Good morning from Paul & Graham!

Today's report is now finished.

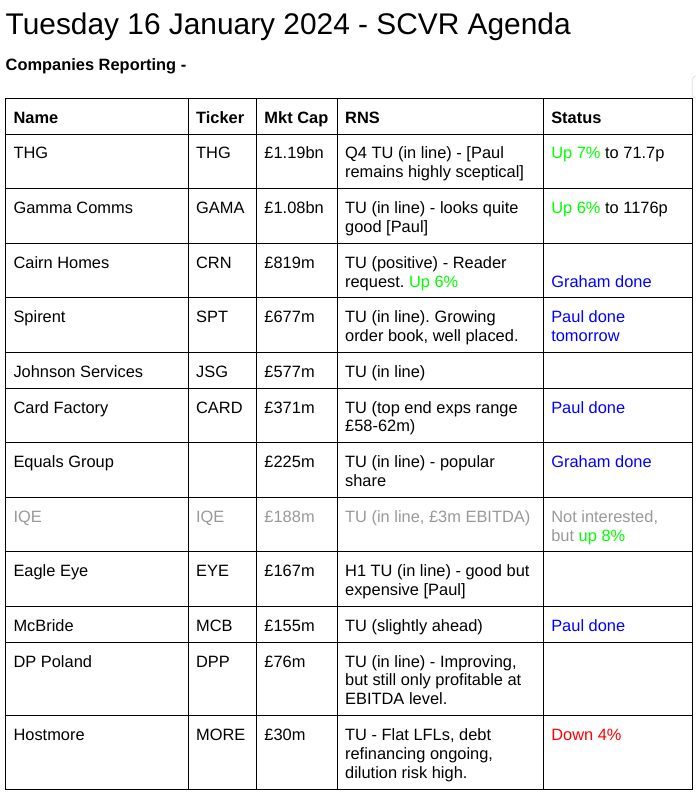

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom),

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Other mid-morning movers (with news)

Northcoders (LON:CODE) - up 19% on big (£10m) contract win - looks potentially interesting, from a previous disappointer.

DP Eurasia NV (LON:DPEU) - up 5% to 100p - recommended & increased final offer.

Summaries

Cohort (LON:CHRT) (Paul holds) - down 1% to 541p (£224m) - Interim Results - Paul - GREEN

H1 results out yesterday look OK to me. Good growth in operating profit almost disappears by the time we reach EPS, thanks to higher finance and tax charges. Full year outlook (with a big H2 weighting) is confirmed in line. Huge order book, so good visibility. Balance sheet is fine. Despite recent rally, shares still look quite good value at 15x, for a quality business. EDIT: whoops, it turns out this was just the formal publishing of figures, and the originals were announced back in Dec 2023. So this section duplicates my review of interim results here on 13/12/2024. Sorry about that! Still looking at the figures twice is better than not at all! Thanks to grumpy5 for pointing out my schoolboy error.

Card Factory (LON:CARD) - down 8% to 100p at 08:34 (£342m) - Trading Statement - Paul - GREEN

Strange fall in price this morning, after its latest update says performance at top end of analysts range. Looks cheap to me, but selling overhang still seems to restrict any short-term upside. So one for patient investors?! The numbers look smashing to me, I think it might be usefully under-priced.

Equals (LON:EQLS) - down 3.5% to 115.74p (£217m) - Trading Update - Graham - AMBER

Equals provides an “in-line” trading update for 2023, which confirms the expectations set out in September. No update on the acquisition front, where there are ongoing talks with an American private equity investor. I remain neutral on this highly rated payments company.

McBride (LON:MCB) - down c.10% to 80p (£140m) - Trading Update - Paul - AMBER

Quite a good update today from this resurgent maker of white label goods for supermarkets. Debt still too high, but not dangerous any more, given much higher profitability, from a remarkable series of upgrades in 2023. Succumbing to profit-taking today it seems. Maybe the best gains have now been had? Still doesn't look expensive yet, providing higher earnings are not squeezed out in future by aggressive supermarket buyers?

Cairn Homes (LON:CRN) - up 5% to 120.8p (£811m / €941m) - Trading Update - Graham - GREEN

This Irish housebuilder reports operating profits in line with expectations for 2023 helped by a strong margin performance. The outlook for 2024 is very positive and supported by an enormous forward order book. I remain positive as the new-build market continues to boom.

Paul’s Section:

Cohort (LON:CHRT) (Paul holds)

(EDIT: sorry, this section is a duplicate of results I previously reviewed on 13/12/2023)

Down 1% to 541p (£224m) - Interim Results - Paul - GREEN

Cohort plc (www.cohortplc.com) is the parent company of six innovative, agile and responsive businesses based in the UK, Germany and Portugal, providing a wide range of services and products for domestic and export customers in defence and related markets.

Interim results are for the six months to 31 Oct 2023.

The Group achieved a strong first half, with growth in revenue, profit, and order book compared with 2022. The increase in the interim dividend reflects the Board’s confidence in the Group’s growth prospects and continued commitment to a progressive dividend policy.

Overall these figures look good to me, and the outlook for FY 4/2024 is confirmed as in line with expectations, with nearly all revenues already visible and ordered (95% full year revenue coverage, and a strong pipeline).

Revenue H1 £94.3m, up 22% (higher sales to UK’s MoD is noted)

Operating profit up strongly, +20% to £6.0m

H1 EPS only up slightly, from 10.12p to 10.36p - reason is higher finance charges and much higher tax charge than H1 LY.

As with last year, it confirms a big H2 weighting to profits this year too.

Massive multi-year order book is at a record high of £354m.

Order intake in H1 was £119m, 1.3x revenues, so healthy growth there.

Positive outlook in the medium term too, with more organic growth expected.

International conflict and tensions is an obvious tailwind for defence sector.

Balance sheet is good, with NTAV of £44m. Although receivables looks unusually high. Net cash of £13.3m is considerably improved from £0.6m net debt a year earlier. I get the impression there are considerable working capital swings throughout the year.

Cashflow also looks fine, with cash generated funding capex and divis mainly (also buybacks this year).

Valuation - broker consensus is 36.1p EPS (so a big H2 weighting as H1 is 10.4p) - hence PER is 15.0x

Forecasts are for only a slight improvement in FY 4/2025 EPS to 37.5p, leaving scope for upgrades I suspect, hence the PER would fall if forecasts are increased in future.

Paul’s opinion - this is one of my favourite value/GARP shares, offering high quality scores, an impressive long-term growth track record, carefully considered & executed acquisitions from time to time, long-serving and decent management, and a strong balance sheet. So it ticks all my boxes really for value/GARP shares.

It spent most of 2023 in a range from 425p-525p, and when at the lower end, was obvious value, which I flagged several times. The recent rise to 544p means there’s less value on offer, with the PER now near to 15x.

That said, it’s not my job to try and predict market prices, and as 15x is hardly overpriced, I’m happy to stick with my positive view, so it remains at GREEN.

Given the big order book and hardly any growth anticipated in forecasts, then this calendar year might produce ahead of expectations updates?

In the last 6 years, CHRT has usually commanded a premium PER in the twenties, so 15x now doesn’t look a stretch.

Good StockRank too -

Card Factory (LON:CARD)

Down 8% to 100p at 08:34 (£342m) - Trading Statement - Paul - GREEN

cardfactory, the UK's leading specialist retailer of greeting cards, gifts and celebration essentials, announces a trading update for the eleven months ended 31 December 2023.

Not quite year end then, but they should have a very clear idea now how FY 1/2024 will turn out. You might think greetings cards are old hat, but CARD was highly profitable & cash generative pre-covid, and has had a good sort out in recent years, and is now nicely back on track. The perilously geared balance sheet is now also no longer a problem, hence why I turned positive on CARD shares ages ago, and reported positively on it six times in 2023. The share price seems to have been held back by the largest shareholder dribbling out shares into the market - with the RNS showing its gradual selling.

That’s the background, what’s the latest? This looks good -

Full year adjusted profit before tax expected to be at the top of the range of market expectations

3 According to Company-compiled consensus estimates as of 15 January 2024, the current range of market expectations for FY24 adjusted profit before tax is £58.4 million to £62.0 million.

It makes analysis so much easier and more accurate when companies add these footnotes - everyone should be doing this. Apparently one or two dinosaur brokers actually stop their clients doing this - overrule or sack them, I say, if they try to stop a company communicating well with its shareholders!

Last year’s accounts show adj PBT c.£49m, when the boost from covid support is adjusted out. This year is likely to have a higher tax charge, as Corp Tax went up from 19% to 25% in April 2023 - something to bear in mind for all UK companies as a headwind, and quite significant size.

Other key points -

Strong store sales, up 8.2% LFL (11 months to Dec 2023)

Online still struggling, down -12.8% (but it’s a small part of the business - still a missed opportunity though) - improved a bit in Nov & Dec.

Outlook - all sounds on track -

Given the strength of performance in the year to date, the Board expects to deliver full year adjusted profit before tax (excluding one off items) at the top of the range of market expectations3 and remains confident in the achievement of the long-term financial and operational targets set out at our Capital Markets Strategy Update in May 2023.

Paul’s opinion - nothing is said about cash/debt position, which I think was a mistake. It’s not a major concern, but was previously, so I think investors probably would have liked some reassurance on that. Cash/debt is a simple enough figure to work out too, the company should have this info in real time - in my retailing CFO days, I reconciled all the bank accounts every morning, and that was 30 years ago! (for a business about a quarter the size of CARD though, and nowhere near as profitable!). I still remember the 14.4k dial up modem doing its “derrrrrrr, diddly diddly diddly” login process, it seemed almost miraculous at the time, as bank statements started coming out of the printer.

Another complaint is that CARD doesn’t get any broker research out to the great unwashed. Only the privileged get to see Peel Hunt notes on it, thus giving them an unfair informational advantage. So at this stage I don’t know if any brokers have updated their models, I would imagine the consensus will edge up a bit reflecting today’s positive news, and that usually drives the base year higher on their spreadsheets for following years. So small upgrades likely.

Around 13.5p EPS seems likely to this year. Put that on an undemanding PER of 10-12x, and I get to a target of 135-162p - well above the current price (08:31) of 100.5p (down 6%) - which strikes me as an attractive entry/hold price. So it’s another GREEN from me, but as always, make up your own mind.

This seems a share where holders need to be patient, as there’s clearly still an overhang of sellers. There’s always a worry that they might know something we don’t!

Note that there's been no dilution over the 5-years shown below, so in theory there's no reason why it couldn't return to previous peak share price, if performance continues improving. Very high StockRank too, encourages me -

McBride (LON:MCB)

Down c.10% to 80p (£140m) - Trading Update - Paul - AMBER

McBride plc (the "Group"), the leading European manufacturer and supplier of private label and contract manufactured products for the domestic household and professional cleaning and hygiene markets, today provides a trading update for the six months ended 31 December 2023 ("the Period").

An encouraging H1 update today -

The Group expects to report first half adjusted operating profit slightly ahead of our expectations.

This comes on the back of stunning increases in EPS forecasts during 2023 -

Revenue growth of 10% combines both volume growth, and higher prices.

Inflation & supply chain - a bit of caution here - I'm surprised it says supply chains are still volatile, as most companies are saying the opposite -

While input costs have generally stabilised, energy, employment and financing costs continue to apply inflationary pressures. Additionally, the Group continues to manage significant supply chain volatility.

Net debt - previously at crisis levels, it’s now very much more under control - reduced somewhat, and with much higher earnings, heavy debt becomes less problematic. 2x EBITDA is within the range of what many investors and banks think is reasonable -

The Group's focus on reducing debt and maintaining tight control of costs resulted in net debt closing the Period at £145.7m (30 June 2023: £166.5m), with liquidity at £85.0m (30 June 2023: £59.3m), comfortably above the minimum requirement per the banking covenant. The Group continues to anticipate that net debt / adjusted EBITDA will be close to 2x by 30 June 2024.

As mentioned before, the bank has been extremely accommodating, which has enabled MCB to trade its way out of a crisis, rather than having to do a ruinously dilutive equity raise, which looked highly likely when the shares were bombed out.

So risk-takers did very well on this one, with it 4-bagging in the last year - well played!

Valuation - I can’t find any new broker notes. Going on the existing consensus figure of 15.3p for FY 6/2024, that gives a current year PER of only 5.2x. Although we do need to adjust for net debt being about the same as the market cap. If we eliminate the debt, then finance costs would fall a lot, so EPS would need to be adjusted up. So debt-free PER would probably be roughly something like 7-8x I’m guessing (haven’t got time to work out the detailed numbers).

That doesn’t look a demanding valuation to me, probably about right for this type of business?

Paul’s opinion - the big question is whether earnings are sustainable at this markedly higher level, or whether the supermarkets will once again squeeze the profit out, as they’ve done in the past?

I’ve read differing opinions on this, some saying that MCB has made effective internal reorganisations & efficiency savings (which often happens when companies are close to going bust), hence is now achieving permanently higher margins.

Or an alternative view is that it locked in some c.1-year contracts with customers that reflected higher priced raw materials, and is now making one-off margin gains as those raw materials are receding in price. Hence the next set of contract negotiations could tighten its margins again perhaps?

Also the debt has not disappeared. Servicing the interest costs, and reducing the amount outstanding suggests to me little prospect of generous divis any time soon. The last divi seems to have been paid in 2010!

So I see this as a low quality, overly indebted business, in a horrible sector (supplying supermarkets) that’s having an unusually good year, which may or may not continue in future.

Given the 4-bagging of this share, I can see why some investors are banking their gains today, on what has been a superb trade, no doubts about that.

I’m not convinced there’s quite as much upside potential from here on, but who knows, it depends on how it performs in future, which none of us knows yet.

Looking back at our reviews here last year, we reflected the improving performance, starting off at red, then shifting up to amber/red, before ending the year amber - good performance, but still far too much debt. I think that remains my opinion, which may well differ from yours, that’s the thing about opinions isn’t it! So I’m sticking at AMBER - some good points, and some not so good points, but nothing seriously wrong with it overall.

20 years to get back to where it started -

Graham’s Section:

Equals (LON:EQLS)

Share price: 115.74p (-3.5%)

Market cap: £217m

Equals Group plc (AIM:EQLS), the fintech payments group focused on the Enterprise and SME marketplace, announces, consistent with prior years, a pre-close trading update for the financial year ended 31 December 2023 ('FY-23' or the 'year').

This payments company put itself up for sale late last year. At the time, both Paul and I made some comments on the situation.

Here we are in mid-January and there is just one horse in the race to buy Equals, a Chicago-based private equity outfit. But will a bid eventually emerge and be presented to shareholders? We still don’t know.

I must reiterate that I found it unusual for a company in seemingly rude financial health and with good prospects to go out of its way to contact potential buyers.

But let’s turn to today’s trading update, which is in line with expectations. I believe these expectations were set following the September upgrade.

Key points:

Revenues up 37% to £95.5m.

Cash £18.3m at the end of 2023, plus another £2.3m received on 4th January 2024.

The company focuses on “revenue per working day”, which helps to strip out differences caused by bank holidays, etc. This metric reached £397.6k in H2 2023, with impressive growth versus H1 2023 (£362.9k) and H2 2022 (£301.6k).

CEO comment:

Whilst the Strategic Review announced on 1 November 2023 remains ongoing, we will continue with our plans in 2024 and look forward with confidence in our proposition, our teams, our technology and, ultimately, our sustained growth prospects.

Profit estimate: 2023 expectations, according to Zeus in September, were for adjusted PBT of £19.5m.

The company adds a disclaimer at the end of today’s RNS, in line with regulations, that profits for 2023 have not yet been fully audited - this is just a regulatory requirement.

Graham’s view

We have covered this one numerous times in the SCVR, and hopefully some readers have participated in its share price strength:

It’s a stock that I failed to get bullish on, due to heavy adjustments to its profit figures, what I perceived as a high valuation, and difficulty understanding its product set - a wide mix of B2B and B2C products.

With most financial stocks, including payments companies, I can instantly recognise what the company is doing or at least what it is trying to do. With Equals, I’ve never been entirely sure about their USP or what they are ultimately aiming to achieve. What do they have that makes them stand out from any other bank or payments provider? I still don’t know.

I do think the Equals Money website is attractive, and you can read many reviews from happy customers on Trustpilot.

Their ambition remains “to become the leading independent payments company of choice for SME’s and the professionally prosperous”.

Valuation is still on the higher end of the spectrum, and I’m remaining neutral on this one.

Cairn Homes (LON:CRN)

Share price: 120.8p (+5%)

Market cap: £811m

This Irish home builder reports a full-year update for 2023.

Key points:

1,741 new home sales (previous year: 1,526)

Revenues €665m (previous year: €617.4m) are just below the €675m level expected in September.

Gross margin 22.1% (previous year: 21.7%) seems to be a little better than expected.

Operating profit €113.4m (previous year: €103m) is within the range of expectations.

All in all then, 2023 has gone in accordance with the upgraded expectations.

The forward order book is over €900m, up from €374 million a year ago, due to 2,350 properties having been forward sold. A remarkable increase, “clearly illustrating the current demand for our homes across all tenures”.

Build cost inflation has cooled to 4% from 8%.

The company is focused on starter homes and notes that “over 80% of Cairn’s starter homes are available to our customers at prices which are below State support pricing caps”.

That may sound very affordable, but the price caps are set at up to €500,000, which is 60% higher than the median house price in Ireland! These aren’t cheap houses.

Share buyback - the company did a €75m share buyback in 2022, and is currently working on another €75m buyback it started last year. €42.6m completed so far.

The buyback - mostly done at lower prices compared to where Cairn is currently trading - is one of the reasons I gave this stock a green rating, as the reduction in the share count is significant.

But shareholders have also been getting a nice dividend; the company says:

Significant cash generation in 2024 and beyond will continue to fund consistent and growing shareholder returns.

FY 2024 Outlook is excellent:

Cairn starts 2024 with a forward sales pipeline of 2,350 new homes. Momentum is very strong entering the year with over 500 new homes due to close in the first three months of the year and 1,600 of our current forward sales pipeline expected to close in 2024.

Cairn is therefore poised to deliver an exceptional output and financial performance in 2024, and expects to deliver year-on-year turnover and profit growth of c. 30% and:c. 2,200 new homes;

operating profit of c. €145 million; and

15% return on equity.

Graham’s view

I don’t see any major reason to change my positive view here, even at a higher share price.

When previously covering this share, it was trading sub-100p.

At 120p, it now trades at a modest premium to book value and at a more demanding earnings multiple:

Even so, these numbers are justified to my eyes by the growth numbers and by the capital allocation - there are now only around 655m shares outstanding, vs. 755m a few years ago.

It should go without saying that this company - and its stock - are vulnerable to economic forces beyond its control and that there are unavoidable risks in the housing sector.

There is a degree of financial leverage involved, with net debt of €230m as of the end of H1 (forecast to reduce as inventories convert to cash). The company is also losing its CFO, with an “orderly transition” and “a smooth transition of responsibilities” being planned. Something to be aware of.

But my view is that if someone wanted to invest in the housing sector, this stock stands out as being of particular interest - a nice focus on starter homes where there is lots of government support and booming demand, and a great track record of profits, dividends and buybacks.

Cairn does command a higher valuation now than it did last year, but I see that as being justified. So I’ll leave my positive stance here unchanged.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.