Good morning, it's Paul and Jack here.

Agenda -

Paul's Section:

Gresham Technologies (LON:GHT) - a positive, ahead of expectations year end update. Repeated broker upgrades to forecasts throughout 2021 is good. Looks interesting. Valuation looks about right to me.

Shoe Zone (LON:SHOE) - very impressive results for FY 9/2021, following several positive updates in Oct-Nov. My initial view is positive, but I need to clarify an accounting detail about changes in the net lease liabilities, which may have boosted profits by £2.9m. I've lodged a call with the company, so hopefully they might get back to me.

Jack's Section:

Robert Walters (LON:RWA) - another profit upgrade from this international recruiter. The shares have rerated but the outlook remains positive, with ongoing signs of wage inflation, and it’s been buying back stock and investing in headcount. It suggests, on balance, that the good times might continue for a while yet.

Knights Group (LON:KGH) - another acquisitive legal and professional services company. Revenue is growing but the group makes an H1 loss after tax after accounting for contingent consideration payments relating to acquisitions. It is more expensive than some of its listed peers, while margins and ROCE have so far fallen, so I’m not yet sure why you would pick this one over the others.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul’s Section

Gresham Technologies (LON:GHT)

171p (pre market open) - mkt cap £143m

Gresham Technologies plc (LSE: "GHT", "Gresham", "Group", "Company"), the leading software and services company that specialises in providing solutions for data integrity and control, banking integration, payments and cash management, is pleased to provide a trading update for the financial year ended 31 December 2021 ("FY21").

Company’s summary -

…continued strong growth; revenues, earnings and cash ahead of market consensus

Highlights section looks impressive, although note how most of the growth has come from an acquisition (Electra, acquired on 22 June 2021, is performing in line with mgt expectations).

Although GHT also achieved an impressive 27% organic revenue growth (a record).

Note (below) the big difference in EBITDA, and “cash EBITDA”, due to capitalised R&D. The (lower) cash EBITDA figure is more reliable than the inflated £7.1m EBITDA figure, which is meaningless to me, because it ignores R&D spend.

.

**Group Adjusted EBITDA less capitalised development spend and any IFRS 16 lease related cash payments.

.

Diary date - 8 March 2022, for FY 12/2021 results.

Cash - sounds healthy. Software companies tend to get paid up-front, so enjoy a favourable working capital position -

The Group finished the year with net cash and cash equivalents of £9.1 million, well ahead of market expectations. This is due to very strong Q4 cash collection, lower cash spend on exceptional acquisition related costs during the year than originally expected, and improved operational leverage within the Clareti business flowing through to cash generation as it continues to scale.

Outlook - excellent visibility of contracted revenues here -

…Looking ahead, with a strong pipeline, a great client base and a business model that gives us in excess of £37 million of 2022 Group revenues already under contract, we are very well placed to take advantage of the growing market opportunity."

Forecasts - I haven’t seen any updates this morning yet, but the broker consensus graph shows a very positive progression of forecast EPS, possibly helped (partially) by the acquisition of Electra in June 2021 -

.

Stockopedia shows the forward PER as 28.5 - not cheap, but growing software companies often look expensive on value metrics. Today’s update is ahead of expectations, which should see consensus earnings forecast increase - hence perhaps justifying a high PER.

My opinion - neutral, because the valuation looks up with events.

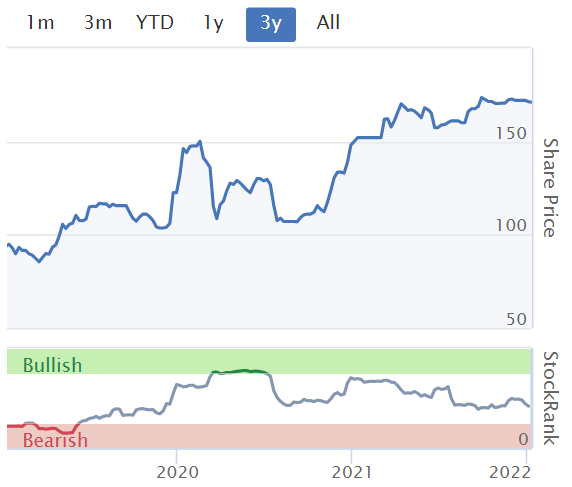

Repeated forecast upgrades throughout 2021 looks bullish, which has been reflected in a buoyant share price.

.

Shoe Zone (LON:SHOE)

127p (up 8% at 08:28) - mkt cap £

Preamble - This share has done tremendously well (roughly doubling) since a turning point in early Oct 2021. All the more impressive, given that many small caps have been suffering badly over that timeframe, with a general market correction in UK small caps.

I was late to the party, but gave it a thumbs up here on 1 Nov 2021, when SHOE raised guidance again for FY 9/2021.

.

As you can see from the 3-year chart above, the share price of SHOE is still well below pre-pandemic peaks. It’s essential to check the share count for all companies, and see if there’s been dilution over the pandemic period. SHOE has not issued new shares, so the share count has been static for years now at 50m. This is a key advantage of investing in owner-managed businesses, which tend to be very reluctant to issue new shares, and often run a more prudent balance sheet, providing safety in downturns.

Whereas CEOs that are hired hands, and have only small shareholdings, tend to be motivated more by empire building through acquisitions, issuing shares willy-nilly, and then enjoying bigger salaries, bonuses & share option payouts from running a larger business, before they move on, sometimes having destroyed shareholder value with botched acquisitions that turn out to be not what the company thought they were buying.

This is why management having meaningful skin in the game (personal shareholdings) is so important, and often results in better outcomes for outside investors like us. As with everything in the stock market though, sometimes generalisations work, and sometimes they don’t!

I wonder if there are any studies which provide the statistical proof on whether big management shareholdings result in better outcomes for all shareholders?

Wow, these numbers look great!

The CEO gives a good summary -

Shoe Zone had a very successful year due to the incredible hard work of our teams, by reducing costs, reducing non-essential capital expenditure, continuing to accelerate investment in our digital business alongside improving and streamlining operations.

Profit before tax was at £9.5m for the Period (2020: £14.6m loss) with an earnings per share of 14.0p (2020: (23.8)p loss per share)

This is despite FY 9/2021 including the lockdown in early 2021, so SHOE’s stores (the bulk of sales) traded for only 36 weeks out of 52. However, it will have benefited from Govt support measures (esp suspension of business rates, which is a big amount when you have 410 stores), and migration of some sales online.

Digital is becoming more important, and is now a key focus, as mentioned in a previous trading update. I’d like to see how they calculate the “contribution” of £8.5m. In retailing, “contribution” is usually defined as the profit an individual store makes, before allocating any central overheads. I’m not sure how that would work for online sales, because some central costs (warehousing, and staff) are core costs for online operations.

Online sales should be very lucrative for SHOE, because it has a high gross margin on product, and a very low returns rate of only 8.4%. That’s fantastic, and should result in this becoming a highly profitable eCommerce business, as well as having a store estate with low overheads, short leases (average length only 1.9 years), and cheap fit-outs. A very attractive business model I reckon.

In the new financial year, the split of online/store sales might change, since (we hope) stores might be able to trade uninterrupted in future. Obviously though if you’re more cautious about covid than I am, then at least you have the reassurance that SHOE has traded fine through previous restrictions. That’s assuming Govt would repeat support schemes though, which they might not.

I do like companies which navigated the pandemic without needing to do crisis fundraisings, it improves risk:reward for investors, since we know the company could cope with another crisis, due to its track record.

I won’t cover absolutely everything in these results, am just picking out key points, including -

Store closures - net closure of 50 unprofitable locations. That’s a strikingly high number, and shows the benefit of a flexible store estate with short leases.

Balance sheet - looking much better, with NAV almost doubling to £23.4m at 30 Sept 2021, from £12.4m a year earlier. The accounting is conservative, e.g. no capitalisation of intangibles.

Note the pension deficit, which has reduced from £10.6m to £5.9m. However, the cashflow statement shows a cash payment of £1.5m for the year, so it’s still a significant negative.

Lease asset/liabilities - the net deficit on the IFRS 16 balance sheet entries has reduced from £15.0m last year, to £12.1m at 30 Sept 2021. I have a feeling this might go through the P&L, because I can’t see anything relating to leases in the Consolidated statement of total comprehensive income - which shows the reconciling items that by-pass the P&L, such as re-measurement of the pension scheme, and movement in fair value of cash flow hedges.

I’ve left a telephone message with the company, to query this point. If I’m correct, that the P&L has benefited from a £2.9m reduction in the lease net liabilities, then that’s material to profitability, and would correspondingly boost EPS too. I’ll update if/when I’ve had a chance to clarify this with the company.

Cashflow statement - this is absolute nonsense, thanks to IFRS 16. The supposed cashflow from operating activities is £30.1m, but further down, there’s an outflow of £(20.0)m relating to “Capital element of lease repayments”. That’s an essential manual adjustment, so the real world cash generation before (modest £1.4m) capex, is £10.0m - pretty good.

Dividends - now the CLBILS (covid) loan has been paid off post period end, SHOE is able to recommence divis. I imagine that mgt is likely to be prudent over future divis, and want to keep a bigger cash buffer on the balance sheet, having sailed close to the wind in 2020.

My opinion - on an initial review, this looks very good indeed.

I need to clarify the point about a possible £2.9m boost to profits from a reduction in net lease liabilities, so will reserve judgement for the moment.

I’ve printed off the full announcement, so will attach it to my clipboard, and spend an hour or so in a comfy chair, properly going through everything more thoroughly.

Hence if you are interested, do check back later, to see any additional comments here.

.

EDIT: added to the article at 13:03 -

Additional comments - I’ve properly read the results RNS now, and also read the Zeus note out today (thanks for flagging, matylda in the comments).

Net cash is very healthy, at £14.6m, and the company confirms all rents & creditors are up-to-date, so securely funded now.

Rents - annualised savings on lease renewals of £1.8m, an average reduction of 53% - that’s a huge reduction in percentage terms (remember the £1.8m would only relate to some stores, not all stores). Therefore rent reductions should provide a good tailwind for future years’ profits, as rents adjust to more realistic, lower levels.

Dividends - as I suspected, the company confirms that divis will be “modest”, so don’t expect a big yield here in the short term, although that could improve longer term.

Returns process - for online sales, is “very efficient”, and the “vast majority of these are returned to store” - this sounds ideal, as it avoids postage costs for returns. This hybrid model, of having an extensive stores portfolio, which assists online operations by handling returns at no additional cost, looks perfect to me. Much better than pure play online retailing, arguably.

Gross margin for product is very high, at 61.5%

Provisions - I’m tied up in knots on this! The commentary says that an additional provision was made (i.e. a cost through the P&L) of £1.2m relating to store closures. However, I’m not sure if that relates to the IFRS 16 entries or not?

Zeus forecasts - an update note today says that profit was boosted by £1.1m from the release of provisions not needed. Hence Zeus uses an adjusted profit figure of £8.4m, instead of the published £9.5m, a reduction in profit of 12% from the number investors are probably using to value the company.

Zeus uses an adj EPS figure of 13.5p, which is 4% less than the published 14.0p EPS number from the company. I have lodged a query with Zeus’s analyst as to why their model has a £0.9m tax adjustment specifically for the £1.1m “exceptional” profit from provision releases, which doesn’t look right to me. Hence I suspect the adj EPS number should be about 12.3p, which I get if I take 12% off the published EPS number of 14.0p.

In future, Zeus has forecast 10.6p for the new financial year, FY 9/2022. The current share price is about 138p, so that’s a PER of about 13.0 - good value I would say, if you think (as I do) that the forecasts look beatable.

It’s very difficult for us to do forecasts, because there are so many moving parts here - adding back in additional revenue from 52 weeks trading, reducing some rents, business rates kicking back in, higher utilities & wages costs in future. You only have to make a small mistake, and the forecast numbers can be wildly wrong.

My opinion - is positive. I could see this share rising back up to 200p pre-pandemic levels in time. That’s because it’s a better business now - having closed many loss-making shops, getting huge reductions on rents on lease renewal, and with less competition. Plus the online business looks fantastic - growing well, high margin, and with low returns rate (which are mostly handled at minimal cost through the store network).

I think I've talked myself into buying a starter size position for my personal portfolio, at some point when funds permit.

Jack’s section

Robert Walters (LON:RWA)

Share price: 810p (pre-open)

Shares in issue: 76,612,035

Market cap: £608.3m

It’s a case of ‘another day, another ahead of expectations update’ from this recruiter. Labour markets are tight people appear to be searching for fresh starts, so it’s been a positive period for recruiters across the board. Importantly, despite the reratings, this shows no signs of slowing.

Broker EPS forecasts have struggled to keep up with the improving conditions so far.

Group net fee income for the full year was up 21%. Following a strong quarter including a record December, trading is now comfortably ahead of current profit expectations.

Momentum has remained strong, with group net fee income up 39% at constant currency, and ended ‘very strongly, with a record December performance’. Some 83% of net fee income is now generated by international business, so there’s good geographic exposure.

Gross profit / Net fee income figures at constant currency:

- Asia Pacific +56% to £44.8m,

- Europe +36% to £27m,

- UK +7% to £16m,

- Other International +48% to £7.3m.

Permanent and interim recruitment activity were the strongest drivers of growth as organisations continued to hire for the longer-term. Contract and recruitment process outsourcing also grew very well.

Asia Pacific - buoyant despite lockdowns in parts of the region. Strong performers in the quarter include Japan and Australia (the two largest and most profitable businesses), which were up by 63% and 40% respectively year-on-year. Indonesia, Hong Kong, Singapore, and China all did well.

Europe - the group’s two largest markets, France and the Netherlands, were up by 23% and 44% respectively. Belgium, Spain, and Germany all strong with NFI up more than 40%.

UK:

Candidate shortages continued to drive heightened competition for talent across both London and the regions with the legal, commerce finance and technology disciplines particularly active.

Other International (the Americas, South Africa and the Middle East) - NFI across Brazil, Chile, and Mexico jumped 115%.

Robert Walters, Chief Executive, commented:

The fourth quarter was another very strong period for the Group with net fee income increasing by 39% year-on-year. We are seeing candidate shortages across all locations and disciplines, a fierce competition for talent and wage inflation kicking in which together create huge opportunities across the recruitment market.

Conclusion

Another strong performance in a sector that continues to benefit from tailwinds. Stocks have rerated, but the question is whether or not we are partway through a recruitment cycle that has further to run.

With wage inflation looking fairly secure and an active labour market, recruitment is an area is a promising (but ultimately cyclical) area. And of those stocks, Robert Walters presents itself as one of the best candidates in my opinion. The group continues to invest in headcount, has growing operations across multiple geographies, has a solid net cash position on the balance sheet, and has been buying back stock.

It’s high up on my watchlist so I actually would have personally preferred the company wasn’t updating the market quite yet -I hadn't realised we'd get a Q4 RNS so soon after December's update. Let’s see how the market reacts.

Knights Group (LON:KGH)

Share price: 420p (+2.44%)

Shares in issue: 83,892,589

Market cap: £352.3m

Knights is a legal and professional services company, which is looking to grow organically and acquisitively. This shift was catalysed by a law change a few years ago seeking to break the barriers to ownership of law firms, which continues to spur M&A activity in the sector.

Highlights:

- Revenue +29% to £59.7m (including organic growth of 9%),

- Gross margins up from 46.4% to 48%,

- Underlying PBT +26% to £7.6m and underlying PBT margin of 12.6%,

- Reported PBT of £0.8m compared to a loss of £1.1m,

- Underlying EPS +18% to 6.98p,

- Net debt of £23.3m (FY21: £21.1m) after £7m of acquisition costs,

- Dividend reinstated with interim divi of 1.46p.

There’s a notable gap between underlying and reported profit levels. Knights actually generated a loss after tax of £1.7m in the period. The difference between the two PBT figures is £1.9m of amortisation and £4.8m of ‘non-underlying costs’.

Of that £4.8m, £3.2m was ‘contingent consideration treated as remuneration’ relating to acquired businesses which extend over periods of one to three years and are ‘significantly in excess of market salaries’. Some nice payouts there, but I can understand to some degree why they are stripped out of underlying results.

Knights was also loss-making in H1 21 but was profitable for the full year. Consensus FY22 EPS forecasts appear to be for around 22p, so today’s 6.98p of underlying EPS leaves some catching up to do in H2. Management does indicate a typical H2 weighting:

We anticipate good trading in the second half, which will be against a stronger comparative, and we continue to expect our typical second half weighting… We are confident in delivering a full year performance in line with market expectations.

Four acquisitions were completed in FY21 and the following six months have seen the integration of Keebles and Mundays, strengthening its presence in Yorkshire and the South East, while the acquisition of Archers sees the group enter the North East.

Group CEO and 20% shareholder David Beech comments:

Our outlook for the medium term is positive with recruitment supporting good levels of organic growth, and with further acquisition opportunities. We continue to build on the critical mass we achieved last year, further cementing the strong position we have built in key markets for legal services outside London.

Knights talks about how its increasing breadth, scale, and national coverage is allowing it to recruit senior talent from Top 50 firms. A post-lockdown reappraisal of work life balance and commute times is also helping.

An interesting tidbit regarding UK wage inflation:

[Our regional business is] not currently seeing the same salary inflation issues which are affecting London and major city professional service businesses.

Strategy - one of consolidation, much as you would expect if you’ve encountered these firms in the past:

Our recently agreed £60m revolving credit facility provides significant headroom, with net debt having stood at £23.3m as at 31 October 2021 (FY 21: £21.1m), to continue to scale our business across the UK organically and through selected acquisitions, as we further strengthen our position as a leading legal and professional services business outside London.

Balance sheet - assets show intangibles up from £68.3m to £75.8m but down as a percentage of total assets (from 43.4% to 39.6%). The current ratio is healthy at 2.36x, up from 1.88x a year ago, and cash conversion is above 100% which is somewhat reassuring given the likelihood of debt-financed acquisitions.

Conclusion

Meeting consensus EPS figures would value the shares at 18.7x FY22 earnings per share.

There are a few legal and professional services companies looking to grow organically and acquisitively at the moment. I suspect they won’t all be winners. Of those I’ve encountered, K3 Capital (LON:K3C) looks intriguing given it appears to have more scalability in its model, and I hold Rbg Holdings (LON:RBGP) which looks fairly cheap. Gateley Holdings (LON:GTLY) also looks like a sensible outfit. Most of these have lower valuations and PEGs as well.

Where does that leave Knights? It’s slightly larger, which means it might be more stable but could also have to fight to protect market share from smaller aggressive competitors. The group’s scale does bring benefits, and it has invested in its acquisition engine as it vets ‘a growing pipeline of acquisition opportunities’.

Acquisitions can be tricky to do right though, and Knights’ margins have fallen since listing (as have returns on capital) so I’m not yet sure how much value is being added.

And then there’s a complaint that applies to all of these companies - high staff costs (about 63% of revenue for Knights) and the potential conflict over whether profits go to shareholders or colleagues. The high contingent consideration payments suggest talent is not shy about demanding (and, indeed, is highly trained and skilled at) negotiating their part of the pie.

So I’m slightly conflicted on these businesses, although I do see an opportunity that a few listed companies are attempting to take advantage of. Of those though, I’ve not seen enough from Knights to make it stand out.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.