Good morning!

Graham here.

Viral thoughts

As you've probably noticed, markets are looking much more perky now, compared to three weeks ago.

Versus the recent lows:

- The S&P 500 is up about 25%.

- The FTSE-100 is up about 21%.

- The Euro Stoxx 50 is up about 24%.

(All indices measured in their own currencies.)

(Source:Stockopedia.)

Anecdotally, I am still seeing a lot of scepticism about these gains from commentators on Twitter and elsewhere.

As I said last week, the duration of "lockdown" measures is the most important unknown in the short-term, since many companies are closed for business until these lockdown measures are removed.

This is a truly unknowable variable - lockdown will only be ended when the combined weight of medical evidence and public opinion convinces national governments that it is feasible to make a change.

The data

I continue to check Worldometer for daily charts of coronavirus progression. The underlying data quality remains extremely poor, but these are the headline numbers which influence public opinion, so I think they're important.

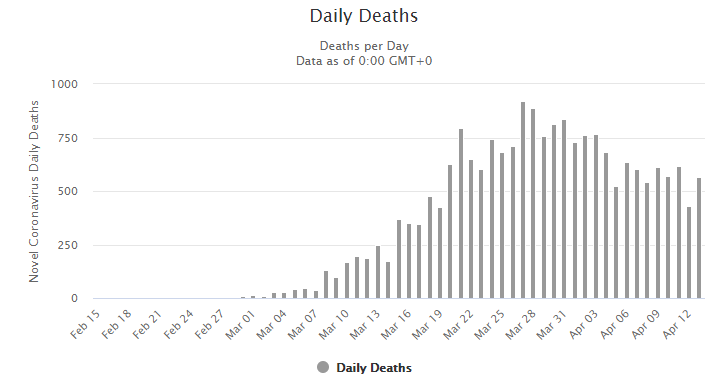

Itay has seen a steady decline in numbers dying with the virus in recent weeks:

New cases are falling too:

In Italy, "bookshops, stationers and children's clothes shops" are open from today. Factories might open again on May 3rd (I expect that they will since I think the peak of the coronavirus has been seen for Italy).

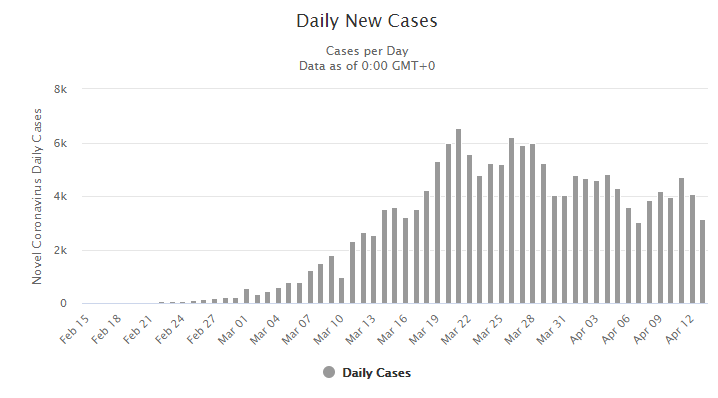

Deaths in Spain are on the decline too:

And new cases in Spain have plunged:

In Spain, construction and factory workers went back to work yesterday.

Elsewhere:

- Austria is reopening schools and some shops.

- Denmark is reopening primary schools and creches.

- Czech Republic has reopened hardware stores and a range of others, and is rumoured to publish its exit strategy today.

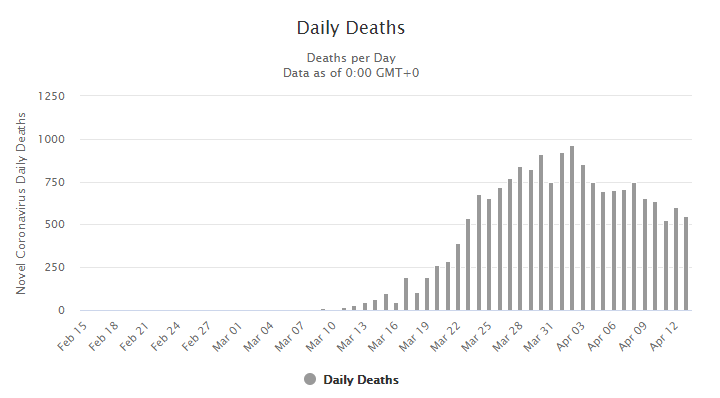

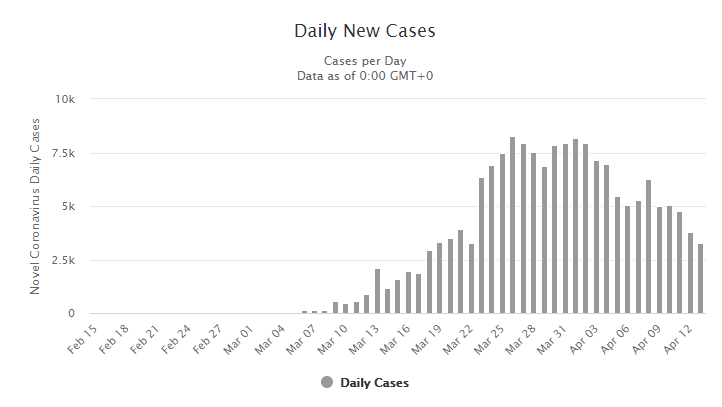

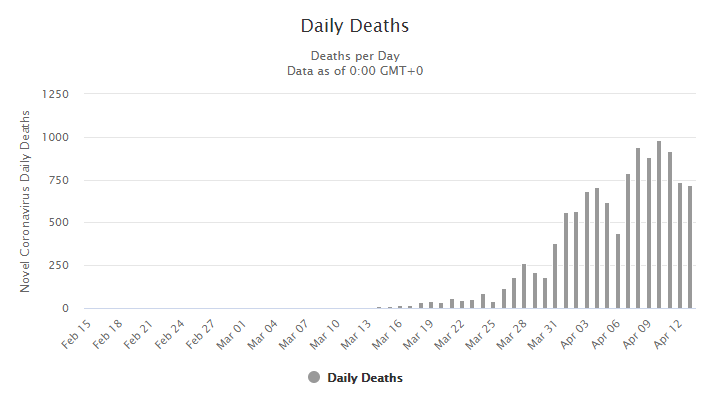

The UK figures show deaths still rising, though not at an "exponential" rate:

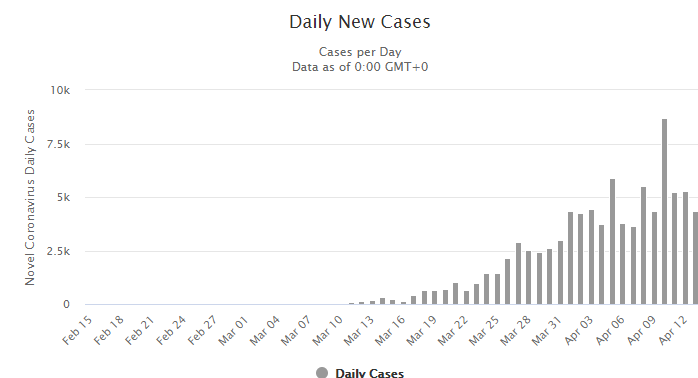

Barring the occasional daily spike, new cases in the UK suggest that exponential growth is now very weak:

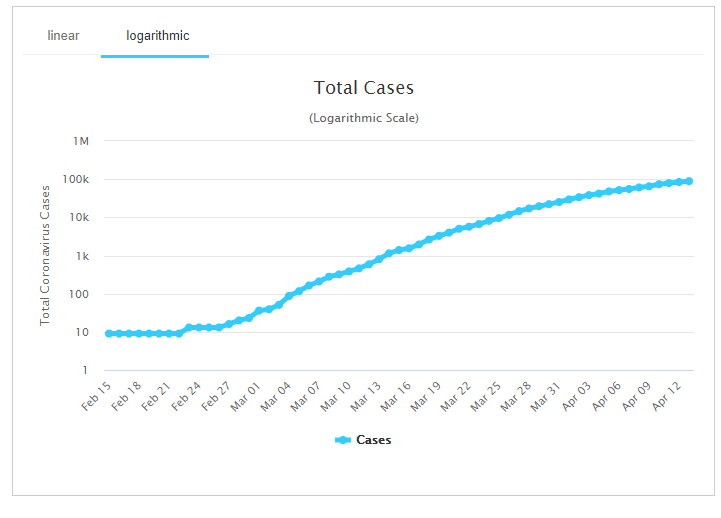

We can see this on a logarithmic chart:

From where I'm sitting, the main "risk" to lockdown ending soon is that there is a lag in the process.

The process is:

- data is published, suggesting that the virus is under control.

- the public mood shifts from fear to calm, and risk aversion goes back from elevated to normal.

- governments take steps to re-open the economy, before the bill gets even bigger.

According to the CEBR, the daily lost production under lockdown is worth £2.4 billion per day, or 31% of pre-lockdown GDP.

Portfolio decisions

I can't say I believe in making a lot of investment decisions around the Covid-19 story.

We have never had a virus-induced lockdown before, and who knows when we will see one again? Maybe never?

Anything is possible, but I doubt that this will become a regular occurence.

I do believe in companies with sound balance sheets. A company with lots of cash and low fixed costs can survive pretty much any crisis. You don't have to worry about refinancing risk (which often leads to wipeout, in periods of distress).

For companies with unsound balance sheets, I would stay away whether there is virus-induced lockdown or not. If the virus doesn't ruin them, something else might.

On the other hand, if a risky company raises money to fix its balance sheet, then it might be worth a second look.

For example, I looked at Carnival (LON:CCL) after its recent refinancing, to see if I could be tempted. While I do think its equity is interesting at these levels, it is still too risky for me (I would prefer the debt).

My main point is that if you have a long-term portfolio, or are building one, you need to put this virus situation in context: for 99% of your holding period or more, the Covid-19 crisis will probably be irrelevant. Act accordingly!

In my view, all that really matters during this lean period is balance sheet survival. So long as you know that your equity position will survive, you can move on and worry about other things.

The heavy supply of RNS announcements this morning is something to behold.

Next (LON:NXT)

In big-cap land, I note that Next (LON:NXT) (in which I have a long position) has started taking online orders again, "with support from colleagues who are willing and able to safely return to work".

The UK homepage says "NO MORE ORDERS, WE'RE OPEN AGAIN TOMORROW" as of 9am. It will take orders every morning, until its warehouse staff can't take any more without breaching the social distancing rules.

I'm not under any illusion that this will generate normal revenues. At least it will keep up some degree of customer engagement.

In small-caps, we have:

- Jarvis Securities (LON:JIM)

- Cake Box Holdings (LON:CBOX)

- Fletcher King (LON:FLK)

- Revolution Bars (LON:RBG)

Jarvis Securities (LON:JIM)

- Share price: 413p (+3%)

- No. of shares: 11 million

- Market cap: £45 million

I'm familiar with this company from a customer perspective and as a former shareholder.

It owns X-O, which is the Ryanair Holdings (LON:RYA) of stockbrokers: very low, fixed-rate dealing costs and very few other costs.

The most important cost feature is the absence of percentage-based administration fees

For example, the annual SIPP fee at X-O is £99 +VAT (there are other fees for drawdowns, dealing, etc.)

At Hargreaves Lansdown (LON:HL.), by contrast, the SIPP fee is up to 0.45% (capped at £200 for a portfolio of shares).

A large portfolio of funds at Hargreaves will pay vastly more in annual administration fees than a share portfolio at X-O.

Why do people pay so much for Hargreaves? I've never been a Hargreaves customer, but I think the reasons are:

- it's a trusted name

- very slick website

- lots of information for beginners and those who need help

- a wide range of funds available

At X-O, on the other hand, you get a "bare-bones" website and are left to your own devices.

Today's RNS

This is a very reassuring letter from the CEO.

Disaster recovery planning at Jarvis has worked as intended. Service has been uninterrupted.

Some staff are in the office, "only where absolutely required" and are adhering to safe working practices.

It gets better:

At the same time, we have seen an increase in trade volumes following the election result in December and the market volatility as a consequence of COVID 19; and believe the reduction in the Bank of England base rate should have a negligible effect on interest income.

Nice!

On a personal note, I've only made one trade since the COVID-19 crisis began. That was a long trade on the FTSE, which remains open. My share portfolio hasn't been touched.

But I can see that many investors have been trading more frequently than usual over the past six weeks.

Typically this involves selling shares and then buying them back, hoping to pay less when buying back but in any event waiting for the threat of economic catastrophe to pass.

I'm sure that some investors will do this successfully. Others will find that doing nothing would have worked out better. The only guaranteed winner is the broker, who is making money in both directions.

This is a theme I frequently mention, and it's extremely important right now: the financial services firms which benefit from volatility are currently in the most perfect of conditions. This includes IG Group (LON:IGG) (in which I have long position), Plus500 (LON:PLUS), CMC Markets (LON:CMCX) and little old Jarvis Securities (LON:JIM).

Dividend - there is no change in the plan at Jarvis to pay a dividend in June.

My view

There's no change to my view on Jarvis. It's a well-run, high-quality little company.

Perhaps I shouldn't have sold my shares in it several years ago. At the time, I started to question whether such a bare-bones platform could remain competitive against disruptive new entrants in the brokerage space, such as Degiro and IG Group (LON:IGG).

Jarvis did subsequently upgrade its website and its growth has been consistent. There is evidently still room in the market for a value broker, without any of the bells and whistles.

Cake Box Holdings (LON:CBOX)

- Share price: 122p (+8%)

- No. of shares: 40 million

- Market cap: £49 million

This is a retailer of egg-free cakes (not vegan, since they do have cream). It has a big focus on personalised cakes for parties:

Egg-free cakes have wide appeal, from what I gather. You can read about the founders here.

Using the franchise system, the company earns excellent returns on capital. It makes most of its money from selling sponge and cake supplies to its franchisees, and it also charges a small franchise fee.

As such, it gets a QualityRank of 96 from Stocko.

Trading update

- like-for-like sales growth of 5.1% in franchise stores up until March 8th (pre-COVID-19).

- the rest of March was obviously not great. All of the stores closed on March 23rd.

- adjusted PBT expected for FY March 2019 of £4.1 - £4.3 million (last year: £4.0 million).

Covid-19

- CBOX helping franchisees apply for Retail, Hospitality and Leisure Grant.

- Advising and assisting franchisees with staff furloughs.

Being a franchise business, it doesn't directly face the problem of rent - its franchisees do. This is a key distinction.

The current situation appears tolerable for CBOX and its franchisees:

As a result of the above, noting that our franchise stores have relatively low levels of rent and overheads, we are very confident that our franchisees will be able to navigate this unprecedented period. The Group has very healthy stock levels and therefore is well placed to support the reopening of its franchise stores as soon as UK Government advice allows.

Balance sheet - £4 million cash balance. The only debt is a £1.6 million mortgage on properties.

CBOX expects to have monthly cash burn of £200k while franchisees are shut. That would be no big deal.

Dividend - not recommending a dividend, despite the strong balance sheet, as it would be "inappropriate" when there is so much uncertainty. That wouldn't bother me if I was a shareholder here, but views may differ.

My view

This share gets the thumbs up from me. I like what I see. Worth researching.

Fletcher King (LON:FLK)

- Share price: 33p (+12%)

- No. of shares: 9.2 million

- Market cap: £3 million

Financial health warning: this is a tiny company. Micro-cap value investors have sometimes found it to be of interest, since it can get exceptionally cheap with respect to the traditional metrics.

It's involved in the property business, doing all sorts of different things: valuations, advice, property management, fund management and direct property investment. Profits have been lumpy.

Some good news today: performance for FY April 2019 "is not currently expected to be materially affected by the current crisis".

But looking ahead, it sees the risk of a "severe and prolonged" economic impact from the COVID-19 crisis:

In this scenario, transaction-based fees such as investment deals and bank valuations are likely to be materially lower than would otherwise be expected.

The progress of rating appeals is also likely to be further delayed.

Property management activity (which is a core service of the Company) is not expected to be affected to the same extent, although fees may come under pressure should there be a significant decline in the collectability of rents from tenants in client properties (the Property Management team has been successful in collecting 85% of rents for the March quarter by the due date, compared with normal achievement of 99%).

FLK is too small for most people to invest in - I mention it because of the read-across to other property-related shares.

It's not easy to be bullish on commercial property in the current environment - it feels like the work-from-home and buy-online trends are speeding up.

Revolution Bars (LON:RBG)

- Share price: 19.01p (+23.5%)

- No. of shares: 50 million

- Market cap: £9.5 million

COVID-19 and Banking Facilities update

The lockdowns are a disastrous scenario for all sorts of businesses, but particularly for bars and pubs.

RBG shares had already dropped to around 20p as of mid-March, when it gave its first virus update.

At the time, I noted that RBG was "proactively exploring all the options" with respect to its funding requirements.

Having net debt of over £10 million, I reckoned that the company would need a major refinancing (unless the lockdown ended very quickly).

Today's RNS

The bad news is that net debt has ballooned to £17.8 million, almost twice the current market cap.

Its existing bank debt facility was set to reduce to just £18 million (from £21 million) at the end of June. If net debt is £17.8 million, then gross debt is £18 million+.

The good news is that Natwest is not pulling the plug:

...subject to final documentation, Natwest has agreed to increase the Facility to £30.0m until 31 August 2020, following which it will step down to £24.0m as the Group begins to benefit from its normal positive working capital cycle following an assumed recommencement of trade in July 2020. Natwest has also agreed to waive all financial covenant tests at March and June.

The lifeline should last until September, around which time Natwest will review "both the amount of available facility and the covenant tests applicable".

Debt load

Weekly running costs are said to be £0.4 million, i.e. £1.7 million per month.

At that rate, another 2.5 months of lockdown to the end of June would burn through £4.3 million and take the net debt level to £22 million.

The gross debt level will be higher again, so RBG will need to benefit from that "positive working capital cycle" it references above, and start generating some operating cash flow in July and August.

As a reminder, it will only be able to borrow £24 million in total from the end of August.

My view

It won't come as a surprise that I remain extremely cautious when it comes to these shares. The level of debt doesn't look very comfortable, and it therefore makes sense that management are still monitoring "the Group's funding requirements and all options available to it".

According to Paul's previous notes, RBG was looking to make £12.3 million in adjusted EBITDA this year, and pay down £5 - £6 million in debt.

If the turnaround plans succeed, post-lockdown, then maybe the debt load could be managed lower over the subsequent four years, say?

If you are very patient, and happy to wait for this thesis to play out, then you are more patient than I am.

I could be wrong, but even in a bullish scenario, I don't see this company having the capacity to pay dividends for the next several years. Cash flow will have to be devoted to debt reduction, a debt load that gets bigger every week the sites are closed.

Most of RBG's "enterprise value" is, appropriately enough, tied up in the debt held by Natwest.

And when the sites eventually re-open, we should be cautious about what the recovery might look like. Many people will be repairing their personal balance sheets, instead of going out for drinks. It could be a slow rebound.

Therefore, if it is possible to raise equity, I think RBG should try to do that now. If it can't or chooses not to, then existing ordinary shares are a bet on:

- a fairly quick rebound in consumer spending, after trading restarts by July, so that debt reduction can begin.

- Natwest being relaxed and happy in September.

These things could happen, and RBG shares could multi-bag from here.

But I agree with the market's current pricing of the shares: if these things don't happen, then RBG shares probably won't be worth anything.

If I was Stonegate, and I still wanted to own Revolution, what would I do? Having previously bid £101 million for the business, I could:

- Offer a premium to the existing market cap (£10 million), and take on £18 million of net debt. Enterprise value £30 million+.

- Put the feelers out at Natwest over the next few months, and check if they would like to sell their position.

I know that I'd look at the second option, before I even considered the first option.

As I said last time, I don't see RBG shareholders coming out of this situation any better than their landlords, the bank and the tax man.

I think they should raise equity and start again, if they can.

Calling it a day there, thanks everyone. Paul is back tomorrow.

Cheers

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.