Good morning. It's Paul & Graham here!

Today's report is now finished.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

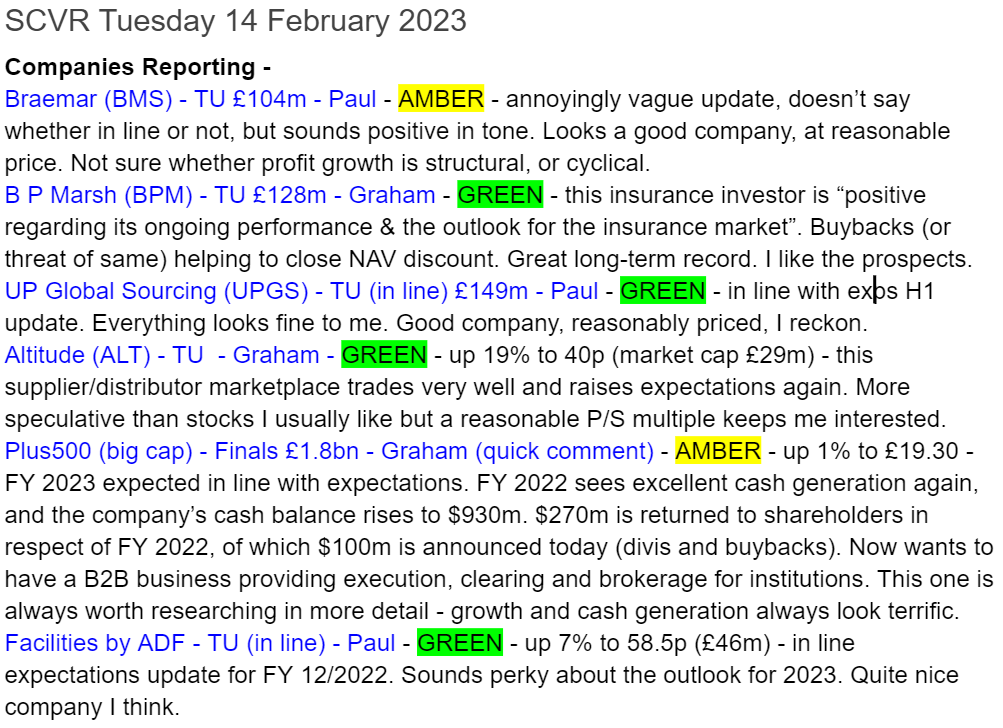

Agenda/ Summaries

Paul’s Section:

Braemar (LON:BMS)

317p (pre market open)

Market cap £104m

Braemar Plc (LSE: BMS), a provider of expert investment, chartering, and risk management advice to the shipping and energy markets, today announces an update on trading for the year ending 28 February 2023…

It’s only a vague comment today, with no mention on how the company is performing vs market expectations -

The board of Braemar is pleased to report that the Group has continued to trade well since the release of its interim results in November 2022. The integration of the Group's newly acquired Spanish and US businesses announced in December 2022 has progressed well and both businesses are set to make an immediate and strong contribution to the Group's trading in the next financial year.

The board looks forward with confidence to providing a more detailed update on trading for the year ending 28 February 2023 and on expectations for the year to February 2024 in a pre-close update to be announced in mid-March 2023.

Capital reduction - this is just a minor administrative matter. It looks as if the company inadvertently paid out divis incorrectly. This is to be fixed by creating distributable reserves, and a deed of release. Nothing to worry about in my opinion, and it will ensure that future divis can be paid out without breaching the companies act. I’m not aware of there being serious penalties for this kind of thing, as nobody is actually harmed by accidentally not having enough distributable reserves, where a company is comfortably solvent, as is the case here, so I can't see why anyone would take legal action against the company or its Directors in this situation.

My opinion - we covered competitor Clarkson (LON:CKN) here on 6 Jan 2023, which was trading well, enjoying good market conditions for shipping.

Braemar published excellent interim results to Aug 2022, more than doubling adj profit to £10.5m. This was above expectations at the time, and the FY 2/2023 consensus forecast of 41.7p was already three-quarters in the bag from the interim results (H1: 31.8p adj EPS)

Looking back at the last couple of years, there seems to be a strong H1 bias to profits, so the current year looks to be following that same pattern.

The last balance sheet wasn’t particularly good, with negligible NTAV, so the company is relying on its profits to generate the cash for divis, rather than any large reserves of cash (net cash was £1.8m at end Aug 2022).

Overall, BMS looks a decent company, trading well, on a reasonable valuation (forward PER of 9.5, and 4.2% dividend yield). The crux of the investment case, is whether it’s enjoying a cyclical or pandemic-related boom in profits, that is likely to subside? Or whether the much higher profits this year FY 2/2023 are sustainable? I don’t know, as this is not a sector I understand, so for that reason I’m neutral.

Note below very high StockRank.

As you can see this share has done well since the pandemic lows, which are coming up almost 3 years ago, so I might have to switch to 5-year charts shortly, to include that detail (which is a useful reference point for peak market gloom in March 2020) -

UP Global Sourcing Holdings (LON:UPGS)

154p (down 7% at 08:48)

Market cap £139m

Ultimate Products, the owner of a number of leading homeware brands including Salter (the UK's oldest houseware brand, est.1760) and Beldray (est.1872), is pleased to announce its trading update for the six months ended 31 January 2023 ("H1 2023").

There’s a cheerful headline, but the market doesn’t seem to agree, with a 7% drop in share price so far this morning.

A robust trading performance, boosted by strength in Online and ongoing demand for energy efficient and money saving products for the home

Having gone through the update, I can’t see anything of concern, so maybe this morning’s drop in share price is just a bit of profit-taking? Who knows. Anyway, here are the main points -

H1 revenues up 2% to £87.6m (perhaps this has disappointed? It’s not very impressive in an inflationary environment, so I assume prices are up, but volumes down?)

“Continued normalisation of global supply chains” - good to hear.

Retailers in UK overstocked, but now returning to more normal ordering pattern.

Net debt - no figure provided, but we’re told it’s 1.0x EBITDA, down from 1.3x in July 2022.

Plenty of headroom (£22.4m) on bank facilities.

Inflation being offset by cheaper freight costs, and partial recovery of £:$

EDIT: the update mentions robotics process automation. I raised a query on this, asking if it's automating the warehouses with robots? It's not. Just to clarify this, it's automating processes within administration, that were previously repetitive & manual. End of edit.

Outlook - this is the most important bit, and it reassures -

The Board anticipates a full year performance in line with current market expectations.

There’s no footnote detailing what market expectations are, which is glaring omission - it is best practice to include a footnote, simply because it helps investors, providing clarity, avoids misunderstandings, and saves us time.

As you can see below, UPGS has developed a nice track record of earnings growth, after an initial disaster shortly after it listed in 2017, which is now a distant memory I’m pleased to see.

My opinion - I like UPGS. It seems an entrepreneurial business, with hands-on management owning big stakes, which is what I like to see - interests aligned through shareholdings, not the all too common overly generous free share options schemes.

When watching webinars, or having calls with management, they always seem on top of the detail, and capable of managing the business through all manner of crises - it’s important to remember that in the last 3 years, many companies have had covid, lockdowns, major disruption to shipping & supply chains, periodic collapses in demand, major uncertainty, an energy crisis, and rampant inflation to deal with. Not to mention gyrations in commodity prices, labour shortages, interest rates shooting up, you name it! UPGS seems to have handled all of this with aplomb. That gives me a lot of comfort in the resilience of the business, and that even if new problems emerge in future, UPGS is likely to cope.

As you can see below, UPGS has attractive fwd PER & dividend yield. There’s not a lot of balance sheet support though. Also note high quality scores too. The StockRank is correspondingly high.

Overall then, all the facts & figures are pointing me towards taking a positive view of this share, so it's a thumbs up from me (please remember our views are just an overview of the fundamentals, we’re not making any predictions on what the short-term share price is going to do - which is in the lap of the gods!) So it’s always up to you to decide if you find the price attractive as a buy, hold or sell, based on your own methods.

Facilities by ADF (LON:ADF)

58.5p (up 7%)

Market cap £46m

Facilities by ADF, the leading provider of premium serviced production facilities to the UK film and high-end television industry, today provides an update on trading for the full year ended 31 December 2022 ("FY22").

Strong trading delivering on all areas of growth strategy

Key points from today’s update -

FY 12/2022 results in line with market expectations.

Revenue up 13% to £31.4m

Adj EBITDA up 3% to £7.9m

The reason why increased revenues didn’t flow directly through to EBITDA is because (previously announced) smaller individual contracts meant more down-time as equipment had to be moved around between jobs. So this mix effect does show the flaw in the business model - gaps between jobs, which could get a lot worse the next time the industry has a recession (no sign of that at the moment though).

Cenkos (many thanks!) publishes an update note today, showing that the £7.9m EBITDA becomes £4.3m PBT. As it’s an equipment hire business, we cannot just ignore the depreciation charge.

Basic adj EPS is 4.6p, so the PER is 12.7x which seems reasonable to me.

Capex - it spent £8.9m enlarging the hire fleet in 2022, with similar spend expected in 2023. Which raises the obvious question as to whether this is value for money, given that the big capex barely moved the dial on EBITDA in 2022?

Expansion in the UK is continuing, more detail in the announcement. It sounds as if things are going well. There was previous talk about expanding into Europe through acquisitions, which I’m not at all keen on. Better to stick to its knitting in the UK, I reckon.

Outlook - we’re told several times that the order book is strong, but no figures are provided.

Cenkos is forecasting a big increase of 50% in revenues for FY 12/2023, and EPS rising from 4.6p (FY 12/2022) to 6.3p. This type of equipment hire business should probably be valued on a PER of about 12, so I make that a share price target of 76p, a useful 30% ahead of the current share price.

My opinion - I’ve always quite liked this share - it floated at a reasonable valuation, and raised fresh money for the business in its IPO (unlike so many companies which float so that a private equity backer can exit at a premium).

The UK seems to be a popular destination for big TV/film productions, so there seems to be plenty of work available for ADF, and it sounds upbeat about the future.

It’s a cyclical business, so at some stage there’s likely to be a downturn, hence why I wouldn’t over-pay for this type of share. But right now, it looks to be in a good spot, and the shares seem reasonably-priced, hence I have to give it a thumbs up as things currently stand.

Graham’s Section:

B.P. Marsh & Partners (LON:BPM)

Share price: 342p (pre-market)

Market cap: £128m

This is an investor in the insurance sector, where Chairman Brian Marsh owns 40% of the company.

It has often been available to purchase at a discount to NAV and this remains the case today as the company had a NAV of £179.8m as of July 2022, a whopping 40% higher than the market cap (using last night’s share price).

Today’s announcement is a full-year update for the financial year ending January 2023.

The main thrust of the update is that “the Group remains positive regarding its ongoing performance and the outlook for the insurance market”.

We do not yet have a NAV figure for January 2023, but the implication is that we’ll be pleased when we find out what it is.

Shareholder returns: there is a small interim dividend (1.39p) and there should be a final dividend of similar value, if BPM is going to meet its “aspiration” to pay out £1m to its shareholders this year.

In addition, there is a share buyback programme, “to reduce the discount to Net Asset Value at which the Group’s Shares are trading”.

This was initially announced on January 16th of this year, and the BPM share price has already made some progress in closing the discount, even with very few shares having been bought back so far:

Buybacks will happen when the discount to NAV is at least 20% and to a value of up to £1m.

So for example, if NAV is still £179.8m, the buybacks can happen so long as the market cap is below £143.8m (share price c. 383p).

Investee companies: I am a former shareholder here at BPM. I must admit that I always found it tricky to follow their investee companies. Note that 66% of revenues are generated abroad.

I will only mention developments at the top two investees:

Kentro Capital - this is an insurance agent/broker with two main subsidiaries. It earned EBITDA of over £18m in 2022, up by 14%, and is growing by acquisition.

XPT Group (US-based) - another highly acquisitive company, BPM lent XPT $6m recently, to make yet another acquisition. Total premiums written by XPT in 2022 were over $500m, up 25% compared to the prior year.

Liquidity and new opportunities: BPM has no debt, cash of £7.2m and loans outstanding to investees of £16.4m.

It has “an active pipeline of new business opportunities which are currently being considered”.

Outlook

The company sounds quite bullish on pricing in the insurance sector, especially given the increased costs to insurers arising from recent events and macro challenges (including higher interest rates and inflation).

The insurance market has seen five years of constant rate increases across most lines of business, with the pace of these increases slowing somewhat over the past four quarters.

Accordingly, there have been various market discussions regarding the longevity of these price increases, given the slowing of rate increases over 2021 / 2022. Nonetheless, there has been no drastic downward change in rates, with the decline taking longer than the market expected…

Overall… the Group does not foresee a return to soft market conditions in the near future.

My view

This is a company that I would not mind owning shares in again at some point. Based on the published numbers, the company has been growing book value per share very well over the years (CAGR is 10% recently, according to Stockopedia):

It has also paid a modest dividend.

And with the prospect of buybacks closing the discount to NAV, there is another reason to think that shareholders do well.

Therefore, given its very long history of good performance, I personally would be open to the idea of allocating a percentage of my portfolio to BPM again. I would be cautious about making it a very large position, however, without a really good understanding of the investees.

Altitude (LON:ALT)

Share price: 40p (+19%)

Market cap: £29m

We last covered Altitude in the SCVR back in November. It is a “marketplace for the global promotional products industry”. It runs the “AIM” platform in the US and also in the UK, but most revenues are from the US.

There have been some false dawns in the past:

Recently, the investment thesis has been built around the company finally breaking through to profitability and seeing operational leverage kick in.

Today’s trading update for the current financial year (FY March 2023) is materially ahead of current market expectations, as strong trading has continued in the months since the last update.

The Group continues to deliver on its strategy and has been experiencing continued robust trading via expansion of its Services and Merchanting programmes.

“Services” refers to Altitude generating revenue from serving suppliers and distributors in the industry (connecting them with each other and helping them to get the most competitive pricing or increased revenues).

“Merchanting” refers to the sale of promotional products by Altitude itself, using affiliates as sales agents.

The tone of the outlook matches the current momentum:

…the Board anticipates that the Group will continue to experience revenue and EBITDA growth throughout the remainder of calendar 2023 and 2024.

Cash - the company has an increased (but currently undrawn) credit facility of $1.5m. I would prefer if the company had a more comfortable net cash position.

Estimates - analysts at Zeus increase their FY23 revenue forecast by 4.8% to £17.3m and their adj. EBITDA forecast by 17% to £1.7m.

Adj. PBT is expected to rise from £0.8m in the current financial year to £1.7m by FY March 2025.

My view

This is a short update but it clearly adds strength to the investment thesis that this company can become a profitable “platform” type of business, deriving revenues from buyers and sellers while also using the platform for itself to generate revenues.

I’ll tentatively give it the thumbs up, though it’s more speculative than the type of thing I usually take an interest in. But after so many positive trading updates and with the price/sales multiples still only c. 1.7x, I don’t think the valuation is ridiculous, given the growth prospects.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.