Good afternoon! It's Paul here.

Graham's already written an article today, which is here, in which he covers;

Just Eat (LON:JE.) - Q1 trading update - not a small cap, but it's one I've covered before, as it's a very interesting internet disrupter/platform type growth stock - which is a very topical (and lucrative) investment area. We stray outside our brief occasionally, when interesting, topical mid or larger caps are reporting.

PPHE Hotel (LON:PPH) - trading update from this hotels group. I know quite a few readers hold this stock, and the shares have done very well over the last 3-4 years.

In this article, I will be reporting on 3 RNSs which caught my eye today, as follows;

Plastics Capital (LON:PLA) - trading update

Premier Veterinary (LON:PVG) - trading update & disposal

Digital Barriers (LON:DGB) - trading update & framework contract

Plastics Capital (LON:PLA)

Share price: 121p (down 2.0% today)

No. shares: 35.8m

Market cap: £43.3m

Trading update - for the year ended 31 Mar 2017.

This is a small group of niche plastics products manufacturing companies.

Overall, trading is slightly below expectations, which is what the phrase below means;

...expects trading for the financial year ended 31 March 2017 to be broadly in line with market expectations.

Forex - some interesting comments here on the impact of big currency moves post Brexit vote, and the impact of hedging;

The impact of currency movements, particularly post-Brexit, have been substantial with differing impacts across the Group.

For the time being, our export based business have become significantly more competitive.

However, in aggregate over the financial year, the impact of currency has been broadly neutral because of the forward contacts we have in place as part of our hedging policy.

The effect our hedging policy is to delay the impact of currency movements on profits by approximately two years.

It's worth thinking more widely about this point. Many companies hedge their currency exposure, thereby fixing future profits on particular contracts. However, as stated above, this will only delay the impact of big currency movements. Therefore, companies which should benefit from the weaker pound (mainly UK exporters, and companies with overseas subsidiaries which are consolidated into sterling denominated group accounts) might see that benefit not yet appear in their latest accounts. This could provide upside for investors - i.e. future profit potential, which may not yetbe built into the share price, in some cases, perhaps? (and the opposite of course - i.e. importers [e.g. retailers] may have a large negative profit impact in the pipeline, but not yet reflected in accounts, due to hedging).

We really do need to look into how forex is affecting company results, on a case by case basis.

There's lots more detail in the narrative, which I won't go into here. It sounds upbeat.

Net debt - this strikes me as a rather heavy debt burden, given the small size of the group, and in relation to profitability;

net debt finished the year in line with expectations at approximately £16.1 million.

Outlook - this bit sounds good;

The pipeline of projects won but not yet in full production is very strong and capacity will continue to be added as necessary to meet these growth opportunities.

Accounting changes - there's a paragraph explaining how KPMG, PLA's auditors, has determined that two minority investments will now be consolidated into the group accounts;

The conclusion reached by KPMG is that both these minority investments should be treated as subsidiaries as we have significant control. The changes will result in a material increase in reported revenues for FY16-17, a smaller increase to EBITDA but will not materially affect reported earnings per share.

One of the things I like about using EPS as a measure of performance, is that it adjusts for minority interests. Whereas if you only look at profit before tax, then you can end up inadvertently over-valuing companies which don't own 100% of all their subsidiaries. Thankfully, most companies do own 100% of their subsidiaries, so minority interests are not usually a problem. However, it's always worth double-checking to see if there is a minority interests line on the P&L.

Directorspeak today is characteristically upbeat. Ithink it's worth bearing in mind that management always sound bullish at this company. However, there hasn't really been much shareholder value created, compared with a lot of smaller caps in this bull market;

"We are pleased to report strong growth both organically and through acquisition. Generating sustainable organic growth has been a challenge in recent prior years but we now see that the investments that we have made in people, business development, product development and new capacity have put us onto a stronger growth trajectory.

We can see this continuing as we move into FY17-18 and hope we can complement this with further acquisitive growth too."

My opinion - I'm rather sceptical about this company. Specifically;

- Big adjustments are made to the accounts each year, which makes me wonder how real the adjusted profits are?

- Capex is required - so free cashflow has been negative since 2014.

- Relentlessly upbeat commentary, but little to show for it, in terms of profitability.

- Net debt looks too high to me.

- Heavy central overhead doesn't make sense to me, when operating companies are largely autonomous. What value are the main board Directors really adding? Very little, in my view.

- Dividends look nice, but are being paid at the price of increasing debt. So dilution, or over-gearing look to be the only choices, if more acquisitions are made.

- Apparently low PER is arguably not so low, once you adjust for the net debt.

- We're in a bull market, where faster-frowing companies are zooming up in price. So there's an opportunity cost to buying shares like this, which languish at around the same level. This can create a revolving door of shareholders, thus keeping the share price down.

On the upside, today's commentary sounds strong in terms of outlook. Not just orders placed, but not yet put into production (giving future upside). But also a deferred forex benefit which should come through once the hedging expires in 2 years' time.

So it's possible that the share price could begin rising, once improved financial performance begins to feed through. For now though, I feel there are probably better opportunities elsewhere.

Premier Veterinary (LON:PVG)

Share price: 182.5p (down 24.1% today)

No. shares: 15.3m

Market cap: £27.9m

The share price here has really tanked today, so clearly the market doesn't like one, or both of the 2 RNSs issued today.

This company is a tiny, loss-making pets-related business. Its main business seems to be Premier Pet Care Plan - which is described a preventative healthcare programme for pets. This business requires additional financing, so the company announced here in Mar 2017 that it intended selling its profitable business, Premier Buying Group.

Successful completion of business sale - this RNS today confirms that the disposal has now completed. Although I'm wondering whether it might have been a mistake, to sell off the profitable part of the group, in order to fund losses in the jam tomorrow part?

Is this a good deal?

The net cash proceeds after transaction costs and taxation of between £4.5m and £5.0m will, as previously announced, be used to repay all existing debt of £1.25m and further fund PVG's international growth plans for its Premier Pet Care Plan ("PPCP") business in both the USA and Europe.

For the year ended 30 September 2016, the Premier Buying Group contributed revenues and operating profit of £1,120k and £766k respectively.

Still, at least it eliminates debt, and gives the remaining, smaller group a bit of cash to pursue growth of its PPCP business. Clearly shareholders need to be 100% sure that PPCP will succeed, as it doesn't look like there's anything else to fall back on now, if it fails.

I can't see why this would clobber the share price by 24% today, since it was pre-announced in March. So it must be the trading update which has displeased the market. Let's have a look.

Trading udpate - the company has a 30 Sep 2017 year end, so it is today reporting on Q2 performance, and hence half year figures.

Trading in the UK and Europe remain in line with expectations.

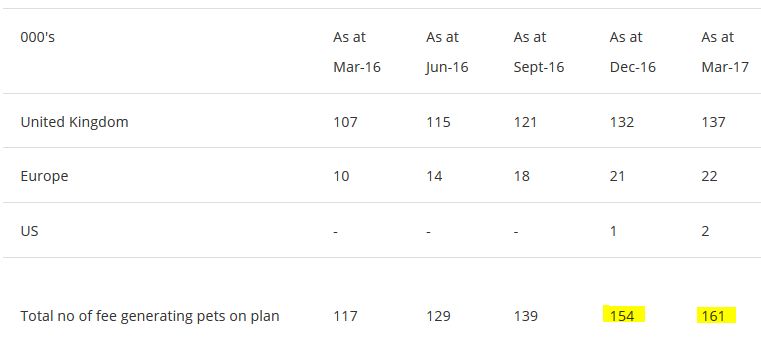

Although I note that the sequential growth in numbers of pets has slowed down in Q2;

I've highlighted the growth, which was only 7k additional fee generating plans. That's much slower growth than the previous quarter, which saw growth of 15k in plan numbers. Maybe there's seasonality affecting this, I haven't checked.

US problems - combined with this, is a disclosure that things have gone wrong with US expansion - a very common outcome for UK companies trying to crack America.

The additional investment in the US is being made and the number of hospital sign ups and pets on plan continues to increase.

During this period of increased activity the Company has identified a number of differences between the UK and US markets necessitating a different approach to certain elements of the provision of preventative healthcare plans in the US.

Changes to the business model have been identified and are being actioned and as a consequence it is estimated that a further period of six months may be required until critical mass is achieved in the US.

Given the strong pipeline of sales, the Board of PVG remains confident that the opportunity to access a significant segment of the available US market still exists.

I don't like the sound of that one bit, and nor does the market, it seems.

It sounds to me as if the company launched in the US, without having done sufficiently thorough research. That sounds a potential recipe for disaster for any kind of business offering services in return for a payment plan. If they don't really know what they're doing, then costs could run ahead of forecast. Also, the US is notorious for being highly litigious, and hence unforgiving for companies which launch products without having adquately researched their market.

My opinion - why take the risk? This looks a jam tomorrow share, i.e. loss-making for now, which may or may not succeed. How can I possibly gauge whether it's going to work or not? I don't have a crystal ball.

The key issue would be to find out what number of pet plans need to be secured in order to reach breakeven. Also, what is the attrition rate? If it's high, then the company might end up running to stand still. What are the competition offering, and how does that differ to this company? It would need a very thorough assessment of the business, to determine if it looks viable, or not. Personally, I can't be bothered, as there are easier & safer investment decisions elsewhere.

What worries me most, is that the company has entered (admittedly on a small scale) the US market, apparently without properly understanding it. That seems crazy to me. Good luck to the company, but it seems far too high risk for me to consider investing in it.

Digital Barriers (LON:DGB)

Share price: 30.25p (up 3.0% today)

No. shares: 165.1m

Market cap: £49.9m

Framework contract & trading update - the latest contract news is something I'm taking largely with a pinch of salt. Loss-making companies like this one are fond of announcing contract wins. However, what does it matter, if they remain relentlessly loss-making overall?

The company seems to have a range of niche products in the surveiilance & security sector. So things like body scanners (at airports, etc) to detect hidden weapons, explosives, etc. To get a better idea of its products, here is the link to the company's website.

Trading update - for the year ended 31 Mar 2017.

Various figures are given, which are slightly confusing. Reported revenues of £26.5m is up 26% on prior year, but includes the benefit of an acquisition.

Organic reported revenue is actually down 11% on prior year, at £16.2m

The only mention of profitability is to say this;

EBITDA is expected to be in line with market expectations.

Unfortunately, the company an its advisers didn't insert a footnote, to tell us what that expected EBITDA figure is. All I've got to go on, is the Stockopedia broker consensus, which is for a loss of £7.6m for y/e 31 Mar 2017.

I've had a quick look at the last interim results (to 30 Sep 2016), and the adjusted loss was a hefty £4.2m.

Net cash - if you're going to invest in heavily loss-making companies, the golden rule for me, is to ensure that they have more than adequate cash reserves. This company does not, I'm afraid.

Net cash at 31 March 2017 was £1.0 million.

So the cupboard is almost bare, yet losses remain substantial. So why isn't everybody panicking? The reason seems to be that there's a credit line available. Looking back to the interims from 09/2016, there is a going concern note, which indicates that the bank is providing enough credit for the company to survive until end 2017;

On 17th October the Group replaced an existing £5.0 million secured working capital facility for export activities with HSBC Bank Plc with a new two year £10.0 million secured revolving credit facility with Investec Bank plc. The funds available through this facility will be used to meet the increasing working capital requirements of the Group's organic growth.

The facility is secured by a fixed and floating charge over the Group's assets and includes covenants which are tested quarterly. This facility has been factored in to cash flow projections for the Group.

I'm amazed that Investec is prepared to loan money to such a heavily loss-making company, which has a dire track record of missing its targets, and accumulating enormous losses.

Equity fundarisings - The bottom section of the balance sheet shows that DGB has raised almost £111m in equity from investors, and generated cumulative losses of £65.2m.

Also, note that the share count has increased about 6-fold since it floated in 2010. So this is a company which is seemingly addicted to equity fundraisings. I think it's highly likely to do another equity fundraising in 2017 too. Who would buy the shares now, knowing that the company is almost out of cash?

Will investors smile warmly at another fundraising later this year? Or will they have reached fatigue in terms of funding the never-ending losses? Who knows? That's such a key uncertainty, that personally I wouldn't go near this share, until it's raised enough fresh cash to continue operating for another 2 years.

Outlook - 8 delayed contracts failed to be signed by the year end, but 4 have since been signed. On the new financial year, the company says this;

The current financial year has begun as we would have hoped and we have signed many of the contracts deferred from the year ended 31 March 2017 early in the current period."

There are various other comments, which reinforce my view that this company has little revenue or profit/loss visibillity.

My opinion - this company's technology & products do look interesting. However, profit has remained very much elusive.

This makes me wonder whether the company has been too ambitious, and scaled its overheads at much too high a level? Perhaps it needs to face the reality that sales are still modest, and focus on achieving breakeven? It may not be able to tap investors for yet more cash, if the prospect is of that next tranche of money being blown funding further losses.

The best investors can hope for, is that a surge in sales begins soon, and that the company can then raise more cash on the back of an improved share price. In that type of scenario, it's usual to get a flurry of breathlessly enthusiastic RNSs from the company, pointing out any positives they can conjur up.

Also you often see companies that need to raise money suddenly show an interest in meeting private investors, and doing presentations - because they want to suck in some punters to help get the share price up - before diluting them by issuing cheaper shares to institutions in the next placing.

The StockRank is only 8 too - which I always take as a very important warning sign that it usually pays well to heed.

Overall then, this share just looks a total punt to me. Why take the risk?

All done for today!

See you in the morning.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.