Good morning from Paul & Graham!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom),

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

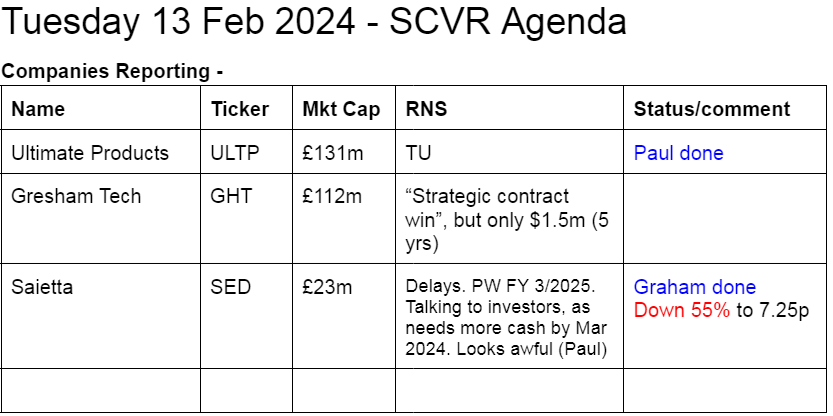

Thin pickings today so far -

Other mid-morning movers (with news) -

Belluscura (LON:BELL) - up 8% to 21.5p - Distribution agreement with Sunset HealthCare (USA & global). Nothing said about contracted or expected sales quantities or margins. Will be interesting to see if the hype turns into reality or not. Heavy historic losses, and it’s trying to raise cash through buying a cash shell with paper.

Cornerstone FS (LON:CSFS) - up 7% to 32.0p - receipt of regulatory licence, so can now operate in Canada, to accelerate growth (medium to long-term).

Dispensa (LON:DISP) - down 69% to 0.29p (£2m) - only floated in Sept 2022, but says today it plans to de-list. Auditor resigns with immediate effect. We didn’t have the pleasure of reporting on this share, so now can cross it off our to do list forever!

Summaries

Saietta (LON:SED) - down 53% to 7.58p (£11m) - Commercial Update (PW) - Graham -BLACK (profit warning flag) - RED on fundamentals

If there was a category below RED, Saietta would be a strong candidate for it. Cash is rapidly running out as the company reveals that a contract manufacturing job in Sunderland won’t be happening, and it sells the production line. Endless talk about possible contracts.

Ultimate Products (LON:ULTP) - unch 148p (£131m) - Trading Update [in line] - Paul - GREEN

H1 TU says revenues down 4%, but has recouped the shortfall through efficiency gains & lower freight costs. FY forecasts left the same. Looks a well-managed value share, with an attractive yield of 5.5%, and talk now of doing potentially quite sizeable share buybacks. We like this share here, and remain at GREEN.

Paul’s Section:

Ultimate Products (LON:ULTP)

Unch 148p (£131m) - Trading Update - Paul - GREEN

Ultimate Products, the owner of a number of leading homeware brands including Salter (the UK's oldest houseware brand, est.1760) and Beldray (est.1872), is pleased to announce its trading update for the six months ended 31 January 2024 ("H1 2024").

Full year profit performance in line with current market expectations, planned share buy backs in-line with new capital allocation policy

H1 revenues down 4% to £84.0m

Reasons - strong prior year comp (demand for air fryers), supermarkets ordering less due to overstocking, and “modest” delays recently due to supply chain disruption (interesting to hear this mentioned, I wonder if more companies will start reporting problems with global shipping having to re-route around Africa instead of via Suze?)

Improved operating profit margins, helped by lower freight costs, and improved productivity.

Outlook improving for 2024, as issues above subside.

Net bank debt: EBITDA is now 0.4x (down from 0.7x end July 2023). Remained below 1.0x even during seasonal peak - excellent reporting, we need more of this from all companies, not just a year end snapshot (often unrepresentative of normality).

Capital allocation policy - 50% of earnings to be paid out in divis - but that looks to be pretty much what the company has already been doing in recent years. Supplemented with share buybacks. Maintain bank debt at c.1.0x EBITDA. That all sounds sensible to me. Equity Development estimates there could be substantial scope for buybacks of c.10% of the issued shares, so this could become significant.

Outlook FY 7/2024 -

The Board anticipates a full year profit performance in line with current market expectations*

* Consensus market expectations for the financial year ending 31 July 2024 are, adjusted EBITDA of £21.6m and adjusted EPS of 15.6p.

This is flat vs FY 7/2023, and similar to FY 7/2022, so the risk is that investors might start to view ULTP as ex-growth? Although to be fair, that’s how it’s priced already, on a forward PER of only 9.0x, and a divi yield of an attractive 5.5%.

I like the idea of doing buybacks at this modest valuation, which would enhance EPS and DPS.

Paul’s opinion - I’ve been impressed with how ULTP skilfully navigated major pandemic-related problems. When you talk to many companies, management point out that they don’t know what “normal” is any more, as the last few years have been constant crisis management. For that reason, I’m not worrying too much about the disruption of the Suez Canal route for shipping, they should be adept at handling problems like that. It seems to be adding about a fortnight in delays for some products, hardly a disaster, and customers will probably order earlier, which might help to give a boost and recoup some of the reduced revenues in H1.

Overall, ULPS is a simple share to understand, looks well-run by owner-management, and seems to have fully recovered from the mishaps which caused the shares to plunge in 2018, soon after floating. It’s a better, larger business now, with a good track record, and priced on a PER of only 9.0x, I can only give it a thumbs up, so GREEN again.

Graham’s Section:

Saietta (LON:SED)

Share price: 7.58p (-53%)

Market cap: £11m

Paul and I have been consistently and frequently RED on this share, most recently on 29th December 2023 when Paul said:

I remain extremely negative, because the company is a big cash-burner, but seems to limp along from one fundraise to the next, with no discernible commercial progress apparent in the figures yet, other than talk about orders, etc.

Today’s news, as you can tell from the share price reaction, is not good.

First, the company has received an offer of £600k for a redundant production line at its Sunderland facility. It seems that the offer will be accepted:

This sale is a result of the Company being unable to reach commercial agreement on an electrical steering pump contract manufacturing opportunity at its Sunderland facility, announced previously.

This contract was supposed to generate £58m of low-margin revenues for Saietta over the next four years. Won’t be happening now.

Second, we have an update on the Indian joint venture. There are three contract opportunities with a major customer, and the status of each opportunity is as follows.

1) purchase order received, pilot production underway, commercial production expected October 2024.

2) purchase order received for pilot, pilot production expected July 2024.

3) purchase order hoped for by end of March 2024.

The company refers us back to their announcement of 27th Nov 2023.

I’ve checked this announcement and it seems to me that even in the case of 1), with commercial production “expected” in October 2024, that this is not yet entirely in the bag and it depends on the success of pilot production.

I also note that the 27th Nov announcement included a fourth contract opportunity with this customer, and it’s not mentioned today - presumably because there is no progress.

Third, Saietta are “in discussions” with another customer about another potential sale. They are hoping for a “proof of concept” letter by the end of next month.

My conclusion from the above is that nothing much has happened in terms of orders and sales. The company continues to hope for contracts being signed and to make plans for pilot production, but I don’t think there are in fact any large non-pilot orders.

Working capital

The company needs more cash soon, and results in FY 2025 are likely to be worse than previously planned:

As previously stated, the Company has positive cash balances that take it through to the end of March 2024. The Company continues to engage with all its stakeholders regarding its funding requirements beyond the end of the quarter.

The Company remains confident in its financial forecasts for the financial year ended 31 March 2024 as set out 27 November 2023, however forecasts for the subsequent financial years will inevitably be impacted by today's update.

CEO comment

The CEO is taking the line of argument that Saietta didn’t really want the contract manufacturing opportunity anyway:

…Being unable to agree terms on a contract manufacturing opportunity is no reflection on the quality of the Company's products. The sale of the redundant production line in our manufacturing hub in Sunderland (UK) makes sense for Saietta in comparison to a relatively low margin contract to manufacture a non-core product under license. This route allows Saietta to remain 100% focused on our strategic focus of providing proprietary eDrive solutions to manufacturers of lightweight electric vehicles…

Graham’s view

There is a space in the market for pre-revenue/early-stage companies, but I dislike the practice of posting dates and indicative contract values for contracts that have not yet been signed and may never be signed.

Some investors may feel that there is a benefit to having the company set out its goals in this way, but I would argue that it’s better to be approximately right than to be precisely wrong - even if this means a company should admit it doesn’t really know when contracts with customers will be signed and how much they might be worth. Maybe a wide range of possible values could be given instead.

As the company’s cash balance dwindles, only the brave and the well-off will be hanging around to see what happens next.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.