Good morning, it's Paul here.

CVA newsflash

There was an interesting twist in the topical theme of retailer/hospitality companies seeking to restructure their property portfolios using CVAs.

CityAM reported via the Sunday Times, that Next (in which I have a long position) is asking for a "CVA clause" in new leases. This would trigger a rent cut for Next, if any of its neighbours gain a rent reduction through a CVA.

If a landlord is desperate to attract or retain Next as an anchor tenant in a struggling shopping centre, then they might agree to this.

Therefore, if Next is successful in gaining favourable CVA clauses in new leases, then that could result in landlords voting against some future CVAs. My feeling is that landlords may start to dig their heels in, and refuse some future CVA proposals. Otherwise, the flood gates would open, as numerous struggling retailers chanced their luck with a CVA proposal.

Landlords might start refusing CVA proposals, as a deterrent & warning to retailers seeking to exploit the process unreasonably. Perhaps landlords should demand equity (through options or warrants) as part of agreeing CVAs? After all, why should landlords take all the pain, only to see restructured retailers emerge as highly profitable, and shareholders receiving all the benefits from the CVA process?

Let's start with a profit warning:

Produce Investments (LON:PIL)

Share price: 149.5p (down 8.8% today, at 08:49)

No. shares: 27.3m

Market cap: £40.8m

Trading update (profit warning)

Produce Investments plc, (AIM:PIL) ("Produce," "Company" or the "Group"), a leading operator in the fresh potato and daffodil sectors, is today providing an update on current trading...

It's quite a nasty profit warning today;

... the Board now expect the Group's profit for the year ending 30th June 2018 to be substantially below current market expectations.

The reason that the share price is only down about 9% today, seems to be because the weather issue was pretty obvious, and was mentioned in detail with the interim results commentary on 22 Mar 2018, here. Although management seems to have been too optimistic about the full year outcome back in March.

Other points mentioned today;

- Impairment of intangibles will be incurred this year.

- lower margins on UK potato crop, in an "oversupplied market"

- Moving year end to August (from June) in future.

My opinion - why on earth would I want to own shares in a potato grower? the only reason would be if the dividend income was very good. Stockopedia shows the forecast yield at 4.87%, which is pretty good actually. Although with profits now much lower than forecast, there is a risk that divis might be cut.

The PER looks very low, but of course that is likely to rise now that the company has said that it will miss forecasts by a substantial amount.

I've had a quick look at the most recent balance sheet, and there's rather too much debt for my liking, and a pension deficit.

It seems strange that broker forecasts were not reduced, given that the weather problems should have been foreseen. Existing forecast is for 26p EPS. Substantially below that could be anything below say 20p, at a guess. Since the company hasn't given proper guidance, then the share is impossible to value.

It doesn't interest me at all. Although I can see an argument for buying a weather-dependent share like this when the weather has been adverse, as the share could then be attractively cheap, and subsequently recover in a good weather year.

As you can see below, the share price is back to where it was 2 years ago. Although investors have received a decent flow of divis over that time.

Bloomsbury Publishing (LON:BMY)

Share price: 222p (up 7.3% today, at 09:42)

No. shares: 75.33m

Market cap: £167.2m

Preliminary results - for the year ended 28 Feb 2018, from this book publisher (including Harry Potter).

I'm impressed, these are good figures (and outlook).

Key points;

- Revenue up 13% to £161.5m, which is slightly above the consensus forecast of £161.2m shown on the StockReport

- Adjusted diluted EPS up 10% to 13.92p (PER of 15.9) - ahead of the 13.5p consensus forecast

- Total dividends up 12% to 7.51p (also ahead of 7.0p forecast) - well covered by both earnings and cashflow. This gives a yield of 3.4%

- Excellent balance sheet, includes net cash of £25.4m - which is material to the valuation of the company

- Strong cashflows this year & last year, although note that increased trade creditors boosted cashflow in both years

That all looks impressive.

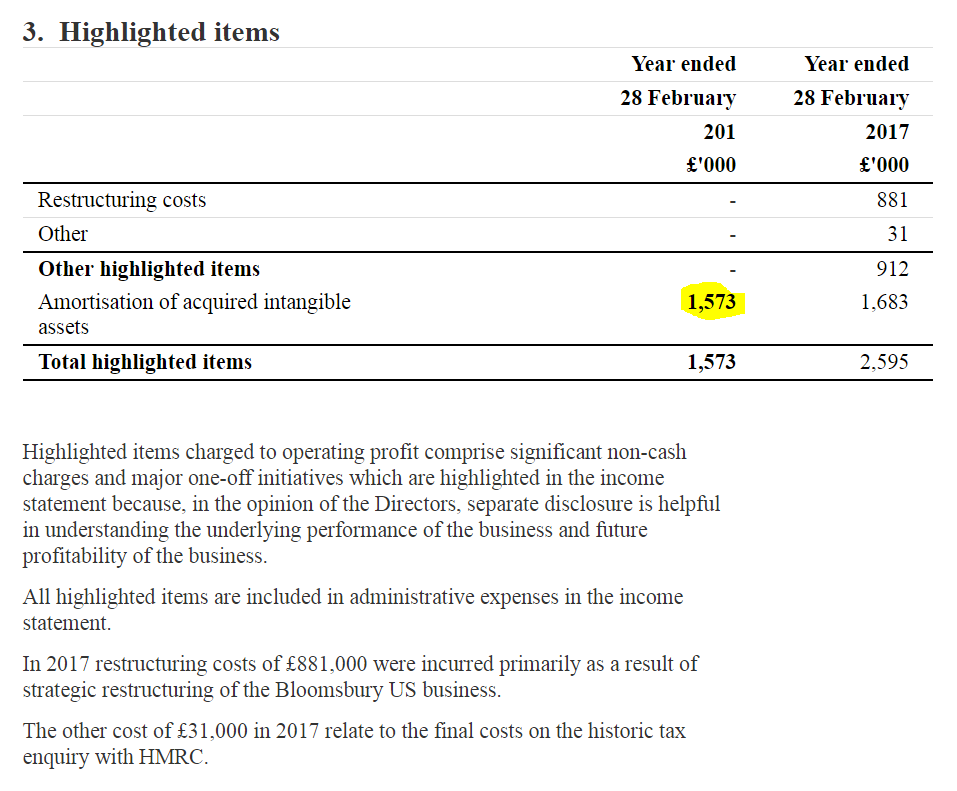

Adjustments - I always like to double-check that the adjustments being made to accounts, to arrive at the headline EPS figure, are reasonable.

Here is note 3 from today's accounts;

That looks absolutely fine to me. The only item this year is stripping out amortisation of acquired intangibles (i.e. goodwill), which is perfectly sensible & reasonable, in my view.

Outlook - is also impressive. I won't cover all the detail, but the conclusion is good;

... the Board believes the Group's performance will be well ahead of our previous expectations for the forthcoming 2018/19 year.

Shareholders must be delighted with that, although it looks like the good news might have leaked out yesterday;

Valuation - unfortunately, I can't find any broker updates today, there's nothing on Research Tree as yet. That's a pity, as to value the company now, I'm having to use a degree of guesswork.

The existing forecast for the current year seems to be only 13.3p EPS (down 4.5% on 02/2018 actual result). What does "well ahead" mean? At a guess, maybe 5-15%? That implies EPS of somewhere between 14.0p and 15.3p - so at 222p per share, the PER would be between 14.5 and 15.9.

Given that the net cash pile is about 15% of the market cap, I would be inclined to adjust down that forecast PER range, by 15%, which gives a PER of 12.3 to 13.5 - that's on an adjusted basis resetting the balance sheet to a nil cash or debt basis.

My opinion - the valuation looks fairly attractive for a company that seems to be firing on all cylinders. It has a very attractive balance sheet, and a reasonable yield too.

Overall then, this gets a thumbs up from me. I'm impressed with the figures and the outlook, and the valuation looks attractive, even after recent gains. The question is how high can the valuation of a book publisher go? It's likely to face a permanent headwind of investor scepticism in the long-term prospects for the sector.

EDIT: There are some excellent reader comments below on these results from Bloomsbury Publishing (LON:BMY) - especially comment numbers 12,13, and 14, so please do scroll down to have a look at those.

Topps Tiles (LON:TPT)

Share price: 72.25p (up 4.7% today, at 11:01)

No. shares: 193.5m

Market cap: £139.8m

(at the time of writing, I hold a long position in this share)

Topps Tiles Plc, the UK's largest tile specialist, announces its interim results for the 26 weeks ended 31 March 2018.

This share cropped up in my talk at the Mello Derby investor conference a few weeks ago. I noted how the valuation looked reasonable, and the share could have growth upside from it entering a new market - commercial tiling (Parkside) - thus potentially (long-term) doubling the size of its addressable market.

Therefore, after the conference I decided to dip my toe in with a smallish initial purchase.

For the half year;

- Revenues (adjusted to exclude Parkside) up 2.8% to £109.6m (of which LFL growth was +0.6% - NB they define LFL as including online, as well as stores, which is a bit cheeky)

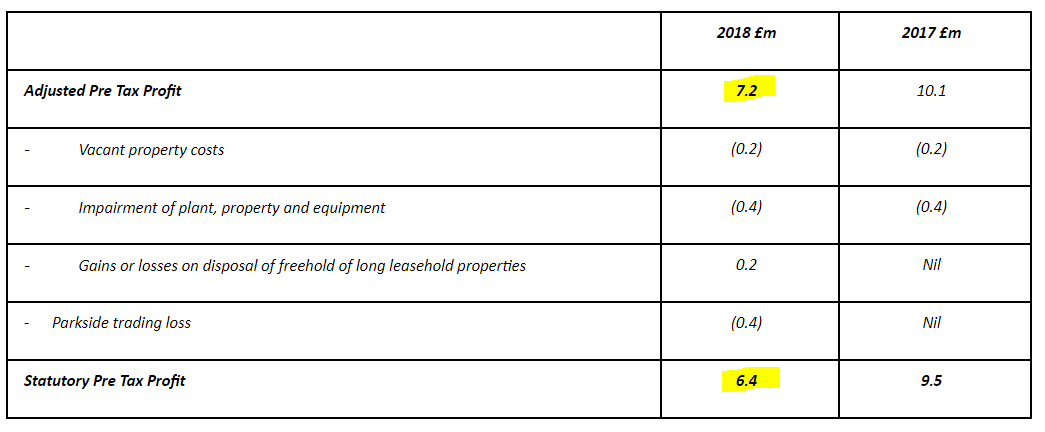

- Adjusted profit before tax down 28.7% to £7.2m

- Adjusted EPS down 26.8% to 3.01p (4.11p H1 LY)

Adjustments - I think the company is pushing the envelope here, with some of these adjustments (see table below). However, they're relatively modest in size, so I can live with this;

I think it's always worth scrutinising adjustments, as creative accounting often rears its ugly head! However, in general I think most companies are simply trying to show the underlying trading performance of a business. We're free to adjust the figures manually ourselves anyway, if we don't agree with any adjustments.

Balance sheet - I'm not madly keen on this, as it has a bit more debt than I would like. Net debt is £25.1m. However, the cash generative nature of the business is such that this is not a concern.

However, if trading were to seriously fall off a cliff, then I would be out of here like a shot.

Interim dividend - held at 1.1p. The full year divis will be 2x covered, so that implies a small cut in the final divi is probably on the cards.

Current trading - is down 0.2% LFL for the 7 weeks to 19 May 2018. Since this includes online sales, which are likely to be strongly up, then the performance of the stores is likely to be worse than this headline number.

Outlook - this sounds similar to the wording last time, from memory;

We continue to take a prudent view of the second half outlook and expect that pre-tax profits for the full year will be within the current range of market expectations....

... The current range of analyst expectations is £15.5 million to £16.5 million, with consensus at £15.9 million

It fills me with joy when I see a company clearly stating what market expectations are! This is very private-investor-friendly, so well done to Topps and its advisers - excellent stuff. Everyone should do this please.

Broker commentary - there's a very useful update from Liberum, published today, and available to subscribers of Research Tree. They've prepared a useful chart showing LFL sales by quarter, for the last 2 years.

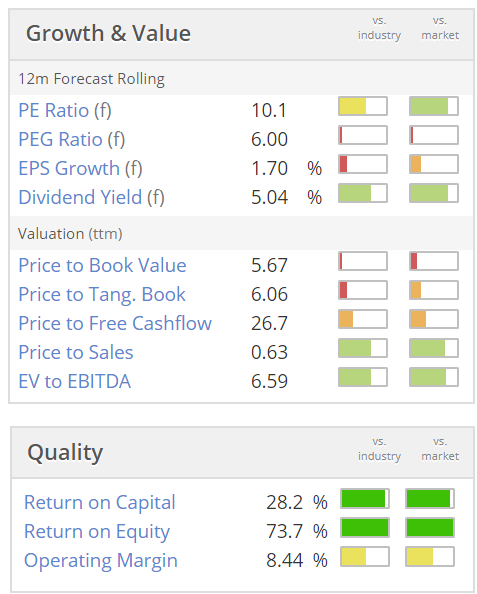

Forecasts are unchanged, with 6.3p adj. EPS expected for this year, which looks do-able, and results in current year forecast PER of 11.5.

My opinion - I'd say this is a satisfactory set of results, in terms of being what was expected. I have a few reservations though: balance sheet not as strong as I would like, and the reporting of LFL including online sales is probably masking a bigger deterioration in store sales - which would explain why profit has fallen a fair amount.

On the plus side, the valuation looks reasonable, and this has always struck me as a well managed business, with a strong market niche. I like the expansion into commercial tiling, and that's the main reason I decided to buy some shares in this company. The new growth potential from that could, at some point, possibly trigger a re-rating of this share.

A risk to consider is that competitors doing CVAs (e.g. Carpetright) are gaining an unfair competitive advantage by lowering their rents drastically, and exiting all their problem stores in one fell swoop. This is both a threat and an opportunity to Topps - because it should gain market share in the areas where Carpetright is closing stores.

I'll see how things progress over the next year or so. If progress is made, then I'll buy more. If profits continue to deteriorate, then I'll ditch them. Hence why it's only a small opening position for me, at the moment. I usually like to scale into positions over time, depending on the progress the company is making, starting off small.

Value and quality look quite good, but the missing link is earnings growth;

Reach4Entertainment Enterprises (LON:R4E) - just a quick comment here, as the company doesn't interest me at all really. This is a supposed turnaround situation, under new management, of a group of marketing companies focused on theatre.

There are far too many adjustments to the accounts, which massages a £2.4m operating loss into a £976k positive adjusted EBITDA.

2018 is expected to be a "year of transition", which is code for profit not rising any time soon.

Despite having raised £5.5m in fresh equity, in Dec 2017, the balance sheet still looks weak - NTAV is only £590k. The current ratio isn't great either, at 1.01 (well below my usual cut-off, of 1.3)

I can't see any attractions to this share, and why it's valued at £16.3m, when it doesn't make any real profit, is beyond me. Investors here must have faith in the new management, and their ability to improve performance. That's not something I'm inclined to punt on.

Unless I have a second wind later, that's probably it for today.

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.