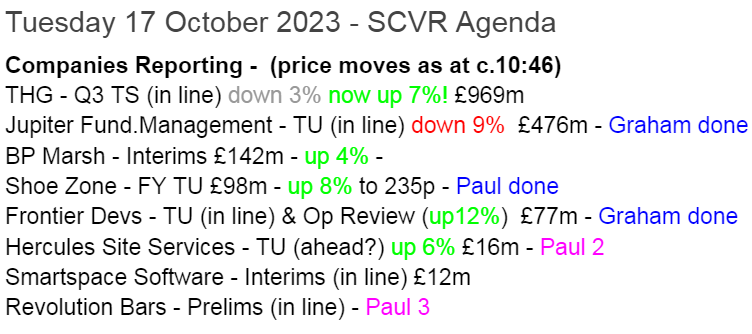

Good morning from Paul & Graham!

Graham's 11:30 (live) and recorded daily show will today be looking at Frontier Developments (LON:FDEV) , Jupiter Fund Management (LON:JUP) and one not covered in today's SCVR, Moneysupermarket.Com (LON:MONY) - simples!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Summaries

Jupiter Fund Management (LON:JUP) - down 12% to 77p (£149m) - Trading update (AuM declines) - Graham - GREEN

The year-to-date performance remains within expectations but the net outflows seen in Q3 are nevertheless a disappointment. A new fee structure is also going to take another small bite out of Jupiter’s profit margins in the short-term. I remain positive. PER 7x, divi yield 7%.

Shoe Zone (LON:SHOE) - up 9% to 233p (£107m) - FY Trading Update - Paul - GREEN

Knockout numbers for FY 9/2023 in this superb year-end trading update, they've more than just blown the bladdy doors off! There's so much to like about this company, which I rave about below, and even after today's rise, the valuation is still modest because forecasts have been beaten so much. Although I cannot ignore the looming competitive threat from Chinese direct-to-consumer competition such as Shein and TEMU - ignore at your peril, I would say, as we discovered to our cost with Boohoo (LON:BOO) and ASOS (LON:ASC) .

Frontier Developments (LON:FDEV) - up 11% to 215p (£85m) - Organisational Review and Trading Update (in line) - Graham - GREEN (under review)

This has more than halved since I took a positive stance on it at the start of the year. EPS estimates have been in a consistent downtrend but today’s trading update is in line and the company is cutting costs to stabilise performance. Still worth investigating, in my view.

Paul’s Section:

Shoe Zone (LON:SHOE)

Up 9% to 233p (£107m) - FY Trading Update - Paul - GREEN

Shoe Zone is pleased to announce its unaudited full year trading update for the 52 weeks to 30 September 2023 ("FY 2023").

Strong sales and highest recorded profits

This is obviously the retailer of cheap, Chinese-made shoes. It’s an impressive owner-managed business that has navigated recent years of almost permanent economic turmoil very well I think. The strategy has been to keep lease liabilities low, and relocate from small town centre stores into more efficient sheds on retail parks.

Checking our previous notes here for background, our last 3 comments were -

16/5/2023 - shares had a wobble, down 16% to 203p due to unimpressive interim results, and only an in line outlook on quite soft forecasts. I was AMBER, based on the facts & figures at that time.

9/6/2023 - up 11% to 233p - a much improved trading update, causing a good upgrade to forecasts. The facts improved, so I moved up to GREEN.

12/7/2023 - shares rose 10% to 257p on an ahead of expectations TU, and forecast earnings moved up a whopping 29%. I moved back down to AMBER, due to share price rise, and worries about competitive threat from TEMU (Chinese co selling direct to UK consumers).

So quite mixed messaging from SHOE earlier this year. Or maybe just a wobble in trading, before it returned to the usual, strong form, from June onwards?

Revenue £166m (up 6.1%)

Split: 81% stores, and 19% online.

Store numbers down from 360 to 323, which I imagine is due to the strategy to focus on the larger, more efficient retail sheds.

Notably strong gross margin of 62.1% (LY: 61.2%) - margin is absolutely key in retailing, but often overlooked by investors. Helped by lower shipping container prices.

Profitability - adj PBT looking very good at £16.0m+ (LY: £11.2m)

Modest adjustments, which look reasonable.

Dividends: interim of 2.5p (£1.2) paid in Aug 2023. Final divi to be determined. Note that it has paid several special divis of c.8p in recent years.

Big share buyback: 3.8m shares costing £8.1m (avg 214p), shares since cancelled. This is significant, as share count has fallen from a static 50m (2017-2022) to 46.2m now, a drop of c.8% in issued shares - thus boosting EPS for remaining shares.

Net cash was £16.4m at end Sept 2023, down from £24.4m a year ago, due to £8.2m divis paid, £6.4m buybacks, increased capex at £11.3m. As you can see, most of those outgoings were paid for out of cash generation, and in any case are not a concern because these items are all controllable cash costs (e.g. divis & buybacks are a policy decision by mgt, not something that just happens by accident).

Current trading - nothing said, which is fair enough as we’re only 17 days into the new financial year.

Outlook - nothing said about this either, which is a bit frustrating. I think we’ve had this problem with SHOE before, rather leaving investors in the dark about how they see the outlook. The closest it gets is this bit -

We continue our strategy to expand our Hybrid and Big Box formats via refits (15) and relocations and new stores (35). Shoe Zone continues to show how resilient it is, with a proven track record of delivering robust results during times of economic uncertainty.

We look forward to updating shareholders in more detail at the time of our final results in January 2024.

Broker update - many thanks to Zeus for its update. This is very good - Zeus says the adj PBT of £16.0m is 19% ahead of its forecast, which had already been raised twice in June and July.

Good grief! That translates into 26.1p EPS for FY 9/2023. That’s a fabulous outcome, given that original forecasts for this year were only c.11p - a terrific out-performance, with 3 big upgrades, and a big final flourish beating the latest 21.8p broker consensus by a country mile! I’m so impressed with this.

Zeus is forecasting a small drop in adj EPS to 24.7p for FY 9/2024. What’s the betting they’ll need to raise those numbers again? Although bear in mind that SHOE has almost reached a 10% PBT margin, so profit growth might be harder to come by from now on, given that the base figures for comparison are now strong.

Valuation at 233p/share this morning is now a PER of 8.9x - that’s clearly excellent value, for a strongly-performing, high margin business with net cash, and generous shareholder returns.

Paul’s opinion - I’m blown away by these numbers! Therefore there’s no alternative than viewing it positively, GREEN.

Although I have to mention my background worry, that the Chinese are trying to dis-intermediate retailers, by selling value products direct to consumers. Shein and TEMU are therefore a big worry for me - look how Shein has decimated the fast fashion sector already, wiping out its profit margins.

I did buy some cheap shoes from TEMU to try them out, and noted that they don’t post them boxed, they just come in compact soft parcels, which are air-freighted from China. Product was meh - you get what you pay for.

If Chinese direct to consumer companies take say 10% of SHOE’s business, at 62% product margin, that would be a loss of £10.5m gross profit, on a largely fixed cost base, the result would be ugly. It might also force SHOE to lower its selling prices to compete, thus imposing a further margin squeeze on the sales it retains. So ignoring this risk could be costly.

Do people really need to try on cheap Chinese shoes for fit? Maybe for rapidly growing kids, but personally I buy my trainers online, just ordering the same size every time, and have never returned any.

For that reason, I don’t imagine I’ll buy any SHOE shares, even though they look very attractive. If you don’t see Chinese competition as an issue (Why? Do explain!) then I can see why you would want to buy/hold SHOE shares. Certainly a remarkable performance, and reasonable valuation too, hence why I have to be GREEN.

Note the StockRank is jammed on maximum!

Graham’s Section:

Jupiter Fund Management (LON:JUP)

Share price: 77p (-12%)

Market cap: £149m

I’ve been positive on this fund manager since last October, when I noticed the remarkably cheap valuation and the potential for some catalysts to improve the situation for shareholders.

The market seemed to initially share my enthusiasm, before selling the stock lower again. It is lower again today:

The company does pay a significant yield (around 7% currently) so that offers some consolation to shareholders nursing a capital loss.

Today the company has published a Q3 update to the end of September.

I’d summarise the key points as follows:

Quote: “Overall flows year to date remain within expectations.”

However, Q3 net flows were negative by £1 billion. This follows small positive net flows in the first two quarters.

AuM reduces to £50.8bn (down from £51.4bn at the end of Q2).

While overall flows for the year are still within expectations, the Q3 outflow is not good news and so today’s share price decline is understandable.

Institutional clients have contributed positive or neutral net flows for five consecutive quarters. But retail customers have been far more difficult to attract and continue to inflict outflows:

As an aside, I think institutions are less prone to pull money out of the market when stocks are cheap - they have systems and processes that don’t change too much over time, and so they stay invested and continue to invest more steadily than retail investors.

This is consistent with the fact that institutions are consistently putting money into Jupiter, or leaving it there, while retail customers are still taking money out.

Unfortunately for Jupiter, it is mostly a retail shop and four-fifths of its AuM is classified as “retail, wholesale & investment trusts”, as opposed to “institutional”. So its net flows remain highly sensitive to sentiment among retail investors.

We get an insight into the themes investors are most interested in currently: “The areas of client demand remained relatively unchanged from the first half, with inflows into Asian Income and Japanese Equities not enough to offset outflows from unconstrained fixed income and UK and European equities.”

CEO comment: a key reason I have been positive on Jupiter is my expectation that the new CEO could be a catalyst for change. Here’s an excerpt from his comment today.

We have rationalised our fund range and right-sized the business and are investing to ensure the company is aligned with clients' requirements which are fundamentally changing. Whilst progress will not be linear, the growth of our institutional and international businesses are encouraging indications of our ability to increase scale and grow our appeal to a broader range of clients.

His agenda for change continues today with the announcement of various actions:

Client-facing teams have been restructured. They will seek “alternative methods for clients to access our investment capabilities” (I think this means a more bespoke and personalised client service).

A range of thematic funds will be launched shortly.

A new tiered fee structure for UK unit trusts and OEICs. This might initially hurt the net revenue margin by a few basis points, but both customers and Jupiter will be incentivised for AuM to grow and to hit the higher tiers with lower fees.

Graham’s view

The share price is now 14% lower than it was when I first spoke positively on this stock a year ago.

AuM at the time was £47.4 billion. So AuM is actually up by 7% over the past year.

Thanks to a share buyback programme, the share count has reduced from 553 million to 545 million over the past year.

EPS estimates have been stable:

So the bigger picture here doesn’t strike me as discouraging.

The bad news today is that we’ve had a poor quarter in terms of flows, and the company’s profit margins will take an additional short-term hit from the new fee structure they wish to implement (on top of the gradual decline in margins that they are experiencing, along with the rest of the active fund management industry).

I don’t think these reasons are dramatic enough to sway me from my positive stance on these shares. Below is a reminder of the value metrics on offer here (calculated based on last night’s share price).

During the bull market, it was exceedingly rare to see opportunities such as this in large reputable companies:

Frontier Developments (LON:FDEV)

Share price: 215p (+11%)

Market cap: £85m

Frontier Developments plc (AIM: FDEV, 'Frontier' or the 'Company'), a leading developer and publisher of videogames based in Cambridge, UK, announces an Organisational Review and provides an update on trading.

A former stock market darling, this is down by over 90% from its high in 2021:

Let’s check the trading update first: the existing game portfolio is performing in line with expectations. Christmas always sees frenzied buying of video games and Frontier will release Warhammer Age of Sigmar: Realms of Ruin next month.

The financials this year (FY May 2024) are going to be poor, as is already known. It will include a dreaded loss at the adjusted EBITDA level:

The Board remains comfortable with market expectations for FY24, with consensus revenue at £108 million and consensus Adjusted EBITDA* loss of £9 million. The cost reductions from the Organisational Review are expected to be fully effective for FY25.

The pre-tax loss estimate from Zeus for the current year is £14.7m.

Now let’s see what the organisational review announced today has to offer:

The review will deliver enhancements to Frontier's leadership and structure, drive efficiencies across the Company and achieve a reduction in annual operating costs of up to 20%. The cost reductions will be achieved through a recruitment freeze, spending cuts and, unfortunately, redundancies, subject to consultation.

The Organisational Review and resulting actions are expected to conclude by early 2024, placing Frontier in a strong position to deliver efficiently on its strategic plan over the medium term, and capitalise on future opportunities.

Graham’s view

Given the scale of the current losses, I can’t argue against the company cutting costs.

The company has historically been cash-rich, but its cash balance fell to £28m as of May 2023, and then fell to £25m by August (as reported by Paul here).

With the company now incurring significant losses at the adjusted EBITDA level, the bleeding needs to stop before it gets into trouble. I think shareholders should be relieved that Frontier is taking action before the situation gets critical.

The main point about Frontier for me is that it remains a concentrated bet on a few titles selling well. The Formula 1 franchise was supposed to be a goldmine but it hasn’t worked out that way, with the 2023 edition failing to draw in a sufficiently large audience beyond the most devoted fans of the sport.

The company is now hoping that its Warhammer game can be a hit, and will then look to reinvigorate F1 with a new edition released at some point in 2024.

EPS estimates have been cut many times this year:

I took a positive stance on these shares back in January 2023, after a major profit warning, failing to anticipate that EPS momentum would remain so negative for the rest of the year.

The Frontier share price has more than halved again since then, and the price to sales multiple is now only about 0.8x. This is 10% of the price to sales multiple at which Activision Blizzard was recently trading (8.5x), prior to its shares being suspended to allow its acquisition by Microsoft. Activision deserves to be valued at a premium, of course, but a 10x premium is quite something!

Even with it trading horribly in the red, therefore, I think I have to again put out a positive view on Frontier shares. It’s rare to see a video game developer trading at a P/S multiple like this. Yes, it’s unprofitable, but management have today announced concrete actions to cut costs and get themselves onto a firmer foundation. So the risk/reward here must be worth researching at this valuation.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.