Good morning from Paul & Graham!

Today's report is now finished at 13:13

My podcasts went up on Saturday, and my SCVR summary spreadsheet is also now up-to-date (links in the reader comments below), so we're starting the new week on the front foot!

Banking turmoil (again)

I see another troubled US bank, First Republic, has been put out of its misery this weekend, taken over by JP Morgan. First Republic's shareholders are wiped out. So far the system is holding together, and everyone knows what to do (and fast) with troubled banks. So I think this still ranks as "turmoil", rather than a "crisis". I've just seen a press report, saying that JP Morgan's longstanding boss Jamie Dimon has said that the collapse of SVB, Signature Bank, and and now First Republic, "pretty much resolves them all", in terms of problem banks. He also says the US banking system is "very stable". Let's hope he's right!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

I did start to look at Smoove, but ran out of time. It's heavily cash burning, but has cash remaining, and is in bid talks. Actually, my initial impression is that this could be worth a closer look another time.

Summaries

(with main sections further down)

Restaurant (LON:RTN) - up 12% to 45.3p (£344m) - TU - Paul - AMBER

“Encouraging” trading in first 4 months of FY 12/2023. However, it uses weasel words to avoid saying whether or not it’s trading in line with expectations. Awful balance sheet and too much debt. But with decent sales growth, will the negatives matter?

Carr's (LON:CARR) - down 5% to 121p (£114m) - Interims - Graham - AMBER

A small profit warning from this specialty agricultural and engineering group. Much jam is promised in future periods but with auditors confused and few signs of quality, I am cautious.

Kitwave (LON:KITW) - up 1% to 271p (£190m) - H1 TU - Paul - GREEN

This wholesaler traded well in H1, and sees the FY 10/2023 being slightly ahead of expectations. It's a decent GARP share this one, thumbs up from Paul.

Facilities by ADF (LON:ADF) - up 3% to 60.5p (48m) - FY 12/2022 results - Graham - AMBER

I’m tempted to give this the thumbs up but need more time to monitor it. This rental company and service provider to film & TV studios is highly ambitious and already profitable.

Quick Comments

(no further detail below)

Plant Health Care (LON:PHC) - down 23% to 8.85p (£28m) - FY 12/2022 results - Paul - RED

I bargepoled this share here in 2015, and Graham confirmed his negative view in 2017 here. We haven't seen any reason to trouble you with any updates until now. PHC has made multi-million losses every year since, and the share count has tripled. FY 12/2022 results show revenues up, but continuing heavy losses. There was $5.7m net cash remaining, so no immediate worries over solvency (going concern note is clean), although the clock is ticking. Accumulated losses are now close to $100m!

Today it announces a consultation on whether to maintain its AIM listing. Management doesn’t take any responsibility for years of losses, instead blaming AIM for its lowly share price (I’d actually say the share price is generous!). 4 major shareholders own 50%, along with poor financial performance for years, so I’d say the de-listing and dilution risks are now very high, hence safest to steer well clear, in Paul’s opinion.

Tribal (LON:TRB) - up 5% to 41p (£87m) - Damages claim - Paul - RED

A short update on its major contractual dispute with a Singpaore university (NTU) which has rejected Tribal’s software. NTU has demanded £6.0m equivalent in damages from Tribal, which says it disputes, and will legally defend itself against this claim.

Paul’s view is unchanged - this seems an accident-prone company, that has gone nowhere in 22 years being a listed share - check out the long-term chart. This latest debacle just reinforces my negative view. Although the client relationships might be attractive to an acquirer possibly? Software companies, no matter how lousy their track record, do sometimes attract bids (look at Tungsten, and Proactis as examples).

Made Tech (LON:MTEC) - down 25% to 20.4p (£31m) - Trading update - Graham - RED

A nasty profit warning from this 2021 IPO (the words “2021 IPO” should strike fear into the hearts of investors). Previously, MTEC’s management suggested that profitability could improve in H2 (for FY May 2023). However, public sector spending is under pressure and consequently “several of the Group's clients have moved the start date of work packages, which had previously been scheduled for April and May 2023, into FY24”.

Revenues this year and next year were supposed to be £43m and £50m, respectively. Broker Cenkos has slashed these estimates to £40m and £43m.

Adjusted PBT was supposed to be £3.4m this year and £4.1m next year. These estimates are now £1m and £1.1m. The company’s fixed cost base was set up for higher revenues, which are now unlikely to materialise.

I’m going to give this stock the thumbs down because even if it has cash, its underlying quality appears to be unusually poor. In previous comments I noted its lack of profitability despite surging revenues. It now does not even have surging revenues and looks like just another opportunistic IPO from that annus horribilis.

Vianet (LON:VNET) - up 11% to 78p (£22m) - Trading Update FY 3/2023 - Paul - AMBER

Ahead of mkt expectations - operating profit to be £3.1m (up 30%). Revenues are 85% recurring. Renewals & new contracts “encouraging”. Good gross margin, despite semiconductor shortages. Hoping to shortly receive a £0.9m R&D tax refund. Improving products, and seeking to enter new markets.

Paul’s view - both broker notes out today seem to show operating profit almost completely disappearing, and only £0.5m adj PBT for FY 3/2023. So these numbers need close scrutiny. Capitalised R&D is a big number too, so ignore EBITDA. I’d like to see the full numbers, as this update looks to be cherry-picking an unrealistic profit measure, maybe? But at least it's ahead of expectations.

Totally (LON:TLY) - down 9% to 20.25p (£40m) - TU FY 3/2023 - Paul - AMBER

Provides outsourced health services. It says EBITDA of £6.3m is in line with consensus mkt exps. Net cash is £3.9m. Exceptional costs (no £ amount indicated) incurred, related to restructuring & cost inflation.

Paul’s view - an interesting company, although these seem large and complicated contracts, with wafer-thin margins. News today of restructuring costs & inflation worries me, as it implies that maybe contracts have not been set up sufficiently robustly to accommodate changing macro conditions? Shares are probably cheap for good reason, with several contracts not going smoothly, I worry what other potential problems might surface in future? Might be cheap enough to have a small punt on this, but I wouldn't want to risk a big position size here.

Paul’s Section:

Restaurant (LON:RTN)

45.3p (pre market)

Market cap £344m

The Restaurant Group plc operates approximately 410 restaurants and pub restaurants throughout the UK as at 02 May 2023. Its principal trading brands are Wagamama, Brunning & Price and Frankie & Benny's. It also operates a multi-brand Concessions business which trades principally in UK airports. In addition, the Wagamama business has a 20% stake in a JV operating seven Wagamama restaurants in the US and over 50 franchise restaurants operating across a number of territories.

The current financial year is FY 12/2023.

Encouraging trading momentum through the first four months of the year

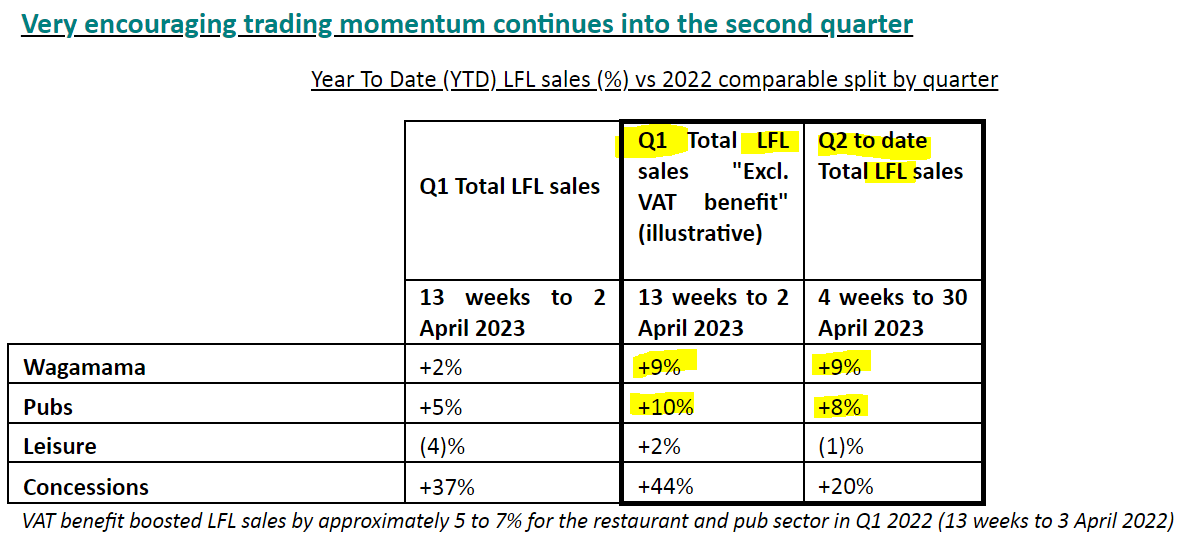

The table below shows surprisingly good LFL (i.e. excl new , or closed sites) revenue performance - this is better than I would have imagined -

You could argue that this is only keeping up with inflation, and with many costs a lot higher, RTN needs to generate this sort of revenue growth, just to stand still. But even so, I’m impressed, given the headwind of the current cost of living squeeze on household spending.

Leisure division is under-performing, and is being restructured (23 sites closing shortly).

Concessions division is booming, due to a soft comparative when airports were depressed due to omicron in early 2022.

Note that column 1 above is impacted by last year’s VAT concessions, so it’s columns 2 & 3 that show the true underlying performance I would say.

Another table shows that there’s been a marked shift away from delivery/takeaway, in favour of people dining in the restaurants. Unsurprising I suppose, given decreased anxiety about covid these days.

Cost savings of £5m pa achieved.

UK property market still favourable, with new Wagamama sites available on attractive terms (7-8 new sites [previously 5] now planned for 2024).

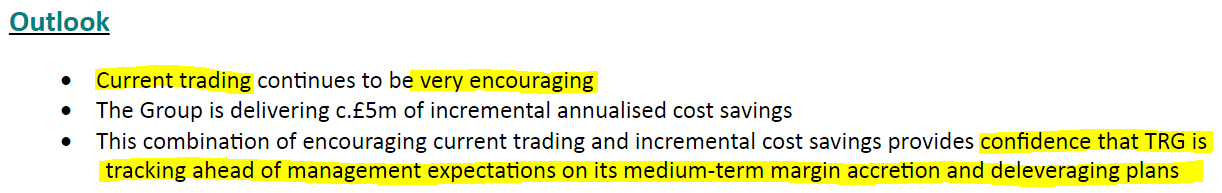

How is it trading vs market expectations? - this is what investors need to know, and is the whole point of trading updates. We’re not told. Instead we have these weasel words (point 3) -

This is not good at all! It comes across as deception - they clearly don’t want to say if they’re trading in line with market expectations (which makes me wonder if they might be trading behind expectations?). Instead they invent a new definition - tracking ahead of medium-term margin accretion & deleveraging plans! An E-minus for whoever wrote this cobblers!

We like simplicity and clarity here at the SCVR. RTN’s update today has taken too long to pick through, trying to work out how the company is actually trading, and ends up being ambiguous.

To conclude, trading is first described as “encouraging”, then “very encouraging”, but it then dodges saying how it is trading vs market expectations! What to make of that? I’m not sure.

This bit also sounds vague -

TRG is pleased with the early progress in executing the plan to deliver significant EBITDA1 margin accretion over a three-year time horizon2 and the Board continues to consider long term strategic options.

My opinion - a really badly-written, unclear trading update. It should have been shorter, and just told us if they’re trading in line with market expectations, or not. That’s what everyone wants to know. A trading update that doesn’t disclose this, is not a trading update, it’s a PR release.

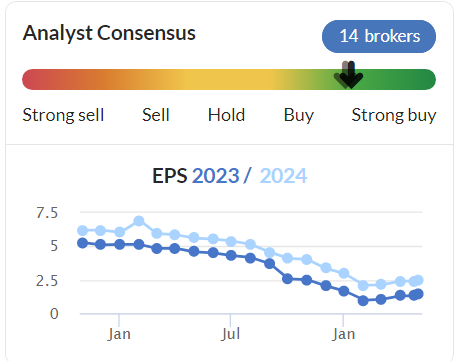

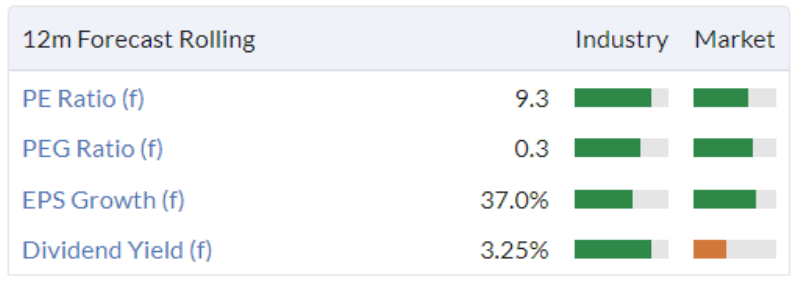

I can’t see any broker updates yet today. As you can see below, the existing forecasts have been reduced a lot, but have started edging up in recent months.

Casual dining is just a horrible sector right now, where it’s very difficult to make any profit at all. So the shares are only of interest if you think that there’s likely to be a decent consumer recovery, and that margins can be improved (e.g. from falling ingredients prices, lower energy costs, maybe?). The gross margins are high, so there’s considerable operational gearing, and a lot of competitors have closed.

RTN also has a horrible balance sheet, with too much debt. Graham reviewed the 2022 accounts here, which is a sobering read (how does NTAV of negative £(224)m strike you?!)

I can’t make up my mind between maintaining Graham’s RED view, or going AMBER on it, given the strong revenues reported today? Tricky one. As I’m not sure, it has to be AMBER from me. Although Graham’s probably right that at some stage RTN will probably need to raise fresh equity to repair its horrible balance sheet. Debt is a lot more expensive now too, so it would be worth checking the terms of RTN's debt pile.

It's also worth considering the long-term performance of RTN, which has been dire, for anyone who bought in the glory days of 2014-15. Also note that the share count has risen almost 3-fold in the last few years, from 277m to 765m. So in market cap terms, the 500p share price peak would equate to only about 170p now. I'd say it needs to increase that share count further, since the balance sheet remains weak and overly indebted.

Despite an upbeat-sounding update today, it's still only trading a little above breakeven, once you include finance costs.

Anyway, it doesn't matter what I think, the market likes the update, with RTN shares up 11% to 44.7p at 08:51 - so maybe it's a hold your nose share and ignore the problems, because momentum looks to be moving in the right direction?

Kitwave (LON:KITW)

271p (up 1% at 10:13)

Market cap £190m

Kitwave Group plc (AIM: KITW), the delivered wholesale business, today announces a pre-close trading update for the six-month period ended 30 April 2023.

The current financial year is FY 10/2023.

This is pleasing -

The Board anticipates that the Group's results for the full financial year will be slightly ahead of market expectations.

All divisions traded well in H1.

Normal seasonality is an H2 weighting.

Well placed to mitigate macro & inflationary risks.

Recent acquisition (Westcountry Food) is going well, and performing as expected.

Outlook - sees “considerable opportunities” for organic growth, and more acquisitions.

Paul’s opinion - I’ve commented favourably on this company before. Today’s update reinforces that positive view. It’s still reasonable value, on a fwd PER of about 10x, paying good divis of c.4.1%, and self-funding bolt on acquisitions. Experienced founder-CEO holds 15.6%. Thumbs up from me!

Thumbs up from the computer algorithms too -

Behold! A most unusual thing - a recent float which has actually done well -

Graham’s Section:

Carr's (LON:CARR)

Share price: 121p (-5%)

Market cap: £114m

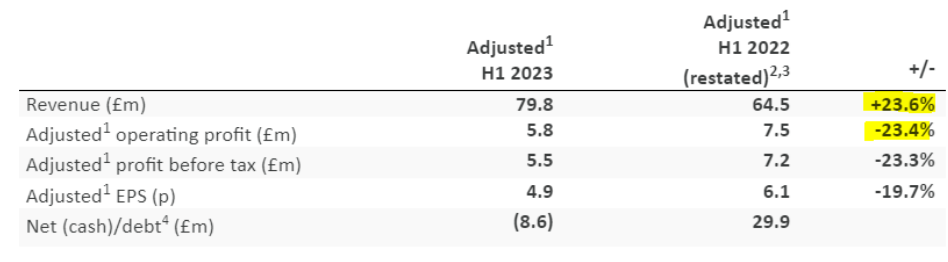

We have a small profit warning from Carr’s today:

Carr's (CARR.L), the Speciality Agriculture and Engineering Group, announces its Interim Results for the 26 weeks ended 4 March 2023.

In recent months, the company had a messy situation involving delayed accounts and the suspension of its shares, but hopefully that is all behind it now?

They sold the agricultural supplier Carr’s Billington and received a nice chunk of cash for it, so they now have a net cash position, as expected.

The remaining divisions are “Specialty Agriculture” and “Engineering”, each of which are made up of multiple specialist businesses.

Let’s take a look at these interim results:

So we have nice growth in revenues (lots of inflation, I’m guessing), but unfortunately this has not translated into higher profits.

Also, I’ve had a look at the footnotes here and read about the prior period restatements: the new accountants at Grant Thornton have done a lot of work trying to make the numbers add up and conform with accounting standards.

Carr’s has been on the auditor merry-go-round: PwC held the role from 1909 (yes, really) to 2018. Then KPMG, of Carillion fame, had a go.

Last month, the Financial Reporting Council indicated that it was investigating KPMG’s audit work on Carr’s for FY August 2021.

Grant Thornton is now attempting to make sense of the company and its financials. Judging by the prior period restatements, it has been something of a clean-up job.

It can be hard to know exactly where blame lies in situations like this. For investors, I think the main conclusion should be that the underlying business is complicated. If it wasn’t so complicated, then surely it would have been much less likely to run into these problems in the first place?

At least Carr’s is marginally less complicated now that they have made the aforementioned disposal. Let’s read on and see how the two remaining divisions are doing.

Highlights (I’ve added the bold):

Revenue increased 24% on prior year, reflecting raw material cost recovery in Speciality Agriculture division

H1 profits impacted by volumes in Speciality Agriculture and contract timing in Engineering

Record Engineering order book of £57 million at 28 April, up by 30% from start of the period

Phasing in engineering work will be favourable in H2, with strong profit generation in the division expected

Outlook:

The outlook for Engineering in the second half of FY2023 is positive. The division has several key contracts coming through… These factors will offset the low summer season for Speciality Agriculture which also continues to manage historically high input costs.

Acknowledging the challenges ahead, the Board anticipates full year adjusted profit before tax of c.£10m and remains confident in the prospects of both divisions in the medium term.

According to the most recent Edison note, PBT of £10.5m was expected for the current financial year, so this is a slight profit warning.

Agriculture: the major theme here is inflation as the cost of molasses for making feed blocks has increased by 70% in three years.

Carr’s increased its average feed block selling prices by 35% this year and it’s not obvious that this was even enough. But of course there’s a limit to what their customers can bear: volumes fell 13% in H1.

In the US, there is inflation and a drought. Hard times! Volumes fell 10%.

More positively, Carr’s management do tell us that farm input prices are currently coming down and that the longer-term outlook is more positive, i.e. from FY 2024. We shall see.

Engineering: H1 adjusted profits in this division saw a much larger percentage fall to just £1.1m. But with a larger order book and “confirmed high value contracts continuing into FY2024 and FY2024”, there is much jam to look forward to in future periods.

My view

There is plenty to digest with this one but at the end of the day, I’m finding it difficult to come up with any reasons to treat this as a high-quality stock.

At the current time, its main attractions are probably the cash balance (£23m, though net cash is only c. £9m) and the £120m of net assets on the balance sheet (including nearly £30m of intangible assets).

Perhaps more disposals would make sense? Can anyone explain why it makes sense for the remaining agricultural and engineering businesses to stick together?

I’ll stay neutral on it because they are at least still profitable and not suffering from financial distress. However, the underlying quality is questionable to me. And if even the auditors are struggling to understand what is happening, that is one more reason for investors to tread carefully.

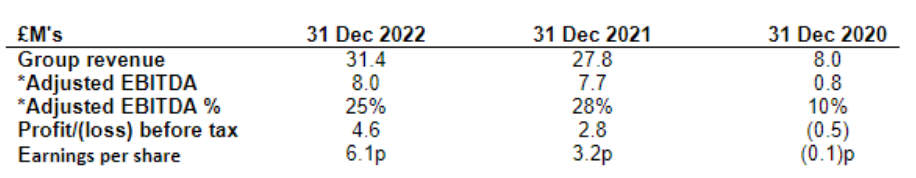

Facilities by ADF (LON:ADF)

Share price: 60.5p (+3%)

Market cap: £48m

Paul usually covers this one, but I’ll take a look at these full-year results for 2022. Trading in 2023 is in line and expectations are unchanged.

Facilities by ADF, the leading provider of premium serviced production facilities to the UK film and high-end television industry ("HETV"), is pleased to announce its audited final results for the year ended 31 December 2022.

It’s a January 2022 IPO, and is currently trading higher than its IPO price of 50p. That’s impressive, considering how many IPOs have disappointed by this stage in their life on the stock market!

The headline numbers show year-on-year growth coming in as expected (see our coverage of the full-year trading update):

As noted by Paul, the EBITDA number is irrelevant, due to depreciation (£2.5m in 2022), so I would hone in the PBT result (£4.6m for 2022) and forget about EBITDA.

The 76 productions supported by ADF in 2022 include Netflix, Apple and BBC shows.

And H2 saw a nice improvement in trading with bigger projects:

H2 productions were larger and more clustered around London resulting in improved margins. The Group generated an average revenue value of £386k per production.

Expansion: the company added 136 vehicles during 2022, to bring the total fleet to 632 by year-end.

Other expansionary actions:

Acquired Location One (initial cash consideration £4.4m)

New office in Scotland

Doubled capacity at manufacturing facility in Wales

New operational hub in Surrey, “perfectly located to serve several major studios” including Apple, Disney, Netflix and Sky..

Outlook

A very confident outlook statement based on “underlying market drivers” that will ensure demand remains strong for ADF’s services. More acquisitions are on the cards.

The FY23 order book is strong, indicating a continuation of the H2-FY22 profile, with larger productions generating higher revenue per job. The Group is presently taking orders for Q1 and Q2 FY24 providing strong levels of revenue visibility for the year.

UK film/high-end TV spending certainly appears to be enjoying a boom period, especially, since Covid-impacted 2020:

CEO comment is similarly upbeat:

We have a growing addressable market, an expanding network of contacts and a high-quality business model driving growth in Group revenue. Alongside positive market drivers, where demand for film and HETV in the UK continues to accelerate, I am confident in the Group's ability to deliver on its strategy and plans in FY23."

The strategy is to treble revenues to over £100m (I’m not sure over what timeframe), with the help of acquisitions. They want to be a “one-stop shop” for film and TV producers. Sounds ambitious!

Cash flow statement shows lots of capex, so nothing to write home about in terms of free cash flow yet. Still at an early stage of development.

Balance sheet has tangible net assets of £18m, with £9.5m of cash.

Estimates from Cenkos are upgraded due to a tax boost relating to depreciation and FY 2023 after-tax profit is now estimated at £6m (up by £1m). However the estimated capex bill has also increased by £1.5m.

New forecasts are released for 2024, suggesting after-tax profits of £7.5m.

My view

I’m new to this share but it does look potentially quite investible. It’s profitable, ambitious and growing, and exposed to an industry that I believe is only going to go from strength to strength over time: domestic film and TV production.

As noted by Paul, it’s not an industry that you can bank on every single year. There will be bumps in the road, and ADF as a service provider will have to make do with whatever the large studios want to produce in any given year.

The ambition to be a “one-stop shop” is perhaps aggressive, but I think that’s what we should want from most small-caps: we should want them to have big aspirations to grow and to become larger companies.

I’m going to stay neutral on this one purely because I’m new to it and would need more time to come up with a firmer view, but I do like what I’ve seen so far. It doesn’t hurt that the value metrics are already so good:

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.