Good morning from Paul (early shift, posted overnight from Washington DC), and Graham (UK shift).

Just FYI, we'll be switching on Weds, with me (Paul) giving you my undivided attention back in the UK, whilst Graham takes a little time off. As I think we've already demonstrated, we can juggle things just fine, and get a decent report out each day!

Graham says: all done for today. See you in a while!

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom),

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

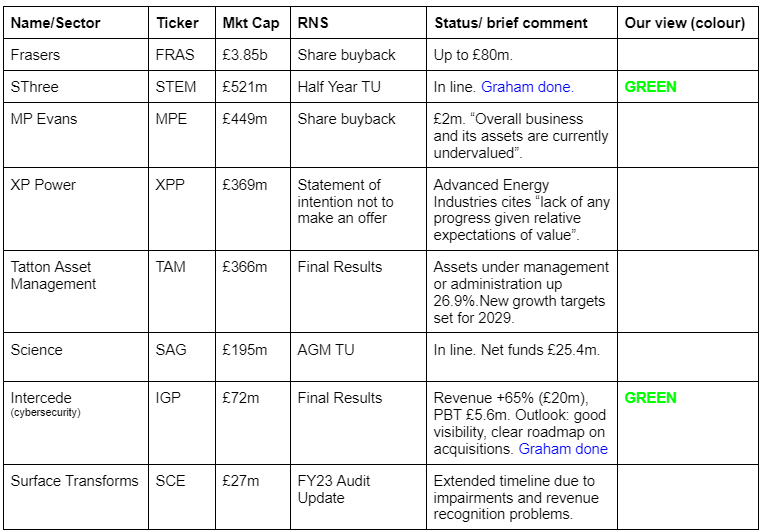

Companies Reporting

Summaries

Norcros (LON:NXR) - 212p (£190m) - FY 3/2024 Results - Paul - GREEN

FY 3/2024 results from last week were in line, and the outlook, but the value metrics are so favourable that I've circled back to it. I'm really encouraged that the legacy issues dictating a low valuation are now small, and maybe even resolved. That leaves a PER of only 6.7x, a yield of 4.8%, and recovery potential. It looks very attractive to me. Although we've been saying that for years and nothing ever happens! So one for patient value investors only.

Motorpoint (LON:MOTR) - 141p (£123m) - FY 3/2024 Results - Paul - AMBER

Lousy results for FY 3/2024, as expected. Not much balance sheet support, and forecasts mean you're being asked to pay up-front for 2 years' of trading recovery that has only just started. The bull case seems to hinge on an operationally geared recovery in used car sales on a leaner cost base. That may well happen, who knows? Although much higher finance costs could well blunt a profits recovery. Share buybacks seem inappropriate. I just don't want to pay up-front for a recovery, so the valuation doesn't work for me.

Intercede (LON:IGP) - unch. at 123.2p (£72m) - Final Results - Graham - GREEN

Sparkling results with the help of a large one-off contract to a US federal agency. There are recurring elements to this deal but it's mostly a one-off sale. After giving these results an overview, I give an example of how someone might try to value this cybersecurity software business with a mix of recurring and non-recurring revenues.

SThree (LON:STEM) - down 0.5% to 420p (£567m) - FY24 Trading Update - Graham - GREEN

Full-year results to November are still expected in line with expectations after a tough H1 with net fees down 7%. But looking past current challenges, I remain a big of this company for all of the same reasons as before. Progress in switching to a Contract-driven model continues with Contract now responsible for 84% of total revenues.

Paul’s Section:

Norcros (LON:NXR)

212p (£190m) - FY 3/2024 Results - Paul - GREEN

Background - this bathroom fittings group in UK & S.Africa always looks cheap, due to S.Africa risk (its second largest market), China supply risk, and a large pension scheme. When I last looked at it on 18/4/2024 I raised it from amber to GREEN at 175p, due to the exceptional value even allowing for the risks that everyone has known about for years.

Shares are usefully higher now at 212p, but we still have strong value figures on the StockReport of 6.7x forward PER, P/TBV 3.9 (so some asset backing), and a generous 5.0% dividend yield. Plus a stonking 99 StockRank.

We didn’t cover it last week, due to results & outlook being in line with expectations, hence nothing price sensitive, but the value scores have pulled me back to it. Also I’m curious how the pension scheme numbers now look, given this wasn’t mentioned in its April 2024 trading update.

Higher interest rates have had some intriguing effects on some defined benefit pension schemes, dramatically shrinking some deficits, and providing a potentially good upside catalyst for shares to re-rate. Remember too that Wincanton attracted a takeover bid shortly after declaring that its pension scheme was now fully funded. Reach (LON:RCH) is another one where the market could re-rate it if concerns about the pension scheme reduce. I’m sure there are others too worth seeking out where pension scheme changes could be a nice opportunity for investors.

Company headlines -

Robust performance in line with market expectations

Strong foundations in place to execute medium-term growth strategy

Unimpressive results, with profit down, but I don’t see this as a particular problem, given that most companies supplying home improvement products are struggling with tough macro conditions. Also, note that the fall in profit is entirely due to a weak S.Africa performance, where profit more than halved from £10.1m to £4.8m. Almost 90% of group profit came from UK/Ireland, so my leaning is to ignore S.Africa altogether, and just value this share on UK/Ireland profits only, and use a higher PER. Maybe it should sell the S.African business, in order to drive a potentially higher valuation for the group?

That’s a flat dividend at 10.2p, which is a 4.8% yield at 212p per share.

What it calls “underlying net debt” above of £37.3m is excluding IFRS 16 lease liabilities, which is the correct number to highlight in my opinion. Including leases, net debt is £59.5m. The underlying net debt of £37.3m is only 0.8x EBITDA, and with a useful reduction in the year, I don’t have any concerns about debt, it’s fine. Bank facility is a whopping £130m (plus a £70m potential accordion, with bank consent), so it has a lot of headroom for more acquisitions, although I hope management doesn’t go crazy taking on too much debt, which got it into trouble in the past. Bank facilities are committed until Oct 2027, which gives me comfort that the bank seems relaxed about risk here.

Adjustments look OK to me, so I’ll work with the 32.1p diluted EPS number above, giving us a PER of only 6.6x - which on the face of it looks a compellingly cheap valuation, as it always does with Norcros!

Pension scheme - is again showing an accounting surplus, increased about 10%, to £16.5m. However the last actuarial valuation in 2021 showed a deficit, requiring deficit recovery cash payments from NXR of c.£4m pa. The key question is whether the 2024 actuarial valuation will change this, in a potentially positive way? The existing overpayments are only about 10% of NXR’s profits, so it’s not a big issue any more - providing nothing big and unforeseen goes wrong with macro. Unfortunately I cannot find any guidance in the results commentary to indicate what’s likely to happen in future with the pension scheme. My feeling is that any changes are more likely to be positive than negative, since higher interest rates since 2022 should have helped reduce the actuarial deficit. Although it depends what has happened to asset valuations, since most funds are now invested in bonds, which often seem to have fallen in valuation. We’ll just have to wait and see, but I’m now assuming that the pension issue at Norcros is both relatively small, and probably improving. So I don’t think we need to take much off the value of the equity for the pension scheme at all.

Current trading - sounds OK, nothing exciting good or bad here -

Group revenue in the two months to the end of May 2024 was encouragingly 2.2% ahead on a constant currency like for like basis, adjusting for Johnson Tiles UK and Norcros Adhesives (UK and Ireland +2.0%, SA +2.5%). Group revenue was 2.9% below the prior year comparator on a reported basis.

Although market conditions are likely to remain uncertain, the Group continues to make further strategic progress and the Board's expectations for FY25 remain unchanged.

Paul’s opinion - I’m encouraged by my quick skim of the FY 3/2024 results. The traditional reasons investors avoid this share are now largely irrelevant in my opinion, eg -

S.Africa risk - as it only contributed about 10% of group profit, does it matter? I would argue that only a small discount is needed on the valuation to allow for potential country risk. Worst case scenario, the South African business could be sold off, and group profit would only drop about 10%.

Pension scheme - is likely to be close to fully funded, and even on 2021 actuarial deficit, only consumes about 10% of group profit. You could argue that S.Africa profit (£4.8m) pays for the pension scheme deficit (£4.0m pa), as the two numbers roughly offset.

Debt & balance sheet - look OK to me.

China supply risk - does this matter, as Norcros is like so many companies that get products made in China. If trade breaks down then the whole economy and many/most companies would be in turmoil. Although if/when China invades Taiwan then all bets would be off. So actually, it is a risk, maybe I shouldn't be complacent about it?

Overall then this share strikes me as significantly undervalued, and you get a 4.8% dividend yield whilst you wait (possibly a long time!) for shares to re-rate. I think it’s a decent quality business, making pretty good operating margins, and with well-established brands that many people recognise and are prepared to pay upper-mid prices for. I’m sticking with GREEN. Unless I’ve missed something, the low rating doesn’t seem justified by fundamentals any more. So it should re-rate at some stage, or maybe even attract a bid approach? Plus there should be cyclical upside when its markets recover.

Motorpoint (LON:MOTR)

141p (£123m) - FY 3/2024 Results - Paul - AMBER

I must admit to be being perplexed by the recent strength in share price of this car supermarket, as its performance has been lousy in FY 3/2024. Still there are various ways of looking at shares. Bulls must be assuming it’s going to stage a remarkable recovery in profits, from the (as expected) £(8)m loss in FY 3/2024.

One thing I’ve pointed out before is that higher interest rates since 2022 mean that car dealers are now paying very much higher finance costs (on vehicle stocking loans). Hence we need to be careful not to get carried away with operating profit or EBITDA results, that are then engulfed with huge finance costs.

Note that this period covers a rough autumn, where used car prices lurched down unexpectedly quickly, hurting everyone in the sector. Although that’s a one-off I think, so probably OK to disregard. Maybe sector earnings have bottomed out?

Company headline - makes it sound as if MOTR is over the worst -

A challenging year driven by macroeconomic headwinds. Return to profitability in Q4 and good momentum going into FY25

Here are the highlights, or rather lowlights -

Outlook - quite interesting in that there’s obvious potential for operational gearing on a leaner cost base, with recovering demand. It mentions a move back into profitability, but at what level? Operating profit, I suspect, which as we know, is not the same as real profits, due to the hefty finance costs, eg £9.7m in FY 3/2024, and could rise further as higher inventories need to be funded with additional vehicle stocking loans (not included in net debt) -

Forecasts - Zeus kindly give us an update, which forecasts a small £4.0m adj PBT in FY 3/2025, rising to £9.0m in FY 3/2026. Those are EPS of 3.4p and 7.8p respectively. That really doesn’t stack up at all well with a share price of 141p.

So bulls need to be very confident MOTR can beat forecasts.

Balance sheet - MOTR has NTAV of about £27m, which is only about 22% of the market cap. So unlike a physical car dealer like Vertu Motors (LON:VTU) which has full NTAV asset backing, MOTR has relatively little.

Share buybacks - don’t make any sense at all to me. The shares are expensive, and MOTR is highly geared (if you include interest-bearing vehicle stocking loans, which are set to soar as inventories rise) - exactly the opposite of the circumstances where share buybacks should be done, in my opinion.

Paul’s opinion - I like the potential for car supermarkets, and the online-only competition seems to be wilting, as expected, leaving potentially more market share for MOTR. It’s just that the valuation seems to have soared in advance of a proper recovery. Still, the valuation remains way below its previous growth company level, and there are excitable Americans on the shareholder list, who as we know pay higher valuations than UK value investors!

The current share price is asking us to pay 2-years up-front for a trading recovery which may or may not happen. I cannot predict the future, but generally I want a discount, not paying a premium for future uncertainty. Especially as this is an ultra low margin business with little asset backing. I’ll leave it to others to predict the future, I’m just assessing the facts figures and forecasts as of today, and on that basis MOTR shares look to have run ahead of themselves, so it’s not for me. Although it wouldn’t be fair to go below AMBER, as there’s nothing wrong with the business as such, it’s just pricing in too much future upside for my personal taste.

Potentially good upside if profits do recover to previous levels -

Graham's Section

Intercede (LON:IGP)

Unch. at 123.2p (£72m) - Final Results - Graham - GREEN

Intercede, the leading cybersecurity software company specialising in digital identities, today announces its preliminary results for the year ended 31 March 2024 ("FY24").

These are sparkling results as has been well flagged, e.g. see Paul’s coverage in April.

Key points:

Revenues +65% to £20m

PBT £5.6m (last year: £0.6m)

Gross margin improves to 97.2% (we might as well think of this as 100%?)

Cash more than doubles to £17m, and is nearly one quarter of the market cap.

The company also publishes an adj. EBITDA figure (£6.2m), with a detailed explanation of how it’s derived. But with such a small gap between adj. EBITDA and PBT, is it really necessary?

Highlights for the year

Intercede has enjoyed some major new contracts, and two in particular are highlighted.

Contract 1 - large US federal agency. $6.6m purchase order for perpetual licences, plus $1.4m annual support and maintenance.

A key disclaimer around this source of revenue:

This is the Group's largest single order to date and the Group highlights that this contract was an exceptional order and deemed 'one-off' due to the substantial number of perpetual licences purchased, which have been recognised in FY24.

Focusing solely on the purchase of licences, $6.6m of revenue is equivalent to £5.2m or one quarter of Intercede’s entire annual turnover for FY2024.

Contract 2 - a client in the US intelligence community. Perpetual licences plus support and maintenance for a total of $1m, plus a separate ongoing subscription for $0.2m.

Contract 1 is the one that really matters: without something of a similar size in the current year, then surely that will leave a big hole in the results?

Outlook

FY24 was an exceptional year for the Group. Intercede continues to invest in its colleagues, IT Infrastructure, product development, sales and marketing to maintain and sustain it current momentum.

We embark into FY25 with good visibility on the pipeline, known and fully resourced internal critical investments, and with a clear roadmap on our acquisition strategy. As mentioned earlier, the focus is on growth and execution of strategic plans to deliver it.

Estimates from Cavendish see revenues for the new financial year (FY March 2025) falling from £20m to £16.1m, and adj. PBT halving to £3m. Within that revenue forecast, recurring revenues (as opposed to one-off perpetual licence sales) are £9.1m.

Strategic Report - notes that the company has transitioned from phase one of its business plan (transformation) to phase two (growth). Additionally, the large cash pile now means that the company can “source, engage and execute on larger M&A transactions”. Some nice detail is provided on the company’s roadmap for the new year, i.e. their plans across various product categories such as password security management and multi-factor authentication.

Dividend - none. I agree that there is no urgent need to send money back to the shareholders.

Graham’s view

I can see why Paul has been so interested in this one; it has enjoyed eight earnings upgrades since 2022, according to Cavendish!

How to value it? Let’s start by noting the March 2024 cash balance, £17.2m.

We can then look at recurring revenues. This is perhaps about £9m now (FY March 2025), maybe £10m in FY 2026

My understanding is that US-based SaaS companies are currently trading at about 7x revenues. So we could value IGP’s recurring revenues (£9m) at £63m, for example.

(This revenue multiple for the market was as high as 19x during the Covid bubble. It never seems to get any lower than 5x-6x.)

We should also assign some value to IGP’s one-off sales. This is not an easy task: by their nature, one-off sales are difficult to predict! I’ll try to find a middle ground and give one-off sales half the value of recurring sales.

With £7m of non-recurring sales expected in the current financial year, I get a value of about £12.6m for this.

Adding it all up:

Cash £17.2m

Value of recurring revenues £63m

Value of non-recurring revenues £12.6m

Total: c. £93m, materially higher than the market cap £72m.

Of course these are really just back-of-the-envelope calculations, without studying Intercede’s specific products and customers in detail and figuring out the likelihood of large new contracts. If the company does get some deals similar to “Contract 1” in the next few years, they will blow these calculations out of the water.

We could argue that Intercede deserves a premium rating, thanks to the positive business momentum it has experienced in the last few years.

Or we could argue that it deserves a discount, as UK-listed software companies tend not to trade as richly as their US counterparts (at least not until there’s a takeover bid!).

Either way, I’m happy to leave Paul’s GREEN stance on this one unchanged.

SThree (LON:STEM)

Down 0.5% to 420p (£567m) - FY24 Trading Update - Graham - GREEN

SThree plc ("SThree" or the "Group"), the only global specialist talent partner focused on roles in Science, Technology, Engineering and Mathematics ('STEM'), today issues a trading update for the half year ended 31 May 2024.

My favourite recruitment company has the following H1 financial highlights. The year is still expected to finish in line with expectations.

Net fees down 7% year-on-year “despite the ongoing challenging backdrop and against a strong prior year performance”.

Contract recruitment (as opposed to Permanent) now 84% of total net fees (a year ago: 81%)..

Net cash improves to £90m (a year ago: £72m) (one-sixth of the market cap).

CEO comment:

Against the challenges experienced by the sector, we are pleased with our trading performance over the past six months, with strong Contract extensions partially offsetting continued soft new business activity. The Group's unique business model, centred on scarce STEM skills and flexible talent solutions, continues to be a source of strength…. We are well placed to take full advantage when the market returns.

We continue to execute our growth strategy, including the phased roll-out of our Technology Improvement Programme. Following our successful launch in the US, our deployment in Germany is well underway…

Business highlights: strong demand for Engineering, with Renewables the fastest growing segment. Life Sciences and Technology were down year-on-year. Technology is still the biggest skill group, accounting for 48% of net fees.

Geographically, there was strong growth in the Middle East and Asia, but the USA was down (again this reflects weakness in Life Sciences and Technology).

Headcount was “down slightly” at the end of the year.

Graham’s view

As it’s in line with expectations there is little need to change my positive view on this one.

The StockRanks are in full agreement, giving it a score of 98.

The PE ratio is 10.4x according to the StockReport, but remember that this is not adjusted for the strong balance sheet. After taking that into account, the “real” multiple is less than 9x.

The stock passes 7 bullish stock screens in a range of categories: quality, value, income and growth!

So from a quantitative point of view, this stock is ticking many boxes indeed. I also think that it’s a fine real-world business with a great track record, excellent geographic diversification, exposure to a wide range of STEM sectors, and Contract income that it can easily be argued is recurring in nature.

If economic conditions remain tough then SThree’s growth is likely to remain limited for as long as that prevails. But personally I would sleep soundly owning this one.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.