Good morning from Graham and Paul! We are finished for today (11.30am).

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £1bn. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk.

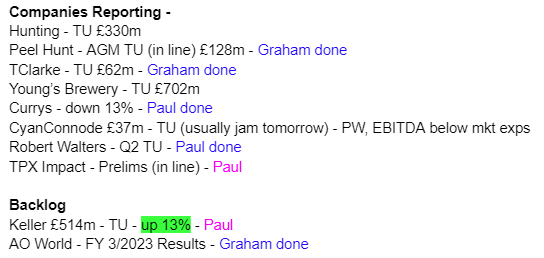

Agenda:

Summaries

Tclarke (LON:CTO) - down 6% to 133p (£59m) - Trading Statement - Graham - AMBER

I am switching back to neutral here due to a placing that undermines my confidence in the cheapness of these shares. At a PER of less than 7x, printing shares should be a last resort. I have previous quibbles with CTO’s announcements and just can’t remain positive on it now.

Robert Walters (LON:RWA) - down 3% to 417p (£303m) - Q2 Trading Update - Paul - AMBER/GREEN

Reports a worsening revenues trend in Q2, but against tough prior year comps. Nothing said about performance vs full year expectations (which were lowered considerably in a profit warning in June). What’s the betting broker quietly lowers expectations again?! (we don’t have access to broker notes). I discuss the bull & bear points below. Short version - should be fine long-term. Short-term: uncertain.

Peel Hunt (LON:PEEL) - unchanged at 104p (£128m) - AGM Statement - Graham - GREEN

I remain interested in small investment bank shares. A depressed UK equity market, especially in small-caps, has left their enterprise values on the floor. If/when there is a recovery, perhaps valuations can be restored? This IPO’d at 228p two years ago.

AO World (LON:AO.) - up 1% today to 82.5p (£473m) - Final Results - Graham - AMBER

These results are much better than last year's, which isn’t saying much, but the company is now following a sensible, simple strategy and focusing on what it is good at. It’s not a company I’d ever want to own but it’s currently in the strongest position it’s ever been in.

Currys (LON:CURY) - Down 12% to 47p (£533m) - Audited Results FY 4/2023 - Paul - RED

Profit is down, due to a particularly sharp deterioration in the Nordics region. UK is OK. Big pension contributions, buybacks, and generous divis have proven too much, with only modest free cashflow inadequate for these burdens. So the dividend has now been passed. Balance sheet is weak, completely dependent on £2bn trade credit from suppliers. Risk:reward looks awful to me, so it’s a continued thumbs down.

Paul's Section

Robert Walters (LON:RWA)

- 417p (down 3%)

- £303m

Q2 Trading Update - AMBER/GREEN

The Robert Walters Group is a market-leading international specialist professional recruitment group. With over 4,200 staff spanning 31 countries, we deliver specialist recruitment consultancy, staffing, recruitment process outsourcing and managed services across the globe.

Checking our archive here, this is the story so far in 2023 -

16 Jan 2023: FY 12/2022 slightly below exps, tougher trading in Q4. Paul wonders if it might wobble in 2023? GREEN

6 Apr 2023: Solid Q1 . Mixed outlook. GREEN.

14 Jun 2023: Profit warning (significantly lower) for FY 12/2023. AMBER/GREEN.

The recent profit warning on 14th June caused a modest drop in share price, down 14% to 402p, since largely recovered - is share price bottoming out, with cyclical downturn now already in the price, I wonder?

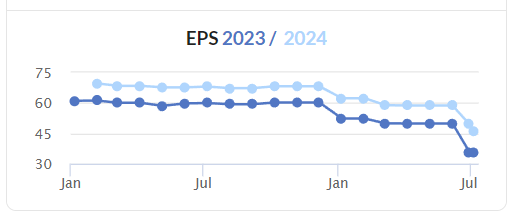

As you can see below, forecasts have been lowered a fair bit. Although remember that once economies return to normal, there’s every chance earnings could recover. So personally I would be pricing the shares on a mixture of the two, to reflect some uncertainty. So it’s currently priced at 11.9x reduced forecast of 35.8p EPS for FY 12/2023, which would drop to 8.5x if earnings subsequently recover to say 50p EPS.

The strong balance sheet means that it still has strong dividend paying capacity, so the forecast yield looks attractive at 5.4%. Not much more than a cash deposit account, you might say. But owning a share gives longer-term inflation protection (with short-term volatility), as the business grows. Whereas cash earning interest below inflation is a depleting asset longer-term, but a safe port in a storm in the shorter term.

Obviously if you’re on Twitter, then you will tell everyone after the event that you switched from cash into equities right at the market low! ;-)

On to today’s Q2 (Apr-Jun 2023) update from RWA, the headline sounds downbeat, so things can’t be good, given that headlines are usually the PR firm’s best idea to put a positive spin on things -

CANDIDATE AND CLIENT CONFIDENCE YET TO SHOW SUSTAINED IMPROVEMENT

Net fee income of £100m is 10-11% down on Q2 LY

Note the geographic split has wide variations, with Europe doing best, with UK (only 16% of group total NFI) down a hefty 21% -

“Global market uncertainty”

Tough comparatives from a record Q2 in 2022

H1 NFI is down 5%, which implies a worsening trend of flat in Q1, and down 10% in Q2.

Internal headcount reduced 3%, so some cost-cutting there.

Net cash of £70m - balance sheet strength remains a key positive for this share.

UK market comments are of interest for potential read-across to other companies/sectors, assuming this is typical (which it might not necessarily be, as under-performing companies often blame macro factors) -

UK net fee income down 21% to £16.0m (2022: £20.4m).

o Recruitment confidence levels in the UK continued to be impacted by the knock-on macro-economic effects of a high inflation and high interest rate environment.

o Activity levels impacted by lay-offs across the technology sector and financial services volatility. Legal recruitment remained relatively robust.

CEO comments are effectively an outlook section -

"As reported in our June trading update, candidate confidence and time to hire are not yet showing the anticipated signs of sustained improvement. Structural recruitment market fundamentals including job vacancy levels, salary inflation and candidate shortages are still holding strong which continues to suggest that when market confidence recovers there will likely be an increase in demand and candidate movement across all areas of recruitment.

"The Group has a strong and experienced senior management team with a successful track record of navigating challenging macro-economic conditions and balancing short-term pressures with longer term growth. We have invested significantly in Group headcount and global infrastructure over the past two years and while we are taking a sensible approach to cost reduction, we intend to protect our strategic core to ensure we can move quickly to take advantage of opportunities when market confidence returns."

Paul’s opinion - I view this share as fundamentally sound, and probably a good long-term investment, albeit with surprisingly high volatility, as the chart below shows - timing has been everything for investors/traders here - so maybe a share to (try to) buy on the dips, and sell on the surges? Easier said than done of course!

Although long-term holders could just ignore market volatility, and collect in the generous, and impressively growing divis -

There doesn’t seem to have been any dilution in the last 6 years, with buybacks having more than mopped up share issuance, with the total in issue currently now 73m.

Ownership is the usual institutional names, with the top 5 owning over half, so a takeover bid would be fairly easy to agree, should any overseas operator decide they want to buy RWA, which I would say is a reasonably high probability in current circumstances, where lots of relatively cheap UK listed companies are being snapped up by overseas buyers.

Note the employee benefit trust owns 9.3%, which reminds me that I flagged up the accounting treatment of this in a previous report, as something for investors to check before you buy the shares. I seem to recall the cash outflows for buying up employee shares were going through the cashflow statement, but were not obvious from anywhere else in the accounts. So it looked a bit like semi-hidden staff remuneration to me, but check it out for yourself, I’m just flagging a potential issue.

H1 results are due out on 1 August.

I’ll stick with my AMBER/GREEN view of this share - which means that there are short-term concerns over trading (due to soft macro), but I have confidence in the long-term fundamentals of the shares. Cyclical shares are obviously seeing some softness at the moment, which I generally see as potential buying opportunities longer term, maybe for starter-sized positions? They’ll obviously become more expensive, as signs of recovery appear, that’s what usually happens.

Currys (LON:CURY)

Down 12% to 47p (£533m) - Audited Results FY 4/2023 - Paul - RED

Many thanks to subscriber Mark Carter, and others, who flagged the results from this large electrical retailer today, which didn’t come up on my usual trawl of the RNS, because the RNS title was wrong.

Recapping on our recent previous comments here, to get up to speed -

15 Dec 2022: Profit warning - soft H1 results, FY guidance reduced. Weak balance sheet, huge trade creditors. Divis look unsustainable. RED (Paul).

19 Jan 2023: In line (with reduced forecasts). High risk - weak bal sht, dependent on huge trade creditors, hence the low PER. RED (Paul).

15 May 2023: Ahead of exps TU FY 4/2023. Key bank covenant relaxed. Paul & Roland both sceptical, over bal sht weakness. Cheap for good reasons! AMBER (Roland).

Today’s results for FY 4/2023 have not impressed the market, with shares down 12% mid-morning. A little surprising, as the first headline says -

Group full year profits at top end of guided range

Adj profit before tax (aPBT) £119m, top end of guidance, but down 38% on LY (last year)

UK performing well, adj operating profit up 45%

Nordics is the problem region, adj operating profit down 82% to £26m - taking action to improve performance.

Big goodwill write-off of £511m creates a £450m statutory loss.

Net cash of £44m LY has reversed into net debt of £(97)m - not good, but a business of this size will naturally have large working capital movements happening all the time, so year end snapshots are not necessarily reliable.

Outlook - I think the passing of the divi is probably what has hurt investor confidence today - but not a surprise to SCVR readers, as I flagged divis looking unsustainable in Dec 2022 -

It’s no good just looking at high dividend yields, and assuming they will continue. We also have to assess the dividend paying capacity. If it’s looking financially stretched, then divis are vulnerable, and they’re often cut altogether, rather than being trimmed, at financially distressed companies.

I continue to regard CURY as financially distressed, which is almost by definition the case where bank covenants need to be relaxed, and the balance sheet has a massively negative NTAV, as this does. All very simple things to check.

A special guffaw has to be awarded for the last bullet point above - whoever thought of that should win a PR industry award, here it is again -

“... well positioned if our market forecasts prove to be too prudent”

Classic!

Detailed guidance -

Some real nasties in there. The pension contributions total £363m over the next 6 years, a huge amount. Hence it’s difficult to see what cash, if any, will remain for divis.

Note that free cash flow was £72m, nowhere near enough to cover the combined outflows for divis £46m, buyback £32m, purchases of shares for the employee benefit trust £41m, and pension contributions £78m. That’s why net cash fell by £125m overall. The business is not generating the cash it needs. In fact, the free cashflow was only enough to fund the pension scheme and nothing else.

Balance sheet - is weak. NAV of £1,892m contains intangible assets of £2,620m, giving NTAV negative at £(728)m! Although the lease entries total a deficit of £(238)m (indicating plenty of loss-making stores), so if we eliminate all lease entries, NTAV improves somewhat, but still heavily negative, at £(490)m.

Does this matter? If it can keep all the plates spinning, then negative working capital doesn’t necessarily kill a business. But as I always mention, CURY is completely dependent on £2,067m of funding provided by its trade and other creditors. If the trade credit insurers (who are on the hook for a lot of this) get cold feet, and suppliers insist on cash up-front before delivering goods to CURY, then it’s game over - administration would be the only option, and shares would then be a zero.

Yet, surprisingly, this main risk to the business is not even mentioned in the list of 13 “risks and uncertainties” in today’s announcement.

So just to make everyone aware, if you ignore this precarious financial position, there is a very considerable risk. Why take that risk? Especially when there’s now no income in divis likely for the foreseeable future?

Going concern statement gives itself a clean bill of health, saying it should be able to operate within bank facilities. The severe downside scenario is only a 5% drop in sales, which doesn’t sound that severe to me. The auditors have signed off on this though.

My opinion - I’m happy to put it back to RED, after Roland’s tentative AMBER last time!

It’s fine buying well-financed cyclical companies that are bargains, in tough macro conditions, that’s often when the best investment buys are made. But buying something so obviously financially stretched, in tough macro conditions, seems reckless to me. Why take the risk when you don’t have to?

Institutions are stuck in many shares at the moment, but private investors can just press a button or make a phone call, and we’re out.

At this point in time, I think risk:reward looks very poor for CURY shares. As always though, the facts could change in future, so we’ll keep an open mind for all future updates.

Graham's Section

Tclarke (LON:CTO)

- Share price: 133p (-6%)

- Market cap: £59m

This engineering services company delivers two announcements today: a trading update and a placing announcement.

Firstly, the placing: the company raises £10.7m (gross) at 122p. That’s a 14% discount to last night’s closing price (141.5p).

The reasons given for the fundraise are as follows:

The net proceeds of the Placing will further strengthen the Group's balance sheet and will provide additional resources with which to capture and deliver identified short to medium term attractive contract opportunities in the London region - in doing so driving further growth and margin expansion.

I covered this company in May and also in March, when I noted their average month-end cash of £2.6m.

Now that they have a forward order book that’s pushing £800m, I can see the rationale for boosting the cash position: any significant amount of receivables on that work could push them into significant net debt.

However, it strikes me as less than ideal that a placing was necessary. TClarke has paid out c. £2m in dividends every year for the past five years. They’ve had clearly stated growth ambitions and I suspect could have foreseen that extra cash might be useful to support their growth strategy. But they carried on paying dividends anyway.

The placing will result in the share count growing from 44 million to nearly 53 million and will also involve broker fees that could have been avoided, if the company had used its own cash.

Let’s move on to the trading update:

Trading has continued to be strong, and the Board remains highly confident that the Group will successfully deliver its growth strategy such that the Group's revenues will exceed for the first time £500m in the current financial year, in doing so achieving the three-year revenue growth strategy set out by the Board in March 2021.

The order book continues to grow and has reached £781m.

Broker estimates are adjusted as the placing proceeds will help to support TClarke’s work on data centres, which has expanded at a blistering pace in recent years. According to Cenkos, the placing will support a “step change” in the growth of the business.

The net income forecast for next year (FY December 2024) increases from £10.5m to £12.8m, but the increased share count results in only a marginal increase to the EPS forecasts.

Graham’s view

I previously had quibbles with this company when it issued trading updates which sounded positive, but where the broker notes included profit downgrades.

Today, my quibble is different: the company is proposing to increase its share count by 20% to raise funds it would already have, if it wasn’t a dividend payer!

I’m sure there are many shareholders who don’t mind this sort of arrangement, but it always strikes me as wasteful (at best) or misleading (at worst). Why give to shareholders on the one hand, and take from them on the other?

20% dilution is material, whatever way you look at it. I can understand occasionally writing off dilution of 5-10% as being unimportant in the grand scheme of things, but 20% is another matter.

I also note that the EPS forecasts are barely changed, so it’s not clear that the placing will ultimately improve the position of shareholders very much at all.

In May, I “tentatively and cautiously” gave this stock the green light, against my better instincts, because of its growth prospects, cheap valuation, and cash on the balance sheet.

In light of today’s news, I’m going to switch back to neutral. Because if the company is willing to dilute shareholders at this cheap valuation, then maybe it’s not so cheap after all.

Peel Hunt (LON:PEEL)

- Share price: 104p (unch.)

- Market cap: £128m

Just a quick comment on a short AGM update from Peel Hunt. Performance for Q1 (April-June) is in line with expectations, with a second-half weighting expected.

...the macro-economic backdrop has continued to be challenging and investor sentiment has remained low. However, during the first quarter of FY24, we have supported our corporate clients in relation to a number of announced M&A and ECM transactions. This has included acting as named financial adviser on approximately a quarter of firm offers made for UK listed companies during the period, and as a bookrunner on the largest UK IPO so far this year.

Graham’s view

I was just looking at Paul’s comments from a few weeks ago, when he concluded with an “Amber/Green” view.

I remain intrigued by this sector; its most recent full-year results saw Peel Hunt report net assets of £93m, almost entirely tangible and very liquid. As Paul noted, net current assets were £100m.

In the end, consolidation might be the best way to crystallise value for shareholders of these companies. Remember that finnCap and Cenkos are planning to merge, and Numis is in the process of being acquired by Deutsche Bank. Peel Hunt is a recent entrant to the stock market and I would be surprised if it stayed here long-term in its current form, at this sort of valuation.

AO World (LON:AO.)

- Share price: 82.4p (+1%)

- Market cap: £473m

This electrical retailer published full-year results yesterday.

I was previously a bear on this stock, but I changed my tune last November (with a follow-up comment in January), after they changed their loss-making growth strategy and decided to start making some money! Paul has also covered it, most recently in June.

Let’s briefly review how they did in FY March 2023:

Revenue down 17% to £1.1 billion (good!)

Operating profit £13m (previous year: they made a loss)

Net funds: £4m (they eliminated their net debt by raising over £40m of fresh equity).

Their new strategy has been to “rationalise, simplify and refocus our operations”.

Cash headroom: £80m RCF provides plenty of liquidity.

Market share: 16% of domestic appliances, 30% of online.

Their latest net promoter score is 85. That is marginally lower than last year’s 86, but I don’t think that shareholders will mind. If the cost of getting a slightly higher NPS is that the company is unprofitable, I think the company should accept a lower NPS!

Outlook

Looking forward to FY24 we are confident in our ability to deliver on our 5% EBITDA ambition in the short term and returning to top line growth in the medium term. Our strategy now is to invest prudently in the business, seize the significant market opportunities that we see in front of us, leveraging our growing and loyal customer base.

A 5% EBITDA margin is nothing to write home about, but it’s a start. It’s hard to believe it but this strategy is much, much better than what AO was doing before.

CEO comment from the founder uses his distinctive terminology; the staff are “AOers” (although there are fewer of them now) and the company does things “the AO Way”. They treat customers “like our grans”.

Here is a revenue breakdown:

“Commission revenue” relates to network connections in the mobile phone business, and warranty sales in the appliance business. The company doesn’t publish a segmental breakdown of profits but I agree with Paul that a significant chunk of AO’s gross profits must come from this source, rather than from product revenue.

It is noteworthy that commission revenue didn’t fall, despite the general decline in revenues. This is due to higher rates paid to AO on an increasing number of mobile phone connections.

Warranties are mentioned a few times in the report, e.g.:

Our Financial Services business performed resiliently as our customers continue to recognise the value and peace of mind that our warranties offer. Our long-term successful partnership with Domestic & General (AO Care) and NewDay (AO Finance) helped us ensure high customer service levels, and we continue to work closely with both partners to enhance our customer proposition.

There has been no material impact to warranty cancellation rates as a result of the underlying macroeconomic conditions.

The cancellation rate is important as AO World carries receivables on its balance sheet from Domestic & General. The ultimate value of these receivables depends on warranty cancellation rates.

Here is the sensitivity of the value of AO’s receivables to changing warranty cancellation rates:

And here is the sensitivity to cancellation rates in the mobile phone business. The second line tells us that there is very little sensitivity to cancellation rates when the customer is out of contract (“OOC”).

Graham’s view

I’m going to stay neutral on this share. The quality of the business is clearly questionable but at the same time, they have fixed their balance sheet by eliminating net debt and they are now scraping a small profit.

The risks associated with warranty and mobile phone cancellation rates are real but have been quantified by the company. In circumstances that saw major changes in these rates, or in mis-selling claims, I don’t think AO World would be the only company to suffer. And I don’t have any particular view on how likely those circumstances are to arise - not very likely, perhaps? So I’m not inclined to criticise the company too much for having this exposure (of course it would be even better if they didn’t have this exposure!).

In summary - I wouldn’t want to own this, but I also wouldn’t dream of shorting it. So I’m neutral.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.