Good morning from Paul & Graham!

Today's report is now finished.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom),

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Agenda

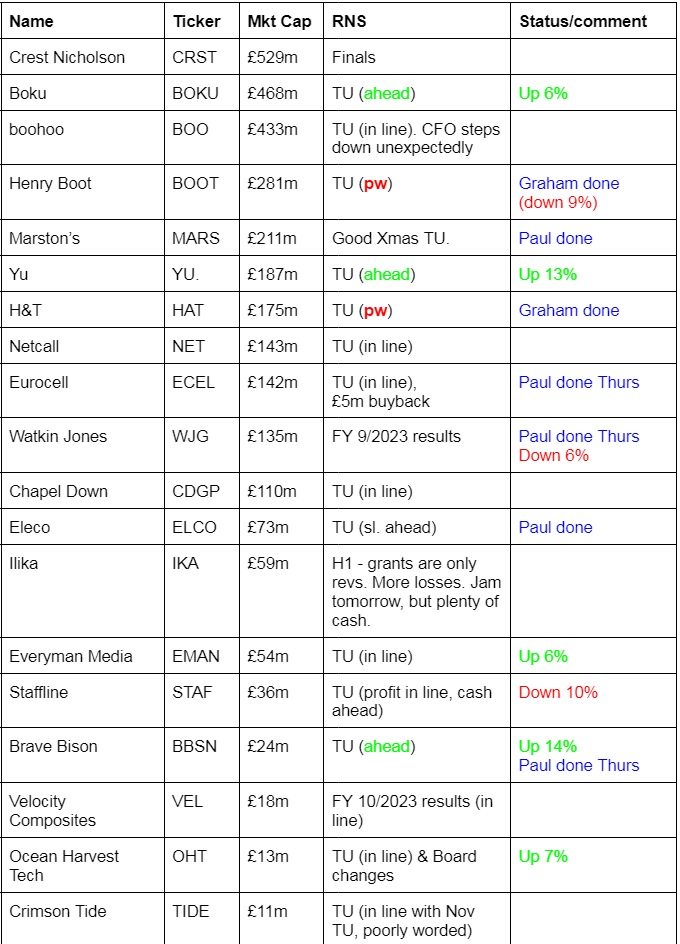

Companies reporting today -

Other mid-morning movers (with news) at 10:25 -

Cornerstone FS (LON:CSFS) - up 9% to 38p - deal with Mastercard to launch corporate cards in Q3 2024.

Big Technologies (LON:BIG) - up 9% to 114.5p - CEO buys 300k at 106.5p, total held 73.4m (25.3%), recent PW.

Esken (LON:ESKN) - down 48% to 48% - serious dispute over £194m conv loan. Equity worthless possibly?

Summaries

Alphawave IP (LON:AWE) - up 16% y'day to 134p (£961m) - Trading Update - Paul - RED

My first review of this (one of many) disastrous 2021 floats. I don't understand its products or tech, but I can see plenty of flaws in the figures. So it's not for me. I think this chip designer needs to establish a more reliable track record of profit/cashflow before it can be viewed positively here. Shares bounced strongly yesterday on an in line 2023 trading update. Will any of the $87m EBITDA turn into cash though? It didn't in H1, which was heavily cash consuming.

Benchmark Holdings (LON:BMK) - up 17% y’day to 41p (£303m) - Strategic Review & FSP - Paul - AMBER/RED

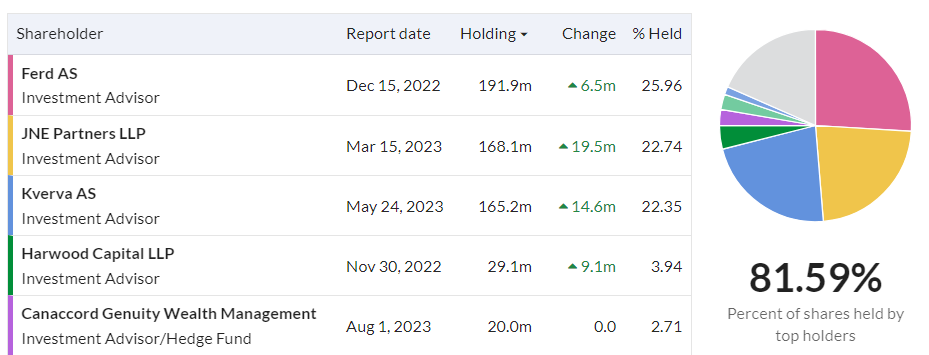

Puts itself up for sale, as management think shares are undervalued. I'm struggling to justify a valuation anywhere near the existing high price, given its years of losses, and indebted balance sheet. So it will be interesting to see how this pans out. 3 major shareholders hold almost 3/4 of the equity, so it's quite illiquid.

Eleco (LON:ELCO) - up 5% to 91p (£76m) - Year-end trading update (slight beat) - Paul - AMBER

Slightly beats 2023 forecast, but that's come from trimming costs, as revenue is slightly below forecast. About half the growth is coming from acquisitions. Balance sheet has plenty of cash thanks to favourable up-front payments by customers, but balance sheet overall is slightly negative NTAV. Overall I think it looks a nice enough business, but as mentioned before, fully priced for now, hence me sticking at amber. Could grow into the valuation though, if forecast growth is achieved or beaten.

H & T (LON:HAT) - down 15% to 339p (£149m) - Trading Update (profit warning) - Graham - GREEN on fundamentals, BLACK (profit warning flag) for spreadsheet

H&T reveals that December was a tough month for it from a retailing perspective, as buyers chose cheap, low-margin new items over more expensive pre-owned items. I remain a fan of this company and see an opportunity here at 6x earnings that warrants further investigation.

Marston's (LON:MARS) - unch 33.3p (£211m) - Trading Update (AGM) - Paul - AMBER/RED

A laggard whilst sector peers have rerated up. However I soon discover why, as this is a special situation with a debt mountain that consumes all the cashflows. Hence no divis, and worries over refinancings. That said, trading in 2023 and YTD FY 9/2024 has been good, with decent +8% LFL so far this year. The equity is only a fraction of the debt, but it has a big estate of property assets. I think somebody might bid for it. Elevated risk from the debt mountain though, so a tricky one - special situation really.

Henry Boot (LON:BOOT) - down 10% to 190p (£255m) - Trading Update (profit warning) - Graham - GREEN on fundamentals, BLACK (profit warning flag) for spreadsheet

It’s a dose of bad news for Henry Boot investors as the company now expects its end markets to take longer to recover. It’s frustrating as the macro indicators have been moving the right way. But the stock may still offer a decent proposition over the medium-term.

Paul’s Section:

Alphawave IP (LON:AWE)

Up 16% y'day to 134p (£961m) - Trading Update - Paul - RED

This is a new company for the SCVR, so it will be good to get something into our system here. It was a £3bn 2021 tech float at 410p/share, so obviously the shares have plummeted since. Note the prospectus says selling shareholders took out £495m in the IPO. Still, it doesn’t seem to want to go below 100p more recently, maybe a base forming here?

Note that the rot seemed to set in after the FT published a critical article in Sept 2023 about alleged undisclosed related party deals, which the company denied here.

What does it do? Search me! Press articles describe it as a “chip designer”. This is the company’s self description today -

Alphawave Semi is a global leader in high-speed connectivity for the world's technology infrastructure. Faced with the exponential growth of data, Alphawave Semi's technology services a critical need: enabling data to travel faster, more reliably and with higher performance at lower power. We are a vertically integrated semiconductor company, and our IP, custom silicon, and connectivity products are deployed by global tier-one customers in data centers, compute, networking, AI, 5G, autonomous vehicles, and storage. Founded in 2017 by an expert technical team with a proven track record in licensing semiconductor IP, our mission is to accelerate the critical data infrastructure at the heart of our digital world. To find out more about Alphawave Semi, visit: awavesemi.com

I don’t understand what the company does, and today’s update very much blinds me with science. So I’m going to purely look at the figures, which I can understand.

I have to get almost to the end of the update today to find something I can lock onto, this bit -

The outlook for 2023 remains unchanged. Alphawave Semi expects 2023 revenue of US$340m to US$360m and adjusted EBITDA of approximately US$87m (or approximately 25% of revenue), which is at the mid-point of the revenue guidance range.

Despite the uncertain macroeconomic environment, our growing pipeline reflects positive secular growth trends in data infrastructure markets and the continued investment in next-generation AI- centric connectivity solutions. This, combined with our talented team and strong balance sheet, give us confidence in our future.

Broker update - I don’t have access to anything, so instead will have a look at the last interim results to get a flavour & compare with the FY guidance above.

H1 Results to 30 June 2023 -

Profit & loss account -

Revenue $187m (up 228% due to substantial “Royalties and silicon” starting - from China)

Adj EBITDA $32.4m

Massive share-based payment of $18.5m in H1, which causes the losses below:

Operating loss $(2.6)m

H1 Loss before tax of $(11.2)m - after $7.6m H1 finance charge due to net debt, plus a $2.7m charge for a loss-making JV.

Balance sheet - at 30 June 2023 -

NAV $487m, includes goodwill $332m and intangible assets $180m, so NTAV is $(24)m.

Net debt of $100m at 30/6/2023 compares with net cash of $452m a year earlier, so where did all the cash go?

Receivables $100m + Accrued revenue (same thing) $67m is equivalent to almost all of H1 revenues, and a lot of those revenues originate in China, so this makes me very uneasy.

Cash of $123m is more than offset by $223m “Loans and borrowings”, so net debt of $100m. Note 18 in H1 results shows this is a $100m 5-year term loan plus an RCF from a banking syndicate.

NB it breached a banking covenant in June 2023, with an amended agreement signed in Sept 2023 relaxing the covenants. Still not a good look. In the going concern statement it blames this on customers paying slowly (higher deferred revenue) and high R&D spending. It gave itself a clean going concern review in June 2023.

Cashflow statement - for H1 2023 is poor, showing it consuming cash. One half year isn’t enough to draw a firm conclusion, but I don’t like the look of this.

Cash generation in H1 was $29m, but then $(60)m was absorbed by working capital, mainly “deferred revenue” creditor which shrank from $92m to $42m.

So operating cashflow was negative $(31)m vs positive $32m in H1 LY. Swings and roundabouts maybe, but it nets off to almost zero, suggesting to me this is not a cash generative business yet.

Then there are further H1 cash outflows, $5m in tax, $13m capex, $25m in capitalised development spending (just in H1), and $4m invested in a JV.

Overall, cash was considerably depleted from $186m to $123m, and borrowings increased a little too. Not a pretty picture, so an amber warning from me here on negative cashflow.

Paul’s opinion - all I’m talking about here are the numbers, as I don’t have any understanding of what the company does, or its competitive position.

My concerns are -

EBITDA does not turn into cashflow, so far anyway. Note that $32m adj EBITDA in H1 was more than exceeded by capex & capitalised development spend.

Also working capital absorbed a lot of cash, and it seems the Chinese customers are slow payers, quelle surprise! Anything that relies heavily on selling things into China is something I would rather avoid, for a variety of reasons, it often seems to cause problems for UK companies and investors.

The balance sheet is weak, and heavily reliant on bank facilities.

Breaching covenants in June 2023 suggests weak financial controls, and performance not going to plan. So although it was resolved with amendments, it’s a warning I think.

Shareholders took cash out in the float, but it’s still dominated by 2 shareholders with a combined 50.7%, which is too much, especially combined with the China connections.

On the upside, the products/services could be the best thing since sliced bread walked through the door, I have no idea on that. But the numbers alone don’t give me the confidence to want to dig any deeper.

So overall I’m going to view this as RED, based on the facts & figures at this point in time.

Once it’s established a better financial track record of real profits and cashflow, which it hasn’t yet, then I’ll be happy to look at it with fresh eyes in future.

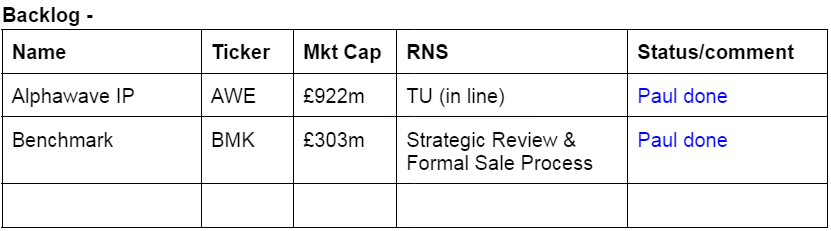

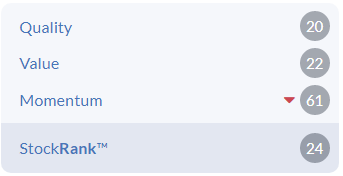

Stockopedia's computers share my unease -

It qualifies for 2 short selling screens, and only 1 long screen -

So I think it's clear that both man and machine want to see a longer track record from AWE before getting keen on the shares. The trouble is, we might miss out on a bull run if we sit on the sidelines, so that's the trade off isn't it.

Benchmark Holdings (LON:BMK)

Up 17% y’day to 41p (£303m) - Strategic Review & FSP - Paul - AMBER/RED

Benchmark Holdings plc ("Benchmark" or the "Company"), is a market leading aquaculture genetics, nutrition, and health business, delivering advanced biotechnology products and solutions that enable the aquaculture industry to improve its productivity and sustainability, helping address the need for sustainable aquatic food to feed a growing global population.

The Company is a supplier of choice for aquaculture producers worldwide with market leading positions in genetics, early-stage nutrition and sea lice solutions and well invested infrastructure to support growth. The Company's specialised mission critical products and solutions reflect decades of invested capital, IP and expertise, which the Board believes are very difficult to replicate.

BMK management seem to think its shares are undervalued, and so has put itself up for sale, through the Formal Sale Process under the Takeover Panel rules. So expect a deluge of announcements each day as the disclosure obligations move down to 1% holdings, and changes to positions above that size. I often have to take companies off my email RNS alerts watchlist once offer periods begin, due to the volume of trivial announcements.

It claims a successful financial track record -

Management actions over the last three years have delivered substantial revenue growth and improvement in profitability and cash conversion. Since FY20, Benchmark's revenue from continuing operations has grown from £105.4m to £169.5m in FY23 and Adjusted EBITDA has increased from £15.5m to £35.5m. The Company is well positioned with a strong balance sheet and significant headroom to grow within its existing markets, as well as multiple potential avenues for expansion.

Although it doesn’t actually make any real profits - so I’d say the financial track record has been lousy, and doesn’t even come close to justifying a £300m market cap.

The £35.5m adj EBITDA mentioned above turned into a £12.7m loss before tax. The same thing happens every year - statutory losses, not profits.

The company says it has a strong balance sheet, but it doesn’t! Net debt was £65.5m at 30/9/2023, which brings hefty finance costs to the P&L.

I don’t understand why it pays heavy taxation, considering it’s loss-making?

Paul’s opinion - this has always been a jam tomorrow company, and I’m amazed investors have been so patient with years of continuing losses, cash outflows, and several equity fundraisings.

It must boil down to investors believing that the company has special know-how that might eventually result in it making some profit, perhaps?

As I say above, the existing valuation doesn’t make any sense whatsoever to me, so why would anyone be prepared to pay even more for it, in a sale process?

There’s not much liquidity in this share, due to 3 dominant shareholders, so maybe taking it private might make some sense? I’d be worried that could happen at a discount, rather than a premium though.

I see Harwood increased in Nov 2022, and they're certainly not fools, so there must be something interesting at BMK that is not obvious from the numbers -

On the upside, sometimes companies with unique technology attract high valuations that are not necessarily linked to financial performance. Maybe this could turn out to be such a case?

Time will tell, I don’t know how this situation will end up, your guess is as good as mine!

Given that it’s so overvalued on poor fundamentals, I have to go AMBER/RED.

10-years as a listed company, and it's gone nowhere -

Eleco (LON:ELCO)

Up 5% to 91p (£76m) - Year-end trading update (slight beat) - Paul - AMBER

The Board of Eleco plc (AIM: ELCO), the specialist software provider for the built environment, is pleased to provide a trading update for the year ended 31 December 2023, based on unaudited management accounts for the period.

I have a generally favourable impression of this software business, having followed it for years. It bombed out after the 2008 GFC (great financial crisis), bottoming out around 7p, so has been a lovely 10+ bagger since then (not far off a 20-bagger during the peak 2021 valuation of c.132p).

Eleco seems a good company, churning out pretty reliable profits. Although I’ve often placed a question mark over its high valuation, eg when reviewing here on 11/5/2023, I could only go to amber then because any higher didn’t seem justified since profit had only gone sideways in the last 5 years.

The bull case is that a long transition to more reliable SaaS recurring revenues (now up to 74% of total revenues) has suppressed short term profits in return for more reliable long-term recurring revenues. Lots of software companies have done a similar thing, but 5-years is a long time for investors to wait.

On to today’s trading update for FY 12/2023.

Record Recurring Revenue Growth

ARR at 31 December 2023 was approximately £22.6m (at 31 December 2022: £18.2m) an increase of 24%.

That is good, and gives nice visibility. Although almost half the growth has come from an acquisition of BestOutcome.

Total revenue for FY 12/2023 is now £28.0m.

What about profitability? The CEO says -

…profitability is expected to be ahead of consensus. This reflects our strategic switch to a SaaS business model and our focus on higher margin core products, and the discontinuation of products that were not contributing to the future of the Group.

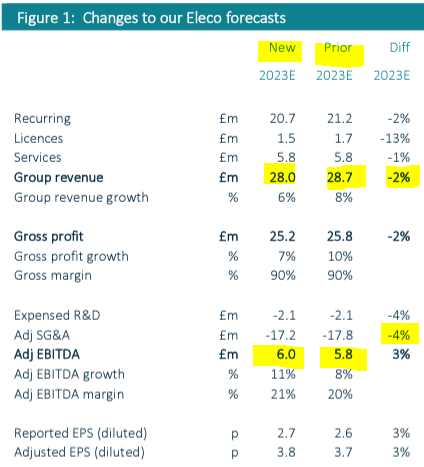

Cavendish updates us (many thanks), and its revised FY 12/2023 actually show a reduction in forecast revenues from £28.7m to £28.0m (6% Y-on-Y growth instead of 8% previously forecast). This revenue shortfall is recouped only through lower costs. The table shown by Cavendish shows an increase in forecast adj EBITDA from £5.8m to £6.0m, but actually both figures arrive at £5.9m, flat. So there must be some rounding differences in the table, or a formula is wrong in their spreadsheet!

I hope Cavendish don't mind me including the excerpt below, and of course I'll remove it if they complain -

Adj EPS is revised from 3.7p to 3.8p, and given that this has been achieved by lower costs, on lower revenue than forecast, I don’t really see this as ahead of expectations - it’s more realistic to see this as in line, thanks to some costs coming in a bit lower than expected.

I’ll call it a “slight beat” so I don’t have a riot on my hands from ELCO shareholders!

Forecasts for 2024 and 2025 are actually slightly trimmed today for revenue (down 3% in both years compared with previous forecasts). EBITDA is unchanged in the 2024 & 2025 forecasts, but that’s only been achieved by cutting forecast costs by 4%. So it looks a rather defensive minor move on forecasts, although to be fair, the numbers are still showing decent earnings growth year-on-year, with this forecast progression -

FY 12/2023: 3.8p adj dil EPS

FY 12/2024: 4.6p

FY 12/2025: 6.0p

I don’t think there’s any point in looking any further forward into the future, although since ELCO has c.74% recurring revenues, it’s easier & safer to forecast than for many other shares. So even if a profit warning were to happen, it probably wouldn’t be a major miss.

Cash looks healthy -

Cash as at 31 December 2023 was £10.9m reflecting strong cash generation outside of an acquisition payment and related costs of £3.8m and increased Interim, Final and Special Dividends.

However, bear in mind that more than all the cash all comes from favourable working capital cycle - getting paid up-front by customers. Eg at 30 June 2023, cash was £9.4m, but deferred income creditor was £(12.0)m.

Overall NTAV was slightly negative, at £(1.3)m. So it’s not actually a strong balance sheet, it’s adequate thanks to a favourable working capital cycle.

We really need to know the average daily net cash figure, plus the annual peak and trough, to be able to properly assess the validity of its cash position. That’s true for all companies. Are the period end cash figures untypical seasonal highs, or are they normal at that level throughout the year? We don't know, it's a big gap in current financial reporting requirements.

My worry is that if ELCO keeps making acquisitions using cash paid up-front by customers, it would reduce NTAV further into negative territory, thus potentially making the share more risky if something bad happened.

Expansion into the USA sounds very interesting, with >40 new clients. That’s something I’d be interested in hearing more about when the full results are published. Obviously a huge market, so if ELCO can succeed there, very tough to do of course for overseas companies, then it might be transformative long-term.

Outlook -

"We continue to see exciting opportunities with the long-term market growth trends and drivers in the geographies we operate in. Given our established positioning and cash-generative SaaS business model, we are confident of another year of strong organic growth, supplemented by further acquisitions, to widen our international reach and customer-focused capabilities."

Paul’s opinion - this looks quite good. There are some nice positives covered above, but as before, valuation seems up with events. Hence I’ll stick with AMBER. Just to emphasise, I don’t see anything wrong with ELCO’s numbers, my only quibble is paying a high-ish multiple for relatively modest organic growth - remember that acquisitions are boosting the growth numbers.

Although taking a 2-year view, if it hits 2024 & 2025 forecasts, then the share would probably have decent upside, as it grows into the valuation. So maybe something to consider as a long-term investment, if your own research makes you feel positive about it meeting or hopefully beating forecasts in future.

Marston's (LON:MARS)

Unch 33.3p (£211m) - Trading Update (AGM) - Paul - AMBER/RED

· Marston's is a leading pub operator with a 40% holding in Carlsberg Marston's Brewing Company

· It operates an estate of 1,408 pubs situated nationally, comprising managed, franchised and leased pubs

I’ve been meaning to look at Marstons for a while, as the shares have been a sector laggard. The chart below shows MARS at the bottom, down 60% in the last 2 years, whilst larger sector peers J D Wetherspoon (LON:JDW) and Mitchells & Butlers (LON:MAB) dropped about 50% in 2022, then recovered nearly all of that in 2023. Whilst MARS only went sideways in 2023.

This makes me wonder whether MARS could be a laggard for a recovery in share price? Either that, or there’s something wrong that is putting off investors from MARS?

The stand out top performer is City Pubs, which attracted a takeover bid - the green line at the top, below -

Current trading -

MARS tells us today it did well over Christmas, with YTD (16 weeks to 20 Jan 2024) showing LFL revenues up a healthy +8.1%, a slight acceleration from previously reported growth of +7.4%.

Outlook - brief, but encouraging comments here from its very new CEO -

"I am pleased to report a strong trading performance with like-for-likes up 8.4% over the festive period. It has been an encouraging start to the year.

This, together with an improving outlook in which inflationary headwinds are broadly abating, and the actions we are taking to operate more efficiently and rebuild margins, position Marston's well for the year ahead."

The financial year is FY 9/2024.

I find that all reassuring, but the market doesn’t, with no change in share price so far today.

We didn’t look at MARS last year, so I’m flying blind here, with no recent notes to refer to, only some old notes here during the pandemic, but nothing before or after.

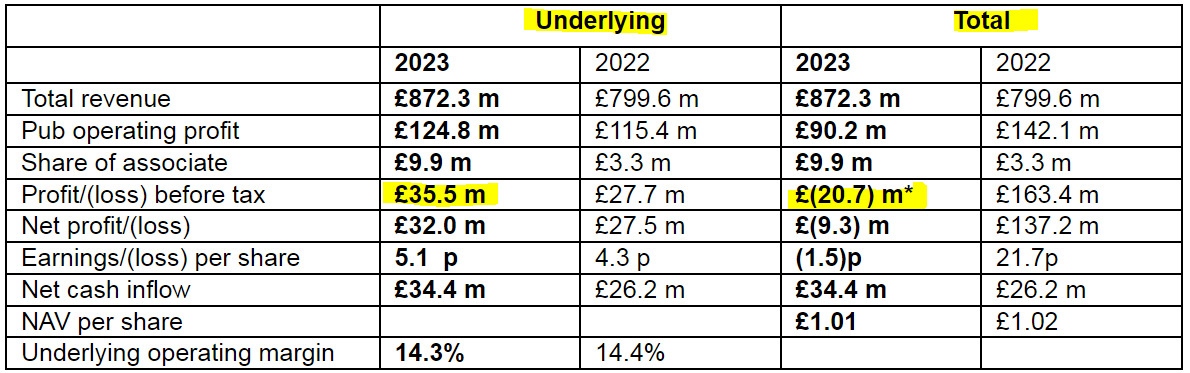

I’ll quickly review its FY 9/2023 results from here -

The company’s own headline was -

IMPROVED UNDERLYING PROFITABILITY, POSITIVE CASH FLOW AND CONTINUED STRATEGIC MOMENTUM

This table below shows an u/l PBT of £35.5m, up 28% on FY 9/2022.

Note the large adjs of £56m, and the £(20.7)m statutory loss - probably asset write-offs I imagine. Yes here we are for the adjustments -

*Includes a £21.6 million net loss in respect of interest rate swap movements, a partial reversal of the £109.2 million net gain reported in FY2022, and £31.2 million of charges in respect of the impairment of freehold and leasehold properties.

Pensions - bit of a drag on cashflow, but doesn’t sound serious -

The net annual cash contribution is c.£6m and is only expected to continue for the short term. The results of the next triennial valuation are expected in early 2024.

Debt - this is the big issue. It had £1,185m of debt (excl. leases, which are future operating costs, not debt), dwarfing the £211m market cap. So properly studying & understanding the debt is the crucial research work here, which I won’t have time to do properly today.

This excerpt below gives you an idea of the complexity, and things that need researching more -

As set out in our Interim Results, we successfully secured an amendment and extension ('A&E') to our banking facility and private placement to the end of January 2025. The revised £340 million facilities are comprised of a £300 million Revolving Credit Facility (the 'RCF') with the continued support of all of our existing banks and with two new banks keen to join the syndicate, together with a restatement of our current £40 million private placement. The RCF replaces the Group's existing £280 million facility. The facility cost is variable: to be determined by the level of leverage or drawings from time to time alongside changes in the SONIA rate, together with issue costs. As previously reported, £120 million of the facility is hedged.

During the period and prior to the A&E, we secured the covenant amendments that we required, as reported in our 2022 financial results, again demonstrating the good relationship and support we continue to have with our banking group and private placement provider. No further covenant amendments have been required.

The Group anticipates commencing formal discussions with the RCF banks and private placement holder in early 2024 in order to secure the refinancing of these facilities to beyond January 2025. Whilst there is no guarantee, based on the successful A&E to the RCF and private placement during the period, and the positive conversations held to date, the Directors are confident that they would expect to be able to secure refinancing on similar terms.

The vast majority of our borrowings are long-dated and asset-backed, including the securitisation debt of c.£611 million, which has low interest rates in the current environment and a payment structure that reduces debt. The weighted average fixed interest rate payable by the Group on its securitised debt at 30 September 2023 was 5.1%. The Group has confidence in the loan to value of its debt, which is improving year on year and is currently 68% for debt excluding IFRS 16 lease liabilities and 53% for the securitisation debt.

The Group's financing, providing an appropriate level of flexibility and liquidity for the medium term, comprises:

· £300 million bank facility to January 2025 - at the year end £229 million was drawn providing headroom of £71 million and non-securitised cash balances of £10 million

· £40 million private placement in place until January 2025

· Seasonal overdraft of £5-£20 million, depending on dates - which was not used at the period end

· Long-term securitisation debt of approximately £611 million - at the year end £10 million of the £120 million securitisation liquidity facility had been utilised, which was repaid in October 2023.

Going concern - says it can manage the debt facilities, but this is obviously a concern -

Accordingly, the financial statements continue to be prepared on the going concern basis, but with a material uncertainty arising from the current macroeconomic environment. Full details are included in Note 1.

Discount to NTAV - is huge with a price to NTAV of just 0.35, which obviously casts doubt on the property asset values - PPE is £2.06bn. It stands by its total property values here -

The Group has performed a market capital gap analysis to determine whether an impairment of the asset values is required. The analysis showed that there is sufficient headroom between the total asset value and enterprise value such that no impairment is required.

Cashflow statement for FY 9/2023 clearly shows that the cash generation from the pubs is all consumed by maintenance capex, and finance costs. So that means unless performance improves, there’s not going to be any prospect of reducing debt significantly other than from selling off properties.

Paul’s opinion - this is special situation, where the c.£211m equity is dwarfed by debt (non-leases) of almost £1.2bn. It would take an enormous improvement in performance to start even making a small dent in the debt mountain, which seems unlikely. So the probability is that debt would have to be rolled over in future, and the terms of such refinancings would be crucial to whether any value returns to equity or not.

I doubt insolvency would happen, as that’s not in anybody’s interests. The main concern is that equity doesn’t see any cashflows at all (no divis have been paid since early 2020), and it might require a substantial equity raise to persuade lenders to refinance at a more affordable cost perhaps? So equity holders would probably have to put more money in, before they’re likely to get much (or any) share of future cashflows.

Asset disposals is another possible direction to take, but buyers would probably be mainly interested in the best performing pubs, so sales would then mean losing profits. Alternative use might be helpful in realising some asset values maybe, after all lots of pubs in London have been turned into fancy flats. Although I see from its website that Marston’s doesn’t have many sites in London. They’re mostly concentrated in the Midlands and Northern England. There’s also its brewery partial holding, which could be sold.

What about a takeover? That looks a distinct possibility to me. If a bidder offered a say 50% premium, it would only cost about £300m, to take control of 1,400 pubs, and maybe negotiate upside on the borrowings?

So I think the main attraction of this share is for a potential takeover bid.

The heavy debt burden could make it higher risk, so a lot of detail needs to be checked before proceeding here I think. I’ve got to flag the elevated debt risk, so have to view this AMBER/RED, but I can also see upside potential in a consumer recovery that’s probably in the pipeline. Decent LFLs last year, and so far this year, probably make the risk in this share tolerable.

Graham’s Section:

H & T (LON:HAT)

Share price: 339p (-15%)

Market cap: £149m

H&T Group Plc ("H&T" or "the Group"), the UK's largest pawnbroker and a leading retailer of high quality new and pre-owned jewellery and watches, today provides an update following completion of the financial year ended 31 December 2023.

This is a surprising (to me) profit warning from the UK’s largest pawnbroker.

2023 profits are up 40% compared to the prior year, but retail conditions pre-Christmas were “challenging”, particularly in December. So despite strong year-on-year growth, the profit result is still 10% below market forecasts.

With thanks to Research Tree and Shore Capital: the old PBT forecast for 2023 was £29.5m, whereas the new forecast is £26.6m.

Shore Capital have also reduced their PBT forecasts for 2024 (by 9%) and for 2025 (by 10%).

Let’s explore the trading update a bit more:

Pawnbroking: continues to go from strength to strength. The pledge book is up 30% year-on-year to £131m, ahead of expectations. The characteristics and performance of loans are unchanged, i.e. average loan size £201, redemption rates 85%, loan to value 65%.

As an aside, perhaps the warnings in recent months from HAT on problems in the luxury watch market should have been taken as a bad omen for Watches of Switzerland (LON:WOSG) investors? HAT is now more cautious when it comes to lending on watches, and watches are now just 15% of the pledge book (previously 17%).

Retail: Q4 was “challenging”, due to the pressures on disposable income. More items were sold than the previous year, but “customers displayed caution in their spending, with a significant shift towards lower priced items”. Customers favoured cheap, new items over more expensive pre-owned items, and Q4 revenues fell 3% year-on-year.

FX/Holiday Money: revenues are up 11% and a “click and collect” service launched in June 2023. It seems to be making good progress, but “it is taking longer than anticipated to achieve forecast volumes and revenues.”

Gold purchasing: up 18% at consistent margins.

Costs: the 10% rise in minimum wage from April 2024 is flagged.

CEO comment: addresses the challenging retail conditions

We believe, despite this challenging backdrop, that we have the right product offering and have continued to invest in our store estate and our technology platforms.

Graham’s view

I’m a long-term fan of this business and I’m disappointed for shareholders that they’ve seen such limited share price progress. At 326p, the shares are back at levels they first reached in September 2017.

Here’s a 5-year chart:

I used to hold this as my largest position. One of the reasons I no longer felt compelled to continue holding it was a belief that it was struggling to do well in terms of ROCE/ROE. Here are those latest quality metrics according to Stockopedia:

As you can see, returns have been good but not “great”.

However, I still view this as a really solid business and am struggling to understand this valuation. Even after today’s downgrades, the company is still forecast to generate an adjusted PBT of £33.5m in the current year, vs. a market cap of less than £150m.

At a 25% corporate tax rate, we have an adjusted PAT of £25m, meaning that the shares are trading at 6x adjusted earnings (note that adjustments were ZERO in 2022, i.e. adjusted profits were the same as actual profits).

At 6x earnings, how can I not give this stock the thumbs up?

To summarise, the bear points are:

Exposed to retailing sentiment which has been difficult.

Cost inflation, particularly minimum wage.

Unexciting return metrics.

Against that, you have:

The biggest pawnbroking book in the country, by a mile.

A very long track record of responsible and profitable operations.

An earnings multiple of 6x.

(Paul adds: the first profit warning from my top 20 ideas for 2024, drat! Still, it's fairly mild, and as readers have commented below, why did the company guide brokers to set forecasts so high in the first place? The reduced outcome announced today is still an excellent improvement on last year's profits. We also have a bulletproof balance sheet, with nearly the whole market cap now supported by NTAV. The share price has fallen from 490p peak in the last 3 months, to just 344p today. I think that actually makes it more appealing overall as a value share. So for me, this profit warning is very much glass half full, not half empty. I don't see anything wrong with the core business, it's more a case of overly ambitious forecasting, creating the illusion of under-performance, in what has actually proven to be a good year in 2023. So I very much agree with Graham's view that it's GREEN on fundamentals)

Henry Boot (LON:BOOT)

Share price: 190p (-10%)

Market cap: £255m

And now for my second profit warning to look at today, it’s Sheffield-based Henry Boot:

Henry Boot PLC, a Company engaged in land promotion, property investment and development, and construction, is today issuing a trading update for the year ended 31 December 2023 ahead of the announcement of its full year results on 25 March 2024.

CEO comment

The CEO describes it as a “resilient performance” in 2023, in line with market consensus.

However, he also says that 2024 results will be “impacted” by inflation and interest rates, even if those two factors are now on a path lower.

He says the company is “well placed to achieve its medium term growth and return objectives”. This sort of phrase is often used when short term objectives are impossible to meet…

Trading update for 2023

Key points:

“Robust sales” despite activity reducing in three key markets (Industrial & Logistics, Residential and Urban Development).

PBT in line with consensus (£37.2m)

Net debt increases to £77m, gearing “towards the top end of the optimum stated range of 10-20%”.

Boot’s subsidiary Hallam Land Management has grown its land portfolio to nearly 101,000 plots.

Developer HBD has beaten expectations, completing on a range of schemes and nearly doubling the value of its development programme year-on-year.

Stonebridge Homes - a premium home builder based in Leeds - completed 251 homes (2022: 175), working its way towards a target of 600 homes. As mortgage rates stabilised towards the end of the year, reservations picked up. Supply chain/cost pressures also moderated.

Henry Boot Construction “traded below expectations but remained profitable”. Two projects were impacted by “the availability of materials and the resultant delays”.

A bit of a mixed bag for 2023, then, although mostly positive and ended up meeting expectations.

Unfortunately, the 2024 outlook is less positive.

Despite the company’s optimism around inflation and mortgage interest rates, they say the following:

The Group is well positioned to benefit when our end markets recover, however we expect there will be a lag in performance due to the time it takes for projects and sales to complete… we are now more conservative with our estimates of completions for 2024 and anticipate the impact from a recovery in residential sales will be more weighted to 2025.

Perhaps this is another case where the company might have been more careful with its estimates in the first place, and might have avoided this profit warning? After all, as the company itself points out, the outlook for inflation and rates has improved. But it seems that Boot’s forecasts assumed these macro factors would improve and would boost performance even faster than they already have.

Additionally, Boot’s level of gearing is going to remain at the high end of the range through 2024, as they have agreed to extended payment profiles with housebuilders on strategic land sales (I wonder why? Why not let the housebuilders use up their own cash or borrow to invest?). The result is that Boot’s interest bill will be higher than anticipated and this will also impact profitability.

As a result, profitability for 2024 will be significantly below current market consensus.

That consensus, according to the company, is PBT of £37.2m, the same as 2023.

Graham’s view

I looked at this stock last March and liked it. Paul also liked it in May.

Interim results posted in September showed NAV rising to 303p and net assets of £405m, almost entirely tangible.

However, ROCE fell to 6.3%, below the target of 10%-15%. I do give the company points for keeping shareholders updated on this important metric.

On balance, I think I’ll continue to give this one the thumbs up. It’s probably on a single-digit earnings multiple against the earnings that it could achieve in a “good” year, it’s at a discount to NAV, it has a long track record of profitability, and it passes a nice screen:

Against that, investors are going to have to be more patient while they wait for a full recovery in the company’s end markets - I look forward to finding out the new earnings estimates from Peel Hunt and Panmure. I also note that the debt position is less comfortable than it ought to be, and ROCE is likely to be underwhelming in the short-term (less than or around 10%). But for patient investors who want to benefit from land development and construction, this could be a reasonable choice and one that’s worth investigating further.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.