Good morning from Paul & Graham!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Jupiter Fund Management (LON:JUP) - down 2% to 129p (£703m) - Graham - GREEN

I continue to take the contrarian view that these shares are underpriced. Retail outflows continued in Q1 but institutions stayed flat and market movements boosted AUM. Remains very cheap by historic standards.

Smoove (LON:SMV) - up 28% since Friday (£24m) - Graham - AMBER

Smoove’s assets may have strategic value, as a large Australian group is currently in talks to buy the entire company. After poor results released last year, this could be a nice way for shareholders to exit.

Ab Dynamics (LON:ABDP) - up 1.8% to £17.30 (£396m) - Graham - AMBER

Interim results are in line and full-year expectations are unchanged. Good visibility for H2 and acquisition integrating as planned. But valuation remains high even if you give the benefit of the doubt re: adjustments.

Graham's Section

Jupiter Fund Management (LON:JUP)

- Share price: 132p (pre-market)

- Market cap: £719m

This is one of the pure-play fund managers I’ve taken an interest in since late last year, when I noticed that valuations in the sector had become (in my opinion) excessively depressed.

As a consequence, I started to make positive noises even - or especially - about fund managers which I did not consider to be best-in-class, as their valuations looked far too low.

Jupiter is up by 36% since the last time we covered it in the SCVR. Let’s have a look at this morning’s Q1 update.

Assets under management are up by £0.6 billion to £50.8 billion.

The improvement is broken down as follows:

Market returns positive £1.5 billion

Net flows negative £0.9 billion, due to retail outflows (more than 80% of Jupiter’s AUM is retail money).

Institutional money was static: there was a slight £0.1 billion positive flow from institutions.

Company comment:

…the 'risk off' environment we saw through 2022 continued into the first quarter of 2023. Client demand for UK and European equities remained muted, although this was partially offset by continued positive net inflows into global equity strategies. Outflows from Fixed Income continued to slow, but market uncertainty remains.

Positive momentum was maintained in the institutional channel as we again generated net positive flows. This was primarily driven by mandates funding into global equity strategies managed by NZS Capital. Our pipeline of late stage opportunities remains strong and we look forward to increasing scale in this channel over the medium term.

Graham's view

This is just a brief quarterly update, and so I’ll try to keep my comments brief.

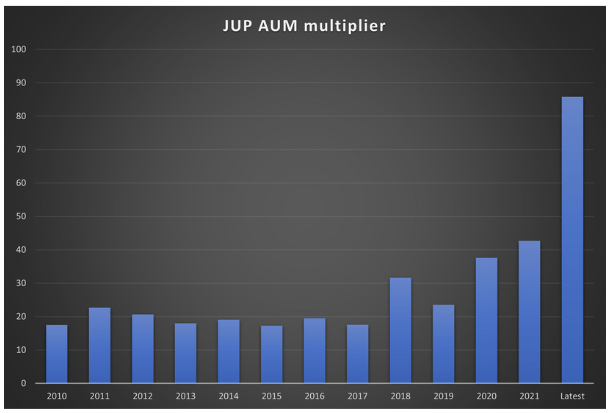

One of the exercises I did last year, when studying this stock, was to provide my own spin on the “EV/AUM” multiple that gets used when studying companies in the fund management sector.

I called it the “AUM multiplier”, and it asked the question “for every pound that I spend buying shares in this fund manager, how many pounds of AUM do I get”?

This was the result I got when studying Jupiter last October, and comparing it to prior years:

The AUM multiplier had grown from a “normal” reading of about £20, to what I thought was a silly reading of £86.

That number today is £72, still an extraordinary reading by historical standards.

Of course it will not be very easy for Jupiter to win the hearts of minds of retail investors, but I suspect that the new CEO at Jupiter understands this. Still in his first year, I look forward to tracking his various initiatives to improve performance.

With the share at this valuation, I have to remain positive on the prospects for shareholders from here.

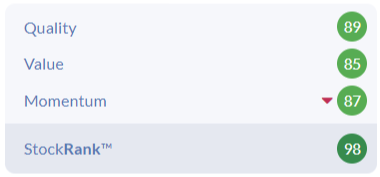

This share also enjoys a stunning StockRank of 98.

Smoove (LON:SMV)

- Share price: 41.4p (+28% since Friday)

- Market cap: £24m

This company owns eConveyancer, DigitalMove and Legal Eye.

I’ve found this one interesting over the past year, due to its large (but shrinking) cash pile, last seen at £17m in September 2022.

In a positive sign of shareholder orientation (and hopefully not a sign of overconfidence), they returned £5m to shareholders in January via a tender offer, buying back shares at a price of 40p.

Results have been poor, including a £3m underlying loss in H1 of the most recent financial year, with very little revenue growth. I remained open to the possibility that the company could cut costs and get itself onto a steadier financial footing.

Today’s news: stock market investors might not see the final outcome here, as there are talks around a possible offer. Thanks to sharw for flagging this in the comments this morning.

The unofficial stock exchange announcement service at Sky News broke the story, followed by an RNS:

The Board of the Company notes recent press speculation and confirms that it is in early discussions with PEXA Group Limited ("PEXA"), regarding a possible cash offer for the entire issued and to be issued ordinary share capital of the Company. Discussions with PEXA remain at an early stage.

PEXA is an Australian property settlements platform, providing similar and complimentary services to Smoove.

PEXA is worth £1.3 billion according to its StockReport, so this deal, if it goes ahead, will be peanuts to them.

There was also some kind of an “alternative potential transaction” that Smoove was working on, instead of the possible PEXA deal. But in a separate RNS today, Smoove says that discussions around this alternative transaction have ended.

My view

Sky News said there were “several takeover approaches from unnamed suitors”. Doesn’t several mean three or more? So I’m wondering if PEXA might still face some competition in its efforts to buy Smoove.

It’s difficult to comment on this proposed deal without more information around the terms (which may not be agreed yet) and on Smoove’s current trading We still don’t have results for FY March 2023.

Based on the FY 2022 results and the H1 results for H1 2023, I do think that Smoove will be negotiating from a position of relative weakness, i.e. the argument that it will be able to succeed as an independent company is not as strong as it might have been. Those H1 results really were very poor.

Perhaps Smoove’s openness to discussing takeover offers reflects a difficult H2? Maybe they realise that turning the corner to profitability is going to take longer than anticipated? If that’s true then a cash offer from PEXA would be a nice way for shareholders to gracefully exit their positions.

I should mention that one of the NEDs at Smoove owns 19% of the shares (the largest shareholding), and he has a background in corporate finance. Harwood Capital (the company managed by Christopher Mills) owns 15%.

Ab Dynamics (LON:ABDP)

- Share price: £17.30 (+1.8%)

- Market cap: £396m

Today we have H1 results from this company, described as a:

“designer, manufacturer and supplier of advanced testing, simulation and measurement products to the global transport market”.

Key points:

Revenue +30% to £49m (organic growth is 14%)

Adjusted op. profit +37% to £7.8m

Actual op. profit + 16% to £2.9m

“Recurring and service based revenues” continue to represent 41% of the total - not bad.

Net cash remains strong at £21m after £11m was spent on acquisitions during H1 (this is part of the upfront cash payment for Ansible Motion).

The integration of Ansible is “continuing as planned”. Note that the maximum price of this deal is £31m, so they may need an additional £12m to pay this.

There is “a promising pipeline of potential acquisition opportunities”.

If more cash is needed, they also have a £15m RCF with NatWest (partially drawn).

Outlook

As noted previously, they have good visibility for H2 this year. Expectations are unchanged.

Looking further ahead:

Future growth prospects remain supported by long-term structural and regulatory growth drivers in active safety, autonomous systems and the automation of vehicle applications

My view

This remains a very solid business, and the exposure to ADAS testing (advanced driver assistance systems) is an attractive niche to be involved in. These systems are surely only going to become more popular and more advanced over time, and ABDP can hopefully play a big role in developing them.

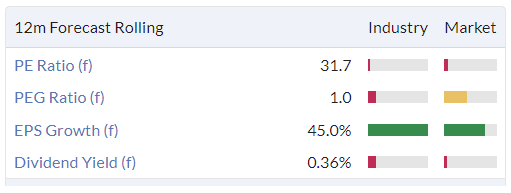

As for the merits of the shares, well, I’m going to risk repeating myself by saying that they are very expensive.

Over the past five years, only the investors who were price-sensitive have done well. Caution has worked well in the past:

Is it possible to justify their current rating?

One way to do it would be to use the company’s “adjusted cash flow from operations”, which was £9.5m in H1. Double that and we are nearly at £20m of adjusted cash flow for the year.

The adjustments to cash flow include £0.8m for ERP (enterprise resource planning) software development, £0.4m for acquisition costs, and £2.1m for “a bonus paid to employees of the acquired entity for pre-acquisition service”.

It may be possible to justify all of this, although I have major doubts about treating ERP spending as “exceptional”.

You then also have to ignore capex and capitalised development costs.

And even then, the pre-tax cash flow yield is still only around 5% annualised.

I like the stock but I can’t give it the thumbs up at this price,

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.