Good morning, Paul & Jack here again, to review today's trading updates & results statements. Plus a couple of stragglers left over from yesterday, which I prepared last night.

If you're a new subscriber to Stockopedia, then firstly welcome! Secondly, could I ask you to read the brief "explanatory notes" below, as this explains a lot of the things that we're asked questions about by newcomers.

Agenda -

Paul's Section:

Omega Diagnostics (LON:ODX) - interesting comments from this company about potential difficulty raising fresh equity. This looks likely to become an issue for other companies which need to raise money, so beware.

Venture Life (LON:VLG) - what drove yesterday's 35% share price recovery, and was it justified? The short answer, is no! Its trading update looked superficially very good, but was actually only in line with lowered expectations, and growth seems to have come from an acquisition.

React (LON:REAT) - a small cleaning company. Results for FY 12/2021 were out yesterday, and don't show anything interesting. Looks over-priced to me, and not a convincing story. Hyped up during the pandemic.

Joules (LON:JOUL) (JOUL) (I hold) - oh dear, it's another profit warning. Current trading revenues look OK to me, but the company says it's trading below expectations, and supply chain/logistics problems seem to be continuing to play havoc. No great surprise, as the share price has been relentlessly falling, and we've all seen the poor customer reviews online. Broker forecast for FY 5/2022 is halved, so no doubt the market looks set to punish JOUL shares further. However, outlook comments do suggest the worst might now be over. So I remain bullish on the long-term outlook, and we shouldn't be far away from a turn in sentiment, as people begin to look beyond short-term supply chain issues.

Warpaint London (LON:W7L) - a positive trading update for FY 12/2021, ahead of expectations. Although looking at valuation, W7L seems fully priced, with a PER over 20 looking warm, given the recent market valuation reset downwards. I think investors need to rely on further out-performance to justify the current price, let alone see further upside.

More to follow, as we work through today's news.

Jack's section:

Property Franchise (LON:TPFG) - I hold - profit expected to be ahead of expectations. Business has been helped over lockdowns by government initiatives such as the Stamp Duty holiday, but the group’s pipeline remains strong going forward. Post-Hunters acquisition, there’s an attractive mix of stable lettings revenue and sales revenue. Further acquisitions are being considered, and Ewemove is also building momentum. Valuation remains modest given the mix of quality and growth, in my view.

A G Barr (LON:BAG) - another modest upgrade to profits. It’s a family owned business with a long history, the Irn-Bru brand, and good profitability metrics, so there’s a lot to like. Meaningful growth has been hard to come by over the past decade though, and I think signs of this are needed in order to take the share price significantly higher in the long term.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Omega Diagnostics (LON:ODX)

Not a share (or sector) that we follow here, but there was an interesting announcement yesterday, which could have wider read-across.

Speculation regarding a potential fundraise

Omega (AIM: ODX), the specialist medical diagnostics company focused on industry-leading Global Health (CD4 and COVID-19) and Health and Nutrition products , notes the recent online speculation and confirms that it is in discussions with certain investors and shareholders regarding a potential equity fundraising.

This highlights the absurdity of the UK system, where shares remain trading, whilst behind closed doors companies are secretly trying to raise funds. It’s totally wrong, and of course this price-sensitive information often leaks out, because so many people know about it - creating a false market in the shares.

I believe shares should be suspended immediately when a company begins a fundraising. We need a new, high speed system brought in, with low fees, via an online auction, to do fundraisings fast - offered first to existing shareholders, then anything left over going to other investors. The only reason this hasn’t been implemented, is because vested interests (the army of overpaid advisers) make so much money from the current system, at our (investors) expense. If we remain saddled with an outdated system, London looks set for a downward trajectory.

Discount - ODX flags that it might have to raise money at a discount. This is a warning to all of us, I think we’re now in an environment where companies that need fresh equity could struggle to raise it. So checking balance sheets, and making sure companies we invest in don’t need to raise fresh equity, looks a sensible approach right now.

I doubt we’ll see many IPOs from now on, either. Good thing too, as most of the ones over the last couple of years have been opportunistic & over-priced. As one broker memorably told me a while ago, "Why on earth would you want to list on the stock market, if you own a decent private company?!". That's worth bearing in mind when looking at new floats - what is the reason they're listing? Often, it's so founder/major shareholders can cash out at a high price. The only recent float I like, is Facilities By Adf (LON:ADF) (I hold) which looks sensibly priced, and raised new money mainly for expansion.

Although it doesn’t sound as if ODX is desperate for cash -

Market conditions remain challenging and accordingly any issue of equity would be at a discount to the current share price. Any fundraise would include an open offer to accommodate retail investors.

As per the announcement of 19 January, the Company has significant cash resources . Accordingly, there is no immediate need to raise additional capital and the Company may choose not to proceed with a fundraising until such time as conditions are more favourable..

They wouldn't be trying to raise money, if they didn't need it, would they? So that's less than 100% convincing!

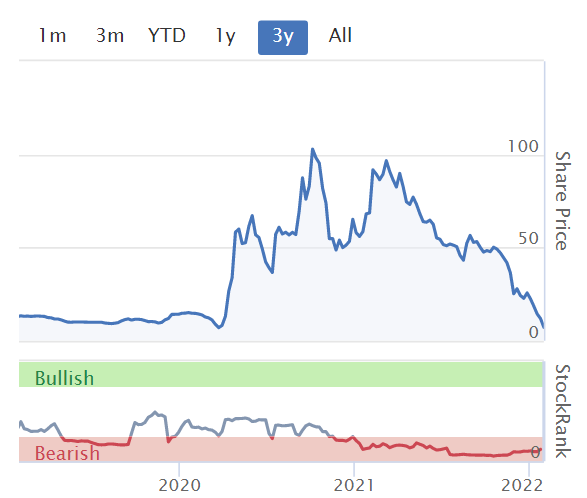

The chart for ODX is remarkable - a major multi-bagger from when covid started, which has since managed to come all the way back down again. It's a similar story with so many other covid bandwagon stocks.

.

Venture Life (LON:VLG)

50.5p (up 35% yesterday) - mkt cap £64m

Full year trading & commercial update

Venture Life (AIM: VLG), a leader in developing, manufacturing and commercialising products for the self-care market, is pleased to provide the following trading and commercial update for the year ended 31 December 2021 ("FY21").

To refresh my memory, I’m reading Jack’s notes from VLG’s profit warning here on 1 Dec 2021.

The headlines in today’s update from VLG read very well, but remember that it made a large acquisition of BBI Healthcare last year, for £36.0m, more than half the current market cap. So of course the numbers are improving in H2, due to this acquisition being newly added to the group numbers. Maybe some punters are reading the big growth numbers reported today, and wrongly assuming they’re organic growth?

Revenue of £32.6m for FY 12/2021 is only £0.6m above Cenkos forecast.

Adj EBITDA we’re told today is in line with market expectations, which Cenkos reckons is £6.25m, which reduces considerably to £1.6m statutory PBT - but some of the amortisation charge (for acquisitions) can legitimately be reversed out of that. The broker figures are a bit confusing, so I’m not entirely sure which profit figure to lock onto.

There are a lot of adjustments, and £1.0m in exceptionals in the forecasts. I’ll need to check the published numbers when they come out to be sure, but it looks as if the adj EPS figures from Cenkos of 2.63p for FY 12/2021, and 4.32p for FY 12/2022 are possibly the most appropriate figures for valuation purposes.

At 50.5p share price, that gives us a current 2021 PER of 19.2, falling to 11.7 times, if 2022 earnings rise strongly and hit target. That might be possible, since 2022 will include a full year of the large acquisition.

Net debt of £3.2m doesn’t sound a problem.

Order book significantly ahead, but no figures provided, and no indication of what organic growth is like.

Details are provided of new product launches.

Diary date - “The Company expects to publish its results for FY21 on 24 March 2022.”

My opinion - this update is a good example of PR - dressing up an in line update to sound more positive than it actually is! It’s strange to see a 35% share price rise triggered by an update that is only in line with (lowered) expectations.

I think this company has a lot to prove, before it would interest me.

Also, don’t forget the Directors dumped a lot of their shares at a much higher price.

It's easy to hit targets, when they've been lowered so much beforehand:

.

React (LON:REAT)

I’ve had a quick look at results for FY 12/2021, but there’s nothing much of interest here. It’s a small contract cleaning company, with the shares getting hyped up during the pandemic. It only made £277k adj PBT in FY 12/2021 (up 46%).

Outlook comments mention new contract wins.

There’s nothing much on the balance sheet (note the cash is offset by deferred consideration creditor). So it would need to raise fresh equity to do any more acquisitions.

My opinion - too small to be listed, and not a very convincing story. £10m market cap looks too high.

Joules (LON:JOUL) (I hold)

118p - mkt cap £132m

I’ve been expecting another profit warning here, because it’s obvious that the company has been suffering from supply chain issues. We can all see this from overwhelmingly negative reviews on review sites. Although the quantity of negative reviews is tiny compared with the number of customer shipments there would have been over the last few months, so should always be treated with caution.

My view is that, with the share price down almost two thirds from the peak in mid-2021, the market is being very short-termist, and has already over-reacted to temporary, fixable supply chain problems. Hence I’m ignoring the share price, taking a long-term view of what seems to me an excellent, and differentiated brand, that has been successfully selling at least half online since before the pandemic. It also has a growing marketplace of third party brands, called Friends of Joules, which is growing strongly.

Hence this share is very much for people who understand the long-term attractions, and can cope with short-term bumpiness.

Today’s update shows there are still problems - it's served up another profit warning, coming hot on the heels of a previous warning in Dec 2021. So things are not good right now. However, JOUL is still profitable, and today's disappointments set up the soft comparatives for next year's recovery, assuming it gets on top of supply chain delays & excess costs.

Joules, the premium British lifestyle group, provides a trading update for the second half of the financial year to date as well as an update on the timing of its FY 2022 Interim Results.

The current financial year ends May 2022.

H1 results -

Further to the Group's Trading Update on 14 December 2021, the Group confirms that its financial results for the six months ended 28th November 2021 were in line with previous guidance, with revenues of £127.9m (H1 FY2021: £95.4m) and PBT pre-adjusting items of £2.6m (FY 2021: £3.7m).

No change to interim figures (to 11/2022), which should be released shortly. Why on earth do they mention completion of the going concern notes (below)? That could spook some investors. It’s seems almost as if this update today has been designed to drive the share price lower (which does make me wonder if they want to take it private?) -

The Group is in the process of finalising its Interim Results, including completing its going concern analysis, reflecting the impact of trading performance up to the end of January. The Group intends to release its Interim Results as soon as this is concluded.

Current trading - I find this confusing. At the start, it says H2 revenue to date (9 weeks to 30 Jan 2022) was up 31% against last year - unsurprising considering the shops would have been shut in Jan 2021 due to the lockdown.

However, it says sales this year are also up 19% against the 2-year, pre-covid comparative, which seems good to me.

… however, this performance, along with the Group's PBT performance over the same period, is behind the Board's expectations.

These following factors are mentioned, and it’s clear that the problems are supply chain related, causing delays & extra costs. That’s to be expected to some extent, and fits in the category of fixable problems, so I’m not particularly worried by any of this -

· Weaker than expected revenue in January, in part as a result of the negative impact of the Omicron variant on retail footfall (down 36% vs. the comparable period two years ago);

· Delays to new stock arrivals as a result of global supply chain challenges, resulting in a lower full price sales mix, in turn impacting revenue and gross margin;

· Lower than expected wholesale revenue due to delayed stock and customer cancellations;

· The continued impact on gross margin of increases in freight, duties and distribution costs; and

· Continued operational disruption, lower productivity, and higher than expected costs within the third-party operated Distribution Centre (DC). DC costs for December and January were c.£1.2m above expectations, which is more than double compared to the prior year. In the second half of FY22 so far and post peak trading, wage rates have reduced but are still higher than seen in the comparable prior year period.

Action taken looks sensible, and remember Joules has an exceptionally high marketing spend, so it has a lot of cost flexibility. Also Joules is a brand, not just a retailer, which I think gives it a lot more pricing power - because customers don’t buy Joules product on price. It’s bought primarily on quality & brand image, which should allow it to pass on cost increases better than the competitive price-led end of the fashion market.

· Cost restraint in marketing, head office and capex;

· Liquidation of aged and slow-moving stock via outlets and third parties;

· Simplifying wholesale operations including exiting selected UK and EU agent and third-party stockist arrangements, introducing minimum order value requirements in the US, and the cancellation of unprofitable orders; and

· Selected appropriate price increases for SS22 reflecting the higher cost environment.

Outlook - the good news is that the company remains profitable, despite all these issues.

Also, it sounds as if the supply chain & logistics issues are now improving.

The Board's base case expectation is for trading for the balance of the year to recover in line with its previously stated expectations, supported by recovering footfall and an improved level of newness in the stock position. The wholesale orderbook for Spring / Summer 22 remains strong and the DC operation is normalising with delivery times back to standard service levels and productivity improved.

Assuming the Board's base case is met, adjusted PBT for the full year is not expected to be less than £5.0m (FY 2021: £6.1m).

That’s quite a significant drop from the last guidance, which was £9-12m profit. JOUL is now saying at least £5m adj PBT, so basically a halving of profit guidance this year - ouch.

Liquidity - I’d like to see this net debt figure come down, but there doesn’t seem to be any particular worry here -

As at 31 January 2022, the Group had net debt of £21.5m, with £11.5m of total liquidity headroom.

Based on the expectation set out above, the Group has sufficient liquidity headroom for the foreseeable future.

My opinion - disappointing, but I was expecting more bad news, and so was the market - because the share price has been relentlessly falling.

Obviously this is going to hit the price today, although I think the problems impacting this sector are so widely known now, and possibly have peaked (supply chain issues), that the market really should be starting to look beyond short term problems, and see the bigger picture longer term. As soon as sentiment does go that way, we should see good recoveries in bombed out share prices from companies that have suffered the most from supply chain issues.

When that happens though, I have no idea. In the meantime, JOUL shareholders are likely to take a bath today.

Many thanks to Wayne Brown at Liberum for an update note this morning, available on Research Tree. He’s obviously lowering forecasts, to only 3.6p for FY 5/2022, recovering somewhat to 7.4p, and 11.4p in the following years.

I reckon we could see sub-100p today, as weak holders move on, but I remain very happy with the long-term potential of this company. Once its supply chain & logistics problems are sorted out, then the profit recovery could be much better than forecast. And despite all the problems, it remains profitable, and doesn’t have an overhang of problem stores.

Holders will just have to continue to be patient, and brace for a bad day today, as inevitably the price is likely to take another leg down.

It’s a very good recovery situation though, in my view, once supply chains normalise. The brand, and high margins, remain valuable, and profits/growth are likely to return, once conditions normalise.

I have to say, this is not the first time JOUL has suffered logistics & supply problems, which does lead me to believe its management seem weak on management of supply.

Poor current performance looks excessively priced-in now. Remember we're not buying only this year's earnings. We're buying all future earnings, which should improve once supply chains normalise.

.

Warpaint London (LON:W7L)

165p (up 7%, at 09:45) - mkt cap £127m

Full Year Trading Update

Warpaint London plc (AIM: W7L), the specialist supplier of colour cosmetics and owner of the W7 and Technic brands is pleased to announce an update on trading for the year ended 31 December 2021.

Company’s headline -

Strong 2021 trading and results expected to be ahead of market expectations

Just as a general aside, we do have to be careful with this latest fashion of companies putting a headline at the top of trading updates. They’re PR, and should be seen as such - i.e. stressing the positives only!

Usually, headlines are sensible, but I have seen a few that are misleading - e.g. CARD recently gave an upbeat headline, but then put a bombshell profit warning right at the end of the announcement due to big cost increases in the pipeline. That was the key point of the update, but wasn’t mentioned in the headline.

If however, in this case with W7L, the result is ahead of market expectations, then flagging that in the headline is a good thing, and saves investors time, by quickly spotting the positive updates, when we have loads of company updates to look at from 7-8am.

Revenues - FY 12/2021 is now a slight beat against previous guidance, with £50.0m actual, being £0.7m ahead of previous guidance. This is back to (slightly) above pre-pandemic revenues, and 24% ahead of FY 12/2020 revenues - good stuff.

Gross margins at 33.8% also slightly ahead of pre-pandemic levels (despite increased freight costs), and usefully up on 31.1% achieved in 2020. Even so, this gross margin seems low to me, in a sector that is known for high margins.

Profit guidance - almost top marks here, for giving precise figures, and we’re provided with both EBITDA, and real profits, Profit Before Tax (PBT). Excellent, but the only thing missing is EPS, which is my preferred profit measure, as I can quickly work out valuation from EPS.

For the year ended 31 December 2021, subject to audit, the Group's Adjusted EBITDA*is expected to be approximately £7.7 million (2020: £4.2 million, 2019: £7.0 million) and Adjusted Profit Before Tax** (2020: £2.3 million, 2019: £5.2 million) is expected to be approximately £6.6 million, both of which are ahead of market expectations.

As you can see, PBT is now £6.6m, well ahead of pre-pandemic £5.2m in 2019.

A lot of businesses restructured, and became better businesses under the pressure of the pandemic, maybe this is one of them?

Cash looks fine -

The Company's cash balances as at 31 December 2021 totalled £4.1 million (31 December 2020: £4.9 million) and the Company had no debt, after significant stock purchases to satisfy anticipated Q1 2022 demand.

Diary date - imprecise, but we’re told FY 12/2021 results will be out in April 2022. That seems a rather slow reporting schedule, but I note from pre-pandemic results that the 10 April 2019 results for 2018 were audited results, not just preliminary results.

Outlook comments sound upbeat, with some good growth initiatives in the pipeline by the sounds of it -

Commenting, Sam Bazini Chief Executive, said: "I am pleased to report that we ended 2021 ahead of current market expectations. In 2021 we enjoyed particularly strong sales growth in the UK, significant growth internationally and further increases in online sales. It was pleasing that we were able to maintain our margins at pre-pandemic levels, despite some inflationary headwinds, particularly with freight costs.

"We expect to see a continuing improvement in performance in 2022 and have started the year strongly. In line with our stated strategy we have significant opportunities for further growth, both with our existing retailers, and those such as Boots where we are expecting to launch very shortly, together with others that we are in discussions with. I look forward to providing further updates at the time of the release of the Group's results in April."

Broker updates - many thanks to both Singers, and Shore Capital, for releasing update notes today via Research Tree. This is tremendously helpful, and the more information private investors have, the more likely we are to buy the shares.

Singers has 6.3p ADJ EPS (FD) for FY 12/2021, going to 7.2p and 7.9p in 2022 & 2023, which don’t seem aggressive forecasts, so hopefully there might be scope for upgrades, rather than profit warnings.

At 165p per share, we have PERs of 26.2, 22.9, and 20.9 times - for 2021, 2022, and 2023.

My opinion - it’s good to see W7L trading well, and having an upbeat outlook.

However, given the big downward valuation reset which has happened in the market over the last 6 months, I see the valuation of W7L shares as currently looking unappealing.

It looks fully priced, and investors here will need to bank on earnings beats. Which may or may not happen. So nice company, trading well, but fully priced for now. Although looking at the outlook, and the investment in stock to meet demand in Q1, it does sound as if the newsflow in 2022 is lined up to be positive, from W7L.

Stockopedia likes it, see the high StockRank in the lower part of the chart below. For anyone new to Stockopedia, the charts I copy into these reports show the share price in the top part, and the Stockopedia StockRank in the lower part.

Like so many companies, the share price got ahead of events last year -

.

Jack’s section

Property Franchise (LON:TPFG)

Share price: 327.2p (+2.89%)

Shares in issue: 32,041,966

Market cap: £104.8m

(I hold)

TPFG is the largest property franchisor in the UK and manages the second largest estate agency network and portfolio of lettings properties in the UK. It’s similar to Belvoir, which reported yesterday, although its finance arm is probably a bit behind, and TPFG has a hybrid estate agency called Ewemove.

The company was founded in 1986 and has since grown to nine brands operating throughout the UK. These are Martin & Co, EweMove, Hunters, CJ Hole, Ellis & Co, Parkers, Whitegates, Mullucks & Country Properties.

Trading update for the year to 31 December 2021

Profit anticipated to be ahead of market expectations

It’s been a strong 2021, with a very active residential housing market and the fortunately timed Hunters acquisition, which bolsters the group’s sales revenue. That market has been helped by government initiatives over lockdowns, as well as the growth in remote working.

Like-for-like (LfL) revenue and management service fees (MSF) were ‘significantly’ up on 2020 and 2019.

- Group revenue +119% to £24.1m (+26% LfL on 2020 and +23% LfL on 2019),

- MSF +57% to £14.7m (+19% LfL on 2020, +16% LfL on 2019),

- Network income +67% to £157m (+17% LfL on 2020 and +18% LfL on 2019),

- Ewemove sold 58 territories, up from 11 and taking the total so far to 167,

- The number of offices has grown by 72% to 591, including 209 Hunters offices,

- Sales agreed pipeline of £26.5m, up from £15.3m,

- Rental properties managed up from 58,000 to 72,000,

- Net debt down from £8.8m to £2.7m.

It is encouraging to see the strong sales agreed pipeline, as initiatives such as the Stamp Duty holiday ended in September and there has been a question mark over how sustainable the current property market conditions are.

Ewemove’s good progress is similarly encouraging, as the deal initially raised some eyebrows. TPFG says it is on track to double sales here to 230 by the end of 2022.

Post-period end we launched a new hybrid franchise model, 'Hunters Personal Agent'. This model follows our established, successful hybrid model and complements the Hunters brand. Hunters Personal Agent is designed to provide agents with greater flexibility in running their business from a low-cost base and the initial response to its launch has been encouraging.

Diary date - preliminary results for the year ended 31 December 2021 on Tuesday 5 April 2022.

Conclusion

TPFG has great profitability and financial health metrics over time. It has also demonstrated an ability to grow year-on-year. It’s in a big market and is investing for expansion. Meanwhile, its business model is shored up by a good proportion of lettings revenue, which is relatively secure. That stable cash generation comes through in the group’s steady net debt reduction throughout the year.

So I think when you take all that together it probably warrants a higher valuation.

The Hunters acquisition was significant, and there has been an increase in share price on the back of that, but the valuation of the enlarged enterprise still remains fairly modest in my view. There’s likely plenty of scope for additional acquisitions as well, plus organic growth in line or slightly ahead of the market.

There is the health of the wider property market to consider. Sales prices are at historically high multiples of earnings thanks to decades of low interest rates and other monetary policies inflating asset prices. Rents too have become a larger part of people’s spending. So there’s clearly a limit to how far that can run.

We are encountering a wave of wage inflation though, so perhaps that can provide a slightly sounder footing for price growth. If you take the longer term view and expect to hold through multiple cycles, then this franchise network model is probably more robust than most. I expect TPFG, Belvoir and the like to be able to weather downturns or quieter markets as and when they arise, and use them as opportunities to emerge, ultimately, with stronger market positions.

A G Barr (LON:BAG)

Share price: 496.28p (+0.26%)

Shares in issue: 112,028,871

Market cap: £556m

AG Barr produces and markets drinks brands, including IRN-BRU, Rubicon and Funkin. It’s got an exceptional Quality Rank of 98, with a strong track record of profitability.

And yet it has been a poor investment over a five-year period. This is because the company has struggled for growth, grappling with sugar taxes, price cuts, and subsequent price increases.

However, shares in issue have reduced slightly, while the group has continued to be profitable throughout the period. And Irn-Bru is obviously a brand of no little value. So there are points of interest here, but the lack of growth and poor share price returns makes me more cautious.

Trading update for the year to 30 January 2022

Revenue for the year is expected to be c.£267m, a 17.5% increase compared to the prior year (2020/21: £227.0m) and marginally ahead of the revised guidance issued in November 2021. This means AG Barr is now ahead of the pre-pandemic revenue of 2019/20 (£255.7m), despite disruption from Omicron-related restrictions.

Both the Barr Soft Drinks and Funkin business units have traded well, particularly during the periods when restrictions were eased.

Cost pressures:

The inflationary pressures highlighted in our November 2021 update have materialised as expected, particularly across packaging and energy linked commodities. We have initiated several cost control actions to reduce the impact of these rising costs and have adjusted our pricing with customers where appropriate. With the published rate of inflation in the UK now above 5%, the highest level for 20 years, we will continue to seek opportunities across the coming year to offset the impact on our business.

AG Barr strikes me as the kind of company that should be better equipped than most to handle reasonable levels of inflation.

Operating margin before exceptional items for the financial year is expected to be around 15.6% (2020/21: 14.8%), delivering profit before tax and exceptional items marginally ahead of our November 2021 guidance.

The group expects to end the financial year with c.£66m of net cash following the completion of the previously announced equity investment in MOMA Foods Limited.

Conclusion

This strong trading performance was achieved despite the increased UK Government restrictions related to the Omicron Covid variant. I think it goes some way to validating the quality and resilience of the company.

For me, the key here is for the group to prove it can grow over the medium term. AG Barr is trading well right now but results are still affected by the nuances of lockdowns and Covid comparators.

While marginally ahead of expectations, diluted normalised EPS is still forecast to be below FY19 levels.

That said, if it can grow revenues, then AG is likely a promising long term hold candidate. It’s been in business for a long time, retains a degree of family ownership, and has some valuable brands that allow it to generate decent double-digit operating margins.

The group comments:

We plan to further invest in our business in 2022/23 and remain confident in our ability to deliver continued growth in both revenue and profit in the coming year.

Quality companies can struggle to grow though. When that happens, there is the risk of a further derating. It’s entirely possible to realise a sub-market performance with quality stocks. I can’t say I’m overly familiar with AG’s brands beyond Irn Bru, so I wonder what their potential might be?

Based on what I know, the share price looks about right for a profitable, long-standing company that has struggled for growth in recent times.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.