Good morning from Paul & Graham!

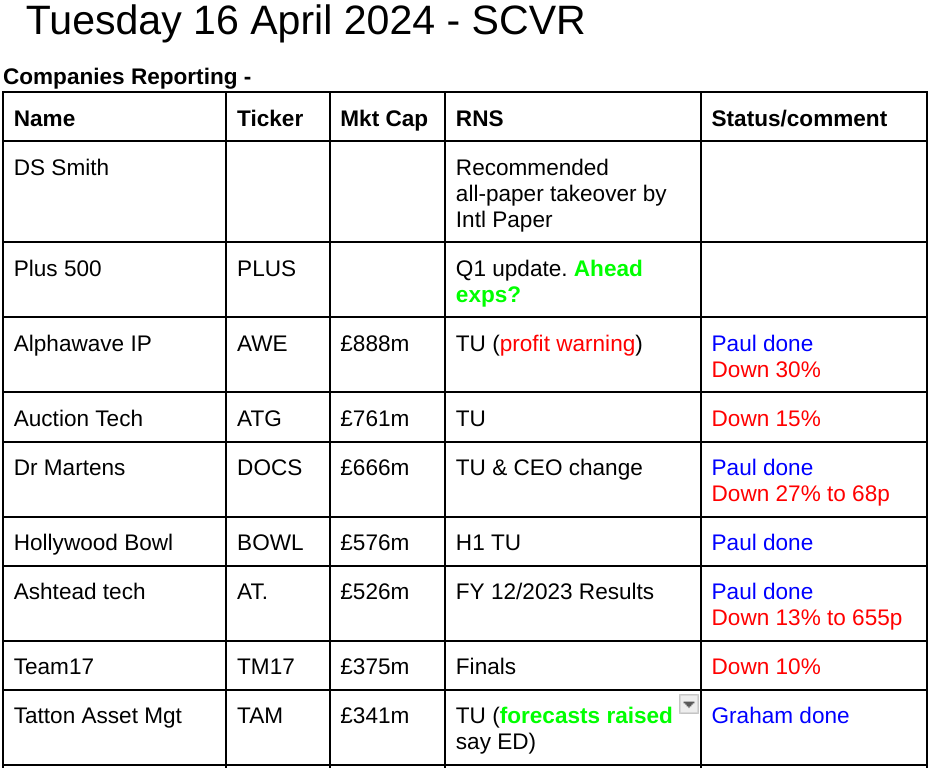

Today's report is now finished.

The SNS (Sky News Service!) was saying last night that Superdry (LON:SDRY) is about to announce details of a CVA to reset its rents to an affordable level, so I'll keep my eyes peeled for that. EDIT: see details of restructuring & fundraise below.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom),

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

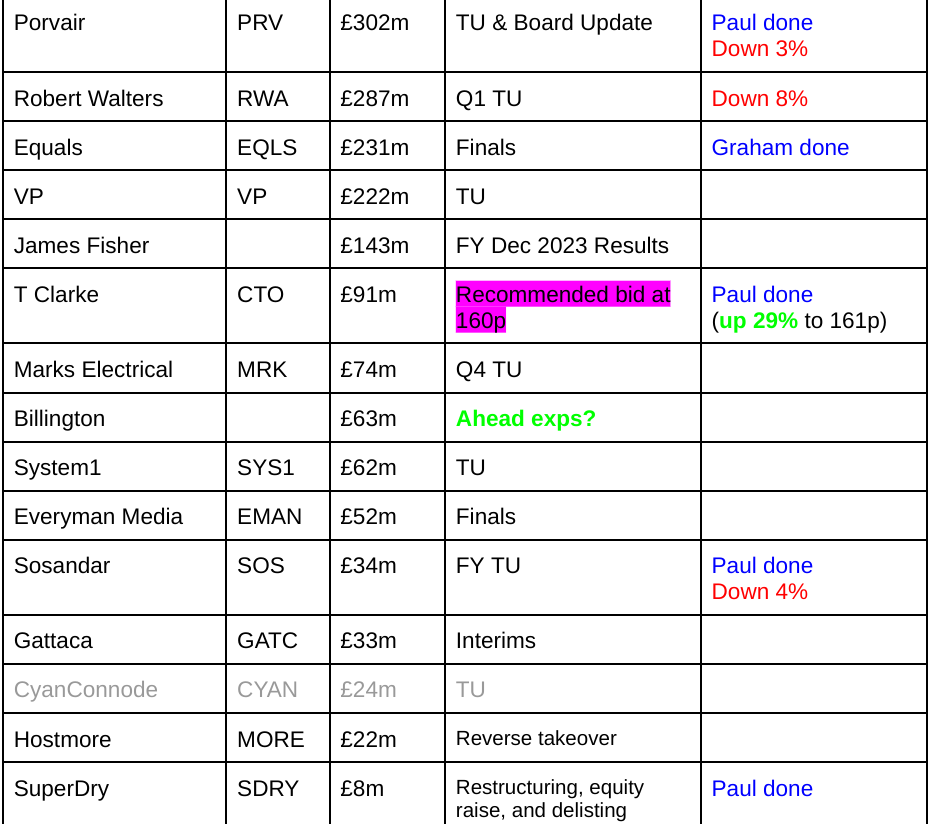

Lots of companies reporting today, so please remember we can't cover everything. We focus on over/under expectations updates, top viewed (by subscribers here), shares on our top ideas lists for 2024, takeover bids, and anything else interesting that we have time left to look at.

Summaries of main sections

Superdry (LON:SDRY) - Down 25% to 6.0p at 08:22 (£6m) - Restructuring & fundraise - Paul - RED

Confirms details of its expected restructuring. Equity fundraise at either 1p (open offer), or 5p placing (Dunkerton only). De-listing in June 2024. Equity probably worth nothing now, in my view, unless you want to hold shares in a struggling, highly indebted private company.

Dr Martens (LON:DOCS) - Down 27% to 68.5p (£666m) - Trading Update & CEO Change - Paul - BLACK (PW) (on fundamentals: RED)

Things go from bad to worse at this fashion boots brand. FY 3/2024 in line, but profit warning for FY 3/2025 says worst case scenario profits could be down by two thirds. It has balance sheet issues - too much debt, and excess inventories. Looks a mess, and it's not cheap even after today's plunge. A terrible over-priced, opportunistic 2021 float.

Tatton Asset Management (LON:TAM) - up 5% to 585p (£354m) - Trading update - Graham - GREEN

I try to justify a continued “GREEN” stance on this one: Tatton has performed amazingly well over the past year with significant net inflows and a 27% increase in AuM. Some investors may wish to take profits here, but I could see it continuing to run. PER is now over 20x.

Alphawave IP (LON:AWE) - down 28% to 119p (£871m) - Trading Update (PW) - Paul - BLACK, fundamentals: RED

Profit warning from this chip designer. I go through the numbers, and struggle to value this share, due to its poor cashflows, lack of broker notes available to us, and complicated accounts. As I mentioned last time in Jan 2024, until it establishes a proper track record of profitability & cash generation, it's impossible to value. An over-priced 2021 IPO. Tech experts might be able to shed some light on the company's products/markets & prospects, all I'm doing is reviewing the numbers, and I don't have any view on those other things.

Equals (LON:EQLS) - up 0.5% to 123.6p (£232m) - Final Results - Graham

Excellent results from this provider of payments services to businesses. Revenues have grown strongly (+37%) and converted to 70% growth in adj. EBITDA. Perhaps being overly cautious, I take a neutral stance as there are some aspects of the story which I find puzzling.

Hollywood Bowl (LON:BOWL) - down 1% to 333p (£570m) - H1 Trading Update - Paul - AMBER/GREEN

This update sounds OK, but they don't specifically confirm trading vs expectations, which raises questions. UK LFL revenue growth is only small. It's had a good share price move, and looks to be fairly priced I'd argue. That said, this is a high quality business, very cash generative, paying a nice 4.1% yield and self-funding modest expansion. So I still like it, but a little bit less now the price has gone up.

Porvair (LON:PRV) - down 1% to 647p (£298m) - AGM Trading Update - Paul - GREEN

Reassuring update. Nice quality group, with an excellent long-term track record, and still reasonably-priced I think. Thumbs up as a long-term share idea from me.

Sosandar (LON:SOS) - down 11% to 12.25p (£30m) - FY Trading Update - Paul - AMBER

It's trading around breakeven, not bad going in a very tough sector. Plenty of cash, and about to start its trial of physical stores. Maybe priced about right for the time being?

Paul’s Section:

Superdry (LON:SDRY)

Down 25% to 6.0p at 08:22 (£6m) - Restructuring & fundraise - Paul - RED

Restructuring announced. Confirms intention to delist (in June 2024), to save money and “heightened exposure of public markets”. Equity raise being underwritten by founder Julian Dunkerton. Landlords and local authorities (business rates) will be asked to reduce liabilities. Suppliers will not be affected. Expected completion June 2024. Alternative is insolvency (Administration) if this deal doesn’t go through.

Fundraise - shareholders are given 2 options to vote on: 1p fundraise through an open offer to existing shareholders to raise E8m. OR a placing at 5p to raise £10m but only for Julian Dunkerton! So in reality the fundraise price is irrelevant, as he will take full control under option 2. I'm not sure why option 1 is in euros, and option 2 in sterling?

Paul’s view - grim, as expected. I remain of the view that the existing equity is probably worth nothing now - unless you want to own shares in a heavily indebted, tired brand, which is about to de-list. I don’t believe that rent cuts will transmogrify this into a successful business, it's probably more a stay of execution - that's what normally happens with retailers that do this kind of restructuring - they go bust or do another restructuring a year or two later typically. This outcome (de-listing & deeply discounted fundraise) was indicated in the last update from the company, so shouldn’t come as a surprise to anyone.

Dr Martens (LON:DOCS)

Down 27% to 68.5p (£666m) - Trading Update & CEO Change - Paul - BLACK (PW) (on fundamentals: RED)

FY 3/2024 sounds OK -

Dr. Martens Plc (the Company) will announce its FY24 results on 30th May, with results expected to be in line with guidance and consensus expectations.

Outlook for FY 3/2025 is what’s caused the 27% share price plunge today.

Key points -

USA wholesale orders down sharply, expected to hit profit by £20m.

Cost inflation will hit profit by £35m, and won’t be raising selling prices this year, so can’t mitigate it.

Extra costs of £15m to store (presumably excess) inventories in FY 3/2024 will repeat in FY 3/2025.

Overall - it’s heading for a serious fall in profit -

There is a wide range of potential outcomes for FY25 given that we have only recently started the year. However, we have assumed that revenue declines by single-digit percentage year-on-year and at the PBT level we could see a worst-case scenario of PBT of around one-third of the FY24 level. There are also scenarios where the profit outturn could be significantly better than this, with the key factor being if USA performance is stronger than our planning assumptions as we progress through the year. We will also look to drive cost savings wherever possible, whilst protecting our brand and future growth opportunities. Against this backdrop, we are focused on cash generation and have already significantly reduced purchases from the supply chain, which will underpin the strength of the balance sheet.

Our business is always second half weighted, however this year, given the phasing of USA wholesale and costs, this will particularly be the case…

"We have built an operating cost base in anticipation of a larger business, however with revenues weaker we are currently seeing significant deleverage through to earnings…

Paul’s opinion - this sounds grim, and I won’t be tempted to catch this particular falling knife. DOCS clearly has lots of problems.

Is it likely to go bust, or need an equity raise? The last (Sept 2023) balance sheet showed only about £99m NTAV, and hefty net bank debt of c.£275m. So investors need to look carefully at the terms & covenants of the bank debt. Banks don’t like funding excessive inventories that aren’t selling, and DOCS will have to figure out how to shift its excess inventories (that means discounting, which lowers profit margins of course).

The trouble with holding shares like this, is the temptation to average down because it seems cheap. However, at £666m market cap with little asset backing, and a big profit warning today (FY 3/2025 profit could be up to two thirds down on FY 3/2024), I’d say it’s actually not cheap. DOCS looks like an opportunistic float at an over-valuation during the pandemic boom.

The CEO says he will step down and hand over to the COO this year.

I think it could take a year or two to sort out this business.

Overall, it’s a mess, so it’s an avoid for me at the moment, RED.

Alphawave IP (LON:AWE)

Down 28% to 119p (£871m) - Trading Update (PW) - Paul - BLACK, fundamentals: RED

This is another 2021 float. I’ve only looked at it once here on 23 Jan 2024, where I concluded negatively (RED at 134p) because of the lack of a profitable track record, and that EBITDA didn’t turn into positive cashflow in H1.

LONDON, United Kingdom and TORONTO, Ontario, Canada 16 April 2024 - Alphawave IP Group plc (LN: AWE, the "Company" or "Alphawave Semi"), a global leader in high-speed connectivity for the world's technology infrastructure, is publishing a trading update for the year ended 31 December 2023 and for the year-to-date 2024.

Revenue and EBITDA for 2023 are below expectations -

Based on the near completion of the audit process, the Company now expects FY 2023 revenue of approximately US$318m-323m which is below the original outlook for the year (US$340m to US$360m). This is mainly due to the accelerated transition away from China, and changes in expected revenue recognition of long-term contracts in advanced nodes.

As a result of the lower revenue and continuing investment in advanced R&D, the Company now also expects reduced adjusted EBITDA for FY2023.

Net debt is much worse than a year earlier at end 2022 -

At the end of 2023, the Company held US$101.3m in cash and cash equivalents and had borrowings of US$220.4m, comprising a revolving credit facility of US$125m, a term loan of US$94m and other long-term borrowings of US$2m. The net debt position was US$119m (FY 2022: US$24m)

Guidance for FY 12/2024 - it makes positive noises about this year, saying it’s had a “stronger than expected start to 2024…”

Alphawave Semi expects 2024 revenue of US$345m to US$365m and adjusted EBITDA of approximately US$70m or approximately 20% of revenue, which is at the mid-point of the revenue guidance range.

Guidance for 2025 is also provided (unusually) -

...the Company now expects 2025 revenue to be approximately US$450m and adjusted EBITDA margin to be between 20% to 25%. The new 2024 and 2025 guidance has been prepared on a bottom-up basis with projects that are currently being delivered across IP licensing, custom silicon and silicon products…

Paul’s opinion - I remain wary of this share. As I mentioned last time, it doesn’t have a track record of proper profits or cashflow. It spent a large cash pile on acquisitions, so the balance sheet is now full of intangibles.

We’re being asked to value it on EBITDA, but overall cashflow was negative in H1 for variety of reasons - negative working capital movements, heavy capitalised R&D, finance costs, etc.

It may be the best thing since sliced bread walked through the door, but the figures are telling me to keep a wide berth. So I’ll stick with RED for now. We need more proof that there’s a successful business here. The contract wins sound great, and it mentions AI of course, so who knows what the future holds? I think we’re being asked to pay far too much up-front for something without an established track record that backs up such a hefty valuation.

Ashtead Technology Holdings (LON:AT.)

Down 14% to 652p (£521m) - FY 12/2023 Results - Paul - AMBER/GREEN

The context of today’s 14% fall is that this has been a very good float from Nov 2021. Is today’s fall a blip in an uptrend, or has the excitement come to a shuddering halt?

Ashtead Technology Holdings plc (AIM: AT.), a leading subsea equipment rental and solutions provider for the global offshore energy sector, announces its full-year results for the period ended 31 December 2023.

Some lovely numbers in the highlights table -

Really impressive organic revenue growth of 35%, with the rest being acquisitions.

Valuation - using adj EPS of 33.4p, at 652p currently, the 2023 PER is 19.5x - not expensive if it can keep growing at anything like the rate of growth in 2023.

The StockReport shows 29.7p broker consensus, so this could be a beat, if the figures are calculated on the same basis.

Note that finance costs have shot up from £1.46m to £4.0m as it's geared up with more bank debt.

Outlook - sounds fine, with more detail provided, the key bit says -

The Board is encouraged by the Group's performance in Q1 2024 and our full year 2024 expectation remains unchanged.

Broker updates - nothing is available to us. I wonder if one of the premium brokers might have slipped out some more caution on the outlook to their privileged clients? We’ll only find out later this week, if the broker consensus forecasts dip. But why would brokers lower estimates, given that AT.’s outlook comments say there’s no change in the outlook?

There’s an IMC webinar this Friday.

Balance sheet - not great. Taking off £95m intangible assets (goodwill & similar), gives only £3m NTAV. So the rapidly growing hire fleet is being funded entirely through increased debt.

You can decide for yourself whether that matters or not. Bulls would say that AT. generates a strong return on investments, so it makes sense to borrow more cheaply than the return it makes on those investments. Bears would point out that there’s no net tangible asset backing to protect the company if/when it runs into an industry downturn - oil & gas being a particularly volatile sector (although currently doing well, and with renewables also providing an additional boost through offshore wind farms).

Cashflow statement - looks good. It made £39m in post-tax, post finance costs operating cashflow, up about 20% on 2022 (2022 was boosted by favourable working capital movements that didn’t repeat in 2023, so the underlying increase is more than 20%).

The main outflows were £19.5m in capex - buying more equipment to hire out, and a whopping £51.2m in acquisitions of bolt on companies. That obviously leaves a big shortfall, which was plugged with a net increase of £36m in bank loans.

There seems to be loads of headroom on the bank facilities.

Going concern statement is clean, no issues there.

Paul’s opinion - these are really impressive numbers. I can’t see any reason why the share price would sell off 14% today. If I’ve missed anything, please leave a comment in the comments below.

Ashtead Tech looks an excellent niche business, that is clearly making hay whilst the wind blows! But high returns attract competition, and the good times don’t always last forever.

That said, after a pullback today, I’m finding the valuation overall quite reasonable, and with further expected increases in profits in 2024 (in part due to the acquisitions contributing further growth), I’m happy to up my view from amber to AMBER/GREEN.

Hollywood Bowl (LON:BOWL)

Down 1% to 333p (£570m) - H1 Trading Update - Paul - AMBER/GREEN

Hollywood Bowl Group, operator of the UK's and Canada's largest ten-pin bowling brands, is pleased to announce a trading update for the six months ended 31 March 2024.

I have a favourable preconception of BOWL shares, and it was on my top 20 ideas list for 2024, so I could have unconscious bias, you should bear in mind.

UK revenues (87% of the group total) were only up 1.3% on a like-for-like (LFL) basis (excludes new site openings) - that’s not great when inflation has been considerably higher for much of this period, especially wage costs which are likely to be significantly up due to living wage increases.

Canada is performing better with +8% LFL revenue growth.

Outlook - a bit too vague. We need a specific statement that it is trading in line with market expectations. It says that refurbishments and new sites are performing in line with expectations, but it ducks the question for group performance overall. That is bound to raise questions.

The Group is confident about the outlook for the business in FY2024 and although the economic backdrop remains challenging for consumers, remains focused on offering a high quality and great value for money experience, with broad appeal to all customer groups looking for leisure experiences to enjoy together.

Cash position remains healthy -

The Group had net cash of £41.4m at 31 March 2024. Its highly cash generative business model continues to enable further investment in growing the portfolio in the UK and internationally, through new centre openings, acquisitions and the rolling refurbishment and rebrand programme.

Paul’s opinion - I remain of the view that BOWL is a high quality business (see the scores below) at a reasonable price. So I remain GREEN. There’s a decent dividend yield of 4.1%. BOWL is self-funding new sites and acquisitions, so there could be a fairly reliable c.10% pa earnings growth to expect in future.

Shares have had a good run, and some might argue it’s now up with events. So I wouldn’t expect a major upward re-rating (unless someone bids for it, as happened with its smaller competitor Ten Entertainment).

I’ll moderate from GREEN to AMBER/GREEN, given the decent upward share price move at BOWL, and the only modest H1 LFL revenue growth.

Tclarke (LON:CTO)

Up 29% to 161p (£85m) - Recommended Cash Takeover - Paul - PINK (takeover bid)

Price: 160p cash + 4.525p final dividend.

Premium: 28% higher than last night’s close - a fairly standard c.30% takeover premium.

Buyer: is called Wider Regent Group -

The Wider Regent Group, which was established in 1995, is a leading supplier of gas and metering services to industrial and commercial customers in the UK. The Wider Regent Group provides services to large consumers of gas across a range of sectors including, leisure, care homes, manufacturing, food production and retail.

Paul’s opinion - this is a good outcome I think. I’ve followed CTO for many years, and even went on a site visit to one of its large clients which was fitting out a complex office building in London. It installs complex electrical and computer infrastructure into offices and other large buildings, operating on tiny operating margin of about 2%. It has to maintain skilled staff in downturns. It’s just not a very good business, and too small to be listed. That said, performance anticipated for 2024 and 2025 looks quite good, and the PER is very low. But it’s low for a reason - this type of business is only ever one bad contract away from disaster. I don’t think its divis are reliable either.

Shares have a weak 20-year track record -

Holders of the shares should be pleased with this outcome I think.

I’ve just noticed that Regent Gas is already the largest shareholder, with 21.5%.

The rest of the shareholder base looks very fragmented, and we’re seeing institutions actively encouraging small caps to put themselves up for sale, in order to create a liquidity event allowing them to exit.

Therefore I imagine this is a done deal. Possible upside? If someone else comes along with a higher counter-bid, as happened with Spirent Communications (LON:SPT) recently.

I wonder if the new owners will be quite so happy to give CTO Directors the wildly excessive remuneration that they've enjoyed in recent years?!

Porvair (LON:PRV)

Down 1% to 647p (£298m) - AGM Trading Update - Paul - GREEN

This is another share that’s on my top 20 share ideas for 2024. I’ve been really impressed with its strong long-term track record of self-funded growth, it’s a quality business at a fair price I think.

Shares are surprisingly illiquid for a c.£300m market cap company, due I think to it being tightly held by lots of long-term shareholders.

The current financial year is FY 11/2024.

I reviewed its last FY 11/2023 results here in Feb 2024.

Today’s update looks price neutral to me -

At the time of the results statement in early February the Board noted its optimism for 2024 and beyond, and this has not changed.

Opportunities afforded by recent acquisitions; strong order books in aerospace and petrochemical; and new product introductions at Seal Analytical are all developing as planned.

De-stocking in laboratory markets is easing and lead times are returning to more normal levels. Industrial consumable order patterns, while still weaker than the prior year, are now also steadier, with several large orders, including one for gasification spares, due to ship at the end of the year and into 2025.

As outlined in February, the Board expects a quieter first half of 2024 to be followed by a stronger second half, in line with market expectations.

CEO retirement - the highly regarded CEO is winding down after a remarkable 28 years on the Board! He certainly deserves more than an Elizabeth Duke carriage clock for his part in making this share a 10-bagger from the 2009 lows. I remember attending a presentation he gave to investors about 10 years ago, and can still recall how brisk & efficient he sounded, rattling off all the detail - exactly what I look for in a CEO, a hands-on entrepreneur.

Mind you checking the 2023 Annual Report, he can afford to buy his own carriage clocks after £1.3m total remuneration in 2023, and almost £1.0m in 2022. That’s about 5% of operating profit paid to the CEO, which is strikingly high, as we often find with small caps. Whilst the FTSE 100 Directors are accused of greed, their pay as a percentage of group profits is tiny compared with many small caps, including Porvair.

Paul’s opinion - I remain positive on Porvair shares. It’s not amazingly cheap, but bear in mind that the forecasts tend to drift upwards with Porvair. So the PER should turn out to be lower than it initially looks. There’s a nice mix of different sectors too, which tends to be a good shock absorber if any particular industries suffer an unexpected downturn.

I enjoyed this interview with fund manager Josh Northrop, who gave a good summary of why he likes Porvair, worth a listen as some of his other stock ideas were really interesting too.

PRV shares could attract a takeover bid I reckon. Nice high StockRank too is the icing on the cake.

Impressive -

Sosandar (LON:SOS)

Down 11% to 12.25p (£30m) - FY Trading Update - Paul - AMBER

The ladieswear fashion brand, which originally was pure eCommerce, but has since broadened its strategy to include more wholesaling, and trial physical stores. It is also trying to move away from price discounting, towards more full price sales. So I’m expecting moderate revenue growth (if any), but improved margins.

FY 3/2024 update today -

Strong H2 with FY24 revenue growth of 9%, continued margin growth and strong cash position to execute store strategy

Revenue of £46.3m for FY 3/2024, and it’s trading around breakeven - not great, but things haven’t got any worse after the profit warning last year -

As a result of a substantial positive swing in PBT from H1 (£1.3m loss) to an expected profit of £1.1m in H2, FY24 will be broadly in line with market expectations* with a marginal loss of £0.2m expected to be reported for the year overall

* Sosandar believes that market expectations for the year ended 31 March 2024 are currently revenue of £46.8 million and PBT of £0.1 million.

H2 is the busier seasonal half, so I’m not reading too much into the above sequential half year improvement.

Net cash is very good at £8.3m, more than a quarter of the market cap, and bear in mind it’s not burning cash operationally any more. Although some of the cash is likely to be spent on opening physical stores.

Current trading - this sounds encouraging -

Post year-end, April trading has been strong with continued improvement in profitability driven in particular by gross margin

International expansion - seems to be going OK, but not madly exciting at this stage (my interpretation of the RNS!)

Physical stores - this will be very interesting, as the first physical store openings are imminent. Obviously they should trade well when new, so expect some gushing RNSs about how incredible and amazing the new store openings have been, in the coming months. That could be a catalyst for boosting the share price. However, what matters is the level of consistent trading the stores produce after they've been open for a while, which is usually lower after the honeymoon period ends.

Paul’s opinion - I think the market cap of £30m looks about right at this stage. Overall I think I’m warming to the new multi-channel strategy. Store openings are likely to consume a fair bit of the cash pile. I rate management here very highly. What they’ve achieved so far is almost impossible - creating a new brand from scratch, in an incredibly competitive sector. Yes it took lots of fundraisings to get there, but they managed it. Unfortunately, things have now stalled in terms of profitability at around breakeven, and the exponential growth story has really gone out of the window. So upside now looks a lot more pedestrian than it was. Even if the stores work, I’m struggling to see this business really scaling up, or making much profit anyway. So maybe c.£30m market cap is a fair valuation at this stage? I’ll go with AMBER, but will watch with interest to see how things develop.

If I'd said to you 5 years ago that Sosandar would out-last Top Shop and (probably) SuperDry, you'd have called me a maniac.

Note that the share count has more than doubled over this 5-year period -

Graham’s Section:

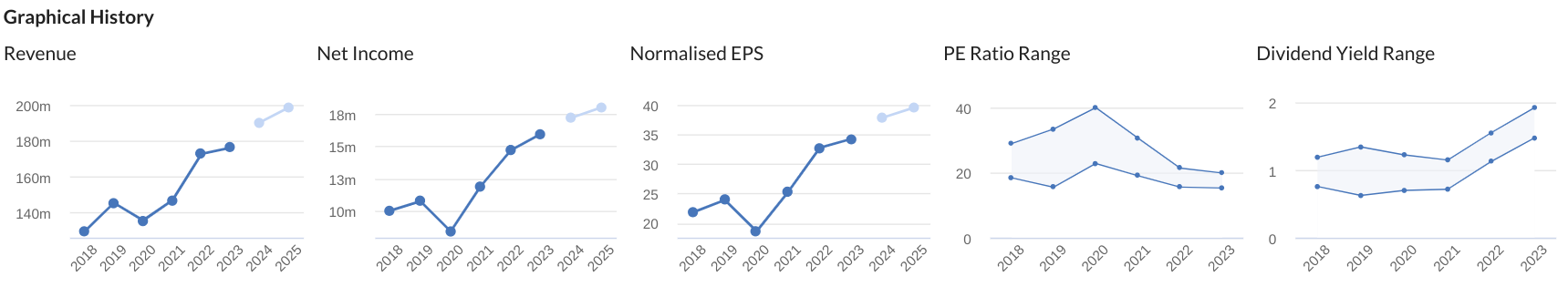

Tatton Asset Management (LON:TAM)

Up 5% to 585p (£354m) - Trading update - Graham - GREEN

This asset manager has slipped my attention for too long, so let’s have a catch up today.

Roland covered its final results last June.

Please note that it’s not a fund manager making direct investments. Instead it provides managed portfolio services, investing in a range of active and passive funds.

Today we have a full-year update for the latest financial year, i.e. FY March 2024. Results will be in line with expectations.

The headlines are very impressive:

Record net inflows of £2.3 billion (18% of starting Aum)

Assets under management (including “assets under influence”) up 27% to £17.6 billion

The company had a three-year plan to reach £15 billion AuM by March 2024, a goal they have exceeded (partly because of acquisitions, although they would have exceeded the target even without the acquisitions made).

Mortgages - Tatton has a compliance consultancy business, Paradigm and a mortgage club, Paradigm Mortgages. They participated in £13.1 billion of mortgages in FY 2024, down 10% year-on-year. The broader mortgage market was down 29%, so this implies that they grew market share!

CEO comment excerpts:

As a management team, we are excited about the future market opportunity and the continued growth and adoption of MPS [GN note: Managed portfolio services] as a core investment proposition by the IFA community. We look forward to announcing our new medium-term AUM/AUI target when we release the full year results in June…

Tatton was “recognised in a recent Defaqto DFM survey as the preferred and most recommended DFM MPS provider” (i.e. discretionary fund management managed portfolio services).

Incidentally, Paul Hogarth is the founder, CEO and largest shareholder of Tatton - a combination I like to find in potential investments!

Estimates: Paul Bryant at Equity Development has raised his forecasts today and suggests that FY March 2025 could see AuM of £18.7bn (prev: £17.1bn), revenues of £42m (prev: £39.8m) and PBT of £18.3m (prev: £17.7m).

Graham’s view

I’ve clearly not paid this one enough attention, as the share price has performed very nicely over the last couple of years:

This puts it on a high earnings multiple and a modest dividend yield:

How could we justify paying this sort of multiple for Tatton?

Some reasons I could agree with:

It’s still led by its founder, who is very well aligned with other shareholders.

Very impressive AuM growth in difficult market conditions, suggesting that there are structural growth drivers (as argued by Equity Development).

Excellent quality metrics (see the StockReport).

If the survey mentioned in today’s update is to be believed, Tatton has the highest-rated MPS service in the market.

I am still tempted to retreat from Roland’s “GREEN” stance (when the share price was 460p). Over 100p higher today, it would be natural to switch to “AMBER”. But I’ll let this winner run a little longer.

At 650p, the stock would be trading at 25x forecast adj. EPS. I think I’d feel obliged to take a neutral stance there.

Equals (LON:EQLS)

Up 0.5% to 123.6p (£232m) - Final Results - Graham - AMBER

Equals (AIM:EQLS), the fast-growing payments group focused on the SME marketplace, announces its final results for the year ended 31 December 2023 (the 'year' or 'FY-2023') and an update on trading for the period from 1 January 2024 to 12 April 2024.

This in the midst of a long-running saga around whether or not it will get acquired. See Paul’s coverage in February and in March.

Today’s numbers (for FY December 2023) are terrific:

With numbers this good, surely the company could have a bright future if it retained its independence?

The company paid a maiden dividend in December (0.5p, value £0.9m) and has proposed a final dividend of 1p.

It finished the year with £18.7m cash.

Since we are already four months into 2024, let’s focus on the H1 trading update (up to 12th April 2024):

Revenue year-to-date £31.9 million, up 30%.

Revenues per working day £443k, up 27% vs. Q1-2023, up 5% vs. Q4-2023.

Cash of £21.6 million.

With such great momentum, again I have to wonder why the company was so interested to put itself up for sale? I suppose with bid interest coming through in recent months, there is the potential for a premium offer - but it’s still quite unusual for management to publicly go looking for that offer, when their standalone strategy appears to be working.

CEO comment:

We continued to grow strongly in 2023, achieving record levels of revenue, Adjusted EBITDA, and operational cash generation. This allowed us to continue to invest in the business and declare a maiden dividend. We also expanded internationally, broadened our product offering and hired greater talent to take the Group forward….

It’s easy to get confused when there are so many forex/payments companies to study. So let’s again turn to the CEO for a reminder of what makes Equals different (emphasis added):

The vision for the Group continues to be the simplification of global money movement for business customers. Equals achieves this through its B2B platforms, Equals Money being targeted at SME customers and Equals Solutions which targets larger corporate opportunities. The Group's growth potential is particularly strong given that the core building blocks of its platforms, namely own-name multi-currency IBANs and bank-grade connectivity and clearance, are highly complex and time consuming to replicate. This 'first mover' advantage was achieved by the investments made in previous years and will be continuously enhanced by the developments planned in the Group's technical roadmap combined with further investments into direct connectivity to payment networks.

Graham’s view

It’s easy to overlook the underlying business here, given the ongoing takeover situation. It makes it tricky to know what’s driving the share price: underlying business progress or deal speculation?

The next PUSU (put-up-or-shut-up!) deadline is tomorrow. So we will have to get an update then regarding whether or not a takeover is going ahead.

Personally, I agree with Paul that when talks drag on for a long time, the likelihood of a deal happening tends to diminish. But named parties are said to be interested in a takeover, and talks are ongoing, so who knows?

Estimates: the most recent Canaccord equity research note I can get my hands on (Sep 2023) upgraded forecasts and suggested that the current financial year, FY Dec 2024, would see revenues of £112m and adj. PBT of £23m.

For a fast-growing business, with net cash, the current £232m market cap doesn’t seem particularly demanding.

Quantitatively, therefore, it appears cheap vs. adjusted numbers.

Qualitatively, I still struggle to understand the USP of Equals’ products (this is my own fault, not the company’s). I’m also perplexed by the proactive search for a bidder when the company’s standalone strategy appears to be working.

Therefore I’ll keep my AMBER view on this one for now. Using unadjusted numbers, the StockReport would agree with my cautious stance:

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.