Good morning from Paul & Graham!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

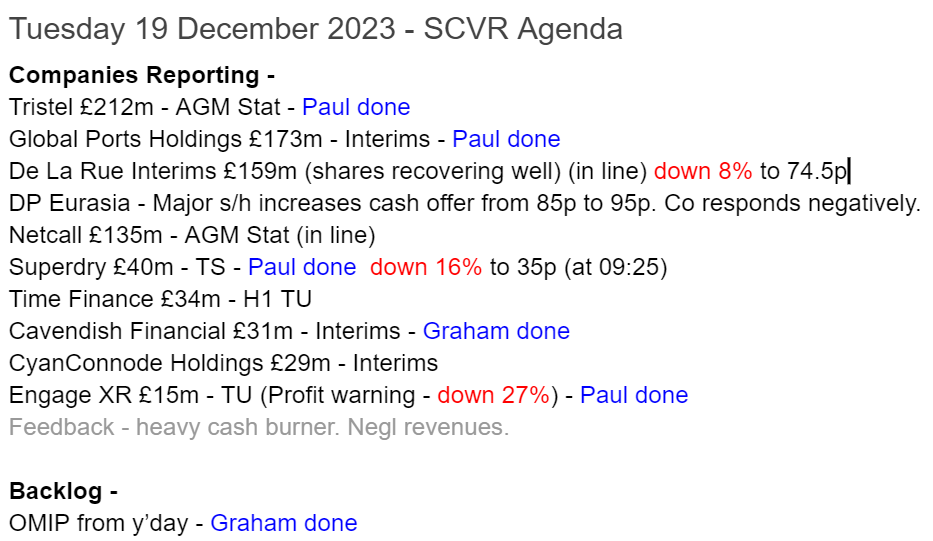

Summaries

One Media IP (LON:OMIP) - up 3% to 5.4p (£12m) - Trading Update - Graham - AMBER

OMIP’s core business - digital music rights management - delivers in line with expectations. However, the cash balance has declined as OMIP invests in an anti-piracy software subsidiary. I would treat these shares with caution, as the company appears to be sub-scale.

Superdry (LON:SDRY) - down 14% to 36p (£36m) - Trading Statement (profit warning) - Paul - BLACK (profit warning), and RED on fundamentals.

Another profit warning, with poor performance so far in FY 4/2024. I'm not able to quantify the shortfall, as no broker updates currently available. I'm not sure SDRY will survive calendar 2024 in its current form, hence am steering clear. EDIT: I'm told that broker forecasts have been massively slashed. So this looks very bad.

Tristel (LON:TSTL) - up 2% to 455p (£216m) - Trading Update (AGM) - Paul - AMBER/GREEN

H1 update today is brimming with positivity. It doesn't directly mention full year market expectations, but a note from Cavendish seems to suggest that the next update might be ahead of expectations maybe? As always, this share looks very pricey, so it's up to you if you're prepared to pay up for growth and quality, or not!

Cavendish Financial (LON:CAV) - up 5% 8.9p (£32m) - Interim Results - Graham - GREEN

This AIM-focused investment bank reports its maiden interim results following the merger of finnCap and Cenkos under this new name. The cash balance has risen to £17m, over half the market cap, and £7m of operating cost synergies make this almost irresistibly cheap.

ENGAGE XR Holdings (LON:EXR) - down 27% to 2.05p (£11m) - Trading Update (profit warning) - Paul - RED

Contract slippage means that FY 12/2023 falls way short of forecasts. The only saving grace is that it has enough cash left for the time being. It's quite a nice story, but so far EXR has failed to achieve the scale needed to be a viable business.

Global Ports Holding (LON:GPH) - unch 255p (£174m) - Interim Results - Paul - AMBER/RED

An interesting special situation, which I untangle below. It owns operating rights to lots of cruise ship ports, all financed with massive debts - which are now getting a lot more expensive to service. Hence it's not clear to me what, if anything, equity is worth. Needs a lot of detailed research to properly judge that.

Paul’s Section:

Superdry (LON:SDRY)

42p (pre-market) £41m - Trading Statement (profit warning) - Paul - BLACK (profit warning), and RED on fundamentals.

Superdry plc (“Superdry” or the “Group”), today issues a trading update for FY24 covering the 26-week period to 28 October 2023 and an update to current trading covering the 6-week period to 10 December 2023.

An admirably honest headline from this struggling fashion brand -

Despite progress on our cost savings programme and inventory reduction, full year profitability expected to be impacted by well-documented challenging trading environment…

… trading performance has been significantly below management expectations. Profits for the year are therefore expected to reflect this weaker trading seen to date.

There’s plenty of detail, but no specific guidance on how much profit will miss forecasts.

Liberum has published notes on Superdry several times in 2023, but I haven’t seen anything new come through yet on Research Tree today. I'll update if anything comes through later today.

EDIT: A friend tells me that broker forecasts for city insiders have been massively cut for SDRY today, but there's still nothing available to private investors. I'm told that it could be a loss of c.£45m for FY 4/2024. That reinforces my view that this share will be lucky to survive calendar 2024. End of edit.

In a previous note (5 Sept 2023) Liberum forecast a rebound from last year’s £(21.7)m adj LBT, to a much reduced £(1.5)m LBT this year, FY 4//2024. That was based on anticipated sales decline of 6% this year.

Today’s update says H1 has seen retail sales down 13.1%, and wholesale down a whopping 41.1%. Most recent 6 weeks trading in H2 is said to be down 7% LFL.

Therefore, it sounds like actual results for FY 4/2024 are likely to be well below current forecasts, and at a guess I’d say a thumping loss is on the cards, despite (previously announced) £35m cost-cutting.

Paul’s opinion - sadly, there’s still no sign of any turnaround at Superdry. It bought some time through selling off Far Eastern IP, and there could be other similar deals, possibly? Additional debt facilities are also available. So it strikes me that the company is likely to survive this current season, limp into calendar 2024, and then it probably only has one last chance to effect a turnaround during 2024.

Overall then, although the market cap is tiny, the situation looks precarious, hence I won’t be tempted to gamble on a rebound here. The collapse of Joules taught me that it’s not worth the risk, trying to bet on a turnaround of struggling fashion brands.

As you can see from the 10-year chart below, this is a structural decline, which set in well before the pandemic -

Tristel (LON:TSTL)

Up 2% to 455p (£216m) - Trading Update (AGM) - Paul - AMBER/GREEN

Tristel plc (AIM: TSTL), the manufacturer of infection prevention products, will hold its Annual General Meeting at 11am today …

H1 has been good - and note the fabulous gross margin, giving excellent operational gearing when sales increase -

"I am pleased to report that the Company has had a record first half with revenue for the six months ending 31 December 2023 expected to be £20.7m, an increase of 18% compared to £17.5m in the first half of last year. Revenue growth has been delivered across all our geographical markets. Gross margin remains above 80% in line with our expectations.

Outlook - sounds confident & upbeat -

"The business is performing strongly on all fronts and the confidence that we expressed in October in our medium-term outlook remains unchanged. With the growth possibilities for our business stronger than ever, and as a business with no debt and forecast cash balances of approximately £10.4m after payment of this year's final dividend on 22 December, we are in a strong position to capitalise upon our global leadership position in the medical device decontamination market."

USA expansion - again, this sounds encouraging -

"In the United States, Parker Laboratories, our manufacturing and distribution partner, completed its first production run for Tristel ULT in early October, following receipt of our FDA approval in June 2023. This has enabled Parker to stock its national distribution network and provide product to the first beta site users. We expect to make steady progress in building our customer base throughout the United States during the second half of our financial year. We remain very excited about our prospects as we begin serving the largest healthcare market in the world.

Broker update - Cavendish helpfully updates us this morning, forecasting 13.7p adj EPS for FY 6/2024. Although it points out that H1 has exceeded this, if we use the same seasonal weighting as last year. Combined with the very upbeat-sounding management commentary, I imagine Tristel is likely to produce one or more ahead of expectations updates over the next 6 months. On a PER of 33.2x (455p/share divided by 13.7p EPS), it needs to!

Forecast for FY 6/2025 is a decent jump to 16.5p - presumably based on royalties from US sales kicking in?

CEO retirement - long-serving founder/CEO Paul Swinney has announced his intention to retire in the next 12 months, after 30 years. That sounds reasonable, and I don’t sense anything untoward from this.

Paul’s opinion - things seem to be going well, and I like everything about Tristel, apart from the price! Bulls need to be certain that Tristel can thrash forecasts, as otherwise the valuation could be too high.

That said, with management so upbeat, and 80% gross margins providing operational gearing, I’m leaning more to the positive side, despite a high valuation, so let’s go with AMBER/GREEN. High StockRank too.

ENGAGE XR Holdings (LON:EXR)

Down 27% to 2.05p (£11m) - Trading Update (profit warning) - Paul - RED

Contracts have slipped, so revenue is now expected at 3.6m to 3.8m euros for FY 12/2023. That’s a long way short of the 7.5m euros consensus shown here on the StockReport.

Heavy losses continue, but it still has enough cash for the time being -

…the Company expects to report an EBITDA loss of approximately €4.6m and a net cash position at the year-end of approximately €7.3million giving us adequate funding to reach break-even in the short to medium term.

Paul’s opinion - we’ve reviewed EXR here 6 times in the last year and every time it’s been a RED view from us. That’s because, so far anyway, there’s no sign that this is a viable business. Revenue is subscale, hence it racks up heavy losses each year, with 2023 repeating that pattern. The remaining cash pile does give it time to deliver on the promises though. Some of the stuff it’s doing does sound interesting, it’s a nice story, but we need to see better execution, and growth. Until that happens (if!) it’s just a high risk punt, for optimists only. Why get involved, when this type of speculative share nearly always goes wrong on AIM? I’ll just wait on the sidelines, to see how things go, ready to pounce if it reaches a positive turning point.

Note also that the share count has considerably more than doubled since it listed, due to fundraisings.

Global Ports Holding (LON:GPH)

Unch 255p (£174m) - Interim Results - Paul - AMBER/RED

Global Ports Holding Plc ("GPH" or "Group"), the world's largest independent cruise port operator, today issues its unaudited results for the six months to 30 September 2023 (“Reporting Period”).

There are only really 2 key questions re this share -

To what extent is profitability increasing, from cruise ships activity post pandemic?

Can it survive given the huge debt burden?

As you can see from the highlights table below, unusually it adjusts revenue heavily to show an adjusted 50% rise. However, the profit gradually disappears from the hefty EBITDA level, to a post-tax loss, given the heavy depreciation, and finance costs.

Net debt - even taking the most favourable number, net debt is gigantic, dwarfing the market cap, and has gone up considerably (note the accounts are in US dollars) -

This snippet gives an idea of how this share would need very careful analysis of the structure, terms, and costs of the debt -

GPH issued USD 330 million of secured private placement notes (“Notes”) to insurance companies and long-term asset managers at a fixed coupon of 7.87% shortly before the end of the Reporting Period, mainly to refinance the 2021 Sixth Street loan. The Notes received an investment grade credit rating from two rating agencies and will fully amortize over 17 years, with a weighted average maturity of c13 years. Over 90% of GPH’s gross debt is now fixed and close to 85% of GPH’s gross debt (ex IFRS-16 Leases) is made up of the investment grade rated Notes and the ring-fenced project financed issuance for Nassau Cruise Port

Outlook - more growth is expected -

Demand for cruising remains exceptionally strong and our call reservations for calendar year 2024, are supportive of further significant growth in the business.

Balance sheet - at first sight, this looks dire. NAV of $25m includes $556m of intangible assets. However, looking at note 7, $543m of those intangible assets are rights to operate ports, which presumably GPH paid for, and are then amortised over long periods. Only $13m is goodwill.

So this looks like an unusual situation where the intangible assets are real, and have value. For that reason, I’d be inclined to leave the intangible assets in situ, rather than writing them off.

Overall then, I’d see NAV as being around $12m - negligible for the size of business.

Paul’s opinion - I’ve got my head around this now.

This business owns the rights to operate cruise ports. These rights were financed entirely with huge (and now much more expensive) debt.

All the operating profit is consumed in servicing the debt interest.

Therefore, equity is almost like a call option, on the business being able to increase profits such that equity holders might receive dividends again (which stopped in late 2019).

The trouble is, with the zero interest rate era apparently having now ended, the dynamics have all changed. Debt is now expensive, and the question is whether that will leave anything left for equity holders? If not, then arguably the equity is worth little to nothing.

Hence I’d treat this as a special situation, which would need much more detailed work (e.g. on debt covenants, maturities, etc), to determine if the equity is worth anything.

Just on a superficial look, I can see that the rising finance costs are consuming all the cashflow. Debt is rising because the company has been buying up more intangible asset rights, to further expand its port operations.

Unless you’ve done detailed work to understand all these issues properly, then this share would just be a high risk gamble. One for special situation experts, and mad punters only!

A further risk is that the major shareholder owns 58%.

On the upside, the shares seem to be in an established up-trend -

Graham's Section:

One Media IP (LON:OMIP)

Share price: 5.4p (+3%)

Market cap: £12m

We look at this “digital media content provider” very rarely; it’s an investor in musical intellectual property rights “with proven, repeat income streams”.

Today’s update reports that its core business of digital music rights management has delivered in line with expectations for FY October 2023.

Besides the core business, there is also an anti-piracy software subsidiary, TCAT.

Key points:

Revenues £5.4m (up 5%)

Net revenues £3.6m (up 10%)

The definition of net revenues is total revenues minus “distribution charges, royalty costs and other costs”. Perhaps it makes sense to treat net revenues as the real top-line number, rather than gross revenues?

Continuing:

EBITDA £1.4m (last year: £1.8m)

Cash £1.2m (last year: £2.2m), reflecting the strategy to allocate resources towards the software subsidiary TCAT.

CEO comment doesn’t add too much:

These numbers are very much in line with our expectations, notably the continued growth of our music rights management business and the strategy that we set out during the course of this year to reinvest into the future potential of TCAT, our proprietary anti-piracy software tool.

Graham’s view

I’m reluctant to take any stance on this one, as it strikes me that OMIP’s software subsidiary is likely to be at an early stage in its development (considering how small OMIP’s total revenues are, and that TCAT is only a fraction of this). I don’t take any joy in being negative on companies purely because they are small and starting out.

However, if I had to choose a positive or negative stance, I’d probably choose a negative one. It remains true that most early-stage software ventures don’t work out. Meanwhile, OMIP’s management’s decision to invest heavily in software suggests perhaps a lack of excitement around the core business. OMIP has never generated sufficient profits to justify a stock market listing, which itself brings additional delisting risk for investors.

I’ll take a neutral stance on these shares for now. Hopefully they can keep losses low enough to avoid diluting shareholders too heavily over the next couple of years, and their investment in software will be richly rewarded. Be warned, though: the general trajectory here is for the share count to increase.

Cavendish Financial (LON:CAV)

Share price: 8.9p (+5%)

Market cap: £32m

This Cenkos-Finncap combination now has two joint CEOs. This is how they begin these interim results:

"We are delighted with the progress our teams have made in the short time since the merger in September. Careful planning enabled rapid business integration, unlocking £7m of cost synergies, more quickly than we originally forecast.

We are already winning clients and have executed over 20 transactions across all divisions since coming together. Despite the significant one-off costs of merger, our cash balance had risen to £17m on 30 November…

Bear in mind that the market cap here is currently only £32m; to have £17m of cash leaves an enterprise value of only £15m. And then we have £7m of synergies. I’m not sure if I’ve ever seen a company trading at only 2x synergies before! On its face, this is a very, very cheap valuation.

There must be a catch, and the catch is that the company is most likely loss-making, for now. As readers will know, sentiment in UK small-caps is on the floor (particularly for AIM). After the merger, Cavendish is now “the clear no. 1 AIM adviser with over 200 retained corporate clients”.

With Cenkos and finnCap no longer competing with each other, the new combined entity should be, in their own words, “well positioned to benefit from improving market conditions when they come”. In a bull market with regular IPOs and more active trading, I think we can expect great things from Cavendish. But of course nobody knows when that might happen - is 2024 too soon? 2025? 2026?

H1 numbers - these are for finnCap alone from April 2023 until September 7th, the date of the merger.

Then, until September 30th, they include Cenkos.

The adjusted pre-tax loss is £3.6m.

Outlook is relevant for all of us touched by conditions in the market. The key takeaway is that the situation remains difficult for the time being.

I’ve highlighted the part most relevant for investors in Cavendish:

The current interest rate upcycle appears to be nearing completion, but inflationary pressures, although reduced, remain a risk. With relatively higher yields available to investors on cash deposits we continue to see a drag on market demand for UK growth equity. This has continued to adversely impact equity transactions and trading, but private and public M&A activity remains resilient. The breadth of the service offering was a key driver for the merger, putting us in a strong position to weather market conditions. Post-merger enhancements in winning and executing business allied to a tentative pick up of the markets in the last three months has enabled us to get off to a good start in the second half. We look forward to building on this momentum, underpinned by a good pipeline, lower overheads and a strong cash position.

Graham’s view

The key point for me is the £7m of synergies. Here is the company’s description of its cost control achievements:

Merger related advisory and severance costs are materially behind us. Most of the targeted £7m reduction in annualised operating costs, from co-locating and eliminating duplicate roles and support services, has already been achieved.

We are now focused on firmwide cost controls, automation and outsourcing to further reduce our cost base.

So when (if?) revenues recover, we should see enormous operating leverage: the combined revenues of finnCap and Cenkos, but with £7m fewer operating expenses attached to this.

As for balance sheet support, tangible net assets as of Sep 30th were £26m, including cash of £12m. We already know that a flurry of deals in October and November pushed that up to £17m. These are significant numbers given the market cap.

Given all of the above, I’m going to have to stay positive on this one as a highly geared recovery play on the AIM market. If/when sentiment in AIM becomes positive once again, I would expect a huge pop in financial performance here. When that happens, maybe the share price can start to reflect a sunnier attitude.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.