Good morning, it's Paul & Jack here with the SCVR for Tuesday.

Agenda -

Paul -

Scs (LON:SCS) (I hold) - Interim results

Eagle Eye Solutions (LON:EYE) - Interim results

Jack -

Litigation Capital Management (LON:LIT) - litigation financing firm; revenue down due to Covid but but optimistic on future business

Mello Tuesday

Investing in Metals and Mining - a very topical subject, with this sector being buoyant at the moment. It's not something that I cover, but readers may be interested, I know a lot of you hold Sylvania Platinum (LON:SLP) for example. More information here, including a discount code for Stockopedia readers.

.

Paul’s Section

Scs (LON:SCS)

(I hold)

232p (pre market open) - mkt cap £88m

ScS, one of the UK's largest retailers of upholstered furniture and floorings, is pleased to announce its interim results for the 26 weeks ended 23 January 2021.

ScS has an unusual year end, close to the end of July each year.

It’s quite tricky to work out what has happened in each 6 month period, so I’ve gone back to the last year pre-covid (FY 7/2019), which looked like this:

H1 (26wks ended 26 Jan 2019) - Revenues £151.4m, Underlying EPS 2.2p

H2 (26 wks ended 27 Jul 2019) - Revenues £166.0m, Underlying EPS 28.1p

As you can see, in a normal year, ScS makes almost all its profit in H2. I think that’s because the busiest time for taking orders is Christmas & January sales, but due to the time lag between orders being placed, and actual deliveries weeks later (it’s delivering the finished goods to the customer that would trigger revenue being recognised), then the busy period feeds into revenues in H2.

Numbers for 2020 were normal in H1, ie. around breakeven, then H2 (26 wks ended 25 July 2020) bore the brunt of covid lockdown 1 (the most severe), generating only 2.9p u/l EPS, instead of the usual large H2 profit.

What seems to have happened is that, when the shops re-opened (in June 2020, I think), then there was a great deal of pent-up demand, which caused a surge in orders. The time lag then meant that a lot of this surge in orders were not delivered until H1 2021 (26 wks ended 23 Jan 2021) figures which were published today.

Therefore, instead of looking at the usual seasonally slower H1 period, we’ve got boom-time numbers, as all that backed up demand was fulfilled.

As you can see from this excerpt of the financial highlights below, the profit that was foregone in H2 last year due to lockdowns, has surged through in H1 this year. This is a key point that I like very much about SCS (I hold) and also demonstrated recently by larger competitor Dfs Furniture (LON:DFS) - that covid/lockdowns cause only delays in sales, which are then recouped later. As opposed to many other companies which lose sales forever (especially in travel/hospitality/leisure sectors) during lockdowns.

Another factor to consider, is the well-publicised trend for people revamping their homes, due to spending so much more time at home, which will have boosted demand for ScS.

Taxpayer support - another complicating factor is that ScS has been very open about receiving £6.6m in Govt support, mostly business rates relief, which has significantly boosted these numbers, and of course is being phased out this year gradually. ScS clearly didn’t need this taxpayer support after all, which raises the thorny issue of whether it should be repaid? It looks as if the furlough money is likely to be repaid;

As stated earlier in this statement, the Group intends to repay its current year CJRS grants if trading of our stores is in line with our expectations...

Outlook - the key question now, is how the latest lockdown has impacted orders for H2? Re-opening of ScS’s stores is scheduled for 12 April 2021, which sounds early enough for pent-up demand to be fulfilled by the end July year end.

There’s a lot of catching up to do -

Overall order intake decrease of 87.2% on a like-for-like* basis for the first seven weeks of the second half of the year to 13 March 2021 due to the current temporary store closures, resulting in order intake decline of 23.8% for the 33 weeks to 13 March 2021

Evidence from the last lockdown, is that demand springs back with a vengeance, so I would expect the same thing to happen this time as well.

I think the key phrase in the outlook comments below is “cautiously optimistic” -

With consumer confidence and the economic environment remaining uncertain, it is difficult to provide clarity on the Group's outlook for the weeks and months ahead. However, we remain cautiously optimistic as recent government announcements have provided further clarity on the anticipated reopening of our stores. The business continues to adapt and respond to trading conditions, with increased focus on the development of our digital channels....

Order book - this is important, it was a lot higher at 31 Jan 2021, than a year earlier (just before covid started), which gives me comfort that the company has enough work to tide it over through during this latest lockdown.

The Group's order book at the end of January 2021 was £90.5m (including VAT), which is £16.8m larger than at the end of January 2020.

Given that a normal half year is around £170m revenues, then 53% of H2 revenues should already be in the bag from existing orders. Then ScS should see a surge in new orders from re-opening in April 2021, which should be delivered before end July year end. Put that together, than I think the outlook for H2 is looking promising.

Online sales - growing fast, up 81% in H1 to £17.7m, but that’s only 10.2% of total revenues, a long way behind the 25% that Dfs Furniture (LON:DFS) recently reported, so there’s clearly an opportunity here for ScS to increase its online sales. Maybe they should look at what DFS is doing, and emulate it?

Online sales in H2 (first 7 weeks) are up 157.5% (no other figures given), an increase which I would expect given lockdown 3 is underway. On the results webinar, they've just said that online sales should be up to 15% by year end.

There’s some good commentary about further initiatives to boost online sales.

Variable cost base - I particularly like this analysis, showing how the cost base is mostly variable or discretionary, making the business model very resilient in a downturn -

Excluding government support, total costs before tax for the year were £171.2m (2020: £160.7m).

Of this total, 76% (2020: 74%), or £129.5m (2020: £118.5m), are variable or discretionary, and are made up of:

· £98.6m cost of goods sold, including finance and warranty costs (2020: £88.4m);

· £9.8m distribution costs (2020: £9.1m);

· £11.5m marketing costs (2020: £14.5m), and

· £9.6m performance related payroll costs (2020: £6.5m).

Semi-variable costs totalled £21.3m, or 12% of total costs, for the year (2020: £19.8m; 12%) and are predominantly other non-performance related payroll costs. Depreciation and interest (including ROU assets), rates, heating and lighting make up the remaining £20.4m (12%) of total costs (2020: £22.4m; 14%).

Balance sheet - NAV is good, at £39.5m. Removing £2.2m intangibles assets takes NTAV to £37.3m, still good.

There are large IFRS 16 lease related entries, which I also remove (£108.3m Right of use asset, and £24.9m current liabilities, and £103.1m non-current lease liabilities). Future years’ rents should not be on the balance sheet at all, simple as that, in my opinion. The old system was far better, with just a provision required for any loss-making sites. The IFRS 16 entries are a net deficit of £19.7m, so I would add that back to NTAV of £37.3m, to arrive at adjusted NTAV of £57.0m, a very healthy position.

The financial position is further helped by a very favourable working capital structure. Furniture retailers make the product to order mostly, so this means low inventories, and receipt of cash from customers well before suppliers have to be paid to make the furniture.

The Group operates a negative working capital business model whereby:

· For cash/card sales, customers pay deposits at the point of order and settle outstanding balances before delivery;

· For consumer credit sales, the loan provider pays ScS within two working days of delivery, and

· The majority of product suppliers are paid at the end of the month following the month of delivery into the distribution centres.

For this reason, whilst the current ratio of 1.15 is nothing special (current assets of £113.0m, divided by current liabilities of £97.8m), note that current assets includes a whacking great cash pile of £97.8m! There’s no interest-bearing debt, so that’s net cash of £97.8m, which is more than the market cap of the whole company!

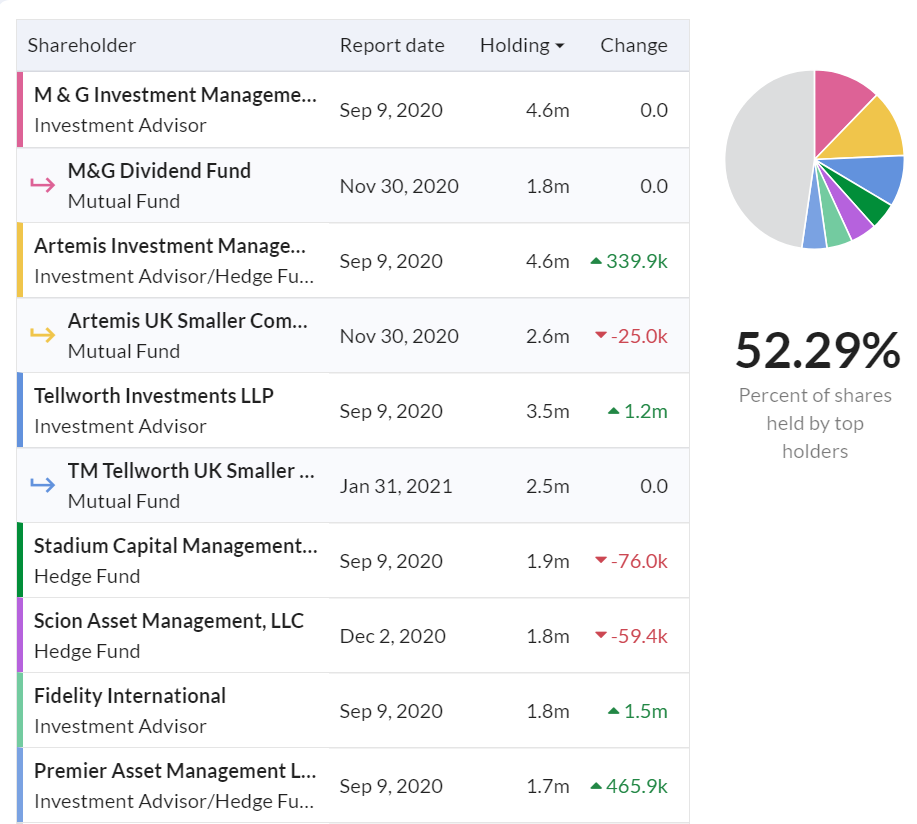

I think this makes ScS a sitting duck for a private equity takeover bid. They’d strip out that cash in the blink of an eye, load it up with debt, and therefore get the company for free! There are no dominant shareholders, it’s all institutions, so agreeing a bid would probably be quite easy, and I reckon they would like the prospect of an opportunity to exit at a premium. A bid at 400p would get my vote!

Valuation - it’s blown the 23.5p full year (FY 07/2021) forecast out of the water, with 37.5p achieved in H1.

I feel there are so many moving parts in last year & this year’s numbers, that we need to make lots of adjustments. I can’t find any broker forecasts. The most logical, and simplest, way to look at things, in my opinion, is to refer back to profitability before covid, and just assume it’s likely to achieve similar profits (or higher) in future. After all, it’s essentially the same business.

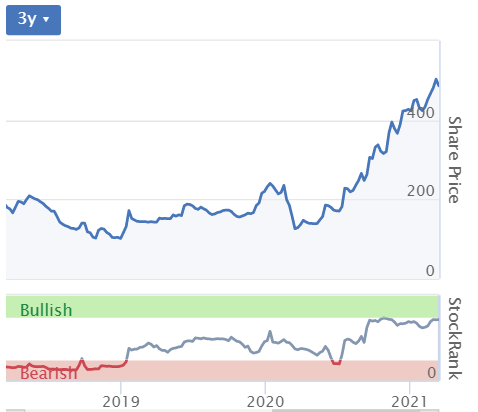

That means 30p EPS is the ballpark figure I’ll use for valuation. Put that on a PER of say 12-14, which looks about right to me, and I have a target share price of 360-420p - way below the current price of c.243p. To me, this share is quite obviously the wrong price, but I’ve been saying that for quite a long time! So it might be one of those frustrating shares that never seems to re-rate, despite being absurdly cheap.

The other issue is that ScS went bust in 2008, and I think that has weighed on sentiment ever since. The reason was that credit dried up in the credit crunch, which looks very much like a one-off. ScS has sailed through the covid/lockdown situation, thanks to a very much stronger ungeared balance sheet, and resilient consumer demand. Totally different situations. Hence I feel investors should see the ScS of today as a very much stronger business than in the past.

My opinion - a very impressive set of H1 numbers.

This is a very resilient business, and has a bulletproof balance sheet.

As explained above, I think this share is completely the wrong price. A more logical valuation is something like 300-400p, in my opinion, so there’s good upside here, from the current c.244p.

I’m just on the results webinar now, so might add additional points below if anything interesting crops up.

.

EDIT: Webinar - has just finished. Management come across really well, as down-to-earth, hands-on management. Very much what I like, if we can't have an owner/manager (my top preference).

Here are the presentation slides which were talked through by management on the webinar. They're really informative, so I do suggest you take a look at them - presenting key information in an easily digestible form.

Here are my notes from the webinar (not comprehensive, just things that I thought were noteworthy) -

- Over half the product is manufactured in the UK (slide 13) - so container freight issues from Far East less of a problem

- Online - now doing virtual walkarounds in stores (by appointment)

- Marketing spend is very flexible, can be adjusted up or down, deferred, etc, when needed. Big splash planned for re-opening in April 2021, will be similar to peak Xmas trading (augurs well)

- New CEO has 30 year career in retailing (mainly Sainsburys & Argos), been shadowing long-standing CEO for last 10 weeks, going very well, saying "The business is everything I hoped it would be, and more"

- Market share has grown from 9.4% to 9.8% estimated

Q&A

- What will you do with cash pile? Reinstate divis in due course, also looking at possible acquisitions

- Freight costs re containers from Far East a problem? So far just small cost increases, via UK distributor. If cost pressures come through, then would be passed on via price rises. Hoping that freight charges might return to normal now Chinese New Year has happened

- I queried difference between gross sales of £182.3m, and revenues of £173.9m. It's the cost of providing interest-free credit.

- Why did Trustpilot approval fall from 4.6 to 4.5? (from memory, I hope those numbers are right) - still very good, but was affected by product manufacturing & freight delays. Stores typically ring every customer fortnightly, to update them, even if not delayed.

- Might look at doing own manufacturing in the UK. Sofa.com do this, for example

- Rents - will they reduce? Yes there are ongoing opportunities, e.g. in weaker retail parks, but still good demand in better sites. Some reductions will feed through, but expected to be offset by other cost increases (e.g. distribution costs)

Recording of the webinar is now up on BRR Media's website - you can search for it , or hopefully this link might work. Not sure if it's personal to me, or will work for everyone?

End of edit.

.

Half year results

I've just discovered a really useful feature buried in Stockopedia, that I've never noticed before.

I often like to work out sequential half year performance on the profit & loss statement. It's easy enough to do manually, by deducting the interim H1 numbers from the full year figures, the difference is therefore the H2 performance (including any audit adjustments, so it may not be exact). It's important to do this, to ascertain what seasonality there is. Otherwise, if you just double the interim profit to get to a full year profit, you can end up making a hideous mistake on a highly seasonal business. A good recent example was the stellar interim numbers from Hotel Chocolat (LON:HOTC) but on closer inspection, it turns out that the company makes all its profit in H1, and is then loss-making in H2!

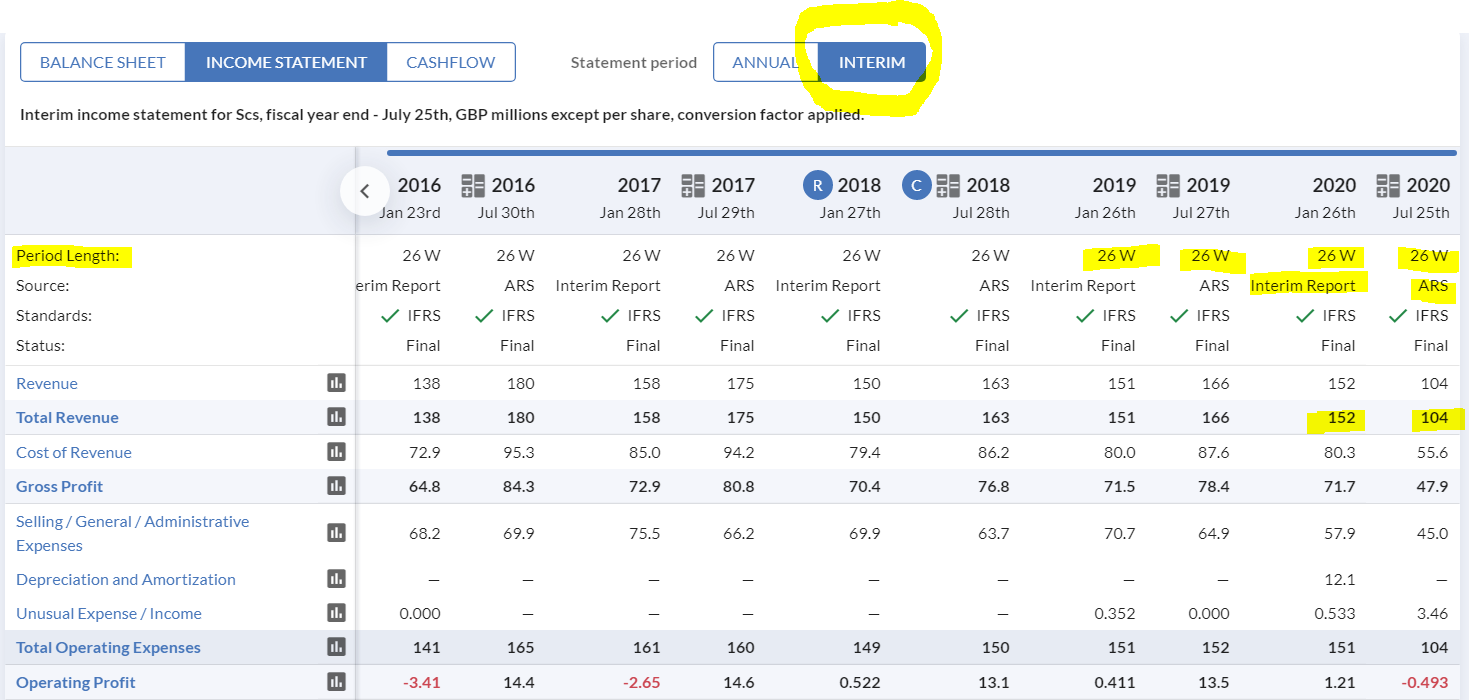

Well, it turns out the Stockopedia has done the work for us! On the StockReport, If you go to Accounts tab, then click on Income Statement, then change the "Statement period" from "Annual" to "Interim", then it shows results for each sequential 6 month period. This enables you to quickly check what the usual seasonality of the business is, by looking at revenues & the various profit measures.

Here's an example from Scs (LON:SCS) (I hold), where you can clearly see the usual cyclicality is for H1 to be near breakeven, and H2 to be highly profitable -

.

So in this case, I've highlighted how each period is 26 weeks, H1 and H2. i.e. Stockopedia has worked out the H2 numbers by doing the calculations for us. You can see above how H1 (labelled "Interim Report") revenues for ScS are usually lower than H2 (labelled "ARS" - maybe Father Jack compiled the table?! Joking apart, I assume ARS that stands for Annual Results Statement). But in FY 07/2020, H2 revenue plunged to £104m, down from H1 revenue of £152m, due to the impact of lockdown 1.

So there's a really useful feature, that I'll be using in future to quickly check on normal seasonality, that should save me a good bit of time not having to manually work out H2 performance figures. I hope you find that useful too.

.

Eagle Eye Solutions (LON:EYE)

474p (down 5%, at 13:45) - mkt cap £123m

Eagle Eye, a leading SaaS technology company that creates digital connections enabling personalised, real-time marketing through coupons, loyalty, apps, subscriptions and gift services, is pleased to announce its results for the six months ended 31 December 2020 ("the Period").

The little PR heading is stretching credibility almost to breaking point, by saying -

Strong profit growth underpinned by new domestic and international customer wins

This is how I see it -

H1 revenues only up 8% to £10.8m

Mostly recurring revenues (73% of total), which is good. Balance is development & set up fees (see note on segmental analysis)

Churn very low at 0.2%, although I’d be interested to see how the figures are worked out, as some companies offset customer losses with increased business from other customers. Don’t know how EYE calculates churn, but with a very impressive large client list, it looks like revenues are indeed likely to be very sticky, once integrated into the systems of e.g. large supermarket chains.

High gross margin, so once systems are installed, it’s lucrative business.

EBITDA - is meaningless, because it ignores £1.3m of capitalised development spend in H1 (was £2.8m last full year)

In reality, EYE traded just above breakeven in H1, £197k profit before tax, a tiny profit for a company valued at £123m, but improved from £(632)k in H1 LY.

Taxation - I’m surprised it’s paying corporation tax on such a small profit, and given that I would have expected to see R&D tax credits claimed, so a query on this point.

Outlook comments - very bullish, with mention of a record pipeline. Covid has slowed down growth, fair enough that makes sense. Company says growth should accelerate. Good - it needs to, to justify the current valuation. Overall, trading in line with expectations for FY 06/2021. Is that enough to justify the huge rise in share price? I’d say not.

Balance sheet - threadbare. Only £0.1m net cash, but the company is relying on having access to a £5m borrowing facility. With the valuation this high, it’s a no-brainer to do a small placing, to strengthen the balance sheet, I reckon.

Receivables look high at £5.4m, which looks to be about 90 days revenues. Cash collection maybe could be better?

Weak current ratio. Negative NTAV. So quite weak overall, but with predictable recurring revenues, does that matter? Arguably not.

My opinion - these are not good numbers, for a company valued at £123m. I think the share price has run well ahead of reality. But, we’re in a roaring bull market for growth/tech stocks. The attraction of EYE is the blue chip client list, strong retention, recurring revenues at high margins, and the global market opportunity. So if you’re feeling gung-ho, then this could be the type of share to just buy, and ignore valuation altogether. Risky, but that’s an approach which has worked well for quite a few years now.

For me, the growth isn’t strong enough at EYE to make me want to take an interest. I think Pci- Pal (LON:PCIP) (I hold) looks a much better proposition - growing much faster, almost at breakeven on a monthly run rate, yet less than half the market cap of EYE.

.

.

Jack's section

Litigation Capital Management (LON:LIT)

Share price: 71.32p (-7.4%)

Shares in issue: 115,654,666

Market cap: £82.5m

Founded in 1998, Litigation Capital Management (LON:LIT) is one of Australia’s most experienced and successful litigation finance companies. It helps clients achieve recoveries from claims that, without help, would have been too costly and/or risky to pursue.

These alternative asset managers specialise in dispute financing solutions. Their accounts and operating characteristics are fairly unique (at times even controversial) in that revenue and profit recognition can be quite subjective on account of how long court cases take to resolve.

For LCM, the average case has lasted around 27 months over the past nine and a half years.

During that time, growing litigation managers also tend to exhibit large cash outflows as they raise capital and then deploy it into new cases. This makes them hard to value on a cash flow basis but, if you believe that this capital is being deployed prudently and competently into high return activities, then it is a logical use of cash.

LCM quotes a cumulative IRR of 78% and a cumulative ROIC of 135% over the past nine and a half years of operations.

But some of its peers have had similar metrics disputed in the past, with accusations of inflated revenue and profitability figures arising on partially completed contracts. Wherever you stand on this issue, the net present result is that these managers are cash hungry and tend to raise a lot of capital both from debt and equity holders.

Stockopedia’s algorithms struggle here: LCM qualifies for two short screens and is flagged up by our Earnings Manipulation Risk measure. This type of company requires more than your usual amount of due diligence into accounting policies and corporate governance.

For what it’s worth, LCM strikes me as more prudently managed than some others, with a cash-based accounting policy that recognises litigation at historical cost rather than on a fair value basis.

Today LCM announces its interim results for the half year ended 31 December 2020.

Financial highlights:

- Gross revenue down 68% to $7.7m, including the resolution of two single cases and two investments in acquisitions of claims strategy.

- Gross profit down 59% to $5m

- Adjusted loss before tax of $0.6m; statutory LBT of $1.2m

- Cash -83% to $5.8m

- Investments at cost up 108% to $71.4m

- Total capital invested up 21% to $22.3m

LCM accounts for revenue only when that revenue is earned or received. It’s interesting that a company feels the need to clarify this point but is indicative of the troubles the market has had in understanding these companies.

More specifically, LCM recognises revenue from contracts with customers once the performance obligation is satisfied and the transfer to the customer of the services has been satisfactorily completed.

Litigation service revenue is not recognised as revenue until the successful completion of the litigation project, which is generally once a judgement has been awarded or a settlement between the parties to the litigation has been agreed, and therefore when the outcome is considered highly probable.

The result of this is that the revenue line will appear lumpy. LCM is quite clearly taking a short term hit here, but what is more important is the general performance of investments over time and the maturity of the group’s portfolio of cases. On that point, the group’s cumulative IRR of 78% and a cumulative ROIC of 135% are notable.

LCM has a mature portfolio of investments, with 26 of its 40 investments more than 13 months old. Based on the group’s average case life of 27 months, investors might reasonably expect revenue to increase in the coming years.

Meanwhile, LCM is building scale. Its third party pool of capital was 64% committed by the end of December, and is now 70% committed. Applications are up and the group has entered into a $50m credit facility, which will be used to accelerate growth and provide access to larger investments.

The balance sheet shows a combined $26m asset of contract and portfolio costs in current assets and an additional $73m of contract costs in non-current assets. Together, these make up about 77% of total assets.

Those contract costs are estimated using a discounted cash flow model and uncertainty over their true value continues to be both an opportunity and a risk. Meanwhile, there’s a net cash outflow of some $35m.

Conclusion

Compared to its peers I have a favourable impression of LCM but still, the impressive growth in KPIs and optimistic management tone contrasts with the actual operating results.

The question is whether you believe the foundations continue to be built for growing future profits and cash flows.

Revenue is expected to be lumpy. Litigation finance involves a series of investments into disputes which historically take around 27 months to complete. Each case is different and it is tricky to anticipate the timing of completion.

And then LCM’s investments vary in size, further contributing to top line and net profit volatility. It’s true that in part this volatility is a consequence of LCM’s reasonably conservative accounting policies - but it is still a factor that prospective shareholders should consider.

Management says that investing in disputes is an ‘uncorrelated’ asset class, but I would suggest that LIT’s Covid-affected results have so far been highly correlated to global disruption.

Given the nature of lockdowns and their inevitable impact on court proceedings, that is perhaps understandable. I do take the point that litigation investment may have counter-cyclical properties, insofar as economic uncertainty or instability can lead to an increase in disputes.

It could therefore be that LIT stands to benefit from delayed Covid insolvencies, restructurings, and the rest.

On this point, LCM says it has seen a 68% increase in applications from corporates year-on-year. The CEO expects to see this come through in the form of new business in about 12-18 months and should then act as a tailwind ‘for many years thereafter’. Meanwhile the majority of LCM’s existing cases are approaching maturity.

A key variable is the deployment of cash into new litigation investments.

Source: company presentation

Assuming you are comfortable with this use of cash then the rest of today’s results shouldn’t be too much of a surprise given the scale of global disruption over the past year.

But the simple fact is this part of the market remains outside of my circle of competence. It’s a fast growing industry and LCM is generating some attractive KPIs - but for now I will leave this area to other investors that have more insight into the world of litigation financing.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.