Good morning, it’s Paul here, with the SCVR for Tuesday. Jack's busy with other work today, and I reckon I can handle the relatively modest newsflow on my own today.

Today’s Agenda

Smiths News (LON:SNWS) - left over from yesterday, refinancing (Paul, done)

Wey Education (LON:WEY) - Final results (Paul, done)

Capita (LON:CPI) - Trading update (Paul, done)

Mccarthy & Stone (LON:MCS) - Irrevocable undertakings, re takeover bid (Paul, done)

Zoo Digital (LON:ZOO) - Interim results - see tomorrow's report

.

Timing - update at 12:55 - I'm taking a break for lunch now, and will finish off the last 2 sections later this afternoon. Should be done by 4-5pm. Today's report is now finished.

.

Market gyrations (written by Paul)

What can I say about yesterday? FTSE-100 up c.276 points, to 6,186. What a remarkable day - large, seemingly knee-jerk market moves up (and down) happened on a colossal scale, once the seemingly positive news from Pfizer came out about its vaccine, subject to all the usual caveats about peer review, further testing, and regulatory approvals.

I hope readers did OK overall. When such large market moves up or down happen in such a short space of time, I’ve noticed that things seem to fan out afterwards - some instant gainers continue rising, whilst others gradually give back the gains as people bank profits. Hence it should be an interesting process of price discovery in future, as the short term traders bank their profits or losses, and we get to see how much conviction investors have in their positions.

For me, it was a generally up day, I’m positioned for an overdue covid recovery rebound, but there were some losses too. Such is life. In the overall scheme of things, one day is nothing more than a blip on the chart. That said, it does feel like a turning point has possibly been reached, where we should be looking forwards, towards a gradual reduction in covid over the next 6 months, as mentioned here last week, with lucky timing.

That said, personally I’m not interested in chasing up stocks that have perhaps already priced-in a recovery. I want plenty of upside (100%+ ideally), because there’s an opportunity cost at times of great opportunity. If you back the wrong stocks in a recovery, then the bull market can gallop right past you. Mind you, there are always overlooked laggards - I remember having a very good year in 2009, when everything was soaring, it left behind some smashing bargains amongst smaller shares. Mind you, that still wasn't enough to repair the damage from 2008 - I lost about £5m of mine & Spreadex's money (£3m mine, £2m there's), which was certainly a harsh lesson in combining illiquidity with gearing, something I never tire of warning newer investors about. Illiquidity on its own is survivable. Gearing can be survivable, if you manage it well. Combine the two, and you're toast. It's only a matter of time.

I’m also mindful that many larger, often travel-related companies, have been forced to take on very expensive debt, to survive through this unprecedented year. Therefore, I wonder how much of the recovery ends up paying bumper coupons to debt providers? Bonds in big travel companies might be safer than equity? Or could debt-laden companies refinance later, onto cheaper debt? Then resume divis? Analysing the terms of debt and pension deficits, strikes me as a key theme going forwards.

Anyway, I’ll leave the short term stuff to traders, and the debt to experts. I’ve got no idea what short term share prices are going to do. It’s just sentiment in the short term, but logic in the longer term.

.

Let's start with a straggler from yesterday, as I got swept up in the market chaos, and couldn’t concentrate properly yesterday afternoon.

.

** This section written by Paul **

Smiths News (LON:SNWS)

Share price: 27.2p (up 11% yesterday)

No. shares: 247.7m

Market cap: £67.4m

I last covered this share, in a fair bit of detail, here on 1 Oct 2020. The main issue was expiry of bank facilities imminently (31 Jan 2021). A decent trading update made it look a bit more interesting, as I concluded at the time;

The long-term chart tells a story of a business in structural decline. It could be a nice trade, if the refinancing is pulled off without dilution, but it's not the sort of thing I would want to hold long term.

Today the company has addressed its biggest issue, saying;

New term loan and revolving credit facilities

The Company is pleased to announce it has signed a new facility agreement to refinance its existing senior finance agreement, which was due to mature on 31 January 2021.

The new facility is expensive, which reflects the risk involved, with a weak balance sheet;

The new three-year £120 million facility, comprises a £45 million amortising term loan (Facility A), a £35 million bullet repayment term loan (Facility B) and a £40 million multicurrency revolving credit facility (RCF). The agreement is with a syndicate of banks comprising existing lenders HSBC, Barclays, Santander, AIB and Clydesdale and one new lender, Shawbrook Bank. The final maturity date of the new facility is 6 November 2023.

The facility is available at an initial margin of 5.5% per annum over LIBOR (in respect of both Facility A and the RCF) and 6% per annum over LIBOR (in respect of Facility B). This pricing is higher than current levels, but remains competitive, and is reflective of the tightened credit markets at this time.

The margin reduces as the Company reduces its net leverage.

The announcement makes it very clear that the banks want to reduce their exposure, so this probably delays an equity fundraising until better times - which is good;

Consistent with the Company's stated strategic priority to reduce net debt, the new facility agreement includes an amortisation schedule of £15m per annum for the repayment of Facility A and certain restrictions on payments of dividends and other distributions, which in the short term will preclude a dividend in respect of FY2020. In addition, the Company and its principal trading subsidiaries will provide security over their assets to the lenders.

I can almost detect the relief in the CEO’s comments here, since the company has clearly sailed far too close to the wind;

Commenting on today's announcement, Jonathan Bunting, Chief Executive Officer, said:

"We are pleased to have reached this agreement after a thorough and robust process. The support of our banks positively reflects the strength of our business and the vital role we play in serving thousands of communities throughout England and Wales. This agreement, together with the recent completion of all our major contract renewals, completes a year of considerable strategic progress which further enhances the resilience of our trading and business model."

The Company was advised on the refinancing by EY Capital & Debt Advisory and Herbert Smith Freehills.

My opinion - disaster is averted for shareholders. So perhaps a situation where nervous laughs and deep exhalation is warranted, rather than trying to grab the bunting back from shareholders in last week’s premium takeover bids.

Banks hate risk. Only one customer going bust, wipes out the profits from lending to dozens of other customers. This deal looks to me like a pragmatic compromise, but don't be under any illusions that the clock is now ticking, and the banks want their exposure reduced. So an equity fundraising still looks highly likely. I'm not convinced there would be much appetite for a business that could be seen as "old economy".

I was naive on this very issue, re Revolution Bars (LON:RBG) - a new banking arrangement was agreed, and all looked well. But it turned out that behind the scenes the bank deal was probably linked to a future equity fundraising. This one has the same smell.

.

General points

Banks don’t want to put fundamentally decent businesses into administration. Why would they, when interest rates are near zero? Or rather I should say, when base rates are near zero. This announcement shows that when banks perceive risk, they want a hefty premium to lend.

There was a very good newspaper article over the weekend, complaining that banks are cranking up interest rates for riskier lending. So far from having interest rates at an all-time low, apparently the real-world lending rates are going up. This is blamed on something like £60bn going out in Govt-backed covid loans, leaving banks a bit short of capital, and wanting higher margins. Stands to reason, doesn’t it? Therefore, maybe the next step needed could be wider intervention by the Bank of England, to ensure low interest rates are pushed through to actual lending? Watch this space, I reckon they’ll probably do something. All of which is probably bullish for shares. I just don’t see any rationale for the Govt slamming on the brakes. So why do people think a recession is likely? It doesn’t make sense to me, but we’ll see.

I had a fascinating chat with Ed earlier, and he recommended I read, “The Deficit Myth”, by Stephanie Kelton, which is about modern monetary theory. We’ve got to approach things with an open mind, and I’ve already mentioned several times here before, how QE and conventional economics seem to be diverging. So if all this MMT stuff is right, or even partially right, then some equities could be really good value still. I’m starting to lean that way, and am interested in nice GARP shares that also have decent dividend paying ability, longer term.

After a day staring at computer screens, poor eyesight means I can only manage audiobooks these days, being in the Saga (I hold) demographic. Thankfully, The Deficit Myth is available on Audible, so I soaked in the bath this evening, and listened to a couple of chapters, finding it alarmingly persuasive at first. Although I'd also like to take Ms Kelton on a guided tour of Zimbabwe, to show her what happens when money printing gets out of hand, as it seems to have done in the past.

Could we be coming to the end of the GAAP fad? (Growth At Any Price)? E.g. Tesla and Zoom? Possibly. It does feel that way a bit. Similarities with 1999-2000 are cropping up a bit in my mind. Not with the top tier FAANGs, but with the next tier down maybe.

That's enough late night rambling, see you in the morning.

Mccarthy & Stone (LON:MCS)

Share price: 115.7p (unchanged)

No. shares: 537.8m

Market cap: £622.2m

It looks as if the American bidder (Lone Star Real Estate) for this retirement housing developer, is struggling to get much traction for its 115p cash bid.

There’s an almost embarrassing update today, which indicates that another MCS Director has given an irrevocable undertaking to vote in favour of the deal, for his, wait for it… 399 shares! Representing;

0.000074 per cent. of McCarthy & Stone's issued share capital

So far, it looks as if only the Directors total shareholdings combined (under a million shares) and one major shareholder, are supporting this deal, as far as we know;

...amounting in aggregate to 902,964 McCarthy & Stone Shares, representing approximately 0.2 per cent. of the issued share capital of McCarthy & Stone; and (b) funds and entities managed by Anchorage Capital in respect of a total of 91,740,467 McCarthy & Stone Shares representing approximately 17.1 per cent. of the issued share capital of McCarthy & Stone. In aggregate, irrevocable undertakings have been received in respect of 92,643,431 McCarthy & Stone Shares, representing 17.2 per cent. of the issued share capital of McCarthy & Stone.

My opinion - 17.2% is very low, which raises the interesting possibility that;

- Lone Star might need to raise the offer price to get more acceptances, or

- Someone else might launch a higher priced bid, or

- The bid might fail, and share price fall back again, although probably not all the way back to the 70-75p range where it traded over the summer, because we now know that under-valued the company.

The 115p offer price is certainly not generous. It was a nice premium to the prevailing share price, but the prevailing share price was obviously wrong! There was no reason at all why MCS should have been trading at a discount to NTAV, which is why I bought some shares in it over the summer. Covid has made sheltered housing a much more appealing option for the elderly, than ending up in a care home and contracting covid there. Therefore MCS really should trade at a premium to NTAV, like other housebuilders.

I shall watch from the sidelines, as for me personally, I was very happy with a >50% profit in just a few months, and sold my MCS shares in the market as soon as the bid was announced. A bird in the hand, etc.

It doesn’t bother me if a higher bid happens. As I was saying to a friend yesterday, it’s pointless to do “if only”, or “what if” scenarios in your mind, after the event. I just make a decision, and then live with the consequences. There’s no point in looking back with regret, other than to learn from each mistake, but then draw a line under it & move on.

.

Wey Education (LON:WEY)

Share price: 26.5p (down c.4%, at 09:17)

No. shares: 138.6m

Market cap: £36.7m

This is a very interesting little company, which operates online schooling. I researched it in a fair bit of detail a couple of years ago, and very much like the concept. There are even some online videos available, created by students at Wey’s schools, who speak very highly of the experience.

Covid has highlighted how hopelessly outdated our current system of education is, and that we really need to modernise it, including use of online, at least some of the time. This can make education so much more efficient, and broader, e.g. offering niche subjects in small schools, by scheduling them online, with one teacher simultaneously teaching students in different schools, thus making it economic to teach a wider range of subjects.

So, a very interesting company, and concept, which has a lot of potential I think.

There’s an online presentation tomorrow afternoon, which anyone can tune in to, on the InvestorMeetCompany platform which I find very good.

Incidentally, I asked if IMC could make it possible to browse all their recordings of previous meetings, which they thought was a good idea, so they have recently added the button below;

.

.

I must find a better way of highlighting things, as it looks like a 4-year old has scribbled on the page!

The highlights for Wey’s FY 08/2020 look quite good;

.

.

Nice revenue growth. A small profit of £652k, after adding back a few adjustments, like £75k share based payments. Plenty of cash in the bank.

I’ve reviewed the balance sheet, which looks fine to me.

The cashflow statement looks fine too. The increase in cash seems to mainly be due to increased liabilities, which I’m guessing is likely to be deferred income - i.e. monies received up-front from student fees. That’s a nice business model, being paid up-front is always good! So no issues there.

Outlook - rather over the top language, as MrC flags in his daily roundup in the comments section! This is an interesting point;

...robust strategy for accelerated growth has meant that the pandemic growth and subsequent changes in behaviour have presented yet further opportunities.

My opinion - I like the company, and the niche it operates in. There’s clearly a big opportunity long-term. Getting digital marketing right is probably the key to growth, and being able to manage rapid growth whilst maintaining quality of service is vital too.

Which brings me on to valuation. I think this company, for where it currently is, might sensibly be valued at say £10-20m. The actual market cap is £36m, so I think it’s significantly over-priced at the moment, therefore it’s not of interest to me.

Barriers to entry are fairly low, for example I know plenty of private individuals who teach online, one-to-one. With Zoom, and other platforms, it’s quite straightforward to teach online. Although I appreciate that Wey has a much wider offering, with the ability for students to confer, and various tools to allow the teacher to monitor & control a class online.

My other reservation, is that I’m not convinced Wey are ambitious, or aggressive enough, to make this into a really big company, therefore it might be overtaken by new entrants at some stage, possibly? Plus, as it grows, the likelihood seems to be that profit generated would be sucked into increasing overheads, and a larger marketing budget.

I can see why people like the concept, and the company, but for me, I’m lukewarm about it at the current high valuation, for what is a very small company, that’s only eked out a small profit this year.

.

.

Capita (LON:CPI)

Share price: 30.7p (up 18%, at 12:08)

No. shares: 1,669m

Market cap: £512.4m

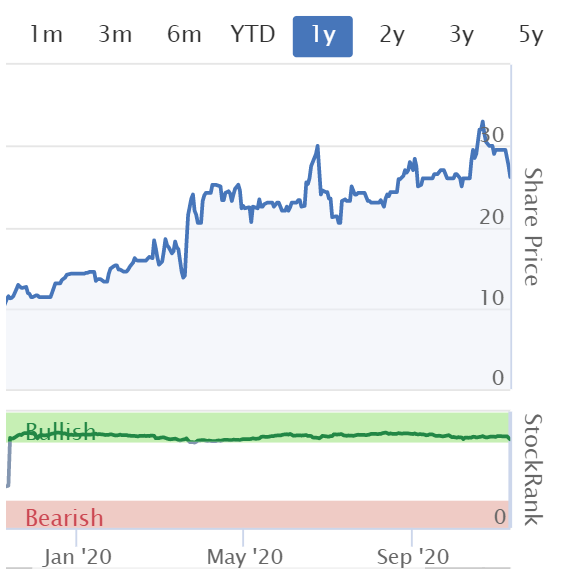

This is a sprawling outsourcing group, which manages a lot of services for Government. Check out the figures in the graphs below, it’s astonishing that such a large group is appearing in a small caps report, such has been the shareholder value destruction accomplished (see the dismal 5-year chart below);

.

.

.

Those little graphs tell us a lot;

- Huge, but declining revenues

- Lowish margins & erratic profitability

- Declining EPS trend

- De-rated from a PER above 20, to single digits

- Dividends have stopped

Trading update for Q3;

Trading in the third quarter was in line with our expectations at the time of the half-year results.

Q3 revenues down 11% to £803m

Adjusted operating profit flat at £66m (but the trouble is, this ignores a lot of costs - see the figures below from the last interim results, showing that adj PBT was just over half of adj operating profit)

The commentary for Q3 says;

The greater part of Capita’s revenues have remained resilient, with the vast majority of our colleagues able to deliver services for our clients. The year-on-year revenue reduction has been driven by both the impact of COVID-19, largely in our transactional businesses – such as travel and training - and contract losses announced in 2019. The revenue reduction this quarter has been mitigated through the cost actions we have taken over the last 12 months.

Disposal - discussions continuing re its education software business. Does anyone know what sort of price this might be sold for?

Outlook - uncertain, but continuing to trade in line with expectations.

Bank covenants mentioned (OK for 31 Dec 2020), which sounds like there might be a problem in 2021 perhaps?

Balance sheet - I checked the latest interim results, and Capita has one of the worst balance sheets of any UK listed company that I’ve seen. Intangibles (mainly goodwill) total £1,514m. Deduct that from negative NAV of £(87.1)m, and we get an alarming negative NTAV of £(1,601)m!

There’s loads of debt, with some needing to be repaid in 2021.

Going concern notes with the interims flag up that this share is a risky proposition at the moment;

Financial projections across a range of severe but plausible scenarios, in which downside risks are partially offset by appropriate mitigations, indicate that there is potentially limited liquidity headroom and a risk of insufficient headroom when assessing the Group’s future compliance with the financial covenants.

In considering the potential impacts of these projections, the Board has modelled the additional funds expected to be received from the disposal of ESS which is planned for 2020. It is the Board’s expectation that these funds will provide the necessary liquidity headroom to address any potential shortfalls arising in the downside scenarios evaluated. It is also the Board's expectation that these funds will provide for compliance with all covenants although in certain circumstances this headroom is potentially limited at June 2021.

The Board has confidence in the robustness of its primary mitigation (the ESS disposal) against these downside scenarios. The Group has several other options which are being actively pursued to provide further resilience in the event of a downside scenario. These include additional disposals and a refinancing of short-term maturities, which are discussed further below.

My opinion - this is too large and complex for me. Clearly it's a financially distressed special situation, so anything could happen. There looks a high likelihood that fresh equity is needed, to patch up a pretty disastrous balance sheet. That could involve a high level of dilution, as we’ve seen with some other financially distressed companies this year.

The going concern notes are very helpful, and demonstrate that the disposal of ESS seems very important.

For me, it's way too high risk, so I’m not interested.

I wonder if Capita is too big to fail, or if it might get nationalised, if it can't refinance in 2021?

My sector pick, for a risky outsourcing share, is Mitie (LON:MTO) which I've recently picked up, after reviewing it last week. Only a small position, as I hate this sector with a passion. But, it might do well from a return to work trend in 2021, maybe? Who knows, it's all guesswork to some extent.

.

I'll leave it there for today. Please see tomorrow's report for a new section on ZOO.

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.