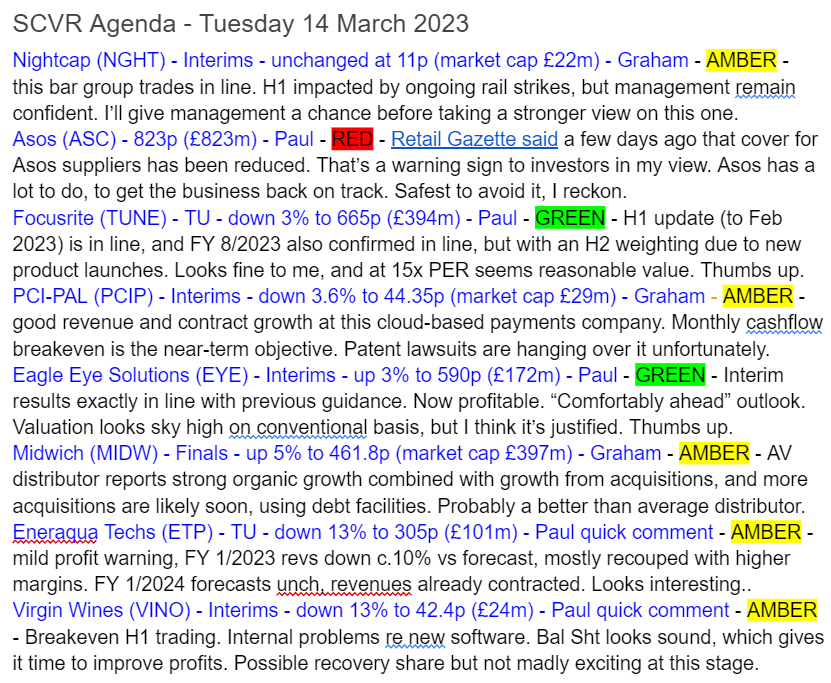

Good morning from Paul & Graham!

Today's report is now finished. We covered most of the things on the to do list.

Superdry (LON:SDRY) - I forgot to mention this yesterday, but there are press reports that this fashion brand has called in Interpath Advisory, to help it restructure & cut costs. That doesn't sound good, does it? It suggests to me that the company must be seriously struggling, which f you strip back the presentational gloss put on its last poor interims results, was obvious from a little digging - see my report here on 27 Jan 2023, where I pointed out the problems. The way I look at it, if the business was trading well, then there would not need to be consultations with expensive advisers. The last update showed that there was some sign of improvement at the stores, but that wholesale orders had plummeted. I'm changing my view from amber, to red, at this latest worrying sign. Thumbs down from me, it's too risky right now.

Banking problems

We seem to be in something of a banking crisis, although not many people in the UK are aware, because our media is instead obsessing over something Gary Lineker said on Twitter.

It's difficult to know where this latest banking problem (mainly SVB) ends. On the upside, swift actions have been taken so far to contain the problems. On the downside, it strikes me that overly fast interest rate rises have put a big strain on the system, and the cracks are now appearing. What other strains are lurking below the surface at other organisations which held a lot of bonds (which are now worth less)? Might banks be more cautious in agreeing new lending from now on?

At the moment I cannot see any reason to panic sell any of my shares. Let's just hope it all blows over, and it might at least stop the central banks from continuing down their dangerous path of raising rates too far, too fast? You can't have zero rates for 14 years, and then flick a switch to return to normal, without it doing a lot of damage, as we're discovering.

Graham and I decided not to cover the flurry of RNSs yesterday relating to Silicon Valley Bank UK, because it was announced first thing that the bank had been saved, with HSBC buying it as a going concern. Hence any impact on customers should presumably have been resolved. Indeed, as an example, I see that Polarean Imaging (LON:POLX) suspended its shares yesterday over uncertainty re SVB, but has today said there has been no impact, and everything's back to normal, so wants to unsuspend its shares.

Storm in a teacup, or the tip of the iceberg? No idea, we'll just have to wait to find out.

P.S. Budget Day tomorrow, so it's being/been leaked to the media as usual. Apparently a big rise in the pension lifetime allowance is likely, because too many people are retiring early to avoid getting clobbered with punitive pension taxation.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul’s Section:

Focusrite (LON:TUNE)

685p (pre market open)

Market cap £406m

Focusrite plc (AIM: TUNE), the global music and audio products group supplying hardware and software used by professional and amateur musicians and the entertainment industry, is pleased to give the following update on trading for the six months ended 28 February 2023 ("H1 2023").

H1 2023 Trading Update: Profits in line with expectations

H1 2023 profits for the Group are in line with Board expectations and remain unchanged for the full year supported by stronger gross margins.

Broker forecasts - Note that broker forecasts stepped down in Sept 2022, but have remained almost flat since. So to be on track to meet the full year forecast seems fairly good to me. I can’t see any update notes available to us today.

What we’re seeing at lots of other companies, is an almost continuous lowering of forecasts every month. This looks more solid -

Other points in today’s trading update -

H1 revenues expected to be c.9% down on H1 LY, at £85m

H2 weighting expected this year due to new product launches, which rings a bell, so I think this has been previously flagged.

Weakness in Asian markets - again I think has previously been flagged.

Improved gross margin due to - lower freight costs, supply chain easing, and price rises to customers - all good.

Net debt has risen to £14m, but that’s not a concern to me, as it’s well within the facility limit, and easily affordable based on profitability. Not a concern. The increase is mainly due to £8.2m acquisition-related payments & inventory build for new products.

My opinion - this all sounds fine. Focusrite has always struck me as a decent company, with a really good track record. Although the valuation previously ran much too high for my liking. It’s now much more reasonable, and 15x forward earnings (confirmed today) strikes me as a nice entry point for long-term investors.

It would be worth deeper research to find out what the new products are, and how they compare to the competition. To some extent, TUNE has to keep innovating, as the products have a finite life. As I always mention, musicians I know tell me that TUNE’s core products are excellent, but tend to be one-off purchases. Hence why making new, improved versions is important to drive repeat purchases.

Overall, my view on TUNE shares is positive, so it gets a thumbs up. As always, that's just an opinion at this point in time, based on the information we currently have. I'm not Mystic Meg, so have no idea what the future holds, so our opinions might change in future, as the facts change.

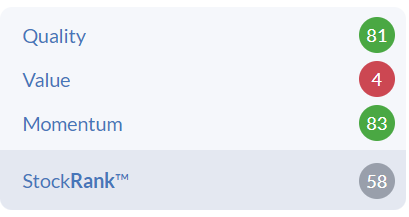

The StockRank seems strangely low, for a good quality business.

Eagle Eye Solutions (LON:EYE)

590p (up 3%)

Market cap £172m

Eagle Eye, a leading SaaS technology company that creates digital connections enabling personalised, real-time marketing through coupons, loyalty, apps, subscriptions and gift services, is pleased to announce its unaudited interim results for the six months ended 31 December 2022 (the "Period").

Strong organic growth and acquisition of Untie Nots supports continued expansion

Rummaging through the numbers, this is starting to look like a proper, viable business now, after years of jam tomorrow, cash burning. That’s really good to see, and is so rare in the UK market unfortunately. I wonder what percentage of speculative shares actually make it to profitability, without ruinous dilution? Sounds like a good question to ask ChatGPT. ChatPAUL’s hunch is that the number would be very small!

So congratulations to EYE for achieving success. There’s no doubt now that this is a good business, growing strongly, and now profitable. The only question is how to value it? That’s tricky because there’s no definitive way to value growth shares, and different investors use often wildly different methods. Higher interest rates also mean tech/growth shares are worth a lot less, as future profits are discounted to a lower number the further out in future they are.

Some key numbers in the table below.

Strong growth - all organic I believe (an acquisition completed a few days after this period end, so won’t have contributed yet)

High proportion of recurring revenues is a good thing, that investors obviously like.

Very little profit before tax of £0.9m, but I’d be happy to add back acquisition-related costs (as one-offs) of £1,068k, and tax credit, which takes PAT to about £2.0m for H1 - not too shabby at all.

Note that the numbers below look exactly the same as the pre-announced numbers in its 18 Jan 2023 trading update. So no surprises in the numbers. Any share price movement today will be down to the commentary, rather than figures.

Balance Sheet - looks OK, with £17m NAV, including £6.8m intangible assets.

Note also that the £14.4m gross cash figure at Dec 2022 temporarily included the money to pay for an acquisition a few days later, so it has sensibly presented an adjusted net cash figure above, which looks adequate at £5.7m.

EYE got caught up in the Silicon Valley Bank crisis, but says today that it now has access to its funds again, so no great shakes there. It has a small drawdown on a loan facility with SVB, but that probably isn’t needed now anyway, and could probably be replaced fairly easily if required, from another bank - which tend to like companies with recurring revenues, and which are profitable, which EYE is now. So I’m not worried about the funding position. In any case, a £172m market cap means that EYE could probably raise a little cash very easily from equity investors.

The only number that looks a bit too high, is £12.9m receivables. So that would be worth questioning with management, if you get the chance on a webinar.

Outlook - ends with a flourish -

While conscious of the challenging wider economic backdrop, trading since the Period end has continued to be strong. The Board is confident in delivering another year of profitable growth, with revenue and Adjusted EBITDA for the year ended 30 June 2023 now expected to be comfortably ahead of current market expectations.

My opinion - checking my previous notes on 18 Jan 2023, I was positive on this share, commenting that a beat against modest forecasts looked likely. So it’s good to see that happen today.

I’m not sure how to value it, and even on upgraded numbers from Shore (many thanks) available today on Research Tree, the valuation looks scarily high on a PER basis. Remember that tech valuations generally have dropped a lot, so there's obvious risk now in paying up for growth. However, I’m still going to give it a thumbs up, because progress has been so good, that the big valuation & rating can be justified for this rare success story amongst UK small cap speculative tech shares. What a pity I didn’t put my speculative money into this one, instead of believing all the hot air from WAND. Never mind, lesson learned.

The StockRank neatly sums it up too - with a very low value rating, but great on quality & value - exactly how I see it too -

Graham’s Section:

Nightcap (LON:NGHT)

Share price: 11p (unchanged)

Market cap: £22m

We have H1 results from this bar owner with 36 sites, for the period ending 1st January 2023. It is led by Dragons’ Den star Sarah Willingham.

We also have a trading update - in line with expectations.

Results:

Revenue £23.5m

Like-for-like revenue decrease of 5.8%, attributed to the rail strikes.

Adjusted EBITDA: irrelevant to investors for a group that needs to do a lot of capex.

Operating loss: £0.1m, after-tax loss £0.8m.

But there is good news, too: the Christmas trading period “exceeded expectations with record amount of corporate Christmas parties, pre-sold events and New Year's Eve almost entirely sold out across all bars.”

Additionally, the new sites opened since November 2021 are on track to hit the company’s target (75% annual return on investment in their third year), and several of them may achieve this in their first year.

New subsidiaries have been integrated into the group with £1.4m of anticipated cost savings to follow annually.

Net debt is £4.1m (cash of £5.5m offset by debt of £9.6m), excluding lease liabilities.

The outlook sounds good:

Management continues to see extremely attractive opportunities within the property market and look forward to the ongoing roll-out of all of its key brands…

The millennial and Gen Z crowd remain resilient consumers, with high disposable income, as they continue to enjoy great nights out.

Trading has remained resilient since the start of 2023. The Group continues to trade in line with market expectations and the outlook is encouraging.

My view

I haven’t got a strong view on this particular share. The track record is still very limited and I have an open mind as to whether their roll-outs might succeed.

But I know that I don’t like this sector, especially when I’m looking at operators with lots of lease liabilities (no freeholds) and bank debt. One consequence of IFRS 16 is that we can see the present value of these liabilities directly on balance sheets: Nightcap has almost £40m of leases on top of its ordinary loans and borrowings. And the risk of something going wrong in this sector always seems very high, e.g. rail strikes in the most recent period.

I’ll keep an amber rating on it purely because the track record is short and I’d like to give management the chance to succeed before taking a particular view on the share.

Remember that this is one of the 2021 IPOs:

PCI- PAL (LON:PCIP)

Share price: 44.35p (-3.6%)

Market cap: £29m

This share is involved in the Silicon Valley situation. It said yesterday:

SVB are the Company's principal bank and as at 9 March 2023, the Group had a total of £3.2 million of cash in accounts with SVB split between the US and the UK. The Group also has £0.33 million of cash held with other banks.

As we now know, the depositors at SVB are not going to suffer at all (the same cannot be said for investors in SVB).

So let’s move along swiftly to PCIP’s interim results for the period to December 2022, which have been released today.

As a reminder, this company describes itself as ”the global cloud provider of secure payment solutions for business communications”.

Key points:

Revenue +33% to £7.3m

Annual recurring revenue +33% to £11.9m

Annual recurring revenue of all signed contracts +30% to £14.7m (“a key indicator of future recurring revenues”)

Operating loss £1.9m (H1 last year: operating loss £1.1m)

Cash at the end of the period reduces to £1.9m (H1 last year: £5.5m).

Highlights section is bullish, outlining growth in customer numbers, upselling success, and customer retention levels.

Outlook: expectations for FY June 2023 are unchanged as trading is in line. Management are still seeking to achieve “monthly cashflow breakeven” in the current financial year.

CEO comment: emphasises the company’s “patented cloud technologies”.

This is where I need to scroll down and get an update on the patent claims surrounding PCIP. As I’ve said before, this strikes me as a potentially serious concern for the company and its investors.

Unfortunately, the wheels of patent law move slowly:

It is nearly 18 months since the Company became subject to unfounded claims of patent infringement in both the UK and US by one of its competitors, Semafone Ltd (now renamed Sycurio Ltd). The action was brought against PCI Pal shortly after Sycurio was acquired by the investment firm Livingbridge. It is our belief that the claims have been made in an attempt to disrupt our momentum and gain a commercial advantage given PCI Pal is the fastest growing provider in the space, with the most extensive partner eco-system, and the most mature public cloud offering.

The Directors continue to strongly refute the claims being made and as a result we have both defended our position on infringement, as well as made a number of counterclaims against Sycurio whose patents we believe to be invalid. We have worked closely with our legal advisors both in the UK and the US and remain confident in being successful across the breadth of our case. The court hearing in the UK is scheduled for mid-June 2023, with the US court dates yet to be set but expected late 2024.

The company adds that they have contingency plans for how they will operate in the “unlikely” scenario that they lose all of these cases, including “various options for product adjustments and enhancements”.

My view

There is no change to my view on this. It’s an interesting company but the patent case seems very important to its eventual success or failure. And predicting the outcome of legal disputes is tricky, to say the least!

Some thoughts on valuation: annual recurring revenue is c. £12m - £15m, depending on which measure you’d like to use, so the price/ARR metric is in the region of 2x. It’s not a value stock by any means (ValueRank is only 9), but that price/revenue metric would be considered cheap by the standards of many tech investors. And if the company reaches cashflow breakeven as it anticipates, that will further strengthen the investment case.

Unfortunately, there are too many unknowns here for me to give it the thumbs up, but it may be worth studying further.

Midwich (LON:MIDW)

Share price: 461.8p (+5%)

Market cap: £410m

This is a distributor of audio visual equipment to the trade market. Paul looked at their trading update in January.

Today we have the results statement for the year, confirming enormous revenue growth of over 40% to £1.2 billion, including record organic growth of over 20%.

Operating profit is up 67% to £35m.

Or if we use the company’s adjusted numbers, then adjusted operating profit is up 46% (at constant currency) to £51m.

Either way, these are interesting numbers for a £400m market cap company.

As a distributor, profit margins are naturally on the thin side. Gross margin is unchanged at 15.3%.

CEO comment:

The impact of the pandemic reduced somewhat in the period, with product shortages easing (but not completely) and the cost of shipping containers reducing significantly during the year. We saw the resumption of a significant part of the live events and hospitality markets, and the corporate market strengthened during the year.

Although still early into the new financial year and mindful of the slower general economic conditions and higher interest rate environment, we remain confident that 2023 will see yet another year of growth in excess of the overall market."

Acquisitions / balance sheet

Midwich brought in c. £150m of annual revenue from two acquisitions early in 2022, and looks set to do some more soon.

The cost of purchasing these acquisitions resulted in a cash outflow of £22m, and Midwich’s net debt has increased from £58m (Dec 2021) to £96m (Dec 2022) (excluding leases).

The net debt to adjusted EBITDA multiple only increased from 1.4x to 1.6x, due to increased profitability, and Midwich says that this multiple is “well within the Board’s comfort range”.

Indeed, the multiple looks likely to increase further as the company has increased its bank facilities from £80m to £175m, “to support future delivery of our acquisition pipeline”.

My view

As distributors go, this looks pretty good. It claims to be “the sole or largest in-country distributor for a number of its vendors in their respective product sets”. I can believe that, given £1bn+ in revenues and its international scale.

If I was going to invest in a distributor, I’d probably choose something like this, instead of a marginal player. I’d want something with high market share in certain categories and products, like Midwich has.

It also has a praiseworthy track record of generating profits, and is recognised by the Stocko computers for having decent quality:

Against that, there are the usual financial risks that go with a debt-fuelled expansion in a low-margin industry. I don’t see how I can avoid taking a neutral stance here.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.