Good morning from Paul & Graham!

Once again, April Fools caught me off guard. Top marks to my nephew, who dumbfounded me by saying their cat, Nigel, had just produced a litter of kittens. Well played indeed!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom),

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Summaries

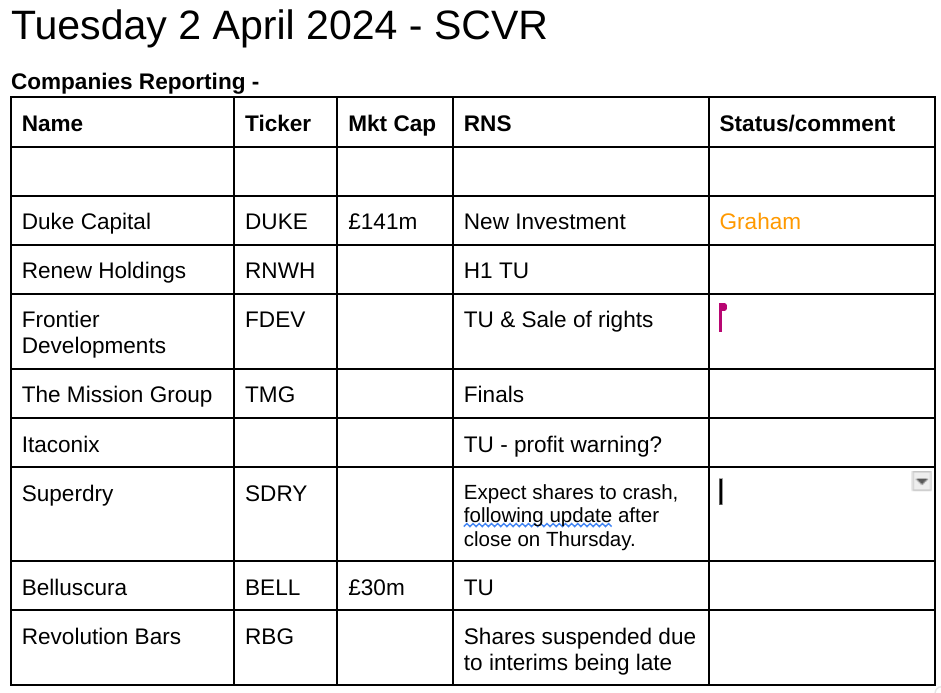

Duke Capital (LON:DUKE) - down 0.3% to 33.4p (£139m) - New Capital Partner - Graham - GREEN

After recently announcing some disposals, Duke has impressively come to the market with the announcement of a new £14.5m investment in a group of nursing homes in the South East. Given its track record since 2017, I think Duke deserves to trade around book value.

Frontier Developments (LON:FDEV) - up 17% to 164.4p (£65m) - Trading Update - Graham - AMBER

Today’s update offers both stability in terms of the cash position (£23m) and good news as Planet Zoo has successfully crossed over to games consoles. I think my three reasons for optimism are intact but having been bitten by previous profit warnings, I remain neutral.

Graham's Section

Duke Capital (LON:DUKE)

- Share price: 33.4p (-0.3%)

- Market cap: £139m

We covered Duke last Thursday when it had a trading update. Noting that it recently made £19m of disposals, I suggested that it would want to reinvest the proceeds without much of a delay.

Today it announces a £14.5m investment in a new “capital partner”.

The deal has some unique features that are worth mentioning.

The £14.5m will go to “a newly formed entity” (name not given?) which in turn will acquire Integrum, an operator of six nursing homes in Kent and East Sussex. It employs 475 people and caters for over 300 service users.

In addition, the funds from Duke will be used to replace a rent deposit with the owner of Integrum’s four leasehold properties. Two of Integrum’s six properties are freehold.

On top of royalty payments to be received over 30 years, Duke becomes a 49% shareholder of Integrum.

I’ve said before that I have some concerns about Duke being an equity investor, but Duke would argue that the equity stakes it receives are merely “sweeteners” with the bulk of the value of their deals being in the royalty payments.

That being the case, the equity value here must be considered very low, if a 49% equity stake is just a sweetener for the royalty deal!

Integrum has a buy and build strategy and is likely to continue acquiring care homes; Duke has agreed in principle to potentially support this with additional funds. So it’s easy to imagine that the initial £14.5m investment could quickly enough become a £19m total investment, soaking up all of the funds received from Duke’s recent disposals.

Neil Johnson, Duke CEO:

"Duke is excited to invest in Integrum and looks forward to contributing to its ongoing success in the future… Integrum has demonstrated a strong track record of buying and integrating quality elderly nursing care homes run by best-in-class home managers and we look forward to supporting the group as it embarks on its next phase of growth."

Adrian Pancott, Integrum CEO:

Duke's unique capital offering is a great fit for Integrum at this time as we look to continue to invest in and improve the homes we already own, whilst looking to further M&A. Duke's existing Social Care sector expertise and the importance they place on quality of care makes them the perfect partner for us, and we are delighted about the opportunity to work together going forward…

Graham’s view

This seems like a promising deal for Duke. For a start, everything I’ve heard about nursing homes as an investment has been positive, and I can’t imagine that there is going to be any reduction in demand any time soon.

If you’re interested in the sector, you might have already looked at Target Healthcare Reit (LON:THRL), an investor in properties that are let to care home operators.

As usual, I tend to worry about the riskiness of Duke’s individual investments. Integrum’s equity value is considered so low, after Duke’s financing, that Duke is being handed a 49% equity stake. This suggests to me that the equity value is considered minimal, and could ultimately prove to be worthless, with repercussions for its lenders? But then I have to remind myself that Duke has been listed since 2017 and that its overall portfolio performance over all of this time has been excellent.

From a portfolio perspective, the £14.5m investment in Integrum is a nice size for Duke, whose total assets as of the interim results were some £225m. It’s not so large as to cause undue risk for shareholders, while still being large enough to potentially make a useful contribution to shareholder returns.

And it’s nice to have the option to fund Integrum’s growth, which would presumably be on the basis that its existing nursing homes continue to perform acceptably.

The company should also be commended for being able to announce a new investment so quickly after making its recent disposals. It certainly can’t be faulted for not putting its funds to work.

I’m going to continue to give Duke the thumbs up at the current share price (33.4p). For me, it would make more sense if it was trading around 39-40p, i.e. around book value. Above 40p, I might be tempted to switch back to neutral.

Frontier Developments (LON:FDEV)

- Share price: 164.4p (+17%)

- Market cap: £65m

This is “a leading developer and publisher of videogames based in Cambridge, UK”.

I looked at its interim results in January and continued to express optimism that a turnaround was possible, following on from arguments made in November.

Here are the key points from today’s trading update:

Sales in line with expectations, led by sales from its core category of games, i.e. “creative management simulations”.

Planet Zoo (previously on PC only) had a successful launch on consoles, including sales of a “season pass” for this game.

The “season pass” is very helpful from a cash flow point of view: cash is received upfront for content that is delivered over 12 months.

From an accounting point of view, cash flow gets boosted now (in FY May 2024) but the associated revenues are recognised across both FY May 2024 and FY May 2025.

Sale of publishing rights: the old game Rollercoaster Tycoon 3 has been the subject of lawsuits over the years - see the Wikipedia article. The story ends now with FDEV selling the publishing rights of this game to Atari for $7m ($4m now, and $3m defcon). The proceeds will be used “for general working capital purposes”.

Cash position: the cash balance improves from £20m (Dec 2023) to £23.4m (March 2024). FDEV has not yet received the funds from sales of Planet Zoo but it has received the $4m upfront payment for Rollercoaster Tycoon 3.

Outlook:

The Board remains comfortable with the financial guidance previously provided for FY24, before taking into account the incremental profit and cash from the sale of the RollerCoaster Tycoon 3 publishing rights. The Board expects to provide an update on the outturn for the financial year in June 2024.

Graham’s view

This has been a difficult stock to cover - its share price has utterly collapsed, and I turned positive on it too early (even though the share price had already fallen by 80%!).

More than a third of the current market cap is covered by cash, so you make a “value” argument for it on that basis.

My three reasons for optimism in a turnaround have been:

The cash balance supporting a chunk of the market cap - that remains the case today.

A low EV/Sales multiple compared to other video games companies. That remains the case today with FY 2024 revenue guidance of £80-95m, and an enterprise value of c. £40m.

The possibility that future titles might perform better, as the company goes back to its roots in “CMS” (creative management simulations).

Unfortunately, it remains impossible to predict the success or failure of future titles. Like a small film studio producing one or two films each year, this stock offers little when it comes to risk diversification.

My stance on FDEV has oscillated in recent months. For now, I’m most comfortable sitting on the sidelines with an AMBER stance. Yes, there are reasons for optimism. But it’s a very difficult one to call.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.