and Porsche among its new advertisers this last year.

An example of a publishing client is CNN Business.

Financial highlights

According to the company, advertising spend flattened out last year. This is evident from the results, which cover the year to 31 December 2022:

Revenue: £35.9m (2021: £35.8m)

Pre-tax profit: £1.2m (2021: (£0.6m))

Diluted eps: 1.46p per share (2021: (1.77p))

Net cash: £11.7m (2021: £10.3m)

I’ve bolded the net cash figure because this accounts for around 40% of Dianomi’s market cap at current levels. Very material, and provides a useful margin of safety.

It’s also reassuring to see the business appears to have converted its pre-tax profit into surplus cash last year.

Operating summary: Dianomi’s operating metrics show a decline in active advertisers last year:

Publishers at year end: 336 (2021: 326)

Active advertisers in 2022: 387 (2021: 427)

Advertiser churn: 5.5% (2021: 2.5%)

Publisher churn: 2.8% (2021: 4.1%)

My reading of this is that while advertisers cut their spending, Dianomi’s publisher clients remained happy and committed to using the service. That might bode well for a return to growth when the economic outlook improves.

Outlook: the company says it is the “contextual native advertising partner of choice in the business and finance sectors”.

Management believes this should position the group well to profit from an eventual return of confidence amongst advertisers.

In the meantime, Dianomi expects to continue investing and developing its programmatic (targeted) advertising offering.

The current year is said to have started in line with management expectations.

Stockopedia consensus forecasts suggest that a flat overall result is expected this year:

Roland’s view

I’ve been familiar with the Dianomi name for many years through other work, although I’ve never used the service.

While profitability was poor last year, with an operating margin of 3%, I can see potential for this business to perform much more strongly in favourable market conditions. There’s inevitably some cyclicality here, which I think was reflected in the timing of the IPO…

However, I’m encouraged to see that chief executive Rupert Hodson retains a 9%+ shareholding.

I haven’t had time to look through the AIM admission document to see how many shares (if any) Mr Hodson sold during the IPO, but it’s good to see that management retains some skin in the game.

At face value, Dianomi shares look fully priced on 25x forecast earnings for the current year. However, on a cash-adjusted basis the P/E falls to 16, which looks more reasonable.

I can see some potential in this business, but I’d need to do much more research to understand the company’s market share, competitive positioning and growth opportunities.

What does Dianomi offer for publishers and advertisers that Google doesn’t, for example?

I’d also want to study the company’s AIM admission document, in particular the risk section (always recommended reading).

For now, my view on Dianomi is neutral. But at current levels, I think the shares could be worth further research.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.