Good morning from Paul & Graham.

Today's report is now finished.

In case you missed it, Graham published his own watchlist of interesting shares for 2023, which stand out as the most interesting ideas he's covered in the SCVRs. As always, we just throw ideas at you, for your own more detailed research.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Agenda

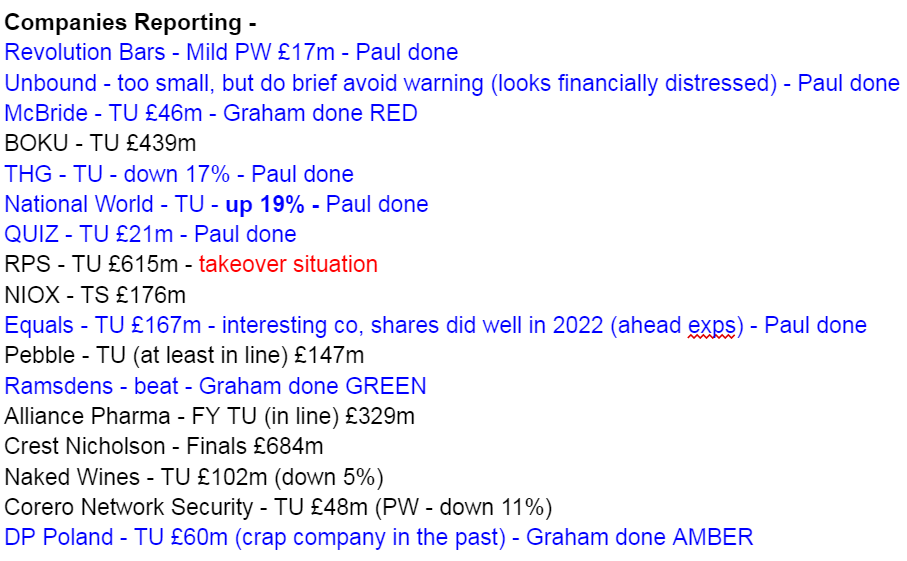

This is the final tally. I think we covered all the main above, or below expectations updates, which is the idea. Obviously we can't cover everything!

Do post a comment below if there's anything significant that we missed (that isn't just an in line with expectations update).

.

Paul’s Section:

Quiz (LON:QUIZ)

(16.75p y’days close - mkt cap £21m)

Trading update looks reassuring. Stores traded well over Christmas (revenues +19% in Dec 2022). Online revenues down -14%, due to reduced third-party website sales (in line with strategy). Own website revenues were flat vs LY. Gross margins good. International revenues good, up +20%.

Cash position healthy at £9.2m, plus headroom of £3.5m from unused bank facility (safe, with no covenants, and it’s not needed in my view, Expires June 2023, but has renewed without problems in the past).

Outlook - confident at least in line outcome for FY 3/2023, same wording as last update. "Well positioned" longer term, but mentions macro pressures which may impact demand (but that sounds a generic warning, not company-specific).

My opinion - after the restructuring in 2020 (which got rid of old leases, with remaining stores now on cheap & flexible turnover rents), QUIZ is resilient - surviving, and making profits again, when many competitors have gone bust or retrenched. Solid finances with plenty of cash. Looks good to me. Valuation still seems modest. So a thumbs up from me.

Revolution Bars (LON:RBG)

(7.4p pre-market, mkt cap £17m)

H1 trading update doesn’t read well I’m afraid, but needs to be seen in the context of a bombed out share price. Peak trading in December 2022 was well up on LY, with LFL sales +17%, but this is against a soft period LY due to omicron. Revenues down -9% vs pre-covid (despite most bars having been recently refurbished), which is no good (because costs have risen so much, especially labour). Good corporate parties, but soft walk-in trade, blames rail strikes and low consumer confidence. Recently acquired Peach Pubs has performed well though.

Revised guidance - pre-IFRS 16 EBITDA will be at bottom end of market expectations of £6.7m to £10.5m. Net debt of £18.5m looks too high to me, after a reckless decision to make the debt-fuelled acquisition of Peach, just as the economy was going into a downturn. Outlook is seen as “challenging & uncertain”. Closing some sites on Mon & Tue, to save money, makes sense.

My opinion - I wish they hadn’t acquired Peach, and loaded the company up with debt again, which seems a bizarre decision (the Chairman should have stopped it, I think) and makes the shares much higher risk than they would otherwise have been. We had 2 emergency, discounted placings during the pandemic. Avoiding another one should have been management’s key priority. So I have to flag the increased risk of having too much debt again, which combined with softer than expected trading, isn’t a good look. Lots of competitors likely to go bust though as 2023 progresses, giving greater market share. Also living wage rising by almost 10% in April 2023 should help put pounds in the pockets of the younger customers, as well as being another headwind for the business. So providing the bank doesn’t go wobbly on them, RBG could be one of the longer-term winners. Overall then, I’m neutral at the moment, but worried about increased risk from debt. The whole hospitality sector looks horrible at the moment, it's so difficult to make money against so many cost headwinds, and soft consumer sentiment.

Unbound (LON:UBG)

(3.7p down 42% at 08:46 - mkt cap £3m)

Probably my second to last comment on this share, to warn people off again. Bad profit warning today, together with excessive debt, means I think the equity is now probably worth nothing. It struggled to raise fresh equity at a deep discount last time (well short of the original amount it tried to raise, I know as a friend was inside on the deal). So next time, I doubt there will be any appetite at all to refinance it. Hence the bank probably now calling the shots. Small shareholders can at least salvage what’s left for a few pence, whereas bigger holders unfortunately are probably facing a wipe-out, sooner or later. It all now depends on what the attitude of the bank is. I imagine they’ll probably want a sale of the business, to recover some of their debt, which would probably leave trade creditors and equity holders with nothing. Who knows though, it could stagger on for a while, but the balance sheet looks insolvent to me. Management misled me previously, so I don’t believe anything they say. Complete bargepole stock, I’m afraid. I flagged, in strong terms, the likelihood of a 0p outcome here in July 2022. Previously, it had looked quite interesting, but subsequently turned out the forecasts were fantasy.

National World (LON:NWOR)

23p (up 24% at 09:35 - mkt cap £60m)

Trading Update - for FY 12/2022, this sounds positive, ahead of expectations. Revenue at least £84m (down 2% on 2021). Adj EBITDA ahead of market expectations at “not less than” £9.4m (ahead of forecast, but down 7% on 2021). Digital revenue up 25% (but fell to +12% in H2), print revenue down 7%. Maiden dividend coming (no figure given). Cost savings of £4m done. Cash £27m at end Dec. Targeted investments and acquisitions (looking mainly at digital businesses, eg 2 recent online content acquisitions, Scoopdragon, and Newschain).

Outlook for 2023 - “maintain our expectations”, but no figures given.

Dowgate’s updated forecast (many thanks) shows EPS of 2.6p for FY 12/2022, so a PER of 8.8 - not cheap for a structurally declining business, I would argue. However, the cash pile makes a big difference, as that’s 45% of the market cap. So the crucial question is what will be done with the cash in future, and that’s likely to drive shareholder value (or not).

My opinion - quite interesting. If experienced management is able to take this slowly dying newspaper business, and make something exciting out of it (on the digital side), then shareholders could do well. That’s not a bad bet at this stage, as the core business is generating plenty of profits & cash, and as we’ve seen with Reach (LON:RCH) the cash cow continues to pay out, as wave after wave of cost cutting is implemented. NWOR is also clean, with a small, but decent balance sheet, and no legacy problems such as pensions, which haunts RCH.

Equals (LON:EQLS)

93p (up <1% at 12:06) - mkt cap £168m

This share has had a great run since the covid lows, rising 4-5 fold. This has been driven by steadily improving broker forecasts, for both 2022 and 2023, as you can see -

I last looked at this forex/payments group here on 5 Dec 2022.

Trading Update today -

Equals Group plc (AIM:EQLS), the fast-growing payments group focused on the SME marketplace, announces a pre-close trading update for the financial year ended 31 December 2022 ('FY-22' or the 'year').

Very strong revenue growth of +59% to £69.7m (consensus forecast was £66.2m)

Adj EBITDA “marginally above” £12.0m (up 79%) - which is 6% above forecast from Zeus.

All very nice, but EBITDA is not meaningful here. That’s partly because the adjustment is to ignore £0.7m of share options costs (which is remuneration), reducing EBITDA for 2022 to £11.3m.

More importantly, there’s a depreciation charge of £1.4m, and a hefty £4.5m amortisation charge for R&D. As I mentioned last time, EQLS is a heavy capitaliser of development spend of about £4m pa, similar to the amortisation charge. So either way, we have to take this into account as a real world cost, and cash outflow.

Overall then, the £12.0m adj EBITDA is only expected to turn into adj PBT of about £5.0m, or statutory PBT of £3.7m (which includes a £1.3m charge for intangible impairment).

So I wouldn’t value this share using EBITDA, as you’ll over-value it that way.

Balance sheet when last reported was small, with NTAV of £12m. So not really any significant asset backing for a company valued at a market cap of £168m.

It’s an asset-light business model though, so this shouldn’t really matter, but worth bearing in mind there’s nothing to support the share price if earnings dry up (unlike asset-rich businesses like housebuilders or car dealers).

Although EQLS did have £15m in cash at end Dec 2022. It also previously (at end June 2022) said it had £272m in client cash, off balance sheet. So a key question (do any readers know the answer?) is who received the bank interest on this cash, now that interest rates have quite recently moved up from zero on cash held at banks? This could potentially be c.£5m interest receivable, if it all accrues to EQLS, which would be rather nice! It’s often not as simple as that, but it’s a key question to ask.

Outlook comments sounds upbeat -

The Group will continue with its strategy of investment in growth, platform and connectivity and the Board is confident of achieving a strong result for FY-23.

Diary date - 27 March 2023 for FY 12/2022 results, a Q1 2023 trading update, and it promises an audio webinar of the in-person analysts meeting will be published on the website later that day - very helpful.

My opinion - I’m certainly impressed with the growth here, and a move into profits in 2022. Although the adjustments and EBITDA numbers are not relevant, due to ignoring a load of costs (almost 20% of the payroll is capitalised, so that by-passes EBITDA completely!)

How you value the shares depends on what’s driving the growth, and a detailed assessment of the services offered by EQLS, and the competitive landscape, which is obviously not what I’m doing here - this is just a review of the numbers, which is only part of the puzzle when considering the investment case.

Overall, I don’t know enough to judge, but I do see signs of something interesting here at EQLS, hence it’s worthy of a closer look by readers.

THG (LON:THG)

57p (down 16% at 13:01) - mkt cap £760m

I don’t rate this share at all, but it’s come up on the top fallers list, so have to cover it. My review of the last interim results is quite detailed, and demolished the bull case.

Trading update - today is for FY 12/2022.

This is really complicated, and I’ve decided not to get into any of the detail. So just a few key points -

Discontinuing non-core activities - eliminating £20m pa losses.

Guidance for FY 12/2022 is £70-80m adj EBITDA. That’s down from £100-130m in the Q3 update, hence the plunge in share price today.

EBITDA is meaningless at this company, as it has large depreciation & amortisation charges, so in the real world, it’s going to continue making substantial losses.

Year end net debt of £200m (which excludes big lease liabilities), should reduce when £40m freehold proceeds received soon. It has plenty of liquidity, with a large cash pile, but even larger debt pile.

Outlook - some good things here, including -

Cost savings implemented should save £100m

US warehouse automation starts soon

“Substantially lower” raw materials prices (mainly whey)

“Broadly” free cashflow neutral in FY 12/2023, and “significantly positive” thereafter.

My opinion - it remains a big, loss-making business, that’s trying to sort itself out - not dissimilar to ASOS (LON:ASC) actually, but worse.

If the turnaround plans work, then profitability could become a possibility. But why would I want to bet on that happening? You’d have to do a lot more research to work out how likely it is that a decent business might emerge from this former tech darling, which it now transpires is a bit of a sprawling, loss-making mess.

Graham's Section:

McBride (LON:MCB) (£45m pre-market) [quick comment] - this European manufacturer of products for the “domestic household and professional cleaning and hygiene markets” gives us an update for H1 (that’s the period to December, since year-end is in June).Trading was in line with expectations. The company reports both price rises for customers and volume growth - it doesn’t say how much of each - resulting in overall revenue growth of 31% (at constant exchange rates, so the actual result could be slightly different).

Inflation continues to pose challenges; raw materials, energy and employment costs all rising to a greater or lesser extent. The company says that it will report “a small adjusted EBITA loss” for H1, which we can presume means that statutory net income will again be negative. Net debt at period-end was £169m.

With this level of net debt, and with the company making losses, I’m surprised that the company’s market cap remains so high. McBride was never a quality stock in the first place, and it’s now dependent on very high levels of bank funding which it is unclear how or when it might be able to reduce. Extreme levels of risk here.

Ramsdens Holdings (LON:RFX) (£69m) (+5%) [quick comment] - these full-year results for FY September 2022 are ahead of expectations as Ramsdens has benefited very well from the return of international travel. Unlike my favourite pawnbroking stock, H & T (LON:HAT) , Ramsdens makes a large percentage (33%) of its gross profits from foreign currency exchange, i.e. from people looking for holiday money, and these currency volumes have improved from £77m in FY 2021 to £364m in FY 2022. Full-year total revenues for Ramsdens are £66m and PBT is £8.3m (it’s not really worth comparing these results to last year, as last year was extremely poor and not representative of normal performance).

We also get a trading update for Q1 (October to December 2022). Interestingly there is still a major shortfall between the latest foreign exchange volumes and their pre-Covid levels, as volumes remain at just 70% of what they were before. But overall performance sounds fine and the outlook statement from the Chair takes a balanced tone as rising energy costs, staff costs and interest rates are balanced against the opportunity for increased pawnbroking business in an economy that squeezes household incomes.

I’ve been a long-term fan of this business, although never a shareholder, and I don’t see any reason to change my tune after these good results. Net cash reduces from £13m to £9m which is often a good sign in this sector, as it means the company is busier making loans and building up retail stock. The company’s broker has increased its FY September 2023 PBT estimate by another 5% to £8.9m, having already upgraded it last October. Up next is the company’s expansion into the South East of England, having traditionally stayed in Northern England, Scotland and Wales.

DP Poland (LON:DPP) (£59m) (unchanged) [quick comment] - since early 2021, this has been a much enlarged group after it merged with another large Polish pizza restaurant group. It also acquired Domino’s Croatia in a tiny deal (£2m). Today’s full-year trading update for FY December 2022 includes some impressive-sounding growth figures, including like-for-like sales in Poland up by 21%. The change in delivery numbers is modest but dine-in and carry-out sales were both up strongly in a post-Covid environment.

The company has just a small cash balance of £4m, which it has been using to fund store development, a TV advertising campaign, and other upgrades and improvements. Profitability is set to be “close to market estimates” for 2022. As for 2023, the company is hoping for improved trade from tourists and for inflation to stabilise, which it expects will boost both sales and profitability. Broker estimates for FY 2022 and FY 2023 are unchanged - these imply negative EBITDA in FY 2022, and a small positive EBITDA of £2.5m in FY 2023.

I’d like to be more positive here, after many years of terrible financial performance by this company, but I can’t get excited about a prospective EBITDA of £2.5m for a pizza business, when the market cap is £60m. The investment thesis here is that the new-ish management theme will be able to make this consistently profitable now that they have a much larger group and can enjoy the economies of scale that go with having over 120 stores. But even if they achieve LfL sales growth of 15% in 2023, they are still expected to earn only meagre profits. I also think it’s worth mentioning that Poland made it to the Round of 16 in the World Cup that we just witnessed, and this may have provided a temporary - artificial - boost to sales.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.