Good morning from Paul & Graham!

Audio interview - this latest one is me talking yesterday to the CEO of Sanderson Design (LON:SDG)

I think Lisa Montague's passion for the business comes across really well in this discussion. Obviously in current macro conditions, anything could happen, but the company did confirm full year market expectations recently. Organic expansion in America seems the main growth strategy, where SDG is only scratching the surface of a large market. Bulletproof balance sheet too. This is near the top of my personal watch list, to buy back in at some point. Lovely strong balance sheet too.

I'll type up a written summary & post it here later today, for those who don't have time to listen to the audio.

Agenda

Paul's Section:

finnCap (LON:FCAP) - confirms press (Sky again!) reports that it has received a takeover approach from rival broker Panmure Gordon. I give my thoughts on this below, and hope that Finncap remains independent, as it has been a good friend to the private investor community, providing us with research, and access to company management teams. Whereas Panmures, not so much - could try harder.

Revolution Bars (LON:RBG) - announces FY 6/2022 results (due out today) will be "slightly delayed" because management are busy working on an acquisition, which has triggered the "substantial transaction" AIM rule 12, so out of curiosity, I have a dig into the AIM rules. Results are confirmed to be "consistent with previous guidance", so I don't think there's anything to worry about here.

UPDATE: news coming through from Propel, the sector newsletter, that this is the acquisition target -

| Revolution Bars Group set to acquire Peach Pub Company: Revolution Bars Group, which operates the Revolution and Revolución de Cuba brands, is set to acquire Peach Pubs, the 22-strong gastropub operator, in a deal valued at between £10m and £20m, Propel understands. |

Sosandar (LON:SOS) - a solid H1 update, trading in line with expectations for the full year (which is a profit of £2.0m). Stunning organic growth. No sign of consumers retrenching for SOS. There's obviously risk from a possible downturn, but I explain why SOS's outsourced business model should protect it. Long term, I think this share could be heading a lot higher. Short term, it should be OK I think. A firm thumbs up from me.

**Sosandar is the mystery share (best idea of the week) for this weekend's podcast **

Graham's Section:

888 Holdings (LON:888) (£381m) (I have a long position in 888) - this Q3 update includes a few disappointments. Pro forma revenues are down 7%, and interest costs are likely to rise. Against that, the integration of William Hill is underway and the Adjusted EBITDA margin for the year should meet expectations. The high-risk strategy to buy William Hill with debt has torpedoed 888’s share price, but I remain interested to see how it will play out. Cost synergies and careful cash control might enable the group to deleverage and restore market confidence. But it’s well within the realms of possibility that it doesn’t work out, and that further dilution is required (or worse).

Saietta (LON:SED) (£103m) - I take an initial look at this 2021 IPO that wants to be “a global eDrive solutions leader”. It has motor design patents, manufacturing capabilities in Sunderland, and joint ventures in the US and in India. Fundraisings have enabled it to hire staff and bring new products to market. I have no firm view on this yet but it looks like there is a huge cut to the revenue forecast today, as the company is changing its strategy in order to secure even bigger contracts with bigger customers in the years ahead. £23m of cash gives it some breathing room.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

finnCap (LON:FCAP)

17p (up 26% at 09:04)

Market cap £31m

This broker floated in Dec 2018. Its shares have obviously plummeted in the last year, due to market conditions, as have similar sized Cenkos Securities (LON:CNKS) and WH Ireland (LON:WHI) - all 3 are too small to be separately listed, I think.

Last night, Sky News reported (why is it always them?!) that Finncap is in early stage merger talks with Panmure Gordon (another city broker, which used to be listed, but was taken private in 2017).

This morning Finncap announces that it is indeed in talks, and Panmures has made an indicative proposal to buy Finncap in cash or a partial shares alternative. We’re not told what the price would be, which is the most important piece of information. It will be interesting to see what the share price does today, which might give an indication of any premium.

Finncap made large profits (relative to mkt cap) in FY 3/2022 and the previous year, but obviously conditions are now horrid. Its balance sheet looks OK, so this is not a distressed sale, in my opinion, therefore FCAP could remain independent. There are 4 big shareholders (each with about 10%), including former CEO Sam Smith, and well-known Vin Murria. It could make sense to combine Panmure & Finncap, and remove duplicated costs.

Finncap have been very good for the private investor community, giving us access to, and research on the companies they look after. So I hope this doesn’t change if they’re absorbed within Panmures, which have been a bit patchy - sometimes giving us research on Research Tree, but having seemingly now withdrawn - there’s no research from them currently on RT - a poor show. So I very much hope Finncap remains independent. I’ve been to their offices numerous times to meet individual companies, and for group presentations, so I’m a keen supporter of Finncap.

The main attraction of shares in brokers, is that they generally pay out good divis in the bumper years. But it's very much a feast or famine sector.

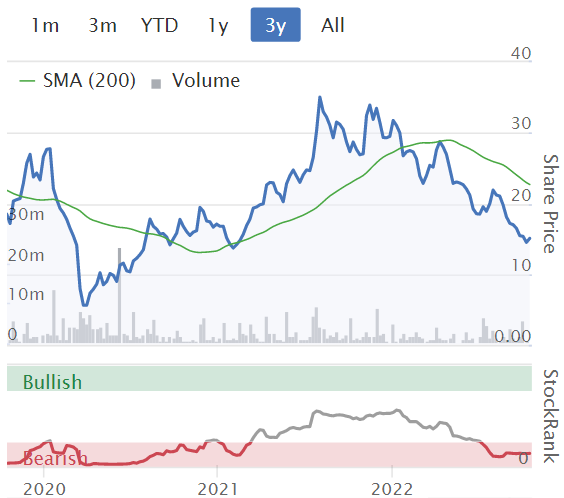

Revolution Bars (LON:RBG)

10.75p

Market cap £25m

Delayed publication of preliminary results

Normally an RNS with that sort of title would set alarm bells ringing.

However this seems to be only a slight delay, due to management apparently being busy working on a big acquisition -

Revolution, a leading operator of 69 premium bars announces that it is in the final stages of negotiating an acquisition, which is expected to be a "substantial transaction" pursuant to AIM Rule 12. As a consequence of the proposed transaction the Group's preliminary results for the 12 months ended 2 July 2022 will be slightly delayed to allow appropriate audit finalisation procedures to take place once negotiations have been completed.

It confirms that results are in line with expectations, so no cause for concern here -

The Group's preliminary results are expected to be consistent with previous guidance, in particular that provided in the Group's announcement of 2 August 2022.

The AIM rules are here (Jan 2021, which I hope is the most recent version).

This is what rule 12 says -

Disclosure of corporate transactions

Substantial transactions

12. A substantial transaction is one which exceeds 10% in any of the class tests. It includes any transaction by a subsidiary of the AIM company but excludes any transactions of a revenue nature in the ordinary course of business and transactions to raise finance which do not involve a change in the fixed assets of the AIM company or its subsidiaries. An AIM company must issue notification without delay as soon as the terms of any substantial transaction are agreed, disclosing the information specified by Schedule Four.

What are the “class tests”? They’re contained in the same document, schedule 4.

These tests are -

- Gross assets

- Profits

- Turnover

- Consideration for the acquisition (as a % of market cap of RBG)

- Gross Capital

If any of those are over 10% (the acquisition target's figures compared with the acquirer's figures), then the acquisition constitutes a “substantial transaction”. So what? Well, schedule 4 just specifies what has to be disclosed, so it's not really that important, as follows -

Schedule Four In respect of transactions which require notifications pursuant to rules 12, 13, 14 and 15 an AIM company must notify the following information:

(a) particulars of the transaction, including the name of any other relevant parties;

(b) a description of the assets which are the subject of the transaction, or the business carried on by, or using, the assets;

(c) the profits (or if applicable, losses) attributable to those assets;

(d) the value of those assets if different from the consideration;

(e) the full consideration and how it is being satisfied;

(f) the effect on the AIM company;

(g) details of the service contracts of any proposed directors; (h) in the case of a disposal, the application of the sale proceeds;

(i) in the case of a disposal, if shares or other securities are to form part of the consideration received, a statement whether such securities are to be sold or retained; and

(j) any other information necessary to enable investors to evaluate the effect of the transaction upon the AIM company.

My opinion - it’s interesting to occasionally dig into the rules! In this instance, it's just a rule that lists what has to be disclosed about an acquisition, if it's over a certain size (with the bar set quite low).

In this case, the substantial transaction could actually be quite small, as for example it would trigger this disclosure requirement under rule 12 if the acquisition is £2.4m+ in consideration (10% of RBG’s current market cap).

My main hope is that RBG doesn’t raise any more equity for this acquisition, because its own share price is so low, that further dilution would surely not be a good thing, at such a bombed out valuation.

The last trading update on 2 August 2022 was good, and forecasts have been raised several times this year. How come? I think they set the bar low, due to uncertainty, and an extensive refurbishment programme is giving sites a boost. Plus the CEO is a highly regarded, effective, hands-on operator, who I think is doing an excellent job.

RBG is well-funded now (after 2 placings at 20p), and had net cash of £2.6m at 2 Aug 2022, and is self-funding its renovation programme of existing sites.

It’s in a good position to expand. Although obviously investors are not interested in operationally geared consumer stocks right now, hence share prices across the sector are bombed out. But that’s where we find the bargains for the next bull market. This could be one of those, I reckon.

I’m not currently holding, but there’s nothing to read into that, as I had a clear out of everything in my geared accounts, which was where most of my small cap positions were held. If only I could wind the clock back a year, and do things differently! But I can't so it's pointless even thinking about it.

I still like RBG shares a lot, as I think it could be a fairly easy doubler, once more stable conditions return (that's true of so many small caps right now). Also the insolvency risk looks very low, because it holds net cash, is cash generative, and restructured the site leases during the pandemic, removing all the problem properties. Plus of course these are ideal conditions for expanding chains, with remarkable ("once in a generation" according to the CEO of £XPF [I hold]) property deals available on new sites.

I’ll keep my eyes peeled for details on the acquisition & will report back in due course.

Bear in mind that the share count has risen from 50m, to 230m, massive dilution, from the 2 placings at 20p. Therefore the chart probably won't ever get back to previous highs of c.200p.

UPDATE: Propel (sector newsletter) says the acquisition is Peach Pubs, a gastropub chain with 22 sites. The deal is said to be £10-20m, which Propel reckons will be funded from existing resources (i.e. no dilution) cash & debt.

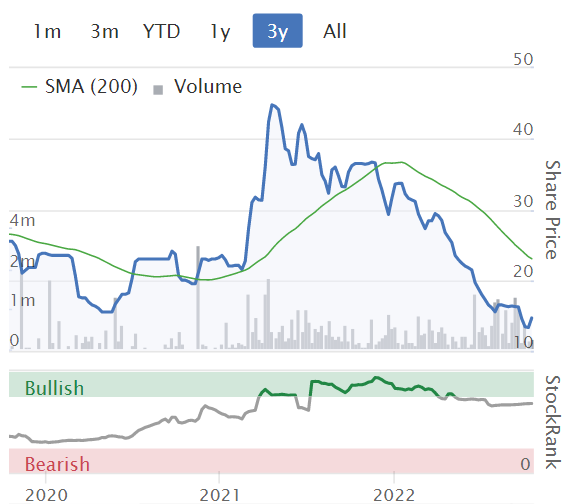

Sosandar (LON:SOS)

15.75p (up 10% at 11:02)

Market cap £35m

Sosandar, one of the fastest growing fashion brands in the UK, creating quality, trend-led products for women of all ages, is pleased to provide the following trading update covering the six-month period ended 30 September 2022.

Trading in line with FY23 market expectations. Revenue +72% yoy and the second six-month period of positive PBT

Note: The Board believes that consensus market expectations for the year ending 31 March 2023 are revenues of £42.8m, EBITDA of £2.2m and PBT of £2.0m.

I’m delighted to see SOS refer to PBT (profit before tax) as the profit number in this announcement. Previously they used EBITDA, which generally doesn’t seem popular with private investors (and certainly isn’t with me), because it often gives an inflated version of profitability.

Key points -

H1 revenue £20.9m (up 72% vs H1 LY) - that’s a terrific performance, given that it’s all organic growth, and occurring at a time when many eCommerce businesses are struggling to even match, let alone thrash their prior year numbers.

Profitability - slightly above breakeven, with PBT of £0.1m in H1, much improved from a loss of £(1.1m) in the prior year comparative period. H2 tends to be seasonally stronger.

Repeat orders - is the stand out KPI - with almost 77% of orders (266k/347k) being repeat customers. That’s highly significant I think, and shows that SOS is building a loyal, repeat customer base. Whereas many eCommerce businesses have to spend a fortune on digital marketing, and only attract one-off sales. This is a key point of difference for SOS, which gives me a lot of confidence in the brand & the future prospects.

Gross margin is down a bit, but still good at 54.4% (H1 LY: 56.5%)

Net cash down from £7.0m a year earlier, to £4.2m. Credible reasons provided, it’s due to larger, and earlier stock intake for the peak season. Also increased use of cheaper sea freight (as opposed to air), which increases lead times & hence inventories. This is all fine I think.

Current trading -

Early autumn trading has been very positive with particular success in key growth areas of outerwear, knitwear and partywear.

Maybe people are buying more jumpers, to keep warm this winter, with the thermostat set lower to save fuel?

…The period saw the Company navigating numerous macro challenges and successfully mitigating the headwinds faced so far. The current economic backdrop continues to be challenging; however, October trading has started well both on the Company's own site and with its third-party partners. There remains a high degree of external economic uncertainty, but the Company is confident that it can continue to navigate the challenging and volatile conditions and take mitigating actions as appropriate to protect margins and profitability.

In the current environment the Company expects consumers to become more selective about where they spend and also more demanding of those brands with which they spend. However, Sosandar is confident that the Company will continue to benefit from its unique product offering and brand proposition that clearly differentiates it from the rest of the sector. As such, the Company is confident of continuing to make market share gains…

Selling Sosandar products through JD Williams will further increase the brand's reach and deliver profitable growth. The partnership has got off to a promising start and together with M&S, Next, John Lewis and the Very Group, there are significant opportunities for further growth.

My opinion - the most important information is the note right at the end, saying it’s on track to make £2.0m PBT this year.

That means, the business now seems home, and dry - it’s now profitable, and growing tremendously fast, organically.

There’s obvious risk that growth could slow, and fashion risk (although that’s mitigated by test & repeat model). Also concentrated key person risk here is high, with the joint CEOs very much being the business. If they lose the plot, or something bad happens, then the main driver of the business would be lost.

In terms of risk:reward, it seems to me that SOS shares have never looked better. The business model is working, a decent level of (full year) profitability is on the way, it shouldn’t need any more cash, and yet the valuation is a modest £35m.

I think patient holders here could do very well, long-term. It’s very rare to find an emerging new brand, that’s really going places, but I think it’s becoming increasingly clear that’s what is happening here.

Overall, a thumbs up from me. In a bear market, and consumer downturn, I can understand why the share price is where it is. But good businesses thrive in recessions, and competitors fall by the wayside. So longer term, I think this share could end up maybe 2-3 times the current level.

There’s good downside protection too, because SOS outsources logistics, and has little in the way of fixed costs. So even in a nasty recession, it could easily scale back marketing spend, and run for cash. Physical retailers don’t have that luxury, so as we’ve seen, they can bite the dust during a downturn.

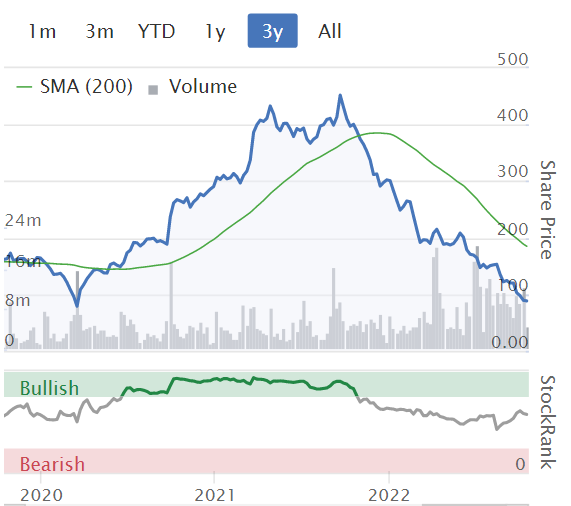

I'm surprised the StockRank is still so low, that has some catching up to do perhaps?

Graham’s Section:

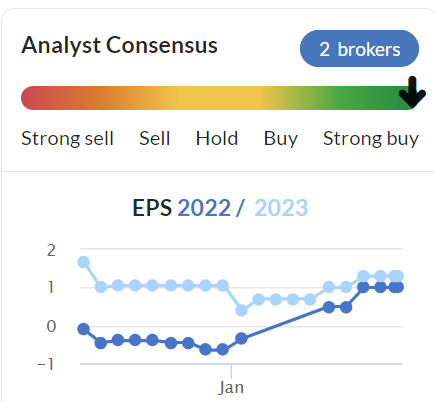

888 Holdings (LON:888)

Share price: 85.46p (-5%)

Market cap: £381m

(At the time of writing, Graham has a long position in 888.)

This is now a little bit of an embarrassment for me: I’ve been holding it all the way down from the peak at 452p. A smarter person would have sold out at some point, but I’ve taken a deliberately “hands-off” approach to my portfolio, only selling shares out of necessity and doing my best to let all other positions run for as long as possible.

Also, this has been my smallest position for some time - currently just 3% of my highly concentrated portfolio. I accept that my strategy of holding onto shares on an effectively permanent basis will see some casualties in the portfolio, from time to time.

Let’s see what this Q3 trading update has in store for us.

888 is “one of the world's leading betting and gaming companies with internationally renowned brands including 888, William Hill, Mr Green and SI Sportsbook”. It has been described as “one of the internet’s oldest casinos”.

Today’s numbers are presented as if William Hill had been owned in all periods, and as if 888 Bingo was never owned (William Hill was purchased, 888 Bingo was sold).

Key points: total revenues are down 7%, and the William Hill UK Online segment is responsible for most of the fall. The core 888 brand did not do well, either.

Let’s break down the key talking points:

Players safety measures - this is one of the main reasons for the online revenue decline. The measures, which had the effect of reducing average spend per player, were introduced in Q3 and Q4 of 2021.

Netherlands - another reason is the closure of the Netherlands market, which was previously worth about 4% of revenue at the 888 segment (and 6% at the William Hill International segment).

This is only a temporary issue: the Netherlands used to be a market where companies would operate without a licence. It is now moving to a licensed regime, but one of the conditions of this is the operators must stop trading until they get their licence!

888 should hopefully be back up and running in the Netherlands again soon (perhaps before the end of the year), and that portion of revenue should return.

Retail revenue - this was flat despite “c.£4m impact from three days of temporary closures together with sporting fixture cancellations / postponements during the period of national mourning”.

Sports - Euro 2020 took place in 2021, so it’s a tough comparison in 2022 with no major tournament yet. Of course we do have the World Cup coming up!

Ok, so there are a lot of excuses for the revenue decline. It’s up to you if you think they are reasonable excuses or not, and if future periods will be better.

I think that future periods will be better: the Netherlands will come back, there will be fewer days closed, and of course the World Cup and the Euros come around every two years. Although of course there is always scope for more rules and regulations which could further hamstring revenue and profitability.

William Hill - the elephant in the room is this acquisition (details published in April here).

This was a £2 billion deal, causing 19% dilution and very high leverage. Everybody, not least 888’s management, knew that the major task after the deal would be to pay down the debt and get the balance sheet back onto a solid footing.

Deleveraging will be much easier if the c. £100m in potential synergies are realised:

The Group has made strong early progress with realising synergies, creating a more efficient operating cost base during the Period and helping to deliver an improved Adjusted EBITDA margin in Q3 2022 versus H1 2022, with further improvement expected in Q4, with the primary focus of the business on integration, execution and deleverage

Debt load - this is not a situation where you can have great confidence that the equity is going to be worth something, after all the debt is taken into account.

Today’s update informs us that cash interest costs are expected (based on the forward curve of interest rates) to be around £170m for the full year 2023.

- Gross debt is £1.81 billion (high interest rates are being charged on this).

- Cash is £186m.

- Undrawn facilities are £150m (so total headroom is £336m).

There aren’t any significant maturities until 2027, so at least 888 has time to study the bond market and make its plans for future refinancing deals.

The operating profit forecast for the current year is around £190m, rising to £260m next year.

Depending on capex and cash conversion, that does provide some scope for debt reduction, based on current interest rate projections. 888 might want to take out some more rate hedges, to fix a greater percentage of its interest costs.

Outlook

Despite the changing macroeconomic environment and ongoing pressure on UK revenues from long-term focused enhanced safer gambling measures, the Board expects revenues in Q4 2022 to grow over Q3 2022 and be similar to Q4 2021 levels

The Group has taken actions to accelerate synergies and drive a more efficient operating cost base, and expects an improved Adjusted EBITDA margin in H2 2022 to meet the current market expectations for full year 2022 Adjusted EBITDA

My view

I have a relaxed attitude to this one. If it doesn’t work out, I plan to take the 3% hit to my portfolio.

Am I already resigned to it not working out? Not completely.

If the company aggressively pays down as much debt as it can over the next year or two, that will set it up for a slightly easier debt reduction profile over the medium-term.

For what it’s worth - I know that ratings agencies are often treated with scepticism - 888 has a credit rating of B1 from Moody’s (positive outlook) and BB- from Fitch (negative outlook).

This means that the agencies believe 888 is somewhere between “high credit risk” and “likely to fulfil obligations - ongoing uncertainty”.

Of course, one way that obligations can be fulfilled is by diluting shareholders: debt holders can be saved, but at the cost of wrecking the value of the existing equity.

This stock is not for the faint-hearted, that’s for sure. But if the debt is successfully managed and shareholders avoid dilution, then we will end up owning a huge, diversified global gambling company, with major online assets and a familiar retail presence. There is potentially a big reward, if it works out.

Cognisant of the risks, I’ll continue taking a chance on this one.

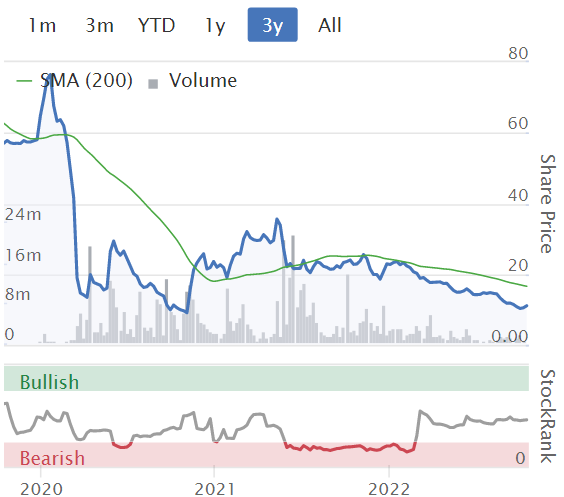

Saietta (LON:SED)

Share price: 100p (+5%)

Market cap: £103m

We’ve never looked at this one before, so let’s briefly describe what this is. Saietta is a “multi-national business which designs, engineers and manufactures complete Light-duty and Heavy-duty e-drive systems for electric vehicles on land from scooters to buses… as well as marine applications.”

It listed on AIM in July 2021 at an IPO price of 120p. As it has fallen by only 20p since then, that makes it a top-performing 2021 IPO!

The company is undergoing rapid growth: it had 28 employees when listed, and now has 200, and has joint ventures in both the US and in India. According to today’s trading update, it is experiencing “very significant positive momentum” with its current strategy.

Saietta has patents over two types of motor design and these underpin its hopes for a new partnership with a major light vehicle manufacturer in India, to hopefully commence at some point in 2023.

The company has cash of £23m and a recently acquired factory in Sunderland; if it’s going to achieve its ambitious goals, it needs to be very careful about how it uses this cash. Accordingly, its strategy includes joint ventures, outsourcing and government grants.

Outlook

There are some exciting points in the outlook statement:

As a reaction to the unexpectedly positive response from substantial customers with more significant longer term contract potential, the Board has decided to divert resource away from pursuing near term lower volume standalone motor sales in order to secure far larger contracts for higher value product systems…

In summary the strategic vision of Saietta has continued to expand significantly which has created the opportunity to increase shareholder value by concentrating on working with some of the world's largest OEM's and achieve 1st mover advantage in multiple sectors and regions.

FY March 2023 revenues are likely to be lower than previously forecast, though the company says they will still be at least 250% of the result in the prior year.

This looks like a huge cut in the revenue forecast: 250% of the result in the prior year (£3.6m) is only £9m, while the existing revenue forecast according to Stockopedia is £22m!

The plan is for “a projected step change into high volume production in several markets during the following financial year”.

My view

I’ve not been studying this for long enough to have a firm view, but the huge cut in the revenue forecast has thrown me. The previous consensus forecasts suggested £22m of revenue would be forthcoming in FY 2023, followed by £67m of revenue in FY 2024.

The company has slashed next years’s forecast but done so while saying that the company is actually more ambitious and has even bigger goals than it did before.

Stockopedia classifies this as a Sucker Stock. Maybe it will be another AIM stock that eventually ends up in the trash heap, but I thought it was worth mentioning. We’ll have something in the archives to refer back to, if this company does eventually come up with the goods!

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.