Good morning from Paul & Graham!

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

** New SCVR summary spreadsheet for calendar 2024 ** This is the live one! (updated 6/9/2024)

Archive - SCVR summary spreadsheet for calendar 2023.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices). My video explaining/reviewing it.

My other video (June 2024) - How to screen for broker upgrades on Stockopedia. More stock screening strategies here (possible bargains?) - 21/9/2024.

Companies Reporting

Summaries

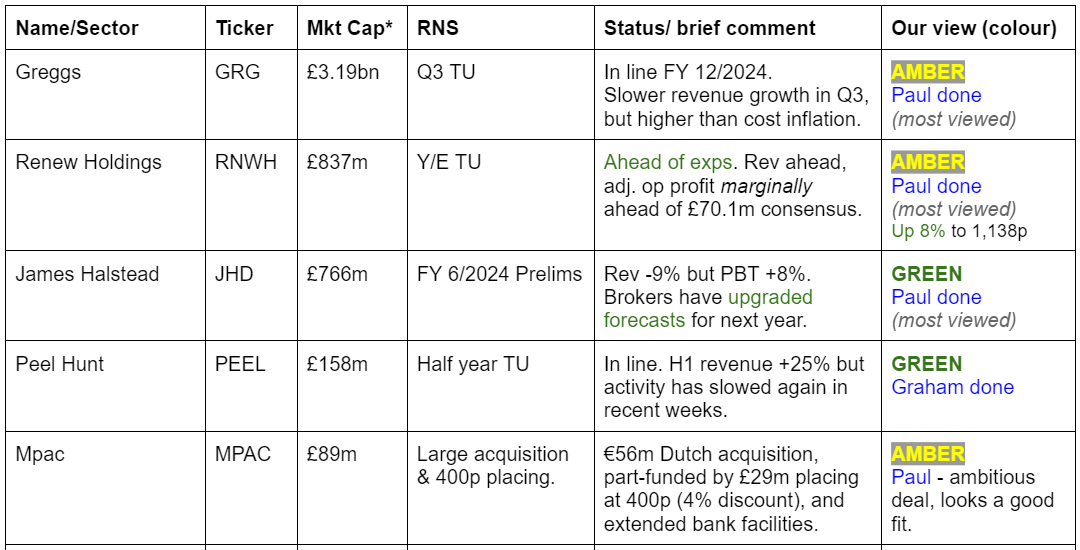

Greggs (LON:GRG) - Down 5% to 2,870p at 08:13 (£3.03bn) - Q3 Trading Update - Paul - AMBER

Revenue growth slowed in Q3, but is still good. Maybe that's to be expected as inflation moderates? Profit expectations are in line for FY 12/2024. Is "in line" good enough when shares are on a punchy 21.6x forward earnings? Lovely company, but shares look fully priced.

Peel Hunt (LON:PEEL) - down 1% to 127p (£160m) - Half Year Trading Update - Graham - GREEN

It’s an “in line” update, although investors may be discouraged to learn that a recovery in activity has been followed by a slowdown (blamed on the UK budget and US election). I’m patiently staying positive on this for now, hoping for a recovery, but my patience won’t last indefinitely.

James Halstead (LON:JHD) - up 1% to 178p (£774m) - Audited Results FY 6/2024 - Paul - GREEN

I'm moving back up from amber to GREEN, as these numbers demonstrate a strong & resilient business with good margins, lovely balance sheet, and a reliable 5% dividend yield. The PER isn't exactly a bargain, but overall this looks a reasonably entry point into a business with a long & good track record. Cyclical upside could stimulate a share price recovery perhaps?

ECO Animal Health (LON:EAH) - down 22% to 76p (£57m) - Trading Update - Graham - AMBER

A disappointing update as this animal pharma company once again suffers from weaker demand in China than had been baked into forecasts. This track record of profit warnings here shakes my confidence, but I’m happy to stay neutral on the basis that the company’s R&D programme has the potential to produce a higher-quality product portfolio.

Renew Holdings (LON:RNWH) - up 8% to 1,138p (£899m) - Year End Trading Update - Paul - AMBER

"Marginally ahead" of profit expectations for FY 9/2024 doesn't really justify an 8% share price rise, on top of a very strong run since last autumn. RNWH has a strong order book, but nothing in assets overall on its balance sheet. I recognise its amazingly good track record, but feel valuation is now at the top end of reasonable, so have shifted down from amber/green to AMBER.

Works co uk (LON:WRKS) - up 6% to 25.5p (£16m) - Prelims 53 wks to 5 May 2024 - Paul - AMBER

Despite tough conditions, it managed to end the year in line with expectations, and reckons it can improve profits in FY 4/2025. I think this is a very marginal business, but am impressed it has survived. The balance sheet actually looks OK, once you strip out IFRS 16 entries. Doesn't appeal to me, but AMBER seems fair for now. I have little confidence it will be a good long-term investment, but there might be a trade here for a bounce, if it has a good Xmas maybe?

Paul’s Section:

Renew Holdings (LON:RNWH)

Up 8% to 1,138p (£899m) - Year End Trading Update - Paul - AMBER

Renew (AIM: RNWH), the leading Engineering Services Group supporting the maintenance and renewal of critical UK infrastructure, provides the following trading update for the financial year ended 30 September 2024.

A positive headline today has propelled RNWH shares to what looks like an all-time high -

“Strong organic growth resulting in financial performance ahead of market consensus with continued momentum into FY25”

This is then moderated by saying operating profit is “marginally ahead”, and a helpful footnote to tell us what consensus is -

“1Company derived consensus for adjusted revenue is £1,081.0m, adjusted operating profit of £70.1m and pre-IFRS 16 net cash of £22.1m.”

Broker updates - none available to us. Stockopedia has 65.7p consensus, so marginally ahead suggests c.67p perhaps? That gives a punchy (for the sector) PER of 17.0x. I wouldn’t pay that for a contracting business, but you might be tempted, given RNWH’s superb long-term multi-bagging track record.

Talking about acquisitions, this seems to have been the secret of RNWH’s success - it has done lots of acquisitions over the years, and they have clearly added value.

Balance sheet - next to nothing, with NTAV only £14m at 31/3/2024, so you don’t have any support here from assets. The business is funded by its trade & other creditors, rather than equity. That seems to be an ongoing (and positive) thing, since finance costs on the previous P&L statements were minimal. This is why, despite a fairly low operating margin of about 6%, RNWH delivers high ROCE and ROE, since it’s figured out how to get creditors to fund the business!

Investors like high ROCE, but it’s worth pointing out that this also increases the risks, since there’s no surplus capital to fall back on if things go badly wrong. A good example of that recently was Headlam (LON:HEAD), where despite awful performance, it’s not in any danger due to having loads of surplus capital. Whereas companies with “efficient” balance sheets can get into serious or even terminal trouble, if they run into major, unexpected problems, and have no surplus capital to fall back on. My view on this might be unpopular and old-fashioned, but it makes sense to me - finding good companies where there’s also a ton of free stuff sitting on the balance sheet, if that value can be unlocked in some way. But each to their own. For the avoidance of doubt, I'm definitely not saying HEAD is a good company! It looks a mess actually, as covered here recently (yesterday).

Like a lot of companies with weak balance sheets, RNWH management like to pretend it’s strong, instead of admitting what we can all see - that it’s got next to nothing in net tangible assets, but doesn’t actually need any assets to generate a great return, which is actually a stronger message than pretending that weak is strong. So I think they should rethink their communications on this issue -

“The Company's balance sheet continues to be strong with net cash at 30 September 2024 anticipated to be ahead of market expectations.1

...pre-IFRS 16 net cash of £22.1m.

Outlook - sounds good -

“momentum into the new financial year is underpinned by a robust order book which benefits from the UK's committed infrastructure spending programmes and to client's long-term operating budgets.”

Paul’s opinion - as always, kudos to RNWH management, which has built an excellent business in an often horrible sector. This share has been all about raising margins over the years from originally only about 1%, to now 6-7%, together with multiple acquisitions plus organic growth. It’s been stunningly successful, as you can see -

RNWH has delivered amazing shareholder value, usually in quite concentrated bursts upwards (like the one we’ve just had in the last year), then treads water for typically 2-3 years. For that reason I’m not really interested in joining the party this late on, so it can’t be higher than AMBER for me personally, because I don’t see how there can be much short term upside on the share price at this valuation (c.15x fwd PER).

Longer term, RNWH has been a big winner, so there’s also a strong argument for just holding it forever, which has worked great so far! Lots of other contracting businesses have re-rated strongly this year too, but sit at much lower PERs than RNWH, some having much better balance sheets than RNWH too (although sometimes with legacy issues too). There’s a limit to how highly we can value contracting businesses, and for me 15x PER is the limit, which is where RNWH sits currently.

James Halstead (LON:JHD)

Up 1% to 178p (£774m) - Audited Results FY 6/2024 - Paul - GREEN

James Halstead plc, the AIM listed manufacturer and international distributor of commercial flooring, announces its results for the year ended 30 June 2024:

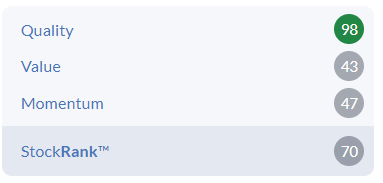

JHD has an excellent very long-term track record, but its shares became over-valued I think, and have actually gone nowhere for the last 9 years (although paying good divis along the way, to be fair) -

What a lovely progression of divis here -

The current forecast divi yield is 4.94%, so given the company’s outstanding long-term track record for looking after its shareholders with growing divis, it’s almost worth just buying some shares for the long-term on this point alone. It pays out almost all earnings as divis.

Checking my previous notes, I was GREEN at 201p on 31/1/2024 with a positive TU, and forecasts that looked too low set to be beaten.

More recently on 2/8/2024 I shifted down to AMBER (on reflection maybe a mistake?) at 191p, with me worrying that PER of 19x looked too high for a company that seemed to be going ex-growth.

On to today, we have FY 6/2024 results (discussed earlier in the reader comments below). Key points -

Revenue down 9% to £275m

Gross margin saved the day, up impressively from 38% (FY 6/2023) to 44%

Profit before tax up 8% to £56.2m

Higher tax rate caused EPS to fall slightly, down 2% to 10.0p - PER 17.8x

Dividend - 2.5p interim already paid, final 6.0p proposed (up 4.3% vsLY), so again almost all earnings are paid out in divis (total 8.5p) -

“Our proposed dividend continues our unbroken chain of dividend payment increases from 1974.”

Outlook - a bit vague, but sounds positive -

“Prospects continue to look positive giving the board confidence in the outturn for the financial year ahead…”

I like this bit, which suggests there could be opportunities to grow further, globally, which may address my concern about it previously looking ex-growth -

“During the year we have secured many prestigious projects around the world, demonstrating the continued demand for our high quality offering on a global scale.”

It doesn't seem to provide numbers on order book, pipeline, etc, unless I missed it.

Balance sheet - looks superb, with NAV of £181m, or NTAV £178m. This includes £74m of net cash, which I would say is pretty much all surplus to requirements, as net current assets are £142m overall - ie inventories + receivables far exceed all creditors, with the cash sitting on top of that. I would say that £82m inventories looks far too high, being over half the £154m full year’s cost of sales on the P&L. Does it really need over 6 months sales’ in inventories? Maybe it has stocked up to get around supply chain delays, but it needs to be questioned. I would have expected to see inventories maybe half that level, so about £40m in capital looks tied up in excess inventories. That might be a problem, but at this type of family run, conservative company, the accounting is usually prudent & we rarely have to worry about black holes in the books.

Cashflow statement - looks very good. It strikes me that JHD generates a lot of genuine cashflow, on a fairly lean fixed asset base, so it’s not as capital-intensive as I would have thought. Capex is only about £3m pa, which seems low considering the commentary talks a lot about having the latest equipment, and being efficient.

Dividends stand out as the massive number (compared with everything else) on the cashflow statement. So this is quite an unusual setup - a business that throws off prodigious cashflows, and doesn’t really need it for anything else, so it almost all gets paid out as divis. I like that business model a lot!

Paul’s opinion - it’s quickly become obvious to me that I made a mistake lowering JHD from green to amber in Aug 2024. So I’m going back up to GREEN today- this is a cracking business, and it sounds like its markets should return to growth as macro improves around the world. It stands to reason that capital projects which typically use JHD specialist floorcoverings might have been curtailed due to higher interest rates, pandemic disruption, etc. So the more I think about it, the resilient performance of JHD in recent years is all the more impressive, with cyclical macro factors suppressing its growth, rather than the business having gone ex-growth structurally.

Zeus has slightly raised forecast for FY 6/2025, from 10.2p to 10.5p, mainly due to plugging higher gross margins into its spreadsheet, given the strong FY 6/2024 gross margin.

Overall then, I think this looks a good quality business, at a fair price. Not a bargain, but worth the price, and it could rise over the next few years if demand improves with the economic cycle. Bulletproof balance sheet, and a c.5% dividend yield are further attractions.

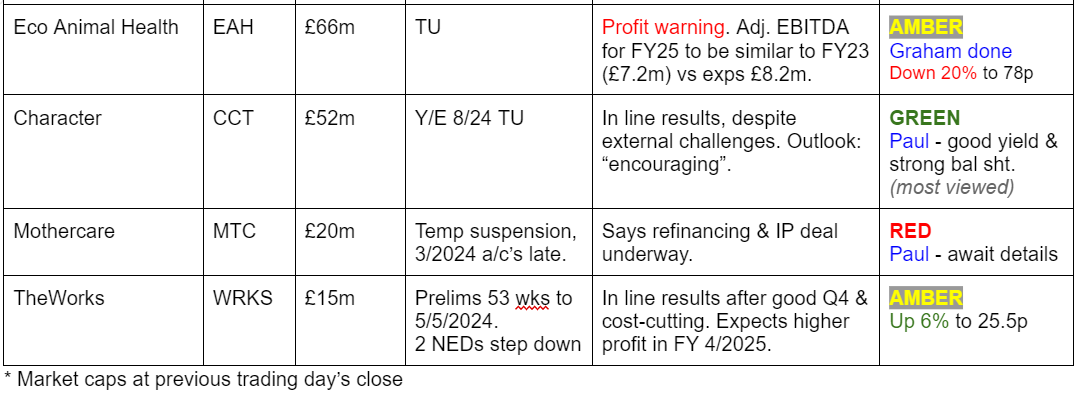

Upper-middling StockRank -

Greggs (LON:GRG)

Down 5% to 2,870p at 08:13 (£3.03bn) - Q3 Trading Update - Paul - AMBER

This share is top of your "most viewed" list, so I thought we should give a view early.

Bakery & fast food chain, now trading from 2,559 shops (2,016 company, 543 franchised).

Impressive speed of reporting Q3 trading, given that the quarter only ended yesterday.

It’s in line with expectations for FY 12/2024.

Q3 LfL sales growth has slowed to 5.0%, but is still above cost inflation (guided at c.4%) -

The commentary today talks about its continuous product innovation, which is great I think. Funnily enough I bought a chicken slice (delicious) from the new, much larger, relocated Greggs in Bournemouth yesterday. I was drawn in by a sign advertising “Katsu Chicken Slices” which sound lovely, but they had sold out. So that demonstrates product innovation does pull people into the store. Plus few people would argue that it’s the best value fast food outlet on the High Street. A bit like the Wetherspoons (I hold) of the fast food sector. I’m looking forward to trying the new “All-Day Breakfast Baguette”.

Outlook -

“Whilst acknowledging ongoing economic uncertainty, the Board expects the full year outcome to be in line with its previous expectations. The Board remains confident in the long-term growth opportunity for Greggs, and we are investing to support that growth.”

Is that enough to keep the bulls interested, given that GRG shares have had a good strong run, and are now priced on a full multiple of 21.6x forward PER?

Shares were down 5% in early trades.

The dividend yield is only 2.3%, because it’s in a heavy capex phase.

Paul’s opinion - Greggs is an excellent business, and still expanding with new, and larger sites. Although at c.£2bn revenues, and with probably many/most UK locations now already having a Greggs, the % growth rate is only c.10%. Is it better to invest in something smaller, but with more exciting roll-out potential maybe? Or go with Greggs, which dominates its space with decent quality, and value for money offering?

I’d be interested to know what the shoplifting rate is like, as I’ve seen plenty of times how the dishevelled of Bournemouth brazenly help themselves to free food & drinks, with no consequences. Many shops are reporting a shoplifting epidemic, so that would be an interesting question to ask GRG management if they do a webinar, as it could be a significant hidden cost.

There’s no doubt GRG is an impressive business, but I’d only want to buy its shares if the price was say 15-17x PER. At almost 22x, with fairly unexciting EPS growth in the last 3 years, I can’t see much of a value opportunity right now. It’s a good share to have on a watchlist though, as when something bad happens to macro/markets, any plunge in this share is usually a buying opportunity. But personally I wouldn’t want to buy right at the top of this 5-year chart -

Works co uk (LON:WRKS)

Up 6% to 25.5p (£16m) - Prelims 53 wks to 5 May 2024 - Paul - AMBER

I was expecting to write off this crafts & books retailer as a lost cause, but the numbers are not as bad as I expected.

The trouble is, revenue growth is elusive, with only +1% to £283m in FY 4/2024, and negligible +0.2% in the first 21 weeks of FY 4/2025.

It’s still profitable though at £3.2m adj PBT (down from £5.3m LY).

Note that the adjustments to profit are stripping out (artificial) profit from writing back previously booked losses on leases. The curse of IFRS 16 strikes again. It’s really good that WRKS adjust out these artificial profits though, showing the true, lower profit as the adjusted profit.

Is it likely to go bust? Well actually the balance sheet isn’t bad. NAV is £10.1m, including intangible assets of £1.9m, so that’s £8.2m NTAV. However, there are also heavy lease net liabilities on there - £57.7m RoU assets, less £77.8m lease liabilities, nets off to a -£20.1m deficit. This can be eliminated I think as IFRS 16 entries are nonsense, so that would adjust the NTAV up to a surprisingly healthy £28.3m.

Just looking working capital shows the reality, and this is £42.9m current assets (including £1.6m cash), mainly made up of £31.4m inventories, less £31m total creditors (excl leases). Hence a useful surplus of c.£12m in working capital. What does that mean? If they can keep turning the inventories quickly, then the business should generate enough cash to keep paying its creditors in an orderly fashion. So I see currently little insolvency risk, unless trading were to deteriorate a lot further - which we sometimes see happen at this type of business.

WRKS reckons that 96% of its 511 stores are profitable, which doesn’t sound credible to me, given that it has a thumping great deficit on the balance sheet lease entries (implying some fairly significant loss-making sites).

Outlook sounds fairly upbeat -

“Strong product margin growth and cost savings are being delivered, more than offsetting ongoing cost headwinds. As such, we remain on track to deliver improved profitability in FY25 and meet Group compiled market forecasts of pre-IFRS16 Adjusted EBITDA of £8.5m.”

Paul’s view - I was expecting to mark this as red or amber/red, as it seems such a marginal business that has done well to just survive. However, its numbers are far from disastrous, and I think it could tick along and survive for maybe a few more years? Is it going to suddenly turn into a great business? I very much doubt it. It’s dependent on people getting out into the High Streets again, and not nicking everything on display. So an improvement in consumer sentiment as real incomes have now become positive again, could help WRKS maybe. It says that things are “well-positioned” for the busy Xmas period.

Good luck to them, I am impressed that The Works has survived the last few years, when so many other smaller retailers have gone bust, some several times. £16m market cap looks cheap, especially if you value companies on EBITDA multiples. But for me, it has little to no appeal. I’ve invested in so many struggling, smaller retailers in the past, and they hardly ever work out to be good investments. So good luck to holders here, you could have a nice short-term trade on your hands if it reports strong Xmas performance.

I do mystery shop my local Works branch occasionally, and always come out with something, some pads or pens, or a book - the prices are attractive. But as a long-term investment I doubt WRKS shares will do well.

I see that 6.2% shareholder Kelso had 2 NEDs on the Board helping to advise management, but they’ve both stepped down today. Aside from the warm words in the RNS, it would be nice to know the real reasons! Maybe it was a question of committing the time to a holding worth only £1m? Or maybe they’ve decided to move on and sell their position, I don’t know.

This was an over-priced float in July 2018 that started going wrong almost immediately & has never recovered -

Graham’s Section:

Peel Hunt (LON:PEEL)

Down 1% to 127p (£160m) - Half Year Trading Update - Graham - GREEN

This is a brief H1 update to the end of September.

Key bullet points:

H1 revenue £53.3m, up 25%.

Investment banking: improved performance as PEEL worked on a main market IPO and an AIM IPO.

Research & Distribution: revenues “modestly up… despite continued outflows from UK equities”.

Execution: trading activity was up, but has slowed in recent weeks in advance of the UK Budget and US election.

When it comes to strategic progress, PEEL says that it has made “targeted investment in talent” and notes that the average market cap of its retained client base has increased from £620m to £860m. This is thanks to client wins and the growth in market cap of existing clients. It now has 4 FTSE 100 clients and 42 FTSE 250 clients.

Outlook is in line:

Market activity has slowed again in recent weeks ahead of the upcoming Budget and US election. Consequently, despite better first half revenues, we expect full year performance to be in line with market expectations and we remain well positioned across all parts of our business to take advantage of increased activity when market confidence returns.

Graham’s view

I put this on my best ideas list for 2024, banking on a return to health in the UK equity market.

An important feature of this stock is its balance sheet strength, covering most of the market cap.

Full-year results to March 2024 showed balance sheet net assets of £92m, including cash of £38m, with very few intangibles (less than £2m) and the vast majority of its assets being equivalent to cash.

However, the company did post a small loss and I’m not convinced that FY25 will have much to cheer about in terms of profitability.

Finding sell-side estimates of PEEL’s financial results is tricky, however. That’s hardly a surprise since PEEL doesn’t make its own research widely available to investors. If you’re want forecasts for PEEL, you’ll want to get in touch with Nomad Grant Thornton or broker Keefe, Bruyette & Woods

My inclination is to leave my GREEN stance unchanged here. There could come a point when I need to throw in the towel and downgrade to AMBER or AMBER/GREEN, if there is still no sign of a meaningful resurgence in activity, although I haven’t yet decided when that might be.

Today’s update is a little disappointing, in the sense that green shoots of recovery were followed quickly by another slowdown. But who knows, maybe after the budget and the US election, a more sustained pickup might emerge?

These shares continue to trade at a 40%+ discount to the price at which they were offered to the market in 2021:

ECO Animal Health (LON:EAH)

Down 22% to 76p (£57m) - Trading Update - Graham - AMBER

ECO Animal Health Group plc (AIM: EAH), a rapidly growing global animal health company with a portfolio of marketed veterinary products and a maturing proprietary R&D pipeline, today announces an update on its trading for the six months ending 30 September 2024.

This update starts positively but quickly goes downhill.

Aivlosin® is “a proprietary, patented medication which is effective against both respiratory and enteric diseases in pigs and poultry”.

This prescription medicine has gained market share for EAH in Brazil, India and the US. Revenues in Brazil and India are ahead of expectations. These markets are expected to remain strong in H2 and Aivlosin will also enter Paraguay, having received regulatory approval there.

That’s most of the good news out of the way. And now for the bad news:

We are however, encountering challenges in China, due to low disease incidence in the summer months, and in Southeast Asia, where sales have slowed reflecting some customer churn.

The ECO Group is second half weighted and this pattern will continue in FY 2025. Nevertheless, the recent challenges we've faced in China and Southeast Asia lead us to believe that revenue for the full year will be materially below market expectations.

Adj. EBITDA for FY March 2025 is therefore likely to be “in the region of that observed in FY23”, i.e. around £7.2m.

New estimates: thanks to Equity Development for publishing on EAH this morning. Their new revenue estimate is £84.3m (last year: £89.4m, previous consensus estimate: £92.6m).

The new adj. EBITDA estimate, as indicated in today’s announcement, is £7.2m (last year: £8m, previous consensus estimate: £8.2m).

Graham’s view

We don’t cover this one particularly often. I was neutral on it back in March 2023, pointing to poor EPS estimates momentum and a high earnings multiple.

Today it seems as if little has changed.

EPS momentum before today’s downgrade. After today's downgrade, it won't look any better:

The share price is down by a third since I last covered it, but the stock is still unable to offer a normal earnings multiple:

The company had a £22m cash balance at March 2024, but only £8m of this was held outside of China and the directors said that they considered ”the cash held in the Group's joint venture subsidiary in China to be unavailable to the Group outside of China”. So while I accept that the company is able to self-fund its R&D, I think it would be a stretch to say that EAH is cash-rich or has a large surplus of cash. That largely depends on how much it could extract from its Chinese JV.

According to last year’s income statement, it spent £4m on R&D that year. It spent nearly £6m the prior year. This says to me that the non-Chinese cash balance might not survive several years of heavy R&D spend, without support from profits from existing or new products.

Once again I find myself leaning towards a neutral view on this stock. Its current earnings aren’t able to justify the market cap but it does have an R&D programme with new medicines hopefully coming on stream in due course. The current product set is not producing the most reliable results but is at least performing well in some geographies.

I can see both sides of the argument here, and AMBER once again seems to be the fairest stance.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.