Good morning from Paul & Graham!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom),

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

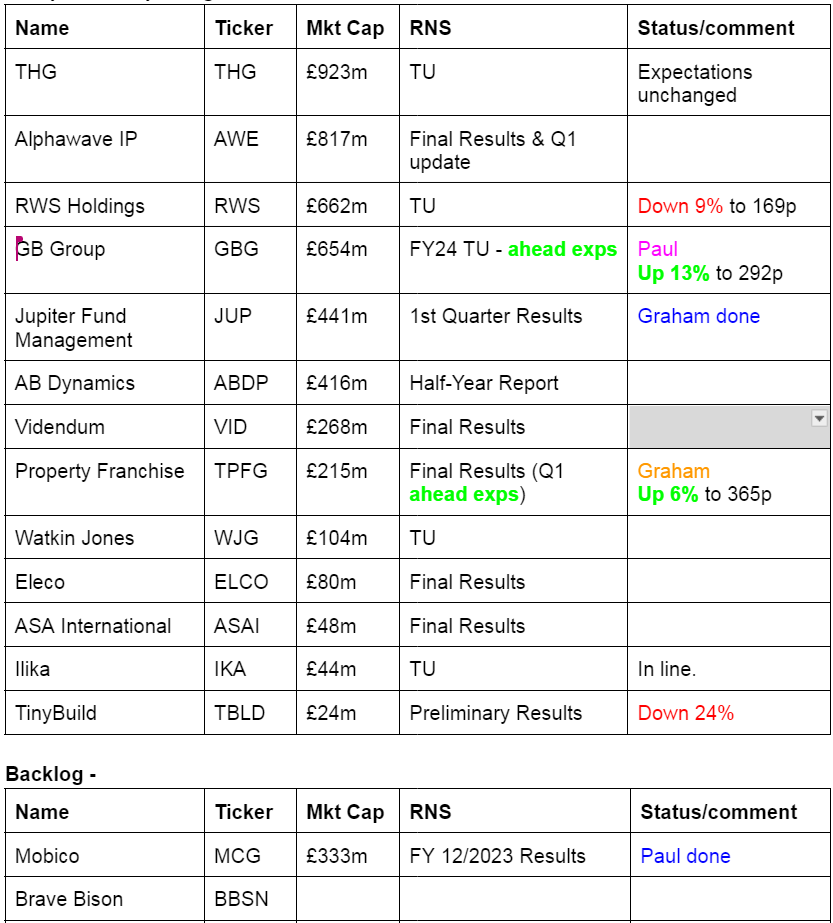

Companies Reporting Today

Mid Morning Movers (with news) -

ABF

.

JD.

.

ITIM

Summaries of main sections -

Mobico (LON:MCG) - down 10% y’day to 54.2p (£333m) - (Delayed) FY 12/2023 Results - Paul - AMBER/GREEN

Delayed 2023 results came out yesterday. Weak balance sheet and too much debt, but debt maturities and cost look reasonable. So providing trading doesn't deteriorate further, then the 3.0x covenant gearing (limit 3.5x) could be OK, but it's getting tight. Guidance is for a slight improvement in 2024 trading. Equity looks very cheap, but above average risk I'd say. It looks tempting for a recovery punt in my view.

Jupiter Fund Management (LON:JUP) - down 0.6% to 80.5p (£439m) - 1st Quarter Results - Graham - GREEN

This Q1 update is consistent with our previous reporting on many fund managers, including Jupiter: large outflows but AuM refuses to shrink, buoyed by market movements. Jupiter suggest they had “underlying” inflows (if you exclude the largest outflows) - but let’s see if they can produce real inflows in Q2!

Paul’s Section:

Mobico (LON:MCG)

Down 10% y’day to 54.2p (£333m) -(Delayed) FY 12/2023 Results - Paul - AMBER/GREEN

Issued yesterday. This is a large, international public transport group. It’s having a difficult time, with 2 months ago the first warning that accounts would be delayed by complicated onerous contracts in Germany. Then a mild profit warning followed on 25/3/2024, although it confirmed significant covenant headroom on borrowings, and £175-185m guidance for adj operating profit.

The highlights table below shows how, after big depreciation and finance charges, there’s hardly any PBT, and these are the adjusted numbers! Statutory numbers show losses before tax in 2022 and 2023. Also note the heavy debt burden, and big falls in EPS & divis, so not a happy picture -

It says the covenant limit for gearing is 3.5x, so that’s not a huge amount of headroom, vs 3.0x above. Although debt maturities look fine, providing it can stay within the covenants -

Improved debt maturity and liquidity with £600m RCF refinanced to 2028, and €500m bond refinanced to 2031.

The table below on debt headroom & maturities doesn’t strike me as a company in financial distress (although it might become distressed if profits fall again in 2024 and the leverage covenant becomes threatened by falling EBITDA - that’s the main downside risk here) -

Dividends - the 1.7p in the table above is the interim divi only. There is no final divi, and it does’t expect to pay divis in FY 12/2024, to focus on de-gearing. So for now the yield is zero. It says today that divis may be reintroduced when gearing has come down.

Divisional performance - as you can see from the operating profit section below, ALSA is currently the only part of the business performing well, with the other divisions being poor (and deteriorating). So it clearly needs a turnaround, and has some restructuring activity already underway -

Pension deficit recovery payments are not large relative to the size of the group -

The agreed deficit repayments on the West Midlands Bus plan are £7.5m, £7.7m and £7.8m per annum for the three years from 1 April 2023.

Balance sheet - is very weak, and MCG is dependent on borrowings. NAV was £1,066m at 31/12/2023, but that includes £1,552m of intangible assets. Write those off, and NTAV is horrible, at negative £(486)m. So there’s a hole in the balance sheet that needs to be gradually repaired, the way I look at it. Hopefully that can be achieved from retaining profits for a few years?

If trading deteriorates in future years, then the downside risk is that it breaches borrowing covenants, and has to do an emergency equity raise (maybe at a discount). That doesn’t look an imminent risk though.

Outlook - the latest guidance says -

Based on current market conditions Adjusted Operating Profit for FY 24 is expected to be within the range of £185m to £205m. Similarly to FY 23, we expect a greater bias to the second half of the year, given the phasing of cost reduction programmes and the timing of price increases.

This compares with comparable adj op pr of £169m in FY 12/2023.

On c.£3bn revenues, it wouldn’t take much of a change in variables to see guidance go either up or down.

Paul’s opinion - that’s probably as far as I can take this, in a quick review. It’s a large, complex business, with a market cap of a very low £333m. Debt is large, but seems to have long maturities, and a fair bit of it was recently refinanced on quite decent terms.

I could be wrong, but I’m quite drawn to this share as a speculative recovery idea. The danger is that I don’t know the business well enough to make that call really.

I’ll take a risk, and up my view from amber to AMBER/GREEN, with the proviso that this is more thinking in terms of a speculative rebound trade, or even possible bid interest from overseas, rather than particular enthusiasm for rather weak fundamentals.

EDIT: I've just noticed that the largest shareholder at 19% in MCG is Jorge Cosmen, who also sits on the board as a non-independent NED. It looks as if he may have got his shares through MCG acquiring ALSA, with which he seems to have previous connections. If any readers have more colour on this, please do leave a comment.

At 5-year lows -

Graham's Section

Jupiter Fund Management (LON:JUP)

Down 0.6% to 80.5p (£439m) - 1st Quarter Results - Graham - GREEN

Outflows continue at Jupiter: another £1.6 billion in Q1 (to March).

They are at least offset by positive market movements (£2.0 billion), so that AuM climbs to £52.6 billion.

The relevant table:

Jupiter suggest that there were “underlying net inflows of £0.3bn”, rather than net outflows of £1.6 billion, if you exclude “outflows related to strategies managed by the Value team and to the Chrysalis Investment Trust”.

The Value team has been hit by fund manager departures, while Jupiter has given up its control of the Chrysalis Investment Trust.

Graham’s view

I wouldn’t exclude the outflows from the Value team, because I think these outflows are a symptom of Jupiter’s overall predicament (persistent outflows, combined with vulnerability to fund managers leaving and setting up elsewhere).

£1.1 billion was pulled from the Value team in Q1, leaving £7.5 billion in AuM. It would be brave to bet on the outflows ending there.

Similarly, the loss of control of Chrysalis could be viewed as a one-off event. If everything else at Jupiter was going swimmingly, then it would be easier to make this argument. But in the current circumstances, I would again view the loss of control of Chrysalis as being part of the overall picture of outflows.

So where do we go from here? I’ve been positive on this share due to the extraordinary cheapness, not just in terms of earnings multiples but also versus AuM.

Based on today’s figures, I think that investors are getting nearly £120 of AuM for every £1 invested in Jupiter stock. This is an extraordinarily depressed valuation, not just against Jupiter’s history but even against the rest of the fund management sector today.

I am therefore going to have to view this one positively, even given the continued outflows.

Note that AuM did rise, despite investors pulling their money out. The fund management sector is unusual that way - they can keep growing even as they lose customers!

I think I first turned positive on this share in the second half of 2022. The share price hasn’t agreed with me yet:

But the StockRanks certainly do agree with me:

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.