Good morning, it's Paul here with the SCVR for Tuesday.

Timings - I'm running late today, so finish time about 3pm. To avoid getting side-tracked & stressed out, I won't look at any reader comments until I've got my main work done.

Today's report is now finished.

Agenda - this is what has caught my eye in today's small cap results & trading updates;

French Connection (LON:FCCN) (I hold) - Interim results, 6m to 31 July 2020

Scapa (LON:SCPA) - Period end trading update

Onthemarket (LON:OTMP) (I hold) - Interim results, 6m to 31 July 2020

Marshall Motor Holdings (LON:MMH) - Trading update

.

French Connection (LON:FCCN)

Share price: 7.8p (down 12%, at 11:11)

No. shares: 96.6m

Market cap: £7.5m

(I hold)

"Majority of Trading Period Impacted by COVID-19 Pandemic"

French Connection Group PLC ("French Connection" or "the Group") today announces results for the six month period ending 31 July 2020.

NB. This is a special situation. i.e. it should not be seen as a normal investment, but instead the loss-making retail stores are being wound down, which eventually should leave a profitable wholesale, and licensing business. The question is whether the balance sheet is strong enough to enable the company to get to that position without going bust. Obviously covid has made things orders of magnitude worse, which has been reflected in the bombed out share price. Therefore equity should really be seen as akin to a call option on the business surviving. Most investors will find this too risky to contemplate, which is a perfectly valid opinion!

The reason I still cover it here, and indeed have a reasonable size position in my personal portfolio (I've bought more since covid), is because I reckon the core (brand licensing & wholesale) business could ultimately be sold for about £50m, once the retail division has been reduced to breakeven, or closed altogether. This compares very favourably with the £7.5m market cap, and no threat of dilution to shareholders. So if I'm right, then this could be a fairly serious multibagger. That's why it's interesting. It's not as risky as people might imagine, because there's no immediate threat of insolvency;

Going concern - the last Annual Report contained a "material uncertainty" over going concern. However, this has now been withdrawn, because FCCN refinanced with a new £15m asset-backed lending facility from Hilco. This was arranged in July 2020, for 2 years, and is sufficient for the company's funding needs, hence going concern is now restored. That greatly de-risks things for shareholders, for the next 2 years anyway. For me, 2 years is long enough to see whether this is going to work out well, or badly, so I'm happy with the position.

CVA? - why management haven't done a CVA, I simply cannot fathom. Now that restructuring specialist Hilco is involved (providing a £15m working capital facility, that so far seems to be undrawn), then I hope they nudge FCCN towards ditching its loss-making retail sites in a CVA, once and for all. Rather than piecemeal disposals as leases expire.

.

.

Here are my notes of the key points, jotted down whilst reading the interim results;

- H1 is nearly always loss-making for FCCN, as it has a seasonal weighting towards profits in H2

- Due to covid closing its own & franchised stores, plus its wholesale customers' stores too, these figures for H1 are awful

- Revenues down 53% to £23.9m

- Underlying loss of £(12.2)m - this includes a £3.1m provision against inventories - clearly a lousy result, but did anyone expect better, considering the business was closed or limping along for much of this half year?

- Permanent closure of 9 stores in H1. It now only operates 72 stores/concessions, so good progress is being made on winding down retail, the problem part of the business. Total retail space (including partners) is down 23% to 124,300 sq. ft. - quite a rapid decline, which is good

Cash is king - there's still £5.2m in the kitty, and no debt. (down from £10.0m LY). Plus it has an undrawn (I think, though this is not explicitly stated) £15m borrowing facility from Hilco. Therefore liquidity is fine for now. No risk of insolvency, and no need for an equity fundraising

Current trading in line with expectations at time of the refinancing in July. NB ignore the broker forecasts, as they are out of date, which renders the StockRank unusable until fresh forecasts are provided by brokers

Online sales growing, but only at +8.1% in H1 (but this includes a slow period at the start)

Licensing income down, to £1.5m in H1 - still a useful amount. H2 should be higher, as licensing partners are retailers, hence have also been hit hard by covid in H1. DFS sofas branded French Connection doing particularly well. Licensing is where the brand value shows through, hence the hidden value in the shares

Gross margin has collapsed - this does concern me. Only £3.6m gross profit made in H1, vs £21.8m in H1 LY. This includes a stock provision for surplus stock, but also implies to me that the company had to heavily discount to clear excess stock. It might also have had to offer discounts to persuade wholesale customers to pay up?

The all-important balance sheet - can it ride out this storm without sinking? In a word, yes. NTAV still decent, at £16.0m. Current assets: £46.5m, current liabilities: £33.1m - that's a healthy position. No long term debt, other than lease liabilities, plus of course the undrawn £15m Hilco borrowing facility. This business is financially sound for the next 2 years.

Leases - a big reduction in liabilities, which is helpful. In this case, IFRS 16 is quite helpful, because I reckon it's safe to assume that almost all the stores are likely to be loss-making at the moment. Hence £7.1m lease liabilities in current liabilities should be the annual rent roll. That's down from £10.7m a year ago, suggesting that the company has got rid of some big, problem leases. I know that its Oxford Street store, on the opposite corner from Selfridges, is now gone, and that was a disaster, with rent of over £2m p.a. I believe. This is encouraging stuff.

The long term lease liabilities figure is now only £17.7m, which isn't that much of a problem any more. It suggests that put together, leases on average have about 3.5 years left to run, before the problem retail division is gone. Overall then, the end is in sight for the retail division losses, if we look forward a couple of years. Hopefully the company will see the sense in doing a CVA, to fix the problems sooner, in one go.

My opinion - at this point, ie. ignoring the past, I think risk:reward here is actually quite good. The market cap is miniscule at £7.5m, yet the business has plenty of liquidity, even holding cash of two thirds of the market cap. I'll have to go through the commentary in more detail, as I only have time to skim read it when writing up these reports.

A key thing will be how well the business recovers in H2. For the moment, Governments seem to be targeting hospitality, rather than retailers, for tighter lockdown measures. There's obviously a danger that covid could spiral out of control over autumn/winter, and lead to new national shutdowns, which would clearly be awful for FCCN and other fashion retailers. But even then, it's got enough liquidity to ride out such a scenario, by drawing down on the Hilco loan, and it might push the company into finally doing what it needs to, i.e. a CVA, to ditch the leases.

I look at every share with fresh eyes. I.e. my spreadsheet doesn't even include my original cost price, because that doesn't matter to good decision-making. All that matters, is whether the share is worth more than the current price, in the most likely scenario of how the future might unfold. It's difficult to be certain, but I reckon the odds with FCCN are actually quite favourable, at the current price. The founder is clearly very motivated to maximise the value of the business, as he's well into his 70s now, and owns something like 45% of the business. Situations like that can often be quite lucrative (remember Avesco a few years ago, when the retiring founder achieved a takeover bid of about 6 times what we paid for the shares?)

I always get reader comments, saying that it's a tired brand, etc. If so, why are DFS sofas branded French Connection selling so well? And why do consumers pay premium prices for French Connection branded glasses, perfume, purses, etc? It's actually still a very relevant brand, which is probably worth multiples of the £7.5m market cap. That's why it's an interesting special situation.

To summarise then;

Upside case - takeover bid, and/or return to profits once retail division wound down, giving multibagger potential.

Downside case - slow death over next c.3 years, and Hilco sell the brand to BooHoo, with probably nothing left for shareholders.

I had to laugh at some of the press headlines - e.g. French Connection plunges on results. It's actually just given back most of yesterday's gain!

.

Scapa (LON:SCPA)

Share price: 133p (up 8%, at 12:15)

No. shares: 187.8m

Market cap: £249.8m

Scapa Group plc (AIM: SCPA) is today providing an unaudited period end update for the six months ended 30 September 2020.

This share has really perplexed me in recent months. It did a refinancing, trading updates have looked OK, yet the share price remained stubbornly bombed out, at a seemingly attractively low valuation, yet nobody seemed to be interested. Then you inevitably start thinking, do the sellers know something I don't? Maybe there's something awful lurking under the surface? The only worry I have on that front, is the legal action underway with ConvaTec.

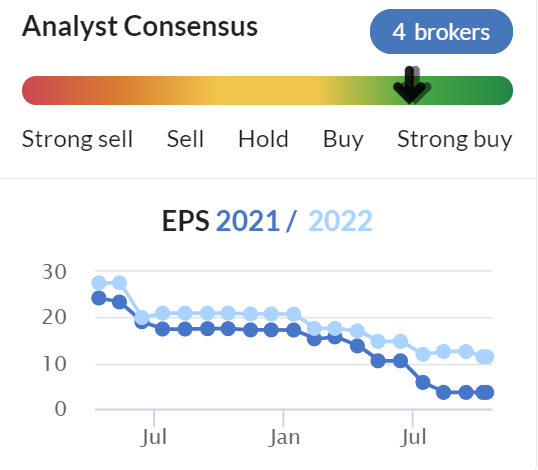

Also as you can see below, brokers have been steadily reducing forecasts, looking like bad news is coming out piecemeal;

.

.

Even so, if it gets back to say 10p EPS next year (forget this year, it's a one-off we hope), then the PER would only be about 13, which seems low for a decent quality business. Plus you've then got all the longer term upside, as hopefully again, earnings return to more normal historic levels much higher than 10p.

Today's update - sounds positive, but it only gives information on revenues. I want to know about profits! The bit below implies that profitability is doing better than expected;

Further to the AGM statement of August 2020, Scapa Group has continued to track ahead of its COVID plan.

Scapa now anticipates that FY21 H1 Group revenues will be ahead of the Board's expectations...

Broker updates - there's nothing available on Research Tree unfortunately. So we're in the dark - very frustrating, as this is a promising share that I want to own, but without proper information, how can we jump into it blindly? Companies and brokers really need to focus more on getting information out to retail investors. After all, its us lot that creates market liquidity, and therefore set the share price! To ignore that crucial part of the market is madness, yet it's a big oversight that many companies are guilty of, and some brokers actively pursue, for their own selfish interests.

Although on second thoughts, the broker consensus figures on Stocko do look up-to-date & credible.

There's a useful set of results slides on Scapa's website, which are worth a look. Hopefully the company can be persuaded to give a results webinar with future interim & final results, so that private investors get the same access as institutions, with Q&A, etc. I often find that the questions from private investors are just as clever as the ones from city analysts, at online webinars which I view. Remember also that many of us watch the webinar recordings later, so even though there might only be say 30 people live on the webinar, hundreds more will probably view it later. So these things are really useful - I'm very grateful to the sterling work being done by PIWorld, InvestorMeetCompany, and others such as Equity Development, to connect us with companies through online webinars. We need all companies to do these webinars. It's not expensive, and why should the institutions get favourable access, whilst retail investors are ignored?

H1 group revenues are about 24% down on last year. Is that good or bad? With no broker updates available, I'll check back to my previous notes here. Here are my notes from 7 Aug 2020 trading update. That update was much more useful. It said that full year trading profit was trending c.10% of market expectations. Today it doesn't say anything about trading profit. I find that confusing, to change the basis of what we're told, from one trading update to another. We'll have to wait about a month for a proper update;

Further details on expectations for the full year trading performance will be provided with the interim results on 17 November 2020.

Also, note the subtle change in tone. Today it says;

Further to the AGM statement of August 2020, Scapa Group has continued to track ahead of its COVID plan....

But in August it said a more positive;

Scapa has delivered FY21 Q1 revenues in the three months to 30 June 2020 well ahead of its COVID-19 scenario plan.

"ahead" instead of "well ahead" suggests maybe there's been a moderation in performance more recently? Or am I over-analysing it? Probably not, because a lot of work goes into the precise wording of trading updates, from companies and their advisers.

Net debt is £21.8m at 30 Sept 2020, compared with £18.4m at 30 June 2020, so slightly worse, albeit given the size of business, working capital fluctuations are to be expected, so I see this as being OK, in the same ballpark.

Last time I looked, the balance sheet was fine, because the company fixed the roof by doing an equity fundraising earlier this year.

Legal action - nothing is said about the ConvaTec case.

My opinion - I'm still kicking myself for selling this one through general anxiety about the share price being so soft. It's since recovered a fair bit, typical!

Brokers consensus is now 3.6p for FY 03/2021, rising to 11.4p FY 03/2022 next year. It still looks good value, if next year's figures are achieved, that's a PER of only about 12.

Providing there's nothing unsavoury lurking in the background, then this share does look good value. With a lot of business being in the USA, I wonder if it might attract bidding interest at some stage?

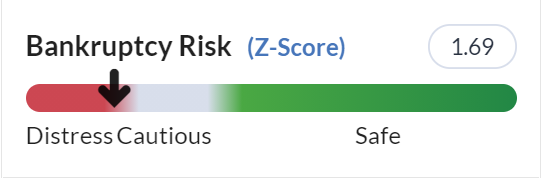

Note that the Altman bankruptcy score below is not great, however this will not yet have taken into account the equity fundraising that Scapa did earlier this year. For this reason, I think we can safely ignore this warning, but as always, it's good to check things out.

.

.

Onthemarket (LON:OTMP)

Share price: 97.5p (down 4%, at 15:33)

No. shares: 71.8m

Market cap: £70.0m

(I hold)

CONTINUED OPERATIONAL PROGRESS WITH CLEAR STRATEGY FOR GROWTH

OnTheMarket plc (AIM: OTMP), the majority agent-owned company which operates the OnTheMarket.com property portal, today announces its unaudited interim results for the six months ended 31 July 2020 ("H1 20/21").

This sector is obviously dominated by Rightmove (LON:RMV) (worth £5.8bn), then there's Zoopla, which was taken private at a staggeringly high price of £2.2bn by Silverlake Partners in 2018. Then we have OnTheMarket, valued at just £70m. This gives an idea of the potential upside, if OTMP manages to even half succeed in carving out a niche. Its key point of difference, is that estate agents own most of the shares, and free shares (with lockins) are used to entice estate agents to sign up from a free starter account, to a full price fee-paying arrangement. The concept is that estate agents are dissatisfied with the price-gouging market leader, Rightmove, hence would be receptive to helping kill it off by jumping ship to OTMP. That hasn't happened yet, because it's an all or nothing thing. Nobody can afford to leave Rightmove, because that's where the customers go. Although I reckon Rightmove is a highly risky share, as at some stage someone like Amazon, Facebook or Google, could set up a free property portal, do saturation advertising on their own platform, and kill Rightmove stone dead. Hence I would never be interested in owning Rightmove shares. Its grotesquely high profit margin looks too vulnerable to me.

Is OTMP just a wild punt then? Not really. It's small, speculative, but has a high level of properties on it, not far behind Rightmove actually. And these results highlights look pretty solid, given this covers the covid lockdown period;

.

.

Revenue up 28% in H1 vs LY, is impressive, considering the property market paused during this period, and that like other property portals, OTMP gave discounts to estate agents, thus reducing revenues. This implies strong underlying revenue growth, if you take out those factors.

More strikingly, it's moved from heavy losses, into profit. As the commentary explains, this was mainly due to deep cost-cutting. This is what I love about online businesses - as we saw recently with Sosandar (LON:SOS) (I hold), in tough times they can slash spending, most of which is variable - people and marketing, and thereby conserve cash. Then re-start spending whenever they want. OTMP has demonstrated the same point. That both SOS and OTMP both managed to usefully grow revenues, despite slashing marketing spend, does make me wonder if the marketing pounds were being spent wisely in the first place? Maybe not.

Cash has risen a little, which demonstrates that the business can tread water without burning cash. That's important, as bears on stocks like this often claim that they could never reach breakeven. These results prove them wrong. Although to really hit the bigtime, then OTMP would probably need to have a marketing budget running into 9 figures (£100m+). Maybe that would be worth doing though, if it drove a huge increase in revenues & established OTMP as a serious competitor to Rightmove? A private equity buyer might see that opportunity, who knows?

Guidance - this is useful, and reassuring;

The Group expects to achieve a broadly breakeven adjusted operating profit position for the full financial year.

Profit & loss can be dialled up or down, depending on the marketing spend. So this is more a statement of intentions in that regard.

New CEO - appointed, joining on 14 Dec 2020. I'm interested in meeting him, Jason Tebbs, who has plenty of sector-specific experience. It's all about having someone on board who can take things on to the next level, or innovate in some convincing way. I actually thought the last CEO was pretty good, and made some good improvements.

The logical next step for the new CEO would be to do a review of the business, and come up with a revised strategic plan, and raise a load of fresh equity to really step on the gas, in terms of expansion. I'd like to see some mechanism to persuade & better incentivise the estate agents, which are both customers and majority shareholders in OTMP, to market the portal to the public themselves. In the past, I've seen lots of estate agents have that symbol of OTMP (like a marker symbol, or a darts board with an arrow on it) in their shop windows, but who knows what it means? It didn't have the company name on it, just a meaningless symbol! Imagine if all estate agents started saying to every customer, don't look at Rightmove.com any more, everyone's moving to OnTheMarket.com - that's surely the way to get some traction? Plus tons of social media ads. TV ads? Well maybe if they're impactful, but in the past OTMP's efforts have been dismal in this regard.

Because I reckon a big placing is likely, I don't want to commit much to this share unless/until that is done. Hence I currently only hold a small position here (less than 1% of my portfolio).

Overall - it probably won't work, but if it does, then this share could be a serious multibagger. As today's results show, the company can run at a profit, and still grow, in a global pandemic - not too shabby really, is it?

.

.

As you can see above, the share price hasn't been a complete disaster.

.

Marshall Motor Holdings (LON:MMH)

135p (up 12%) - mkt cap £105m

I've run out of time today, but just a very quick note to say this car dealers has issued a strong trading update today. This is particularly striking, a big increase in FY guidance;

Targeting underlying PBT for the Year of £15m; previously break-even

We had a good update recently from Vertu Motors (LON:VTU) - so it appears this sector is doing well at the moment, pent-up demand probably. It could be worth looking at other car dealerships too, as we might be able to find a laggard that is overdue a similar rise in share price.

That's it for today. Thanks for the comments today. I'm happy with interesting discussion & views of all kinds. Just don't be obnoxious, or disruptive, and then we're all happy & harmonious!

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.