Good morning from Paul & Graham!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom),

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

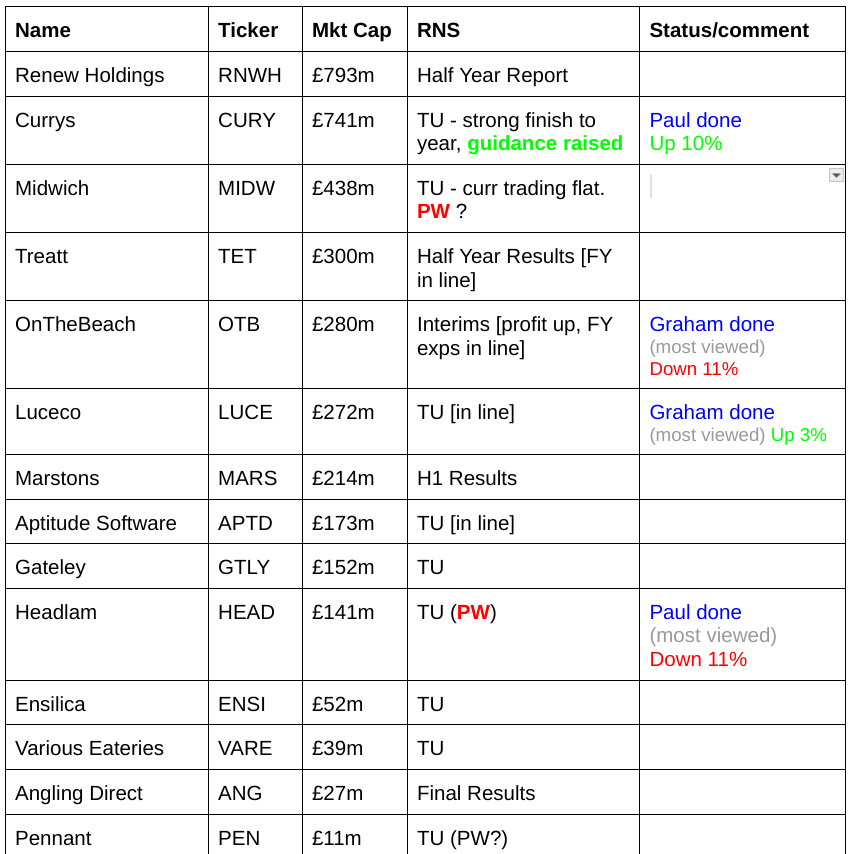

List of companies reporting today

Other mid-morning movers (with news)

BREAKING NEWS! Another takeover bid -

IQGeo (LON:IQG) - up 16% to 470p (£290m) - Recommended Cash Acquisition - Paul - PINK

OK, this is getting ridiculous now. Another takeover bid from America.

Buyer: KKR (according to Wikipedia, it has a total of c.$1 trillion in assets under mgt)

Price: 480p/share in cash.

Premium: only 19% to last night’s close (albeit after a strong run in share price, doubling since autumn 2023)

Recommended by IQG’s board.

Shareholder support: it looks in the bag, with 58% support already. Kestrel is the biggest shareholder. This looks like another situation where institutions want out, with a liquidity event.

Paul’s view - pity it’s going, as IQG was growing on me (see SCVRs 20/10/2023 and 15/1/2024 [AMBER/GREEN]) as an interesting, albeit expensive growth company.

Sondrel (Holdings) (LON:SND) - up 47% to 6.75p (£6m) - Conditional Subscription to Raise £5.6m - Paul - RED

Accident-prone, almost bust chip designer confirms that it’s getting the vital bail-out from ROX Equity Partners, with a big equity raise at 10p. However, the main problem is that, as previously announced, the restructuring associated with this deal involves de-listing its shares from AIM and becoming a private company, as the costs & administrative burdens of the AIM listing are not of any value. A cynic might say it’s served its purpose, of fleecing fund managers in the original over-priced float.

Why would anyone be buying the shares today then, knowing that it’s shortly going to de-list? The only reasons I can think of are that some investors might be prepared to hold shares in a private company. Or they might be gambling on ROX possibly offering to take out private shareholders at the same 10p that it’s putting in fresh funding at? Who knows, but personally I avoid anything that’s likely to de-list.

Zytronic (LON:ZYT) - down 16% to 53p (£5m) - H1 Results - Paul - AMBER/RED

Zytronic used to be a successful, profitable & cash rich maker of bespoke touch screens, for things like ATMs, and casino machines. Unfortunately, it seems to be just withering away, unable to replace end-of-life products with new orders. H1 revenue announced today is down to just £3.3m. The LBT of £(0.6)m isn’t too bad, and there’s £3.7m cash remaining. It’s planning a full business review over the summer, which I imagine should probably include ditching the stock market listing, which should save several hundred £k pa in unnecessary costs that can't be justified for a tiny, struggling company.

Some cautious optimism about new order pipeline, and it does have enough cash to tread water for a while. You need to balance up that tenuous recovery potential against the obvious de-listing risk. I would be amber if I could be sure it would remain listed, since it still has a healthy balance sheet (although inventories now too high). But on balance the de-listing risk carries the day for me, so I have to flag that risk with AMBER/RED. Upside case would be a flood of new orders, taking it back into profit. That’s not looking too credible right now, but you never know!

Summaries of main sections

Saga (LON:SAGA) - 118p (£169m) - Repayment of Bond - Paul - AMBER

£150m bond repaid yesterday. Could it be a recovery situation? Possibly, I'm not sure.

Headlam (LON:HEAD) - down 9% to 160p (£130m) - Trading Update [profit warning] - Paul - BLACK (PW), AMBER on fundamentals

Trading in 2024 to date has been poor, and it serves up a nasty profit warning today. I was expecting trading to be flat, not another big lurch down. No broker updates are available to us. I'm expecting FY 12/2024 to now be loss-making, and with net debt having risen, don't expect any divis for a while. Big freehold property assets save the day though, so with further management action underway, I don't see any solvency risk. That's the only saving grace that allows me to stay at AMBER.

Luceco (LON:LUCE) - up 1% to 171.3p (£275m) - Q1 2024 Trading Update - Graham - GREEN

A confident update from this company. Despite making an acquisition in February, the balance sheet remains strong with leverage multiples below target, so that more M&A is likely in the near-term. As it enjoys very strong bullish momentum currently, I’m happy to leave our positive stance unchanged.

Currys (LON:CURY) - up 10% to 71.75p (£810m) - Trading Update - Paul - AMBER

Giant electrical retailer ended FY 4/2024 with a flourish, so it seems to be managing investor expectations well, reporting that PBT is a bit ahead of expectations. Net cash position healthy after Greek disposal. I run through the bull & bear points, and end up sitting on the fence again.

On Beach group (LON:OTB) - down 10% to 150.9p (£252m) - Interim Results - Graham - GREEN

No change to the outlook although the company does suffer an EBITDA downgrade at Peel Hunt. Existing forecasts did look very challenging to me, as “value” holidays are under some pressure and OTB’s H1 profit figures leave a lot to do in H2. But the stock is cheap and I do think it’s well placed for the long-term.

Saga (LON:SAGA)

118p (£169m) - Repayment of Bond - Paul - AMBER

News yesterday, reported that (as expected) SAGA has repaid the full outstanding £150m on its 2024 senior secured bond. This was cheap borrowing, at 3.375%. There's another bond outstanding, £250m for 2026.

This next bit is rather vague, as it doesn’t say how much has been drawn down, nor how much gross cash remains -

“This bond redemption was funded from Available Cash resources, including a draw down on the £85.0m facility with Roger De Haan maturing in April 2026.”

Paul’s opinion - we’ve had a range of opinions here about SAGA’s debt, which is healthy. My view has always been that, whilst debt is higher than I’d like, most of it is financing the two cruise ships, which are large assets. This should be seen separately as asset financing.

Neville was asking yesterday (in the reader comments) if I see SAGA as the type of share that could re-rate in a bull market, as investors accept a bit more risk. I think that’s entirely possible. The debt has never been as bad as bears made out, because they simply ignored the c.£500m cruise ship assets, which is ridiculous. For example, a sale and leaseback could be done, which would instantly eliminate most of SAGA’s debt (although it would reappear as IFRS 16 entries).

The business is now back in (modest) profit. Although I have been very disappointed with how slow the recovery in its travel division has been, and recurring problems from the insurance division. With the financial clout of its founder family, Chairman Sir Roger de Haan helping to both refinance the equity a few years ago, and replacing bank debt with a loan facility more recently, it seems to me that equity is now reasonably safe. As mentioned in my most recent podcast, as we enter a new bull market, then I think there's money to be made from taking a slightly more tolerant attitude towards debt. I've observed in the past that it can be shares perceived as higher risk that put in the most explosive upward moves in the early part of a bull market, and I think there's already evidence of that happening with some shares.

Overall, this could be worth a punt I reckon, but as I’m not high conviction on this, given the constant disappointments in recent years, am struggling to get above AMBER. However, I'm probably leaning more towards amber/green. Things have undoubtedly improved in the last 3 years, yet the share price remains bombed out. Maybe this could be an opportunity for a profitable trade?

Headlam (LON:HEAD)

Down 9% to 160p (£130m) - Trading Update [profit warning] - Paul - BLACK, AMBER on fundamentals

Headlam (LSE: HEAD), the UK's leading floorcoverings distributor, announces the following update in respect of trading in the 4 months to the end of April (the 'Period) and also announcing the acceleration of the Group's strategy.

Bad luck to holders here, although not entirely unexpected given previous weak trading, and a soft share price. HEAD is one of only 2 laggards on my 2024 Top 20 value/GARP share ideas so it looks like today’s update is probably going to slightly pull down my otherwise rip-roaring average! (Paul up 22% YTD, Graham up 24% YTD) - although people from Twitter say that increasing numbers of investors/traders are catching up with us ;-)

Revenues considerably down, not good in an environment where costs (especially wages) are rising -

Revenue in the Period was down 12.3% year on year, with the UK down 11.6% and Continental Europe down 16.9%1. Revenue in April did not show the expected seasonal uplift usually seen in the Spring period…

Losses incurred for this period (Jan-Apr 2024) look a bit scary, but are not put in context by giving the prior year comparative -

Despite tight cost management and other mitigating actions, the lower revenue has impacted our profitability with a pre-tax loss for the Period of £10.6 million…

Net debt update -

Cash and working capital remain well controlled. At the end of April, net debt was £43 million and the Group had nearly £60 million of cash and undrawn facilities available. This strong liquidity position is expected to be further boosted in the coming weeks with the cash receipts from the disposal of a surplus property in Stockport for around £7.5 million, which is significantly above book value. Following this disposal, the Group will own property valued at £142.1 million.

For comparison, net debt was £29.6m when last reported at Dec 2023, so the rise to £43m is concerning.

Whilst there’s plenty of headroom, the move into losses might put pressure on bank covenants possibly?

Although banks tend to be much more relaxed when they have the security over substantial freehold property assets, as in this case.

Outlook - no recovery imminent, and it’s taking sensible actions to cope -

… a further delay until 2025 for a recovery in the floor coverings market. Accordingly, the Group is accelerating its strategy which will see further integration and simplification across the business.

We expect these initiatives to deliver a material reduction in operating costs along with significant one-off cash benefits from disposal of surplus property and working capital reduction over the next 18 months. The Group will provide a further update on our plans in July.

Overall though, it’s a nasty profit warning -

We expect to report a significant pre-tax loss in the first half based on a double digit decline in revenue. In the second half we expect an improvement based on our mitigating actions, as well as gradually improving market conditions, albeit we do not anticipate the market returning to growth until 2025. For the full year we expect profit to be significantly below current market expectations.

Seasonality - difficult to ascertain due to the lockdowns bust & then DIY boom, but in 2019 there was a small H2 weighting to profits. So that makes the significant pre-tax loss in H1 this year even more worrying, as it’s not in a typically soft seasonal half.

Broker updates - there’s nothing, infuriatingly. So once again preferred customers of the big brokers get the inside information before us plebs. It’s clearly going to be grim though - I can’t see how HEAD is going to generate a profit at all in FY 12/2024, so the £5.8m PAT shown on the StockReport is now out of the window.

Paul’s opinion - I was expecting continuing soft trading in 2024 for HEAD, with a likely recovery beginning in 2025, as that’s what lots of companies in building/renovation type activities have been telling us. However, I definitely was not expecting another serious lurch down in trading, as has been revealed today.

Clearly this worsens risk:reward quite a lot.

However, the freehold property on the balance sheet saves the day, and disposal mentioned above set to raise £7.5m is a useful boost. We need more information from the company about what other cash it could raise from selling other properties - it could become a case of having to sell property, rather than wanting to.

We can’t value this share on a PER basis, as it’s probably now loss-making. Also forget divis for the time being I’d suggest.

Are these problems temporary? I’m no longer convinced they are. We know there’s increased competition from Likewise (LON:LIKE) who look to be taking market share. We need industry data to compare HEAD’s declining revenues with the sector as a whole, to determine if it’s really just a tough market, or whether HEAD is also suffering from competitive strains.

Both Graham and I have colour-coded HEAD as AMBER the last 3 times we looked at it (11/3/2024, 18/1/2024, and 12/23/2023), but trading has significantly deteriorated since then. Also yes it has lots of freehold property, but net debt is rising to uncomfortable levels (although still a lot less than freeholds are valued at, so probably won’t be an issue).

If there was no freehold property, I would definitely be ringing alarm bells with amber/red, but the fact remains that the freeholds are a very substantial asset at £142m, which continues to protect from downside risk.

I’ve just looked at the share price, and am amazed it’s only down 9% to 160p. A profit warning of this severity would normally cause a 30%+ fall, so clearly (so far anyway) investors are not particularly spooked by this PW. That could change though, it only takes one big holder to start selling in the market, and the price could drift down further.

Some of you will probably attack me for this, but I still think AMBER looks just about OK, given the recovery potential, and the very strong net asset backing (main freehold property). Although I don’t think I’ll be buying any personally for a recovery, as there seem much better elsewhere for cyclical recovery shares now.

The 5-year chart seems to be saying this is more than just a cyclical movement -

Currys (LON:CURY)

Up 10% to 71.75p (£810m) - Trading Update - Paul - AMBER

Currys plc, a leading omnichannel retailer of technology products and services, today issues the following trading update for the year ending 27 April 2024.

A useful upgrade to FY 4/2024 profit guidance - but remember the profit margin is tiny, on c.£9bn revenues -

Full year adjusted PBT (excluding Greece) expected to be £115-120m (previously guided to at least £105m)

Greece is excluded as it was recently disposed of, for decent cash proceeds that has nicely improved the cash position -

Year-end net cash position expected to be around £95m

Although as I always remind you here, the business is financed by its suppliers - see the huge trade creditors line on the balance sheet - if you can find the results statements that is, as they’re buried in all the 8.3 and 8.5 rule announcements that clutter up the RNS list, due to abortive takeover talks earlier this year. Can’t someone put a button on the RNS feed that says hide all these announcements? They’re a damned nuisance, and irrelevant clutter once a bid situation has ended.

Paul’s opinion - I can see some merit, but also some less attractive things, so let’s do a bull vs bear -

Bull points -

Several positive trading updates recently

Cyclical consumer recovery likely to benefit CURY now customer wages are rising faster than inflation, so operationally geared upside to profit is possible.

Bank debt sorted out from Greek disposal

CURY has performed fairly well, despite the consumer downturn, indicating it’s a better business than I thought.

CEO pointed out its size means it’s first in the queue with suppliers, especially when supply chain problems emerge.

Bear points -

Wafer thin PBT margin of barely more than 1%.

No pricing power, as selling other peoples’ products in a fiercely competitive market.

Huge cash contributions scheduled into pension scheme - could there be an opportunity here, if the actuarial deficit suddenly disappears?

Another big hike in wages costs from April 2024 is bound to blunt profits somewhat.

Overall then, it’s good to see the share price recovering, and I think that’s justified. However, for me I don’t see anything particularly interesting here, so am happy to sit on the sidelines with a neutral view. AMBER again.

There hasn't been any share issuance over the 5-year period below, so theoretically if the market gets more bullish again, there's no reason why the share price couldn't continue rising - could be a good momentum trade perhaps, now that the negatives & risks are receding? I'm almost amber/green!

Graham’s Section:

Luceco (LON:LUCE)

Up 1% to 171.3p (£275m) - Q1 2024 Trading Update - Graham - GREEN

Full year expectations here are unchanged:

Luceco plc ("Luceco" or "the Group"), the supplier of wiring accessories, EV chargers, LED lighting, and portable power products, is pleased to provide the following update for the three months ended 31 March 2024 ("Q1 2024" or the "quarter").

Key bullet points:

Q1 revenue £51m, +6.2% year-on-year, +4.5% like-for-like.

Adj. operating profit +30% year-on-year, “benefitting from the end of de-stocking pressures which ended in H1 2023”.

“Adj. operating margin improvement year on year, driven by strong operational leverage.”

So many companies spoke in unison about destocking last year, as their customers held too much stock in the aftermath of supply chain worries. But now, most of them seem to be saying that their customers have normalised their inventories, i.e. that the destocking problem is over and that normal orders have resumed.

Other points from today’s update:

Net debt/EBITDA multiple remains at 0.8x, below target range 1-2x.

Checking the most recent full-year results, I see that net debt was £18.4m (Dec 2023), for a leverage multiple of 0.6x.

Since then, the company has made an acquisition for £8.6m (plus defcon), so I imagine that net debt has modestly increased.

However, with the leverage multiple still below 1x, Luceco has “optionality for further M&A consistent with the Group’s stated capital allocation policy”.

Final dividend 3.2p, total dividend for the year 4.8p.

Outlook: performing “comfortably in line with market expectations”.

Key industry metrics, though still in decline, are beginning to trend in our favour, providing some optimism for the second half of the year.

We are pleased with the strength of our order books, which should yield H1 like-for-like organic growth of c. 5%

CEO comment:

"Luceco has performed strongly in the first quarter of the year and we are trading comfortably in line with expectations. Key industry metrics are starting to suggest more favourable conditions, and this provides optimism for the second half of the year. The Group is continuing to identify new organic and M&A opportunities for investment, leveraging our market position and aided by our strong cash flow and balance sheet."

Graham’s view

Paul has been GREEN on this in recent reports. Stockopedia’s calculations also suggest that I might want to take a very positive stance on this one:

As you might be able to tell from the MomentumRank above, this stock is enjoying a wonderful bull trend:

It passes eight bullish stock screens, many of which are to do with momentum, but also the Ben Graham Deep Value Checklist.

So what is the catch?

Well, for a start, valuation has been creeping up:

For a cyclical business that is currently enjoying 5% like-for-like revenue growth, this doesn’t appear to offer great value at first glance.

However, I think the argument that wins the day for bulls is the operational leverage at work here: modest revenue growth is translating to very strong growth in adj. operating profit. If this continues for another couple of years, the valuation multiple here should get back to attractive levels (if the share price doesn’t go up!).

Quality metrics are already very good, and should improve further:

Overall, therefore, I’m happy to maintain Paul’s GREEN stance on this one. However, I should add that lighting (responsible for 38% of Luceco’s revenues) is an industry that makes me very nervous, and personally I’d be quick to jump back to AMBER or AMBER/GREEN at the first sign of trouble!

On Beach group (LON:OTB)

Down 10% to 150.9p (£252m) - Interim Results - Graham - GREEN

There’s a lot to take in here:

The overall picture is one of improvement.

The recovery from the Covid era is taking some time:

Way back in 2019, OTB generated significant profits in both H1 and H2, despite much lower revenues.

And given the modest profits earned in H1 this year, the company will seemingly have its work cut out to hit targets: the (adjusted) net income forecast for FY Sep 2024 is £24m, according to Stockopedia.

Liberum forecasts published last month suggested full-year revenues £202.6m, adj. EBITDA £44.9m, and PBT of £35.3m. Even allowing for seasonality, these forecasts look very challenging to me.

Indeed, it appears that Peel Hunt have today lowered their adj. EBITDA forecast from £44.1m to £40.5m.

Let’s carry on with the company’s explanation of how it traded in H1:

…increased passenger bookings during the period (+15%) as well as an increase in the average value of holidays sold…

Proforma continuing EBITDA following B2B changes of £10.1m (H1 23: £6.5m).

Interim dividend is 0.9p, the first dividend since 2019.

As mentioned by Paul in February, OTB has a new partnership with Ryanair, “which ensures we have secure access to this increase in [airline] capacity”. The two companies have “moved on” from their conflict over refunds, and customers can now book package holidays using Ryanair “with complete confidence”.

Importantly, there is a divergence between “premium” and “value” holidays; premium holidays are performing “strongly” but “the value market remains challenging, reflecting ongoing cost of living pressures” (growth in this segment is running at just 1%).

And reading through the CEO’s commentary, the premium segment is where OTB is now looking to place more emphasis, seeing as profit margins are bigger there and premium customers book earlier, providing greater visibility.

Long haul is another area of focus, where OTB’s market share is currently small (“low single digit”) but where it sees the potential for more.

Current trading/outlook: “in line with current consensus expectations”, but remember that Peel Hunt have downgraded them anyway.

Trading momentum has continued since the half year date.

Summer '24 forward order TTV currently 22% ahead of last year.

As a result of these factors, and our new Ryanair partnership, we expect to deliver another record Summer.

Borrowings: the company has borrowed £55m across two facilities (from Lloyds and NatWest). The max that can be borrowed is £85m.

The balance sheet is seasonal in nature with customer cash paid up front, money paid to hotels in advance of customers arriving, etc. Thankfully the balance sheet does have a positive net tangible worth (about £100m) and as the holiday season gets into gear, the large working capital balances should unwind as usual.

Graham’s view

Again I’m happy to maintain our GREEN stance on this one.

Travel companies aren’t having it all their own way at the moment, with value customers squeezed by cost of living pressures and a perpetual risk of oversupply. This is reflected in OTB’s weak profit numbers posted today and in the EBITDA downgrade.

But OTB is well-positioned as a middleman (though technically it does provide many holidays as “principal”, rather than as an “agent”). And it’s priced keenly to my eyes:

With underlying momentum in the business, and with the overall economic outlook being OK, I’m happy to stay positive on this, looking forward to continued growth and expansion across a range of holiday segments.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.