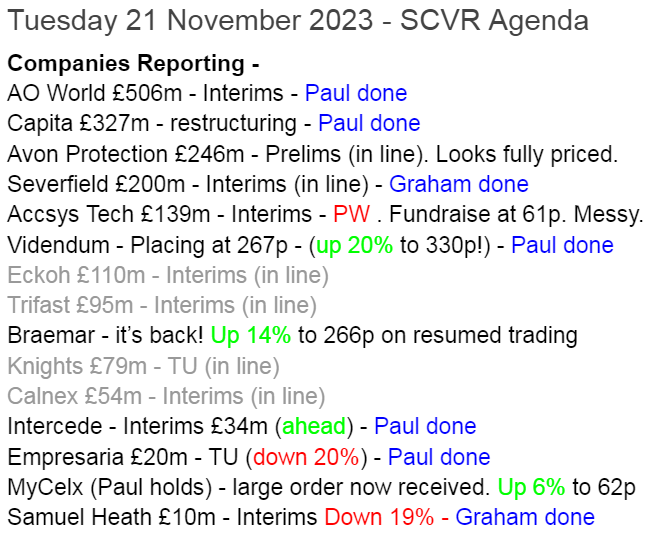

Good morning from Paul & Graham!

Today's report is now finished.

The Chancellor will be announcing the Autumn Statement tomorrow at 12:30, so hopefully some investor/business-friendly measures might be announced? I think we're going to have a separate article here, which me & the team will contribute to. Link to follow tomorrow morning.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Summaries

Capita (LON:CPI) - 19.2p pre-market (£327m) - Cost Reductions - Paul - AMBER/GREEN

In line trading update from this large outsourcing group. It's found £60m of cost savings (mainly from 900 fewer staff). There might be an opportunity here for a rebound in share price perhaps? Worth a closer look.

Intercede (LON:IGP) - up 15% to 68p (£40m) - Interims (ahead exps FY) - Paul - GREEN

Very good H1 figures, and ahead of expectations FY 3/2024 outlook. Broker forecast now looks too low. Plenty of cash on the balance sheet. I was looking for growth to accelerate here, and now it has done, I'm happy to move up from amber to GREEN.

Severfield (LON:SFR) - down 2% to 63.8p (£197m) - Interim Results (in line) - Graham - AMBER

Quite a lot for shareholders to digest in these interim results. Core revenues take a big fall but contract details save the profit performance at this structural steel group. Shares seem cheap at first glance but personally I would hold out for even more value here.

Samuel Heath and Sons (LON:HSM) - down 25% to 300p (£7.5m) - Half-Year Report - Graham - AMBER

This is a tiny company with illiquid stock but it retains a following among micro-cap investors. Unfortunately, economic conditions have taken a toll and its order book has been greatly depleted (exact figures not given). Could be of interest to patient contrarians at this level.

Videndum (LON:VID) - up 20% to 332p (£311m post-dilution) - Fundraise - Paul - AMBER

I go into excruciating detail below about its fundraise announced last night & confirmed today. This properly sorts out the balance sheet, which management destroyed with previous poor decisions on acquisitions funded by excessive debt. The price? Doubling the share count. Looks fully priced now, taking into account hefty dilution, but solvency risk has now gone.

AO World (LON:AO.) - up 7% to 89p (£514m) - Interim Results (6m to 30/9/0223) - Paul - AMBER/RED

A serial under-performer, AO has scraped back into profit in H1, of £13m PBT on £482m revenue. Full year outlook is raised - or is it? Previous guidance was £28m, which is the same as the lower figure in this latest range provided -

… we are upgrading our profit before tax guidance for FY24 to between £28-33m.

It looks like its “strategic pivot” to profitability is working, and really should have been its original focus - just basic stuff on running a low margin business efficiently & minimising all costs - which is what smaller rival Marks Electrical (LON:MRK) has done, and is proven to work. AO got there eventually, after pretending to be a tech business for years.

Balance sheet - needs to be very carefully scrutinised, because the big flaw/risk in AO’s business model is that it’s taken big balance sheet risk with future cash inflows expected from product protection plans and mobile phone connections. I have a big worry over product protection plans, as a potential mis-selling scandal. Some people argue that these high margin add-ons might be consumer rip-offs. So what happens if the regulator comes after them? This point completely puts me off ever investing in AO shares.

Even without this risk, AO shares look expensive for what it is. Note that Mike Ashley’s Frasers (LON:FRAS) has taken a 19% stake, and talked about partnerships with it. The top 3 shareholders control 60%, which makes me uncomfortable. Overall, I’m going with AMBER/RED. [no section below]

Empresaria (LON:EMR) - down 18% to 33p (£16m) - Trading Update - Paul - AMBER

Another profit warning unfortunately, for this slightly bizarre collection of international staffing companies. It says clients are deferring permanent recruitment into 2024. Challenging market conditions expected to continue into H1 2024. Deep cost-cutting already done. FY 12/2023 now expected to be adj PBT £3m to £3.5m, weaker, but not a disaster, and H1 was only £0.5m, so H2 better.

Paul’s opinion - Empresaria is now firmly into potential recovery territory. Only £16m market cap, and historically it has tended to make between £4-10m most years (excl pandemic). Balance sheet is adequate with £7m NTAV. Fair bit of gross bank debt, but that’s funding receivables, and when business slows down, cashflow actually improves typically as receivables reduce. Providing bank facilities remain available, then I don’t think solvency should be an issue.

Concentrated shareholder register, so de-listing is a potential risk.

Overall, I think this could be worth considering as a recovery situation at some point. It’s not a basket case - still profitable, OK balance sheet, and cost-cutting done.

Paul’s Section:

Capita (LON:CPI)

19.2p pre-market (£327m) - Cost Reductions - Paul - AMBER/GREEN

This sprawling outsourcing group has decided to make some deep cost cuts, which could considerably improve profitability maybe -

In its Half Year Results, Capita outlined that its medium-term target to double its operating margin to 6% was underpinned by cost savings of £40m per annum on an annualised basis by the end of 2024.

Based on an extensive organisational review, the Group will shortly commence employee consultation programmes which are expected to deliver cost savings of £60m on an annualised basis from Q1 2024.

In the context of FY 12/2024 revenues currently forecast at £2.8bn, then a 6% operating margin would be a profit of £168m - a large number for a company currently only valued at £327m. I imagine if that is achieved, then we'd be looking at a share price maybe double or triple the current bombed out 19.2p, but that's guesswork of course.

This share therefore looks an interesting potential turnaround situation which could be worth you doing some more detailed research, hence why I’m flagging it as an idea.

I reviewed its interim results here on 4/8/2023, saying adjusted profit looked quite good, and outlook unchanged. Although the market was spooked by £20-25m cost of a cybersecurity incident. I dislike the balance sheet, with its negative NTAV.

On 6/3/2023 I typed up my notes from a management webinar, and it sounds like I was positive on that (difficult not to be with webinars, as companies are putting on their best performance), concluding that Capita seemed a convincing turnaround, and gearing had almost gone.

Current trading is confirmed today as in line with its expectations.

Contract wins in FY 12/2023 so far have been £2.85bn, which is ahead of 2022 total of £2.59bn.

Paul’s opinion - when companies discover large cost-savings (usually people) I do wonder what those people were doing before, to suddenly be not required any more? Stripping out people could result in a poorer service for customers, and hence save money but create new problems. So it would be good to hear more detail from CPI on this cost-cutting programme. There must be numerous processes which could be automated, maybe using AI, if that's all it's cracked up to be?

Overall though, Capita looks a lot of business for the money, so I think this share could be interesting as a potential recovery candidate, but more work is needed. Complicated, low margin contracting businesses tend to be accident-prone, which Capita clearly has been over the years, requiring almost continuous restructuring. Shares peaked at almost 800p in 2018, and it's literally been downhill ever since, with over 97% of the value destroyed. No divis since 2017.

I’ll go with AMBER/GREEN, for potentially interesting recovery potential.

EDIT: looks like my early hunch of a nice rise in price here is shared by Mr Market - up 10% to 21.1p at 09:45.

Intercede (LON:IGP)

Up 15% to 68p (£40m) - Interims (ahead exps FY) - Paul - GREEN

Intercede, the leading cybersecurity software company specialising in digital identities…

An old favourite of mine, we did well on Intercede, getting a 3-bagger between 2018 and 2021, on a decent turnaround by CEO Klaas van der Leest. Progress since then has (understandably, with the pandemic) been a bit sluggish, hence why my interest waned somewhat. It’s still a remarkable little company though, with its software managing digital identities (to provide secure use of sensitive IT systems) for an astounding client list that includes big Govt Departments in the USA, and some of the world’s biggest banks and aerospace groups. Clients are very sticky, and new products have been developed to widen its market.

7/11/2023 - I missed this at the time, IGP reported a strengthening sales pipeline, and $1.4m contract wins & renewals. This underpinned, rather than beat, forecast for FY 3/2024.

Today we get more contract news , and interim results.

Contract news - 4 contracts & renewals are listed, but only totals $0.5m, and “underpin” FY 3/2024 revenue. So no great shakes really, but nice to hear.

Interim Results - this is more like it! Headline is ahead exps -

Record financial performance in H1 and results for the year ending 31 March 2024 are now expected to be ahead of previous market expectations

It strikes me as odd that the new contracts announcement today doesn’t mention that trading is ahead of expectations, but the interim results statement does.

These numbers look good to me -

H1 revenue £7.0m (up 15%)

Profit before tax (PBT) £1.1m (up 83%)

Profit after tax (PAT) £1.55m in H1 - benefits from R&D tax credits

Prudent accounting - no adjustments, and all development spend is expensed, not capitalised.

Tight cost control continues.

No divis.

Strong balance sheet with £9.7m cash pile, assisted by £5.4m up-front receipts from customers (deferred revenue). NTAV £6.3m is fine for the small size, and capital-light business model.

Cashflow statement - is good, it’s generating real cashflow, unusual for a small tech company.

Broker update from Cavendish is most helpful (many thanks) and admits its forecasts may be short of the mark - so more likely to see upgrades than a profit warning I think. Remember that gross margin is 99%, so each new contract win from here drops through to the bottom line. That also brings risk though, if a major client doesn't renew.

EDIT: I'm not exactly sure when Cavendish forecasts were raised, but note that the latest (today) forecast for FY 3/2024 is:

Revs £13.7m, adj PBT £1.5m, and 2.0p EPS.

Their previous forecast on 20/6/2023 was: Revs £13.3m, adj PBT £0.8, and 1.2p adj EPS.

So there's been a decent upward revision in forecasts in the last 5 months - forecast PBT almost doubling!

End of edit.

Outlook - encouraging! -

The integration of Authlogics continues and has expanded the product portfolio has been expanded, a key reason for the acquisition. Intercede is encouraged with the performance to date and with the recently announced new clients wins in the US, EMEA and APAC regions.

This strong performance means the Group now expects to achieve financial performance for FY2024 ahead of previous market expectations.

The Group's financial position and cash generation is a solid foundation for it to maintain and fund its internal investment plans and M&A opportunities to accelerate the delivery on the medium and long term aims.

Paul’s opinion - I’m really impressed with these numbers. Intercede seems to be gaining growth traction again, and that was exactly what I’ve been hoping for.

So it’s very much back on our agenda here, and I’m happy to move my view up from amber, to GREEN, given this strong H1 performance, and ahead of expectations FY 3/2024 outlook.

The decent, recent run up in share price looks fully justified to me.

Videndum (LON:VID)

Up 20% to 332p (£311m post-dilution) - Fundraise - Paul - AMBER

A whopper of a relief rally here, adding £26m to the value of the existing equity, plus £30m instant profit for subscribers of the new shares.

Although it comes on the back of previous massive shareholder value destruction at this specialist broadcasting-related products group.

The potentially lethal problem was a combination of declining demand, and a stretched balance sheet with too much debt. We’ve got to avoid this combination, as it’s so bad for equity.

Hollywood strikes must have had an impact, and forecasts have been slashed in recent months -

The 20% bounce today is barely a blip, even just on the 1-year chart -

Zoom out to 10 years, and we can see how disastrous the last year has been, destroying a previously OK track record -

Were there warning signs? Yes, very much so. We reported here on 3/5/2023 at 713p on a mild profit warning, that the debt position looked uncomfortably high, after too much had been spent on acquisitions. So I do think it’s worth reinforcing that getting out at the first sign of trouble is a good strategy at highly geared companies. Why take the risk?

Further back, on 25/11/2022 I challenged management’s false claim that they had a strong balance sheet. This is hopefully not annoyingly I told you so, as I’m just trying to emphasise that high gearing is something that can be easily & quickly checked, and means we can steer clear of at least some risky situations. You don’t need to check anything, as I’ve done the work for you, hence why our focus on balance sheets here is very much coming to the fore, now interest rates are higher again, and banks less reluctant to take on risk.

Anyway, on to now. What’s being done to sort it out?

Proposed Capital Raising - this was issued after-hours last night.

Key points -

Share count to double, with 46.9m new shares being issued (existing: also 46.9m)

Price 267p, a modest 3% discount, although on a pre-existing bombed out price.

Open offer is 2 new, for 5 existing shares, so people will be diluted by 50% if they don’t take up their entitlement, or 30% dilution if they take up their full open offer entitlement. I can’t see any excess application offer, but it’s a long & complex document, so might have missed it. The firm placing is not subject to clawback by the open offer, so it seems existing holders will be diluted somewhat, even if they take up their full entitlement, which is not great if you’re too small to have been offered shares in the firm placing (which will be almost everyone reading this!)

Total raised will be £125m (before no doubt substantial fees).

Current trading - this is a concern, and it sounds to me like another profit warning (although that’s not spelled out). It says no recovery in 2023, still some (reduced) customer de-stocking, further weakening in Q3, leverage increased further to 4.2x at 30 Sept 2023.

Another update was issued at 07:00 today, confirming everything has been completed. No surprise there, as things only get announced in the first place once it’s all buttoned up.

The only remaining item is what take-up there will be in the open offer, which should be high, if the share price remains 20% above the price of the new shares! Note that the open offer won’t affect the amount raised at all, regardless of uptake, since it’s all underwritten in the placing, and the open offer claws back shares from the placing (not the firm placing though).

Paul’s opinion - this is not a sticking plaster fundraise, this is belt & braces - ie it comprehensively sorts out the issue of excessive gearing. The bank must be very relieved!

For us, it’s a complete lottery in situations like this as to whether existing major shareholders will support the current share price, or demand a massive discount to back it with fresh money. Therefore VID shares are now much, much lower risk.

We’ve seen with both XP Power (LON:XPP) and today with Videndum (LON:VID) that for fundamentally decent, previously mid-cap, profitable companies, the terms of fresh fundraisings have actually been quite fair.

The further down the food chain we go, the more brutal fundraises from a position of weakness tend to be, if they can be done at all.

Still, doubling the share count at a 14-year low in share price, is a terrible outcome, and management must take the blame for creating this situation through overconfidence, too many acquisitions using borrowed money, and not keeping a cash buffer to survive downturns. Why is it that so many good companies go down this route of imprudently over-borrowing, making too many acquisitions, and assuming the macro outlook will always be fine? We don’t usually see this at owner-managed companies, where keeping a prudent balance sheet with plenty of spare cash is more usual. That’s why I usually prefer owner-managers to ambitious, empire-building hired hands.

With the share price now up to 335p, and an enlarged share count of 93.8m, the diluted market cap will be £314m, but with insolvency risk now removed.

That’s equivalent to 670p old share price on the old share count, but with too much debt.

In the past, VID made c.£30-40m pa operating profit, so taking off a bit for finance costs and tax, maybe £20-30m post-tax earnings. If trading fully recovers to this level, then it would be a PER of about 10-15. In other words, the current 335p share price is asking you to pay up for a recovery that hasn’t even started yet!

That doesn’t appeal to me at all.

However, since insolvency risk has now gone, I’m happy to shift up from RED to AMBER.

Graham’s Section:

Severfield (LON:SFR)

Share price: 63.8p (-2%)

Market cap: £197m

Severfield plc, the market-leading structural steel group, announces its results for the six-month period ended 23 September 2023.

Revenues are down but profitability is up:

At the beginning of H1 this year, Severfield acquired a steel fabrication company in the Netherlands for £22.5m (net of cash acquired). So the underlying fall in revenue must be even sharper than what is shown in the table above.

Indeed, the new subsidiary Voortman contributed £28m of revenue (and £1.5m of underlying PBT) in H1.

Therefore, excluding Voortman, Severfield only generated revenues of £187m in H1, down by 20% year-on-year.

Excluding Voortman, underlying PBT would be up 5%, rather than 17% as shown in the table above.

Net funds (i.e. net cash) finishes H1 at £0.4m, down by a couple of million over the six months. But I would treat this figure with extreme caution, as I expect that it sees large temporary swings.

Checking the details, I see that the company achieved a decrease in “underlying” working capital of £5.6m, but it also received advance payments of £10m from customers. These advance payments are expected to unwind in H2, which will be a drag on the company’s cash position.

UK/Europe Order book is £482m at the beginning of November 2023. This is up from £464m a year ago. SFR’s India order book is up by over £20m year-on-year.

Outlook is in line with expectations.

UK/Europe:

market conditions remain challenging but our diversified client base and broad sector exposure provide resilience

continue to see some large project opportunities in the UK and continental Europe

Voortman is integrating well into the Group's operations and helping us strengthen our market position in Europe

CEO comment excerpt:

Although the wider market backdrop continues to be challenging, given our successful track record, diversified activities, the strength of our order books and the favourable longer-term outlook, we have increased the interim dividend by 8 per cent and continue to expect to deliver further progress across the Group.

I’ve looked for a fuller explanation of the fall in revenues, and here it is:

The current market conditions remain a challenge for the business, with some ongoing delays in the conversion of our existing pipeline of opportunities, as clients wait for economic stability, and some lower tendering activity and competitive pricing, particularly in the distribution sector.

Graham’s view

I consider it to be highly encouraging that the company managed to grind out a decent profit result, despite a large reduction in core revenues.

The company refers to “contract execution improvements” as helping the profit performance, despite the lower revenues. Whatever these improvements might be, it’s a relief for shareholders as it means the 1.4p interim dividend is well covered by H1 EPS of 2.7p.

Overall, I think this is an impressive set of interims in difficult circumstances.

I also note the single-digit PER:

And the perfect StockRank (Severfield passes 7 bullish stock screens):

Checking the archives, I see that Paul took a neutral stance on these shares in June, when the share price was 67p (about 64p today).

I’m inclined to reiterate that stance today, primarily for sector reasons. To me, it makes sense for a lowish-margin structural steel company to trade on a sub-10 PER.

Severfield has done very well, with “contract improvements” saving its recent profit performance, but it’s always a risk to get involved with these companies unless you have a lot of confidence in the quality of the contracts they’ve signed.

It could be argued that the risks are already priced in at a PER of 7x and I have sympathy for that view. I think I would have to accept that this share was offering deep value if:

PER was 5x or less, or:

Dividend yield was higher than the PER (ideally >10%) and was covered by earnings, or:

The company was materially reducing its share count with a buyback.

So I am open to changing my stance on this, depending on the evolution of the company’s profitability, share price and shareholder rewards.

Paul adds: yes, I agree with all of the above. I think we have to be very cautious about cyclical, capital equipment type suppliers at this stage in the cycle. The sudden & fairly unexpected rise in interest rates from 14 years at near zero, to 5.25% today, is bound to have major repercussions for private sector capital projects such as new building construction. The danger being that companies like SFR could continue delivering solid results for now, but then see work dry up as the order book is worked through. Although so far, that doesn't seem to have happened. Although look back at the last major recession in 2008 to see what can happen. So caution needed I think. Cyclical companies are cheap, but for a good reason in my view. So just searching for low PERs, whilst ignoring cyclicality can be very dangerous at times like this. Or it might all turn out fine, we don't know.

Samuel Heath and Sons (LON:HSM)

Share price: 300p (-25%)

Market cap: £7.5m

We don’t cover this one regularly as it is too small and illiquid, but we thought that today’s profit warning was worth a brief mention.

Headquartered in Birmingham, Samuel Heath

“is engaged in the manufacturing and marketing of a range of products in the builder’s hardware and bathroom field”.

The company reports “some recovery” in sales towards the end of H1, so that revenues ended higher by 3% compared to H1 last year. But this comes with a big disclaimer:

However, this was only made possible by an improvement in production efficiency restoring output to the previous year's levels and so 'catching up' the historical order book. The order book is now unfortunately much weaker than the prior year, as mentioned later in this statement.

Operating profit fell to just £441k (from £610k) as the company suffered a 37% increase in energy and utility costs, plus various other cost increases.

Cash is £1.5m, down by £1.2m over six months. The company paid £300k to its pension fund and nearly £200k in dividends.

The outlook is very poor:

Addressing the second half, I have to report that trading conditions have worsened materially and since June the order book has been running consistently below management budget. The current level of the order book reduces flexibility to plan efficient production. We have taken soundings from our UK and EU marketplace and there is no expectation that things will improve during this calendar year. Orders and projects remain out there but, in some cases, have been put on hold in the current uncertain economic environment. The only area of continuing confidence appears to be the USA, but there is no guarantee that this will continue.

H2 is therefore expected to show a loss, after taking expected redundancy costs into account. But

“the directors are hopeful of remaining in the black for the year as a whole and that sales will recover early in the new calendar year”.

Interim dividend is 4.5p, reduced from 5.5p last year.

Graham’s view

Last year, I opined that HSM could be a “low-risk” share. I said that on the basis that it’s a family business, has paid out countless dividends over the last couple of decades, and typically runs with a large cash balance and a strong balance sheet.

However, the share price is down by 50% since I uttered those words:

The company is now clearly struggling, and now needs to rely on its cash balance. If I check how the company fared in 2008-2010, I see that it managed to eke out small profits, as it is hoping to do in the currency year.

For me, this is still a decent nano-cap and for the contrarians and deep value hunters out there, it may be of interest. Lots of patience might be needed over the next year or two as the company waits for economic conditions to improve.

For a company that has rarely achieved net income of more than £1m p.a. and is currently operating around breakeven, personally I’m not sure if I’d be in a huge rush to get involved even at this market cap. The shares have traded around 200p from time to time:

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.