Good morning from Paul & Graham!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

It's all kicking off today! 1 takeover, and 2 profit warnings here -

Summaries

SCS (LON:SCS) (Paul holds) - 169p (pre-market) £57m - Recommended cash bid 280p - Paul - GREEN

One of our favourite value shares here, with SCVR reports 5 times on it this year, always GREEN, and it was a mystery share in August. An Italian furniture retailer has offered a generous 66% premium, 270p bid + 10p divi. As we've mentioned here before, SCS has been a sitting duck for a takeover bid, due to its large cash pile, allowing a bidder to almost buy the business for free (using SCS's own cash pile). Not sure why it took so long for someone to act, but shareholders are rewarded nicely today.

R&Q Insurance Holdings (LON:RQIH) - down 52% yesterday to 24p (£90m) - Proposed Sale - Graham - AMBER/RED

I’m taking a neutral stance as the proposed sale of a subsidiary should take insolvency off the table. But shareholders will be left with a complex and in recent times highly unprofitable legacy insurance business. This one is difficult to analyse and perhaps best avoided.

Cab Payments Holdings (LON:CABP) - down 60% to 86.2p (£219m) - Q3 update (profit warning) - Graham - AMBER/RED

Having floated in July and posted a positive outlook in September, this FX company has materially downgraded revenue expectations and says the lost revenue will flow directly to the bottom line. IPO investors may feel hard done by but we’ve seen this many times before.

FD Technologies (LON:FDP) - Down 40% to 788p (£218m) - Interim Results (H1 to 8/2023) - Paul - AMBER/RED

I'm not familiar with this company, so it took me quite a while to realise that it's not my cup of tea at all. Looks like the fancy valuation might be down to excitement about AI, and it is generating very good ARR growth from the loss-making KX division. With a weak balance sheet, customer caution, and negative cashflow, I don't want to get involved in this.

Paul’s Section:

SCS (LON:SCS) (Paul holds)

169p (pre-market) £57m - Recommended cash bid 280p - Paul - GREEN

Marvellous news here for shareholders (I hold a small position).

Yet again we’re provided with more evidence that UK small/mid caps are too cheap, with another takeover bid. The bidder seems to be an Italian trade buyer, Poltronesofa, which retails Italian-made furniture from 300 stores, mainly in Italy and France.

Price is a healthy 66% premium to last night’s closing price, and is 270p + 10p divi, so 280p in total. That’s a fair price in my view, and a good premium, so I imagine shareholders are likely to gratefully accept this deal.

Results for FY 7/2023 are being published tomorrow, so we’ll be able to double-check these numbers against the takeover price.

Paul’s opinion - we’ve been saying here for as long as I can remember that ScS was an obvious sitting duck for a takeover bid, because a bidder could pay for the acquisition using ScS’s own cash pile, and a small amount of new debt. Today’s announcement mentions this point specifically -

… the failure of investors to properly value ScS's cash resources.

A complete no-brainer. So the only question is, why has it taken so long?!

Well done to subscribers here who either sold out at the top in 2021, or were patient, and rode out the last 2-years mispricing of this share by the stock market.

I see that current dividend yield (before factoring in the bid premium) was a remarkable 8.3%, so the only downside of this deal is losing a big dividend income. Still, at the takeover price, the dividend yield reduces to 4.9%, so you could easily reinvest your proceeds at a better yield without too much searching.

A much-needed morale boost, not just to ScS shareholders, but also to everyone holding small caps, as it’s mounting evidence that the UK market is mis-priced to the downside. That means a bull market is coming, timing uncertain, and lots of future profits to be had potentially, I reckon.

FD Technologies (LON:FDP)

Down 40% to 788p (£218m) - Interim Results (H1 to 8/2023) - Paul - AMBER/RED

Since it’s collapsing in price, I just assumed this must be a 2021 float. Actually not, it’s been listed for many years, and used to be called First Derivatives. We last looked at it here 5 years ago (Graham). I know literally nothing about it, so this is going to be a long haul to try to work out what’s going on.

Not helped by an opaque description of its activities, so I’ve bolded some key words, and reorganised the layout below -

About FD Technologies

FD Technologies is a group of data-driven businesses that unlock the value of insight, hindsight and foresight to drive organisations forward. The Group comprises -

KX, which provides software to accelerate AI-driven innovation;

First Derivative, providing consulting services which drive digital transformation in financial services and capital markets; and

MRP, which provides technology-enabled services for enterprise demand generation.

FD Technologies operates from 14 locations across Europe, North America and Asia Pacific, and employs 2,800 people worldwide.

Clear now? Not really, no.

Divisional commentary - summarised by me -

KX - performed in line with expectations in H1. Growing strongly, with “significant H2 pipeline providing confidence” of hitting +35% target growth in ARR - impressive, this part of the group sounds fine. Mentions AI a fair bit. KX is expanding quickly, but sounds like this is being driven by losses -

KX to achieve free-cash EBITDA breakeven by FY26 and margin of 20-25% by FY28

First Derivative - revenue down 1%, and similar result expected in H2. Customers being more cautious. Efficiency measures taken. “Evidence of improvement in pipeline” for next year (FY 2/2025).

MRP - sounds in line with expectations, but revenue down a lot, and it didn't even manage a positive adj EBITDA in H1, well down on last year. So this looks a problem division, but it's small.

Overall performance - it’s going to take me too long to analyse each of the 3 divisions, so let’s get to the H1 group results. Oh, it’s loss-making -

Revenue £142.5m (down 3%)

Loss before tax £(4.5)m (H1 LY: PBT of £1.1m), so a significant deterioration in performance this year.

Net bank debt flat at £7.2m

Outlook - here it is in full - I wouldn’t call H1 “resilient” personally, I think it’s weak, but anyway, here’s what the company says -

The Group delivered a resilient performance in H1, with good progress in KX and challenging market conditions in First Derivative and MRP. The growth in our KX pipeline, driven by our partnerships with CSPs and the recent launch of KDB.AI, provide confidence in achieving our target of at least 35% growth in ARR for the full year.

In First Derivative, we anticipate similar market conditions through H2 with the efficiency measures taken to date mitigating the impact on adjusted EBITDA, resulting in an H2 revenue and EBITDA performance similar to H1.

In MRP we continue to expect to deliver an adjusted EBITDA similar to last year.

At the Group level we expect FY24 revenue to be in the range of £285m to £295m. The additional investment in KX announced today is expected to result in a £9-10m impact to adjusted EBITDA in H2, resulting in FY24 adjusted EBITDA in the range of £24m to £26m.

Looking beyond the current year, we are pleased with the progress and momentum across the Group, particularly in KX where the partnerships with CSPs and launch of KDB.AI provide confidence in the medium-term outlook to accelerate our industry-leading growth rates.

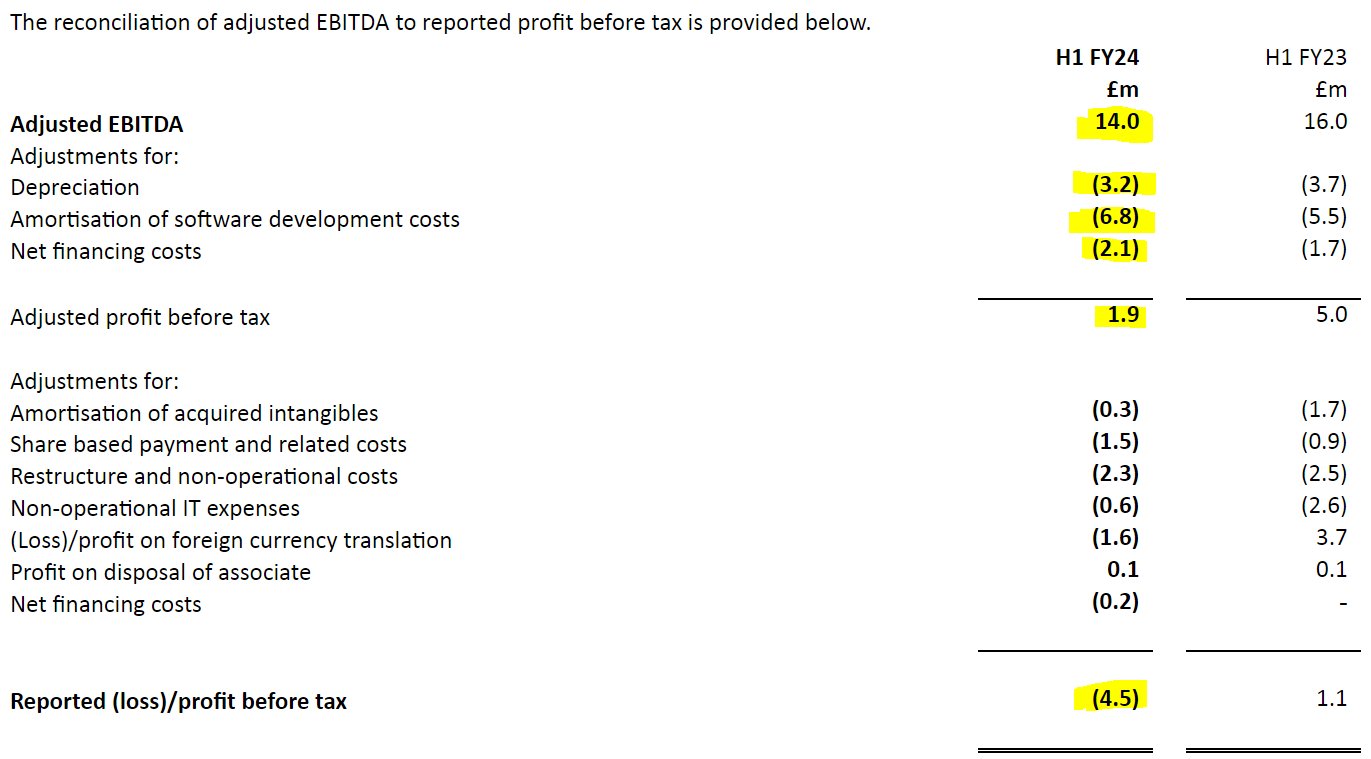

Adj EBITDA of £24-26m for FY 2/2024 might sound good, but it’s not real profit. Note how in H1 adj EBITDA of £14.0m turned into a PBT loss of £(4.5)m, a yawning gap of £18.5m, just in H1. Double that for the full year, and it suggests £24-26m adj EBITDA might result in a pre-tax loss of about £(12)m.

This reconciliation below shows that £14.0m H1 EBITDA is total fantasy, and can be ignored. Even the £1.9m adj PBT is stretching things, so in my view, the £(4.5)m loss before tax is the most realistic measure of performance.

Balance sheet - i.e. is it going to run out of cash?

This looks weak to me. NAV of £188m includes a huge £177m of intangible assets, so only £11m of NTAV - ie no asset backing to speak of.

Receivables looks high at £73m.

Lease liabilities are combined with bank debt, note 9 separates them. A fresh £30m bank loan was drawn down in the period, and partially offset by £23m of cash, hence the £7m net bank debt. I don’t like companies increasing borrowings, when their profit has gone into reverse.

It should have much more cash, given that customers have paid £36m up-front (deferred income creditor).

Cash generation - is negative, once the huge capitalised development spending (£13.7m in H1 alone) is taken into account. It sounds like they’re going to increase this “investment” further in H2.

My opinion - I don’t understand what the company does, but I very much understand that these are not good numbers.

This company is loss-making, and cash-burning. Therefore I cannot possibly value it on conventional metrics. EBITDA is total nonsense, due to the large amounts of payroll being capitalised onto the balance sheet, so that’s no good.

There’s not much asset-backing, and I don’t like the significant gross bank debt, considering it should be in a net cash position, due to clients paying a lot up-front.

So it’s a thumbs down from me.

It’s not a basket case though, so I’ll be kind, and go with AMBER/RED.

Shares like this often come with fancy valuations, due to optimism about the future. The danger with that, is that in economic downturns and bearish stock markets, the gloss can very easily vanish, and lead to a plunging share price.

The price has been gently recovering somewhat this morning, after the big initial 40% drop, now down about 31% (at 12:28).

It looks to me like an exciting, but loss-making growth company, KX, strapped to a mature business that does seem profitable, but is struggling to grow (First Derivative). So overall, this share doesn’t excite me at all. Although KX looks like the kind of thing the Americans might decide to buy at a wacky valuation.

These type of businesses look to be in the firing line for clients retrenching, so it’s a bad sector right now I think. More bad news to come, I wonder? Why get involved? If any readers are more positive, and have researched the company in more detail, then tell us what I'm missing!

Graham’s Section:

R&Q Insurance Holdings (LON:RQIH)

Share price: 24p (-52% yesterday)

Market cap: £90m

This stock saw a nasty fall yesterday in the aftermath of an announcement released on Friday evening (after the close).

This company has a complicated backstory: I discussed it here in August 2022. There was a bid for RQIH at 175p per share which fell through, and it emerged that the company needed additional funds. They ended up raising about £100m at a share price of 105p.

Well-known fund managers Slater and Phoenix have both had a rough ride with this one:

The latest news is that RQIH wants to sell one of its two businesses (“Accredited”) for $465 million. That headline sounds great, but it only gets worse from there:

The “expected net cash proceeds” from the sale are only $300m.

The “net cash proceeds available for utilisation immediately on closing” (explanation not given) are c. $170 - $210m.

This sum ($170 - $210m) will be “entirely used to facilitate a material de-leveraging of R&Q”.

So shareholders aren’t going to see a penny of this. Instead it looks like a bailout for a group in serious financial trouble.

RQIH says that if Accredited isn’t sold, it could be downgraded by the insurance industry’s credit rating agency, below the minimum rating required by its counterparties.

RQIH also says:

…the Board is of the view that the current financial leverage of R&Q is unsustainable and if the Sale were not to proceed and the Available Net Cash Proceeds were not available to facilitate a material de-leveraging of R&Q, R&Q may not be able to continue to satisfy or obtain waivers on the covenant requirements for its existing debt facilities or repay certain of its debt facilities as they become due.

Last year, certain major shareholders attempted to oust RQIH’s CEO. Under the proposed deal, he will leave RQIH and go to Accredited’s new owner.

RQIH will be left with a legacy insurance business. While having reserves under management of $1.1 billion, it sounds like they don’t want to take much underwriting risk in future and will instead focus on collecting fees for their work, sending the insurance risk off to those who are more capable of bearing it.

Graham’s view

The latest interim results disclosed that the “Legacy” business had an adjusted operating loss of $24m and an actual loss of $64m.

The previous full-year results said that Legacy had a pre-tax operating loss of $57m.

This is the business that RQIH shareholders will be left with.

Based on Friday’s RNS, there won’t be any special dividend or buyback to soften the blow. The proceeds from the proposed sale will need to be used entirely to deleverage.

Is it possible that the assets in the Legacy business might start to perform well over the next few years? Sure. But I imagine that very few people outside the business would be capable of predicting this.

I’m going to put a neutral view on this.

Positive points from the deal, assuming it goes ahead:

The controversial CEO leaves RQIH.

Insolvency should be off the table.

Simplification of the group: it becomes a pure insurance legacy business.

Negative points from the deal:

Shareholders lose their profitable subsidiary.

The subsidiary they are left with has been deeply unprofitable and its results are unpredictable (although RQIH wants to make its results more predictable in future by moving to a fee-based model).

No special dividend or share buyback reward for shareholders. Everything rests on the future performance of the Legacy business.

It might be tempting for shareholders to vote against the deal, but they’ve been told in as many words that they face the prospect of insolvency if they do.So it would be very brave if they attempted to hold out for something better.

For anyone who hasn’t yet got involved with this stock, I see little reason to want to get involved with it today. But I will maintain a neutral stance, as the bailout deal should at least take insolvency off the table.

Paul adds: Graham and I have had a negotiation over what colour code we should give RQIH, with me saying Graham's commentary sounded more negative than an AMBER view. So I challenged him on AMBER, with Graham replying with these useful additional points -

Graham adds: I don't mind AMBER/RED. The thing is I don't know if it's undervalued at this level. It's basically a black box. Its insurance assets could perform brilliantly next year! "Legacy business" is an insurance term, it's not that it's a redundant old fashioned, pointless business.

Overall then, we've compromised on AMBER/RED until more details become available for the remaining business.

Cab Payments Holdings (LON:CABP)

Share price: 86.2p (-60%)

Market cap: £219m

This stock has been mentioned one time in the SCVR before today: on 2nd October, when I was discussing Peel Hunt (LON:PEEL) - joint bookrunners for the CAB Payments IPO. It is the largest IPO in the UK in 2023.

Let’s quickly review London’s IPO numbers:

2021: 119 IPOs, £16.3 billion raised.

2022: 45 IPOs, £1.6 billion raised.

2023 year to date: 23 IPOs, £950m raised (combined sources: A B).

As you can see, IPO activity has slowed to a crawl. Investor appetite simply isn’t there, as many of us are nursing losses from the poor performance of the last few years.

And so it must be particularly galling for those who did take part in the CABP IPO in July, to see what has happened to their investment so far.

The company came to the market offering shares at £3.35. It was “a secondary sell-down of existing ordinary shares” by shareholders, i.e. no money was raised for the company.

The market capitalisation implied by the offer price was an impressive £851 million.

The company describes itself as “a market leader in business-to-business cross-border payments and foreign exchange, specialising in hard-to-reach markets”. You can find their customer website here.

Interim results for H1 were published in September, showing adjusted EBITDA of £40m (£14m in H1 2022) and PBT of £24m (£11m in H1 2022).

Now let’s take a look at today’s trading update. Remember that the company already updated the market in mid-September:

In recent weeks, the Company has seen a number of changes to the market conditions in some of its key currency corridors, on top of the ongoing uncertainties surrounding the Naira, which are impacting both volumes and margins; most notably, the Central African franc (XAF) and West African franc (XOF). At the present time, these market conditions are compressing margins and reducing trading volume.

The result: revenue for 2023 is now expected to be 20% ahead of 2022. “This is around 17% below previously issued guidance.”

Furthermore, most of the lost revenue will flow through directly to lower profits, as the company is unwilling to cut costs due to “ongoing confidence in the medium-term potential of the business”.

They go on to say that if current market conditions persist, then “the soft exit rate from 2023 could result in 2024 revenue growth falling below the medium-term potential”. Hopefully the medium-term potential will appear again before 2025!

Graham’s view

I think that if investors believed the RNS - which states that the company is suffering a short-term blip on the path to medium-term success - there would be little reason for the shares to fall 60%.

Instead, I think we have the belief (perhaps the realisation) that the market has been sold a pup. People thought they were buying into an advanced fintech with a bright outlook. Now a few months later, they are being told that problems with African currency flows are going to devastate the profit result for the year.

I note that the Nigerian Naira was allowed to fall 23% in a single trading session in June, after a currency peg to the dollar was abandoned (the FT reports that the real, unofficial fall was more like 40%).

The two other currencies mentioned by CABP, the African francs, are pegged to the euro. I wonder what might happen if those pegs were also abandoned?

I have no idea what CABP shares are truly worth but I tend to avoid IPO shares for at least two years. This one has only been trading for a few months and based on today’s announcement, I don’t think investors can have any faith in the company. It might be a fun gamble for someone with money they don’t mind losing, but it doesn’t look like a serious investment to me. So this one is also going to be AMBER/RED.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.